Hello to all and sundry, I welcome you all to the first week of the third season episode of the crypto academy session. I am much delighted to be part of this community once again.

I would be looking at the Ichimoku Kinko Hyo Indicator which was taught by our noble professor @kouba01. Before I commence I would like to acknowledge the effort of prof @kouba01 for lecturing on such a wonderful topic this week. Without much ado, we move on to the main agenda of this article.

What is Ichimoku Kinko Hyo Indicator?

The Ichimoku Kinko Hyo Indicator refers to a technical indicator developed by Hosoda Goichi (a Japanese newspaper columnist) in the 1930s. Ichimoku Kinko Hyo Indicator has the English name to be The Balance Chart From One Look. This indicator works based on the theory known as All-in-one theory. The Ichimoku Kinko Indicator helps to display information about the trend, support, resistance, momentum, and direction of an asset over a specific period of time. It does this by monitoring the asset's price behavior for a particular time.

This indicator is mainly about identifying patterns of an asset and its price behaviors and how the price of the asset goes back to the equilibrium state before moving in the opposite trend. It does all in this in one chart including the support and resistance movements.

Important Features of Ichimoku Kinko Hyo Indicator

The following features of the Ichimoku Kinko Indicator below enumerate some characteristics of it that differentiate it from the other indicators;

The Ichimoku Kinko Hyo Indicator helps to identify the support and resistance level in any trend at the time the asset's price is in an equilibrium state.

The Ichimoku Kinko Hyo Indicator can work independently without the support or aid of any different indicators as in MACD and RSI indicators where both are required to get accurate trend/ pattern of the asset's price.

It doesn't involve the use of any equation to set up on the chart pattern as in the case of Bollinger Bands indicator where we one has to calculate the Moving Average.

The Ichimoku Kinko makes it very easy for the analyst to easily identify spots or positions to start trade.

Lastly, the Ichimoku Kinko shows several price behavior of an asset over a specific time by using the trend/pattern of the asset, and this aid trader to know when to go in for an entry position and went to exit a trade.

The Different Lines (Components) in Ichimoku Kinko Hyo Indicator.

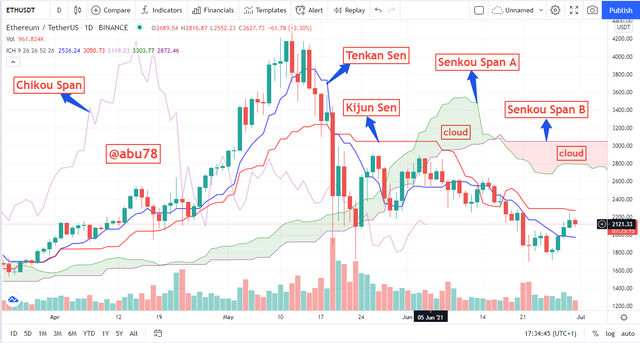

There are five different line in Ichimoku Kinko Hyo Indicator and they are; Tenkan Sen, Kijun Sen, Senkou Span A, Senkou Span B, and Chikou Span.

Let's briefly dive into each line and explain further.

Tenkan Sen (Conversion Line)

The Tenkan Sen line which is known as conversion line in English is the line that determines the volatility of the price of an asset over a period of time. The Tenkan Sen line is associated with the median price over a period of 9. This line is taken as the last line in which it determines the price volatility of an asset. It can be calculated by finding and adding the highest price to the lowest price of the asset over a period of 9 and then divide the answer by 2. This line with the aid of other Ichimoku lines helps to indicate short-term trends and signals. It can predict the short-term trend of assets by moving closely with the asset's price, as shown in the chart below.

Tenkan Sen line

Kijun Sen (Base Line)

Kijun Sen line is a median price point indicator just like the Tenkan Sen line indicated above. The difference between them comes in here in their calculation periods where the Kijun Sen line is calculated over a period of 26 candles. The Tenkan Sen and the Kijun Sen line use the formula, (Highest High + Lower Low)/2 in their calculation. This line is considered to be the slow line and it indicates the volatility for the long-term price of an asset. Both Tenkan Sen and Kijun Sen lines are referred to be the midpoint level of the lows and highs of any asset over a specific time.

Kijun Sen line

The Senkou Span A and the Senkou Span B

The Senkou Span A and Senkou Span B lines are the major components of the Ichimoku Kinko Hyo Indicator. The Senkou Span A is the average of Tenkan Sen and the Kijun Sen lines which is projected 26 periods into the future. The Senkou Span A is calculated using the formula;

(Tenkan Sen + Kijun Sen)/2.

The Senkou Span B is the median of the Highest High and Lowest Low over 52 periods and is also projected into the future in 26 periods. It can be calculated using the formal;

(Higher + Lower)/2. This is done on a period of the last 52 periods and the projected into the future on the 26 periods. When Senkou Span A and Senkou Span B are combined, an area called Kumo or Cloud is formed. This area is colored and it enables the analyst to easily identify the trend or pattern of an asset.

Senkou Span A and Senkou Span B

Chikou Span

This line is also known as the Lagging Span. It indicates the closing price of an asset in the last 26 periods. The Chikou Span plots the closing price of an asset 26 periods behind the currently closed price of the asset. It also helps to predict trend reversals.

Chikou Span line

How to Add Ichimoku Kinko Hyo Indicator on the Chart Pattern.

The following steps indicate the steps in setting up the Ichimoku indicator;

First of all, open tradingview website tradingview.com

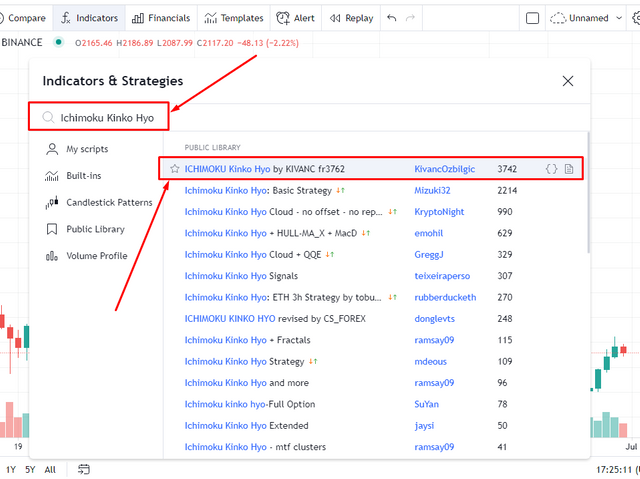

Click on indicators from the menu above as shown below.

Search for the (Ichimoku Kinko Hyo) indicator and click on one of them.

Closed the indicator search window and you would see the indicator fully set up.

Tradingview chart

Ichimoku Kinko

Ichimoku Kinko Hyo Chart

Ichimoku Kinko Hyo Indicator Defaults Settings.

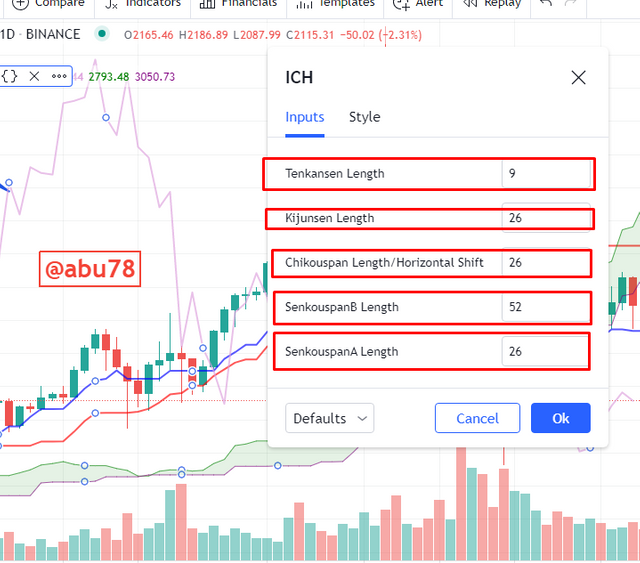

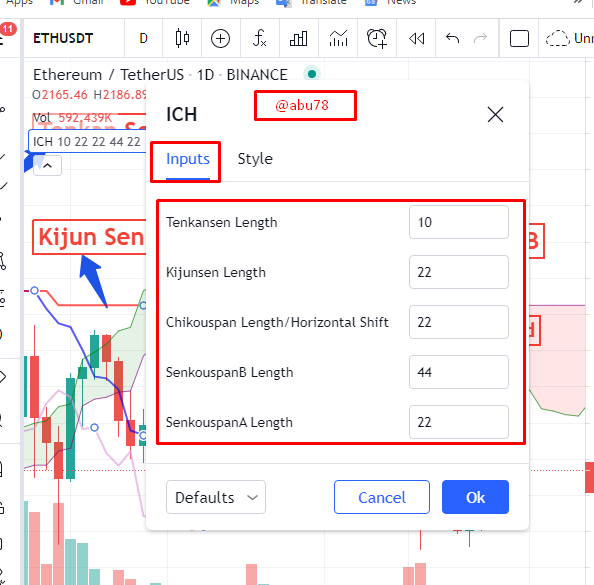

The Ichimoku Kinko Hyo Indicator's default settings have two sections i.e. Inputs and Style. Looking at each setting at a time;

Inputs

The Ichimoku Kinko Hyo Input setting has Length (Period) as the basic parameters. This Length comprises of Tenkan length, Kinju length, Chikou Span length, Senkou Span A length, and Senkou Span B length. The following indicates the default parameters for each line;

- Tekan Sen - 9

- Kijun Sen - 26

- Chikou Span - 26

- Senkou Span A - 52

- Senkou Span B - 26

From the above information, the Japanese that created this indicator include Saturday as a fully working day making it 6 days working day each week. In so doing, length 9 indicates a period of one and a half weeks, the 26 lengths indicate a month ( from 30 days a month assumption taking out the 4 Sundays), and the 52 lengths indicate a period of two months (26 X 2). This can be shown from the chart below;

Ichimoku settings - Inputs length defaults

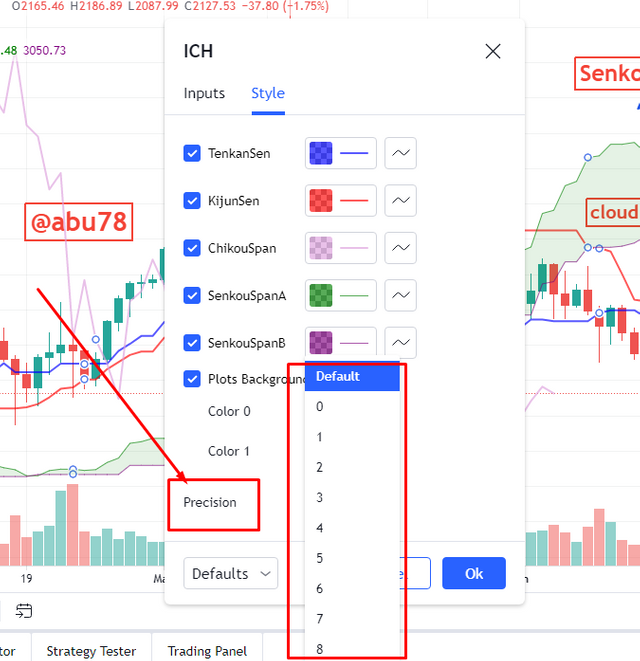

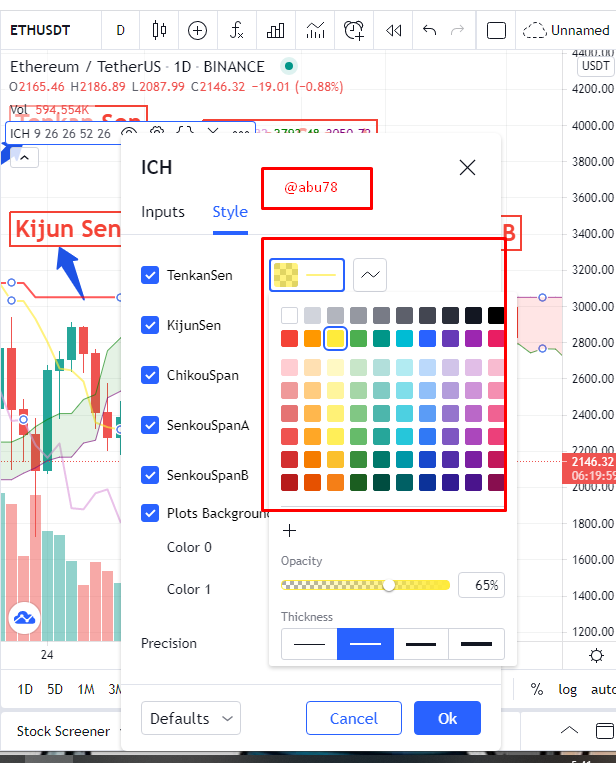

Style

Under the settings of the Ichimoku Kinko Hyo indicator, we have the color defaults for each line and the Precision settings as well. The screenshot below indicates the color parameters and the for each line on the Ichimoku chart.

Ichimoku settings - color parameters

Ichimoku settings - Precision parameters

Should the Ichimoku's default parameters be changed or not?

It can be altered just like other indicators too but before one should change the default parameter of the Ichimoku indicator's settings, one has to have an understanding of the period and the color of each line. Changing the parameters is the preference of the analyst and the above statement should be considered before doing so. Taking the default period as an example (9, 26, 52) which indicates trading days in one and a half weeks, a month, and two months respectively.

These parameters can be altered to (10, 22, 44) based on five working days in a week.

These parameters indicate that 10 would represent 2 weeks trading period, 22 representing a month trading period excluding Saturdays and Sundays, and 44 would represent two months trading period. This is just an example given and I would illustrate that on the settings menu below.

Changes in Input settings

Changing color under style settings

How to Use the Tenkan Sen line?

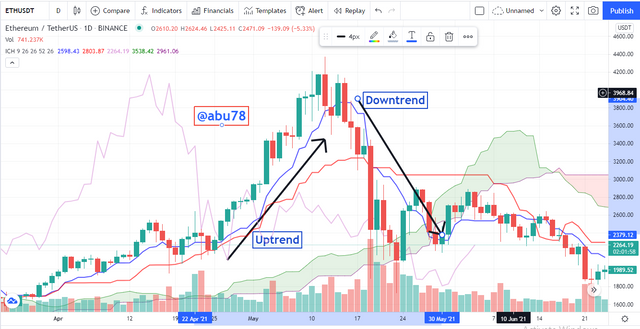

Tenkan Sen line as I mentioned earlier is considered as the fast line and it helps to indicate the price volatility of the asset over time in a short period. It is also considered as the highest high and lowest low of an asset over the period of 9. The Tenkan Sen line helps to identify the trend of an asset for a specific period of time. The Tenkan Sen line helps traders to have insight into the trend of the market by showing an upward trend (bullish) or a downtrend trend (bearish).

Tenkan Sen line also aids in identifying points of supports and resistance on charts especially when the upward or downward trends stop. The diagram below indicates how it is used to indicate downtrend and uptrend on a chart. It moves closely with the market price of the asset.

Using Tenkan Sen line to indicate trends

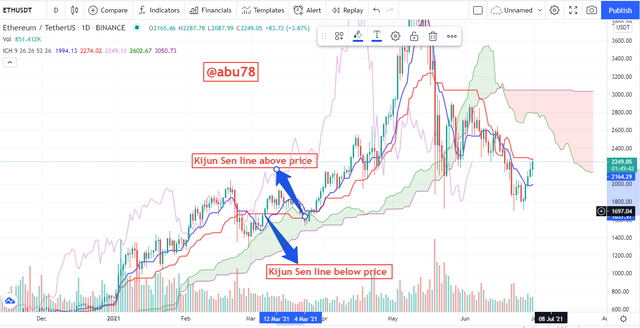

How to Use the Kijun Sen line?

This line as I already indicated earlier also helps in determining the price behavior of an asset in a long-term position. Its calculation is similar to that of the Tenkan Sen line just that it's works based on 26 periods. Meaning, its calculation would now be 26 periods of higher high and lower low divided by 2. The Kijun Sen line when seen above the market price of the asset on the chart pattern, it indicates an upward trend (bullish) and when it is seen below the price of the asset on the chart, then a downward trend (bearish) is indicated.

The chart below gives a detailed explanation.

Using Kijun Sen line to indicate trends

How to use the Tenkan Sen line and the Kijun Sen line together

It is very easier when using the Tenkan Sen line and the Kijun Sen line together in indicating the price trends of an asset. When the Tenkan Sen line and Kijun Sen line are used together, they make it very clear to the analyst or trader as to when to go for an entry position or an exit position.

In using both lines, when the Tekan Sen line is seen above the Kijun line, then there is an indication of a bullish trend in the market's price and this gives traders the go-ahead to go in for a buy position.

On the other way round, when the Kijun Sen line is seen above the Tenkan Sen line then an indication of a downtrend (bearish) and signals a sell position option to traders to enter.

Tenkan Sen above Kijun Sen and vice versa

What is the Chikou Span line?

The Chikou Span line as I already indicated earlier is also know as the lagging line. It's used in determining the closing price of an asset on the chart in the last 26 periods. This means that it aids to determine the closing price of assets in the previous 26 periods before the current closing price.

How to use the Chikou Span line?

The Chikou Span line is also an important line that helps traders to decide when to go for an entry position or an exit position by indicating the previous closing price of an asset and compared to that of the current or recent closing price. The position of the Chikou Span line is usually at a far position from the market price of the asset. There is a bullish indication when the Chikou Span line crosses over the market price of the asset and this gives a trader a buy order or position. Likewise, when the Chikou Span line crosses below the market price of the asset then a bearish trend is expected and this indicates sell position for traders.

Chikou Span line above and below the Price level

Why is Chikou Span often Neglected?

The following points indicates some of the reasons Chikou Span line is being neglected;

Chikou Span line appears as uptrend or downtrend movement signals without any visible action shown on the pattern of the asset.

It's efficiency relies on the other components of Ichimoku indicator and as such users tend in neglecting its use.

It only determines the previous closing price of the asset and does not give any indication of the future price forecast of the asset.

Sometimes when it crosses over and below the market price of the asset concurrently without any relevant trend in its movement, then users tend to neglect it.

What is the best time-frame to use the Ichimoku Indicator

The time frame for using the Ichimoku indicator is limitless and it can be used at any time-frame depending on the trading nature a trader is using. Traders who wish to go in for a short-term trading can use low time-frame such as minutes to a few hours. On the other hand, long-term traders can go in for higher time-frame sucah as the daily or weekly time-frame. Higher time frame because this would make it very easy and clear for them to analyse the market trend for their choice of trade.

One useful feature of the Ichimoku Indicator is that, it can be used by all types of traders, i.e. short-term traders and long-term traders at any time-frame of their choice starting from minutes going upwards. Short-term traders can use time-frame range of 1 minute to 6 hours whilst long-term traders can use higher time-frame ranging from daily to weekly.

Which indicator is suitable to be used with the Ichimoku Indicator?

As I already mentioned above under that the Ichimoku indicator is it being an All-in-One indicator meaning that it can work independently without the help or support of other indicators. Regardless of this feature of it, every indicator gives suitable results when used with other indicators and with the case of the Ichimoku Kinko indicator, it works best with the Relative Strenght Index (RSI) indicator. I would show a good example here below using the following chart.

Ichimoku Kinko Hyo used with RSI on the chart

Looking at the ETHUSDT chart above, there was an oversold at the 38.87% which was an indication of trend reversal ( bullish trend). There was a delayance with the Tenkan Sen line crossing over the Kijun Sen line which gave a late bullish signal.

This has indicated a situation whereby a bullish trend has occurred before the Ichimoku indicator showing it. This is a clear indication of how useful the RSI is to the efficiency of the Ichimoku Kinko Hyo Indicator when used together.

Conclusion

The Ichimoku Kinko Indicator is an indicator with five different components that helps it in identifying trends, supports, resistance, price movements and volatility of assets. It can work on its own without the support of other indicators but it gives more efficient results when used with the RSI indicator.

I am very really gotten the understanding of this indicator and I would make sure I would utilize it anytime I want to make a trade. I would like to say a very big thank you to prof @kouba01 for such a wonderful lecture. I wish for you convenience in your work.

My regards;

@abu78

Dear @abu78

Thank you for participating in Steemit Crypto Academy Season 03 and making efforts to complete the homework task. You got 8.5/10 Grade Points according to the following Scale;

Key Notes:

We appreciate your efforts in Crypto Academy and look forward to your next homework tasks.

Regards

@cryptokraze

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks for your kind review.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit