I have been able to read comprehensively on the class by professor @pelon53 and a lot of information was dished out on Tokens, taking a look at security tokens, equity tokens, and utility tokens. After reading through the professor's post, I will be participating in the homework which is for week 2 of season2 of the Steemit crypto academy.

source

What are Tokens

Tokens are representatives of values built on a blockchain for a community. Tokens aren't the main coins and they are used for different purposes to satisfy the purpose of the creation. Tokens cannot be mined as they are not the major coins on the blockchain but they can be traded. A lot of blockchains have tokens built on their blockchains and very good examples are Ethereum (which literally started the use of tokens), EOS, NEO, TRON, WAX, BOS, and so on.

You should not mistake a crypto coin for a crypto token, They are both cryptocurrencies but they are different.

Difference Between Crypto Coin and Token

First, it is good to understand what a coin is, a coin is a cryptocurrency that has its own native blockchain. it doesn't depend on a secondary chain to survive. Tokens on the other hand require other blockchains (thanks to smart contracts) to survive. Tokens are often swapped with the main coins on the blockchain instead of with other coins.

Types of Tokens

FINMA in 2008 described the different types of tokens which are split into security tokens, utility tokens, equity tokens, and as expected by professor @pelon53 I will be explaining the three types of tokens.

Security Token

Security tokens are tokens used to invest in visible assets. Security tokens are a digital representation of ownership in a company or project. Security tokens are a better option for ICOs as they are digital representations of assets which could include equities, fixed incomes, real estates, investment fund shares, commodities, and structured products on the blockchain. Security tokens can be regarded as Investment Contracts.

Sia Funds [Security Token Example]

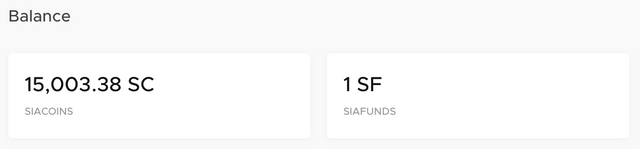

Sia Fund, which is the second token on the Sia network after the Sia coin is a security token that is used to determine the revenue sharing in the Sia network. The Sia Fund can be seen as a

Siafunds are tokens used for revenue sharing on the Sia network; a 3.9% fee from every storage-related transaction on Sia is distributed to the holders of Siafunds. The Sia core team currently holds approximately 85% of all Siafunds and shares the rest to holders of the coin as they represent shareholders in the company. 3.9% of the total revenue made on the Sia Network is reserved for Sia fund holders.

The Sia Fund token was sold so as to enable the development of the Sia network and buyers of Sia Fund definitely bought a security token. There will only be 10,000 Sia Funds to be produced and the entire funds were produced in 2015. The token can be bought on Bisq Netwerk Market, a decentralized exchange designated by the SEC.

Utility Tokens

Utility tokens are tokens that are bought for the purpose of future use. Utility tokens are not tokens that guarantee profit like security tokens, they are bought with the aim of utilizing a product from the platform or project in the future.

Basic Attention Token [Utility Token Example]

Available on the Ethereum blockchain, BAT is a utility token that aims to solve problems in the advertising industry by bringing it to the blockchain and creating a new unit of exchange (BAT) of exchange between all parties involved in the advertising process.

Founded in 2017 after an ICO in May 2017, BAT has been used on the Brave website. BAT serves as a utility token for the Brave platform for several advertising purposes which can be transferred between users as well as exchanged between advertisers, publishers, and as many people involved in media and content creations alike.

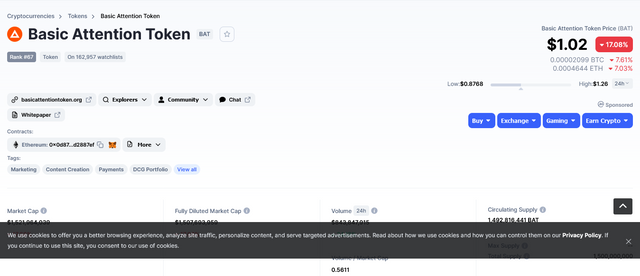

screenshot from coinmarketcap

Currently sold at $1.02 with a market cap of $1,524,710,774. It can be traded on Coinbase Pro, Binance, Huobi, Kraken, Uniswap, Gemini, Bitfinix FTX, and many more.

Equity Token

Equity tokens are tokens that can be regarded as shares tokens. It is similar to security tokens. Equity tokens often represent equity/ownership in an asset. The difference between the regular shares bought in an IPO and an equity token is that Equity tokens are cryptocurrency. So with the standard IPO for publicly traded companies, Equity tokens give the holders the right to a particular percentage of the company. Equity token gives the holders voting rights, as well as the right to dividends.

Governor DAO (Equity Token Example)

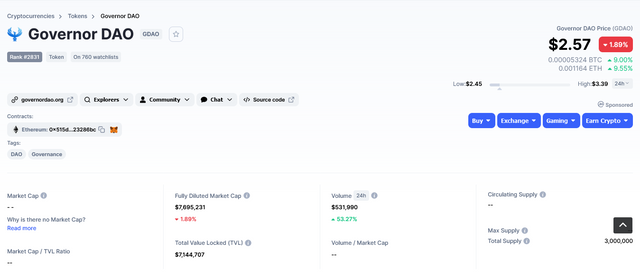

Built on the Ethereum blockchain, it is an equity token built for governance on the governor DAO platform. It is an Open Source platform created by the community and controlled by the community for the purpose of autonomous governance.

The token GDAO is the token that allows users the voting rights (governance) in the community as well as represents a percentage of ownership of the project.

Conclusion

I must confess that attending the class by @pelon53 gave me the ability to do more research on tokens and I hope to participate in future assignments.

Gracias por participar en Steemit Crypto Academy.

Faltó nombrar y explicar el test de Howey, buena presentación.

Calificación: 6.6

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit