Good night everyone, steemians, blogers, readers, and crypto lovers. I will start a positive activity tonight because life must always be productive and tonight I will write a post about cryptocurrency on my blog to participate in the Steemit Crypto Academy Season 4. This is the eight week of Season 4 and the first class I will be taking this week is professor @lenonmc21 class. In this class, we will learn and share knowledge about “Capital Management and Trading Plan” based on the following questions.

Question 1:

Define and Explain in detail in your own words, what is a "Trade Plan"?

A trading plan is a plan that regulates how you start trading. a trading plan is needed to determine what steps to use when you start trading, in the crypto world a trading plan is very necessary considering that in the trading world it is high risk high return, so to minimize trouble in trading That's why you need a trading plan.The trading plan plays an important role.

Question 2:

Explain in your own words why it is important in this profession to have a "Trade Plan"?

To minimize the problems faced by a trader, a trading plan is needed so that traders can determine good entry points, exit points that are in accordance with the analysis results, and stop losses so as not to experience too many losses.

Of the 3 points that must be mastered by traders, a trading plan is needed so that traders do it in a structured manner.

Question 3:

Describe and define in detail each fundamental element of the "Trading Plan"

Looking for reliable sources of information

By following the news on social media such as twitter, or by following expert crypto investors, it would be better not to focus on social media alone, you can also follow forums that discuss crypto.Amount of supply available on cryptoWhen you invest in a coin that you invest you need to know the amount of the coin, whether it wants to reach the maximum limit. When the coin is running low, the value of the coin will increase, and vice versa.

Trading Plan

In making a trading plan there are 4 things you must learn and you must master. So that when you start investing you do not experience big losses, and have a structured plan for you to invest in the crypto world so that you get a greater chance of profit than your losses.

4 things included in the trading plan

On this occasion I will share 4 things on the trading plan that is used, in order to manage your finances so as not to experience losses.

Trading objectives:

you can determine your trading goals, to determine your income target in investing. Starting from daily income to monthly income. So you can build your trading spirit so that you can exceed the set targets.

Example of trading objectives:

In this trading goal I set my daily to monthly target, then I determine the coins I will invest, which suits my goals.

Risk management:

this risk management is very important in the trading plan, if we do not determine risk management we can experience huge losses until our capital runs out. In the world of trading this risk is unavoidable, then you have to make a list of risks that you will take accept, and prepare the strategy to be used.

Example of risk management:

In this risk management I will stop investing in the coin if the coin has floated 5% of the capital I invested in the coin, for me 5% is enough to determine the cutting loss.

Capital management:

capital management is very useful in investing in order to determine the capital we want to invest, so it does not interfere with our needs. The capital used in investing would be nice if the money is not used, because it can interfere with your financial stability.

Example of capital management:

In this capital management I will use 10% of my finances to invest.So that the profits obtained will be added to my capital, so that the capital will continue to grow and can increase profits. My capital management uses the 3:1 method so my profit is 3% of my capital and for a loss of 1% of my capital.

Psychology of trading:

this psychology in trading really determines our trading plan, if we can't control our psychology in trading it will damage the trading plan that has been made previously, then this psychology greatly affects investors in investing so that the targets made can not be achieved because psychology in bad investment.

Examples of trading psychology:

In controlling emotions in trading, you must prioritize the trading plan that has been made, and try not to violate the trading plan that has been made, and try to trade with a happy and calm atmosphere, because mood and thoughts greatly affect the percentage of our trading accuracy, and not too often look at the chart because it can damage the psychology.

Tolerance limits:

financial management really needs to pay attention not to let finances suffer losses because they do not have a tolerance limit. This tolerance limit can determine the target you want to achieve and what you are ready to lose. If there is a loss you can compensate to cover previous losses. This is very risky, therefore a good tolerance limit of 5% is only, because the greater the tolerance, the more difficult it is to recover.

Example of tolerance limit:

If I have a capital of 100$, I tolerate 50% loss, which is -50$, then the next time you invest, you will compensate 100% so that your capital returns. So I chose a tolerance limit of 5%, so on my next investment I only need to 10% compensation so that my capital returns, because 10% is still easily affordable and not too risky when investing.

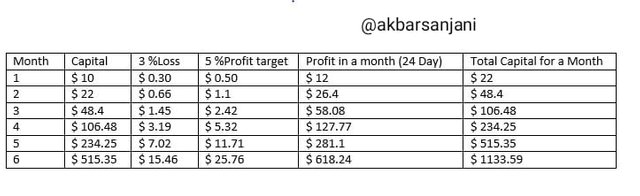

Profit capital planning

In this monthly capital plan I target a profit of 5% per day and a loss of 3% per day for the amount of my capital. In this capital plan I do not withdraw my monthly profit but I add my profit to be capital for the next month, until the profit can be achieve the target that I have set.

The monthly profit earned will be added to the next month, the more capital, the greater your monthly profit, so the target you make will continue to increase than before.

conclusion

In investing or trading, the trading plan is an important factor that must be studied.Trading plans are very useful in risk management, capital management, and psychology in trading, with a trading plan made, we can set daily targets, when to start entry and when to set exit.