What do you understand about the Concept of Dynamic Support and Resistance? Give Chart Examples from Crypto Assets. (Clear Charts Needed)

The Concept of Dynamic Support and Resistance

Dynamic Support and Resistance is a price action strategy formed when non-horizontal support and resistance lines are created on an asset's price chart and moves in a diagonal line known as a trend line. The Dynamic support and resistance are formed using different lengths of EMA (exponential Moving Average). In a price chart of an asset, the EMA line can function as both support and resistance level. The Dynamic Resistance and Support abets traders in entering of trend line market.

There are two main kinds of Dynamic conditions and they include;

- Dynamic Support

- Dynamic Resistance

I would like us to briefly look at each of the types above and illustrate them with examples on a crypto chart.

The Dynamic Support

The dynamic support is formed when the trend-price of an asset continuously bounces back from the EMA 50 line severally and creates a dynamic non-horizontal support line in the movement of the asset. Dynamic support levels are generally formed in an uptrend movement in the market. A good example is illustrated below.

For instance, considering a STEEMUSD chart on a 30 minutes time frame, we can see that between 28th June 2021 to 1st July 2020, the price of STEEM is showing an uptrend movement and the EMA 50 is working as good dynamic support as shown above. This is as a result of the bouncing back of the price of STEEM towards the dynamic support line and moving upwards again. This indicates that the EMA 50 is functioning as dynamic support in this case and it is represented in pink color as seen from the chart.

The Dynamic Resistance

The dynamic resistance is formed when the trend-price of an asset continuously bounces back from the EMA 50 line severally and creates a dynamic non-horizontal resistance line in the movement of the asset. Dynamic resistance levels are generally formed in a downtrend movement in the market. A good example is illustrated below.

For instance, considering SBDUSD on a 30 minutes time frame chart, we can see that between 07th July 2021 to 09th July 2021, the price of BTC is showing a downtrend movement and the EMA 50 is working as good dynamic resistance as shown above. This is a result of the bouncing back of the price of SBD towards the dynamic resistance line and moving downwards again. This indicates that the EMA 50 is functioning as dynamic resistance in this case and it is represented in pink color as seen from the chart.

Make a combination of Two different EMAs other than 50 and 100 and show them on Crypto charts as Support and Resistance. (Clear Charts Needed)

Combination of Two different EMAs (EMA 20 and EMA 70) as Dynamic Support and Resistance

Dynamic support and resistance can easily be formed just with the use of a single EMA of any length but in the case of improving the quality of trend line analysis then, using a pair of EMAs is much appropriate or advisable. This helps traders to make huge profits and avoid losses as well. Using two EMAs together help traders in the following ways;

- Helps traders to easily analyze trends of crypto assets

- It helps to predict better trade entry and exit points on crypto charts

- Lastly it helps reduce risks involved in trading

I would be using EMA(20,70) pair, in this case, to practically illustrate dynamic support and resistance strategy on charts

The Dynamic Support using EMA(20,70) Pair

From the DOGEUSD chart shown above, we can clearly see that the price of DOGE touched the EMA 70 and bounce back on the 23rd June 2021, and it also happened similarly on 24th June, at 3:30 am. The price then moved above the EMA 70 line and crossed over above the EMA 20 line which later touched the EMA 20 line at 7:30 am on this same day and bounced back. The price bounced back by respecting the EMA 20 line and this occurred about three times and took the EMA 20 line as the main support level as the trend continuously moving upwards.

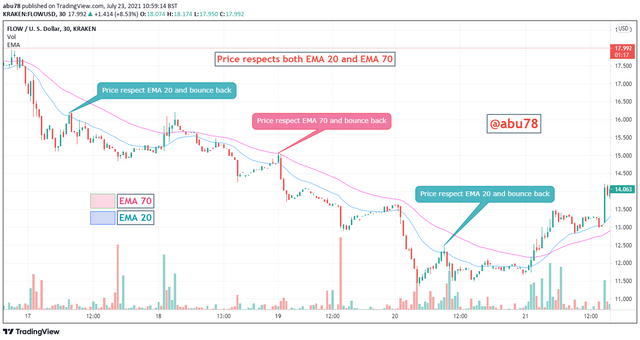

The Dynamic Resistance using EMA(20,70) Pair.

From the FLOWUSD chart indicated above, we can clearly see that the price of FLOW currency respected the EMA 20 line, touched it, and bounced back downwards direction as seen above. The price continued to move below the EMA 20 line until on the 19th July 2021, it breaks the EMA 20 and touched the EMA 70 line and respects both EMA 20 and EMA 70 and it bounces back below both EMAs. The price continued moving below both EMAs and on the 20th of July, the price touched the EMA 20, respects it, and bounces back again towards downwards.

Explain Trade Entry and Exit Criteria for both Buy and Sell Positions using dynamic support and resistance on any Crypto Asset using any time frame of your choice (Clear Charts Needed).

I would be explaining the entry and exit criteria for both buy and sell positions using the dynamic support and resistances strategy by illustrating them on crypto charts

Entering trade using dynamic support and resistance strategy

There are two methods involved in entering a trade and I will discuss both of them in this article,

- Trade entry for buy position

- Trade entry for sell position

The Entry Method for Buy Position

Considering the use of EMA of length 50 and 100, the following criteria must be followed to go in for an entry trade buy position. These criteria include the following:

First of all, set the EMA 50 and EMA 100 on the asset's chart

The asset's price must be above the two EMAs i.e. EMA 50 and EMA 70 before placing a buy order trade.

When the asset's price touches the EMA 50 or breaks above the EMA 50 then a bounce back above the EMA 50 should be waited for before placing a buy order setup.

When the bounce-back of assets' price above the EMA 50 occurs, then a buy setup for the asset can be placed just above the touch or cross of the EMA.

There may be several buy opportunities on a single phase of a dynamic support resistance strategy and one should carefully go in for the right choice to make huge profits.

I would illustrate the above points on a crypto chart so we can understand them better.

The chart above indicates a DOGEUSD of 30 minutes time frame chart. The blue line indicates the EMA 50 and the green line indicates the EMA 100 respectively. The price of DOGE started to rise above the EMA on the 23rd of June indicating an uptrend. On the 24th of June, the price of DOGE touches the EMA 50 dynamic support but a buy order isn't placed immediately but rather we waited until an uptrend indication started just above the EMA 50 line at 5:30 am and then a buy position was implemented as shown above on the chart.

The Entry Method for a Sell Position

Considering the use of EMA of length 50 and 100, the following criteria must be followed to go in for an entry trade sell position. These criteria include the following:

First of all, set the EMA 50 and EMA 100 on the asset's chart just as in the case of the buy position.

The asset's price must be below the two EMAs i.e. EMA 50 and EMA 70 before placing a sell order trade.

When the asset's price touches the EMA 50 or breaks below the EMA 50 then a bounce back below the EMA 50 should be waited for before placing a sell order setup.

When the bounce-back of the price below the EMA 50 occurs, then a sell setup for the asset can be placed just below the touch or cross of the EMA.

There may be several sell opportunities on a single phase of a dynamic support resistance strategy and one should carefully go in for the right choice to make huge profits.

I would illustrate the above points on a crypto chart so we can understand them better.

The chart above indicates a DOGEUSD of 30 minutes time frame chart. The blue line indicates the EMA 50 and the green line indicates the EMA 100 respectively. The price of DOGE started to fall below the EMA on the 04th of July indicating a downtrend in the asset's movement. A sell trade was initiated once the price trend touched the EMA 50 and continued a downtrend its price.

Exiting Trade using Dynamic Support Resistance Strategy

Two main levels are used in the determination of an exit in trade and these are;

- Take Profit

- Stop loss

The Exit Trade Method for Buy Position

Considering the use of EMA of length 50 and 100, the following criteria must be followed to go in for an exit in a buy position. These criteria include the following:

First of all, set up a stop loss on the price chart and this stop loss should be set below the EMA 100 to protect the trader from loss.

When the assets' price crosses or touches the stop loss level set, then an exit position should be taken to avoid loss and wait for the next dynamic support setup to be formed.

Also a take profit level should be set on the chart and this point must be above the EMA 100 level in a buy position trade.

When the asset's price crosses or touches the stop loss level created, an exit position should be taken to acquire the profits booked.

The stop loss and the take profit ratio should be 1:1 risk to reward ratio factor. This indicates that the stop loss should be equivalent to the take profit. A good example is illustrated in the chart below.

The chart above indicates a DOGEUSD of 30 minutes time frame chart. The blue line indicates the EMA 50 and the green line indicates the EMA 100 respectively. The price of DOGE started to rise above the EMA on the 23rd of June indicating an uptrend. The stop loss was set below the EMA 100 and also the take profit was placed above the EMA 100 and EMA 50 in a ratio of 1:1 (risk: reward). This can be seen from the chart shown above.

The Exit Method for a Sell Position

Considering the use of EMA of length 50 and 100, the following criteria must be followed to go in for an exit in a sell position. These criteria include the following:

First of all, set up a stop loss on the price chart and this stop loss should be set above the EMA 100 to protect the trader from loss.

When the assets' price crosses above or touches the stop loss level set, then an exit position should be taken to avoid loss and wait for the next dynamic resistance setup to be formed.

Also a take profit level should be set on the chart and this point must be below the EMA 100 level in a buy position trade.

When the asset's price crosses below or touches the take profit level created, then an exit position should be taken to acquire the profits booked.

The stop loss and the take profit ratio should be 1:1 risk to reward ratio factor. This indicates that the stop loss should be equivalent to the take profit. A good example is illustrated in the chart below.

The chart above indicates a DOGEUSD of 30 minutes time frame chart. The blue line indicates the EMA 50 and the green line indicates the EMA 100 respectively. The price of DOGE started to fall below the EMA on the 04th of July indicating a downtrend in the asset's movement. A sell trade was initiated once the price trend touched the EMA 50 and continued a downtrend its price. The stop loss is set above the EMA 100 and also the take profit is set below the EMA 100 and EMA 50 in a ratio of 1:1 (risk: reward). This is also shown in the chart above.

Place 2 demo trades on crypto assets using Dynamic Support and Resistance strategy. You can use a lower timeframe for these demo trades (Clear Charts and Actual Trades Needed).

In this section, I would be performing my demo trades using the dynamic support and resistance strategy on the following two currencies using ;

- BTCUSD

- AXSUSDT

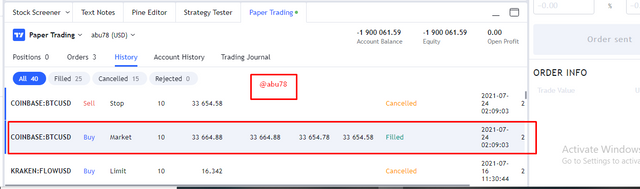

Demo Trade 1 Buying BTCUSD

As we see clearly from the BTCUSD chart set at 1 min below that the price of BTC has been moving above the EMA 50 and EMA 100 then it later fell and crossed below the EMA 50 and it further continued and crossed the EMA 100 as well. Later the price of the asset moved and crossed above the two EMAs and my buy entry position was placed as indicated below.

The stop loss level was placed below the EMA 100 and also the take profit level was placed at a 1:1 ratio to the stop loss.

Buy Entry: $33,664.88

Take profit: $33,664.78

Stop loss: $33,664.58

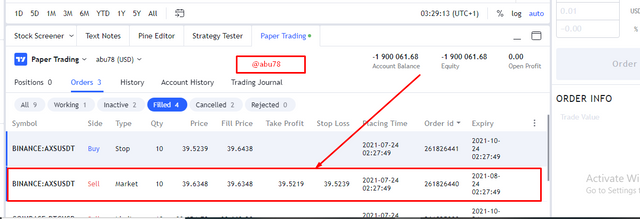

Demo Trade 2 Selling AXSUSDT

As we see clearly from the AXSUSDT chart set at 1 min below that the price of AXS has been moving below the EMA 50 and EMA 100 then it later raised and crossed above the EMA 50 and then I waited for the price to fall below the EMA 50 again the I placed my sell order just as indicated from the chart below.

The stop loss level was placed above the EMA (100, and 50), and also the take profit level was placed at a 1:1 ratio to the stop loss.

Buy Entry: $39.6348

Take profit: $39.5219

Stop loss: $39.5239

Conclusion

In conclusion, I would like to briefly summarize what we have done in this article. We looked at the concept of dynamic support and resistance where we said it is a price strategy in which non-horizontal support and resistance lines are created on the price chart of an asset and moves in a diagonal line known as a trend line. Again, we also illustrated both dynamic support and dynamic resistance on crypto charts with the aid of EMA 50. Furthermore, we looked at the situation of combining two EMAs i.e. EMA 20 and EMA 70 by indicating them as dynamic support and dynamic resistance respectively using two different crypto charts.

We also looked at the trade and exit criteria for both buy and sell positions using dynamic support and dynamic resistance on the DOGEUSD chart. Lastly, I performed two demon trades on BTCUSD and AXSUSDT cryptos using the dynamic support and dynamic resistance strategy. I have really enjoyed doing this homework task and I have really learned a new strategy.

I would like to say a very big thank you to professor @cryptokraze for such a wonderful lecture taught this week. I wish for your convenience in your work. Thank you for your time and attention.

Thank You,

Regards,

@abu78

Dear @abu78

Thank you for participating in Steemit Crypto Academy Season 03 and making efforts to complete the homework task. You got 10/10 Grade Points according to the following Scale;

Key Notes:

We appreciate your efforts in Crypto academy and look forward for your next homework tasks.

Regards

@cryptokraze

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks very much professor your kind review. I wish for you convenience in your work. I am much grateful.🤗

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit