Choose a Project, platform or service belonging to the Polkadot Ecosystem (Polkadot not permitted) and make a detailed post, which must comply with the following aspects:

QUESTION 1. Explain in your own words why you chose it and why do you think it is relevant to the world?

After reading through few of the projects built on the Polkadot blockchain, I found Akropolis more interesting to choose for this writing. This is because of the the real life applications that caught my attention. Little did I know that most of the services offered by akropolis are services at are applied in some financial institutions. Akropolis is a very interesting project to be looked into.

Akropolis is very relevant to the world because people will always have cause to save, borrow and lend money out. Either physical and local or online and standard, people borrow money to run their projects. Both the poor and wealthy individuals of the world populace borrow money to run businesses and projects. The governments of countries also borrow to be able to put up with the economic and financial demands of their country.

In a standard setting, saving, borrowing or lending out money involves signing an agreement with someone or a platform using collateral which would guide and back the parties involved. Akropolis does not just serve the purpose of savings, borrowing and lending alone but it give slots to reliable DeFi DApps that wish to grow under its platform. This means that insurance companies, money lending agencies and cooperatives can choose to run under the platform to be more professional and easily accessible to their members. Therefore the Akropolis platform is a very relevant platform to the world.

QUESTION 2. Description of the project and its platform. (Screenshots needed)

DESCRIPTION OF AKROPOLIS

.jpeg)

source

Ana Adrianova and Kate Kurbanova created Akropolis in 2017. It has gone on partnership with Maker, Polkadot and, Bancor and Chainlink from when it started to exist a cryptocurrency platform.

Akropolis is one of the Polkadot powered decentralized platform for building public economics that has its own governance. Akropolis facilities under collateral borrowing and lending as one of the most innovative cross-chain DeFi protocol. That is it offers less collateral for users to borrow and lend tokens using the platform. In this wise, it becomes a unique protocol compared to other DeFi protocols that charge higher for borrowing and lending services.

Making use of DeFi, project developers can create self sustainable decentralized firms using OpenZeppellin software development kit to scale their projects. Users are rewarded providing liquidity for giving out under collaterized loans because giving such loans is a risk with the use of Akropolis Sparta.

Furthermore, the Akropolis Delphi platform makes it easy to make yield automatic in order to save and generate money with no risk. This is very important for folks who want to engage in DeFi but don't know much about how yield farming works behind the scenes.

Akropolis is seeking to serve as a platform framework on which many DeFi tools such as DApps for savings lending and investment services. Because Akropolis dApps are built with codes and having its own governance, users can vote to make changes by staking AKRO, the native token of Akropolis which is earned by users when they provide liquidity for decentralized applications and protocols that have been built on Akropolis platform.

As powered by Polkadot, the Akropolis uses the cross-chain feature of its parent blockchain to connect with the Ethereum platform to provide liquidity for tokens on the Ethereum platform with lending and borrowing services included.

HOW AKROPOLIS WORK

Akropolis work in a way that it offers opportunities to its users to launch DeFi protocols and use DApps they can manage to hold their asset.

It gives every dApp built on it a free hand to be in control of the governance of its protocol without any mediator.

QUESTION 3. Functionalities and real-life applications. (Screenshots needed)

Functionalities of the Akropolis platform includes:

.jpeg)

source

Akropolis is a Decentralized platform that functions as a medium through which small DeFi projects can grow as it offers loans at a very subsidized interest rate for every DeFi projects built on it.

It also allow users to lend out their asset to other user and let them be in control of their assets.

It also helps DeFi projects and users to provide liquidity to the platform which would yield interest for them as days pass.

The platform allows for users to cross to other blockchains by connecting them in order for them to be able to provide liquidity and enjoy services and get info from these other blockchains making them earn from different platforms.

Real-life application of Akropolis is seen in the banking sectors, Cooperative societies and money lending agencies that lend out money to people.

As we know, banks, cooperative societies and all other money lending agencies lend money to their customers or people who are part of them. They lend money out with an a small collateral consideration which are usually convenient for people who are part of their systems.

For banks, sometimes, they don't take collateral for money lend out but they make sure the individual borrowing money has a monthly, weekly or daily source of income from which they can be removing part of the borrowed money until it is paid up.

Cooperative societies also let people who are part and parcel of their system to borrow money while making sure they have contributed at least one-quarter of the money they intend to borrow and are continuously contributing their quota for the financial strength of the cooperative.

Money lending agencies on the other hand collect collateral as they usually borrow money out to people they do not know. Collaterals are taken from such borrowers to make sure they pay back.

4. Future development and associated projects. (Screenshots needed)

Associated Projects.

There are majorly two projects associated to Akropolis as it relates to crypto. They operate in the Akropolis platform and provides saving, borrowing and lending services too. They are all products of Akropolis.

.jpeg)

source

SPARTA

Sparta is a community-owned fund that helps its members by offering unsecured loans (loans for which less collateral are collected) , optimizing revenues through a variety of liquid DeFi instruments, and preserving incentives for early adopters and referrals. It solves a number of issues that traditional finance faces, including:

- Assessing risk involved in various investments

- Lending users funds with full percentage while considering the risk of loss.

- Provision of liquidity in order to avoid cash gap and going into bankruptcy later.

DELPHI.

This is another project associated with Akropolis. Built with AkropolisOS, Delphi allows for dollar-cost averaging into Bitcoin and Ethereum which enables user participate in various mining of liquidity.

Shifting away from the world of Cryptocurrency, in real life, one project associated with Akropolis that is used in real life is the Insurance Policy used by insurance companies in the world.

People go to insurance company and secure their valuables and properties such as houses, cars, golds, diamonds, company documents and even certificates. These valuables are usually insured with a token as first payment but with the agreement signed, the individual has to continuously pay a certain amount every month to keep up with the insurance of a valuable. In a situation where the individual losses his properties, he is compensated by the company reducing the impact of the loss.

In insurance cases, most times, the money collected by the company as collateral for properties of valuables does not measure up with the losses an individual makes but because of signed agreements, the insurance company pay for the losses of the individual.

5. Make a technical analysis of the token of the selected platform, then through your validated exchange account make the purchase of the token (15 USD as a minimum). Screenshots and an explanation of the procedure are required.

AKRO, TOKEN OF THE AKROPOLIS PLATFORM

AKRO is the native token of the Akropolis platform. It is used to govern and manage the platform. Any holder of the token can make vote on the proposals that will change the rules that guides the use of the platform. Newly mined tokens of AKRO and transaction fees are used to reward validators of blocks and voters.

In the coinmarketcap, AKRO is ranked 399 and as at the time of writing this task, it was trading at $0.0329. It has a market capitalization of $110.512M, a circulating supply of 3.364B and a total supply of 4.000B. It has attained a all time high of $0.0874 since it came into the coin market.

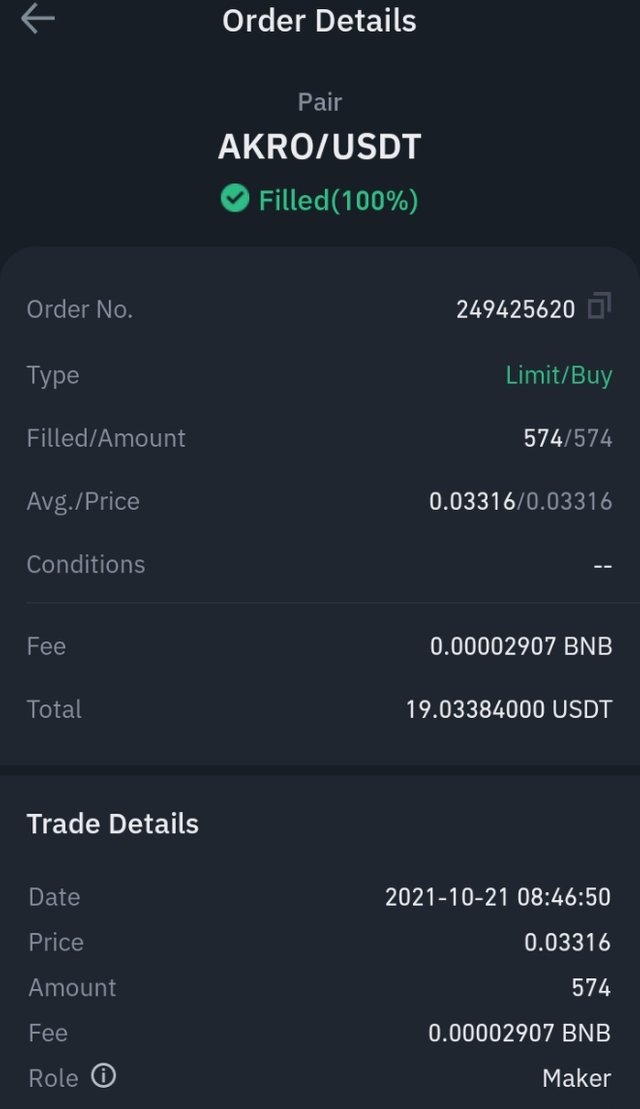

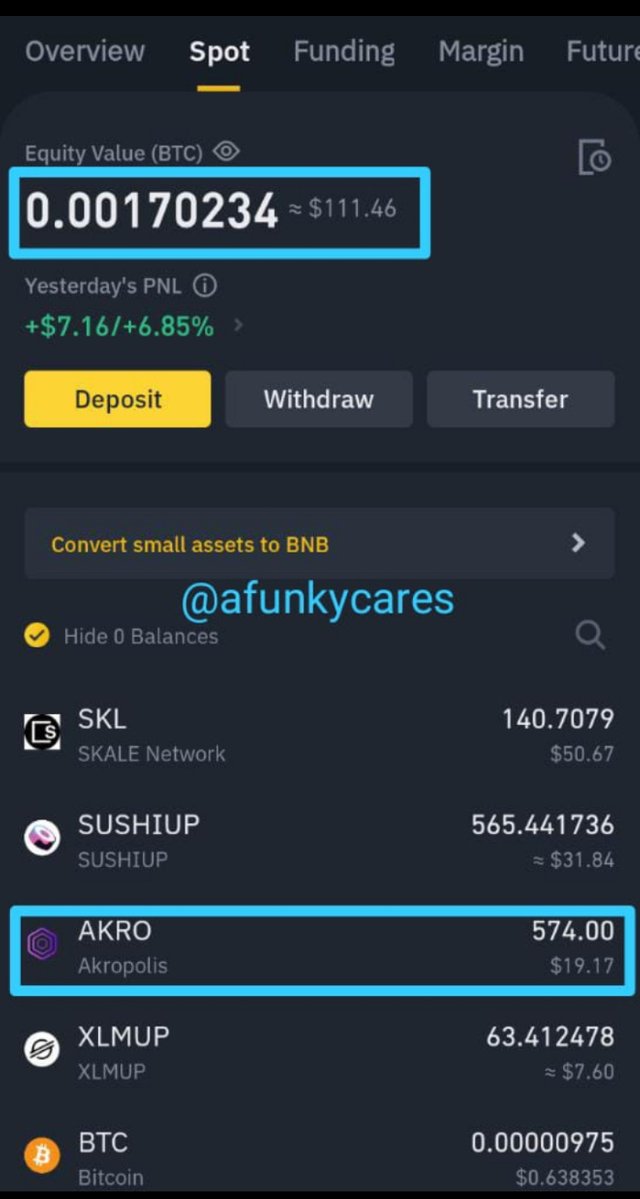

I made a purchase of the AKRO token with about $19 from binance.

Before I purchased the token, I had already done a technical analysis with the RSI indicator.

At first the token was oversold according to the indicator. So I waited to see that the indicator showed that it has left the oversold level, to trend upwards. At the sight of the second bullish candlestick, I made a buy limit order which executed after a short while

So with my 19USDT, I purchased 574 AKRO tokens which has now made part of my wallet portfolio.

CONCLUSION

Out of the many projects built that runs in the Polkadot, Akropolis is one of the few that stands out. It is a platform for the development of DeFi DApps which run on it but not controlled by it. Akropolis itself is decentralized and it doesn't govern the DeFi dApps that are built on it.

Akropolis is very much applicable in real life and we can see this in the banking sector and economic sector of organizations in the society called cooperatives. Insurance companies also use the policies Akropolis in running their organizations while trying to safeguard peoples properties and also make profits.

Cc:

@allbert

@reddileep