Introduction

Hello to everyone,

Welcome to season 4 of Steemit Crypto Academy. This season started faster than last season. This season I will perform my first assignment in professor @allbert's class. The subject of this lesson includes an in-depth analysis of the support and resistance levels we all know and detailed information about the Gap.

Thank you to everyone who reads my post. Also thank you professor @allbert for this nice lecture.

Question 1

Explain graphically the difference between Weak and Strong Levels. (Screenshots required) Explain what is happening in the market for these differences to occur.

Levels refer to support and resistance levels as we all know in our financial trading. These support and resistance levels are the points or regions where the price reacts and buy/sell orders are placed. It is divided into strong and weak levels.

Strong Levels: As we said earlier, levels refer to our support and resistance levels or zones. Strong levels at this point; are our strong support and resistance zones or levels. At these levels, the price encounters a reaction, and in general, after this reaction, the price bounces back or otherwise breaks down. At strong levels, the price is rejected many times and the trend direction is expected to change. Therefore, reliable levels can be counted and buy/sell orders are placed at these levels, these orders are quite large and strong, so the price is rejected many times before it breaks this level.

Weak Levels: Weak levels are our weak support and resistance levels or zones. At these levels, the price rejects the designated levels once or at most twice. For this reason, these levels are not very reliable and can be broken easily. At these levels, buy/sell orders can be given, but as we said before, since there are no reliable levels, we can say that the orders given are few or weak.

- In the screenshot above, the 1-hour chart of the SOL/USD pair is used.

As we can see in the screenshot, I tried to show the Strong and Weak levels clearly. A strong level of price was constantly reacted and a breakdown did not occur. At the weak level, the price does not see another reaction at the point where it sees a reaction and a direct breakdown occurs.

In short; Strong Levels are the levels where the price reacts and the breakdown is not easy. Price generally changes its trend from these levels. At these levels, the buying/selling volumes are quite high. Weak Levels, on the other hand, the support and resistance levels against which the price reacts are quite weak and can easily be broken. Therefore, the trading volume is lower. In general, the direction of the trend does not change and the trend direction continues.

Question 2

Explain what a gap is. (Required Screenshots) What's going on in the market is causing this.

Gap, is when the price skips certain levels and opens a new candle after a candle closes on the market. As we can see from the name, it is seen that there is a clear gap on the graph while this event is taking place. These gaps show us the jumps made by the price.

The new candle, which is opened by leaping after the price closes the previous candle, can be realized above or below the price. I will make it easier to understand by showing you with screenshots.

We can easily see these gaps on the Steem/USD pair.

As we can see in the screenshot above, the price jumped multiple times and created a gap. After these price jumps, newly opened candles can form above or below the closing price of the previous candle.

Gap formation as a result of these price jumps; It occurs due to too much buying/selling on a certain asset. These jumps generally occur with large amounts of purchases/sells made by large investors.

Question 3

Explain the types of Gap (Screenshots required, it is not allowed to use the same images of the class).

In general, we have three different types of Gap.

- Breakaway gaps

- Exhaustion gaps

- Continuation gaps

Breakaway Gaps

This Gap variety is more functional than other varieties. This type generally occurs when the price pattern (lateral movement, etc.) ends. After the gap is formed, the price makes a bounce and starts an uptrend or downtrend. This gap is accepted as a strong level during our trades.

- The 5-minute chart of the Steem/USD pair is used in the chart above.

Exhaustion Gaps

Such Gaps are quite difficult to find and can be confused with Runaway Gap. These types of gaps usually occur towards the end of the trend and as his professor explains it only; "They can only be detected after motion has passed, and they are extremely difficult to detect."

- In the screenshot above, the STEEM/HTB pair 5 minute graphic is used.

As can be seen in the screenshot, after such gaps, the price tries to fill the price range in the bounce zone, and therefore reverse trades can be made. For this reason, its level is not so important. Also, in such gaps, the trend does not generally end, but it may be a sign that it is nearing the end.

Continuation Gaps

Continuation Gaps are also commonly known as Leakage Gaps. The main reason for this is that it usually occurs after the Breakaway Gap. Such gaps generally inform us that the Trend is continuing and getting stronger. They are not very easy to detect and practically cannot be found. However, when we detect these points, they are accepted as important support and resistance points. Because they happen on an ongoing trend.

- The 5-minute chart of the Stem/USDT pair is used in the above chart.

Question 4

Trade (buy/sell) on Strong Supports and Resistances on the demo account. Explain the procedure (Screenshots Required).

One of the best strategies that allows us to buy/sell over strong Supports and resistances is the BRB strategy.

Buying at Strong Levels with the BRB strategy

- In this example, the 5-minute time chart of the ETC/USD pair is used.

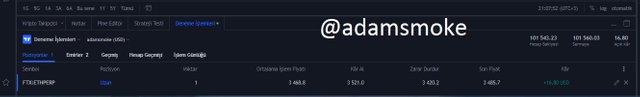

As we can see in the screenshot above, after the price breaks the Strong Level 1 level, it retests and comes back to the same price level. Even though I think that I am a little late while doing this transaction, I open my position at $ 3468.8 as a purchase.

I then set an expired Strong Level 2 point and place my Stop-loss at $3420.2.

Then I adjust my take profit level so that the Risk:Reward ratio is not lower than 1:1. I place this take profit level at $3521, the estimated intersection of the price with a 4-hour uptrend.

As it will take some time for my trade to reach the point I want, I am showing you the instant profit level.

Question 5

Execute (buy/sell) at Gap levels via a Demo account. Explain the procedure (Screenshots Required).

DENT/USD Pair Buy Position

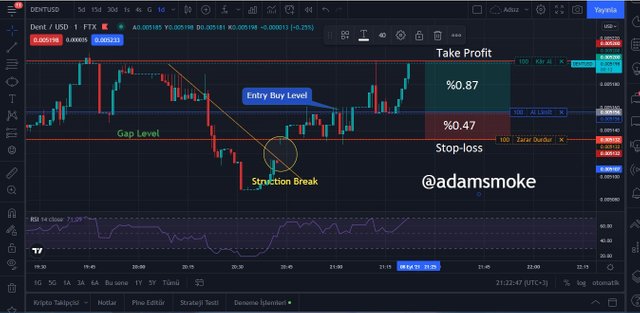

- The 1 minute chart of DENT/USD pair is used in the screenshot above.

- As we can see in the screenshot above, around 20:41, the price jumps and makes a gap movement. As we can see from this Gap type screenshot made by the price, it is a Breakaway Gap type.

- Again, I was able to catch this break a little late. I immediately determined an entry point by doing my analysis and found a point where the price gathered above the Gap level. I opened my buy position exactly at $ 0.005156 level. At this point, I followed the RSI indicator and thought that the values were around 50 levels and that the rise would continue.

- Then I set myself the Gap level as a Stop-loss point, which was $0.005132.

- Then I set the previous highest peak that the price touched as my take profit level, which was $0.005198.

- As you can see in the screenshot, I wanted to close my position because the price was very close to my take profit level while editing my chart, but I couldn't show you how many dollars I made because I canceled my position instead of closing it. However, I was able to reach my target of 0.87% increase.

Conclusion

In this lesson, we saw the Strong levels and the Gap variants. Most of us know how to use Strong support and resistance points in our trades, but I think I learned a good deal about Gap trading in this course.

In this lesson, I actually saw how simple these trading methods are and how hard they are to see. Maybe I was able to learn and apply this lesson easily thanks to the lecture of the Professor. Thanks again to professor @allbert for this reason.

Thanks again to everyone who read my post. I wish you all a healthy and beautiful day.