Hi! I hope all of you have a good day. Today I feel pleasure being a part of the of the Homework task that is given by professor #sapwood. Lecture, that is delivered by the prof. is very good. I learn much about JustLend. My knowledge about JustLend is increased. So, we will talk about the Homework that is given by professor. I completed by homework. I tried by best to touch all the Question well. I hope this will help.

Introduction to JustLend

It is a market protocol that is run with in the Tron cryptospace. It is decentralized market. User can supply their crypto asset to other several market and earn profit from them by using this decentralized protocol. User can transfer their asset on this platform and earn Annual yield percentage. In this platform user can borrow asset as well, and this asset is collateralized all other assets available in the user market.

Question 1:

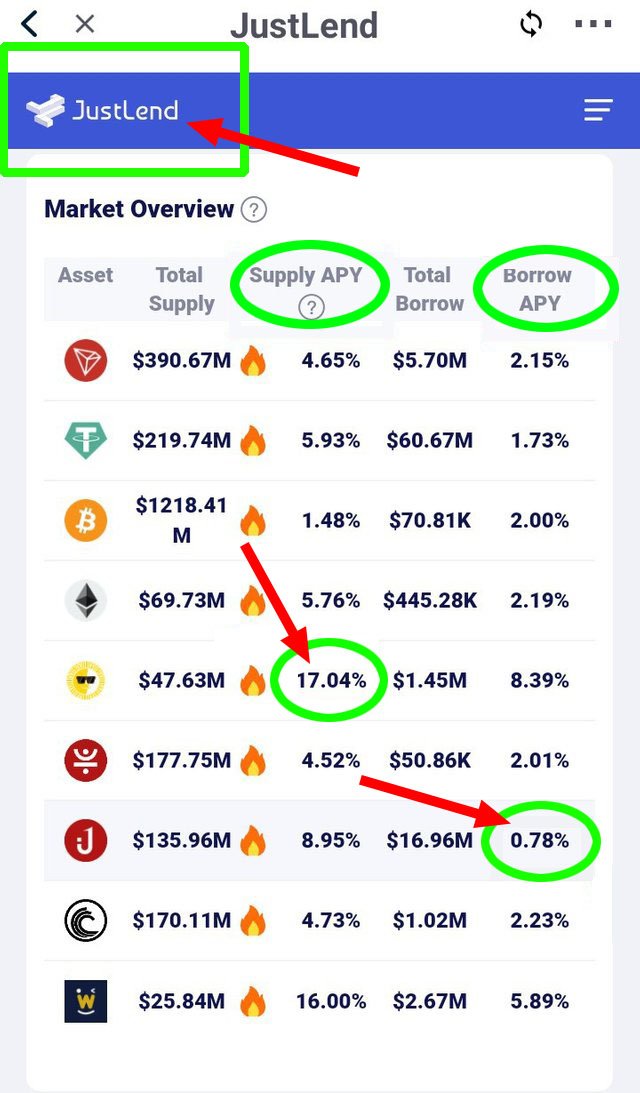

In JustLend there are many markets available. We can list them as TRX, Bitcoin, Ethereum, Wink, SUN, and JUST are different types of markets that are available on JustLend. In JustLend the high supply that a market have is SUN. It has highest supply APY of 17.04. On the other hand USDJ has lowest APY of 0.78% of supply.

Here is the Screenshot that show the Borrowed and Supply APY of markets.

Question 2:

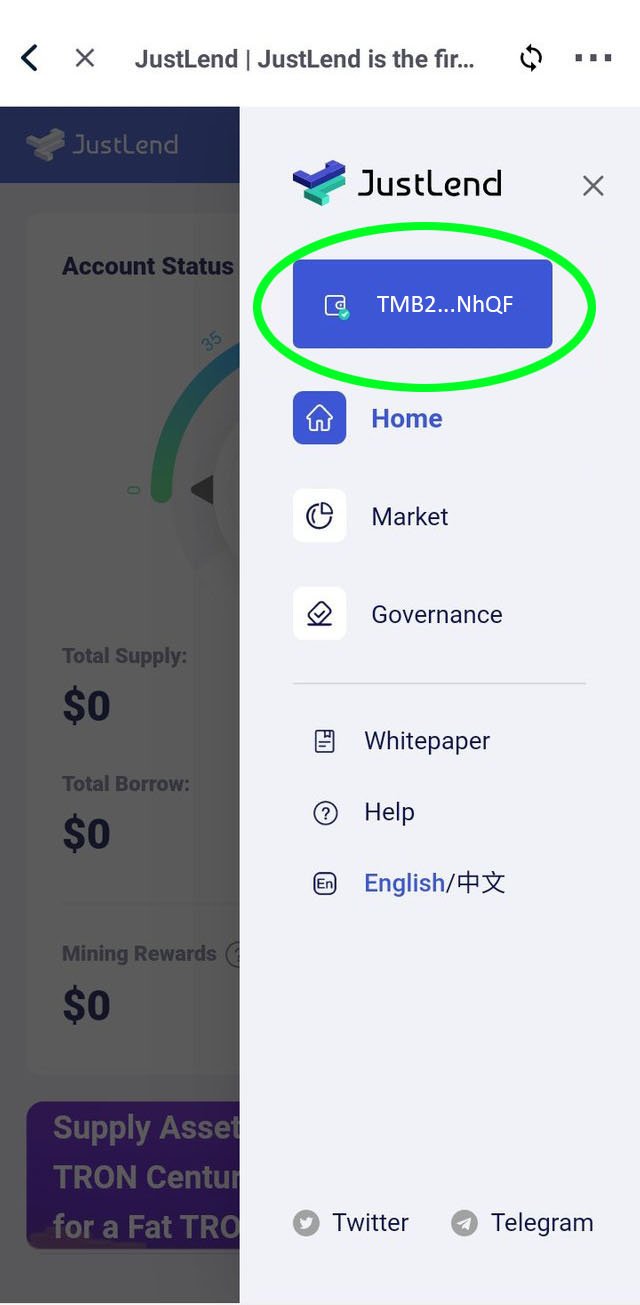

Before doing anything, first we connect our TronLink wallet. After the connection we will able to supply token on the JustLend.

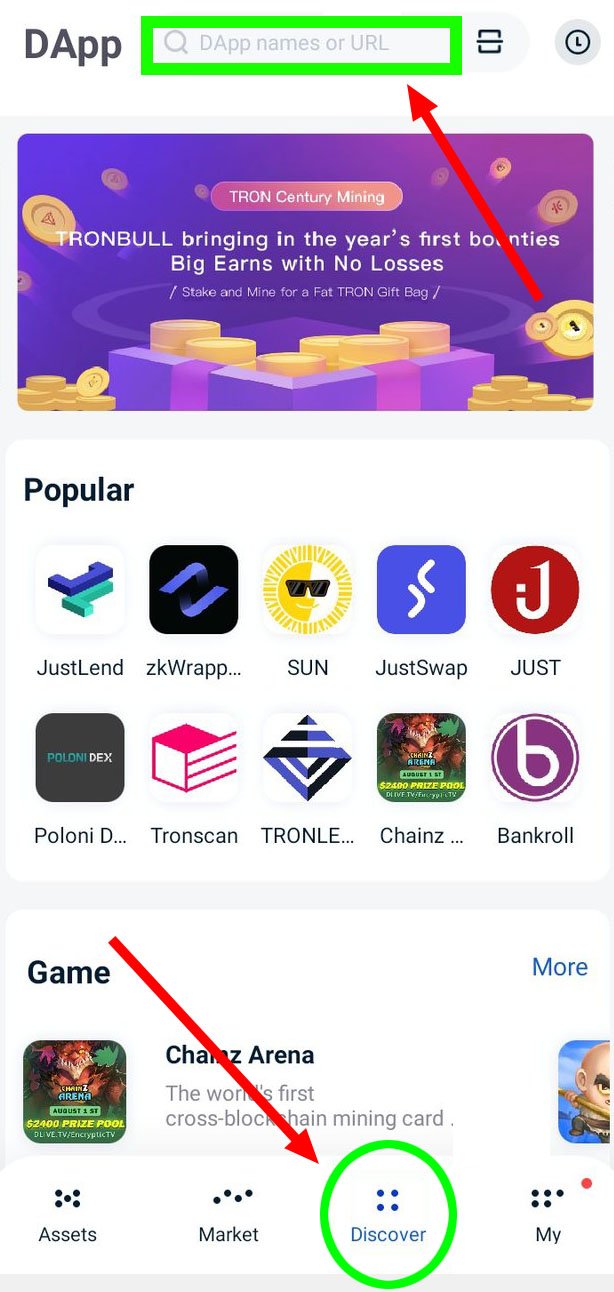

1.First we open our TronLink wallet.

2.Click on the icon that is marked at the bottom to access the TronLink Dapp.

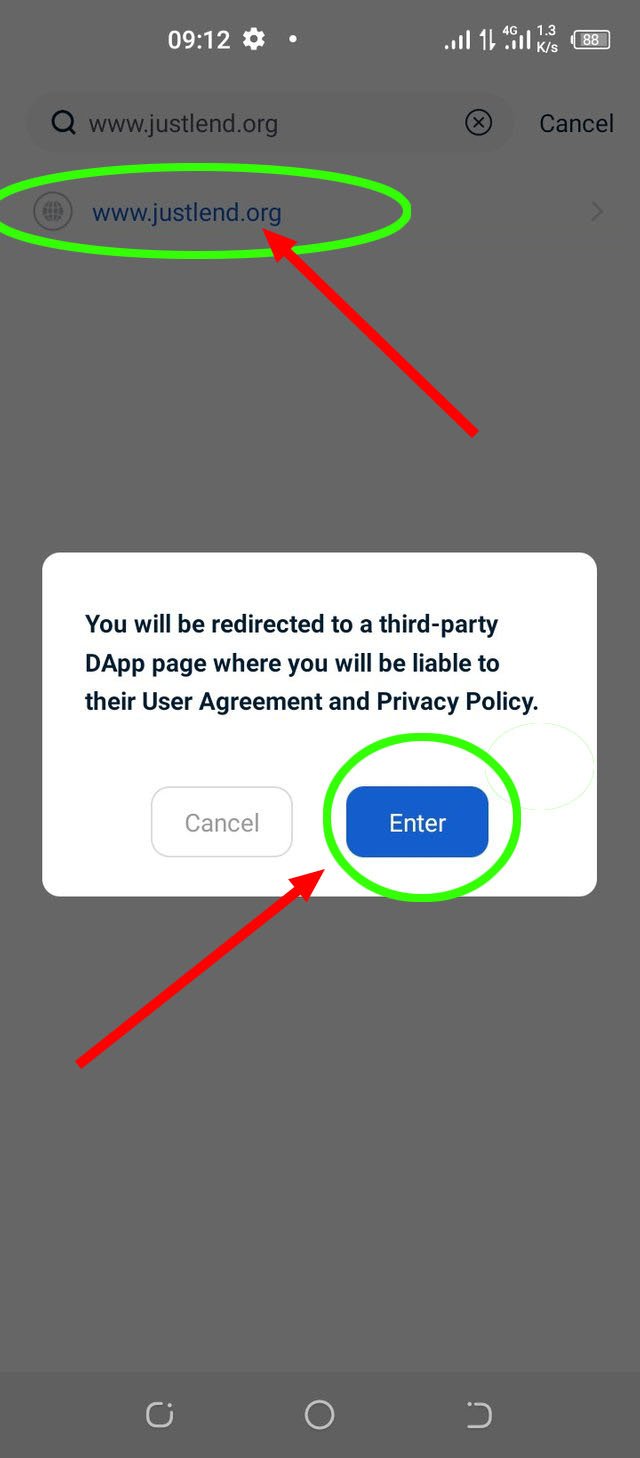

3.Take a visit on the www.justlend.org in DApp.

4.Connect the wallet by selecting the top right menu Icon that is marked.

JustLend Navigation

Connect Wallet

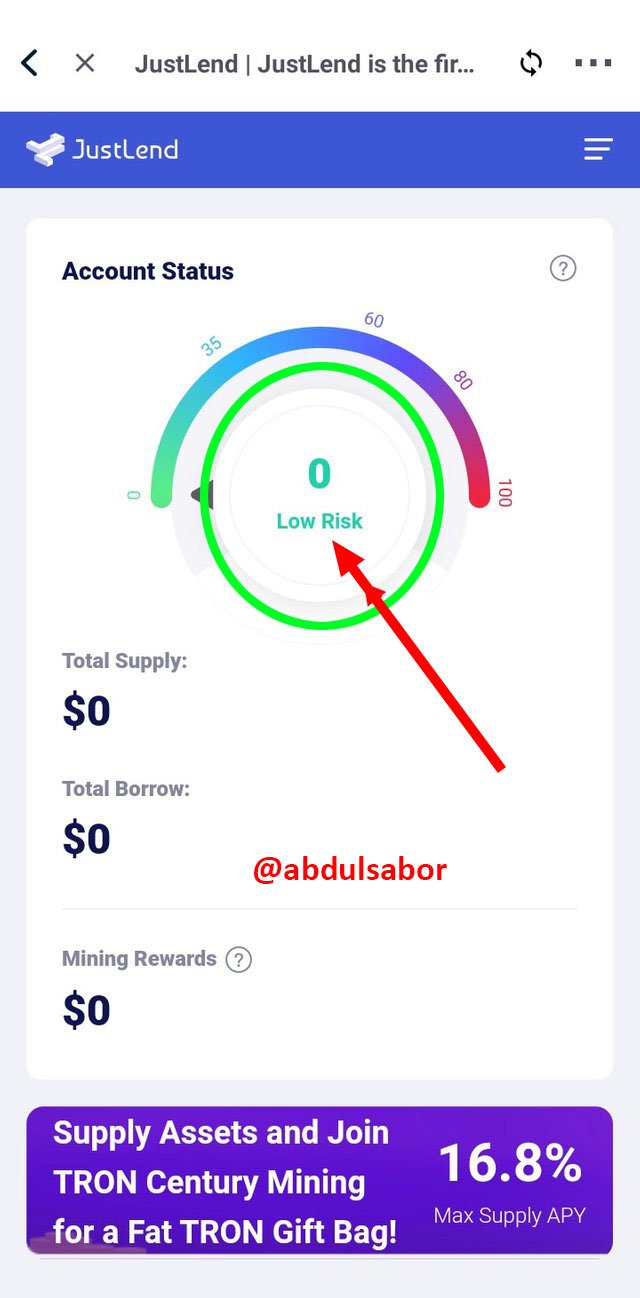

Our Account is Ready.

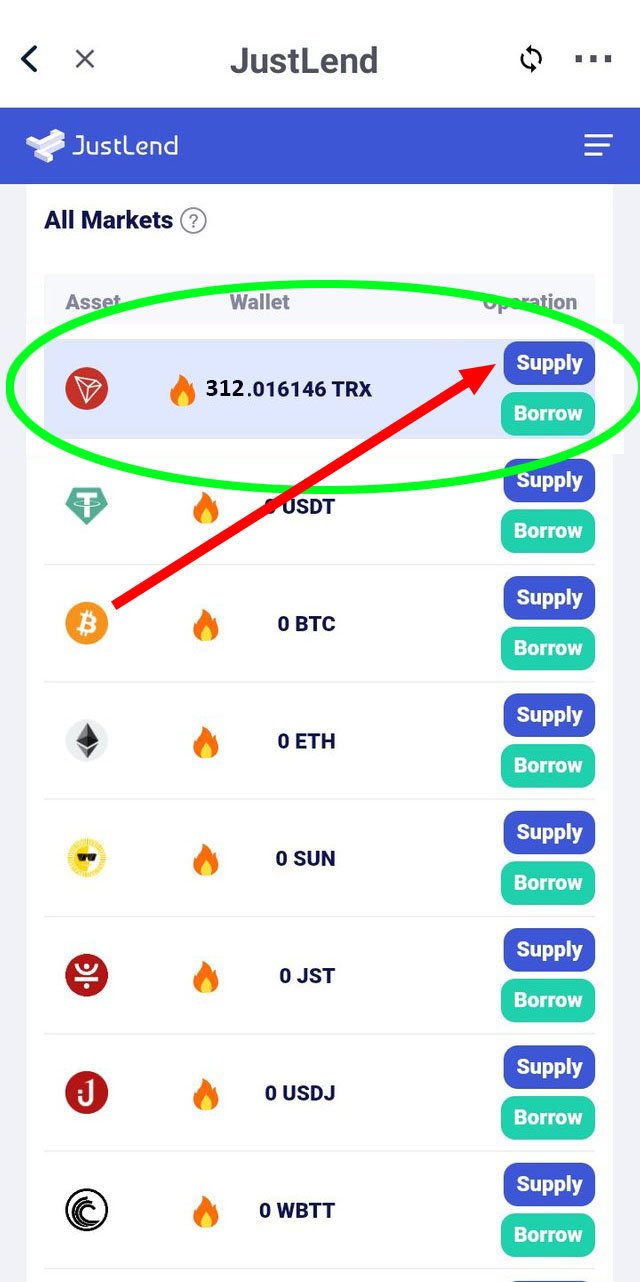

Supply TRX to earn APY

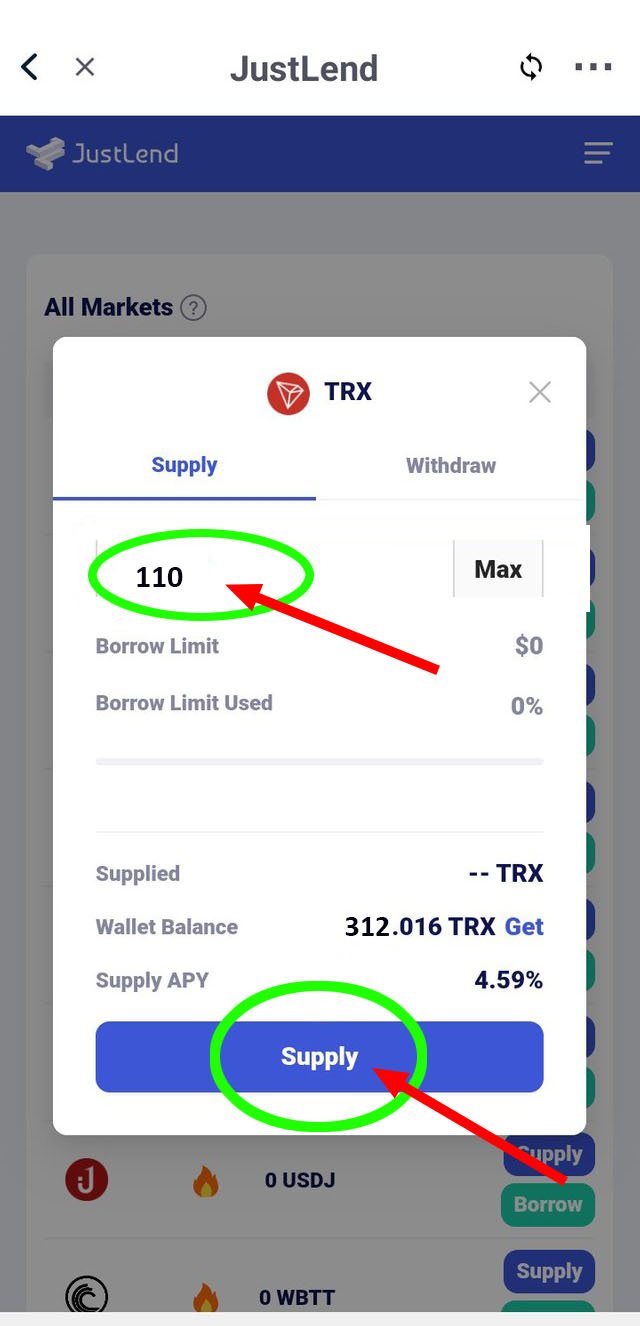

In this market I will supply my asset TRX to earn4.59% and it also depend on how much time my asset present in Supply pool.

1.Selection the marked on that is TRX.

- Click on the Supply that is marked with red arow.

- Enter the how much we want to supply. I want to supply 110 TRX for supply.

- Then click on the supply button that is marked at the bottom.

Supply TRX

110 TRX Value

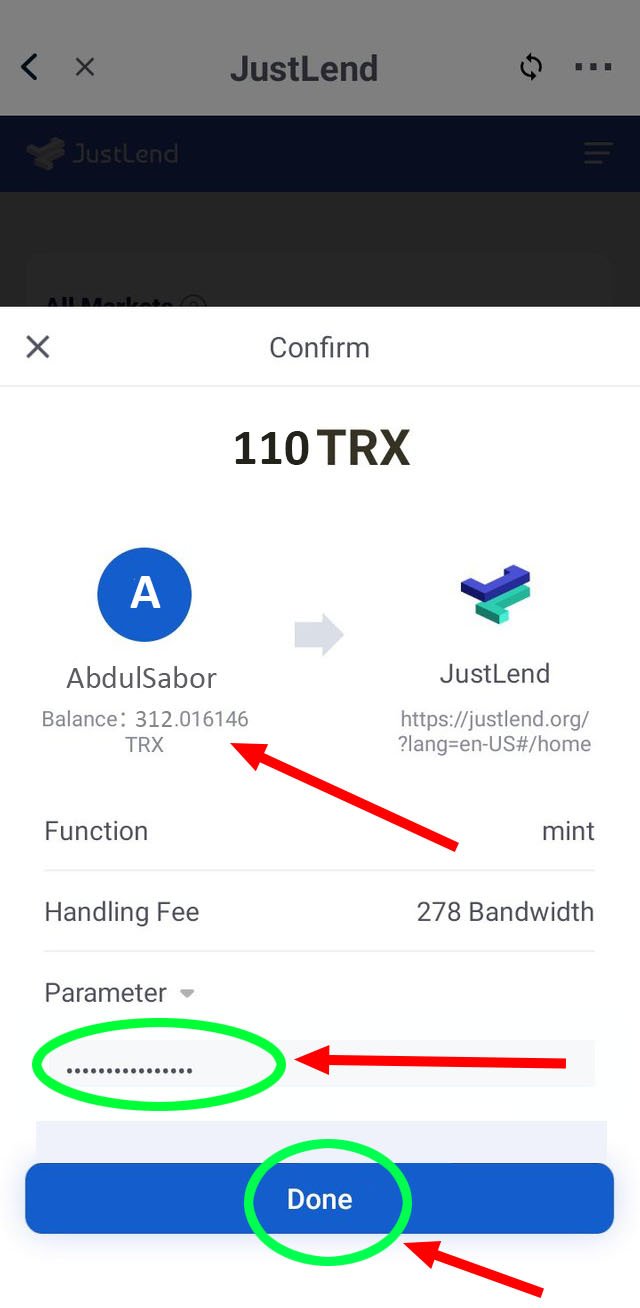

Then we input the password. And Click on the Done button to proceed further.

Proceed Supply

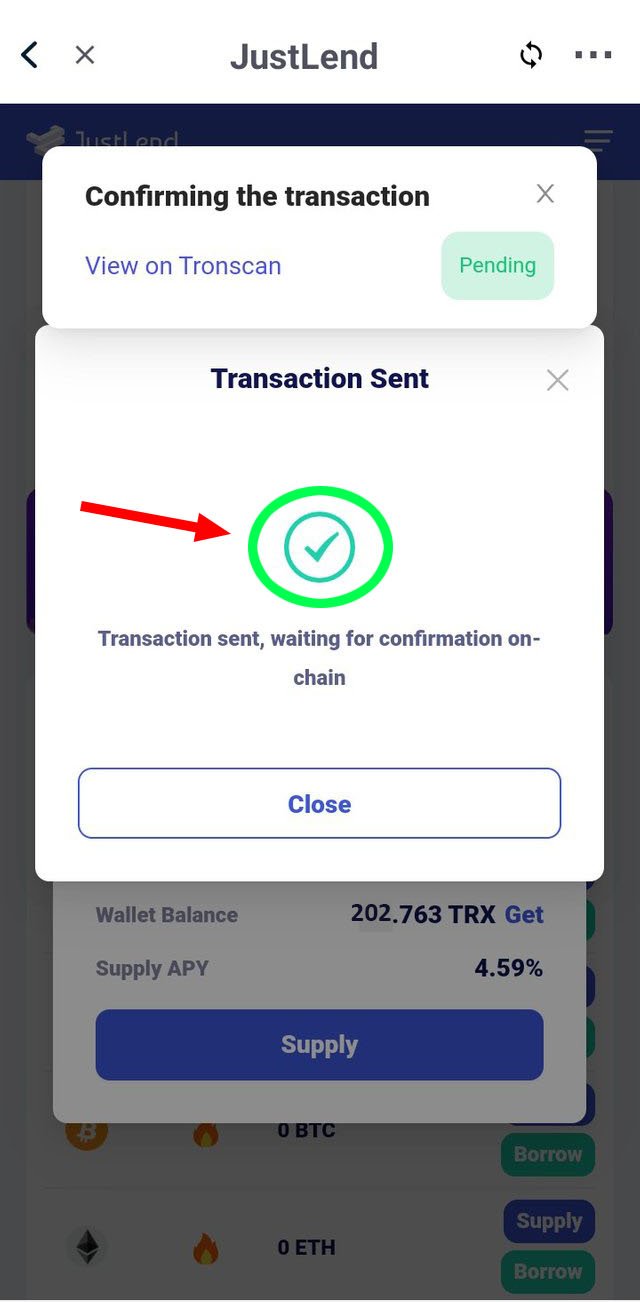

Transaction

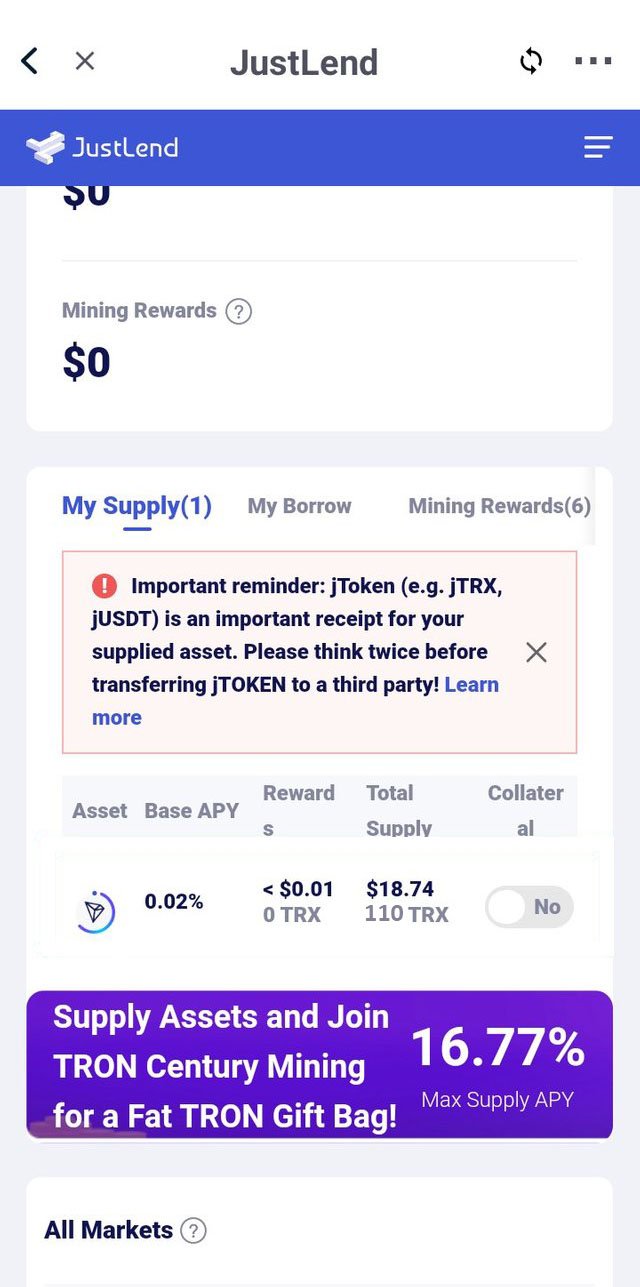

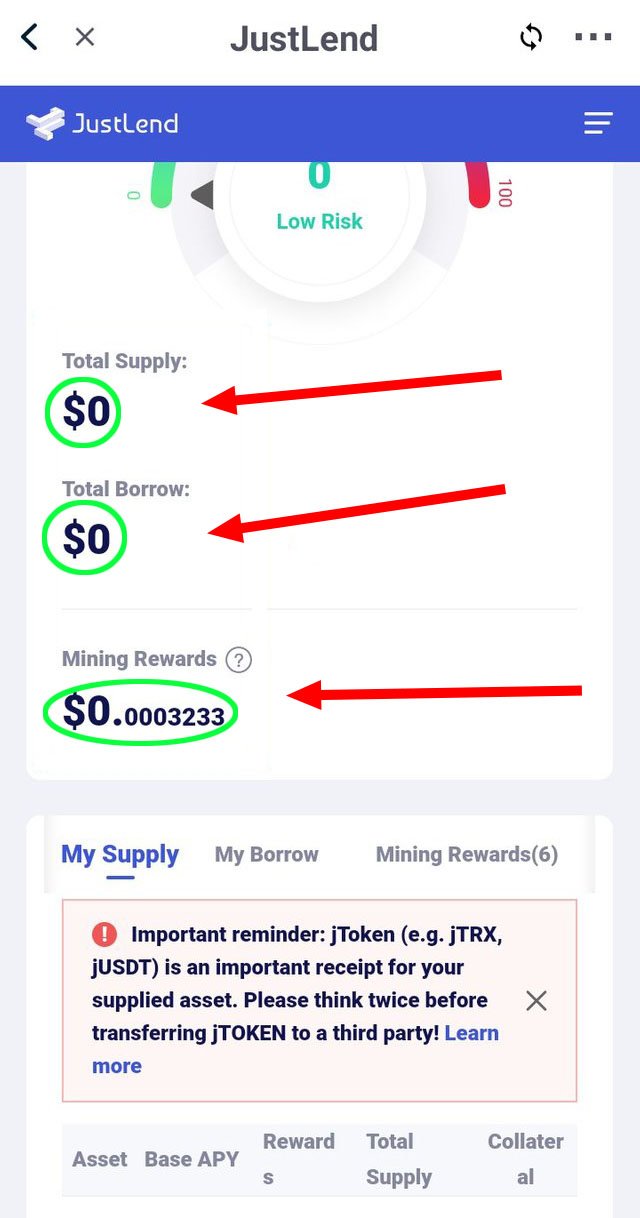

The process was successfully done. On my justlend Dashboard Screenshot below show the history of supply and transaction.

Question 3:

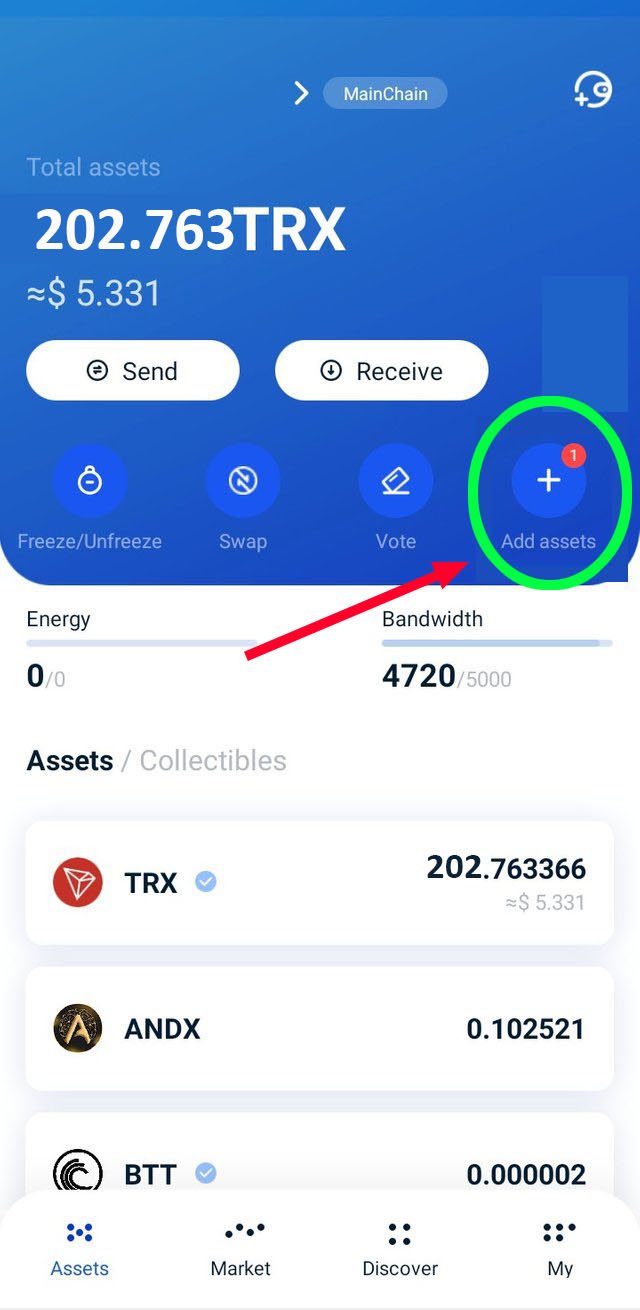

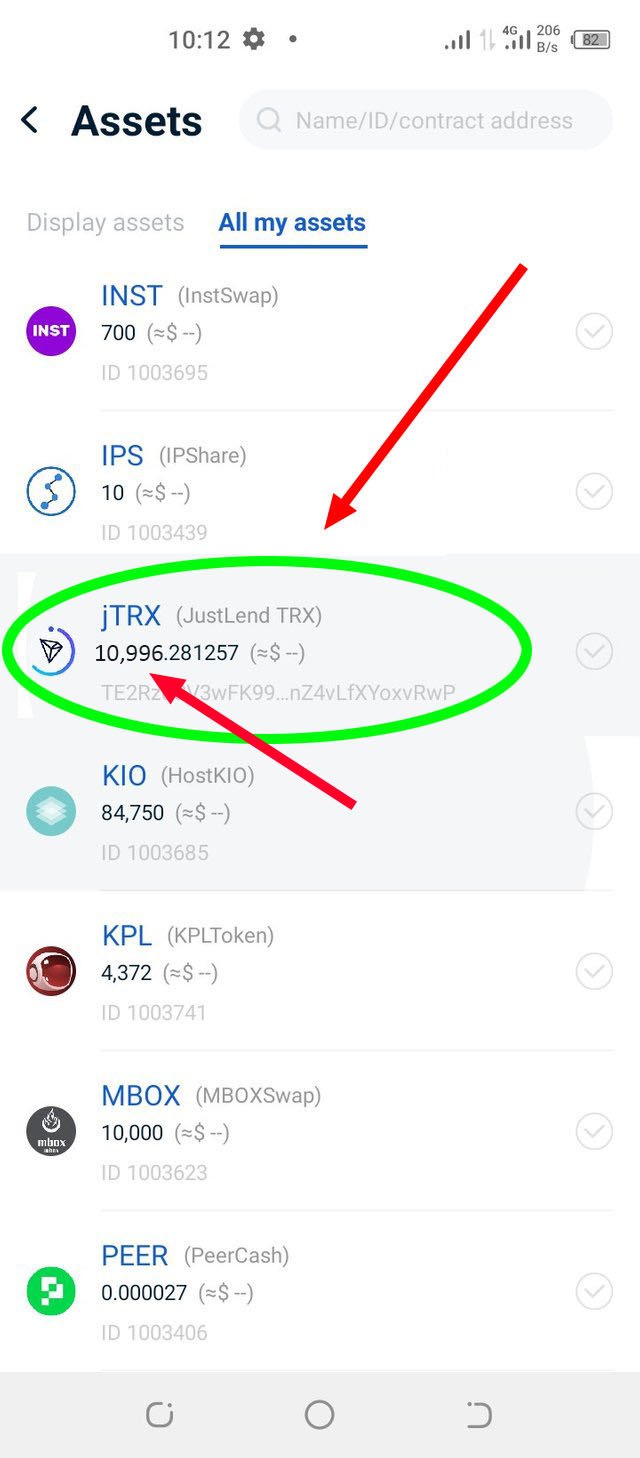

To the jToken we must have to supply of any token in justlend market. For this purpose, our TronLink Wallet must be connected to Justlend to carry out the supply process. To do this process first, we supply the 110 TRX to Justlend Market. As you see in above figure. In the context of supply TRX I have received notification of Add Asset on the wallet. As we Click on the Add Asset, we will see our asset that is 10,996 jTRON. As you see in following Screenshots.

Here is my jTRX Asset

Question 4:

1.First, we will visit the ww.justlend.org website.

- In this site I have already wallet that is connected.

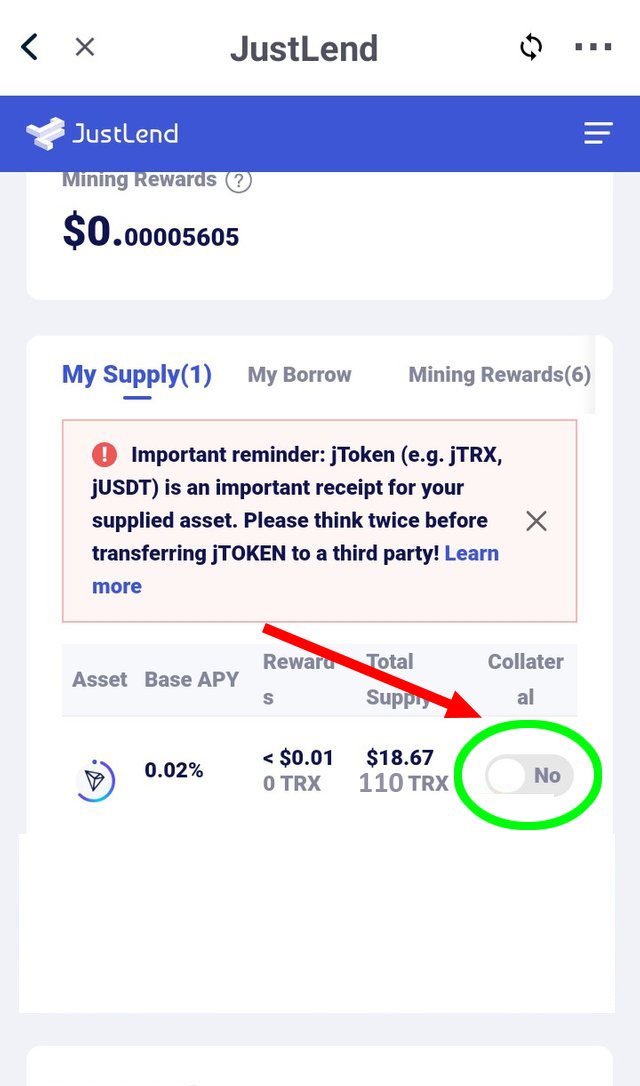

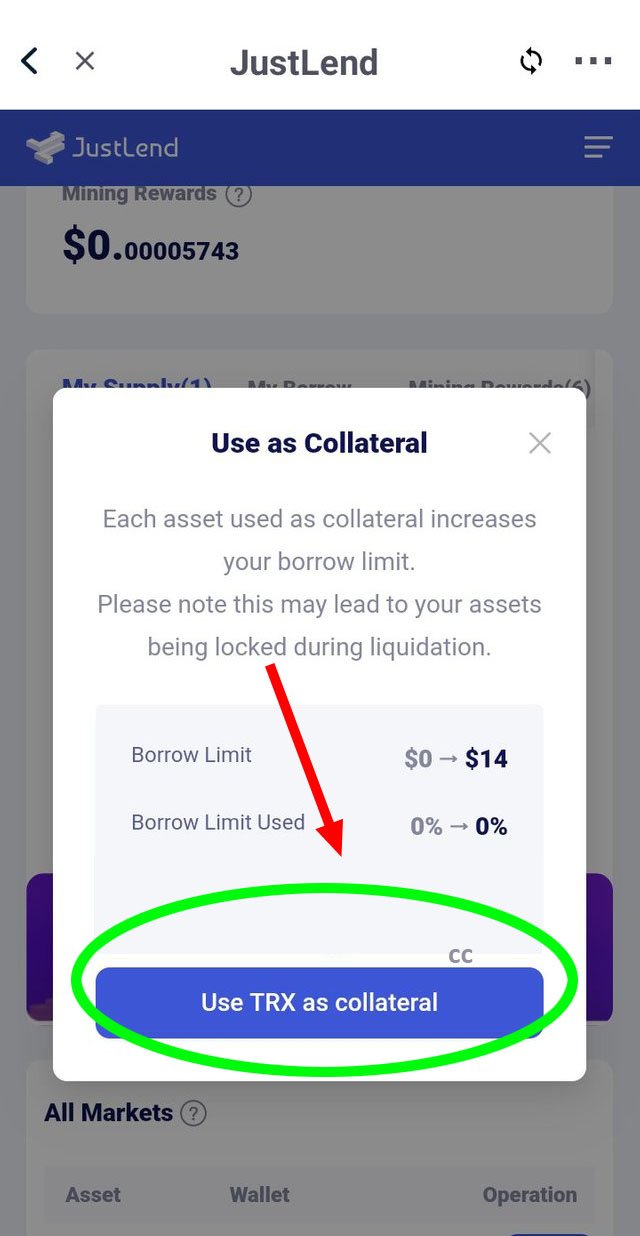

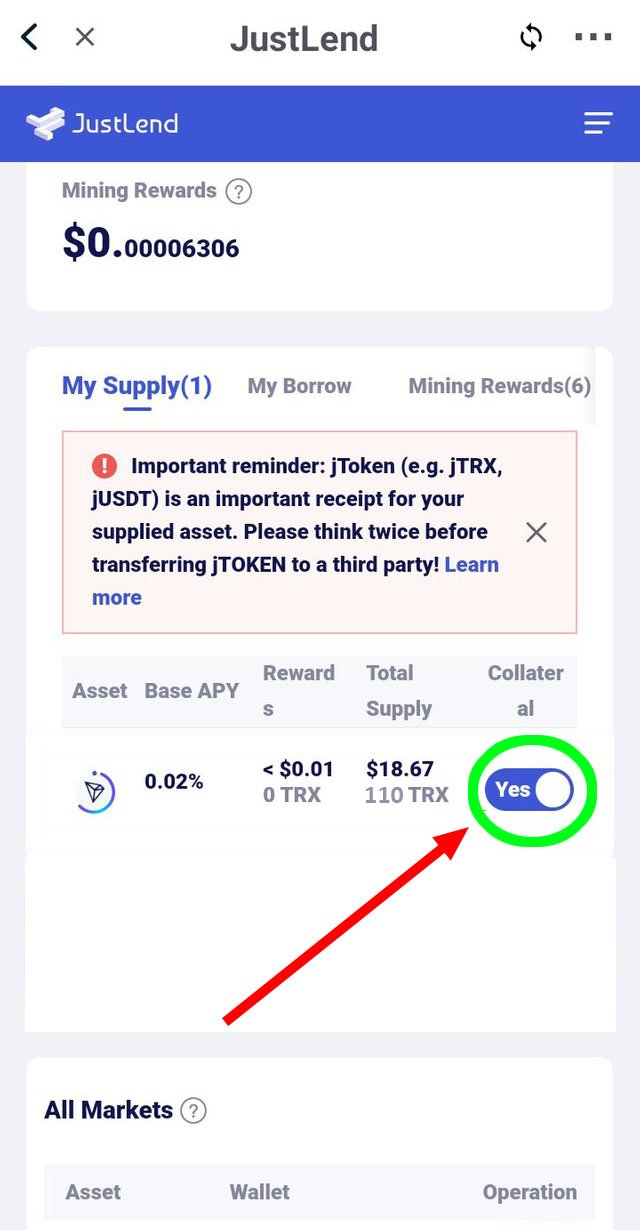

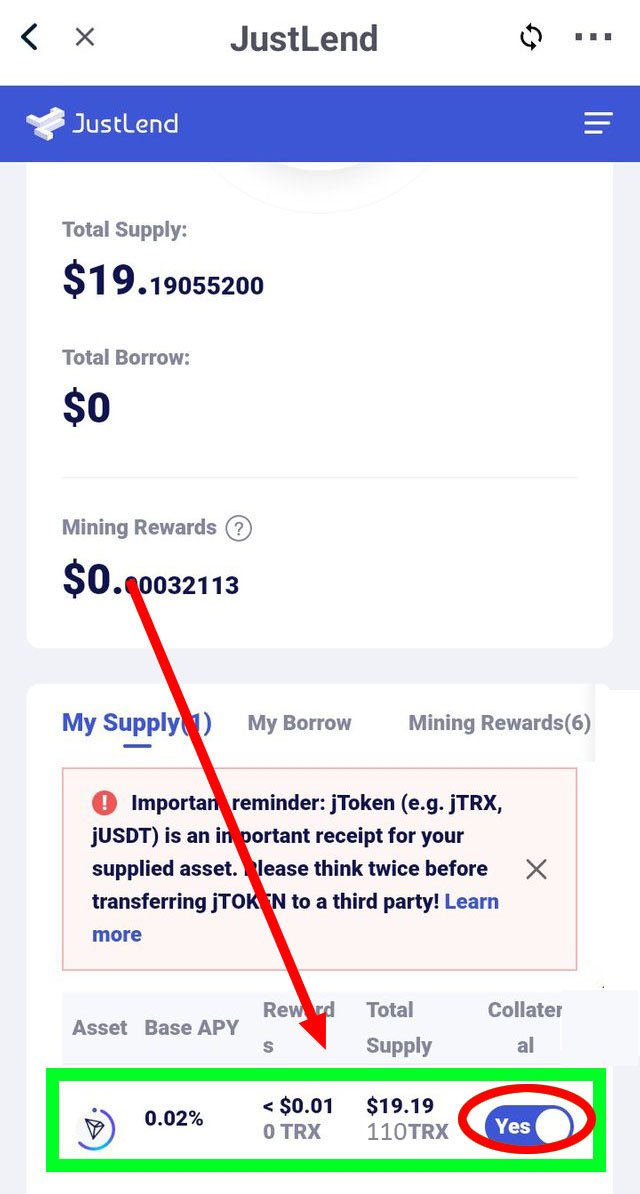

- First, I PUSH collateral to YES. Then I click on the Use TRX as collateral having my borrowed. Limit to be 12 $ which is altogether 75% of my TRX Total Supply.

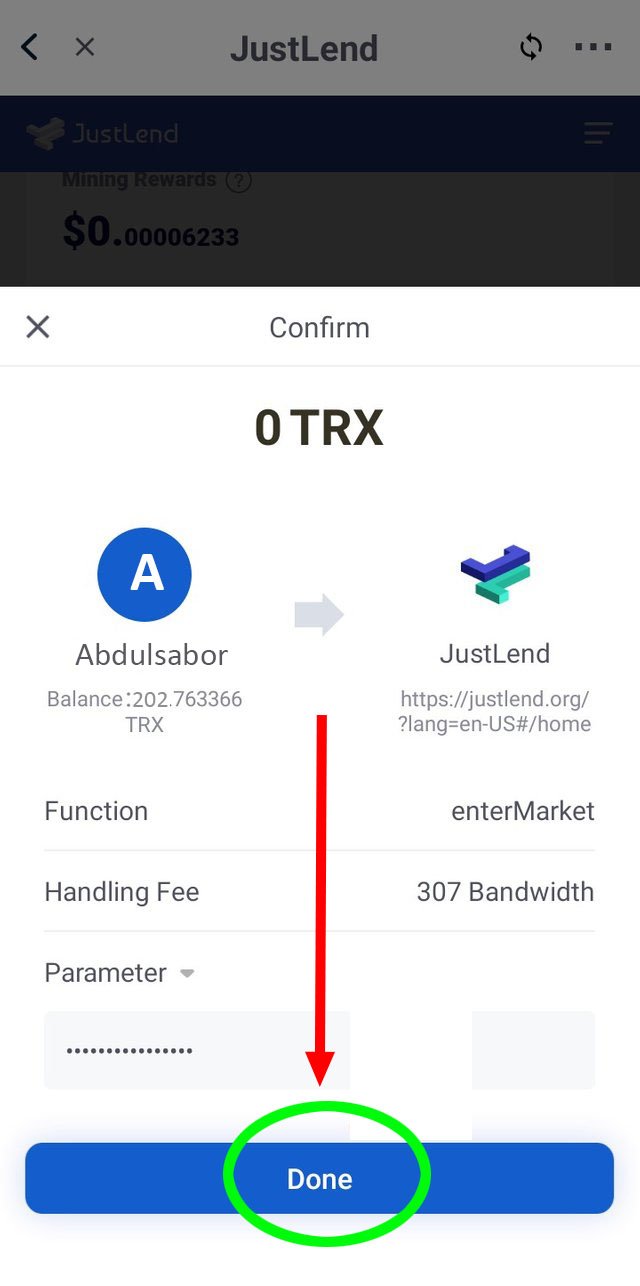

- I enter the password, and then click on the Done Button.

- Now as you can see the I have collateralized my jTRX.

Borrow Asset USDT

1.Next, I will the USDT Using the Justlend market.

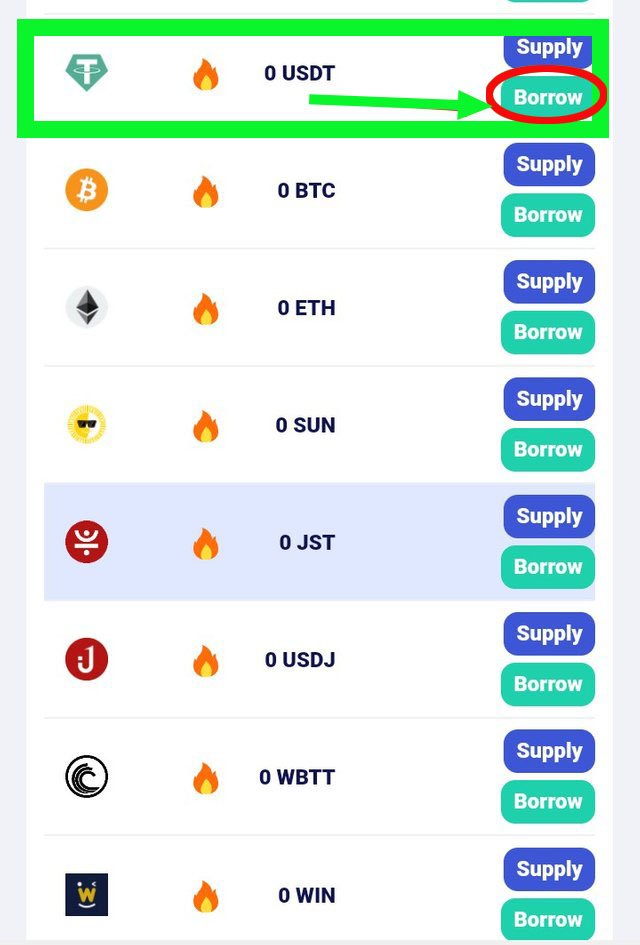

- Visit the Justlend market and Select the USDT.

- Click on the Borrow Button as the marked at top right of the screen.

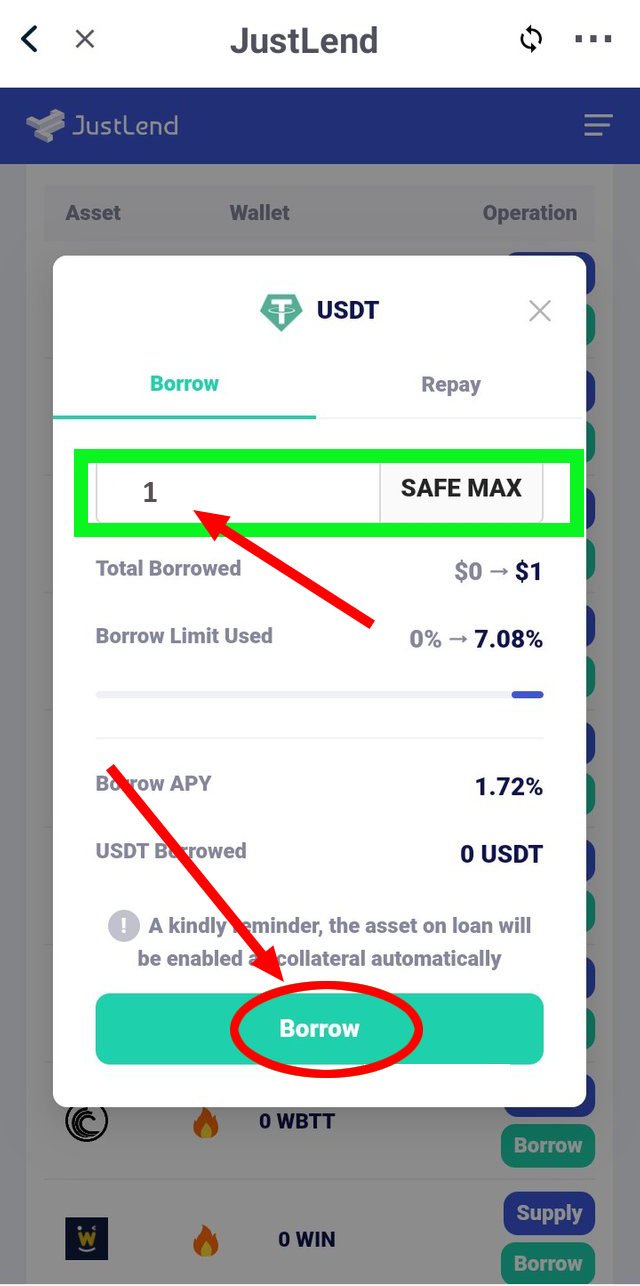

- I enter the 1 USDT in the textbox, then hit the Borrow Button

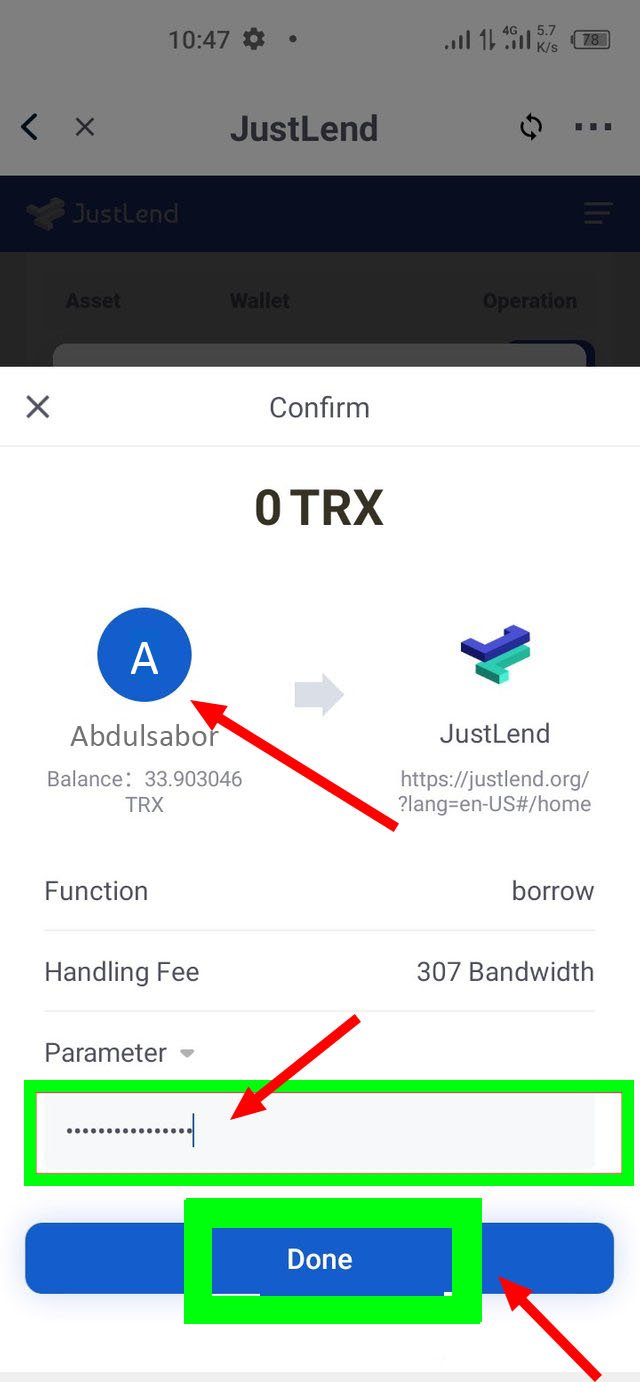

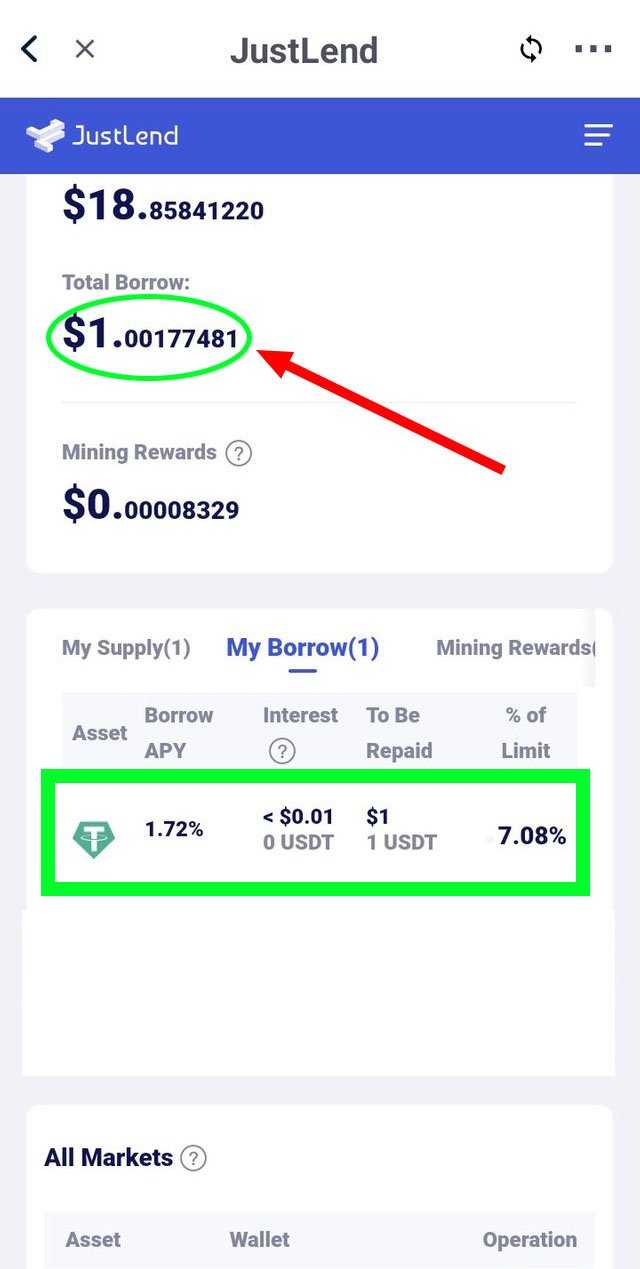

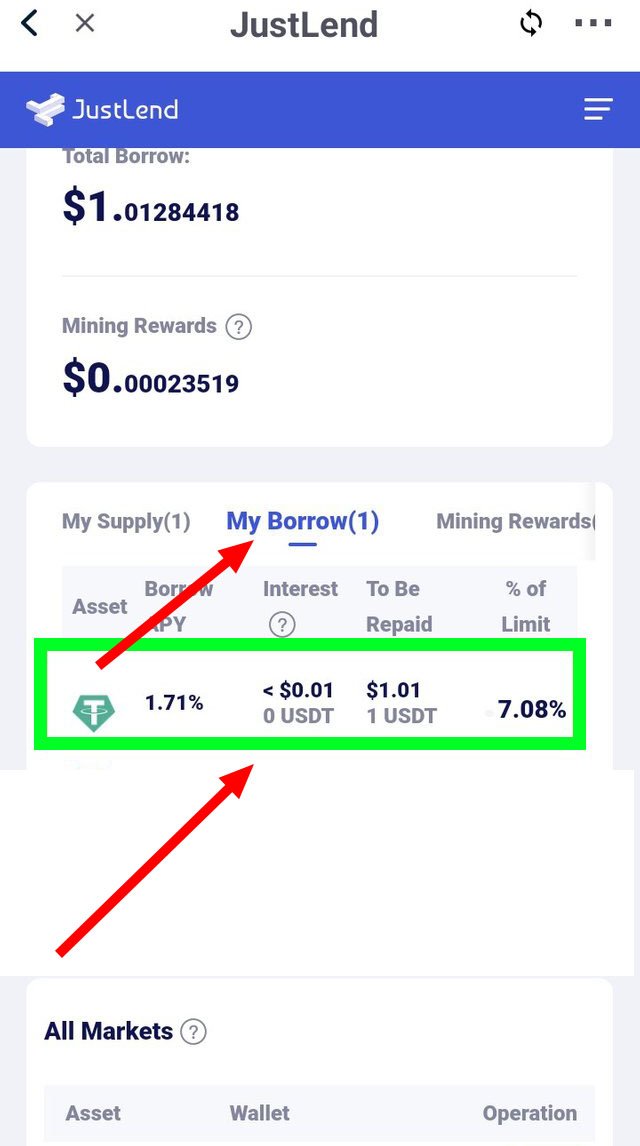

5 Then I Enter the Password, and hit the Done Button. - After Clicking I received 1 USDT returned to my justlend dashboard. You see my borrow 1 USDT.

Question 5:

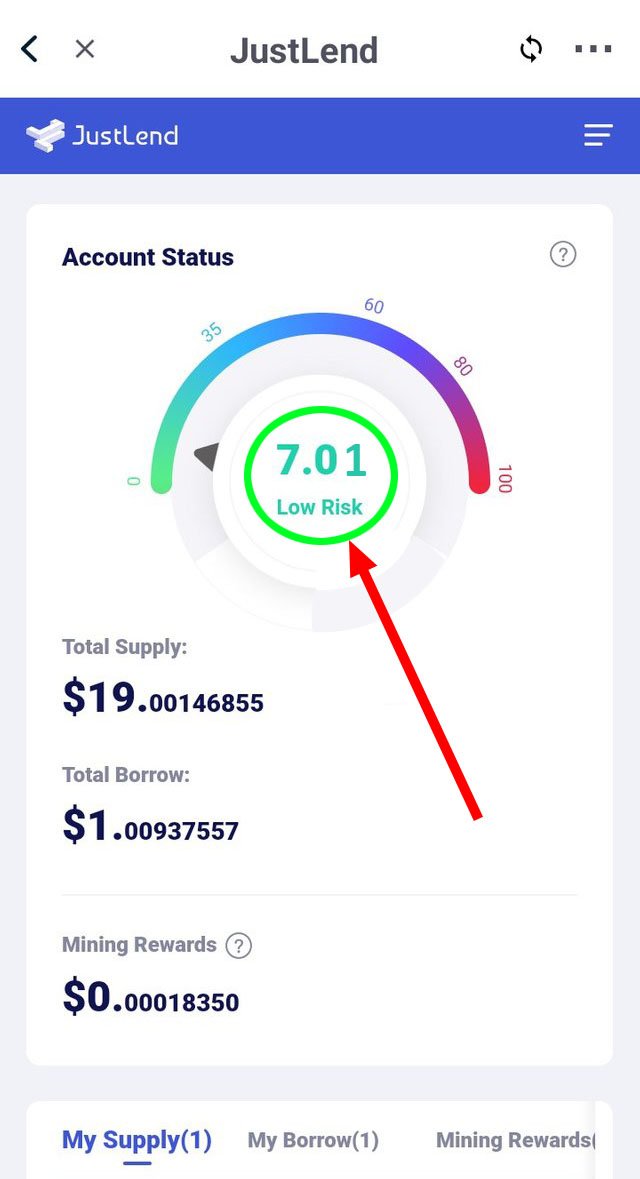

In this process I paid the interest in borrowed the 1 USDT is 0.01 USDT. In this process of borrow as account face the liquidation if risk level hits the 80%-100%. To make account safe it is advice to user to add more collateral. My account is just 7.01 risk. It means that I am safe in this state.

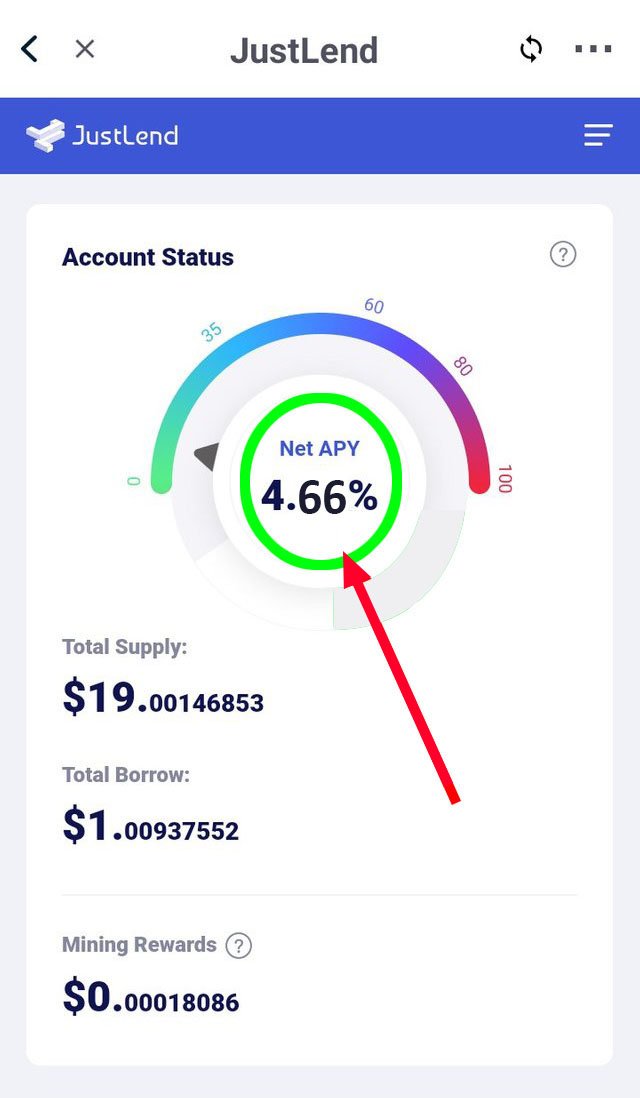

Net APY of mine

I supplied 110 TRX and get 4.59% and collateralized 75% of jTRX. So that I can borrow USDT from market. In process of borrow just 7.01% limit having the APY USDT is 1.72%. My net APY is equal to 4.66% and risk value is 7.01% which is low risk in the market.

Question 6:

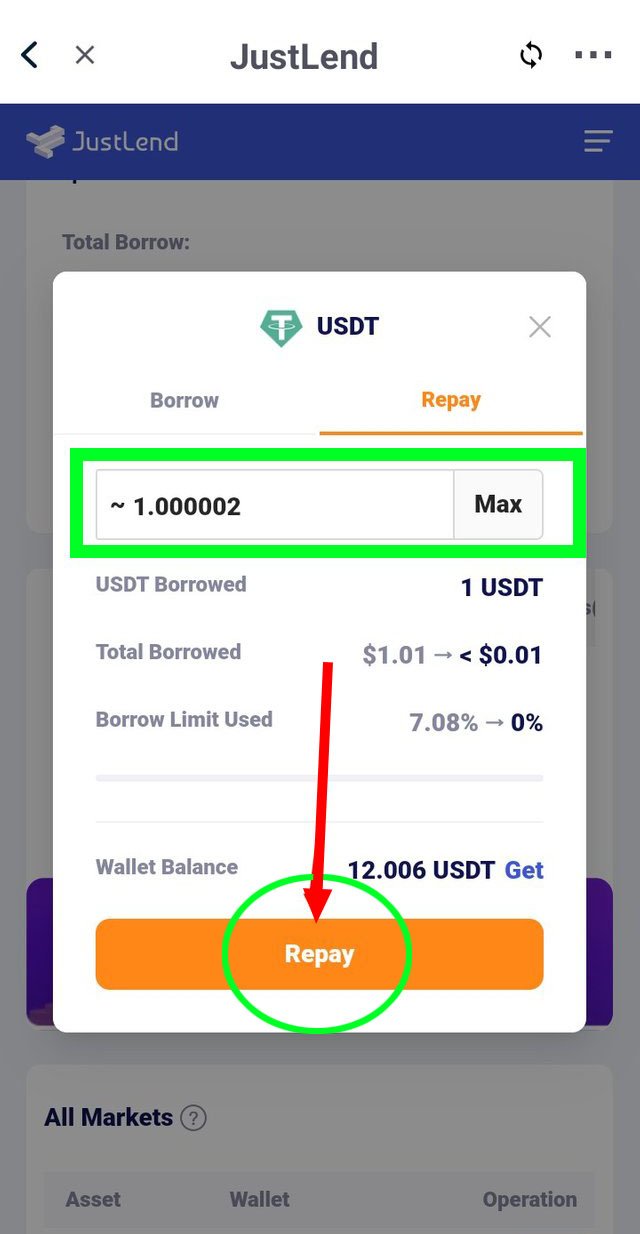

How can I repay the borrowed USDT?

1.First, we visit the www.justlend.org. It is done through my borrowed TronLink DApp.

- Then we move to the borrow tab on my dashboard. Then Click on the asset USDT.

- The repay Interface is appears.

- Then I enter the value of USDT to pay. Then Click on the repay button.

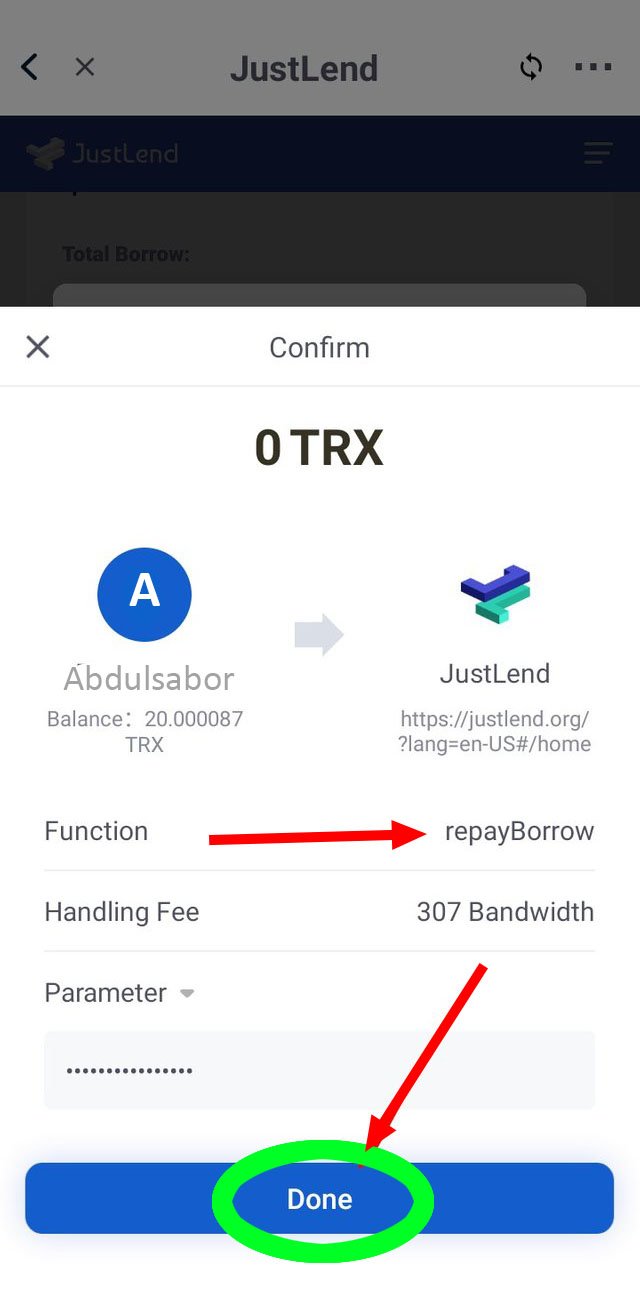

- Next, we enter the password for repay supply, then hit the Done Button.

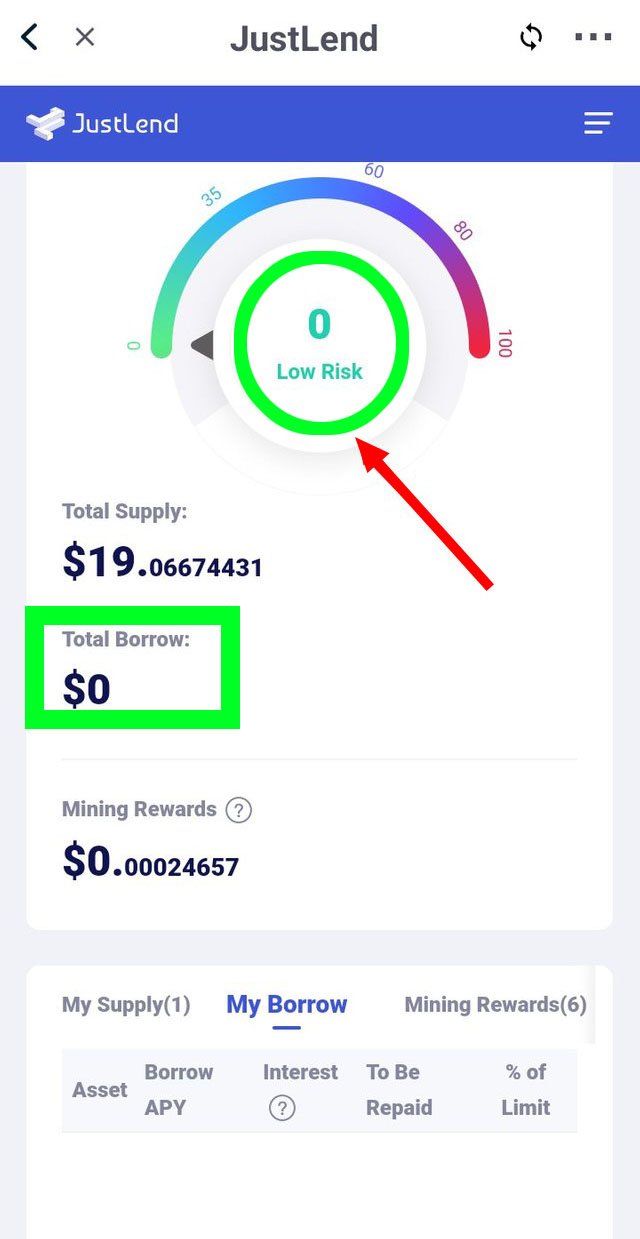

- Repay function of mine is successfully executed. I repay the value 1 USDT the 0-risk value of my account.

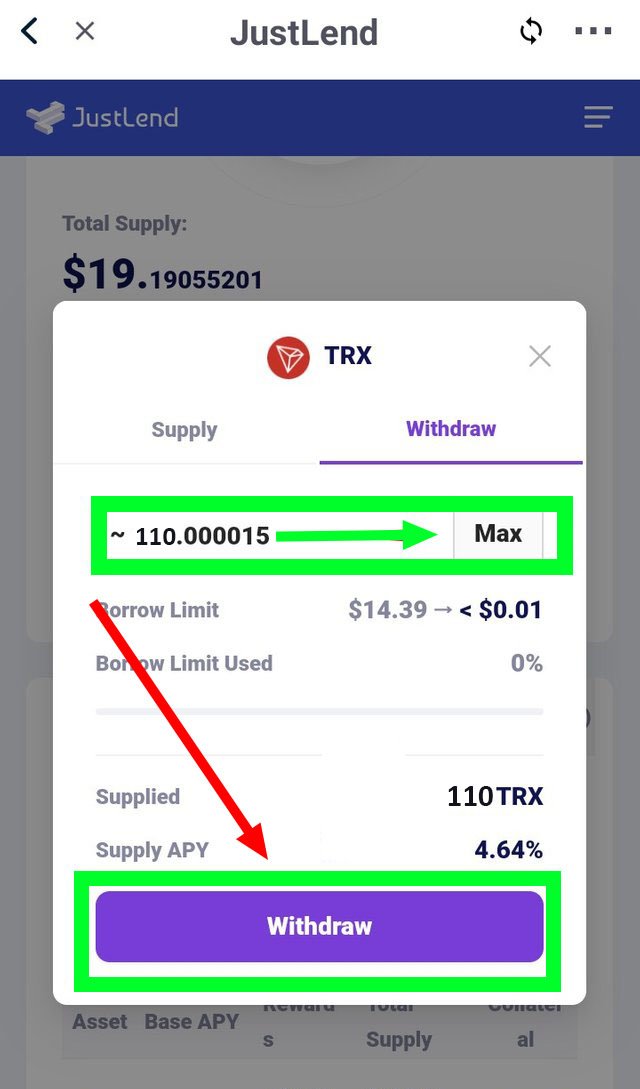

How to withdraw asset

To do withdraw we should follow the following step

1.In the dashboard and homepage of Justlend. we select the supply

- Then Move to Withdraw.

- Then we insert the value that we want to withdraw. I enter the 110 TRX Value. Then hit the Withdraw button.

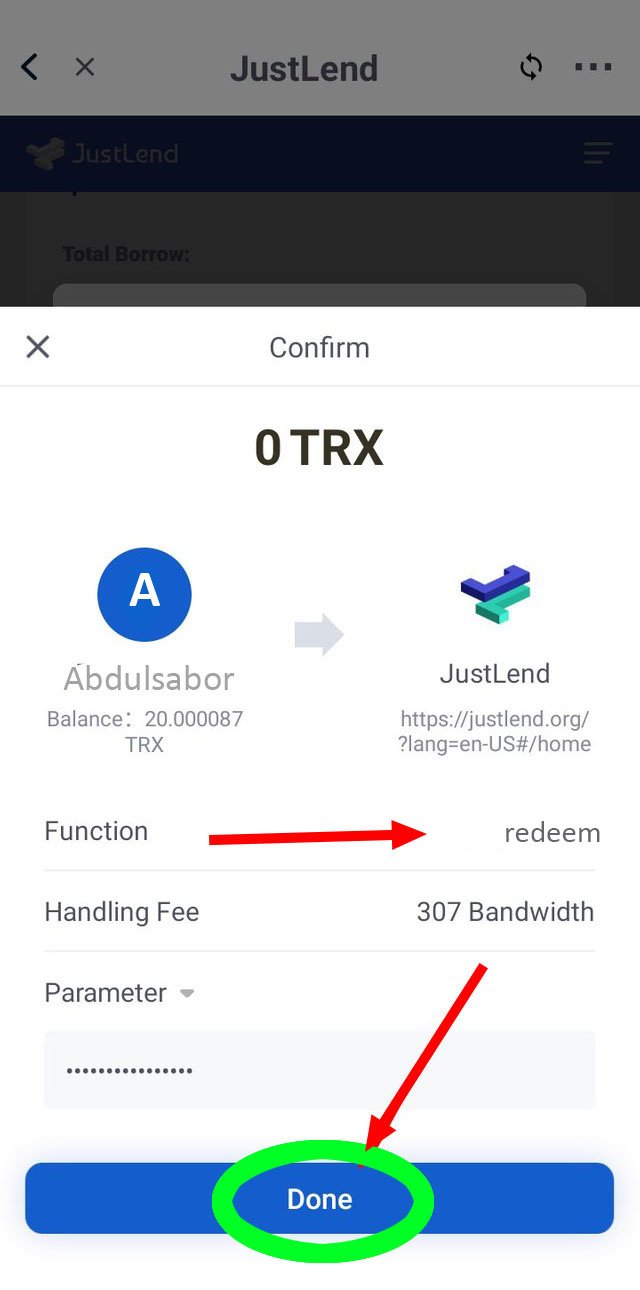

- Next, we move to password. After entering the password. Hit the Donebutton.

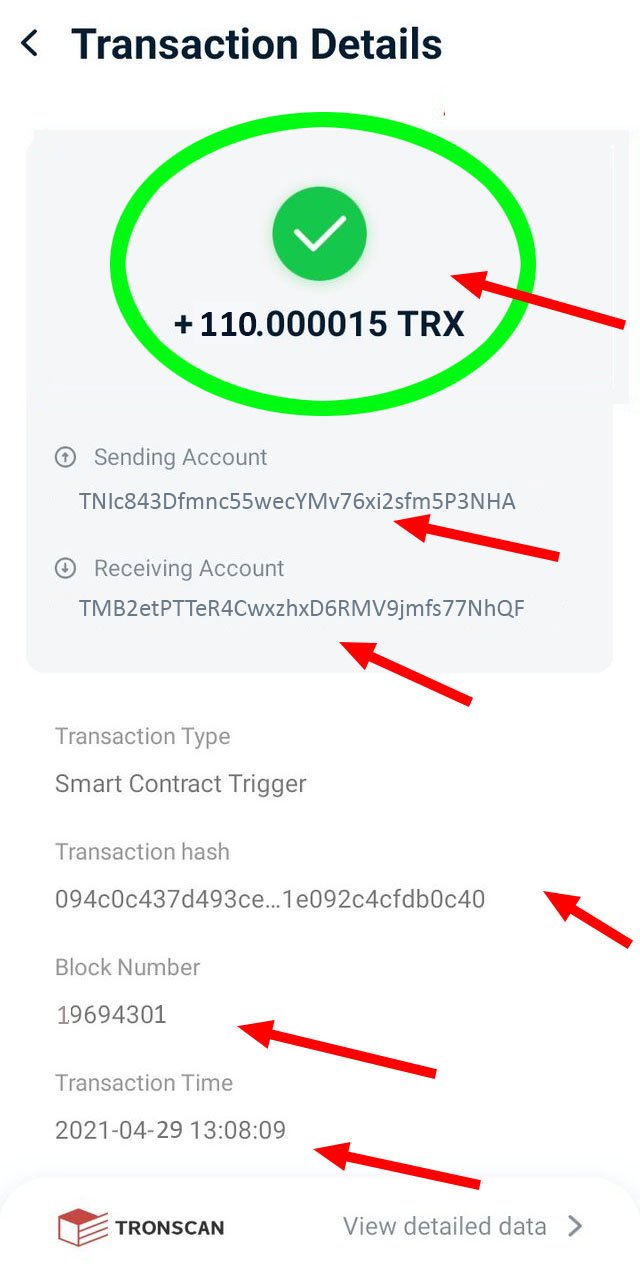

- Next, we can see our transaction is done successfully.

I this lecture of I have learn many things regarding transferring of asset. I learn that how to used Justlend and learn how to connect how to connect of Tron Wallet to justlend. I have learn more that how to supply token. In this lecture I lean about how to borrow asset and how to repay asset. I learn more about how to withdraw our asset. This lecture is very beneficial for me.

THANK YOU

Thank to Professor:

@sapwood

Written By:

@abdulsabor

Hi @abdulsabor,

Thank you for attending the lecture in Steemit-Crypto-Academy- Season 2 & doing the homework task-3.

As I can see, you have used a Wallet other than Steem integrated Tron wallet.

Can you please provide the Tron Wallet Address which you have used for this Task?

Thank you.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Dear Professor @sapwood here is my Tron Walllet Address .

TMB2etPTTeR4CwxzhxD6RMV9jmfs77NhQF

here is Link Of post

https://steemit.com/hive-108451/@abdulsabor/crypto-academy-or-or-season-2-or-or-week-3-or-or-homework-post-for-sapwood-or-justlend

Please rate on my post

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit