Bitcoin's arrival into the mainstream is linked to a massive evaluation of altcoins, the short-lived ICO craze, and many misconceptions about Bitcoin's vision and potential.

Over the past, many developments have taken place which provide more access to developing Bitcoin and the old cryptocurrency before it.

Although access to Bitcoin is still from ideal, the options for confidence in it were much larger a few years ago. From the development of the exchange to alternative ways to acquire it, finding different ways to grow Bitcoin is worth your time and effort.

Bitcoin Price & Market

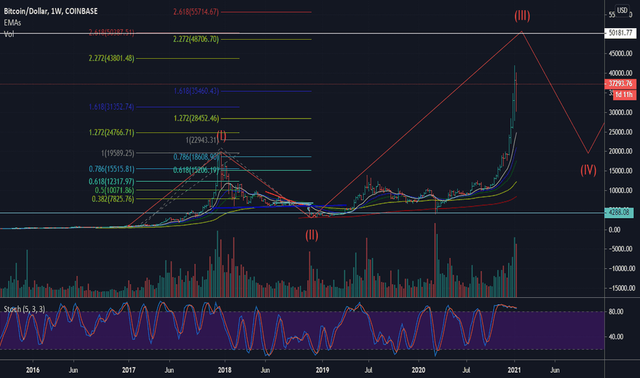

Bitcoin's price has fluctuated since its inception. From the very first purchase of a good or service using 10,000 bitcoins to buy a pizza, the value of Bitcoin is a rollercoaster ride.

Bitcoin prices skyrocketed towards the end of 2017 and peaked at around $ 20,000 in January 2018, causing confusion in mainstream media coverage and questions about what the new digital currency really is.

For the mainstream, Bitcoin's volatility is too much of a risk to invest in, even though millennials have shown a favorable disposition to exchange their hard-earned money for some Bitcoins.

But over the last few months, Bitcoin has been torn and recently breached, its price is high again. This has brought more attention to the mainstream and now customs agencies are taking it seriously and allocating a portion of their dollars to asset classes.

Investing in Bitcoin has inherent risks that investors need to be aware of before buying it, and you can find extensive information about real cryptocurrencies all over the web today. If you are interested in Bitcoin, a wise approach is to do your own research and find out if you are willing to enter a growing digital asset market that has no precedent or not.

Making small investments is a great way to get started and learn about how to get A with a wallet without exposing yourself to too much exposure to market volatility.

If you want to invest in cryptocurrency in general, choosing Bitcoin should be your first choice. Its toughness is unmatched in the industry and is one of its greatest, if not major, strengths.

The common narrative around Bitcoin that has been shaped over the years is about 'digital gold', where a predetermined issuance rate - controlled by adjusting mining difficulties and the decentralized network - provides a significant advantage over fiat currencies knowing that your investment will not profitable. diluted through arbitrary inflation.

If you are a newcomer to the world of Bitcoin and cryptocurrencies, looking for monetary protection from a hyper-inflationary economy, or an advanced user who believes in the ideological aspects of Bitcoin, there are several areas you need to evaluate when investing in Bitcoin.

Long Term Investments or "Hodling"

Many long term 'scammers' see Bitcoin as the hardest money available, and choose to keep a large amount of their income in cryptocurrency. Doing so presents risks, but from their perspective, it is one of the greatest investment opportunities in history and a legitimate way to store and transfer value outside the world of traditional finance.

Their belief in Bitcoin as a digital gold with a high stock-to-flow ratio is reasonable, and advances such as LN Bitcoin could eventually allow the network to develop like the P2P digital money that Satoshi Nakamoto originally envisioned.

Bitcoin wallet

If you want to keep Bitcoin as a long-term investment, the best method for protecting your coins is to use a cold storage hardware wallet. Popular cold storage wallet brands include Trezor and Ledger, and they also offer support for other cryptocurrencies. Cold storage can even be enhanced with multisig services like Casa where the signature of some physical device is required to unlock your stored Bitcoin.

The full Bitcoin client is also a viable means of long-term bitcoin storage, but not as secure as a cold wallet solution. Apart from investing purely in Bitcoin, you can support decentralization and network connectivity by running full nodes, which incorporate yourself into the core Bitcoin protocol that houses the entire blockchain.

Short-term holders who wish to invest in small amounts of Bitcoin out of curiosity or to experiment with sending / receiving can choose to use hot wallets and custodians.

Third parties control this wallet, so it is not ideal for guaranteed security, but it is comfortable to use and offers an excellent user interface for using Bitcoin. Popular custodial wallets include Blockchain Wallets, Copay and BreadWallet.

Mining Bitcoin

In the early days of Bitcoin, users were able to mine Bitcoin on their laptop and desktop computers, earning a lot of Bitcoin at a much lower value than it is today.

As such, initial mining in Bitcoin turns out to be one of the most profitable investments ever. However, mining has developed into a giant industry, where big companies like Bitmain and big mining pools like F2Pool and BTC.com dominate the market.

ASIC miners are truly the only viable way to mine Bitcoin today, and hosting your own ASIC rig is a serious investment that requires hardware costs, uptime and electricity.

Furthermore, small, independent miners using home-based rigs often have to operate at a loss during the prolonged depreciation of the Bitcoin spot price as profit margins are reduced. However, if you want to try Bitcoin mining, there are plenty of tutorials to differentiate hardware and software according to your needs and budget.

The cloud mining service also allows users to purchase contracts for ASIC mining rigs within a large mining warehouse operated by a third party mining company.

These companies offer regular returns based on your investment and can be convenient if you want to earn Bitcoin through mining but don't want to bother setting up your own rig. Hashflare and Mining origin are two popular cloud mining services.

The Bitcoin mining market is an attractive component of its broader ecosystem, and adequate understanding of how it works, as well as observing its future development is essential to understanding the larger cryptocurrency old economy.

An exchange for investing in Bitcoin

The exchange is the easiest and most popular method of obtaining Bitcoin. There are more than 100 Bitcoin exchanges operating around the world, but avoiding exchanges that are known for their minor trades and sticking with reputable, reputable exchanges is the wisest move.

There are several types of exchanges on the cryptocurrency market, including centralized exchanges, decentralized exchanges (DEX), P2P markets, crypto-to-crypto exchanges, and fiat-to-crypto on-ramp. Adequately understanding the advantages and disadvantages of each is essential.

Buying Bitcoin with Fiat Currency

First, the difference between crypto-to-crypto and fiat-to-crypto exchanges stems from their regulatory jurisdiction and whether they can offer Bitcoin direct trading pairs with fiat currencies. Coinbase is the most popular fiat-to-crypto on-ramp in the US and requires users to go through a regulated KYC / AML process.

Furthermore, exchanges like Coinbase are centralized and custodial platforms, which means that when your bitcoins are stored on the platform, they are technically not yours as they can be frozen like in a bank account. Other popular fiat-to-crypto exchanges include Kraken, Gemini, BitMEX (not available for US customers), and Bitstamp.

Exchange Reviews

Crypto to Crypto Exchange

Crypto-to-crypto exchanges only offer trading in and out of different cryptocurrencies, with altcoin prices being pegged to Bitcoin or stablecoins such as Tether or USDC.

These exchanges have been referred to as 'altcoin casinos' because they are basically gambling on the changing prices of many of the more obscure altcoins that are available.

However, these exchanges sometimes offer excellent trading experiences and can be used to access other cryptocurrencies that are not widely available on the fiat channel. Binance is one of the leading cryptocurrency exchanges in the world and is a centralized crypto-to-crypto platform.

Crypto to Crypto Exchange review

Decentralized Exchange

The difference between centralized and decentralized exchange is very important for several reasons. First, a centralized exchange has custody of your Bitcoin, just as a bank maintains custody of your fiat funds.

Second, this exchange is vulnerable to being targeted by hackers, and the scale of hacks on exchanges in 2018 was astonishing. It is a best practice to never store your Bitcoins on an exchange, even decentralized ones.

On the other hand, DEX is useful for direct exchanges between associates, without intermediaries. They do not take custody of funds nor do they require any KYC / AML processes for users. Unfortunately, many DEXs do not have sufficient trading volume to be as liquid as their centralized partners, and a recent briefing by the SEC towards EtherDelta may prevent operators from continuing to run DEX outside of legal jurisdictions.

Additionally, most DEXs only allow trading between Ether and ERC-20 compatible altcoins, offering no Bitcoin functionality. However, the future growth of atomic swaps will help expand the prevalence of Bitcoin among DEXs.

Marketplace Exchange

Other decentralized options for trading Bitcoin for fiat or altcoins include P2P marketplaces such as Bisq, Paxful, HodlHodl, and OpenBazaar. OpenBazaar and Bisq are open-source marketplaces without registration and an emphasis on privacy and security.

OpenBazaar also allows users to set up e-commerce stores to list physical and digital goods / services with direct payments between partners in crypto. HodlHodl even offers TESTNET trading without risking real money.

Volume in the decentralized marketplace is substantially lower than that of their centralized counterparts, but they are quickly gaining traction among privacy advocates and users seeking better security guarantees.

Likewise, Bitcoin volume metrics sites like CoinDance show that decentralized exchange platforms are increasingly being used in countries with inflation and troubled economic conditions, especially Venezuela.

The platform offers censorship-resistant avenues for citizens in countries like Venezuela to buy crypto and fiat currencies that are much more stable than their local currencies.

Alternative Methods for Increasing Worldwide Access

Access to investing in Bitcoin has never been greater, but there are still significant steps that need to be taken so that access reaches the ideal level that supports a decentralized global value system. In particular, the main avenues for acquiring Bitcoin with fiat currency - through centralized exchanges - are strictly regulated and subject to the KYC / AML process.

Decentralized exchanges do not have the volume or widespread popularity to rival today's centralized exchanges.

Most of the investors in Bitcoin live in countries where Bitcoin is more of a speculative investment or part of a professional focus rather than stemming from an outright need for an alternative value medium. In countries such as Venezuela, Zimbabwe and Argentina, the situation for investing in Bitcoin relies more on the legitimate need to seek alternative currencies due to adverse economic conditions.

Increasing access to such regions of the world is an important initiative, and several developments could expand access beyond just decentralized market deployments.

Bitcoin ATM

Bitcoin ATMs are one way of providing easier access in the area, often available at convenience stores and supermarkets. According to CoinATMRadar, there are more than 4,200 crypto ATMs in the world, spread across 76 countries.

Leading crypto ATM manufacturers include Genesis Coin and General Bytes. Many ATM services also offer two-way buying / selling of cryptocurrencies for fiat currencies.

You can even buy Bitcoin on Coinstar machines in certain locations in the US right now. However, the regulatory framework for this service is complex, and is unclear in the US at this time due to cross-border remittance laws.

Other alternative ways to invest in and use Bitcoin include a new project that focuses on Bitcoin vouchers and credit sticks. Azte.Co - Bitcoin voucher service - allows people to buy Bitcoin at convenience stores in cash or with a debit / credit card using Azteco vouchers.

You can top up your Bitcoin account using only Azteco vouchers as you would to recharge your phone, and details are available on their website.

Another method

Likewise, OpenDime is a service where users can physically swap Bitcoin credit sticks. A credit stick is a secure USB stick that contains a private key on the device itself.

Such functionality allows Bitcoin to be transferred between parties locally with the assurance that the private key is not compromised as long as the wand is sealed. The user can even pass the stick multiple times.

OpenDime has some interesting long-term implications, and its emergence in economies with weak economic conditions will be something to watch out for.

Financial instruments using cryptocurrency are also on the rise, with services such as the Celsius Network and BlockFi allowing users to take out loans with their crypto holdings as the underlying collateral.

In addition, lenders on the Celsius Network can earn interest through their P2P loan pool which is paid by borrowers, paid directly in the crypto where their deposits are made, including Bitcoin.

Lightning Network

More advanced Bitcoin users familiar with the second layer - the Lightning Network - also have the future potential to earn BTC via relay fees and The Watchtower.

Watchtower is a service that monitors the Bitcoin blockchain for their clients to identify transaction violations on the LN and issue penalty transactions. Relay fees can be earned by LN nodes connected to multiple peers and help route payments over a mesh network for users who are not directly connected by channel to the party they wish to exchange BTC for.

These developments are still in their infancy, but they offer a useful mechanism for users willing to provide services to LN users to accumulate BTC in fees.

Spend Bitcoin

Many avenues for merchants to accept Bitcoin as payment are also available, including Coinbase Trading which is integrated with major e-commerce platforms such as Shopify and WooCommerce. Traders can choose to keep their BTC as an investment or exchange it directly for fiat.

Open source projects such as Lightning Charging - part of Blockstream Elements - are also available for merchants to accept LN BTC payments using a drop-in solution. The LN's large design space and its increasing number of applications should also further assist the network to grow as a means of payment for online purchases over the next few years.

Other, less obvious methods of acquiring Bitcoin include the Bitcoin puzzle. Bitcoin puzzles are digital art that individuals post to the Internet containing private keys to access bitcoins that are locked as rewards for solving puzzles.

They're not very common, but some of the benefits have been very lucrative, including a $ 2 million prize for a 310 BTC-filled puzzle late last year.

Traditional Financial Instruments for Investing

Beyond the emerging alternatives to investing in Bitcoin, the convergence of traditional finance and blockchain is also set to create more opportunities to increase exposure to assets.

Bitcoin ETF

The Bitcoin ETF proposal has been rejected by the SEC several times, but several important decisions are coming - in particular the decision on the Bitcoin ETF VanEck-SolidX proposal pushed to February.

ETFs are investment vehicles for individuals or groups of assets that allow investors to speculate on market prices without actually owning the asset. Bitcoin ETFs will allow more mainstream investors to access Bitcoin through investing in ETFs that are on regulated exchanges without having to buy Bitcoin directly from crypto exchanges.

Bitcoin Futures

Likewise, Bitcoin futures are readily available, and investors can long or short long cryptocurrencies on regulated futures exchanges, including CBOE and CME. Bitcoin futures and ETFs are the best way for mainstream investors to speculate on the Bitcoin price while reducing their direct interaction with cryptocurrency, which often requires technical knowledge to store and use safely.

The increase in Bitcoin regulation in developed countries is likely to continue at an accelerating pace, and open up wider access to doubtful investors

to touch cryptocurrency using alternative means or an unregulated exchange.

Conversely, the doubts of many other countries to adopt regulatory frameworks for digital assets suggest that alternative means of investing in Bitcoin need to gain wider adoption to avoid censorship of access to assets.

Proposals for Bitcoin and other digital asset trading on regulated platforms are underway in several countries, including TSE Thailand which will be one of the first platforms to offer digital asset trading on major regulated exchanges. Finally, Bitcoin should be offered alongside other conventional financial instruments including CFDs, derivatives, futures contracts and multiple fiat currency trading pairs on a comprehensive platform.

Binary Options & Contracts for Difference

A large number of brokers now offer Binary Options and Contracts for Difference on a variety of Cryptocurrencies, including Bitcoin. If you have traded using one of these types of brokers before, you can also use them to trade Bitcoin.

The difference between this and a typical exchange is that you don't own the underlying asset, you only trade based on the difference in price.

Conclusion

Looking back at Bitcoin's humble origins reveals just how far the cryptocurrency has come. Access to investing in Bitcoin has never been better, and despite the inherent risks and high barriers to entry, Bitcoin is slowly cementing itself as a viable means of transfer and storage of value outside the world of traditional finance.

Investing in Bitcoin always requires that you do your own research, and carefully evaluating your options for acquiring it based on your situation will allow you to make the optimal choice of joining a growing community of users, businesses, investors and developers.

Thanks For Reading

Cc:

@steemcurator01

@steemcurator02

@steemcurator04

@besticofinder

Hello @adson,

I have found lot of places with plagiarism. Please submit only original work by you. [0]

Thank you.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks you proff..

It is trying..

I will make good home work..

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Good day Professor @besticofinder. Please kindly review my homework task. It is 3 days old. Thank you.

https://steemit.com/hive-108451/@reminiscence01/homework-task-week7-for-professor-besticofinder-or-cryptocurrency-investment-or

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Very voluminous but at the same time clear information about how to invest in bitcoin and in general almost everything about this cryptocurrency and its use. I was particularly interested by the part that talks about ATMs and how you can pay in the store by exchanging bitcoin for example. This is not the first time I have heard about crypto ATMs. The first time I heard it was when I saw a friend's map https://paydepot.com/pa-bitcoin-atm with the location of cryptocurrency ATMs. I didn't even know about their existence, but it turns out that there are already more than 5 thousand of them around the world.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit