Hello fellows. How are you all?

This is @AizazGhumman, here I am going to share my homework post on topic " The wayckoff Method" given by respected professor @fendit

.jpg)

Q1:Understanding regarding the fundamental laws and the “Composite Man”.

"Wyckoff Method"

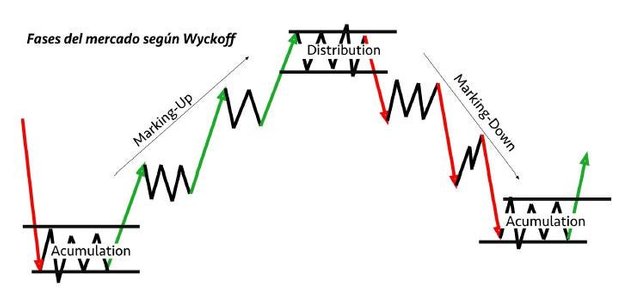

- Accumulation

- Upward Trend

- Distribution

- Downward Trend

Just as there are so many other analysis tools in the market Wyckoff method is one that is quite useful among them all. But that does not mean that there are no cons to this method. Trading in the stock market and cryptocurrency is a risky business without the proper logistics and knowledge. And this tool which is called the Wyckoff method helps make decisions that are based on pure logic rather than dwelling on some emotions and losing your money in the market which is quite common. The stock market is a risky business but

the Wyckoff method helps you get a better understanding of how the market works and reduce the risks increasing the chance for success. But even though this method helps a lot still there is no 100% guarantee that you will end up in profit because there are always chances of loss in the cryptocurrency market.

This is a unique technology that lets you understand the stock market and makes it much easier. As we know that the market is not controlled by any bank or entity but instead it is controlled by the investors and institutions. And when there are so many different aspectsit gets harder to predict the movement of the stock market. So instead, there is s imaginary character “The Composite Man” which represents all the traders, investors, and institutions. This Composite Man’s sole purpose is to buy at a low price and sell at a higher to make a good profit out of the stocks.

The market makers are represented by the composite man. Because whales and institutional investors are the market's movers and shakers. They purchase at a low price and sell at a high price. They act in their own best interests at all times. In order to gain more money, we must also read the market extensively and act on this reasoning.

We can see that the wealthy people that are somehow controlling

the market are using it to get profits from the market that is already at their

disposal. They are not like the minority investors that also lose money because

they can turn it the way they want. I see this as a selfish act for their

profit but to be honest if any one of us gets this opportunity right now they

will do the same. This is a very useful technique as they are the high

investors and with the help of their money, they can pull the market to the

point where they want it to be.

There are four phases of this technique that the Composite Man uses to get the profit. And if we study and practice it well, we might be able to get a better understanding and even make money while they do too.

Four step are:

This is a phase in which the Composite man purchases a large

portion of the coins in the market but without affecting the price in the

market. After this is done the Composite man then is in charge to make the

first move that will decide the price of the asset but that does not happen

without properly studying the asset. As the Composite man is the one that is

making the move it is always one step ahead of the investors making a heard of

assets and then it can be used in the next phase of the strategy.

The composite man started accumulating enough assets. He bought the assets he had accumulated at the lowest price. It may push the direction of the market upwards as the selling pressure decreases.

Here we can see the focal point of the previous phase. The purpose of this is to cause an increase in the price of the asset. Now that they hold most of the coins in the market, they make the supply scares and increasing the price. And at this point, the investors get excited and make their orders. Now that the price of the assets is high, they can sell their assets for a profit now by achieving that the demand is much greater than the actual supply of the asset.

Sometimes you can see the accumulation period

again which is called the re-accumulation period. In this period the upward

trend stops for a while before starting to rise again

This is the step when the Composite man has achieved what was

intended according to the strategy.

The composite man starts making a move here. He starts selling the assets he has accumulated in the first phase here. Those who start buying later buy these assets. As supply and demand balance each other during the distribution phase, the asset price remains horizontal.

This is the step when the Composite Man

sells its assets progressively where you may notice a lateralizing movement

until the Composite Man manages to sell all the assets. This is where you can

take the advantage of the moment because there are always some last-minute

investors that come in at the last minute and ends up selling their positions

for a higher price and this way the demand for the assets runs out. Then begin

the final step of the strategy.

This is the final step in the completion of the whole master strategy which is somehow selfish. But that is the truth and it has been like this from the beginning of time. The law of the strongest has been around for centuries and all the entrepreneurs use this law to turn conditions in their favor and get an advantage. After achieving the mission, the Composite man makes a very malicious move where he starts to work towards the lower markup. Now, most investors start selling their positions and assets. As of now, there are no buyers in the market and all sellers this will cause the currency to plummet in price. And in terms of economics, we can say that the supply is more than the demand causing the downwards trend.

In my opinion, this strategy of the Composite Man is very genius but surely it is selfish. As it only cares about the interests of the bigger investors. As the big investors use their greater purchasing power to dominate the market. As the retail investors do not have the power to do this, they just play their part in this well-designed strategy.

Everything in the world works by the Law of Supply and demand from economics. As there is a higher supply of the asset and there is lesser demand the investors will start selling the assets together. And that is what happened with BTC when the price fell precipitously. There was a sudden increase in the sale and the number of sellers in the market rather than buyers and demand in the market.

You can use this method by looking at the bars

in the graphs and this way you will be able to compare the price movement. This

technique helps you study the relationship between supply and demand and

predict future movement. By practicing this technique, we will know when to

enter and exit the market with some profit at hand

The rich and the powerful as we are calling it the Composite

Man put a lot of effort into the movement of the market in their favor. And the

Law of Effort vs Outcome is the one that deals with the whole work. As we know

that it is not really an easy thing to do to purchase a large chunk of the

assets and selling them gradually. One has to do this very carefully so that it

does not cause any effect on the price of the assets before the intended time.

Most of this is because of the volume and the price of the assets. The key

point to accomplish is to maintain equilibrium so that the trend continues. As

if the opposite happens the trend will just go in the wrong direction or even

stop causing a great loss. So, when you see a large volume that will mean that

there has been a lot of effort on one side.

Q2:Share a chart of any cryptocurrency and analyze them using this method. It clearly shows the different phases, how the volumes change, and gives details of what you see.

.png)

Accumulation :

As you can see in the

first part of the graph Volume is mostly maintained for the time being there

was a little variation in the graph preparing for the bigger image. This is a

solid example of the pure accumulation period in which Composite man is buying the

assets

Distribution :

And as the price of the coin has increased to its maximum

potential then begins the distribution phase in which the composite man starts

selling the assets. After that, the market is seen to fall increasing the

number of sellers so that the supply is higher with short demand causing the

price of the asset to come back down. But right before hitting the bottom with

the downtrend, the market went right into an accumulation period.

Re-accumulation : After the purchase of

the assets is completed, you will notice a buy trend. That is when most of the

investors come in and place their orders, Supply is short demand is high

pushing the price higher. But the market goes back into the accumulation

period. This is noticeable in the graph as the trend is set to buy after the

accumulation period ends

Now to come back to the conclusion it is safe to say that this

method is quite handy when it comes to take some benefit of such strategies and

have a better understanding of the market. But surely there are some cons to

this strategy as well. And by pros, that means for the wealthy who make a great

profit by practicing this strategy but one thing you can be sure of is that

this is not just a theory. The market goes up, down, sideways anyway it wants,

and gives quite a handful of strategies for the investors. And by practicing

these Laws and these methods it will become easier for retail investors to make

better more educated decisions and prevent the huge loss of money. One thing

that this method helps with is the accurate time to enter the market and when

to exit which is a very crucial thing to understand before trading in stocks.

And this method will help to know a little more about the market movement by

seeing and understanding the graphs and trends.

Regard:

Thank you for being part of my lecture and completing the task!

My comments:

Your explanations were really good, but there's a thing when it comes to the chart. The accumulation phase is supposed to have very low volume and to be a bit more larger as it's where the composite man stocks. Also, reaccumulation was not properly identified (you marked something that was the beginning of the next cycle) and redistribution was missing. The analysis was too vague as well.

Overall score:

4/10

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit