.png)

What do you mean by Global In/Out of the Money? How is a cluster formed? Explain ITM, ATM OTM, etc with examples?

The crypto market is very versatile. The price of the coins change their direction according to the movements of the traders in the crypto market. The traders buy, sell coins every second and thus their activities effects the movement of the price. The price goes up or down according to the buying and selling pressure of the traders in the market. There are a lot of tools which are used in crypto market to determine the price action in the market.

The Global In/Out of the money is the on-chain matric. This matric is use to reveal the number of the addresses which a crypto asset can be own and show the profit or lose which they have made in between the price in which they have been bought and their current market price. The prices of the crypto asset in which it has been purchased by the traders in the market as well as the addresses of the wallets in which these coins are been holded are bring together in form of the chain data.

This on-chain matric group the addresses of the blockchain wallets in the cluster form. The wallets are organized according to the price range in which those blockchain's crypto are purchased and hold. The average cluster value is determined by the given range. This also show which cluster is most profitable using the asset's purchased price. The simplified price range is determined by using the volume, price range and the wallets addresses in which these coins have been held.

The current price of the assets is use to determine whether the cluster is in profit or lose. The clusters of the addresses which have been bought the crypto assets at a specific price and are been holding these coins are used to determine whether the address is making profit or facing lose.

This is really helpful in the crypto market to determine whether the market is in bullish trend or bearish trend. This concept help to analyze the market in effective way.

Formation of Cluster

The amount of the crypto asset which have been bought at particular price and been held in the wallet addresses of the particular blockchain is use to form the cluster. The data of all the wallets addresses is collected. Then these wallets are organized with respect to the price at which the coin have been bought and held by the wallet. This is known as on chain data. This on chain data collection of wallets which have been bought the crypto assets at the specific price are grouped together to form the clusters. This is actually the grouping of the wallet addresses. The following information is required to form the cluster;

- Max/Min coin's price(price range)

- Volume

- Number of the wallet address which bought and held the coin

- Average price of the crypto asset.

Each cluster which is formed is contain the min/max price, average price of the coin, total volume and at last the number of the wallet addresses. These parameters are used to form the cluster.

Now we have different types of the clusters. The classification of cluster is done on the base of the profit or lose of the address. The clusters are classified into three types

- In the money

- At the money

- Out of the money

In the Money

The In the Money term refer to all those cluster whose maximum price is less than the current price of the crypto assets. This term is used when current price of the coin is higher than the maximum range of the cluster. When the price cross the cluster's range, this mean that the cluster is in profit. So all the clusters which are in ITM are considered in profit. The wallets in ITM serve ad the support level..png)

Source

All the green clusters are fall in the ITM category. Here the maximum price of the cluster is. The current price is. SO the current price is higher than the maximum cluster range. Its mean that these clusters are ITM.

Out of The Money

This term refer to those clusters where the price of the coin is lower than the lower range of the wallet. When the price of the assets is less than the lower price range of the wallet, it is considered as Out of the Money. All the clusters in this category are serve as the resistance level. .png)

Source

In the above images, the marked clusters are the OZTM. The current price of the coin is. The cluster minimum range is. The current price of coin is lesser than the minimum cluster range price which mean that the cluster is in OTM.

At The Money

All the clusters whose average price is equal to the current price of the crypto assets are fall in this category. This term refer to all those clusters where the current asset's price is in range of the cluster. The price should be fall in cluster range.

In the above screen short, the marked clusters are in ATM because the minimum range of cluster is. The maximum range of cluster is. The current price is which is in range of cluster.

Question 2- Explain about Large Transaction Volume indicator with examples? What is the difference between Total and Adjusted Large Transaction Volume? Examples?

Large Transaction volume indicator

The large volume transaction have great impact in the behavior of the market. The market can change its direction because of the large transaction. The people who performed such large transaction are known as the whale. Whale entry and exit from the market effect the price of coin highly. That's why the Large Transaction Volume Indicator was developed.

This is an on chain indicator which is use to monitor all the large transaction. The transactions usually more than 100k are considered as large transaction. This on chain indicator monitor all such transactions. This transaction can be done by a whale or by any institute but when such large transactions are performed, it has great impact on market.

When the indicator is in the base and do not have any spike, it mean that there isn't any big transaction is performed in the market. The whales are not interested in buying or selling the coins. In such situation, the indicator remain moving smoothly in base. But when the whale or the institute perform a large transaction, buy or sell the coins equal or more than the 100k, a spike is shown on the indicator. This spike represent that a large transaction has been performed in the market. This influence the market. If the whale or institute have bought the coins in large transaction, the market will rise up. If the selling is performed in large transaction, the market will move downward. In short, whenever the whales or large institute enter or exit from the market, the large transaction volume indicator show a spike.

- To get to know about the large transactions, go to the link

- Click on the below circles option which is named as large transaction.

- The below page will appear where you can get to know about the large transaction occurance in the market. You can set the time frame according to your own

.png)

Source

In the above screen short, we can see spike whenever a transaction more than 100k was performed on the blockchain. The last large transaction was performed on 10 May 2021.

- Total Large Transaction Volume

In total large transaction volume, all the transaction which are equal or above the 100k are considered. Every single large transaction is considered in total large transaction volume. In this case, there may be different wallets or addresses who have been performed the large transaction. Or there may be a single address performing multiple large transaction. Each and every large transaction is considered whether it has been performed by single address or by multiple addresses. Let suppose i have made a transaction of 120k. Then i received 110k from another address. Each and every large transaction of mine will be countered separately.

- Adjusted Large Transaction Volume

In Adjusted large transaction volume, the transactions are eliminated if the amount is transacted back to its origin address. Here the origin addresses are considered. For example, i have sent 100k to my friend. He sent back that amount to me after some time,. The adjusted large transaction volume will not generate any spike on the graph. If the amount is send back to origin address, no spike will be show. The indicator will filter out all those transactions and eliminate those. Only one will be shown on graph. So this indicator is more accurate as it filter out the transactions. The more accurate and authentic view is generated for the traders..png) Source

Source

Difference

Total large transaction volume count all the transaction. If A transaction if performed by an address and then that amount is transacted back to that origin address, both transactions will be tracked and two spikes will be generated on graph. This may mislead the traders.

In Adjusted Large transaction volume, if the amount is transacted to an address from the origin address. the amount is transacted back to the origin address, there will not be the two spikes on the chart. This on chain matric will filter out such transactions and will generate authentic view of the whales activities in the market. This is more accurate and correct.

Question 3- Analyze a crypto asset(other than BTC) using on-chain metric: GIOM, and Adjusted Large Transaction Volume? Ascertain whether it supports a Bullish or Bearish bias or Neutral? How do you find the support and resistance using GIOM? How do you ascertain the upside/downside momentum using GIOM? Use InTotheBlock app or any suitable app? (Examples/Screenshots)?

- I am going to analyze the ethereum crypto coin to answer this question.

Bullish or Bearish in the Short-run

.png) Source

Source

From the above screen short we can see that the In the money has percentage of 83.84 and Out of the money has percentage of 11.74. The ATM has 4.43 percentage. The ethereum current price is 3871.47$. This mean that Ethereum is in bullish trend has gained the strength right now in the long run.

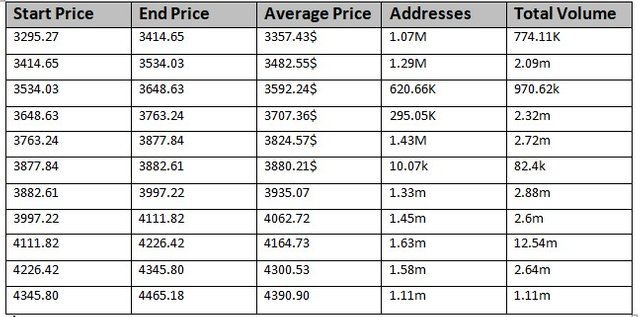

Bullish or Bearish in the Short-run( $3,295.27 and $4,465.18)

.png)

Source

From the above screen short we can see that the In the money has percentage of 39.87 and Out of the money has percentage of 60.04. The ATM has 0.09 percentage. The ethereum current price is 3871.47$. The ITM ratio is less than the OTM ratio. SO here the ethereum is in bearish trend in short run.

Support and resistance levels in the short-run

From the above table, we can extract the support and resistance level with help of average price. The below is the support level

.png)

Support and Resistance in Long-Term

.png)

From the above table, we can extract the support and resistance level with help of average price. The below is the support level

.png)

Momentum using GIOM

We will use the historical in/out of the money chart to calculate the momentum.

We have to calculate the difference between the In The Money and Out of The Money to find out the momentum upward or downward. I am going to calculate for 4 month, from 2nd august 2021 to 2nd december 2021.

.png)

Source

For August 2, 2021, we have;

Price of ETH = 4536.16$

ITM = 63.49m addresses

OTM - 595.46k addresses

.png)

Source

For December 2, 2021, we have;

Price of ETH = 2586.95

ITM =52.63k addresses

OTM - 2.78m k addresses

From the above screen shorts, we have seen that the ITM has been changed from 63.49m to 595.46m from 2nd August to 2nd December. The ITM has been decreased within the 4 month duration. Now if we talk about the OTM, the OTM changed from 595.46k to 2.78m. The OTM has been increased significantly. So the momentum is toward the bearish side as more addresses are turned toward the OTM.

Adjusted Large Transaction Volume

.png)

If we talk about the Adjusted large transaction volume, we can see from the below chart that there is only one spike toward up in this year. On the chart, we can see only single spike in 2021 which was occur on 8 may. There was large transaction of 41.09m ETH on May 8, 2021. AFter that, we can see some small and high spikes on the chart. But the coin is still in bearish zone after that large spike. In the previous week, there was a little spike on 14 December of 3.42m ETH. There is little or zero interest of whales toward TH. No high spikes are being observed in the ETH graph.

Conclusion

The Global In/Out of the money is the on-chain matric. This matric is use to reveal the number of the addresses which a crypto asset can be own and show the profit or lose which they have made in between the price in which they have been bought and their current market price.

This on-chain matric group the addresses of the blockchain wallets in the cluster form. The wallets are organized according to the price range in which those blockchain's crypto are purchased and hold. This also show which cluster is most profitable using the asset's purchased price. This lecture was a complicated and time taking but i tried to answer all question as per my understanding. I am very thankful to professor @sapwood for this lecture as it is highly informative and useful.

.png)

_LI.jpg)

.png)