Introduction

Hello to everyone,

Welcome to Week 4 of Crypto Academy. First of all, I wish you all a healthy and peaceful day. In this post, it will be about the Arbitrage method that Professor @reddileep explained in his lecture. This post contains the assignments of the professor. Let's start doing it now.

Question 1

Define Arbitrage Trading in your own words.

What is arbitrage? The shortest answer to the question is making money because of the price difference between the markets. Well, I would like to explain this in the simplest way with a real-life example.

Example: You want to buy apples in your city, but the price of an apple in your city is 10 USD. Then, by doing some research, you learn that the price of an apple in another city is 5 USD. Imagine that you buy 2 apples by going to the city where you learn that the apple is 5 USD. Let the apple cost you 7 USD per grain, including the transportation fee, the cost of the apple, and the travel expenses. Then you came to the city where you live and sold apples for 10USD. In this way, you have made a profit by buying the same apple cheaper. This system is called arbitrage.

So how is this business developing in the financial sector?

The prices of financial assets on all exchanges are considered the same, but in reality this is not so. For example, there are more than 250 exchanges where we can buy and sell cryptocurrencies. For this reason, the price of the same asset can vary in many exchanges.

Just like the example we gave from real life; It is the process of buying the asset from the stock market where the price of the asset is low and selling it on the stock exchange where the price of the asset is high. Arbitrage is generally carried out between assets of the same type in different markets, but sometimes it can also be carried out on the same market by cross-exchange.

In arbitrage trading, the overall profit level may be very low, but the risk level is just as low as the profit level. For this reason, we can also define it as a low-risk profit-making trade.

Since the risk level and profit level are quite low, this trading method is not preferred for small investors, it is a more suitable method for companies and large investors.

Speed is the most important thing when arbitrage in financial markets. Because the prices in the stock markets change instantaneously and in a market with high liquidity, anything can happen at any time, so it is necessary to be fast. For this reason, large investors or companies use software based on certain algorithms to determine arbitrage and to trade quickly. In this way, they can instantly buy and sell the price difference that occurs instantly.

The issues that a trader should pay attention to while making arbitrage are; price fluctuations (volatility), Transfer and transaction fees and processing time. It is possible that we will lose in the arbitrage trade that we will do without paying attention to these points. Because the volatility of each asset differs and each market has its own transfer and transaction fees. Therefore, arbitrage trading is a professional trading method.

Question 2

Make your own research and define the types of Arbitrage (Define at least 3 Arbitrage types)

1. Exchange Arbitrage

Market arbitrage is the most common arbitrage method used. In this arbitrage method, it is the process of buying the same asset (eg BTC, ETH, etc.) in one market and selling it in the other market.

As we mentioned before, the price of every asset does not have the same values in every market. Some may be cheaper, some may be more. For this reason, we can say that it is the process of buying from the stock market where the price of the asset is low and selling the asset on the stock market where the price is high. In this method, the profit rate is not very high, but the risk rate is also low. In this method, as in other arbitrage methods, speed is important.

While applying this method, the asset's order books on different exchanges are checked and price differences are determined. Then, the purchase is made from the stock market with the lower price and the sale is made on the stock exchange where the price of the asset is higher. Thus, small profits are obtained.

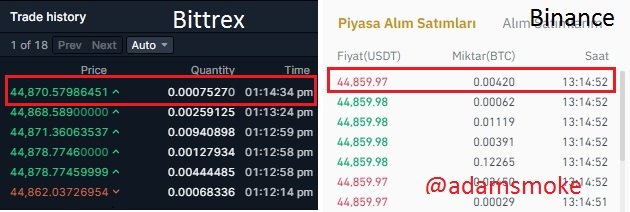

- The above screenshot shows the transaction history of the BTC/USDT currency pair on different exchanges.

| Bittrex | Binance |

|---|---|

| BTC/USDT | BTC/USDT |

| 44870.57 USD | 44859. 97 USD |

According to the above data, if we want to Exchange Arbitrage, we must buy BTC from Binance exchange and sell BTC on Bittrex exchange. If we perform this transaction, we will make a profit of 10 USD in roughly 1 BTC buying and selling transaction without calculating the transaction fees.

As we said before, the profit rates in arbitrage methods are very low, but the risk rates are also very low. When a small investor wants to use this method, the profit rate will be quite low. However, when a large investor performs, for example, a 50 BTC Stock Arbitrage method, they can make high profits of $ 500 in seconds.

2. Funding Rate Arbitrage

Funding rate arbitrage is another popular arbitrage method. In this method, traders protect the crypto assets they buy with futures contracts with a lower funding rate than the purchase cost, in order to protect them from price movements.

E.g; Let's say you invest in BTC, a cryptocurrency. Considering that the price of BTC will be subject to high volatility, at this point we want to reduce our risk by selling a futures contract with the same value as your BTC investment. Let's assume that the funding rate for this contract is 5%. Since we have BTC at this point, it means we're going to get 5% regardless of any price movements. This gives us a 5% profit rate independent of price movements and we qualify it as a profitable arbitrage.

3. Triangular Arbitrage

Triangle arbitrage is another popular arbitrage method that is used. This method is usually performed on the same exchange. It is generally accomplished by determining whether there is a price discrepancy between three assets.

I will explain this method in more detail in the next section. However, to mention briefly, it is a method of profiting from price differences of asset pairs.

E.g; You have 100 BTC and you get 1000 ETH with this amount. Then imagine that you bought 19,500 LTC with this 1000 ETH, then imagine that you bought 102 BTC with 19,500 LTC. In this method, we exchanged three different cryptocurrencies and increased our 100 BTC balance to 102 BTC. In other words, we made a profit of 2 BTC without risk.

Question 3

Explain the Triangular Arbitrage Strategy in your own words. (You should demonstrate it through your own illustration)

As we have explained before, this method is performed by cross-exchanging three different entities among themselves. When the trader wants to buy an asset, he can perform this method when he detects the price difference between the asset pairs. As we said before, they generally perform this method on the same exchange. While performing this method, just like other arbitrage methods, speed is very important. Because the prices of assets can change at any time. Likewise, in this arbitrage method, the profit level is low, but the risk level is also relatively low.

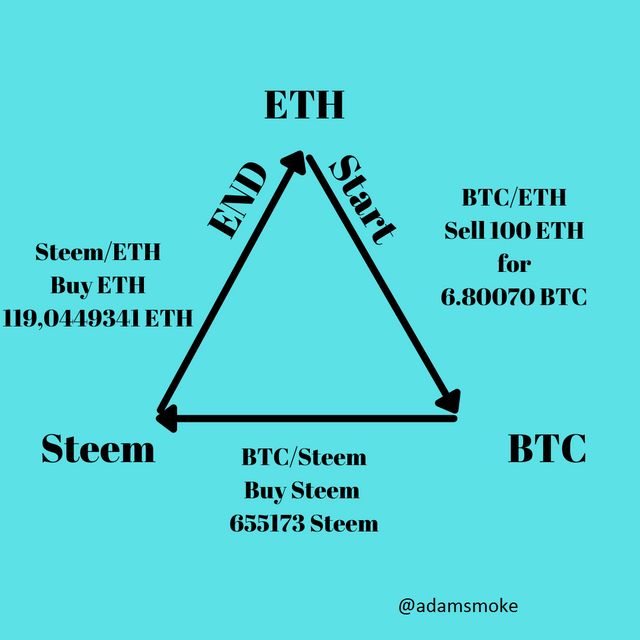

We can understand this better with an image.

- The cross loop above is how a Triangular Arbitrage method works.

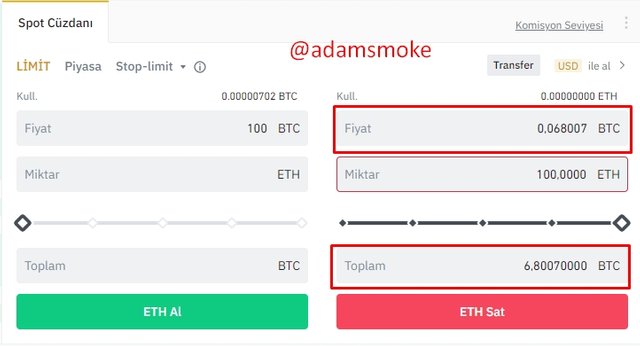

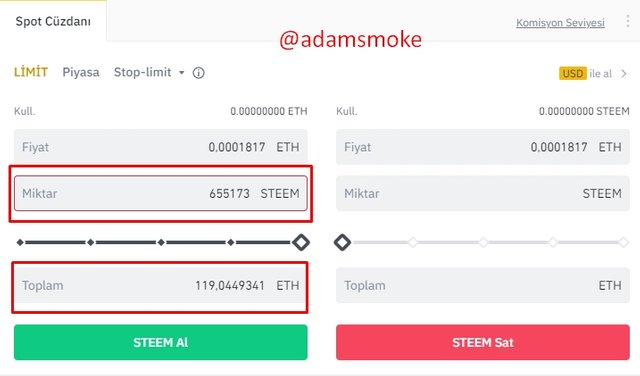

In this method, when we first started trading, we had 100 ETH. Then we bought BTC with 100 ETH and bought 6,8007 BTC.

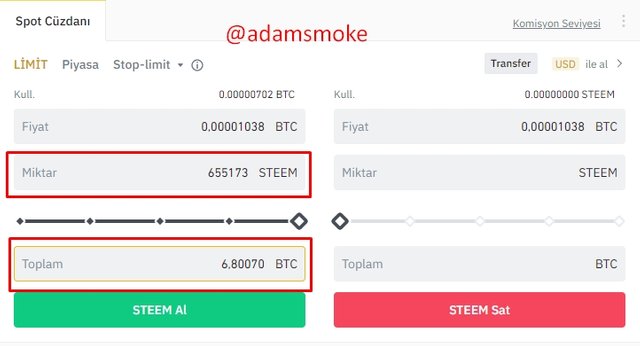

- Then we decided to buy Steem with 6.8007 BTC and we got 655173 Steem with this amount.

- Then we buy ETH again with 655173 Steems and we were able to buy 119.04 ETH with this amount.

- In this situation; While initially holding 100 ETH, our balance increased to 119.04 ETH after applying the triangle arbitrage method. So with this method, we earned 19.04 ETH profit without risk.

Question 4

Make a real purchase of a coin at a slightly lower price in a verified exchange and sell it in another exchange for a higher price. (Explain how you get your profit after performing Arbitrage Strategy, you should provide screenshots of each transaction showing Bid, Ask prices)

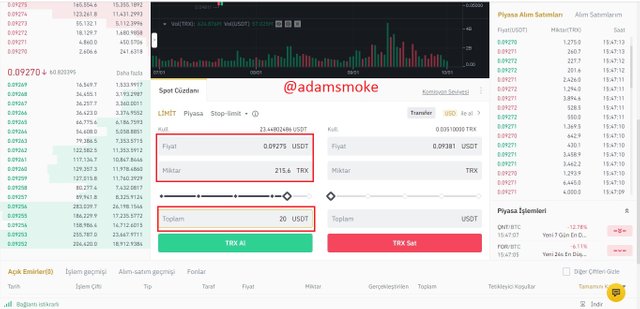

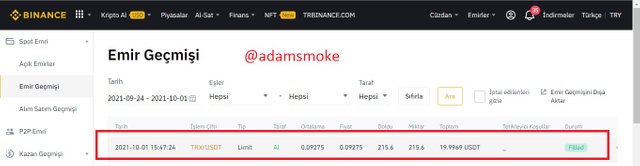

In this section, I will perform transactions between my accounts on verified Binance and FTX platforms.

- As you can see in the screenshot above, I'm buying 215.6 TRX worth 20 USDT at the price of 0.09275 USDT on the Binance exchange.

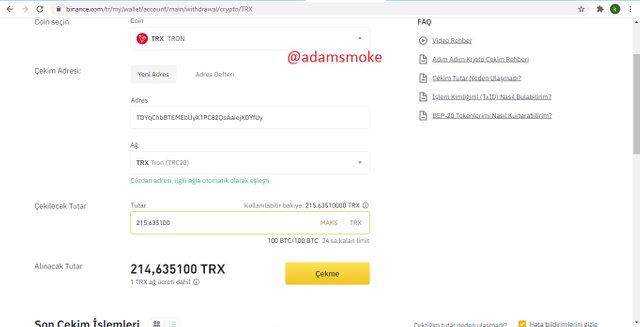

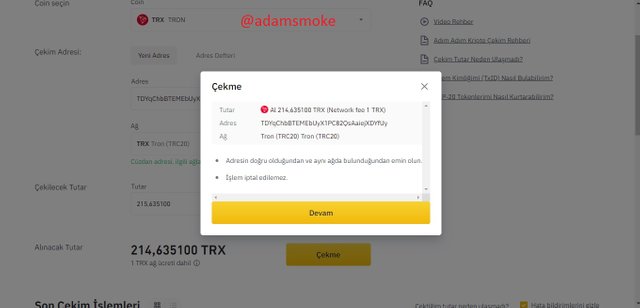

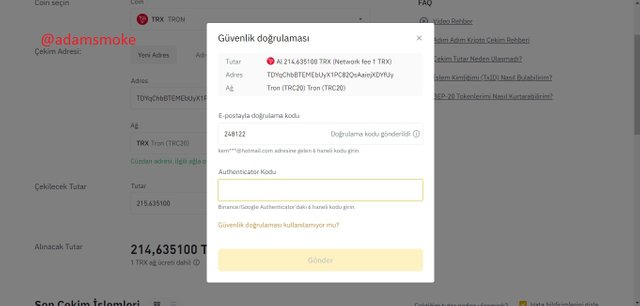

- Then I send my TRXs from Binance exchange to FTX exchange.

- I give the necessary approvals at the time of submission.

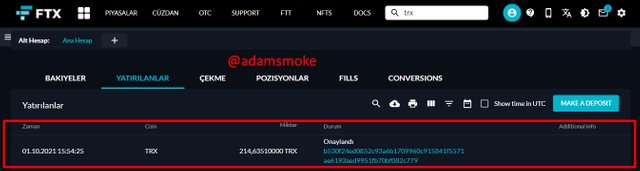

I then transfer 214.63 TRX to my FTX account after the transaction fees are deducted.

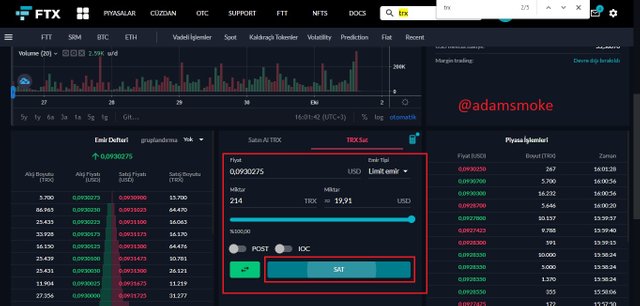

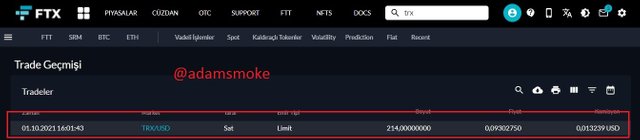

- Then I sell 214 of my TRXs for 0.0930275 USD.

- At the beginning of this transaction, we purchased 215.6 TRX worth 19.99 USDT.

- Later, when transferring between exchanges, we paid a certain transaction fee and 214.6 TRX came to our FTX account.

- Later, while we were making the sale, we sold 214 TRX and a balance of 19.90 USD was loaded into our account.

In fact, if we could buy and sell large amounts of this transaction, our profit rate could be quite nice. Because;

- Our TRX purchase price: 0.09275 USD

- Our TRX selling price: 0.09302 USD

As we paid transaction fees and transfer fees while performing this transaction, we did not make any visible profit. However, as I said, when we trade higher amounts and faster, our profits will be higher and less risky.

Question 5

Invest for at least 15$ worth of a coin in a verified exchange, and then demonstrate the Triangular Arbitrage Strategy step by step using any other coins such as BTC and ETH. (Explain how you get your profit after performing Cryptocurrency Triangular Arbitrage Strategy, you should provide screenshots of each transaction)

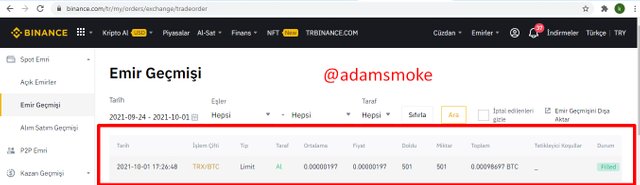

In this section, I will use my verified Binance exchange account.

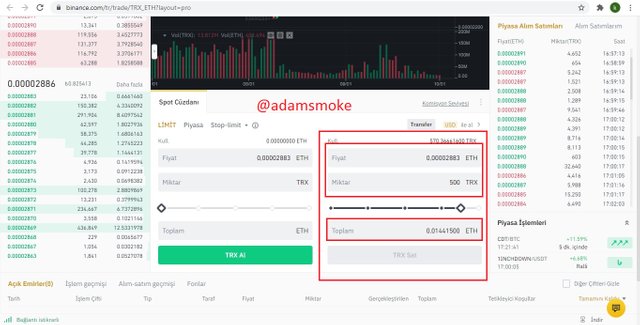

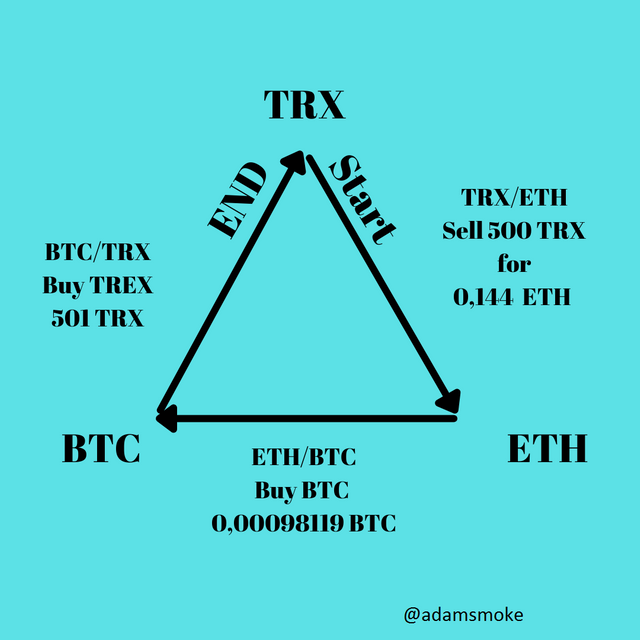

First, let's assume we have 500 TRX.

- We will first convert our 500 TRX assets to ETH. As a result of this transaction, we buy 0.144 ETH.

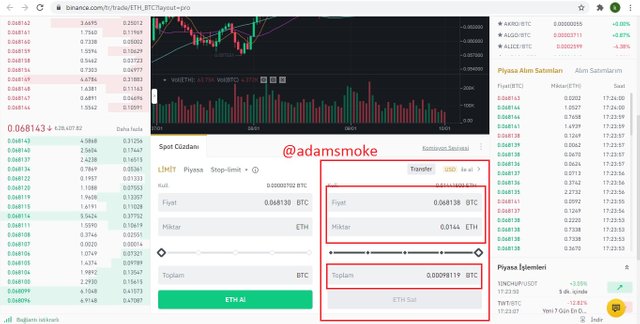

- We will then convert our ETH asset to BTC. As a result of this transaction, we buy 0.00098119 BTC.

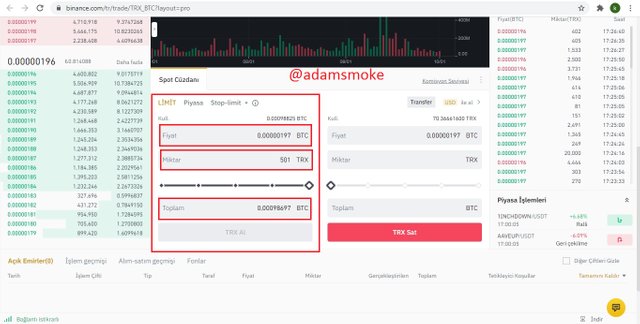

- We will then convert our BTC balance back to TRX. As a result of this process, 501 TRX is loaded into our account.

I will move this triangular arbitrage method on the image so you can understand it more clearly.

- As you can see in the image above, we have increased our 500 TRX holdings to 501 TRX with a very low risk, even though we have removed all transaction fees.

The amount we earn in this trade is quite low, but as we said before, the profit rate in Arbitrage trades is very low. Therefore, we can make better profits by trading with higher amounts. Besides, we must not forget that speed is the number one factor.

Question 6

Explain the Advantages and Disadvantages of the Triangular Arbitrage method in your own words.

The triangle arbitrage method has a low profit rate and a relatively low risk rate. However, as with any method, this method has advantages and disadvantages.

| Advantages | Disadvantages |

|---|---|

| The risk ratio in our transactions is very low. | The risk ratio is quite low, but there is still risk. |

| It is a method that does not require much time. | The longer the processing times, the longer the transfer times, the higher the risk. |

| High profits can be obtained with large capitals. | With low capital, transaction fees, transfer fees can eliminate our profit. |

| It increases the liquidity on the market. | Excessive price fluctuations (Volatility) on the market can cause losses. |

| Operations can be performed more quickly by using different algorithms and software. | Applying this method without doing research and certain calculations can cause great losses. |

Conclusion

In this sharing, we learned a lot of necessary information about the arbitrage method, which I am not very familiar with. With the pleasure of learning by research, I tried to explain what I learned in a beautiful and understandable language.

I would like to thank everyone who read my post and professor @reddileep for this nice lesson.