Hello to everyone,

In this post, professor @imagen's assignments are included. The subject we will talk about in general is about Yield Farming. Thank you to everyone who reads my post.

(1.) Describe the differences between Staking and Yield Farming.

Before examining the difference between Staking and Yield farming, I would like to give a brief overview of what they are.

Staking

Staking is the process of locking our cryptocurrencies in our wallet for a certain period of time and keeping them in our wallet without spending or transferring them in any way. These coins that we lock in our wallet allow us to earn rewards at certain rates during the time we lock them. These earned rewards are generally refunded to us in cryptocurrencies that I lock. For example: If you stake ETH, you will get ETH as a reward.

The concept of stake came to the world of cryptocurrencies with the Proof of Stake (PoS) algorithm. The most basic feature of this algorithm is to prevent wasting large amounts of processing power. Another feature of the PoS mechanism is that it contributes to the supply-demand balance to a certain extent by reducing the amount of cryptocurrency in circulation.

Yield Farming

The Yiedl Farming method is another way for us to earn more cryptocurrencies with the cryptocurrencies we have. This method, in its simplest definition, is the process of lending our cryptocurrency assets together with smart contracts. At the end of this lending transaction, we earn some rewards.

In this method, the first thing we need to do is to choose a liquidity pool suitable for our capital and risk amounts. Then, our assets are locked in this pool we choose. The assets that are usually locked in this method are stable cryptocurrencies. Users who lock their assets after doing this are now called liquidity providers. In this method, each user gets rewards according to the amount of assets locked. These rewards may differ depending on the amount of our assets and the platform we choose. This method is also called liquidity mining.

Staking vs Yield Farming

| Staking | Yield Farming |

|---|---|

| The PoS algorithm is used in the staking process. | In Yield Farming, automatic market makers are used. |

| In the staking method, there is a certain amount of reward, which we express as APY. This rate is usually around 5%, but there may be slight variations. | Yield Farming requires a well thought out and calculated investment strategy. In this way, the amount of reward we get can go up to 100%. |

| Staking rewards are network incentive fees generally given to block producers. | In the Yield Farming method, the rewards are determined by the liquidity pool and may vary according to the price of the asset. |

| Users who try to cheat the system in the staking method may lose their funds. | Yiedl Farming method, on the other hand, if the programming is not done correctly and properly, its security is greatly reduced and it becomes vulnerable to attacks. |

| There is no risk of permanent loss in the staking method. | In the Yield Farming method, permanent loss may occur with price fluctuations. |

| There are certain limits in the form of minimum amount and minimum time in the staking method. | There is no such thing in the Yield Farming method. |

(2.) Login to Yearn Finance. Fully explore the platform and indicate its functions. Describe the process for trading on the platform (wallet connection, funds transfer, available options) Show screenshots

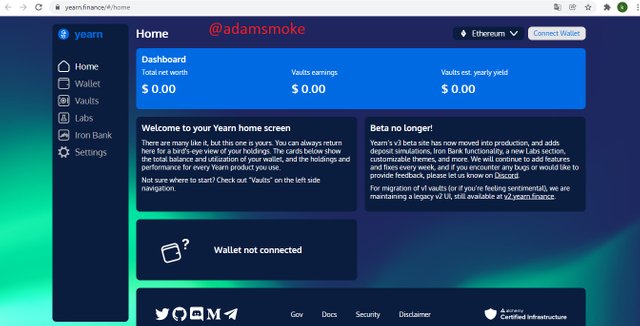

The first thing we need to do is go to yearn.finance.

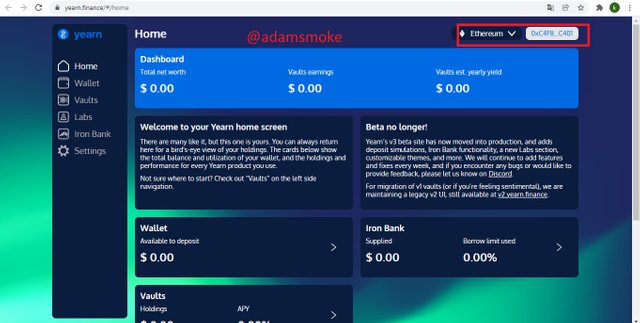

The Dashboard indicator welcomes us on the home page that comes up later. In this indicator, Total net worth, Vaults earnings, Vaults est. There is information such as Yearly yield. Then, when we look at the left side of the main page, options such as Wallet, Vaults, Labs, Iron Bank, Setting welcome us. Then there is the “Connect Wallet” option in the upper right corner. Let's take a closer look at these sections.

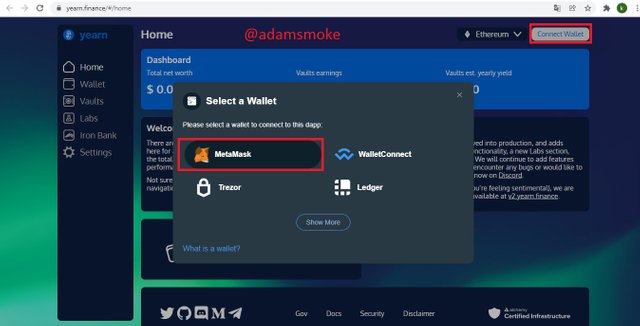

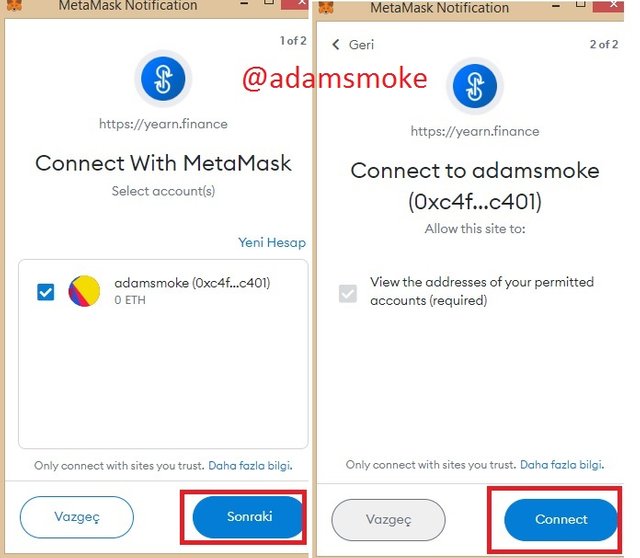

Connect Wallet

First, we press the “Connec Wallet” button. Then we see a screen where we can connect our wallets. From this screen, I click on the Matemask option. Then, after giving the necessary approvals, our wallet is successfully linked.

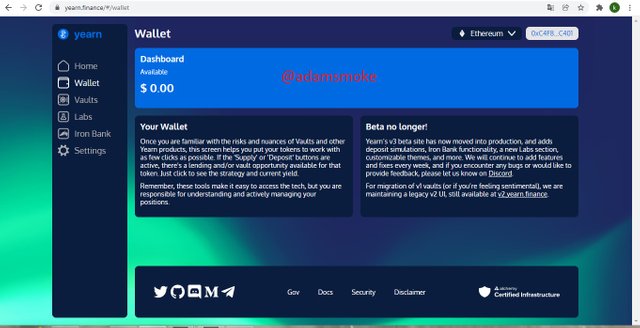

Wallet

In this section, we can see the assets we can invest in dollars and we can see the coins we can deposit again. In this section, there is no visible coin because I do not have a balance.

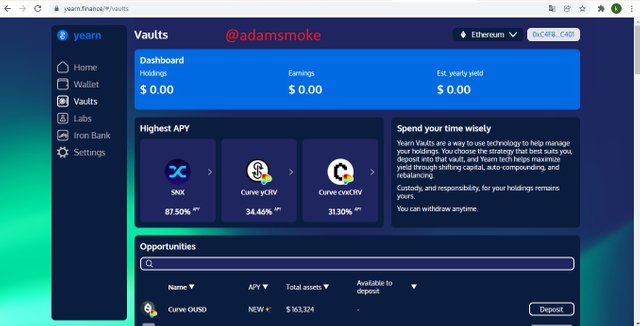

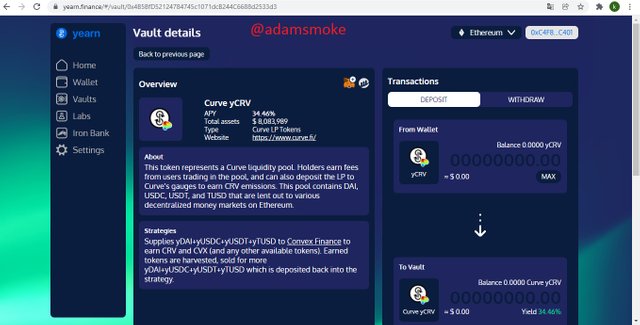

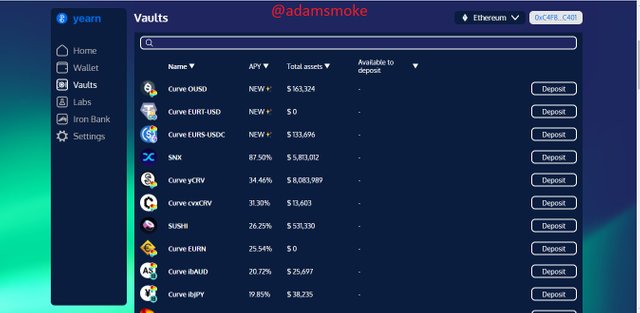

Vaults

In this section, we can see the coins that we can deposit on the platform. When we click on the coin we want to deposit, we can get more detailed information and reach the APY amounts. Again, in this section, we can access deposit and withdrawal options.

Labs

In this section, there are high-risk investment options. For now, 3 options that we can actively invest in are presented to us. In this section, we can see in-depth information about the assets and their APY rates.

Iron Bank

In this section, there are options where we can request and give credit over a token we want.

Settings

In this section, there are options where we can customize the platform. In addition, we can also change the slippage tolerance settings.

(3.) What is collateralization in Yield Farming? What is function?

In the Yield Farming method, the collateral is no different from the real-life collateral method. For example, you wanted to borrow money from a person and you gave the watch on your wrist as collateral in return for your debt. At this point, when you pay back your debt, you get your clock back. But if you don't pay, the borrower can sell the watch. The same is true for getting loans from banks. For example, you want to get a loan from a bank and the bank wants you to provide collateral. Let's say you show your own house as collateral for the loan you get from the bank. Likewise, if you pay off the loan, your house is still yours. However, if you do not pay the loan, your house now belongs to the bank and it can be used or sold as it wishes.

In the Yield Farming method, the collateral works in the same way. For example, you request a loan and it tells you that you must have an investment for the amount you demand. Because otherwise, anyone can request a free loan, and this does not turn out well for the platform.

Now let's assume that you request a loan of $ 100, the platform may ask you for 2 times the collateral for this $ 100 and you may need to show a collateral of $ 200. This rate can go up to 6x in markets where the risk is low.

The purpose of using this method is to keep our assets unchanged and for a longer period of time. It is also used to protect our liquidation risk due to price fluctuations.

(4.) At the time of writing your assignment, what is the TVL of the DeFi ecosystem? What is the TVL of the Yearn Finance protocol? What is the Market Cap / TVL ratio of the YFI token? Show screenshots.

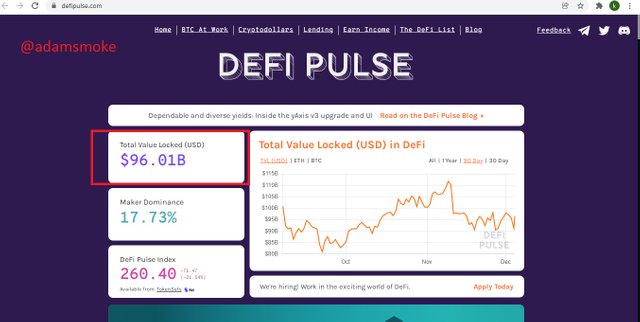

First, we go to the defipulse platform. At the time of writing, we see that the TVL value of the Defi ecosystem is 96.01 billion.

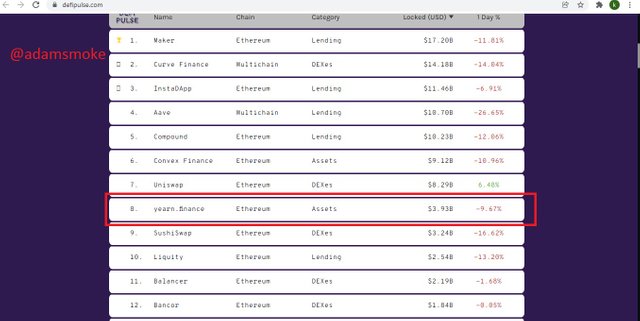

When we go down a little on the platform, we can see the TVL value of “Yearn Finance”.

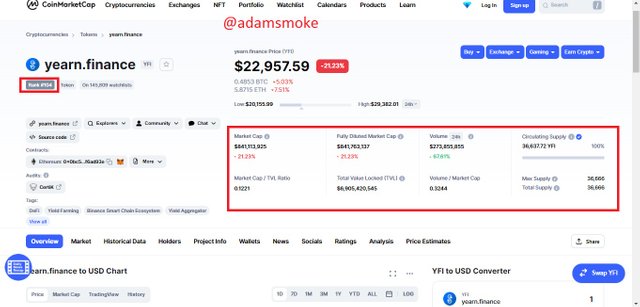

Then we visit the Coinmarketcap platform and look at the YFI coin.

As we can see in the screenshot above;

- Rank = 104

- Marketcap = $841,113,925

- Marketcap/ TVL Ratio = 0.1121

- Total Value Locked (TVL) = $6,905,420,545

We can reach their values.

(4.1.) Is the YFI token overvalued or undervalued? State your reasons.

For an asset to be considered valuable, the TVL ratio must be 1 or higher. Therefore, we can consider the value of the YFI coin to be low because it has a rate of 0.1221. However, when we look at the price instantly, it has a value of 22,957 USD.

(5.) If on August 1, 2021, you had made an investment of 1000 USD in the purchase of assets: 500 USD in Bitcoin and the remaining 500 USD in the YFI token, what would be the return on your investment in the actuality? Explain the reasons.

Invest 500 USD in BTC

I will use the platform Tradingview to look at the value of BTC on August 1, 2021.

As we can see in the screenshot above, there is an instantaneous increase of 17.94% in BTC price with the date of August 1, 2021. Considering we bought 500 USD BTC:

- PROFIT = $500 x 17.94% = $89.7

- Total Money = $500 + $89.7 = $589.7

YFI 500 USD Investment

There is a -27% decrease between the date of August 1, 2021 and the instantaneous YFI value. Considering that we have a $500 YFI investment:

- Profit = $500 x -27% = - $135

- Total Money = 500 USD – 135 USD = 365 USD

Even today, when the value of BTC fell sharply, we were able to profit from the investment we made on August 1, 2021. However, we cannot say the same for the YFI token. This shows us that BTC is still the dominant currency in the crypto asset market and is more popular than the YFI token. At the same time, these rates show us that BTC is preferred and accepted by new investors and new buyers.

(6.) In your personal opinion, what are the risks of Yield Farming? Give reasons for your answer.

Yield farming has many risks. Simply put, they can be set up to steal the assets of their investors. This risk exists not only in Yield Farming but also in many cryptocurrency projects.

The Yield Farming method is really a method that requires knowledge and effort. When you apply the right strategies and make your investment plan, the returns can be high. However, in the same way, uninformed investments can cause us to consume our capital and cause us high losses. In Yield farming method, our risk of permanent loss is higher than other methods.

Certain problems may occur on many of the Defi platforms, and sometimes minor problems may affect the entire platform. Because in completely decentralized systems, certain problems may arise in smart contracts, and this is a risky situation for both the platform and its users.

Conclusion

In this post, we discussed the Yield Farming method in general. Yield Farming method can be shown among the opportunities offered by the cryptocurrency world. But of course, there is risk in every investment, and it's a bit more with Yield Farming. However, with this method, we can earn more income than many methods.

As a result, Yield Farming method is a good method that allows us to make profits thanks to beautiful and successful Strategies. The point we should remember is not to confuse Staking with Yield Farming. Because although they look the same, the differences between the two are quite large.

CC: @imagen