Hello fellows. How are you all?

This is @ahtishamghumman5, here I am going to share my homework post on the topic "In-depth Study of Market Maker Concept" given by respected professor@reddileep

.jpg)

Q: 1 Define the concept of Market Making in your own words.

One cannot trade without someone buying or selling the crypto assets we want. We see in different crypto exchanges the transactions made are real quick which indicates the market is highly liquid. This liquidity in the market is a product of the market-making concept. This concept in practice is brought by individuals hired by exchange or can be normal traders or banks or brokers summed up in labels called market makers. For a definite definition.

“The concept of market making can be defined as the method or strategy a market maker applies to attain liquidity.”

Source

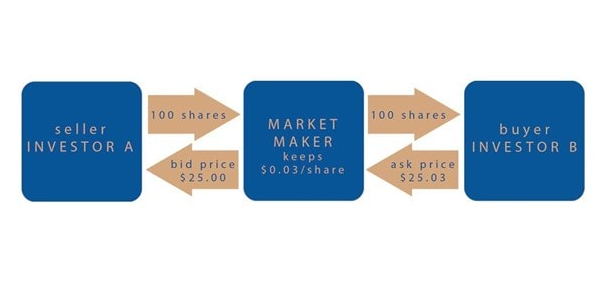

The purpose of this concept is to facilitate traders with a trouble-free profitable trade. This is done by market makers placing limit buy and sell orders of their assets. Let’s understand the market maker concept from the following example

“For instance, the current ask price of an asset is $10 but the market trader is aiming to purchase it at $9 now by limit order feature he will place an order of purchasing that asset at $9 so that when the price fluctuates to $ 9 his order will be automatically delivered. Now the same asset he bought on $9 he decides to sell $11.5 for this market maker will place a limit sell order at $12.5 so that when price fluctuation reaches $11.5 his assets will be sold along with earning him a profit of $2.5 as the difference between the rate he bought and the rate he sold is $2.5 which in the trading world is called the bid-ask spread. The market maker when places such limit orders they assist other trader or traders who do immediate trading a price range to buy or sell their assets which in the above scenario is $9-$11.5. Hence the liquidity is provided by the market maker.”

Q:2Explain the psychology behind Market Maker. (Screenshot Required)

The psychology behind Market Maker

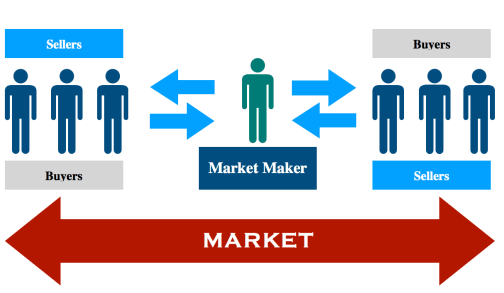

For understanding their psychology it is required to understand their role in the market so let’s start with getting what exactly market makers are and what they do.

The market makers are market liquidity providers which is an essential part of the crypto market. They control the market by providing a range of ask and bid prices to retail traders by setting their limit orders which are placed in order books of an exchange. A normal trade on the price rates showed in these order books. The bid-ask spread set by market makers earns them to profit from the trades of retail traders. For this let's understand through an example that will also aware of their psychology

Suppose a market maker “Ms. A” enters a market where rates of the crypto asset were $19 not satisfied with the rate she places a limit buy entry at $17.5 such that when $17.5 becomes the current rate she will automatically receive what she ordered for. However for providing liquidity and generating profit she place a sell limit order at $20. Now the retail traders have liquidity and a ranging market where they can place their orders. Every time the retail trader makes the purchase or sells the bid-ask spread profits, market maker. A bid-ask spread is the difference between ask and bid price which in the above scenarios is $3.5.

With the above example, the psychology of market makers is easy to understand i.e. they liquidity and earn their profits by doing that. However, there are whales in the market who are not exactly market makers but trade at huge volume switching trend direction quickly forgetting their profits

One cannot trade without someone buying or selling the crypto assets we want. We see in different crypto exchanges the transactions made are real quick which indicates the market is highly liquid. This liquidity in the market is a product of the market-making concept. This concept in practice is brought by individuals hired by exchange or can be normal traders or banks or brokers summed up in labels called market makers. For a definite definition

“The concept of market making can be defined as the method or strategy a market maker applies to attain liquidity.”

Source

The purpose of this concept it to facilitate traders with a trouble-free profitable trade. This is done by market makers placing limit buy and sell orders of their assets. Let’s understand the market maker concept from the following example

“For instance the current ask price of an asset is $10 but market trader is aiming to purchase it at $9 now by limit order feature he will place an order of purchasing that asset at $9 so that when price fluctuates to $ 9 his order will be automatically delivered. Now the same asset he bought on $9 he decides to sell $11.5 for this market maker will place a limit sell order at $12.5 so that when price fluctuation reaches $11.5 his assets will be sold along with earning him a profit of $2.5 as the difference between the rate he bought and the rate he sold is $2.5 which in the trading world is called the bid-ask spread.

source

The market maker when places such limit orders they assist other trader or traders who do immediate trading a price range to buy or sell their assets which in the above scenario is $9-$11.5. Hence the liquidity is provided by the market maker.”

Q 3 Explain the benefits of the Market Maker Concept?

Increase Worth Of Crypto Asset

We now know a market maker aims to generate liquidity when market makers generate liquidity of a particular market it attracts traders more which results in traders holding or purchasing that asset more which increases the worthiness of that asset among individuals. Let’s say the market of BTC has high liquidity which attracts more traders in its market, as a result, more crowd will be there to buy or sell this asset. Such crowds make the value of assets rise and draw more people toward the market.

Helps to Provide Liquidity

The key purpose of the Market maker concept is to assist the market with liquidity. The market maker concept brings liquidity to the market due to the strategy of the market maker. These markets makers bring liquidity by placing limit orders which are explained above. The markets with high liquidity help them to draw more investors into the market.

Buy or Sell Ticket Detection

The retail trader's trade is based on rates defined in the order book which helps them to decide whether they should lace their buying or selling orders or not

Emission of Slippage

When markets are volatile i.e. there is massive price fluctuation the order is placed at the different rate it was aimed for due to high volatility which is called slippage. The market maker emits the possible chances of slippage as they provide ranging rates of an asset which prevent the market from showing lengthy fluctuations of price.

Q4- Explain the disadvantages of the Market Maker Concept?

Depriving small traders of High Profits

There are many people or retail traders who assume that the trading market is running naturally and are completely unaware of the market-making concept. They reduce the high chances of profits to retail traders by keeping their bid spread low which doesn’t make the trader get maximum profits and drives money from small traders to market makers.

Doesn’t Entertain Short-term Trading

There are swing and scalp traders found in crypto markets. The market maker concept doesn’t help traders who are looking for quick transactions. These traders have a pre-settled timeframe they trade from few minutes to some hours hence they are not facilitated with the market maker concept as the difference between ask and bid price is not much to earn the maximum profits.

Liquidity Doesn't Last

The liquidity provided can be taken back by the market makers as they don’t work for retail trader’s interest hence can end up leaving them to meet loss. They are not bound to anyone and can exit the market anytime which results in the shifting of the market from liquid to illiquid.

Manipulating Retail Trader

The existence of market manipulators called whales is selfish traders who earn profit for themselves by causing loss to retail traders. They do this by selling a huge amount of crypto coins at low cost and when they gain sell liquidity quickly purchases these assets at high rates leaving the normal traders to deal with loss.

Q5- Explain any two indicators that are used in the Market Maker Concept and explore them through charts. (Screenshot Required)

MOVING AVERAGE

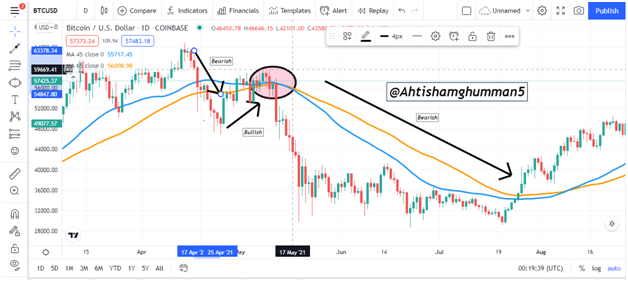

The moving average is a type of indicator which is familiar among all types of traders i.e. either they are market makers or market makers. However, a market maker is not fully dependent on these indicators as they have few other sources to consider price movement. These indicators help traders to detect the direction of price movement through crossing over of the two lines of moving average at “Golden cross”. Which is a signal of a trend reversal in moving average.

Let me further explain to you its relation to the market maker concept through a regular chart of BTCUSD trading pair.

In the chart above it can be seen the moving indicator is applied with line difference of 45 and 65it can be the trend had been bearish however by generating liquidity or sales or purchase the market maker generated a bullish trend before the golden cross which signals a trader of uptrend following however contrary to that the trend further moved towards downtrend which shows the bullish trend was a false signal by market manipulators causing them to purchase assets on wrong time.

RSI

This unique indicator is used by retail traders to predict price movement and used by market makers to manipulate this trader with false signals. The RSI shows the overbought and oversold region by specifying the region which tells about price movement trend according to the direction of the indicator.

Let’s understand it through the chart of the BTCUSD trading pair

In the chart below it can be seen the indicator signaled an overbought region the market makers started purchasing these assets causing their price to go from upward to bearish. Trend making retail traders thinking of it as price reversal they end up selling according to manipulation of the market maker. However, it can be seen in the picture above that the trend reversal was temporarily generated by market makers for manipulating market traders.

Regard

@ahtishamghumman5