This is @aizazghumman, here I am going to share my homework post on the topic " The Bid-Ask Spread (Part II)" given by respected professor @awesononso

.jpg)

Define the Order Book and explain its components with Screenshots from Binance.

Order Book

.jpeg)

The left greenside in the book is called bid side and it consists of the necessary details about the buy orders and their respected prices. Also, the highest bid is always shown on the top.

.png)

The red side contains all the sell orders and just like the bid side, you can see the sell orders with their prices in the form of a column. The higher Ask price is always on the top of the column.

.png)

By understanding the order book and seeing the screenshot, we can say that it has significant importance in cryptocurrency trading. Traders and market makers can use order book before buying or selling any crypto assets. Through listed information in the order, book enables the traders to make informed and clear decisions based on information for particular assets. In addition, the order book is also making the crypto market more transparent and reliable.

Moreover, in the order book, bid side and ask sideshow all the buying and selling order’s prices in a well-recognized sequence as we discussed earlier. We can this information to make any investment decision in the first place. It tells us either a market is bearish or bullish in nature.

What are the components of the order Book?

As we have discussed order book and their uses in the trading market. Now I am going to give the idea about components of the order book and how to get most of the benefits from the book order.

Buyer side and selling side

Ask side is also known as the red side consist of all the open selling orders. The green side consists of buying orders and with their respected selling and buying price. Traders can easily review the stock prices and can make an informed decision on the analysis of the order book.

Bid and ask

The Bid side in the order book is all about buying open orders and asks side known as the red side contains all the selling open orders in the market. It is very convenient for traders to analyze both bid and Ask sides.

Spread

You can see the Spread option on the top right side of the order book. This component of the order book is the most useful for traders in digital currency investment. Spread tells us about the market situation, what is happening in the market? Also, spread determines the market value. For example, a high spread means the market is not liquidated.

Who are Market Makers and Market Takers?

Market Makers and Market Taker

Now we have the idea of the order book and its key components that are very crucial to know to make confident and informed decisions.

Market Makers

Market Makers you can say are the backbone of the market. They are directly associated with making the market for market takers. They have their own fixed bid price and buy the stock at the Ask price.

Market Takers

During the research on Market takers and Market makers, it confused me a lot but after careful analysis and discussion with my crypto learner friend, he solves the puzzle and gave me an absolute brief on this. The market takers just buy any available stock at the market price. They don’t bother to verify or give attention to the ask price or bid price. For instance, crypto Z has a market of $10.00 and I am a market taker so, I would buy at the market price without checking liquidity or any other stock-related information.

Market Makers don’t just buy at a market price they preferred to buy any stock at their specified price. Also, in this way, they provide liquidity in the trade market and make a reliable ready market for market traders.

What is a Market Order and a Limit order?

Market Orders

Market orders are another type of order that’s executed instantly without considering Ask price or bid price. These are the orders which buy or sell instantly at the best possible current market prices. For example, if I need to buy a stock I will buy instantly and directly at the current market price without hard decision and thinking about future predictions.

Limit Orders

In the order book, Limit orders are in waiting to be filled depending on the price of each order in the order book. We can say that limit orders buy at a specific price determined by the buyer or seller at the set price by the seller in the trade market. In addition, limit orders ensure that the order is executed at the preferred price or even at a better price.

Explain how Market Makers and Market Takers relate to the two order types and liquidity in a market.

Market makers place limited orders and also provide liquidity in the market. Through this way, they make a market for market takers to take over the market by buying limit orders. So, the market is full of many stand buy orders created by the market makers in the first place. Now, market takers come into the market and buy available stand-by limit orders at the market price. Once the price of limit orders is matched with the price of market takers transactions occurred. In simple words, we can say that market makers are the ones who provide liquidity in the market and the takers take the market liquidity by executing limit orders.

Place an order of at least 1 SBD for Steem on the Steemit Market place by

a) accepting the Lowest ask. Was it instant? Why?

b) changing the lowest ask. Explain what happens.

(Make sure you are logged in to your wallet).

Accepting the Lowest ask

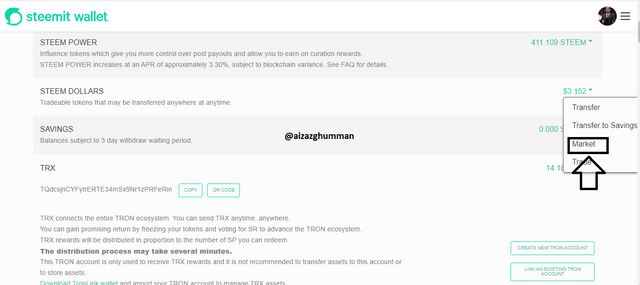

Firstly, you have to log in with steam wallet with an activation key and then we have to Click your Steem or SBD balance, - Click on "Market"

.png)

Then we will enter the internal marketplace, where you will find the various option like Bid price, Ask price, and Spread, Buy steem and, Sell steem.

.png)

As you all know when we buy Steam Coin there can be two scenarios. The number one case is either the order is completed immediately.

Number two, in case the order is delayed, the ask price changes and the order goes to the order book and whenever the asset price returns to our fixed ask price, our order is completed.

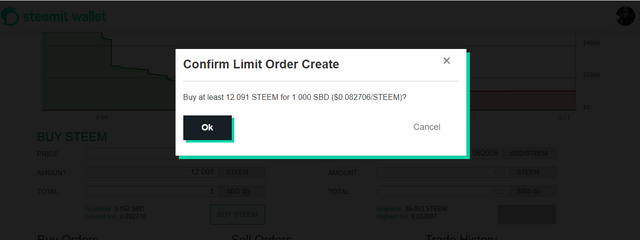

Now we buy steem at the lowest ask price of one dollar and see how long it takes to complete our order.As you can see in the screenshot below

.png)

And now I have confirmed the order.

.png)

As you can see my order was an ad on the order book and after some second it will complete it.

.png)

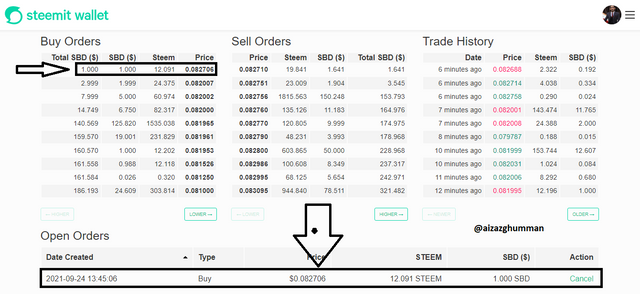

Changing the lowest ask.

Right now I'llll explain to you how to buy steem without the lowest task, I already tell you must have login with your activation key and Click your Steem or SBD balance, - Click on "Market" and then the market steem internal market will open front on you.

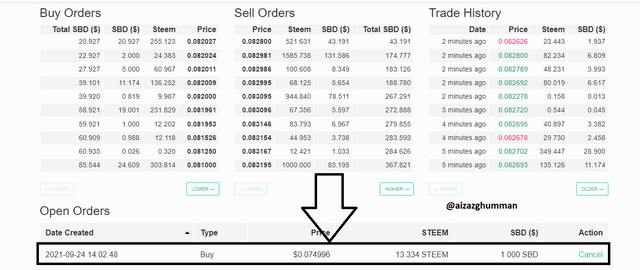

And you ignored the lowest ask price and put your desired price is where you want to buy steem coin as you can be seen on below screenshot the lowest ask price is $0.082750 and ignored it and put my desired price $0.075000

.png)

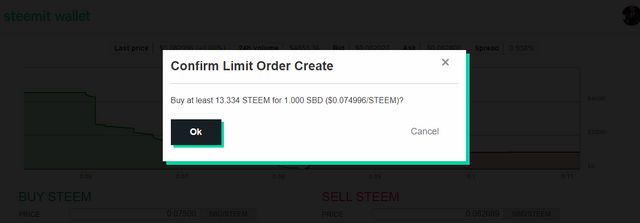

And now I have confirmed the order again.

.png)

as you can be seen on the screenshot below my order is open in order boom when my desired price will hit and my order automatically complete it.

.png)

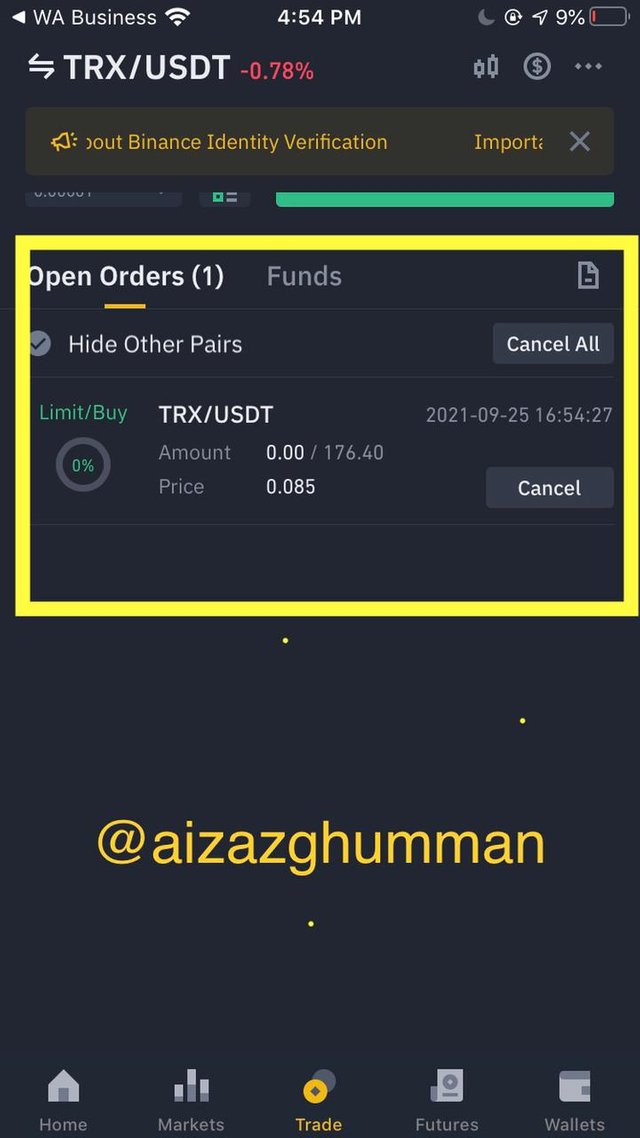

Place a TRX/USDT Buy Limit order on the Binance exchange for at least $15. Explain your steps and explain the impact of your order in the market. (Give Screenshots).

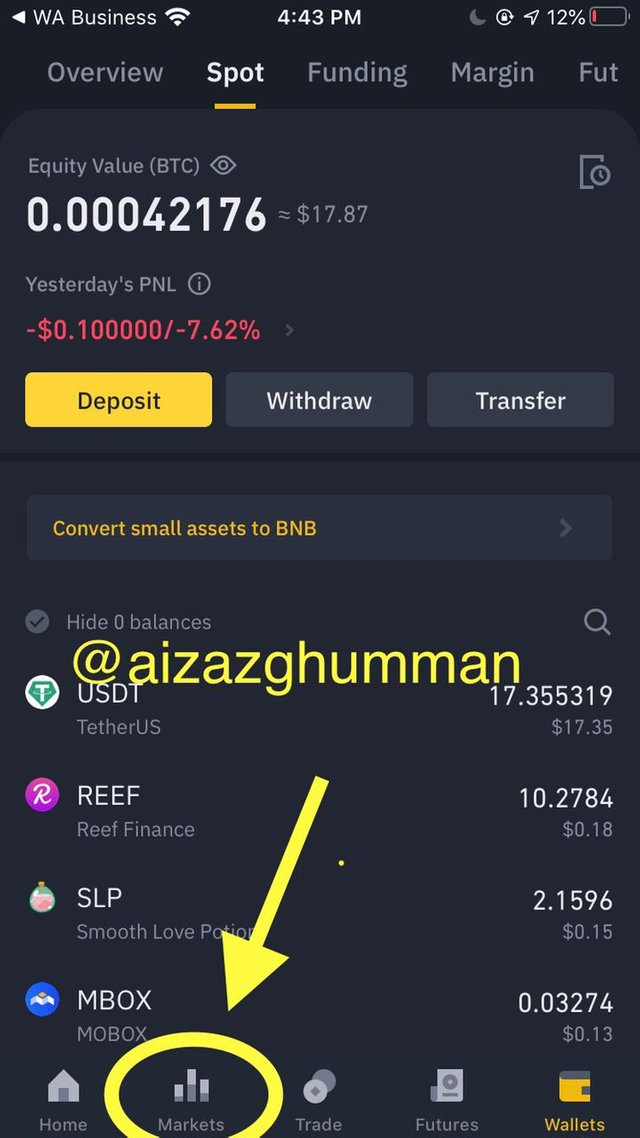

Right now I will demonstrate live trading. I will show you how to buy TRX/USDT with a limit order. First, of all, you have to log in to your Binance account, and then you need to go market as you can screenshot below.

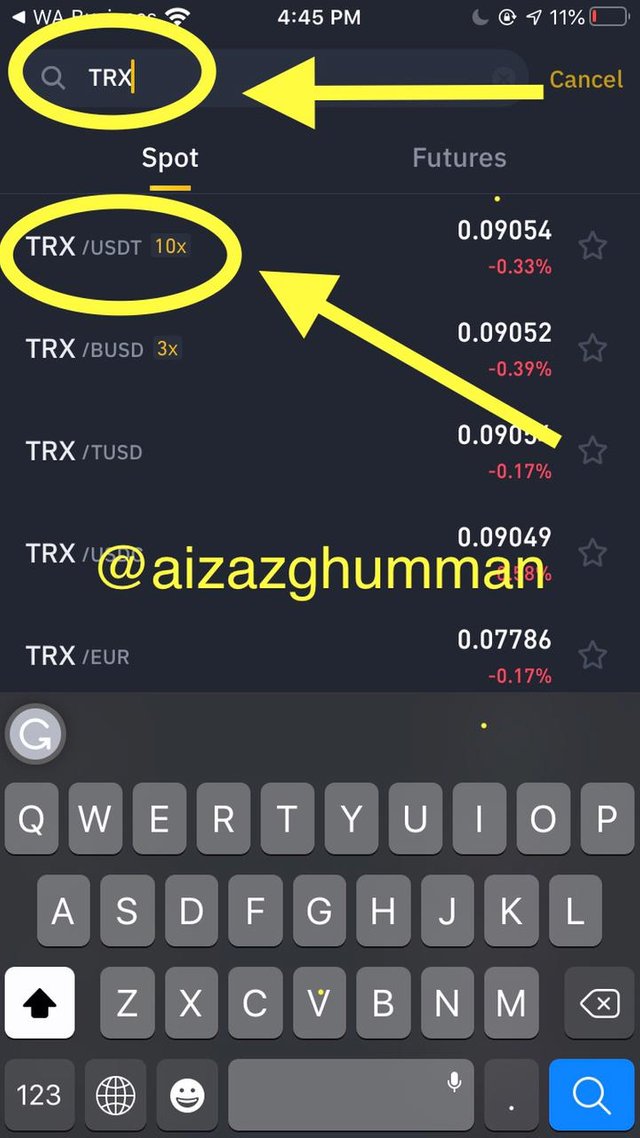

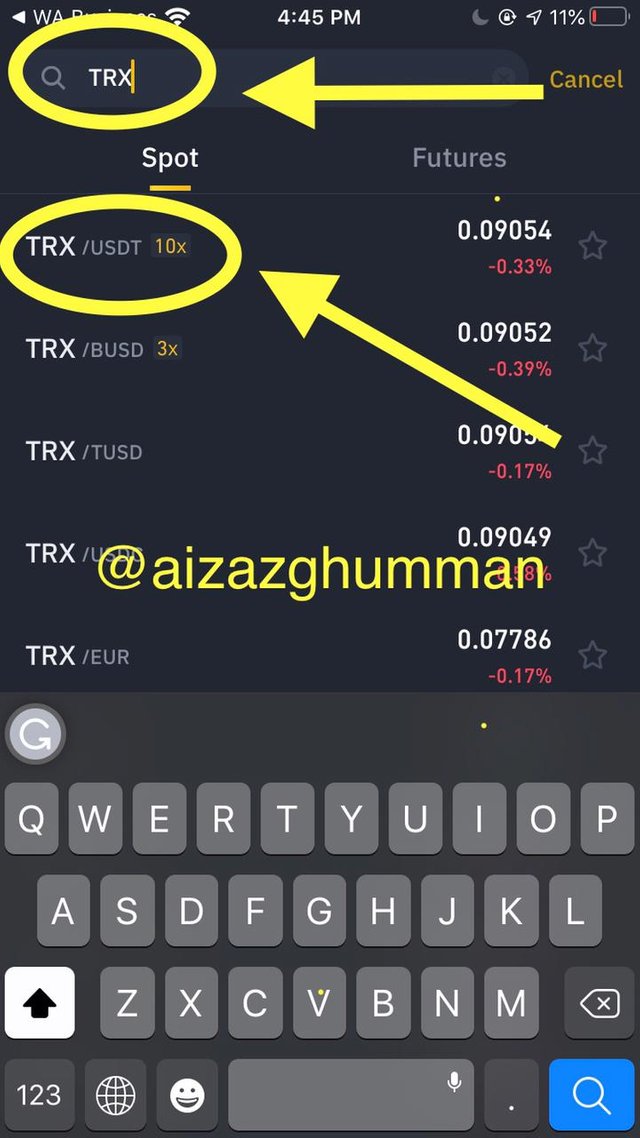

After that, you have to search in the search bar TRX and then you will find the pair of TRX/USDT as you can be seen on the screenshot below.

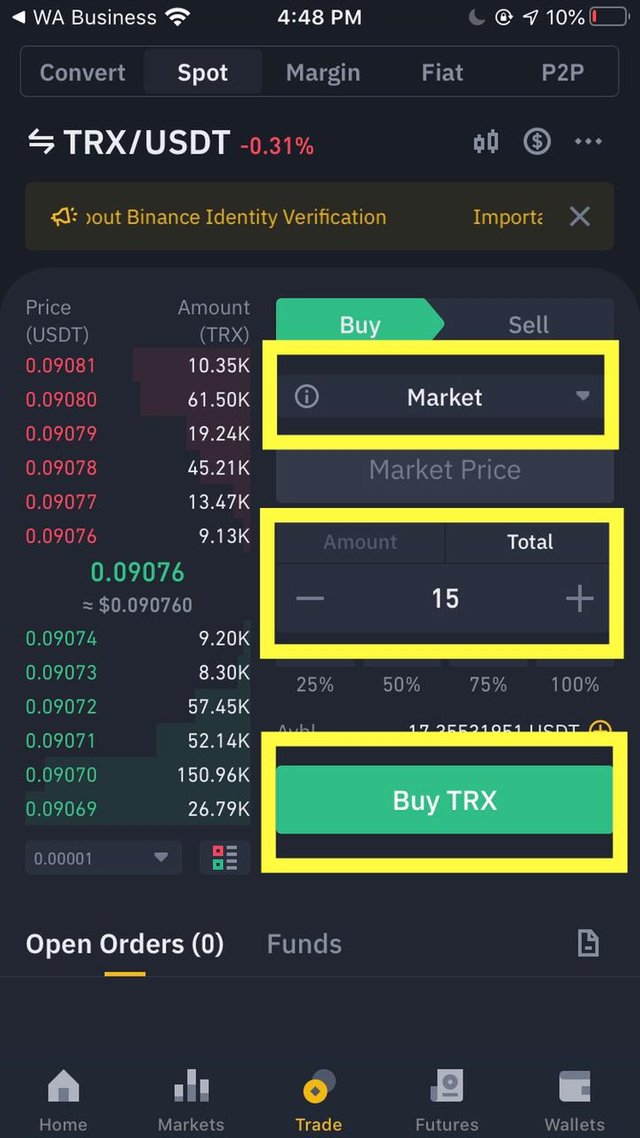

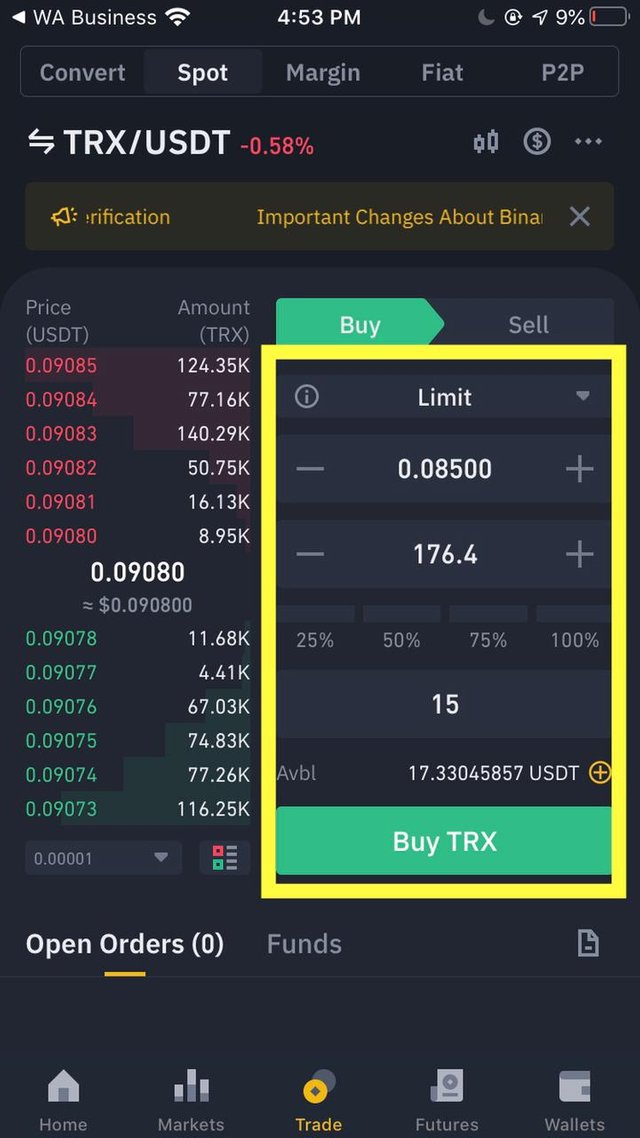

Then you will enter the market of TRX/USDT and you have to select a limit and enter your desired amount where you want to buy Trx as you can see on the screenshot below I put $0.08500 and press the BUY TRX button.

As you can see on the screenshot below my limit order is successfully placed.

Place a TRX/USDT Buy Market order on the Binance exchange for at least $15. Explain your steps and explain the impact of your order in the market. (Give Screenshots of the completed order).

You need to visit Binance exchange and enter the marketplace and search TRX. You can see the pair of TRX/USDT in the below screenshot on the spot trading side.

Now, I'm going to buy Tron in from the market and I have selected a $15 price to invest and then clicked on the buy button. As clearly mentioned in the below screenshot.

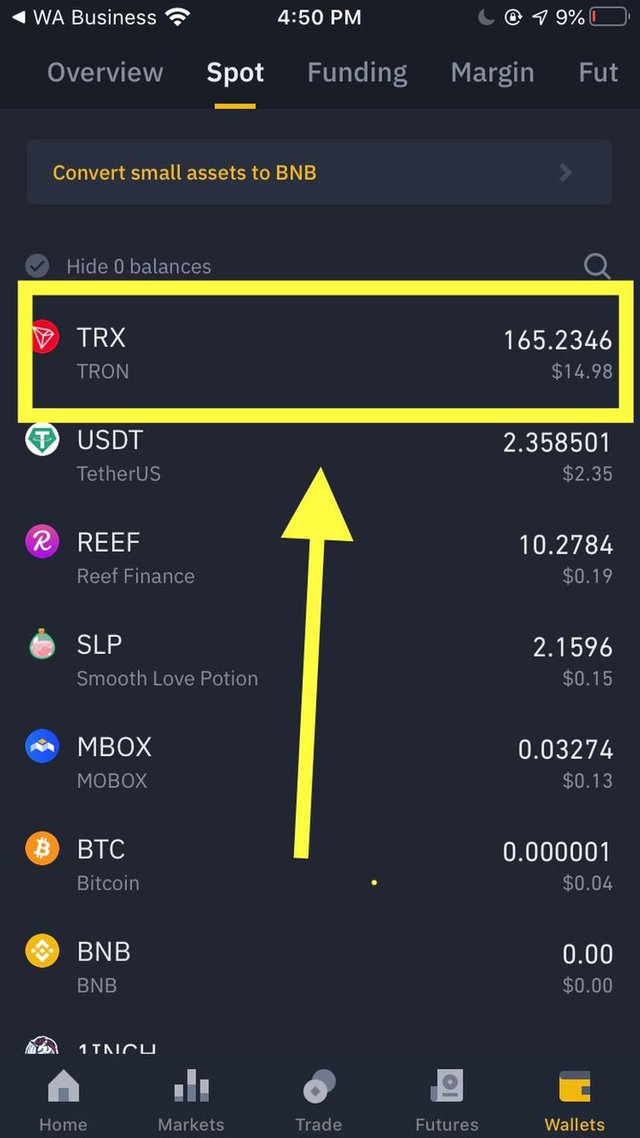

My transaction was executed in real-time as you can see in the below screenshot. My Tron Wallet balance has been increased as highlighted in the screenshot.

Take a Screenshot of the order book of ADA/USDT pair from Binance on the day you are performing this task. Take note of the highest bid and Lowest ask prices:

a) Calculate the Bid-Ask.

b) Calculate the Mid-Market Price.

BID PRICE is 2.417 USDT

ASK PRICE is 2.418 USDT

Let's calculate the BID-ASK spread.

To calculate the BID-ASK spread the formula is Bid-Ask Spread = Ask price - Bid price

BID-ASK spread is 2.418- 2.417 = 0.001

So BID-ASK spread for ADA/USDT is 0.001 USDT.

b) Let's calculate the MID-MARKET price.

To calculate theMID-MARKET price the formula is Mid-Market Price = (Bid Price + Ask Price)/2

MID-MARKET PRICE = (2.417+2.418)/2 = 2.2825 USDT

So the MID-MARKET price for ADA/USDT is 2.2895 USDT.

Regard

@aizazghumman