Bollinger Bands indicator

Bollinger Bands indicator is another type of oscillating technical analysis which is used in combination with other technical analysis by traders when trading any market. It was created by John Bollingerij the year 1980. The band moves based in the price and volatility of an asset.

The indicator help to analyze an overbought or oversold market trend and also help identify entry points.

Bollinger Band is a simple trading tool which has gained popularity among expert and novice traders.

There are ways to calculate the Bollinger band indicator although trading platforms has made it easier and provided it on their platforms already.

Below is the calculation on Bollinger band indicator.

Calculations

It is important to calculate the moving average of the market first before trying to calculate the Bollinger band.

Moving Average = Sum of prices up x days/number of days

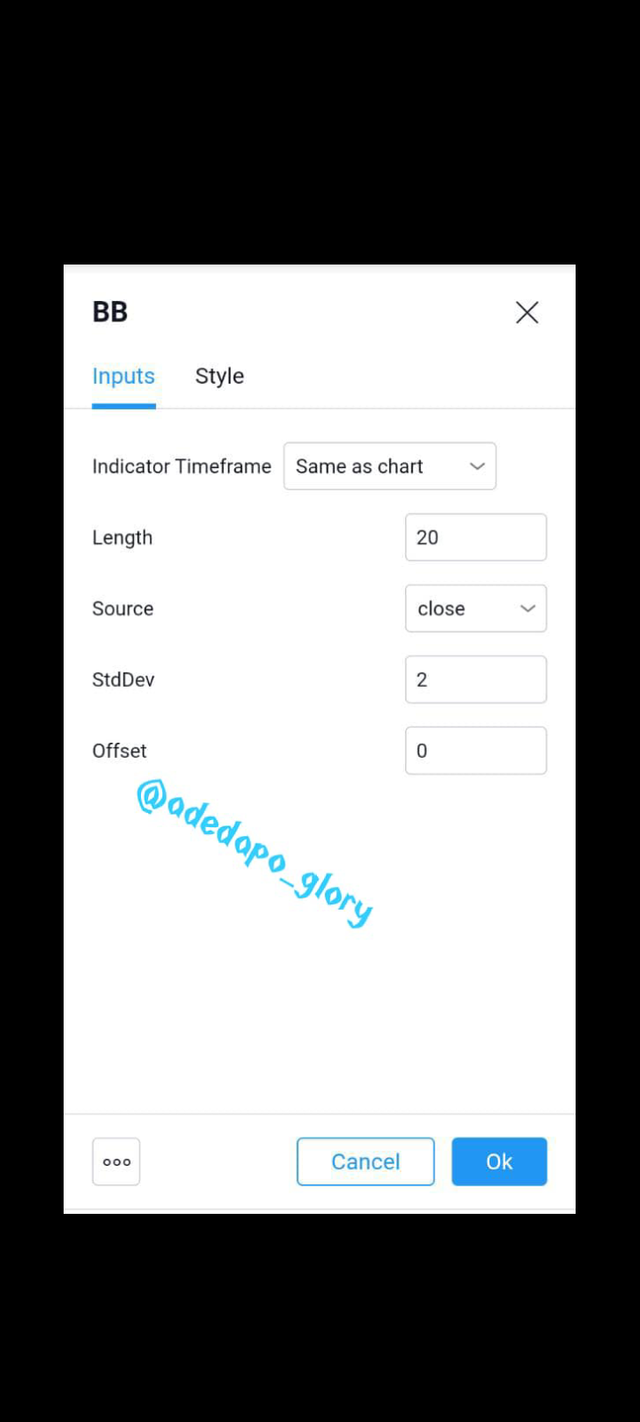

The standard moving average set by John Bollinger is a 20-days moving average, but traders cab modify to suit their taste.

Once the moving average of the market is known, Bollinger Bands can be calculated by using standard deviation of the moving average to determine the volatility

The more the volatility of the asset, the more the space between the bands and this will give a clear trend in the asset. Bollinger band is made up of two bands which are the up band and the down band.

To calculate the upper band 2 standard deviation is added to the moving average gotten initially.

While the lower band is the opposite of the upper band i.e 2 standard deviation is subtracted from the moving average.

Note: A 10- day moving average uses 1.5 standard deviation, a 20- day used 2 standard deviation that's why we use 2 in the calculation above because it is for a 20-day moving average. After the calculation is done it is easy to draw the Bollinger band.

How to set up Bollinger bands

In this tutorial we will be using the tradeview website to set up a Bollinger band on the chart.

First we load the website tradeview.com on our browser, after loading we select a pair that we wish to trade on and open the chart of the market.

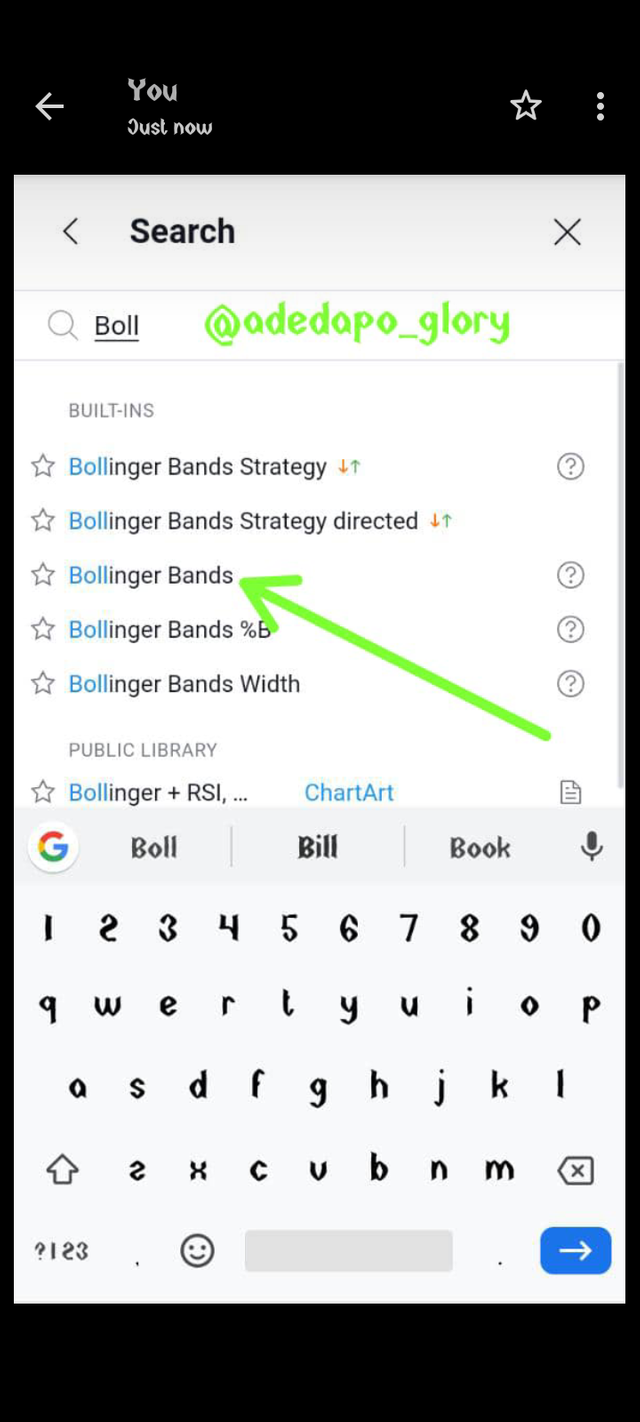

After the page has loaded, them click on indicayor and search for bollinger

Several Bollinger will pop up but click on Bollinger band

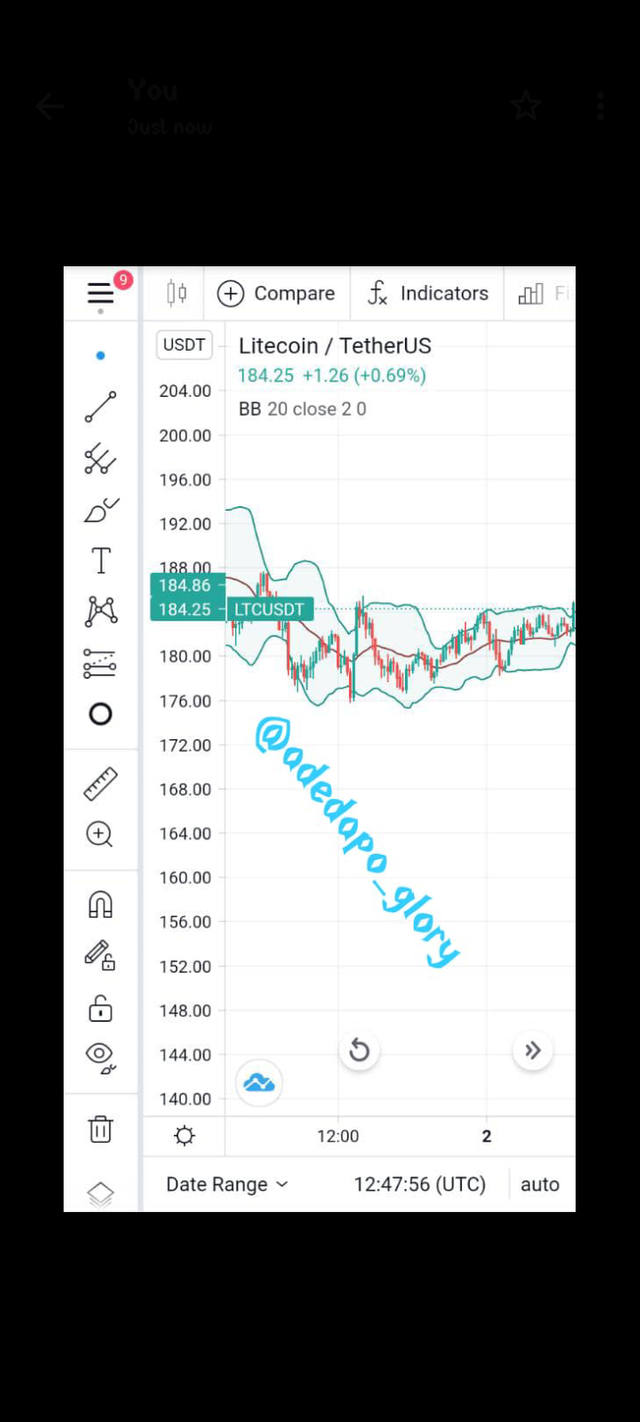

After clicking on it the Bollinger band will show on the chart. If you are comfortable with the settings go ahead with it if not, click on the Bollinger band and click the settings logo then change the settings as desired.

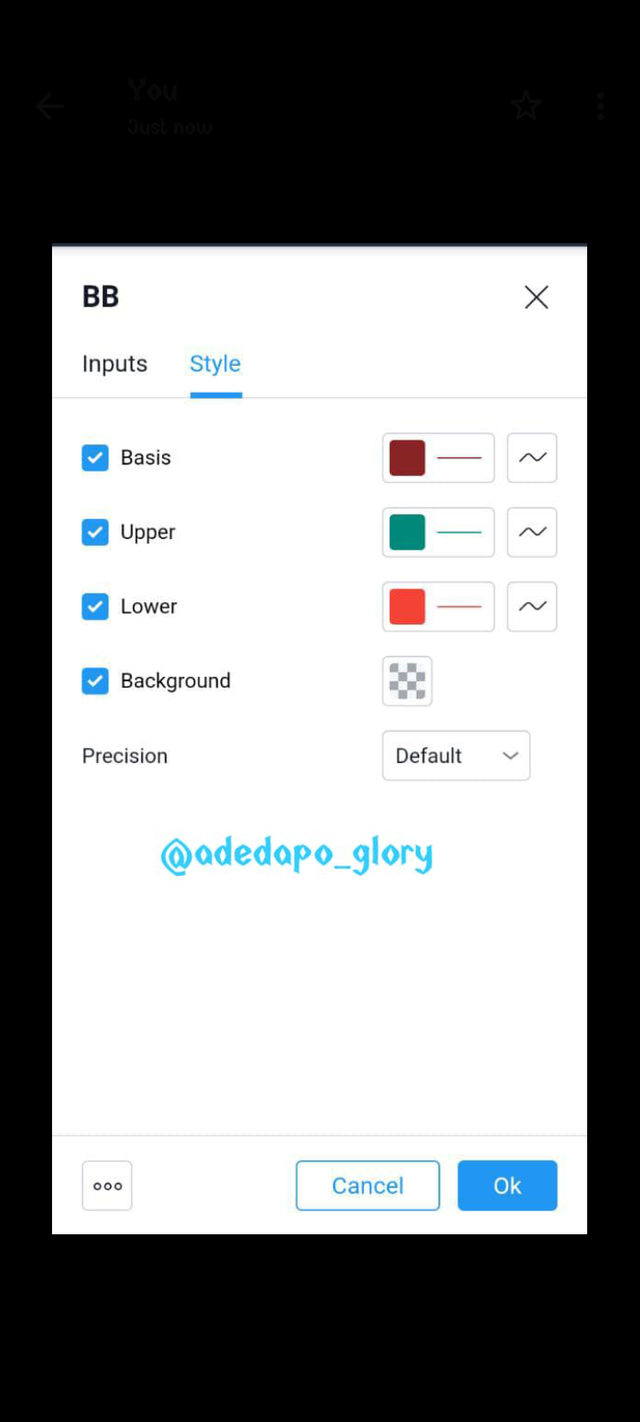

On the chart we can see 3 lines which is for the Bollinger band. The moving average is the brown line on the chart and the green line above is the upper Bollinger band while the green line below is the lower Bollinger band. Not to confuse you it's advised to change the color of the lower and upper bands from the same color.

NOTE; The wider the space between the upper and lower band the increase in volatility likewise the decrease in volatility there is a decrease in space of the bands.

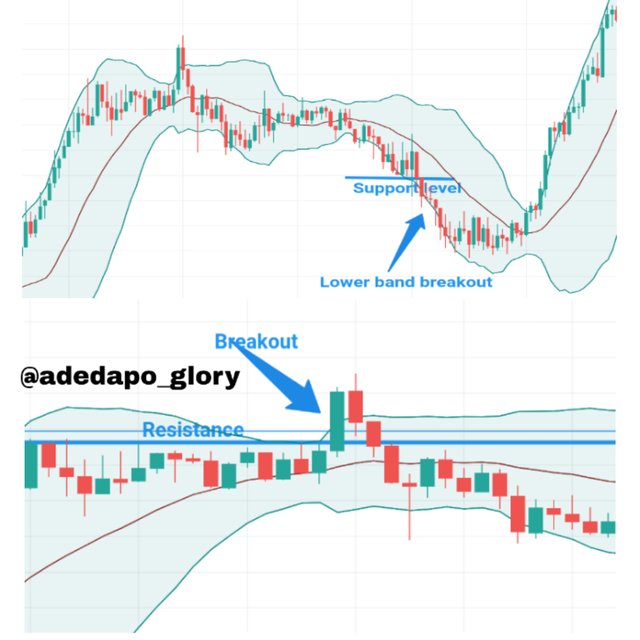

BOLLINGER BREAKOUT

A breakout occurs when after setting a resistance or a support level the price then move pass the level it has then broken the resistance and support level there will be a movement out of the Bollinger bands. Most times traders look out for this breakout because it rarely occurs. So it is used as an entry point for sell or a buy in the market.

How to use Bollinger bands with a trending market

To use the Bollinger bands with a trending market one need to know the various trading strategy of the Bollinger bands.

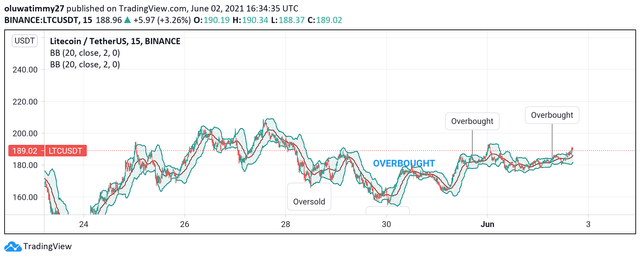

- Over bought and over sold area.

This is the area where the market price rose extremely high and went pass the Bollinger bands be it the higher or lower Bands. When it moves pass the upper hand it means it has been overbought and when it moves pass the lower Bands it means it has been oversold. After an over bought or over sold, there is always a retract which is why traders look out for this in a market. Although a retract might not occur immediately.

- Trend reversal

This happens when there is high volatility in the market the Bollinger band can help is identify when a reversal will occur which means when candlesticks comes out of the bands the next candlestick to enter into the band has called for a trend reversal an the trend will go in the direction the new candlestick is going.

Note: until there is a bar that has moved into the band it's not advisable to trade because there might probably be a retract back.

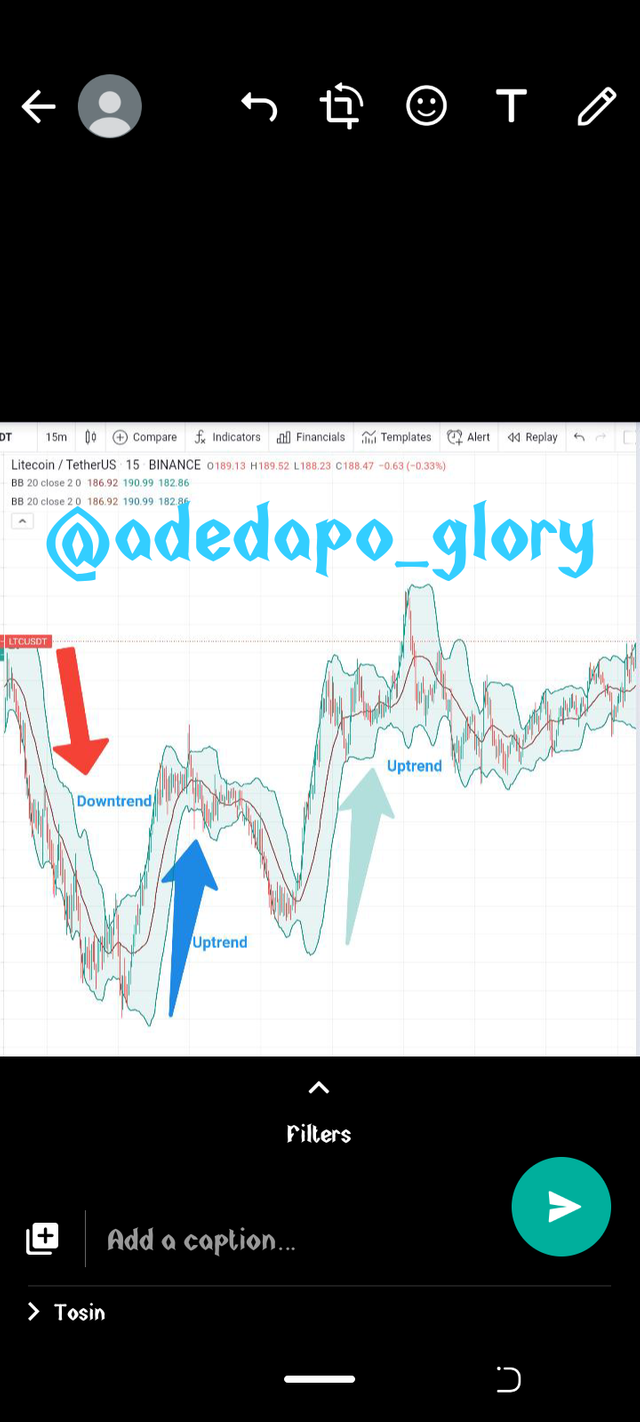

- Market movement

We can use Bollinger band to detect the trend at which a market is moving and this can help traders know the entry and exit level for their trade. Bollinger band is a more accurate trend signal giver than moving average.

Other indicators that can be used with Bollinger bands.

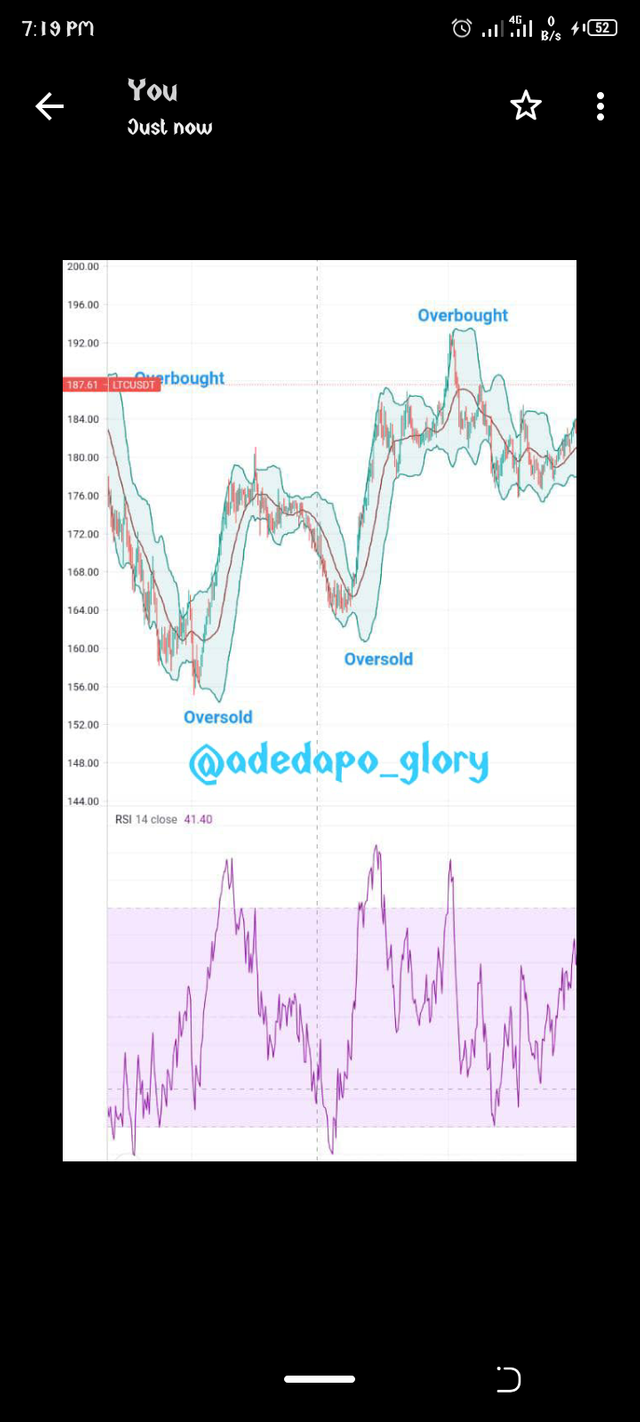

Bollinger band indicator can be combined with a relative strength index. The relative strength index is also a moving indicator that can help confirm the relative strength of an asset.

The relative strength index is range from zero to 100, when an asset price moves pass 70 on the Relative strength index it is said to be an oversold and when it is below 30 it is said to be an overbought.

When the two are used together the RSI helps to confirm the movement of the Bollinger bond.

For example, if an asset price passes the lower band of a Bollinger Band and, at the same time, the RSI reads below 30 the trader could make the interpretation that the market is truly oversold. He can then buy the asset.

Also suppose the price moves higher than the upper hand indicating an overbought and the Relative strength index didn't go above 70 but still at the normal range, the trader can then know that the Bollinger band might just be over exaggerating the market and then wait a little further before he sells his asset.

Note: a relative strength index turn the chart movement upside down meaning when the real market says the price is up on the relative strength index it goes down. Just like the screenshot above. Which timeframe is best for Bollinger band.

The best timeframe is the one set as default.

The width of the bands are more closer, which will make you detect prices well. Unlike when you move the time frame a bit farther the widths of the bands becomes extremely wide and the price movement isn't well presented.

The first screenshot shows the default time frame while the second shows the 1 month time frame. The difference is easily noticed.

Review of the chart of LTCUSDT

This review is based on the litecoin pair with usdt. The current price of the coin as at this review is $187.67. this review is based on a short position. The former resistance of the coin where an overbought occured as indicated by the Bollinger band at $188.63.

then it had and oversold of $187.06. this is the latest support of litecoin in the last 1 hour. According to Bollinger band there is a tendency for an uptrend and litecoin hitting the last resistance of $188.63 once it passed the new set resistance of $187.03. the profit to be made according to my analysis is a small profit.

Also if the coin breaks the support then there will be a drop in price and a trader can enter into the trade once the price goes below $186 which will be a good buy and the trader waits for the price to go up and then sell the asset.

Hello @adedapo-glory,

Thank you for participating in the 8th Week Crypto Course in its second season and for your efforts to complete the suggested tasks, you deserve a 6/10 rating, according to the following scale:

My review :

In general, acceptable content, in which you have provided answers that differ in depth in the analysis. Your submission of information does not adopt a clear methodology, as we find paragraphs containing ideas without sequence.

Thanks again for your effort, and we look forward to reading your next work.

Sincerely,@kouba01

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit