Trading

Trading can be defined as the act of trade, in simple words trading means the buying and selling of commodities or the exchanging of commodities or money by two entities who are always the buyer and the seller.

There is no trading without a buyer and a seller. Trading has been known since the early life of man by exchanging a commodity to get another commodity.

There is also something known as financial trading which is the main purpose of this lesson. Financial trades are the exchange of assets like currencies, Product, commodity and CRYPTOCURRENCY.

Trading in cryptocurrency is the exchange of assets like BTC and ETH or STM and USDT. This form of trading allows for digital exchange of coin with one another, this is always done by buying an asset low and selling it when it goes high to other traders. Another trading set up in cryptocurrency is the prediction of price of a coin whether it will rise up or down.

Working principle of crypto trading

Let's take for example we bought 1000 unit of coin A at a price of $0.1 two days earlier and by the third day the price rose up to $1 for one, this means we bought the whole 1000 unit for $100 but today it's worth $1000, the owner of the unit of this coin will then exchange the coin for other coin which are more stable in price.

This is the principle of trading in crypto. One buy low and sells high. If for example after buying the assets for $100 the coin price then fell to about $0.05 to cost $50 this means the trader has made a lost of $50. This happens alot in crypto due to the high volatility of the market.

The price of assets moves drastically up or down depending on what direction it wants to move.

TOOLS FOR TRADING

For a trader to trade efficiently and less risk due to the volatility of the market there are certain tools such trader will adopt to help in trading efficiently. These tools are known as Fundamental and Technical Analysis.

FUNDAMENTAL ANALYSIS

Fundamental analysis is a method where an analyst takes a deep look into the informations of an asset like it's price changes, use cases, the amount of holders and the commitment of the team members of the project.

The analyst try to find out if the asset price is overvalued or undervalued at a particular time. This information can then be used to know when to enter or exit a trade.

Fundamental analysis is further divided into 3 categories on-chain metrics, project metrics and financial metrics.

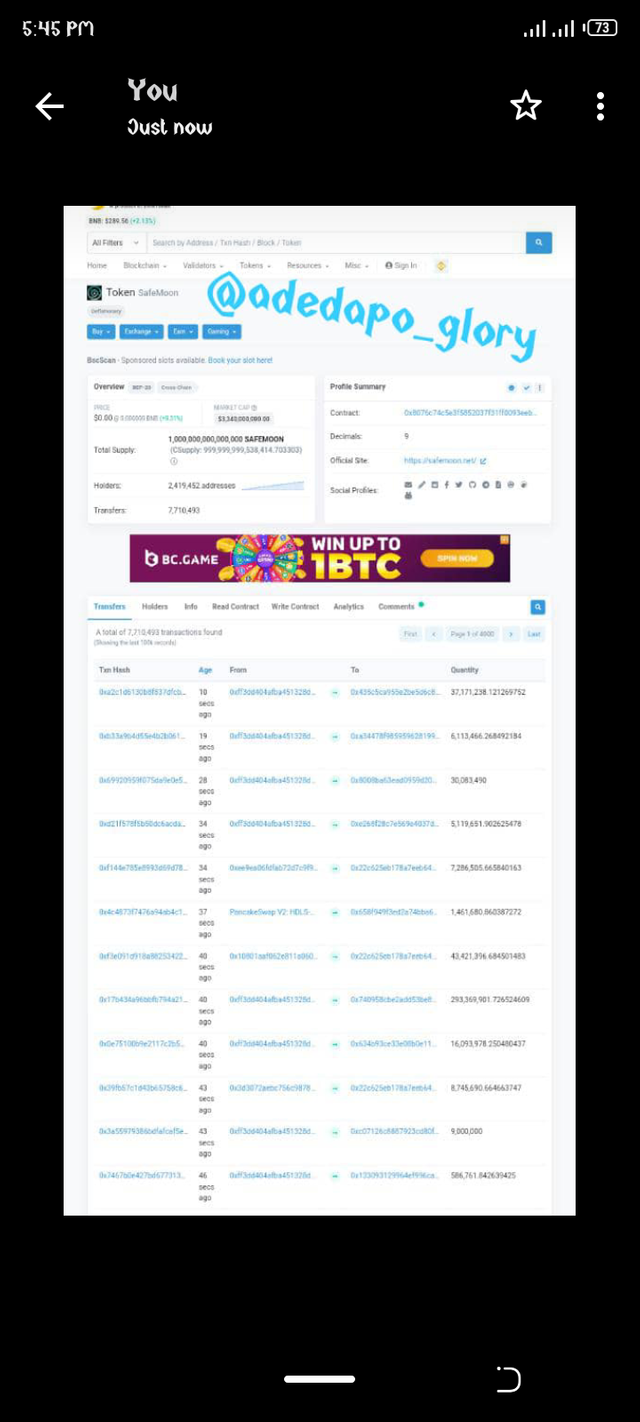

ON-CHAIN METRIC

On chain metrics are informations that are provided by the blockchain that can be pulled up from websites like coinmarketcap etc. Informations like transaction count; the activity that takes place on the network, transaction value; this is the value of how much volume had been traded over a period of time for example if 100 ATC is trading at $1 then the volume of the coin for that day is $100.).

We also look out for the active addresses in the blockchain the sending and receiving transactions over a set period. Also we check for the total amount of addresses that transacts on the blockchain. .

PROJECT METRICS

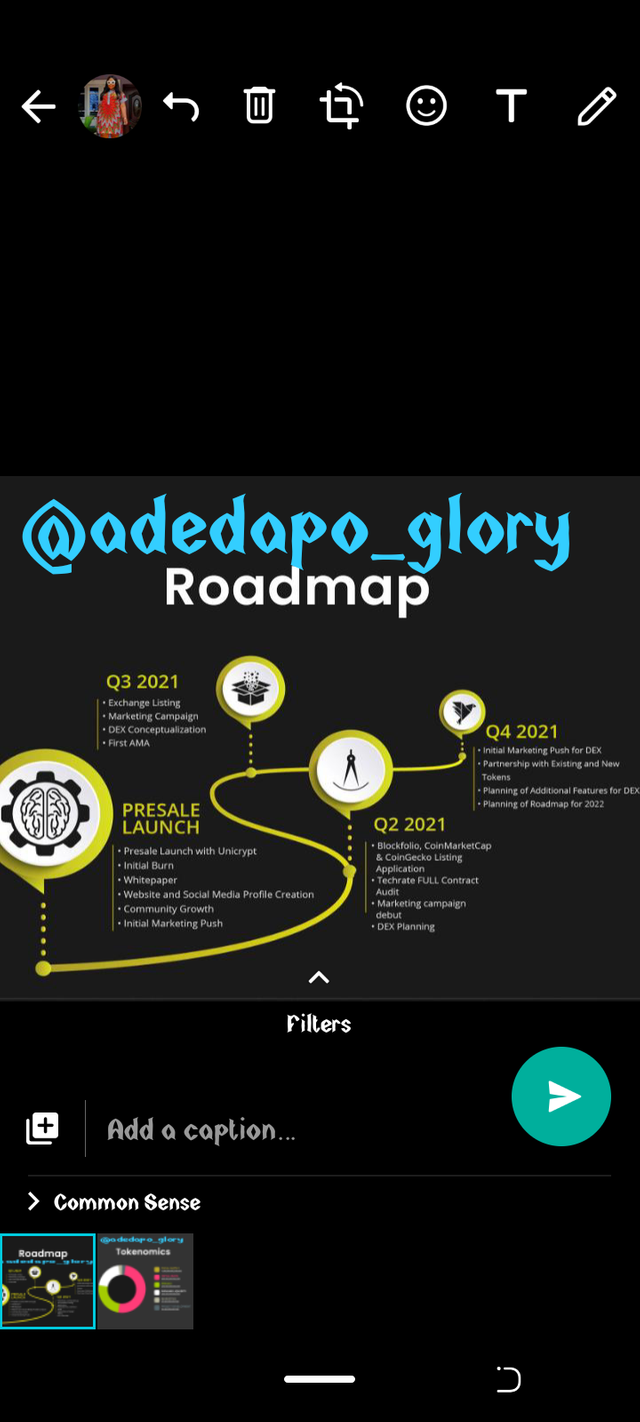

This is mainly about the team performance, the white paper and probably the road maps.

The whitepaper

This is a document that talks about the cryptocurrency project, the goals, the use case of the coin, the technology used, the road map, the supply and new features of the coin.

It's highly recommended that you read the whitepaper of any project before investing. This is a technical document that gives us an overview of the cryptocurrency project.

A good whitepaper should define the goals of the network, and ideally give us an insight into. The white paper also gives us hints about the team of the project and the crypto asset it is targeting like another token it's competing with so as to know which area they want to be better than the other.

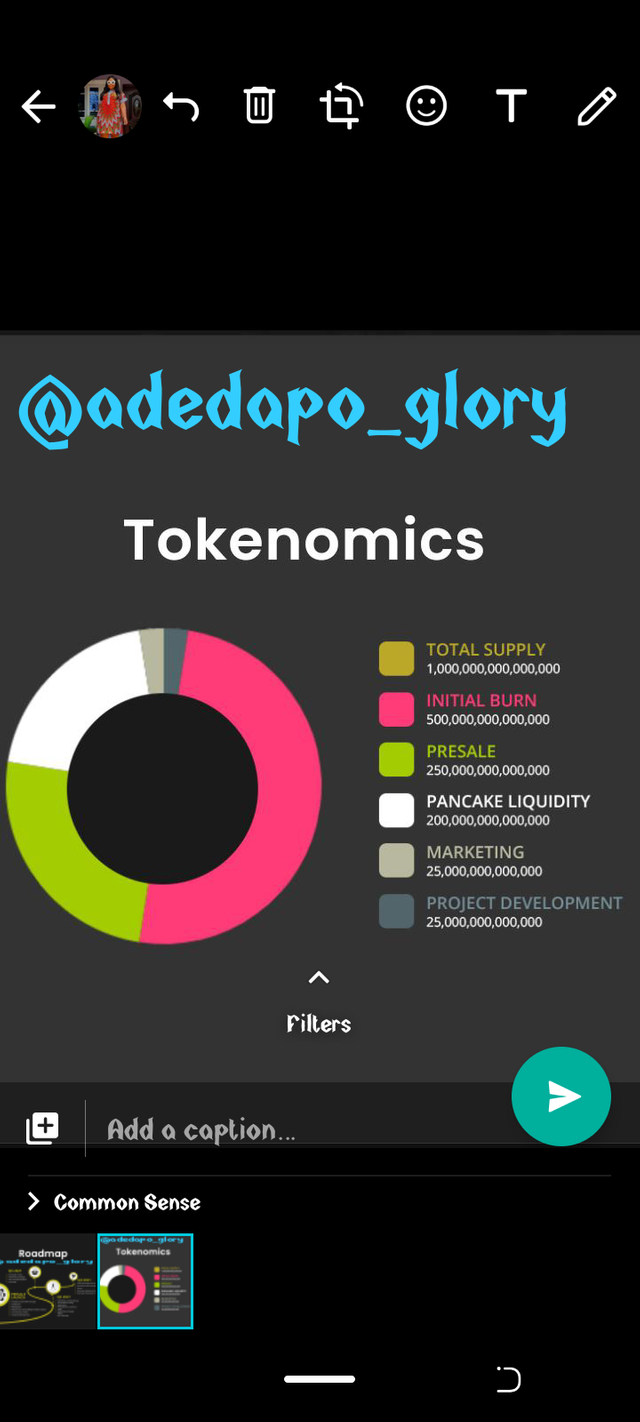

Tokenomics

This gives information as to how the coin was initially launched maybe through and ICO or IEO, the way the coin is distributed, the liquidity of the project. The tokenomics also state how much is kept aside for the team and the founder which is also very important.

FINANCIAL METRICS

This is the information about the asset trade, the liquidity market capitalization, volume and the supply mechanism of the asset.

TECHNICAL ANALYSIS

Technical analysis are tools that helps a trader to predict the future movement of the price of an assets based on following the action and behavior of the asset. The technical analysis is one of the famous Technique in getting the price movement of an asset.

Technical analysis also helps a trader to know when to enter a trade and when to exit a trade and also minimizing risk for traders. There are various kinds of technical analysis tool.such as RSI, BOL, MACD etc.

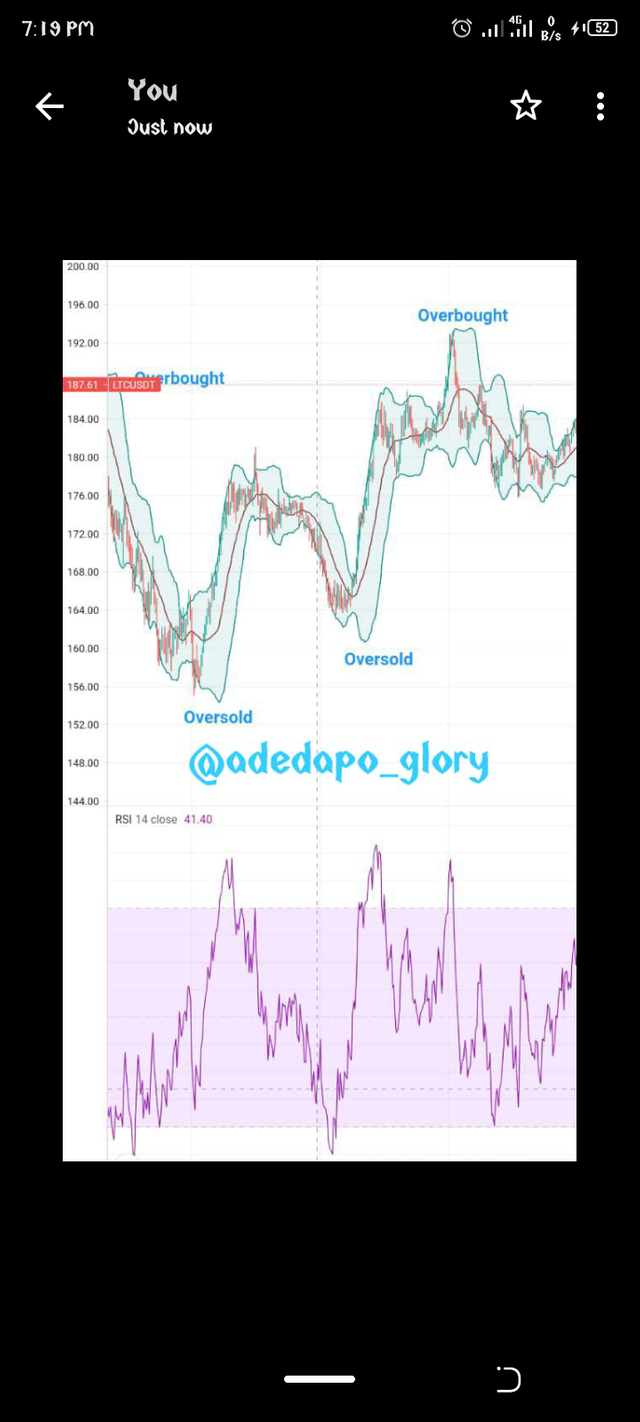

BOLLINGER

Bollinger bands is a technical analysis tool that was created by John Bollinger in 1980. The tool.helo to.identigy an overbought or oversold assets. The band movement is based on the volatility of the assets.

EXCHANGES TO BUY CRYPTOCURRENCY FROM.

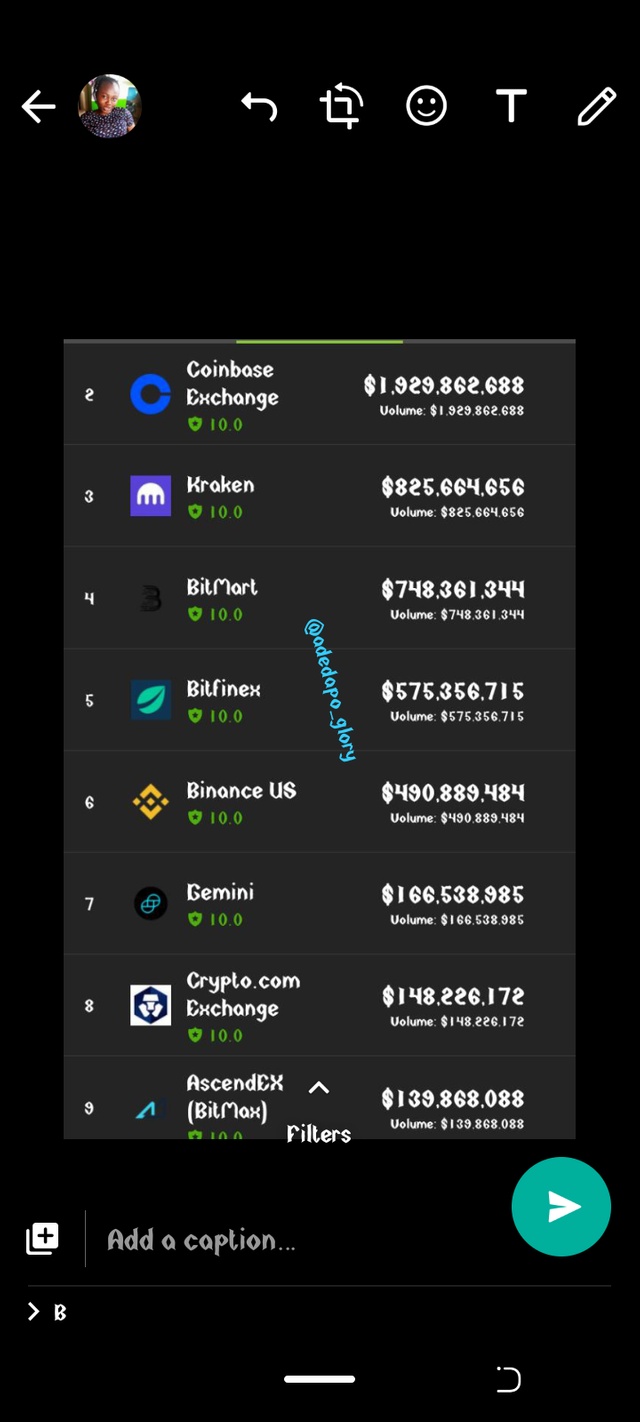

There are several exchanges where one can buy cryptocurrency from and new ones keeps coming in day by day.

These exchanges are listed based on the volumes they have, Binance is the number one exchange with over $3 billion dollar volume, followed by coinbase with $1.9 billion volume then kraken with $800 million volume. There are lot more but if we keep listing we won't end. This listing is by coingecko an information platform for cryptocurrency.

For this tutorial I will be choosing kucoin with a trading volume of $762 million, I will explain how to buy cryptocurrency with the exchange platform.

Step 1

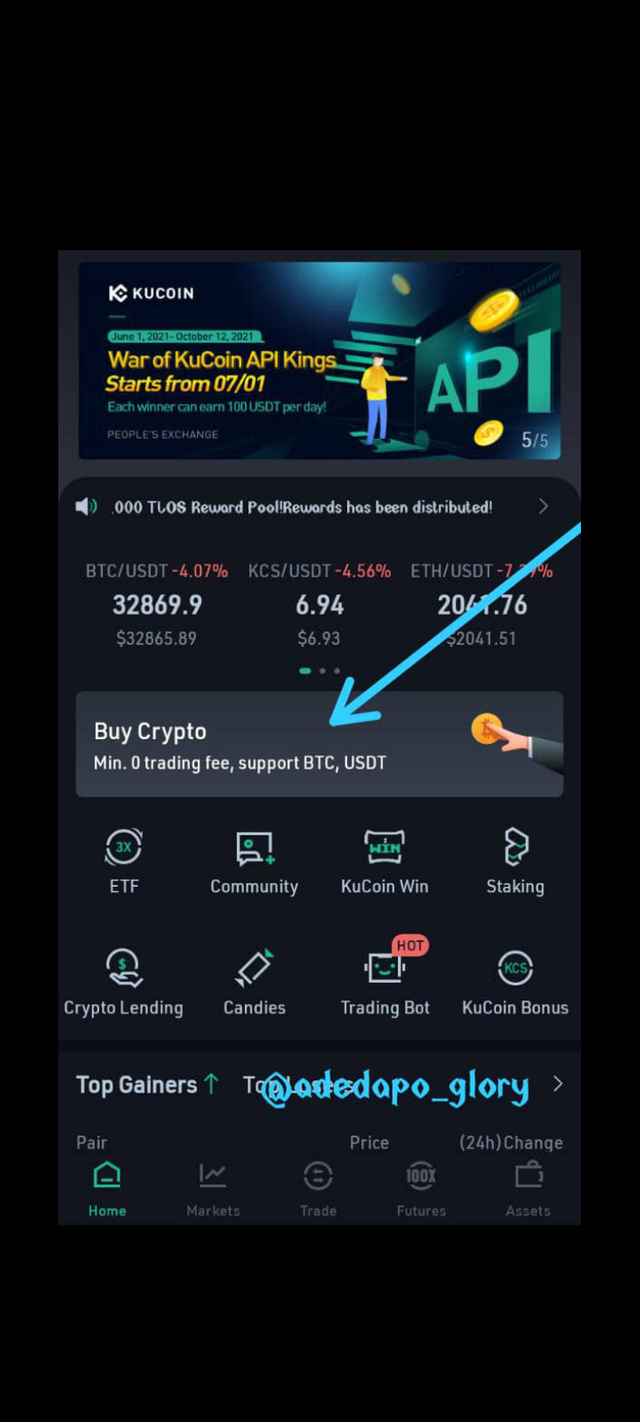

After you must have created an account with them, then you login into the platform either via their website or through the application.

N.B: I will be using the application for the tutorial.

Step 2

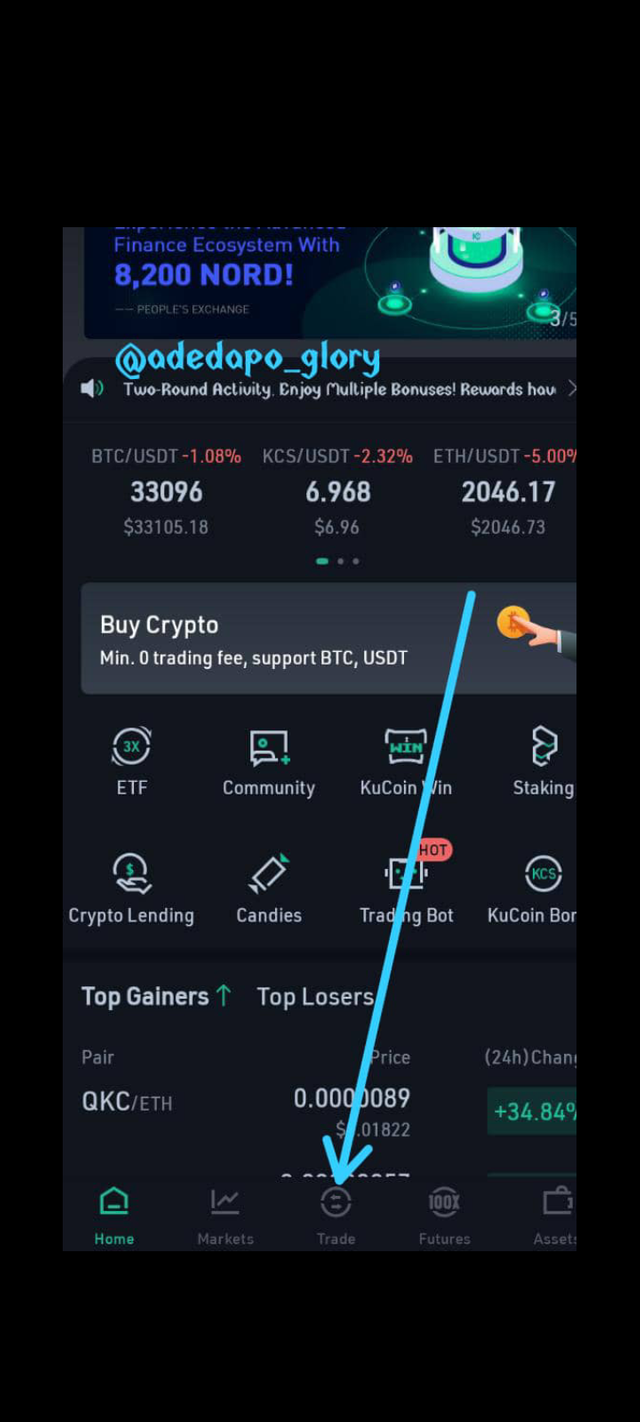

After launching the application, and inputting your login, it takes you to the homepage where you will see different features on the interface. One of the features writes buy crypto, click on it, wait for it to load and take you to the next interface where you can buy crypto in 3 ways. The fast trade, the P2P way and the debit card/master card method.

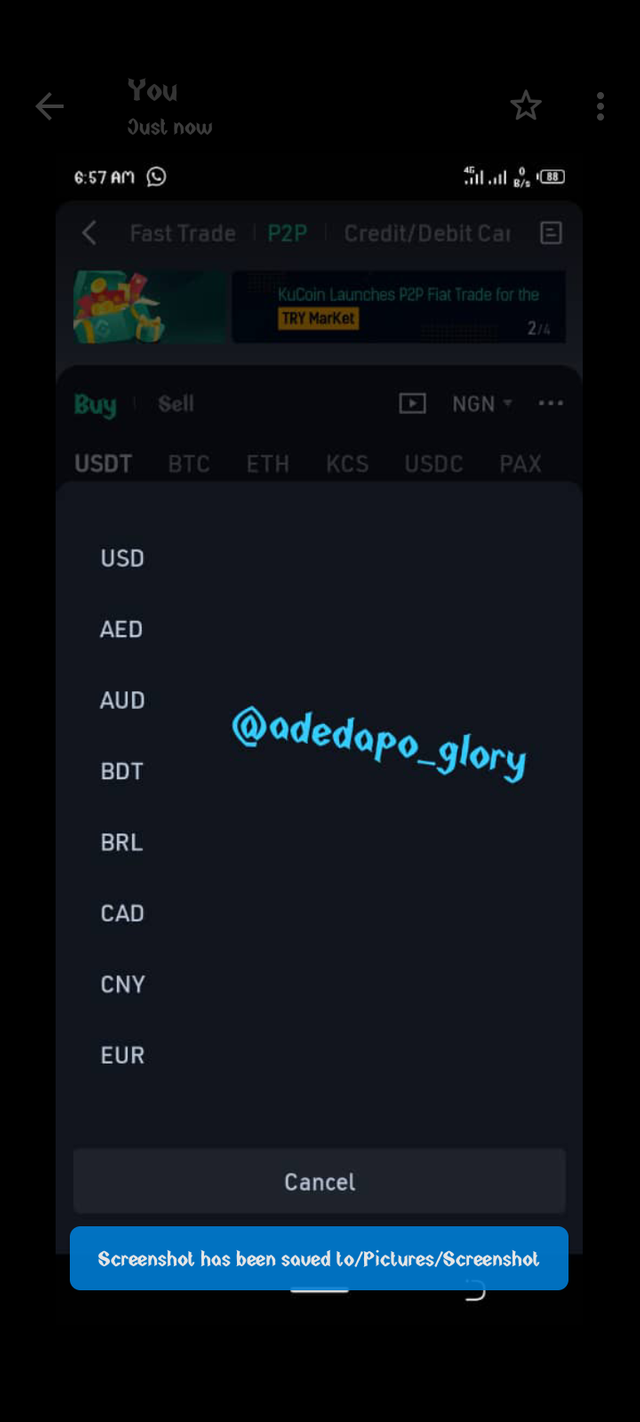

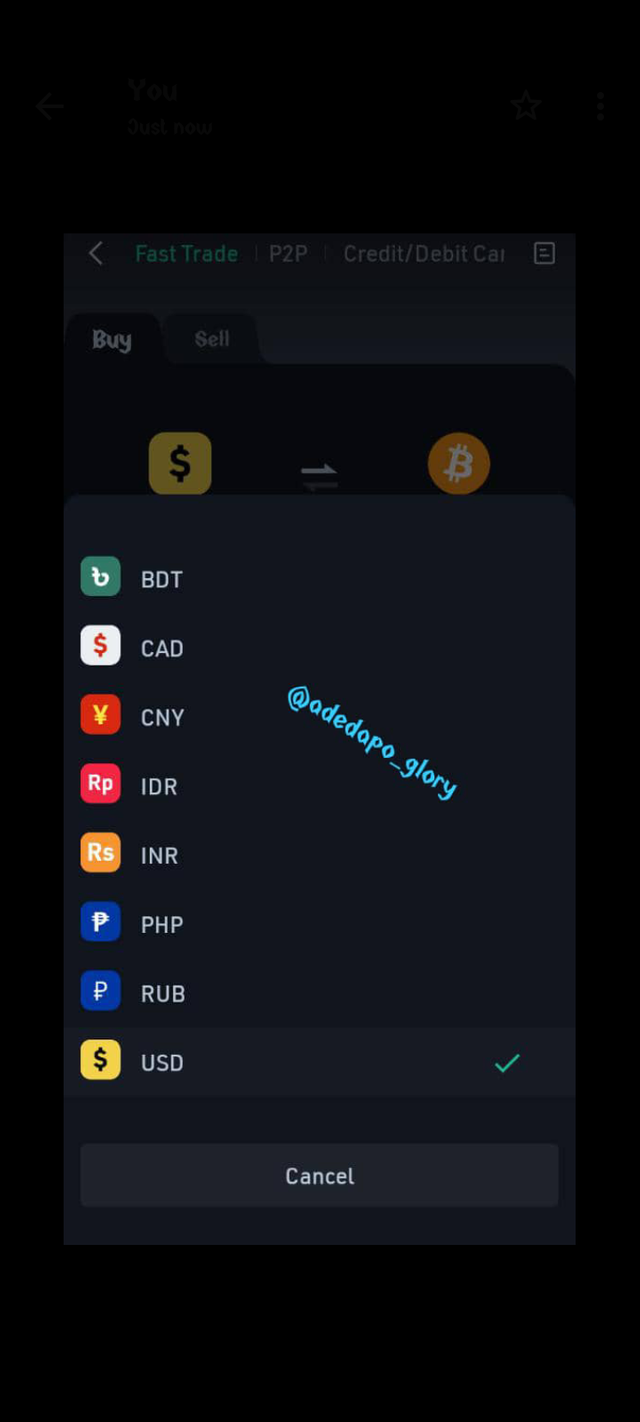

Step 3

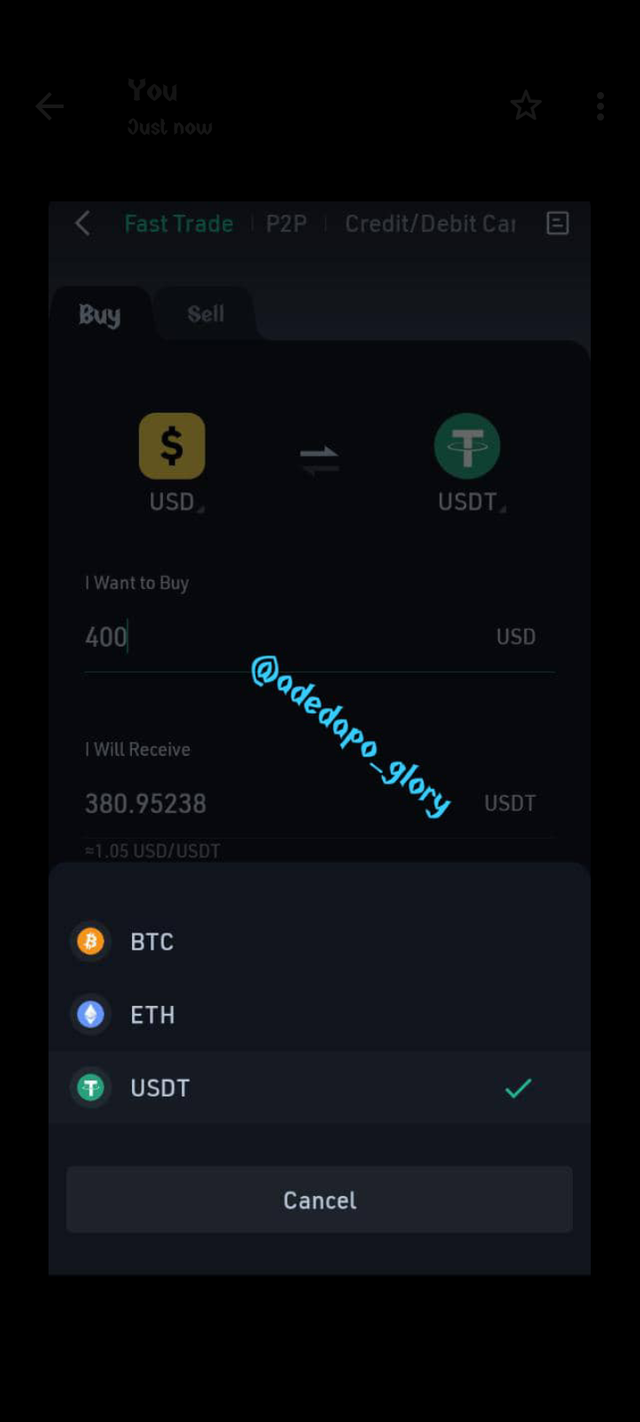

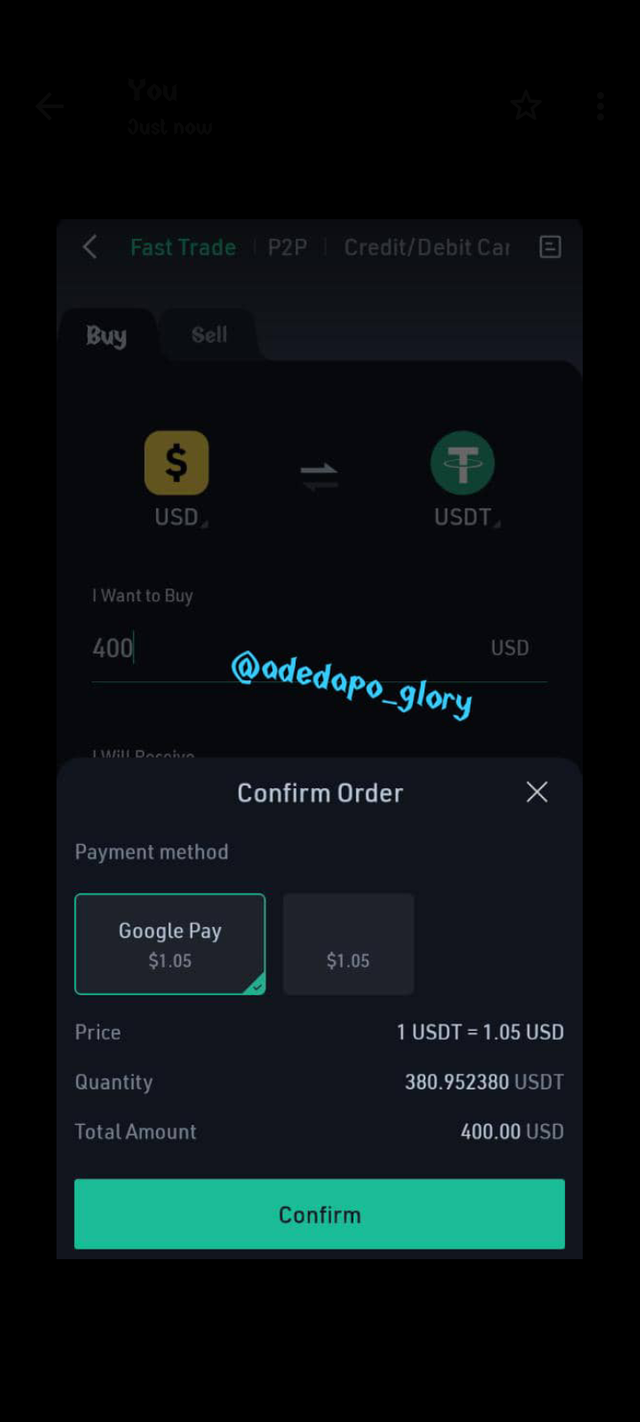

The fast trade method is a very simple method all you have to do is to select the currency you wish to trade in, select the coin you want to buy, input the amount of Coin you want to buy in dollars and click on buy if the order is available. Clicking on the usd will show you more currency and clicking on BTC will show you more coin.

Step 4

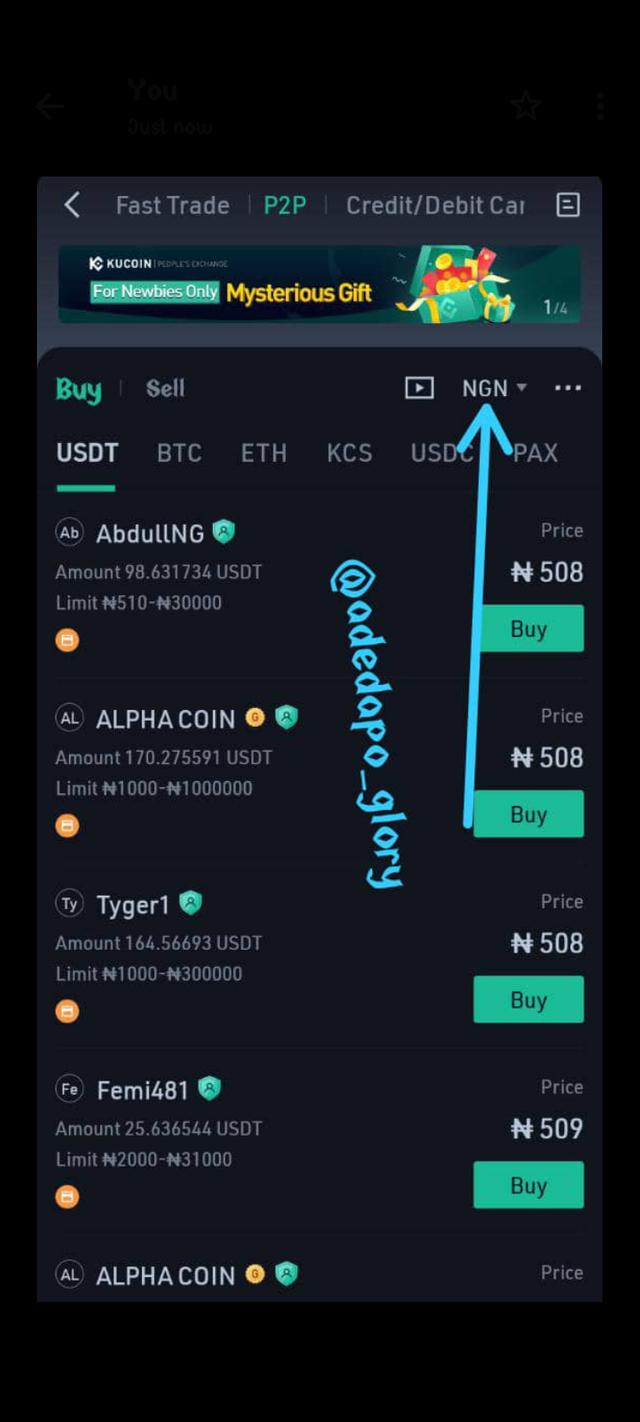

This is buying crypto through the P2P method. P2P means peer to peer, whereby one buys from a seller directly.

When you click on the P2P interface, list of sellers, the amount of coin they want to sell, the price they want to sell at and the minimum value they can sell will be displayed to us. The direction where the arrow is pointed to is where you can change the currency to whatever currency you want to pay with.

When you are satisfied with the seller rate click buy, make payment to the account details dropped, then click paid on the interface.

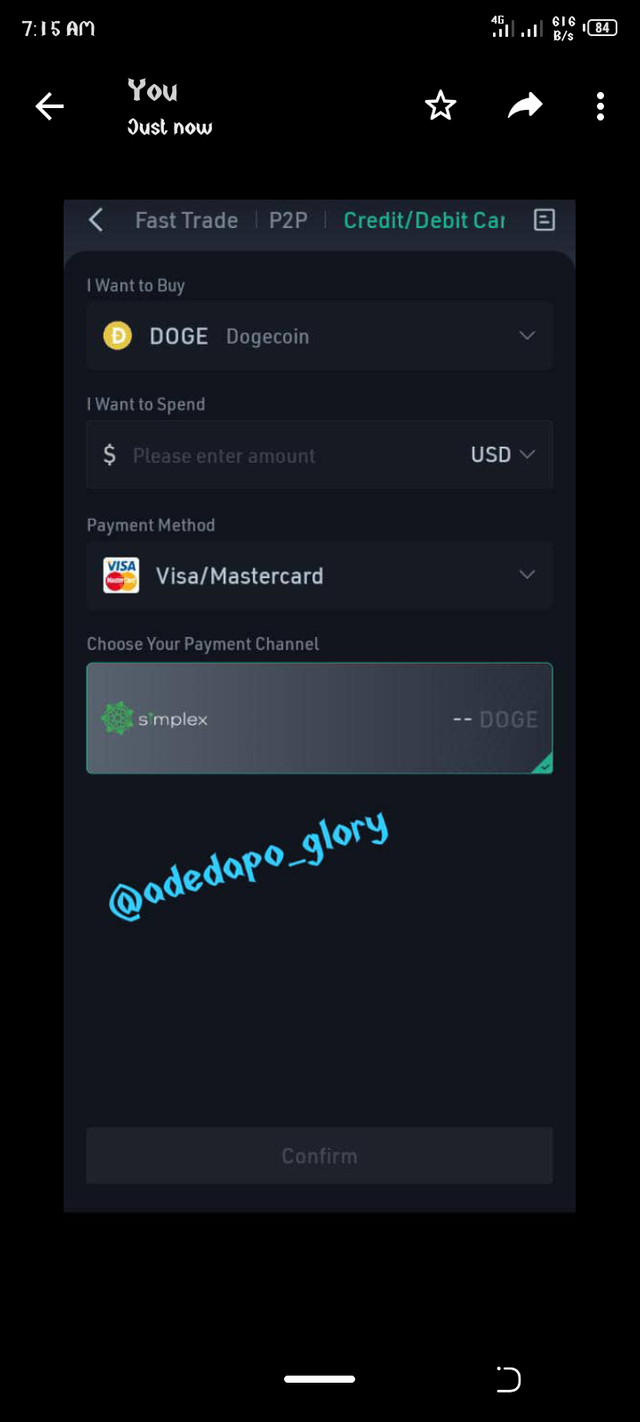

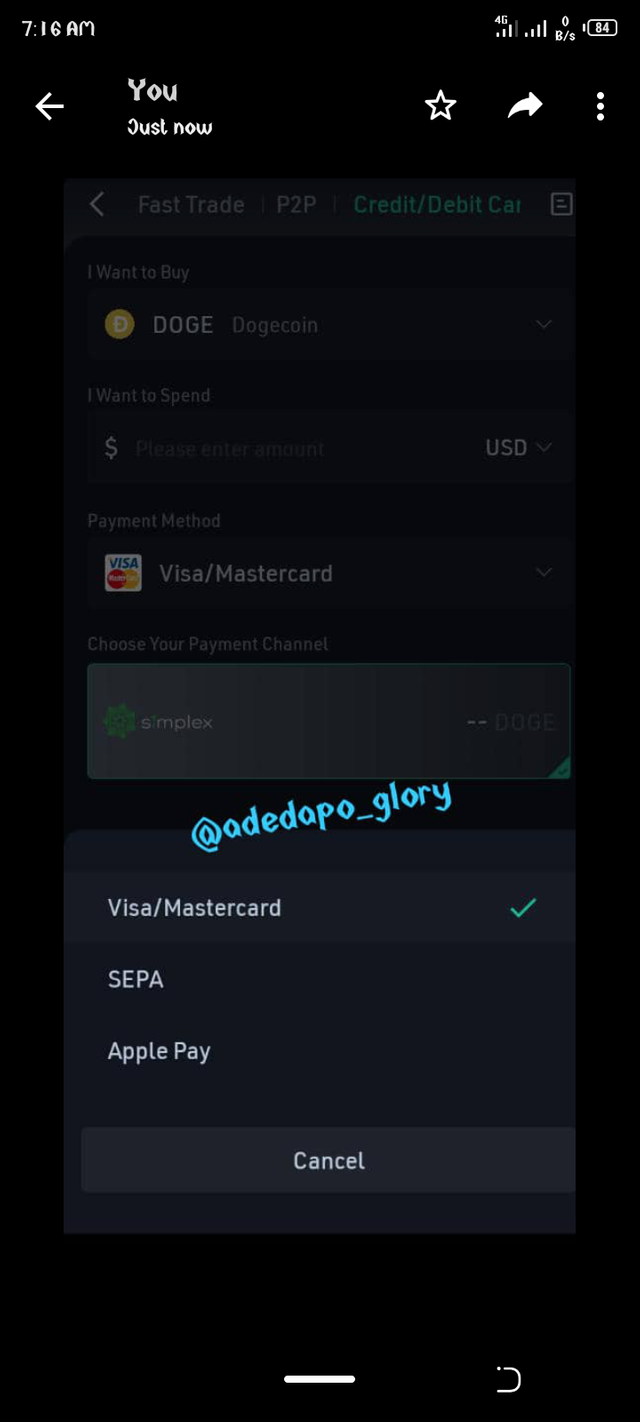

Step 5

Buying with credit/Debit card method. Select the coin you wish to buy input the amount you want to buy then choose which method you want to pay with whether through master card or apple pay or Google pay. Then click buy and continue the procedure.

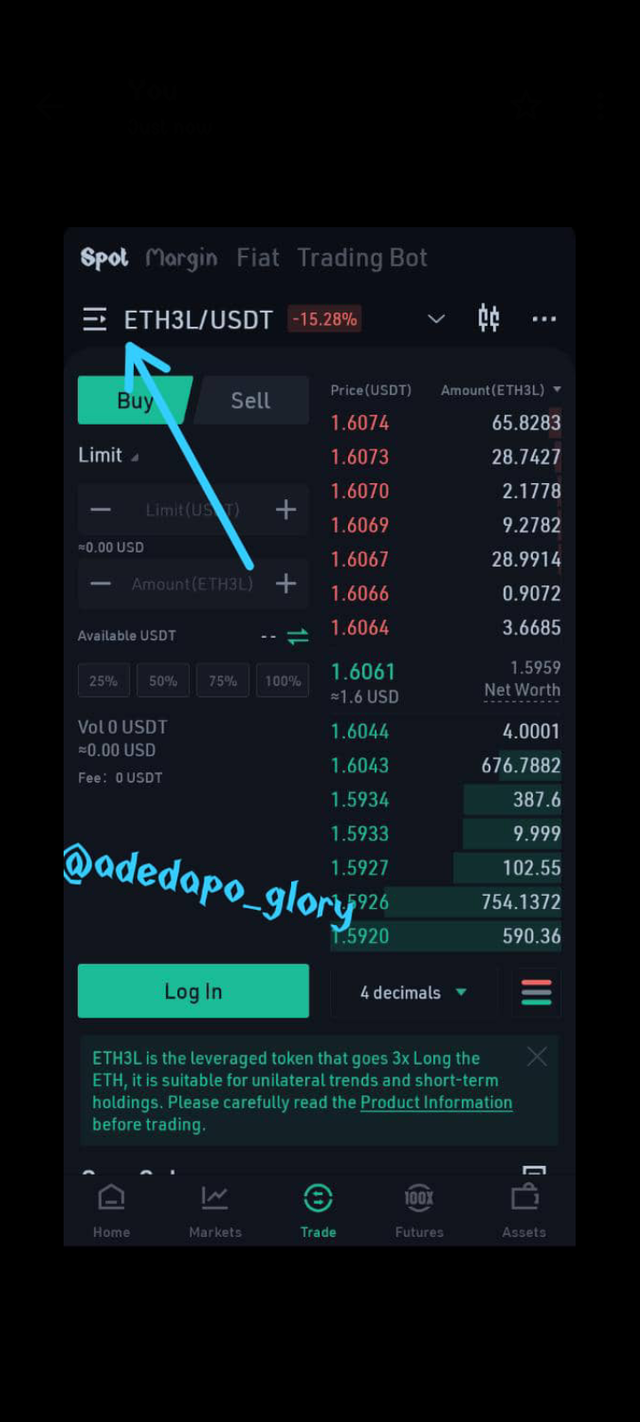

You can also buy crypto using other crypto and this is called the spot market. Let's assume you bought usdt with Fiat and you wish to convert it to other coin like BNB.

On the homepage click on trade it will take you to the spot trade interface.

Click on the current pair and change it to the pair you wish to trade as shown on the screenshot above.

After selecting a pair there are options to choose whether limit, market or stop limit. Under limit you can set the price at which you want to buy, under market you buy at the current price of the coin and under stop limit you set a price you want to buy and at price at which it mustn't exceed buying for you.

According to this screenshot I placed it on limit and set my price at $250 even when the price is currently at $281 so whenever the price goes to $250 dollar my trade will be executed.

This are the ways in which coin can be bought on exchange platforms and most particularly on kucoin exchange.