INTRODUCTION.

Good day my fellow steemians, especially crypto academy students and all the professors!

I hope you all are enjoying this week's lectures, as well as cracking your brain for the home work tasks.

Having gone through this week's lecture presented by professor @reminiscence01 as well as did little research and practical, I am delighted to present my home work tasks on DeFi products.

Question 1.

A)In your words, explain DeFi products and how it is shaping the present-day finance.

DeFi or decentralized finance is a financial system which operates without intermediaries like banks and other financial institutions. All financial products on the system are made available on the public decentralized blockchain network for anyone to use without a middle persons and the stress of going through the rigorous process of proof of address via utility bill and getting a government issued ID card.

DeFi is a collective term for financial products and services that are accessible to anyone who can use Ethereum – anyone with an internet connection.

From the above quote, Defi products comprises of all the financial products and services available on the defi industry which enables anyone to carry out any transaction.

Defi products have positively affected present-day finance by increasing financial security, transparency, efficiency as well as it’s liquidity, and in no distant time, it will take over finance. It has created an open and trustworthy financial system, that is far more accessible than the traditional one. Because it is secured by blockchain technology, in the future, defi will definitely reduce risks of mismanagement of ones assets, corruption and fraud to the minimum. Managing of finance will be more cost-effective, efficient and time saving, because there will be no more overdraft charges, no fees for transfers, and no more waiting for hours for bank to verified ones transaction.

B)Explain the benefits of DeFi products to crypto users.

Defi products are not just for online payments via it’s cryptocurrencies, but allows crypto users to handle a number of financial services like insurances, investing, exchanging, savings, borrowing and lending, in a far more efficient and transparent way . Unlike commercial banks and other financial institutions that grant loans to well known customers, Defi system allows everyone, even unknown customers, to involve in transactions of their choice without a middleman or intermediary.

Below are further benefits of DeFi products to crypto users;

- Transparency: All activities or transactions on DeFi are transparent for all to see. With such transparency, users can easily monitor transactions as well as suspicious transaction. Since everything is recorded on the blockchain, the history of an account can easily be accessed.

- Low Cost: Since no third-party or intermediary is needed in DeFi, transactions are done without series of charges like overdraft charges, transfer charges etc.

- Faster: Without the involvement of banks and other financial institutions, transactions on DeFi is far more faster because no approval or verification is needed from any intermediary before the transaction will be executed. The waiting period for a transaction to be approved is totally gone.

- Secured: The safety of assets lies with the owner. There is no more fear of financial institution failing and ones assets will be gone too or a government seizing and confiscating financial institution along with it’s assets. The only problem is when a user exposes his security key to a fraudster.

- Accessibility: DeFi products are accessible for everyone in the market. There is no limit of any kind for anybody. Unlike banks and other financial institutions, where certain number or amount of transactions are required for a day and some kinds of verification may be needed.

Question 2.

Discuss any DEX project built on the following network.

- Binance Smart Chain.

Binance Smart Chain is just a new and less established blockchain when compared with Ethereum, yet pancake swap is making it popular among DEXs.

Pancake swap being a decentralized exchange built on Binance Smart Chain, allows users to trade cryptocurrencies as well as tokens without an intermediary. Although it is specifically meant for BEP-20 tokens yet it also enable users to provide liquidity that generates passive income from transaction fees.

Just like other DEXs, pancake swap is an aspect of DeFi services that allow crypto traders to perform transaction without an intermediary because it works on Automated Market Maker (AMM) system which depends on user liquidity pools for a transaction. Those who stake their tokens in such liquidity pools get a share of rewards accrued from transactions. It might interest you to know that there is an auto stake option, which automatically re-stake ones token thereby multiplying the rewards continuously.

Pancake swap is one of the best in a long list of food-themed crypto projects like SushiSwap, Yam Finance, BakerySwap, and Kimchi Finance.

Pancake swap for real is making a great boom, in that it has flipped Uniswap many times and became the most popularly known DEX base on it’s trading volume, though it has not been able to maintain that title consistently.

- Tron Blockchain

Tron blockchain is a project solely built for an infrastructure of a decentralized, open-source that based on a system with it’s functionality on a smart contract.

Just swap based on tron network is a decentralized exchange platform for a liquidity provision, a financial market that is open for all. It is said to be the first exchange protocol on tron network for exchanges between TRC20 tokens. Such exchanges between two TRC20 tokens takes place based on the price determined by the system that is perfectly configured. Just swap also allow users to earn income as liquidity providers, as well as gain rewards by participating in liquidity mining.

Question 3.

In the DEX projects mentioned in question 2, give a detailed illustration of how to swap cryptocurrencies by swapping any crypto asset of your choice. Show proof of transaction from block explorer. (screenshots needed)

I will present a detailed illustration of using Justswap discussed in question2, to swap crypto asset. The crypto asset I want to swap is tron. The swapping I did yesterday as a practice was 10 tron to 0.982598 USDC but I didn’t get most of the screenshots because I was going back and forth with it.

I did another one today which is the one am going to present the screenshots. This one is 1 tron to USDT.

To swap a crypto asset to another asset with Justswap is as follows:

Download the tronlink wallet and create account. In my case, I have the tronlink App on my phone.

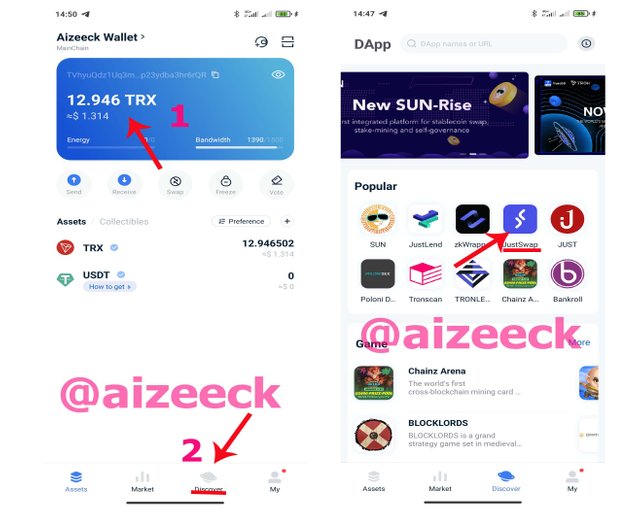

I just opened the App. There on the assets page is a summary what I have in my wallet. There are four things at the bottom of the page, from left to right; Assets, Market, Discover, and My. I tapped on Discover and it opened the DApp page. There you have a list of popular exchanges. I then selected the Justswap. Below screenshot is the visual aid of the above explanation

From the above screenshot;

- On the left picture. 1 is my wallet balance.

-2 is the Discover icon

-On the right picture, the Justswap icon is what the points to.

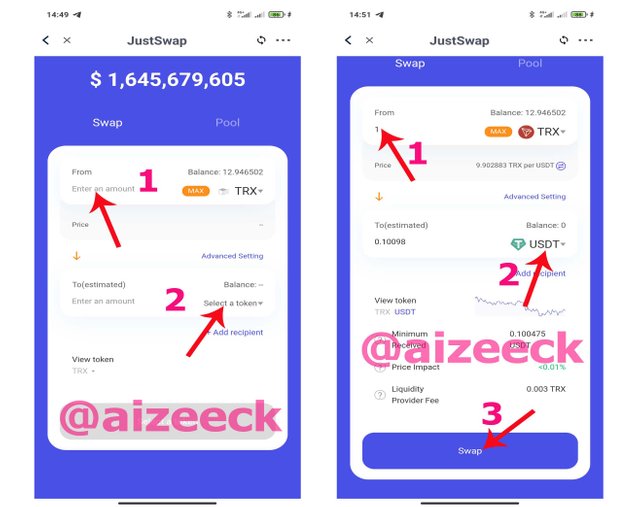

After opening the justswap comes the page where to fill in the swapping details, like the number of tron I want to swap and the asset I want to swap the tron with.

From the screenshot above on both sides,

- 1 is where I put the number of tron I want to swap -just 1.

- 2 is where I selected the asset I want to swap the tron with -USDT.

- 3 is the swap button that leads to the next stage.

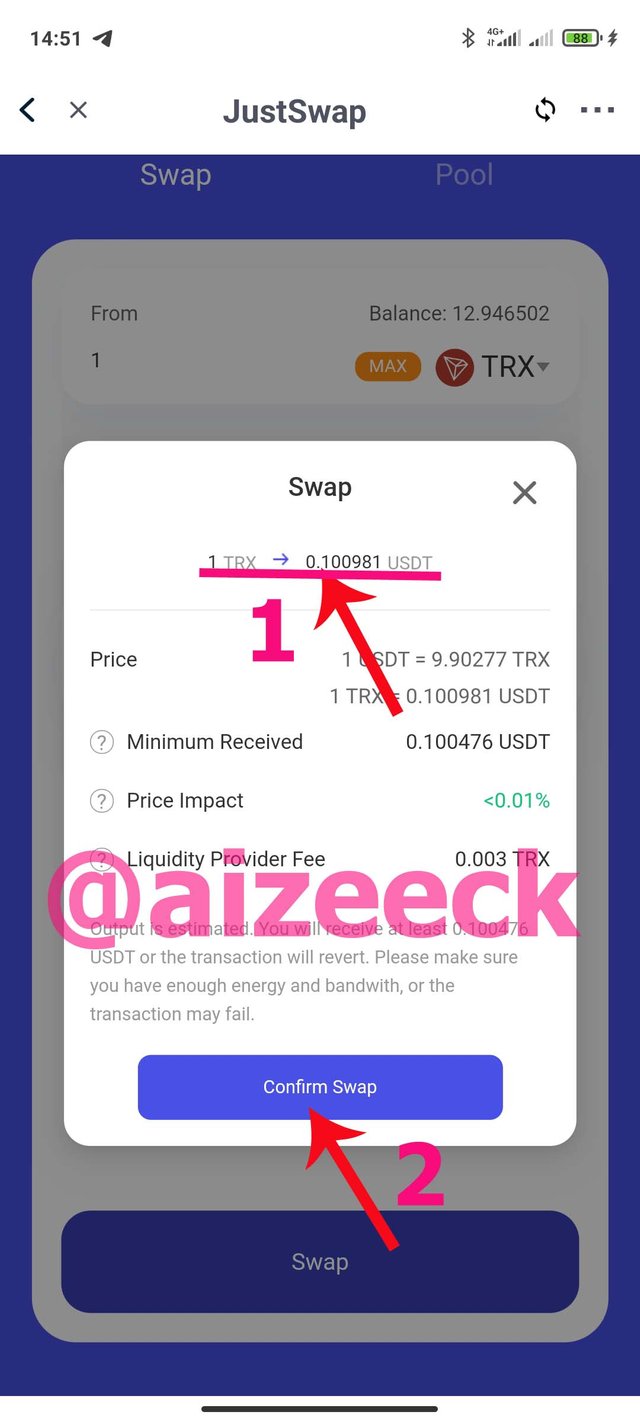

In the left hand side screenshot; 1 is the summary of what I want to swap 1 TRX to 0.100981 USDT.

while 2 is the button for confirmation -Confirm Swap.

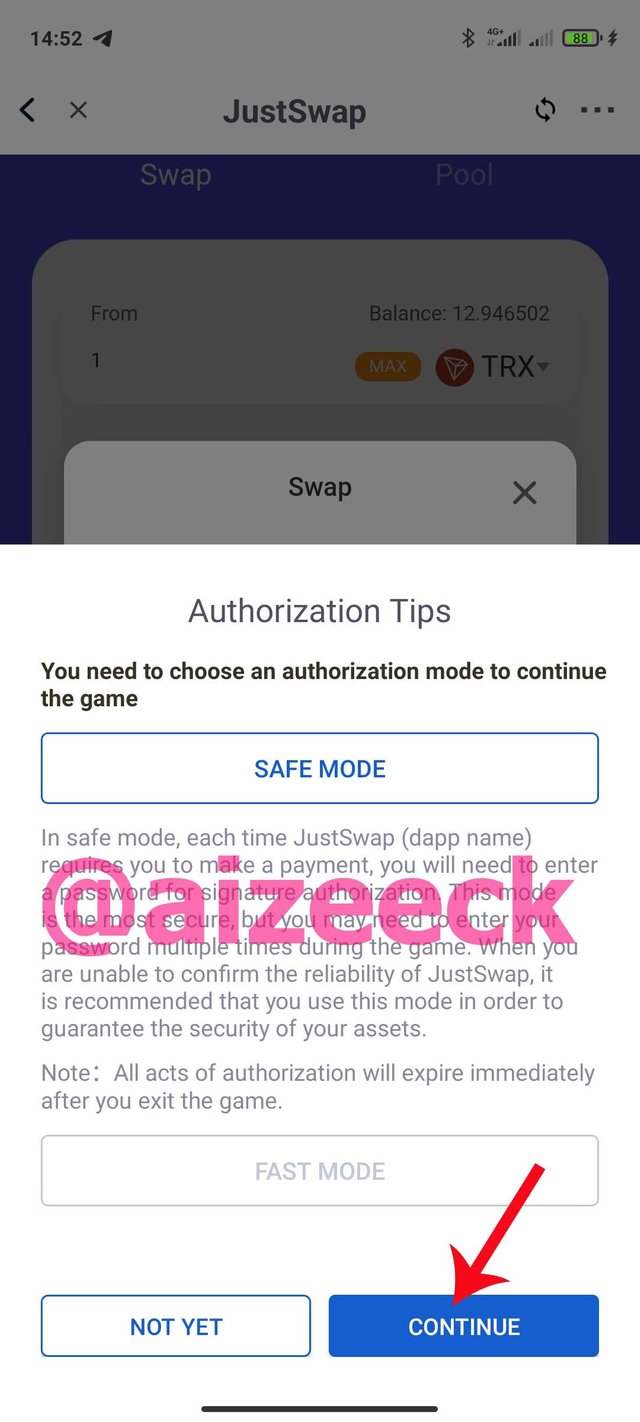

When I clicked on the confirm swap button, it opened the Authorization Tips. Here offers two mode options -Safe mode and Fast mode. I will only talk about the safe mode. This is a secured mode that required password to enter.

The accompanied right hand side screenshot shows that.

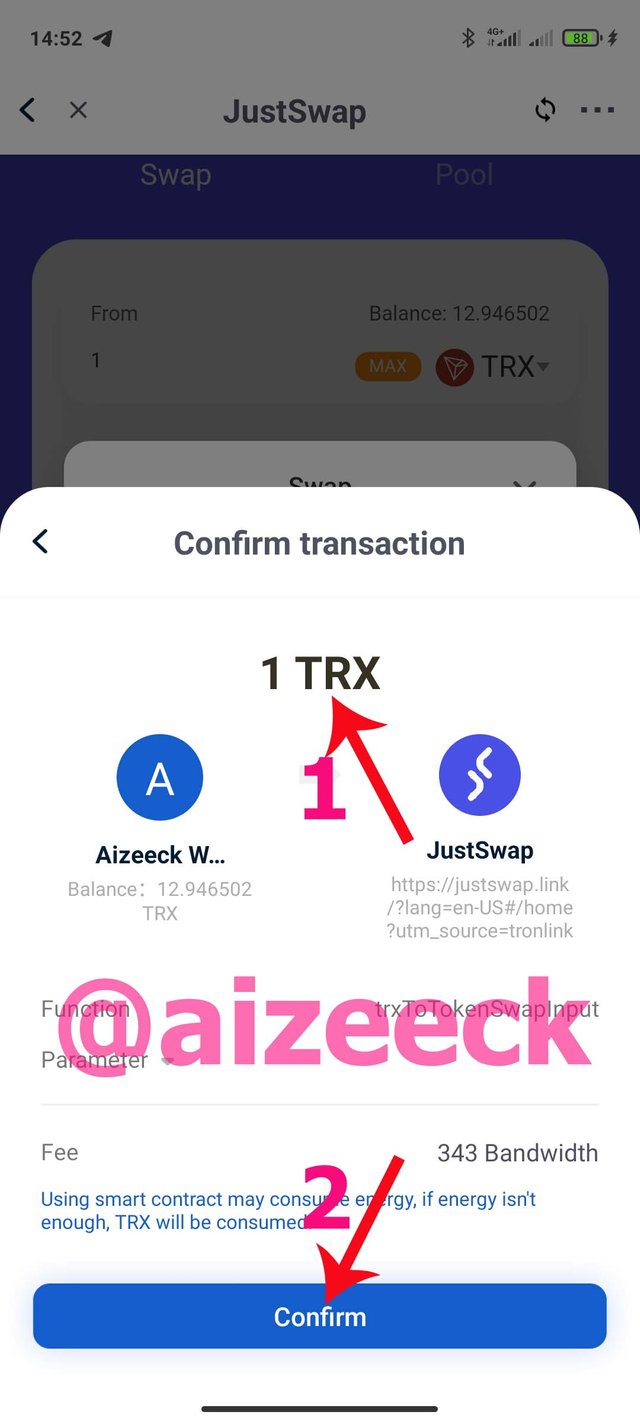

I selected the safe mode and tap on continue. Confirm transaction page comes up. There is nothing much in this page than the number of tron, the original balance and confirm button.

In the left hand side screenshot, 1 is the number of tron I want to swap while 2 is the confirm button.

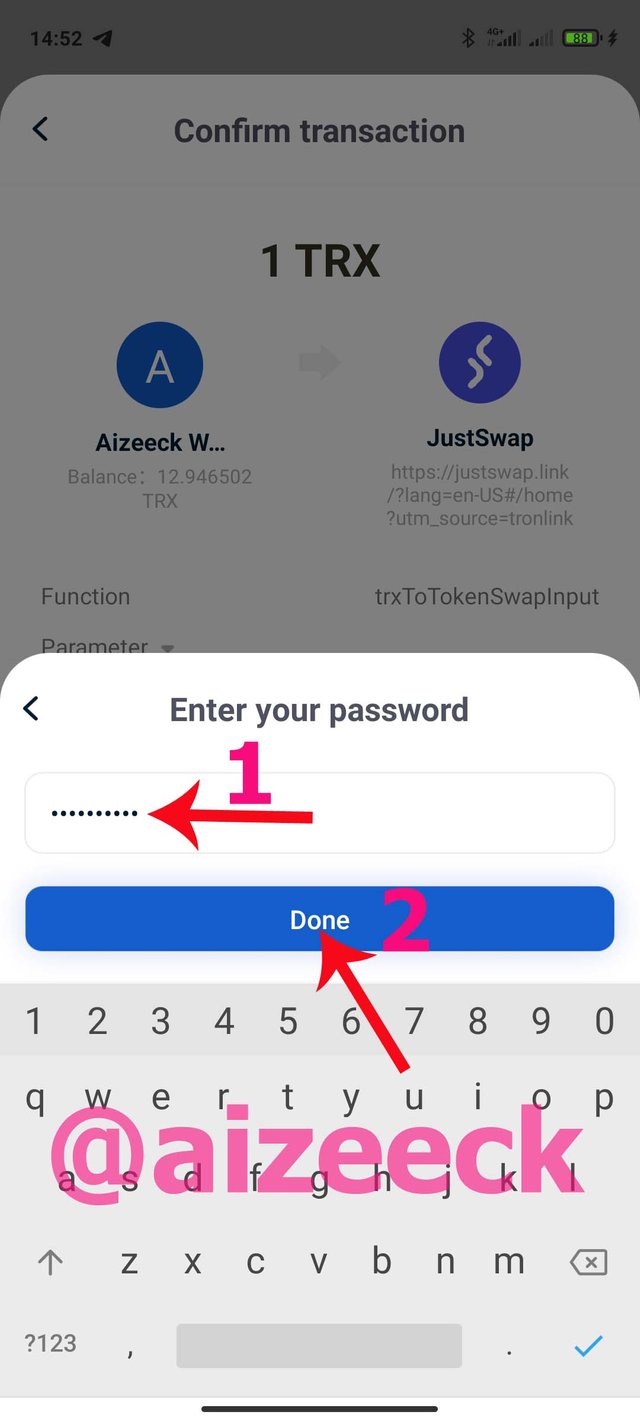

Once I tap on the confirm button, a sub-page requesting for password comes up. This is what makes this mode the most secured. Assuming am using another person’s device to do this swapping, my wallet is safe with this mode. Once I finish the swapping and close it, another transaction will require password unlike the fast mode.

The right hand side screenshot shows two basic things; 1 is where I entered the password of my tron wallet, 2 is where I clicked to get to the next page.

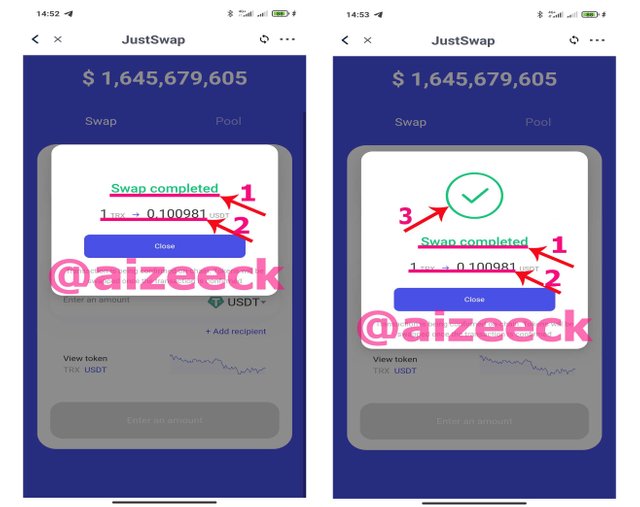

The next page gives the status of the transaction I have been on. It is from this page that I will know whether the transaction is successful or not. In this page, few things are needed. My transaction of swapping 1 TRX to 0.100981 USDT went through successfully as shown from the below screenshot.

As shown in the screenshot on both sides; 1 is the status of the transaction -Swap completed. 2 is the amount of asset swapped and the assets involved in the swapping -from 1 TRX to 0.100981 USDT. It is important to note the difference between the two screenshot above. The first screenshot appeared first and after sometime the circle with good inside it appeared as shown in the second screenshot which I tagged 3. All these, especially the second screenshot gives evidence that the transaction has been completed successfully.

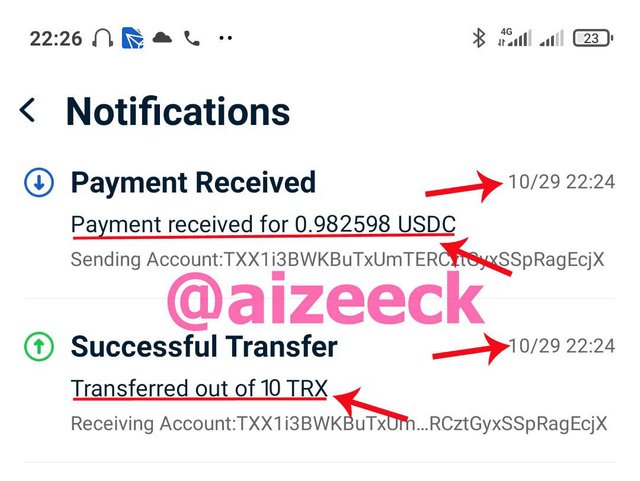

I just want to add this extra screenshot to show what I stated earlier about the swapping I did yesterday because the one I shared the screenshots above is not up to $1 as required by professor @reminiscence01. Both transactions are up to $1.

(0.982598 USDC+0.100981 USDT=$1.083579)

CONCLUSION.

This week’s lecture has been a good and educative one to me as a person. From the little research I did in addition to what I understood from both the lecture presented by the professor and the one I got from the practical I did, DeFi products exist in varieties which have affected the traditional finance system.

Am happy that the effect is not just in one aspect but in it’s totality -it’s entirety. Transactions of all kind can be done without any middle person and the stress of waiting for approval, not to talk of the charges. Thanks to DeFi products.

Great thanks to Prof. @reminiscence01 and steemit executives for this wonderful arrangement of crypto academy -learning and earning!

Hello @aizeeck , I’m glad you participated in the 8th week Season 4 of the Beginner’s class at the Steemit Crypto Academy. Your grades in this task are as follows:

Recommendation / Feedback:

Thank you for participating in this homework task.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you professor for your recommendations, it's highly appreciated.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit