Greetings to all and sundry on this great platform, I am very much delighted to write and submit my homework post assigned by professor @cryptokraze. Before I commence I would like to use this opportunity to congratulate him and the newly appointed professors for indeed they really deserve it. I admit to the fact that I have read and understood his lecture and it was really interesting reading and participating in his class.

Without much ado, I would like to give my response to the assigned task on the concept of market structure.

What is Market Structure?

Market structure refers to the representation of the price movement of an asset in either an uptrend direction or a downtrend direction with the aid or use of graphs. This graphical representation provides traders with information that would guide them in trading and thereby helps them to acquire profits and avoid losses.

The reaction existing between buyers and sellers in crypto trading leads to the creation of the wave-like movement of the price of an asset. This tends to produce points called supports and resistance levels of the price of the asset. The movement of the price of an asset tends to be in either an upward direction (uptrend), downwards direction (downtrend), or a sideways direction(consolidation). This movement type differs in the market structure and I would like to throw more light on each of them below.

What is Uptrend Market Structure?

An Uptrend market structure refers to the graphical representation of the price movement of an asset in the upward direction. The movement creates a sequential consistency of highs and lows positions because of the wavelike movement of the price.

The Uptrend movement of the price of any asset is observed when the movement is in a manner where the current high price of the asset moves higher than the previous high price. A good example is illustrated below,

What is Downtrend Market Structure?

Downtrend market Structure refers to the graphical representation of the price movement of an asset in the downward direction. The movement creates a sequential consistency of lows and highs positions because of the wavelike movement of the price.

The downtrend movement of the price of any asset is observed when the movement is in a manner where the current low price of the asset moves lower than the previous low price. A good example is illustrated below,

What is Sideways Market Structure?

Sideways market structure refers to the graphical representation of the price movement of an asset within a specific range price range. The asset's price movement here is in between the support and the resistance level until a breakout is observed. The price movement of an asset in the sideway market structure is sometimes defined as the sideways fluctuation of price. A good example is illustrated below,

Lets now look at the concept concerning the Highs and Lows in the market structure below

The Concepts regarding Highs and Lows

As indicated above in this article, the movement of the price of an asset is in a wave-like form and there is the creation of points in its movement. The points created indicates support level, resistance level and also indicated the future price movement of the asset thereby aiding traders to avoid losses and make profits.

These points can be classified under each market structure, i.e. there are Higher highs and higher lows in an uptrend market structure and also Lower Highs and Lower Lows in a downtrend market structure. I would demonstrate each of these classifications below,

The Higher Highs

Higher high refers to the type of uptrend in the market structure that is created as a result of the swing movement of the assets price resulting in the creation of a high higher than the assets previous high price. In doing so an upward movement is established thereby resulting in an uptrend. To confirm that a point is a higher high point, the new high has to be significantly and obviously higher than the previous high. A good example is illustrated below,

The Higher Lows

Higher Low refers to the type of uptrend in the market structure that is created at the low point of an uptrend. This point (higher low) is such that the current higher low point is higher than the previous higher low point. The higher lows are an indication of an uptrend (bullish). They influence the assets price bullishly. A good example is illustrated below,

The Lower Highs

Lower highs refer to a type of downtrend in the market structure that is created as a result of the downward swing movement of the assets price thereby forming a high which is lower than the previous high. The lower highs are such that the current high created is lower than the previous high in the trend of the market. Lower highs at the top of an uptrend are the indication of a downtrend (bearish).

A good example is illustrated below,

The Lower Lows

Lower low refers to the type of downtrend in the market structure that is created as a result of the downward swing movement of the assets price which leads to a low lower than the previous low point. The Lower lows are such that the current low price is lower than the previous low price. Also the current must be significantly lower than the previous low point before it can be confirmed as a lower low point. It helps to avoid false price signals. A good example is illustrated below,

The Trend Reversal using MSB

Trend reversal in the market structure is a result of the attitude of buyers to sellers and sellers to buyers as well. This leads to an early trend reversal in the market structure. This early trend reversal is such that its formation is as a result of a lower high and lower low being at the top of an uptrend and also the formation of a higher low and higher high at the bottom of a downtrend. A detailed explanation of early trend reversal in an uptrend and downtrend with charts is shown below.

The Early Trend Reversal in an Uptrend

The formation of an early trend reversal in an Uptrend is the result of a lower high and a lower low forming at the top of an uptrend. When the previous higher low point breakout, this indicates a change in trend from an Uptrend to a downtrend.

This can be seen in the illustration below,

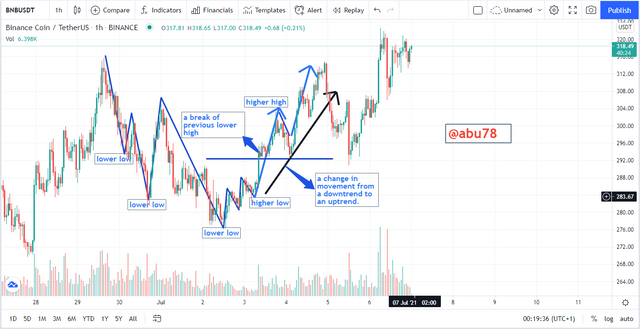

The Early Trend Reversal in a Downtrend

The formation of an early trend reversal in an Uptrend is the result of a higher low and a higher high forming at the bottom of a downtrend. When the previous lower high point breakout, this indicates a change in trend from a downtrend to an uptrend.

This can be seen in the illustration below,

The Trade Entry Criteria Using MSB

As we all know that every trading strategy has rules that one should follow and so is the market structure break strategy too. It also has rules which one must abide by when using it in trading. I would enumerate the criteria involved for both buy entry and sell entry criteria as well.

The Buy entry criteria

The following includes the criteria for a buy entry when using market structure break strategy;

- There should be a clear formation of a higher low point.

- There should be an obvious downtrend forming a lower highs and a lower lows.

- There should be an obvious bullish candle that breaks and close above the previous lower high point, meaning that it should break the resistance level.

- Lastly, the buy trade should be opened once the bullish candle closes above the previous lower high point.

A good example is illustrated below in the following chart,

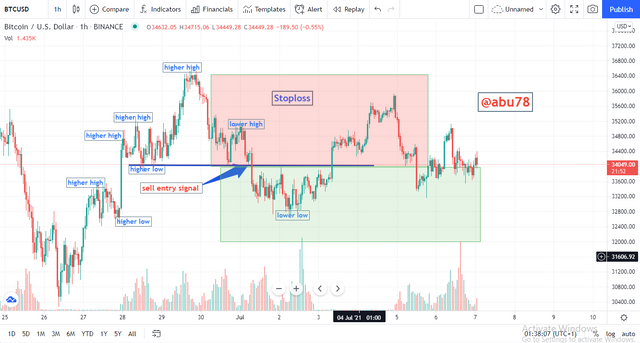

The Sell entry criteria

The following include the criteria for a sell entry when using market structure break strategy;

- There should be a clear formation of a Lower high point.

- There should be an obvious formation of a lower high point

- There should be an obvious bearish candle that breaks and close above the previous higher low point, meaning that it should break the support level.

- Lastly, a sell trade should be placed once the bearish candle closes above the previous higher low point.

A good example is illustrated below in the following chart,

The Trade exit criteria using MSB

Exiting a trade-in market structure strategy can be done in the following three methods;

- Stoploss hit

- Take Profit hit

- Manual closing

I would like to explain each method below,

1. The Stoploss hit method

Stoploss refers to the predetermined price of an asset that helps in protecting the capital of the trader especially when the trend of the market moves in the opposite direction.

The Criteria include the following

- There should be a stoploss involved in the trade

- The stoploss have to be kept below the lower low point slightly in a buy trade as indicated below.

- On the contrary, in a sell trade the stoploss should be kept above the lower high point slightly as indicated below.

2. The Take Profit hit method

The predetermined price which is set in the trade by traders in order to make profits is termed as the take-profit price.

The Criteria include the following

- There should be a stoploss involved in the trade

- The risk to reward ratio for take profit should be of minimum 1:1.

- The market structure would be considered in a take-profit application.

Demo Trade Using the Market Structure Break Strategy

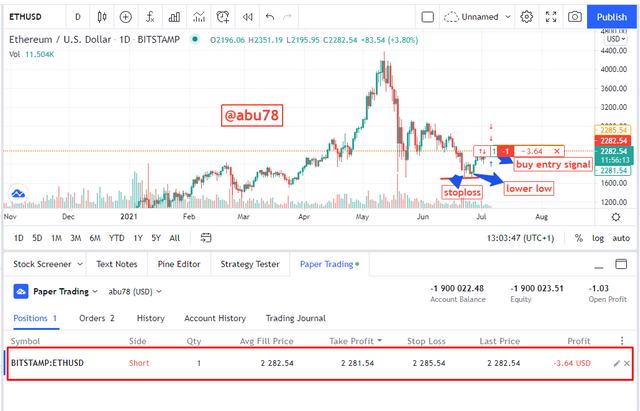

Demo Trade 1 Ethereum (ETH/USD)

Before I executed the sell order here, I observed the consistent formation of higher highs and higher lows on a 1D trading range. I executed a sell order once the price forms a lower high and a break and close of the price below the higher low point.

The stoploss and take profit was set in a ratio of 1:2 risk to reward.

Demo Trade 2 Ethereum (ETH/USD)

Before I executed the sell order here, I observed the consistent formation of lower lows and lower highs on a 1D trading range. I executed a buy order once the price forms a higher low and a break and close of the price above the lower high point.

The stoploss and take profit was set in a ratio of 1:3 risk to reward.

Conclusion

Market Structure strategy is very important to every trader in predicting the trend of the market. Before one uses this strategy, he/she should be an experienced trader. The market structure break strategy helps to indicate the possible reversal trend of assets. The use of the market structure with indicators helps to provide an accurate analysis of the price trend of an asset.

I have read and understood this lesson and I would like to say a very big thank you to prof @cryptokraze for such a wonderful lecture.

Thanks to all for reading and passing by my post.