Introduciton

Hello to everyone,

In this post, there are professor @awensononso's assignments for this week's lesson. Our topic will be on Order Books and a little bit on buy and sell orders. We can start now.

Question 1

Define the Order Book and explain its components with Screenshots from Binance.

Order Book, as the name suggests, is the list of limit orders we give for any asset pair. So what are these orders? It is the recording of the quantity and price of the product in the purchase or sale of any asset. Order books are quickly arranged electronically and according to price. In this way, it is the place where we can see clearly and sequentially how many and at what price the buyers and sellers on the Market have put an asset to buy or sell.

- The above screenshot shows the LUNA/BNB pair order book.

- The list we see in green in the screenshot above is the Buy (Bid) trade orders. The list we see in red shows the Sell (Ask) transaction orders.

- The Bid section of the Order Book always shows the highest price at the top, and the Ask section always shows the lowest price at the top. These lists are categorized and listed according to their price values.

- There is also an option where we can list the prices according to their decimal values, in the area shown with the red box in the upper left part of the order book.

Order books are one of the tools that help the trader in many ways and that we need to know first. So much so that it is possible to access a lot of information that we can access while doing chart analysis on the market with the order book. If we talk about these features;

- It can be understood whether there is liquidity in the market by looking at the order books and calculating the buying and selling spread.

- It can be used to determine the trend of the market. For example, by looking at the order list, we can easily see the amount of buying or selling an asset, so we can know that the price is rising or falling.

- The support and resistance levels we determined in the chart analysis are a real trading congestion zone. When the price reaches these levels, it reacts and rises or falls. In the order book, it is possible to see how many transactions are in which price range, and thus it is possible to determine the support and resistance points.

Question 2

Who are Market Makers and Market Takers?

There are two types of traders on the market. Market Makers and Market Takers.

Market Makers

Market Markers are people who trade according to the price they set when buying or selling any asset on the market. These individuals provide a liquidity on the asset. In short, we can call the traders using Limit Orders as Market Markets.

Market Takers

Market Takers are people who make transactions at the instant price of the asset instead of the price they set when buying or selling any asset on the market. These people do not bargain for any asset and agree to buy the asset at the price it is. These individuals receive liquidity on an asset. In short, we can call the traders using Market Orders as Market Takers.

Question 3

What is a Market Order and a Limit order?

As every trader knows, there are two types of orders on the market. Market Order and Limit Order.

Market Order

In this type of order, we do not determine the price of the asset we want to buy. The moment we place the order, it takes place and our buy or sell transaction takes place at the current market price. We can use such orders when we are going to perform instant buying or selling transactions in general. Such orders cannot be corrected because they are instantaneous.

Limit Order

Limit Order is an order type that we determine the amount and price for any asset we specify. We usually use this order type in our trades. Because in order to make a profit, we have to sell more than our purchase price. Such orders remain in the order book until they are filled and can be edited.

Question 4

Explain how Market Makers and Market Takers relate with the two order types and liquidity in a market.

As we mentioned above, Market Markers provide liquidity to an asset as they use Limit orders. So how does this happen? the more limit orders are placed on an asset, the more orders will accumulate at any price level. This is a positive thing for traders who will buy and sell, because the person entering the market will be able to buy and sell easily. Therefore, traders or market makers using Limit Orders provide liquidity to the market.

Next comes Market Takers, and since these traders use Market orders, their transactions are automatically matched with someone who has placed a limit order. For this reason, we can say that if there are too many Market Takers, that is, traders using Market orders, they get liquidity as they will reduce the accumulation in the order book.

Question 5

Place an order of at lease 1 SBD for Steem on the Steemit Market place by

a) accepting the Lowest ask. Was it instant? Why?

b) changing the lowest ask. Explain what happens.

(Make sure you are logged in to your wallet).

a)

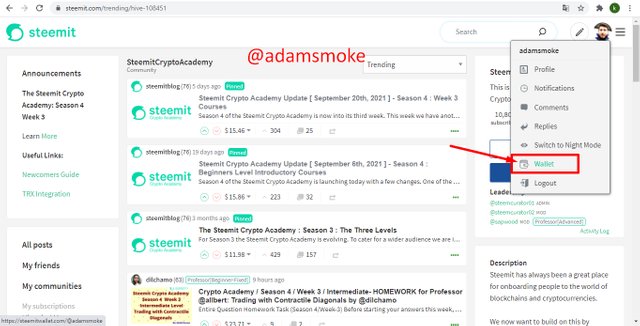

- The first thing we need to write is to open our Wallet by clicking on our Steemit profile.

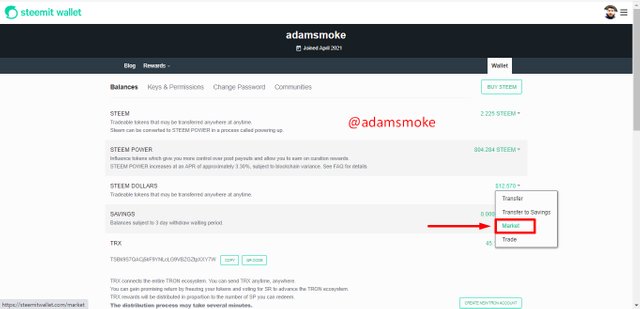

- On the next screen, we come to the section with our SBD balance and click on it. Then click on the “Market” option in the drop-down menu that appears.

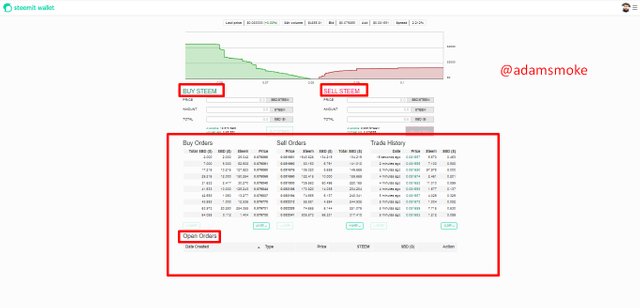

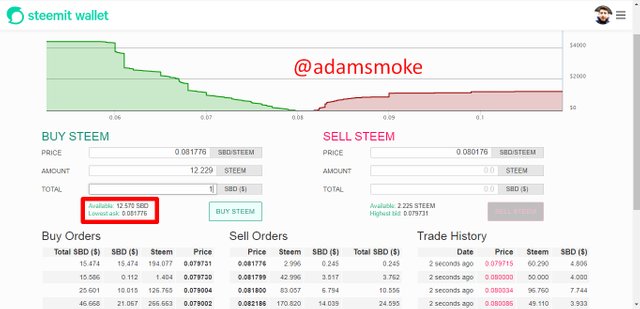

- Afterwards, the Steemit Market section welcomes us. In this section, there is the buying and selling section of the SBD/Steem pair, Order Books, Trade histories and sections where we can see our Orders.

Then we can start buying Steem with accept “Lowest Ask”.

- As you can see in the screenshot above, I want to buy 1 SBD of Steem from the Lowest Ask value of 0.081776. I enter the required data.

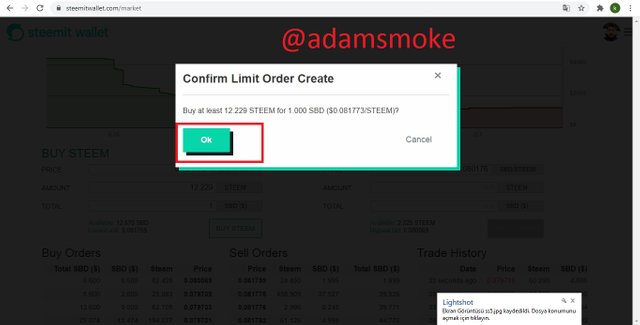

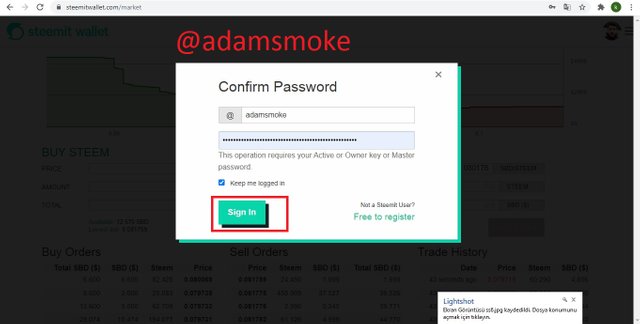

- Then I confirm the transaction and enter my password.

When we carry out all these operations, two scenarios are likely to occur;

- The order is filled immediately

- The order is not filled immediately, it is recorded in the order book.

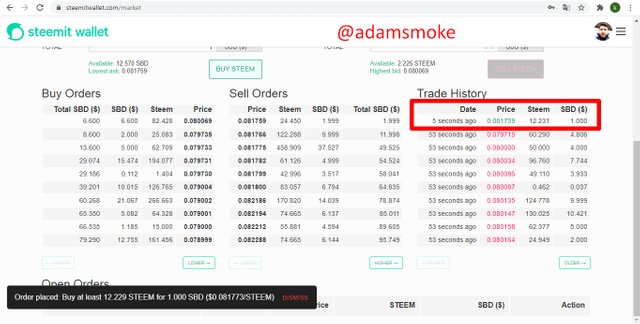

- As you can see in the screenshot above, my transaction was instant. My role here was Market Taker, as I bought the asset directly at the instant price without any negotiation.

b)

In this section, we will perform the transaction by changing the “Lowest Ask” price.

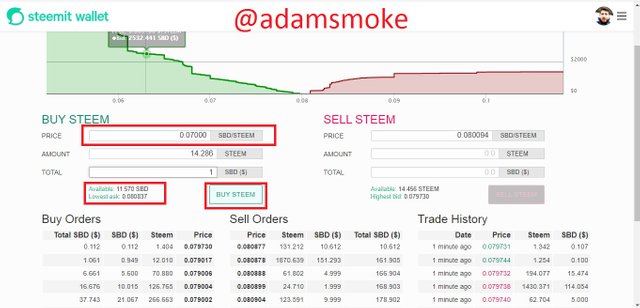

- As seen in the screenshot above, our Lowest Ask value is 0.080837 USD. The price I set is 0.070000 USD.

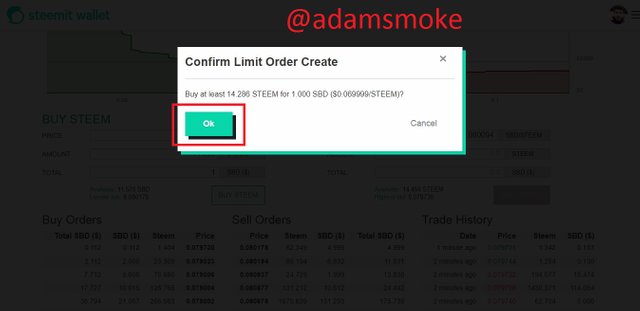

- After typing the necessary data, we call Buy Steem and enter our password after giving the necessary approval.

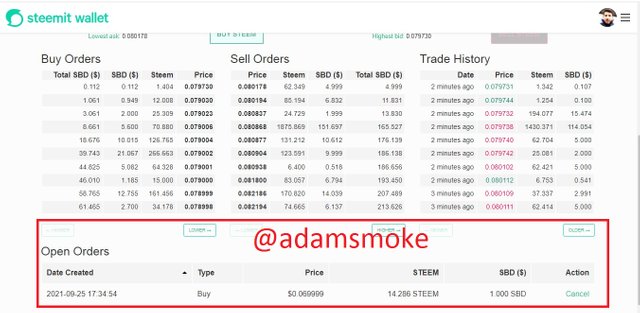

- Afterwards, our transaction is not filled immediately and is recorded in the order book until the price drops to 0.07 USD.

- In this transaction, we play the role of a Market Maker, as I set the price and amount myself.

Question 6

Place a TRX/USDT Buy Limit order on the Binance exchange for at least $15. Explain your steps and explain the impact of your order in the market. (Give Screenshots).

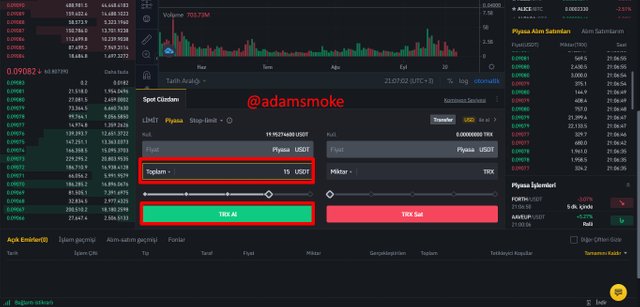

- In order to perform this transaction, we first open the TRX/USDT pair on the Binance exchange.

- Later, when I examine the order book, I see 0.09077 USDT of the highest price.

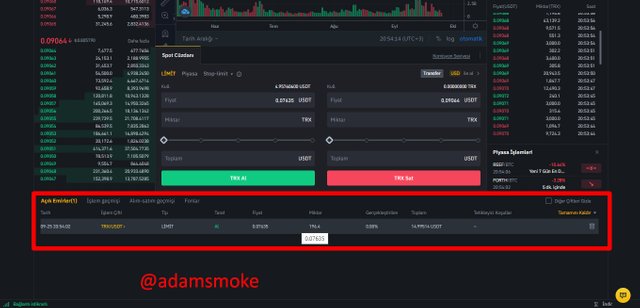

- Since we are going to place a limit order later as the Market Maker, I also enter the data required for the $15 Buy position worth 0.07635 USDT as I think the price will drop.

- Then my transaction is processed in the Order book and appears in the list of my Open Orders.

Impact of My Order

Since we are a Market maker in this transaction, our transaction has been recorded in the order book and is waiting to be filled. Thanks to this transaction, I contributed to the accumulation in the order book and increased the liquidity ratio of the asset.

Question 7

Place a TRX/USDT Buy Market order on the Binance exchange for at least $15. Explain your steps and explain the impact of your order in the market. (Give Screenshots of the completed order).

- In order to perform this transaction, we first open the TRX/USDT pair on the Binance exchange.

- Since we will give this transaction with Market Order later, I don't need to look at the order book.

- Then I fill in the necessary data to buy 15 USDT worth of TRX and click the Buy TRX button.

- As you can see in the screenshot below, our transaction is instant and we buy 164.9 TRX for 15 USDT.

Impact of My Order

As we play the role of a Market Buyer in this transaction; we bought directly at the instant price without questioning and examining the price of the asset. Since this transaction matched a transaction in the order book, we caused a decrease in the number of transactions in the order book. Therefore, we have taken the liquidity of the asset. In other words, we have reduced the liquidity ratio.

Question 8

Take a Screenshot of the order book of ADA/USDT pair from Binance on the day you are performing this task. Take note of the highest bid and Lowest ask prices:

a) Calculate the Bid-Ask.

b) Calculate the Mid-Market Price.

a) Calculate The Bid-Ask

When we look at the Bid-Ask values of the instant ADA/USDT pair on the Binance platform;

- The Bid Price = 2,370 USDT

- The Ask Price = 2,372 USDT

If we remember The Bid-Ask Spread Formulas;

- The Bid-Ask Spread = The Ask Price – The Bid Price

- The Bid-Ask Spread %= ((The Ask Price – The Bid Price )/ The Ask Price) x 100

The Bid-Ask Spread = ( 2.372- 2.370) = 0.002 USDT

The Bid-Ask Spread % = (0.002/2.372) x 100 = 0.0084317 %

b) Calculate The Mid-Market

I am looking at the Bid-Ask values of the instant Ada/USDT pair on the Binance platform again. (The Bid-Ask values had changed because I took a break while doing the homework.)

- The Bid Price = 2,401 USDT

- The Ask Price = 2,366 USDT

If we remember the Mid-Market Formula;

- Mid-Market Price = (Bid Price + Ask Price)/2

Mid-Market Price = (2.401 + 2.366)/2

Mid-Market Price = 2.3835 USDT

Conclusion

This week's topic was generally on the Order Book, which traders should definitely know and learn to use. I have tried to convey all the necessary information to you in a beautiful language as best I can. I tried to show you the use of the order book with practical examples.

Thanks to professor @awesononso and everyone who read my post for this beautiful and instructive lesson. I hope you all have a good and healthy time.

Hello @adamsmoke,

Thank you for taking interest in this class. Your grades are as follows:

Feedback and Suggestions

Good job! You have demonstrated a ood amount of knowledge on the topic.

Number 1 could have been explored more.

There were a few parts that could have been clearer.

Thanks again as we anticipate your participation in the next class.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit