Greetings to all steemians on this great platform, I am much delighted to write in sharing my homework post for this week's assignment. But before I commence, I would like to use this opportunity to appreciate and acknowledge the good efforts of our professor @stream4u for being with us at the start of the season and giving us all these powerful lectures. We are very grateful Sir.

Pivot Point

Since the start of this Season's Crypto Academy, we have been able to learn more about indicators covering all the types or categories of indicators. Today we shall be looking at Pivot Point.

Pivot Point refers to a technical indicator that allows traders/investors to identify the total market trend. In determining the pivot levels, the pivot point uses the closing price, intraday highs, and intraday lows in calculations. The Pivot Point is the main point of this indicator and that is what helps in determining the market trend. Also, the resistance levels and the support levels are found in this type of indicator. The levels help traders in going for entry or exit trades or a reversal signal or continue signal.

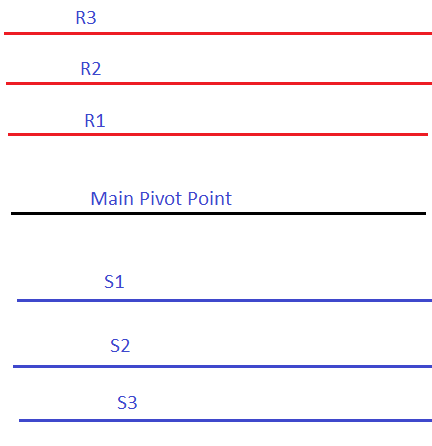

Pivot Point Levels

The pivot point levels in this indicator are the main asset in determining the market trend. The main pivot level is the main indicator level and it's found to be the middle line on the chart.

The levels that are above the main pivot level are the resistance levels while those below the main pivot level are the support levels. The market price is considered to be at a bullish trend when the price is above the main pivot level. This indicates that the resistance level gives a signal of possible reversal and also indicates a profit point in the market trend.

Again the market price is considered to be a bearish trend when the price is below the main pivot point. i.e. enters the support level.

Meanings to the Pivot Point levels

Main Pivot Point level (PP): This refers to the main level on the chart that indicates the current market trend. The market trend is considered to be bullish when the price trade is above the PP. In the same way when the price of the trade is below the PP then a bearish signal is considered and traders are advised to sell their assets at this period.

Resistance 1 (R1): This indicates the first level of resistance that is seen above the main pivot price (PP). The price at this level is considered to move in the reverse direction but a further breakthrough above this level is taken to be a continuation bullish trend.

Resistance 2 (R2): This indicates the second level of resistance that is seen above the main pivot price (PP). The price at this level is considered to reverse to the opposite direction but a further breakthrough above this level is considered to be a continuation of the bullish trend.

Resistance 3 (R3): This indicates the third level of resistance that is seen above the main pivot price (PP). The price at this level is considered to reverse to the opposite direction but a further breakthrough above this level is considered to be a continuation of the bullish trend.

Support 1 (S1): This indicates the first level of support that is seen below the main pivot price (PP). The price at this level is considered to reverse to the opposite direction but a further breakthrough below this level is considered to be a continuation of a bearish trend.

Support 2 (S2): This indicates the second level of support that is seen below the main pivot price (PP). The price at this level is considered to reverse to the opposite direction but a further breakthrough below this level is considered to be a continuation of a bearish trend.

Support 3 (S3): This indicates the third level of support that is seen below the main pivot price (PP). The price at this level is considered to reverse to the opposite direction but a further breakthrough below this level is considered to be a continuation of a bearish trend.

The support and resistance levels help traders in determining when to buy and sell their assets in the crypto market by looking at the current price and the trend in which it is moving towards.

Pivot Points Calculation and R1 R2 S1 S2 Pivot Levels Calculation

The previous day's high, low and close prices are used in calculating the pivot points of a given cryptocurrency. For instance, in calculating the pivot points for Today (Wednesday), we use the high, low, and close price of yesterday's (Tuesday) and use it in the calculation of the pivot point for Today (Wednesday).

Formula in calculating for Pivot Point

PP =(High + Low + Close)/ 3

Where,

PP = the pivot point

High = the highest price of the previous day

Low = the lowest price of the previous day.

Close = the closing price of the previous day.

After calculating for the main pivot level (PP) then it can be used in calculating the support and resistance levels. As we can see from the formulas below that S1, S2, R1, R2 are all dependent on PP, then there is the need to calculate for PP before calculating for any of them.

Below are the formulas calculating for S1, S2, R1, and R2.

S1 = 2 * PP - High

S2 = PP - (High -Low)

R1 = 2 * PP - Low

R2 = PP+ (High - Low)

How to Apply Pivot Points on Chart

Steps:

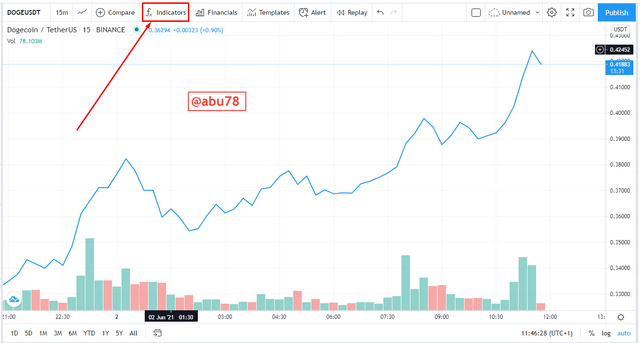

1.I would be using tradingview chart to indicate the steps. Open tradingview Chart and choose any pair of your choice. (DOGE/USDT)

2.Click on (fx) indicators from the menu bar above.

3.Select Candlesticks Patterns and Search for Pivots from the search box and then click on Pivot Points Standard.

after adding the pivot point standard

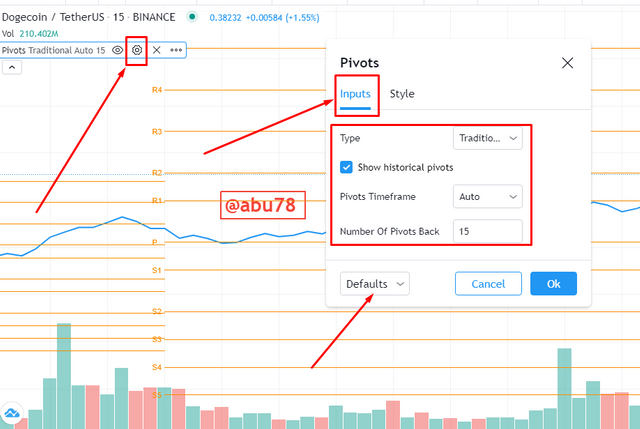

How to configure Pivot Points Indicator Settings

First, click on the Settings icon from the indicator toolbar. Change the inputs settings of the indicator if you wish or you select default settings as seen from the screenshot.

Pivot Input settings

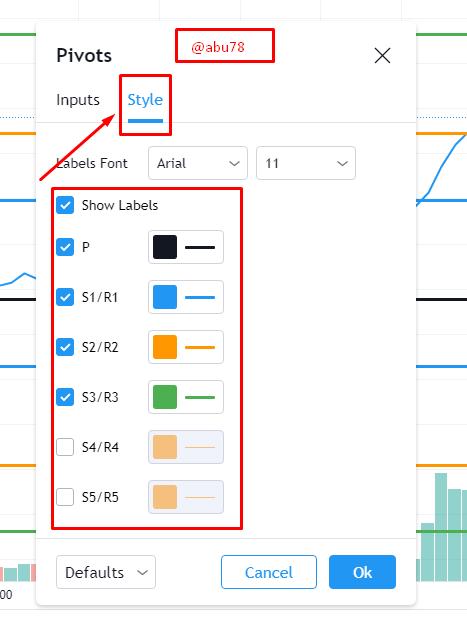

Now we move onto the style settings where we can change the color of the support and resistance level and also the main pivot level. One can also select the label size and label fonts as well.

I would use black for my (P), blue for R1/S1, orange for R2/S2, and Green for R3/S3. I also selected

Pivot Style settings

after changing the style settings

How Pivot Points Work

In determining the market price trend of an asset the main pivot point level is what is used. This pivot point can be calculated from the previous day's high, low, and closing price of the asset. When the price trend of the market is trading above the PP then it is considered as a bullish trend. In the same way, when the price is trading below the PP we consider it as a bearish trend.

Again, the support and resistance levels pivot points also aid the trader to go in for a buy position or a sell position. This aids the trader to make profits and avoid losses. There are incidences when the price reverses after reaching the resistance level and sometimes also it breaks through above the resistance level. It is advisable that a trader take profits at these levels or make a short trade during these levels because they are the reversal points and the price trend can reverse in the opposite direction at any point during such periods.

Price trading above PP

Furthermore, when the price trend tends to move towards the support level, a trader can go in for a long position because the possibility of the price going bullish is high as the price tends to move in the opposite directions during the support level. In the case where the price breaks below the support level then a further bearish trend is considered. Traders in short positions can take advantage of the price at the support levels and make profits.

Pivot Points Reverse Trading

I shall be illustrating how the reverse price occurs at the R1, R2, and S1, S2. The price reverses upwards from the support level and Reverses downwards from the resistance level. As I already explained, the resistance and the support levels are the points which help a trader in taking decision regarding buy or sell of any asset in order to make a profit or avoid a loss.

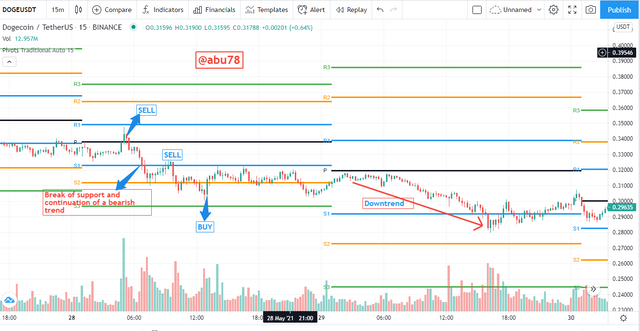

Pivot Point Reverse trading on BNB/USDT chart

The above chart gives information on a 15 minutes chart on BNB/USDT. At the start of the day ( 27th May 2021) the price of BNB was trading above the PP and it started to move below/ towards the PP after it previously hit the R1 level which gave a hint of the fall of the price. The Price continues to fall until it breaks through the PP and further breaks through the S1 level as well. There was a reverse after breaking through the S1 and it even raised above the PP again indicating a price trend change from bearish to bullish. On the next day (28th May 2021), the price of BNB was trading below the PP level until it breaks through the S1 and it further breaks through the S2 indicating a continuation of the bearish trend of the price. later in that day, the price tends to bounce back (reverse) from S2 and break above through the PP, and this breakthrough indicates a bullish trend as shown from my screenshot above. Traders can place a buy option at the point of S2 to achieve profits.

From the second screenshot above, we can see that the price trend of BNB on the 28th May 2021 broke down through the pivot point and hit the S2 which indicated a price reversal and a buy option position for traders. On the next day (29th May 2021) the price trend moved below the pivot point until it even breaks down through the S1. This shows a bearish in the price of BNB.

On the next day (30th May 2021) the price of BNB began to rise towards the PP and it broke above through the PP and further moved until it reached the R1. At this point, a reversal trend was seen as illustrated above. A trader in a short position could have sold assets here and gain profits as well as avoiding loss.

Common Mistakes in Trading with Pivot Points

Common mistakes used by traders in the course of using Pivot Points Indicator include the following;

1.The avoidance of the use of stoploss in trading with Pivot Points. Stoploss helps traders to avoid or be protected from losses especially when a breakout of prices occurs. Because the guarantee of the price reaching the support or resistance level isn't assured, or the reversal of the price at either the support or resistance level isn't also assured, it is very necessary for one to utilize the stoploss to avoid all these errors.

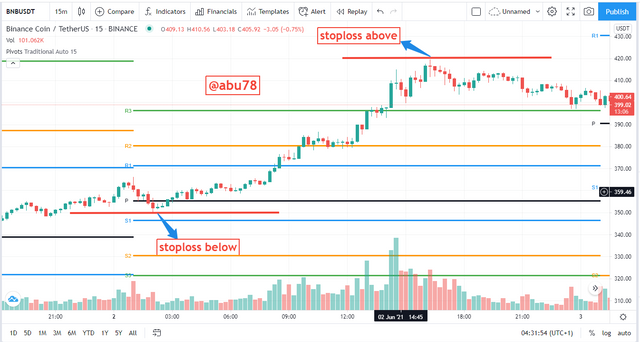

Stoploss Points

2.Again, the common mistake traders do in using Pivot Points is the avoidance of trading plans. The trading plan here refers to the entry and exit points strategy used y the trader. Any trader using the pivot point indicator must draw an entry and exit strategy plan down and must abid by it no matter the situation. Because the reversal of the price at the resistance or the support level isn't assured, the stoploss has to e placed above the resistance level or below the support level in order to avoid false signal indications.

3.Furthermore, the trader depending solely on only the pivot points for entry or exit confirmation. Traders should try their best possible and utilize other indicators before confirmation the entry or exit point of any price. They shouldn't only rely on the resistance or support level of the pivot points and make entries but rather should make use of other indicators such as the Fibonacci retracement tool and also the candlestick analysis.

What could be the reasons for Pivot Points is Good (Pros)

The Pivot Point being so simple to use make it very easy to be accessible by a beginner trader. Pivot points make it very easy for traders to understand the trend and pattern of the price of any asset without difficulty.

Again, the Pivot Point is a great trend-based indicator that can be used during high volatility periods in the crypto market. It makes easy identification of the support and resistance levels on a chart and also in determining the trend of the price of any asset.

Furthermore, the use of a pivot point indicator makes it easy to identify potential price reversal which in turn makes clear entry and exit points to the trader. This makes the trader make profits or avoid loss in trading.

Technical Analysis using Pivot Points Indicator

BNB/USDT Chart

I shall be using the above chart which indicates a 15min chart on Tradingview platform for the past 3 days on BNB/USDT trend.

We can see from the above chart that, on the 3rd day, the price breakout down through the PP and later there was a reversal which raised and breakthrough above the PP point again and continued in rising. The price later breakthrough above the R1 at a price of $345.74 and raised a little bit in addition. A reversal was observed after stoploss was reached. Then a subsequent rise and fall through the R1 were observed for some time until constant breakthrough above the R1 popped up.

This breakout rised until it reached the R2 and a reversal price was observed at the $346.40 price.

On the second day as seen from the chart above the price of BNB was trading above the PP indicating a possible rise in the price of BNB. a subsequent rise and fall in the price of the BNB was observed here, but there was no breakout through the PP.

On the third day, the price of breakthrough below the PP and a reversal was observed at the stoploss, indicating a buy option position. The trend then breakthrough above the PP and further breakthrough the R1 which was still showing a continuation of a bullish trend. This further breakthrough the R2 and R3 as shown below. The breakthrough of BNB price above the R1, R2, and R3 gave a high bullish trend indicating a high increase in the Price of BNB on the third day.

BNB/USDT Chart

On the third day, after that high bullish trend reached the stoploss at resistance, there was a reversal in price. Currently, the price of BNB is trading above the PP and I suggest that by the close of today, the price can retest the R1 and beyond.

BNB/USDT

Weekly Price Forecast for Crypto Coin: (BTC/USD)

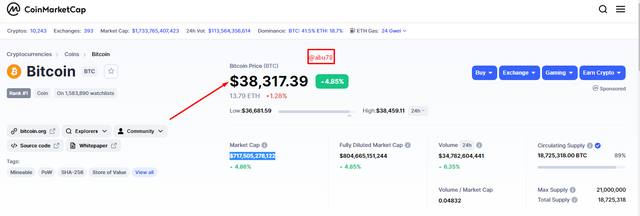

Bitcoin

I would be looking at BTC/USD pair currency. An unknown company called Satoshi Nakamoto founded Bitcoin in January 2009. Bitcoin works on the Blockchain network. It is the current leading cryptocurrency in he crypto market with a dominace of 41.5% and Ethererum being the second leading cryptocurrency having the dominace to be 18.7%. Bitcoin was the first cryptocurrency to e created and the most known one in the globe. It is ranked the #1 in the crypto market in terms of ranking in market capitalization. It can be traded and mined.

Why Bitcoin

Market Statistics of Bitcoin

| Overview | Statistics |

|---|---|

| Market Price | $38,317.39 |

| Market Rank | #1 |

| Market Cap | $717,505,278,122 |

| Circulating Supply | 18,725,318.00 BTC |

| Trading Volume | $34,691,450,073.68 |

| Fully Diluted Market Cap | $805,100,238,849.15 |

| 24h time low | $36,681.59 |

| 24h time high | $38,459.11 |

Bitcoin currency was chosen because it is the most famous and valuable cryptocurrency among all cryptocurrencies. It moves the other cryptocurrencies as its price increases. I looked at its rank and the high market value it has in the cryptocurrency market. It has the ability to stand firm against thefiat currency when there is crisis in the cryptocurrency market. I selected bitcoin because it doesn't operate in the centralized system of regulation. It also has the ability to protect other assets safely and securely.

Technical Analysis on Bitcoin

I would be using the fundamental analysis and the MACD line indicator in predicting the price of BTC in one week time.

BTC/USD

From the above chart, we can the support level of BTC to be around $34,000 which indicates the price of BTC would at least be above this price level by 1 week time. Also the current resistance level is at $42,406.16 which also indicates a possible rise of BTC above $42K when there is a bullish trend.

BTC/USD

Looking at the second chart above, we can see from the MACD indicator that the macd line has crossed above the signal line wich is indicating or signaling a possible rise in the price of BTC, i.e. a possible bullish trend. At the point where the macd line crossed the signal line indicates the support level which is in a good buy option position to go in for.

Again the histogram from the macd indicator is also showing a positive increment, that is increasing above the zero line and this also is a possible signal for a bullish trend in the price of BTC for the next one week.

I Predict the price of BTC in one wwk time to hit $50,000 as the trend is its bullish stage now. A possible rise is shown below from the chart.

BTC/USD

Conclusion

Trading with Pivot indicator is a good strategy in determining the market especially when looking for entry and exi points but they should be used with other indicators so as to give accurate results. This type of indicator is a good one for beginners in trading to utile but also stoploss should be taken note of when using this indicator.

I must say that this week's lesson being the last one for the season has the been the most exciting one to me and I have really enjoyed and understood the Pivo Point indicator and how it works. I would like to use this opportunity to thank prof @stream4u for being with us for that long and I leave with him convenience in his work. Thank you all for reading and passing by my post.

This article was authored by;

@abu78

Hi @abu78

Thank you for joining The Steemit Crypto Academy Courses and participated in the Homework Task.

Your Homework Task verification has been done by @Stream4u, hope you have enjoyed and learned something new.

Thank You.

@stream4u

Crypto Professors : Steemit Crypto Academy

#affable

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks prof for your kind review I would make sure to desist from using images that has watermark on them.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit