INTRODUCTION.

Good day class and my encouraging professor.

Having rested from last week’s learning and cool off the brain, here comes another interesting week of learning. I have improved and hope to keep improving in attending cryptoacademy classes on weekly basis.

The knowledge I have acquired thus far from attending crypto classes have opened my eyes to so many things about trading which I may not have known before getting into trading. This and many other reasons motivate me to keep trying know that am benefiting in many ways.

Having gone through this week’s lecture as presented by professor @yohan2on on Risk Management in Trading, I am poised to do my homework task for the week.

Take the risk and join the millionaires!

The above statement does not mean that risk is something good rather it is a situation of probability of either good or bad thing may happen, success or failure. Simply put; risk is possibility of something negative taken place but without guarantee of the outcome.

Management is about dealing with something or controlling a particular situation.

Therefore, risk management in trading involves controlling situations that will expose a trader to danger or great loss.

It is on this note that I will like to define some terminologies.

Question 1.

- Buy Stop: This is an order to buy an asset that the price is rising. Once an asset value position is opened and the price continue to increase, a trader may then open a buy stop and set his/her desired buy stop price above the current market price of the asset so that once the price rises to that point or above the point, the pending transaction will be executed. The purpose of this buy stop order is to initiate a transaction, to buy the asset at a particular price for the trader, pending when it will get to the desired/determined price by the trader.

I will like to present my illustrations with screenshot as shown below.

Image Source

An asset value position is opened at $1784 and a trader, having examined other factors, believes that the price will keep going up. He decides to set his buy stop order above the current market price, example is at $1820. Once the price of the asset gets to $1820 being the buy stop order, it will execute the pending transaction.

- Sell Stop: This is another stop order but the opposite of the first one above -Buy stop. This can as well be called a “stop-loss” order. A trader set the sell stop order below the current market price so that as the price of the asset drops and gets to the stop price, the order will execute the pending transaction. The purpose of this order is to minimize or stop much loss as the price of an asset does down.

To illustrate the point above, lets look at the screenshot below.

Image Source

As stated above, this order is used to stop or reduce loss. Looking at the screenshot, the current market price of the asset is $3231. The market trend takes a downward pattern. The trader at this point is concern of losing about money, the risk is there. To manage the risk, he decides to set the sell stop order below the current market price, probably at $2900. Although he will lose some money but if the price gets to the sell stop order, it will trigger the pending transaction thereby preventing him from blowing his account since nobody knows where and when the downward trend will stop.

- Buy limit: This is not a stop order like the first two but a limit order. Unlike the stop orders discussed above, limit orders work in opposite direction with a specific price. In buy limit, the trader set the order below the current market price of the asset with a view that it will rise again after dropping to that price. Once the asset market price drops to that buy limit order, it will execute the pending buy limit order. It is usually targeted at a set price or lower.

The screenshot below contains the illustration of what I stated above.

From the screenshot, the current market price of the asset is $46,637. Looking at the price, its on the high side, an interested trader, who want to have a good bite from the asset will set his buy limit order somewhere below the current market price, possibly at $38,000. This will make it possibly for him to buy the asset as soon as the asset price drops to that buy limit order.

- Sell limit: This too is a limit order to sell an asset at a particular price or above. In this order, the price is set above the current market price so that if the asset price reaches that sell limit order or above, the pending order will be executed. The reason for this order is because the trader believes that the asset price will drop once it get to a particular position.

My illustration is based on the screenshot below

The asset price position is at $727. The trader wants to make profit but the fear of regret is on him. He decides to set a sell limit order at a specific price above the current market price as shown in the above screenshot at $750. the trader will definitely go home with something as soon as the asset price gets to the sell limit order. Immediately the price hit the sell limit order, it will trigger the execution of the pending transaction.

- Trailing Stop Loss: This is another market order that traders use to manage the risk of losing money while trying to make profit from trading. Just as the name appeared, it keeps trailing the price when it favors the trader but stops whenever the price turns against the trader. Trailing stop loss order helps trader to lock in profits made from upward trend in asset price thereby protecting the trader from any loss that will be recorded from the day’s trading.

I can say that this type of order is open when the price goes upward or in favor of the trader but locked when the price goes downward or against the trader. If the price goes up with $1, the order will as well go or add $1 as part of the capital but once the price starts coming down, the order will not come down with it.

- Margin Call: I will simply say that margin call is a request from broker to fund ones account because the balance have gone down below the required minimum. When the balance in an investor's account goes below the broker's required minimum amount, the broker will demand for the investor to fund the account.

The reason for margin call is because each account held by an investor have securities purchased both by his money and that of the brokers money. In as much as the brokers money is involved in securing the investor’s account, the investor must have a certain amount of money in his account. But once such money goes below the required amount, the broker will demand for account funding and the investor will either fund the account by transferring money to the account or he will sell some assets to raise the fund irrespective of the asset’s cost.

Question 2.

Briefly talk about Risk management.

Risk management is an interesting topic to every living person because risk exist in all aspect of life and everybody want to know how to manage their own particular risk. In business, risk management is another concerns that closely follows profit making. As much as business owner wants to make profit, he do not want to lose neither his profit nor his capital to anything or anybody.

In crypto trading, risk exist as seen in all other fields of endeavor which traders and investors must struggle to cope with or manage. Losing money is an integral part of trading. Its true that one cannot totally avoid lose, yet such lose can be reduced. There are some strategies that helps in reducing risk.

- Emotional Guide.

The foremost risk management strategy is to guide one’s emotion. Managing one’s emotion is essential in trading because it determines when to buy and when to sell. Take for example; market trend takes unexpected turn and a trader has lost some money, the trading system is giving him signal to take the loss and walk away but emotionally he will believe that it will come back. At the end of the day, he will lose more than he would have. This also happen with profit, market swiftly go high but a trader believes that it will go more high and all of a sudden, it crash below the purchasing price. - Diversity.

“Do not lay all your eggs in one basket.”

This has been an old standing adage. It’s a way of managing risk. Investing in one asset or trading only one stock is very very risky and it exposes the trader or investor to a big loss. If anything happen to that stock, everything is gone but when one’s investment is diversified, the possibility of loosing everything is far fetched. For me, though a beginner, diversified my little investment into various assets.

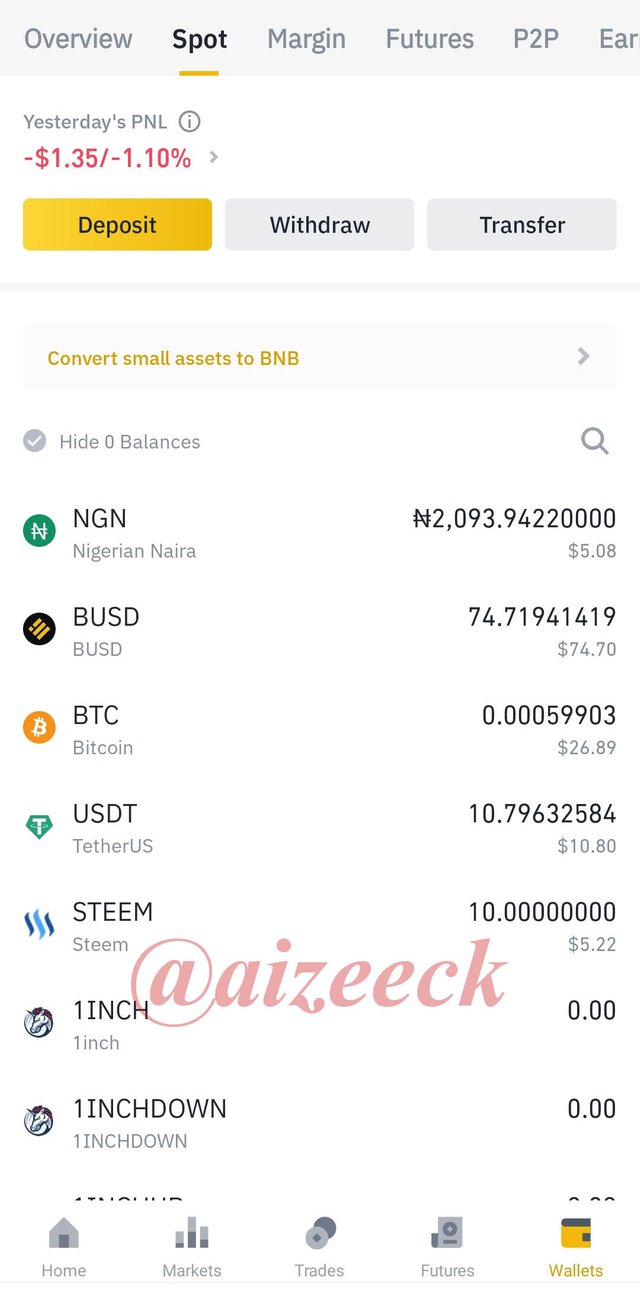

I have about five (5) different assets and hope to invest into more assets with time.

- Stop-Loss and Take-Profit.

Setting a stop-loss point helps a trader to sell his stock and take whatever loss incurred from the transaction. Sometime market trend takes an unexpected turn, with stop-loss, a trader can sell his asset and take whatever loss at that point before the account in blown. The example under emotional guide also fit in here. The trader will sell his assets as soon as possible rather than believing it will come up again.

The principle also applied with take-profit. Rather than waiting to make much profit, a trader will sell at a point when he has pocketed some profit. Emotions also plays an important part in this too. - One percent (1%) rule.

This rule is just simple, to invest or trade only one percent of the capital or the total amount in the account for an asset. The essence of this, is to minimize bigger loss. Assuming I have $1000 in my trading account, base on this rule, I have to trade with only $10 for a particular asset. This seem similar with diversity as discussed above. In case of eventuality on any asset, the trader will loose only one percent of his capital or the amount in his account.

Use a Moving averages trading strategy on any of the crypto trading charts to demonstrate your understanding of Risk management.

From the picture above, market trend is going upward and the moving average is projected above the market price. From what I understood in this lecture, it will help me to manage risk. It can serve as either a “buy stop” or “sell limit” order. Such orders as designed to minimize risk in trading. In the case of sell limit, I have already made a profit by the time it will get there.

CONCLUSION.

From this week’s class by professor @yohan2on on risk management in trading, I have learned more ways to manage risk. The definition of those terminologies have broaden my knowledge on trading. Speaking about the class and the homework task, it all work together to achieve a purpose which is enlightenment.

I am always grateful for this wonderful and loving arrangement to train people on crypto, which is now a lucrative business.

cc:@yohan2on

@yousafharoonkhan

Hi

Thanks for participating in the Steemit Crypto Academy

Feedback

This is good content. Well done with your practical study on Risk management.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you so much my professor for going through my homework task

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit