Hello fellows. How are you all?

This is @ahtishamghumman5, here I am going to share my homework post on the topic " Trading Cryptocurrencies" given by respected professor @reminiscence01

.jpg)

Q 1 Explains the following stating its advantages and disadvantages ,Spot Trading , Margin Trading , Futures Trading

SPOT TRADING

ADVANTAGES

An investor can claim ownership of cryptocurrency by purchasing the underlying assets.

There is no limit on investment capital

Traders do not face any form of liquidation during a bear market

A trader can hold the coin whenever he wants and can recover his losses.

DISADVANTAGES

Due to the volatility of the cryptocurrency in the market, traders buy crypto assets at inflated prices, which is risky to investors' capital.

The trader does not benefit from a bear market

MARGIN TRADING

Margin trading is not for beginners. It is for professional investors as they have better knowledge of how to process in the market. Margin trading has more purchasing power than trading capital in your account, and they have more purchasing power in the sense that they have more purchasing power by borrowing funds from a third party. Third-party means exchange or other traders. Borrowing funds enable the user to trade assets more remarkable than their initial capital. It also has excellent leverage.

ADVANTAGES

Users can make huge benefits with little capital in their accounts

It gives the user more purchasing power

It benefits traders who have less trading capital.

DISADVANTAGES

It needs professionals to trade their funds and carry out technical and fundamental analysis to make the right decision.

There is a greater risk due to leverage.

FUTURES TRADING

Due to the high level of risk associated with trading in the futures market, this trading is not for beginners. The future market enables traders to take advantage of the up and down movement of price. In this market, we can predict future prices. It allows traders to either go long (buy) when the price indicates that it will increase or go short (sell) when the price is going to drop. In this, we will purchase future contracts with fixed costs—prospective traders given leverage which gives them more purchasing power to buy big projects with so little capital.

ADVANTAGES

Because of leverage, traders make huge profits

It gives traders the advantage of hedging

It can take advantage of bear and bull market

DISADVANTAGES

You are unable to purchase underlying assets

It has such a significant risk

It can result in account liquidation

Q2 a)Explain the different types of orders in trading.b)How can a trader manage risk using an OCO order (technical example needed)

(a)Explain the different types of orders in trading.

Trading is useless without placing an order as we all know if we need to buy or sell a product/ goods, we need to place an order first. The same is the case with the cryptocurrency market. If we want to trade cryptocurrencies, we need to order them first. However, there are three types of orders taken in the cryptocurrency market.

Let’s get straight into the explanations of each.

Market orders

A market order is the simple and most basic order to buy or sell an asset. These orders are preferred to use by beginners. If you place a market order, it will ensure that you will execute your order, but the price is not guaranteed.

For example, if an investor needs to buy an X asset, you can immediately initiate the trade at whatever the price of the X asset is going on the market.

Pending Orders

Pending orders are simple instructions to follow when the desired conditions are reached to sell or buy any asset. However, pending orders are further classified into two categories. Limit order and stop-limit order.

Let’s discuss both of them to have a better envision of pending orders.

Limit order

A limit order is a type o order in which a trader sets the price limit at which the trade is executed. Or you can say that a limit order allows the trader to sell or buy the asset at a specific price. For example, if you want to buy an asset Z at $4 and its original price is $5 in the market. You have set the limit at $4. Now, your order will only execute when the price gets lower at $4

Stop limit order

Stop limit order is also a pending order, and it works with limit price and stops price. When the stop price is outstretched, the limit order is executed. To elaborate it further, consider an example. There is an asset named XY, and its original price in the market is $30. If any investor wants to buy coins through a stop-limit order, he will set a stop price at $28 (for instance) and limit the cost to $27. When the price reaches $28, the order to buy the coin will be $27.

However, you can set the stop price and limit price at the same amount.

OCO Orders

In this order, a trader can place two orders at the same time. The first first-order will be canceled when the criteria of the second order are fulfilled and vice versa. It stands for “one cancels the other.” OCO order is a combination of limit and stop-limit order. You can place both orders at the same time, but you will execute only one.

For example, if the asset’s price is $6 in the market and the price is likely to get an increase or decrease, then you can place an OCO order. A stop-limit will be set at $5 and the target price at $6. So, if the price gets fluctuate, a trader can enjoy safe trading

(b)How can a trader manage risk using an OCO order (technical example needed)

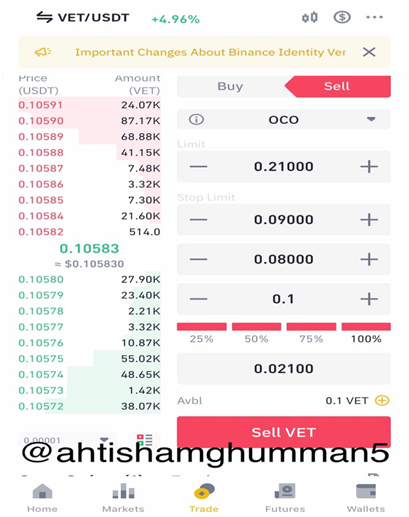

To manage a risk easily, a trader should opt for an OCO order. OCO order is also a type of pending order and allows to place to orders at a same time but only one order is executed. A trader can place a stop limit and sell order at the same time, but only one order will be executed when it reaches the desired criteria.

In this screen shot above I placed an OCO order to sell VET. I ordered this OCO from my Binance exchange platform. Here I placed a limit order to sell VET at 0.21000 USDT and also placed stop limit order. Stop limit is added to sell the VET at 0.80000 USDT when the stop price will reach 0.09000 USDT.

Only one order will be executed, depending upon which order fulfils the criteria first.

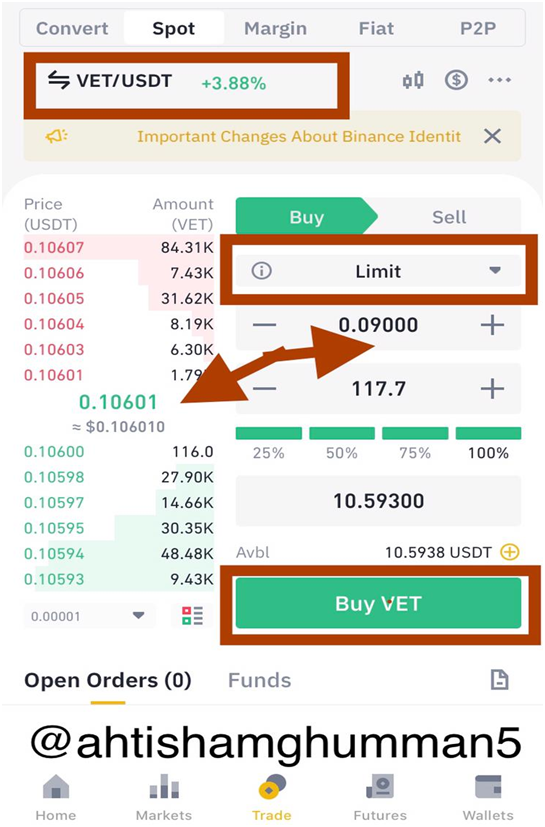

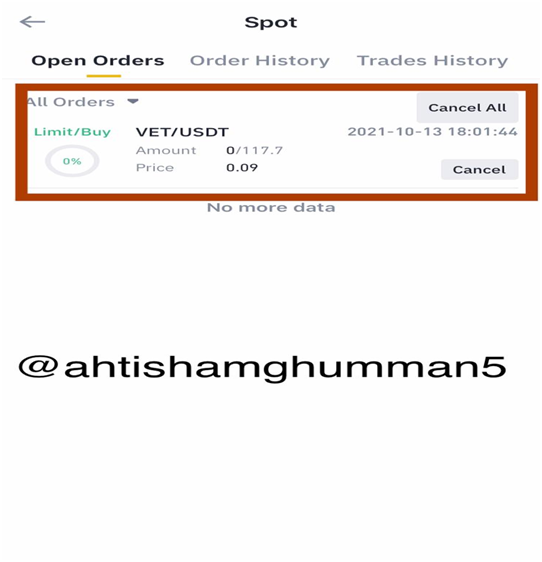

3)Open a limit order on any crypto asset with a minimum of 5USDT and explain the steps followed. (Screenshots needed from any cryptocurrency exchange).

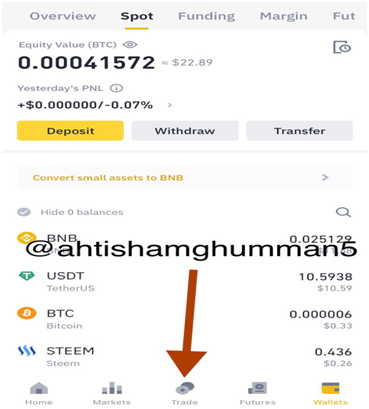

I logged into my Binance exchange platform. Then, selected the trade option as you can see in the screen shot below.

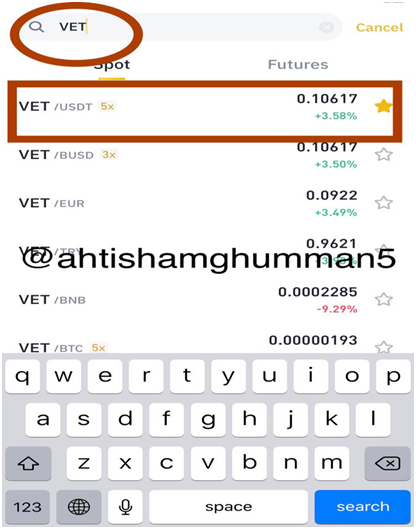

After that, choose a pair for trading. I selected VET/USDT pair for trading. You can choose the pair according to your choice.

Set the limit order. Here I set the limit to buy VET at 117.7 USDT when the stop price will reach the 0.09000 USDT.

After clicking the buy option, my order is place in order history from where I can verify it (see below).

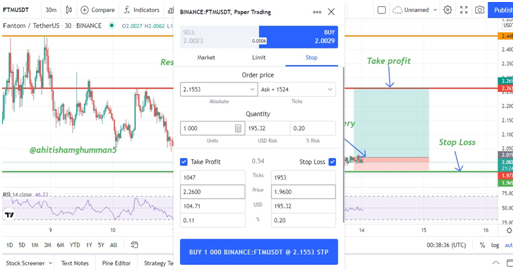

4) Using a demo account of any trading platform, carry out a technical analysis using any indicator and open a buy/sell position on any crypto asset. The following are expected. i) Why you chose the crypto asset ii) Why you chose the indicator and how it suits your trading style. iii) Indicate the exit orders. (Screenshots required).

I performed this task by using Trading view demo account for trading. I selected FTM/USDT pair for trading. The reason I chose FTM/USDT pair is both are sustainable and valuable. In addition, FTM is a viable coin to invest in for a long time. Most of the time I like to trade these coins due to their high sustainability as they are a great source of income. However, overall cryptocurrency market is going towards correction and I am hope full that the coin is chose will also move towards correction. The RSI indicator is indicating that FTM is going at support level, that’s why I selected this pair.

However, I used RSI indicator to enter buy order as you can see in these screenshots. I have purchased 1000 FTM.

The entry point to my trade is 2.0029 and stop loss is placed below entry point at 1.9600. I got profit of $87 from previous nigh till now as my predictions were quite right.

Conclusion

Your effort into this lecture is mind-blowing, sir, and I have learned a lot from it. From trading types to order types, you have covered all the topics pretty well and provided this piece of information to us. I now know how to trade in cryptocurrency and place orders like stop limit and limit order. I am looking forward to learning more from you.

Regard

@ahtishamghumman5

Hello @ahtishamghumman5 , I’m glad you participated in the 6th week Season 4 of the Beginner’s class at the Steemit Crypto Academy. Your grades in this task are as follows:

Observations:

That's correct. The order is executed at the best available price in the market.

Recommendation / Feedback:

Thank you for participating in this homework task.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit