Introduction

Hello to everyone,

In this post, there are assignments in professor @awesononso's class. Our topic is stability in digital currencies. The professor covered this topic in detail in his lecture. I will try to present their assignments to you in a simple and understandable language. Let's start.

Question 1

Explain why Stability is important in Digital currencies.

The doors of the digital money world were first opened with Bitcoin. For this reason, Bitcoin is also known as the father of all cryptocurrencies. However, as with every new technology and every new product developed, Bitcoin had some shortcomings. For this reason, new projects, new systems have been constantly developed and with the effect of this, there have been a large number of cryptocurrencies today.

The fact that cryptocurrencies are so popular and popular has caused new questions in our minds and we tried to find solutions to these questions. One of them was volatility. Cryptocurrencies had so much volatility that anything could happen at any time and our investment could go up or down in seconds. In order to prevent these high fluctuations, stable coins started to be produced. Stable cryptocurrencies are different from other currencies. Because, in general, these currencies are supported by fiat currencies and the price is tried to be kept constant. (like USD – USDT)

E.g; Imagine that you have 5 BTC and the price suddenly drops 50%, your investment will be directly halved and you will lose half of your capital. However, if you had 5 USDT in the same way, since this value is fixed to fiat currency in your wallet, it will still remain in your wallet as 5 USDT.

The example we gave above is a positive example of stable currencies, but if it is the opposite, your capital will increase even if BTC makes a 50% rise. However, if you invest in USDT, you will not lose and you will not be able to make a profit in the same way.

In short, stability is very important in cryptocurrencies. The above example is just one of them. Stable cryptocurrencies in general; backed by fiat currencies, commodities or other cryptocurrencies. These stablecoins are seen as useful and safe in many ways. As we said before, price fluctuations are very small or negligible. For this reason, stable coins are more preferred instead of using unstable cryptocurrencies during our trades. At the same time, when you take your profit in a good trade and convert it to stable Coin, you will also protect your profit. Stable coins generally have lower transaction fees than other cryptocurrencies.

For this reason, stability and stable coins are very important in cryptocurrencies. Because of the volatility that exists in almost all cryptocurrencies, they are not seen as a store of value. However, stable coins have managed to prevent this to some extent.

Question 2

Do you think CBDCs would be good in the future? Weigh the pros and cons in your own understanding and state your position.

CBDCs are attractive in many ways. The simplest of these is that the use of cryptocurrencies can be adapted to our daily lives and become widespread. Many countries have already started this project, but recently, news about CBDCs have started to appear in my country, Turkey. They even announced that they are preparing to make their own cryptocurrency and that they are working on the crypto “Turkish Lira”. But we all know that issues such as reliability, privacy and decentralization that CBDCs will be issued by Central Banks are important to the world of cryptocurrencies and I don't think they can meet these values.

Pros

- Since it is issued by our country's Central bank, it means our country supports cryptocurrencies and that's a good thing.

- When we want to buy an asset (house, car, etc.) in any way, we do not need to carry hundreds or thousands of units worth of money with us.

- Unlike banks, buying and selling transactions can be carried out quickly.

- Elimination of unnecessary time-consuming transactions such as account opening time, documents that need to be signed, in any way (bank account, etc.) as in banks.

- The use of CBDCs causes citizens to learn and learn about cryptocurrencies. This allows our citizens to quickly adapt to the money of the future.

- As CBDCs are issued by our country, they will be backed by our country's currency and high depreciation saves us from bad ending events.

Cons

- The biggest minus is that it will have a Centralized method as it will be issued by Central Banks.

- Since it will be managed by a central system, it will be vulnerable to attacks and will be less reliable than decentralized systems.

- They will ignore the principle of confidentiality, which is one of the most basic features of cryptocurrencies, and they will be able to access our identities while performing our transactions.

- It will be difficult to use them for the elderly population who cannot follow the technology.

As we have said before, it is an unavoidable fact that CBDCs will provide many conveniences to users in terms of use. But in many ways it would go against the principles of cryptocurrency.

Question 3

Explain in your own words how Rebase Tokens work. Give an illustration.

As we mentioned before, stable cryptocurrencies; We said they are backed by fiat coins, commodities and other cryptoassets. For Rebase Tokens, on the other hand, stability is achieved in a completely different way. Rebase Tokens are essentially pegged to a certain value like Stablecoins.

The reason for price fluctuations in cryptocurrency markets is basically based on the law of supply and demand. Basically, as we know, as the demand for a cryptocurrency increases, its price increases at the same rate. On the other hand, when the price of Rebase Tokens increases, there will be an increase in the amount of supply at the same rate and the price will fall back to the desired point or will be reduced to close levels. The same will happen when the price drops; When the price drops, the supply will decrease at the same rate, and thus the price will be pulled to the desired point.

Well, to summarize the above definition:

The asset value in the wallets of Rebase Tokens holders always remains the same. However, the amount of coins changes according to the movement of the price. Therefore, the asset values of the Rebase Token holders will not change, only the token amounts will change.

To give the simplest example; Imagine you buy 50 Rebase Tokens for $10. Halving the price of the coin will not cause any change in your balance. Your assets will still be $10, but the amount of Rebase Tokens in your wallet will increase from 50 to 100. In short, the amount of coins you hold will change and you will not be harmed in any way.

Question 4

Go to the https://www.ampleforth.org/dashboard/. Check the necessary parameters and calculate the rebase %. What else can you find on the page?

In order to fulfill the task in this section, we first go to the ampleforth platform.

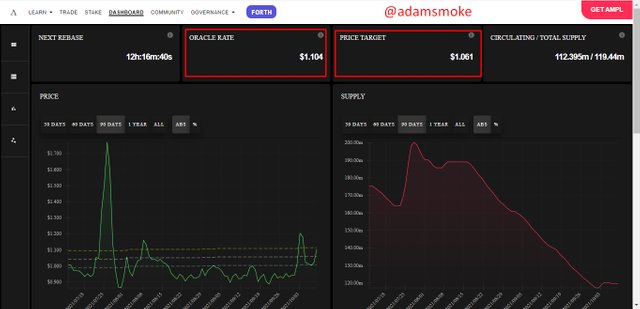

As you can see in the screenshot above, some values welcome us:

- Oracle Rate: 1.104 USD

- Price Target: 1.061 USD

- Next Rebase: 12h: 16m: 40s

- Circulating / Total Supply: 112.395m/119.4m

After obtaining the necessary information, we can perform our Rebase Calculation.

Formula Rebase %: [[(Oracle Rate – Price Target) / (Price Targer)] x100] / 10

Rebase % = [[(1.104 – 1.061) / ( 1.061)] x 100 ] / 10

= [(0.043/1.061) x 100] / 10

Rebase % = 0.0368 %

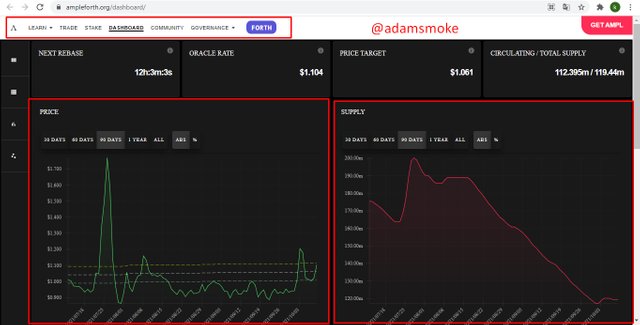

If we want to examine the Ampleforth platform a little more:

As you can see in the screenshot above, there are certain sections. There are some menus in the area that I have shown with the box at the top. These;

- LEARN: Provides information about AMP Token.

- TRADE: This menu covers the trading feature and has various exchange platforms.

- STAKE: This section contains information about Stake.

- Dashboard: Allows us to access the data we obtained in the previous section; Oracle Rate, Target Price, etc.

- Community: Community, as we all know, contains information about events and community.

- Governance: In this section; There are How it Works, Forth Token, Resources sections.

When we look at the screenshot again, there are two graphics at the bottom of the page. These charts are Price and Supply charts.

Question 5

Trade some tokens for at least $15 worth of USDT on Binance and explain your steps. (Give necessary Screenshots of the transaction).

In this section, I will do it through my verified Binance account.

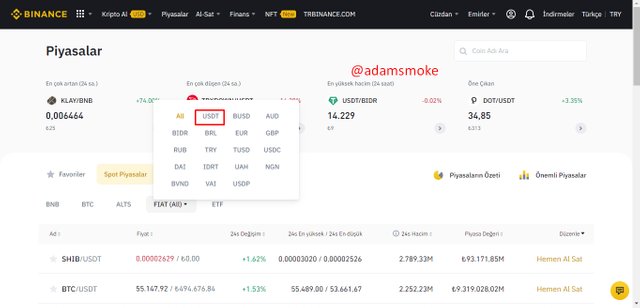

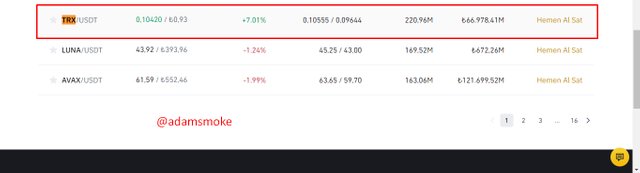

TRX/USDT Sell

- First, I log into my Binance account.

- Then I click on the Markets section and then I come to the Spot markets section.

- From this section, I click on the FIAT option and select the USDT option.

- Since I will sell TRX later, I find the TRX/USDT pair and click it.

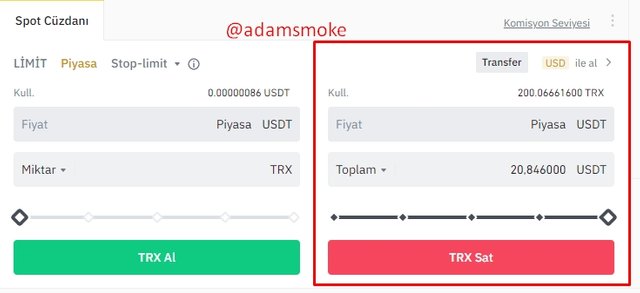

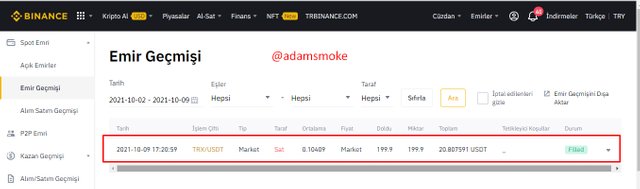

- Then I sell my 200 TRX asset for 20.84 USDT with Market order. Since my transaction is given by Market order, my USDT balance is directly loaded into my account.

Question 6

Transfer the USDT to another wallet with the Tron Network. From the transaction, what are the pros of the stablecoin over fiat money transactions? (Give Screenshot of the transaction).

In this section; In the previous section, I will send the USDT amount we obtained by selling our TRXs from my Binance Account to my FTX account.

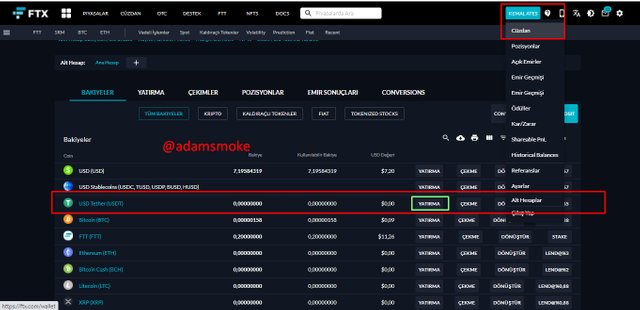

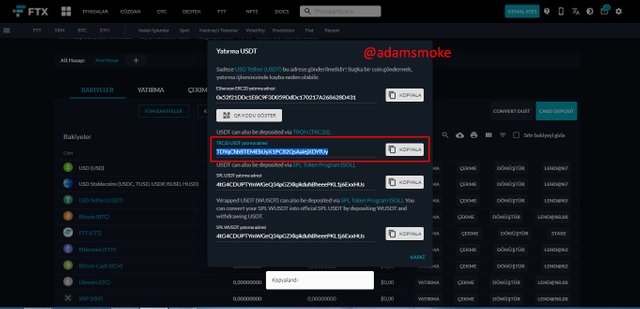

- First, I log into my FTX account.

- Then I open my Wallet and to deposit USDT, I find the USDT option and click the “Deposit” button.

- A drop-down menu welcomes me and the networks to which I will transfer. In this section, I am copying the TRC20 address, since the Professor said to use the Tron Network.

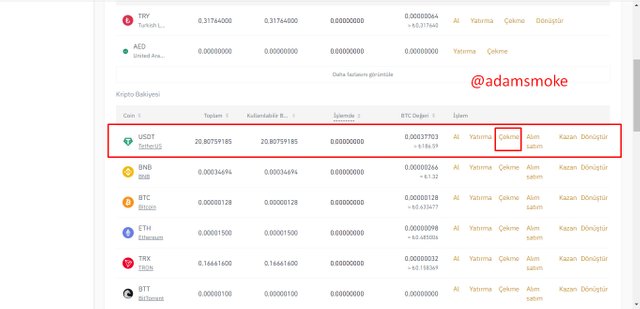

- Then I go back to my Binance account and open my Spot Wallet.

- I find my USDT balance and click the “Withdraw” button.

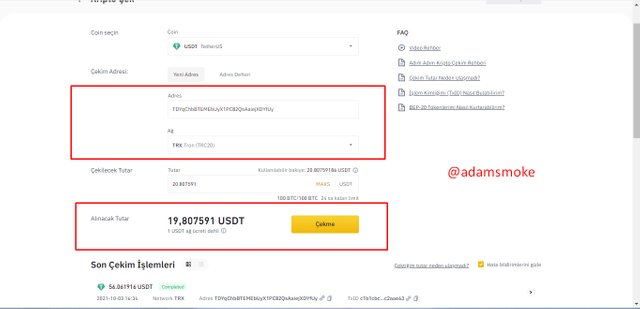

- Then, on the screen that comes up, I choose the Address to which I will send and the network to which I will send.

- Then I say maximum to the amount part and it says that it will transfer 19.80 USDT by deducting 1 USDT transaction fee from me.

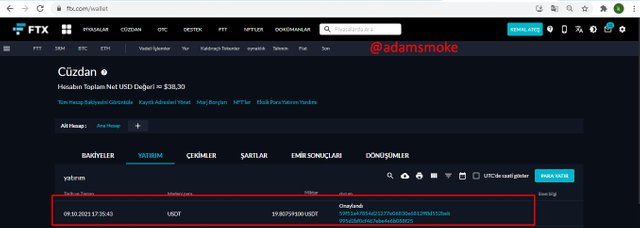

- I accept and send. Then, we fulfill the verification steps that appear and our sending process takes place.

What are the Stablecoin Pros over FIAT Money transactions?

- The most important feature is that it is very fast and easy. The process is quite simple and there are options to choose the network we want. It is a very fast transaction, we can generally complete our transactions in less than 4-5 minutes.

- Decentralized; It was a transfer process in which all stages were managed by ourselves, without being tied to any state or institution.

- At the end of the transaction, only numeric codes appear when money comes to my FTX account. No name or other personal information has been transferred.

- I didn't have to go anywhere to perform this process, I did it directly from my home. In this process, I sent myself, but I will follow the same steps when doing this with another person in the other part of the world. For this reason, I can send even to points where FIAT currencies are not available, with a single click.

Conclusion

In this course, we have provided a lot of information about the precautions taken against the volatility of cryptocurrencies and the requirement that comes with it, Stablecoins. It was still a great lesson. We applied what we learned in the lesson and learned new things about cryptocurrencies, the money of the future.

- Thank you to everyone who read my post. Also, thanks to professor @awesononso for this nice lecture.*

Nice post. if you haven't Get the recent prize from bittorent for steem community don't get behind Sign in Now CLICK HERE and claim your BTT now

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit