Hello great people,

I am grateful to Prof. @wahyunahrul for this lesson. Truly, I have gained a great deal of knowledge from it.

This is my homework task assignment submission for the Season 3 / Week 1 / Beginners Level Course titled; Whales - The Driver of Cryptocurrency Value

Quest. No. 1: Based on the understanding that you've gained from this class, explain why whales are so feared by small investors?

Whales, who refer to individuals or investors that own and control large amount of a particular cryptocurrency. This ownership of huge units of a cryptocurrency makes the activities of these wales to have very significant effects on the direction of the market that is, whether the currency gains in value or reduces in value.

Thus, small investors, who do not have the power to have any significant impact on the movement of the market trends are afraid of the whales because they are at the mercy of the financial games played by these whales. If the whales decide to buy large portion of a currency which will actually make the value of the currency go up and supposing a small investor was selling his unit at that particular point, such a person will incur losses.

Since the price of a token is influenced by the demand for it, whales buying much of a token increases the demand, concurrently increasing the price. This abrupt change in demand alters the existing dynamics if the market and small investors who were not able to correctly predict this trends will be at a loss. Thus, the Wales dictate the market leaving the small investors scampering to save their investments.

For example:

Telsa and MicroStrategy are the newest Bitcoin whales and the two largest examples of a new phenomenon of bitcoin being the central part of a 'corporate treasury' strategy. When Tesla announced its $1.5 billion bitcoin purchase in early February the bitcoin price hit a new all-time high on the news, soaring 15% to USD $44,000.

Telsa's move followed MicroStrategy's series of large bitcoin buys which since August 2020 had seen the company spend over $2.1 billion buying Bitcoin. The price of Bitcoin rose from around 11,000 at the time of Microstrategy's first purchase, to $53,000.

Source

Quest. No. 2: Will we be able to take advantages of the existence of the whale that is so feared?

To everything, there are positives and negatives. Thus, these so highly feared whales can be of positive impact to small investors.

So, yes, a small investor can take advantage of the existence of a whale. This however is subject to some factors and skills.

The whales in the market always aspire to take advantage of the vulnerability of small investors to make gains. Fortunately, the attitude of these whales can be predicted. This predictability of these whales can be exploited by small investors. This is the point where the factors and skills I earlier mentioned come into play.

One skill that a small investor can use to gain from the whales is knowing how to carry out technical analysis of the market. Assessing the pattern that changes in prices take is a necessary skill in dealing with cryptocurrency market.

So, if a small investor is able to adequately determine what direction the whales will want to move the market, such can benefit from the activities of these whales.

Quest. No. 3: Find an example of a whale's cycle on a cryptocurrency chart, and do a detailed analysis of the phases in the cryptocurrency chart (don't take the cryptocurrencies that are ranked in the top 10 as examples). (Screenshot Required)

Currently, these are the cryptocurencies that are ranking in the first ten.

In reality, a mastery of the exact pattern of movement of the whales is not possible. There are bound to be fluctuations and variations from time to time. Yet, with careful study, one can be able to predict with a high level of accuracy what the whales will do with proper analysis of cycles in previous times.

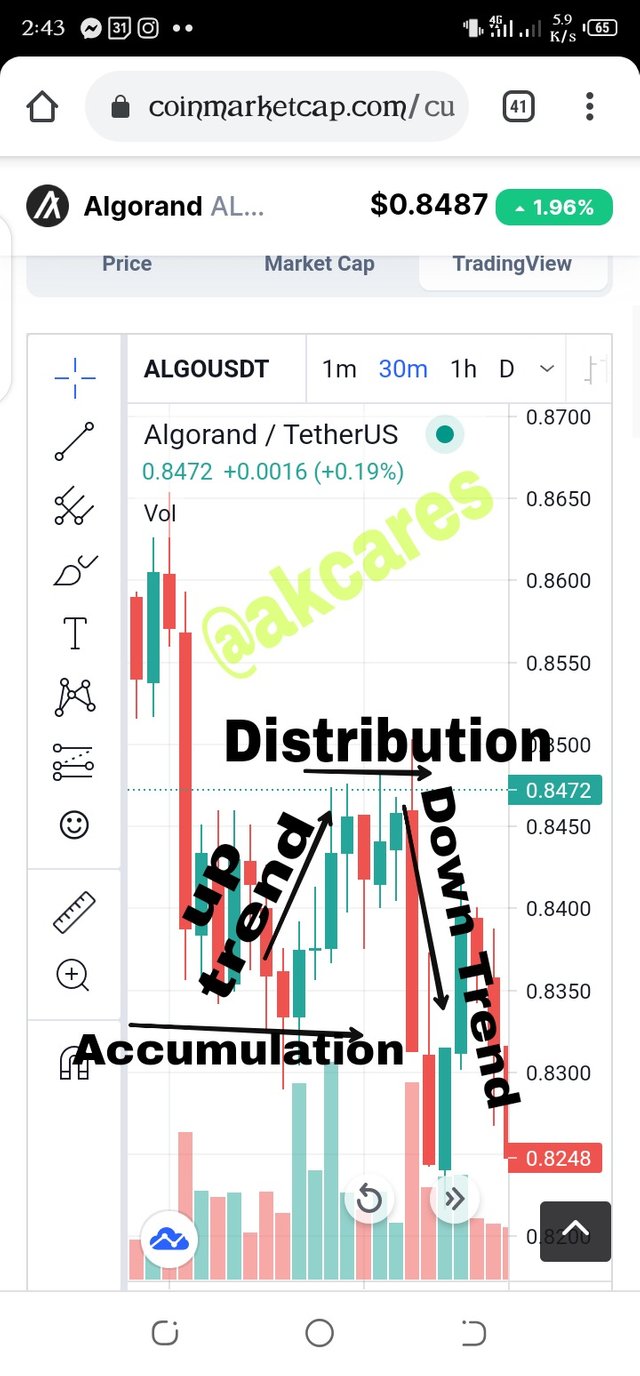

To rightly demonstrate the phases of a whales movement in the market, I will use the screenshot above. The currency in the chart is Algorand which is current number 32 at the time of preparing this assignment.

This chart shows the performance of the currency in the market over a 30 minutes time interval. Accordingly, every candle is formed after half an hour. These phases in the cycle help us to track the motion of whales.

So, I will be explaining the different phases in the cycle.

Note: *the sole aim of these phases by whales is to make gains from their trades.

1st Phase: Accumulation Phase.

This is a kind of warming up period. Here cryptocurrencies are bought and sold in little amounts. At this point, there are no drastic changes in market and the charts are almost remaining flat. This is a preparatory stage for the big move. You can easily locate this phase on the screenshot above.

2nd Phase: Up Trend or Absorption Phase

Here, the whales ( the elites of the market), use the expansive resources and power to rapidly purchase large units of a cryptocurrenty. In this way, smaller investors as well larger ones will be attracted to the market yo also buy as the value of such a currency would have risen greatly.

This results in a kind of market situation called bullish market where the charts keep moving upward with a dominance of green candles

**Note: this happens over a very short period.

3rd Phase: Distribution Phase

Slowly but gradually in this phase, the whales begin to withdraw their trades and sell of their units of the cryptocurrency. At this point though, the trend will not reverse or go down immediately as there will still be persons hoping to benefit from the high prices by continuing to buy units of the currency. This is termed resistance referring to opposition to the power of the whales or any opposition the direction the market at any particular time. Here, the candles are arranged almost on the same line in horizontal pattern.

4th Phase: Down Trend

Just as the name suggests, here, there is steep downward movement of the charts with a predominance of red candles. This shows that many investors are selling off their units of token. This will most appear after the whales have first taken out their share in the market by selling off their units. Thus, everyone, especially the small investors hurry to sell their units off so they will not lose out completely.

A market of this nature is tagged a bearish market and it does not really take much time to occur.

**All these different phases can be spotted in screenshot photo above.

Quest. 4: If you are a “Whale”, what cryptocurrency would you choose to invest or trade (except those that are in the top 10), explain why you chose that cryptocurrency.

Monero is the cryptocurrency I would choose to invest in if I were a whale. It has the designation of XMR. I have a few reasons for this choice. However, I will first give a brief history of this currency.

The current price for a single XMR coin is $101.25. The currency is the 12th most popular in terms of total market capitalization.

the value spiked around January 2018 and has fallen back quite a bit since its all-time high of $480.

" Source

Also,

As of Jan. 15, 2021, Monero was trading at $155.94 and had a market capitalization of $2.778 billion. That's a stark difference from the closing price of $65.68 on Jan. 15, 2020. The market cap on that date was $1.143 billion. That's a jump of more than 137%.

" Source

Monero is also said to have better privacy because of technology called cryptonote which takes away means of traceability.

The values of Monero spiked around January 2018 and has fallen back quite a bit since its all-time high of $480.

" Source

Currently Monero goes for about $209.32 with a change or volatility of 3.44% price change on a twenty four hour duration, making it perfect for control as a whale.

Source

Another advantage of Monero over bitcoin and all other cryptocurrencies is fungibility. This means that two units of a currency can be mutually substituted with no difference between them. While two $1 bills are equal in value, they are not fungible, as each carries a unique serial number. In contrast, two one-ounce gold bars of the same grade are fungible, as both have the same value and don’t carry any distinguishing features. Using this analogy, a bitcoin is the $1 bill, while a Monero is that piece of gold.

" Source

So, considering these facts and and positive outlook it holds, I am positive that this cryptocurrency can be very profitable for me as a whale having control in this particular token

Quest. 5: Do a kind of analysis as a whale with the phases that I explained earlier on the chart of your chosen cryptocurrency, show where you will start buying the cryptocurrency, and explain how you will take profit. (Screenshot Required)

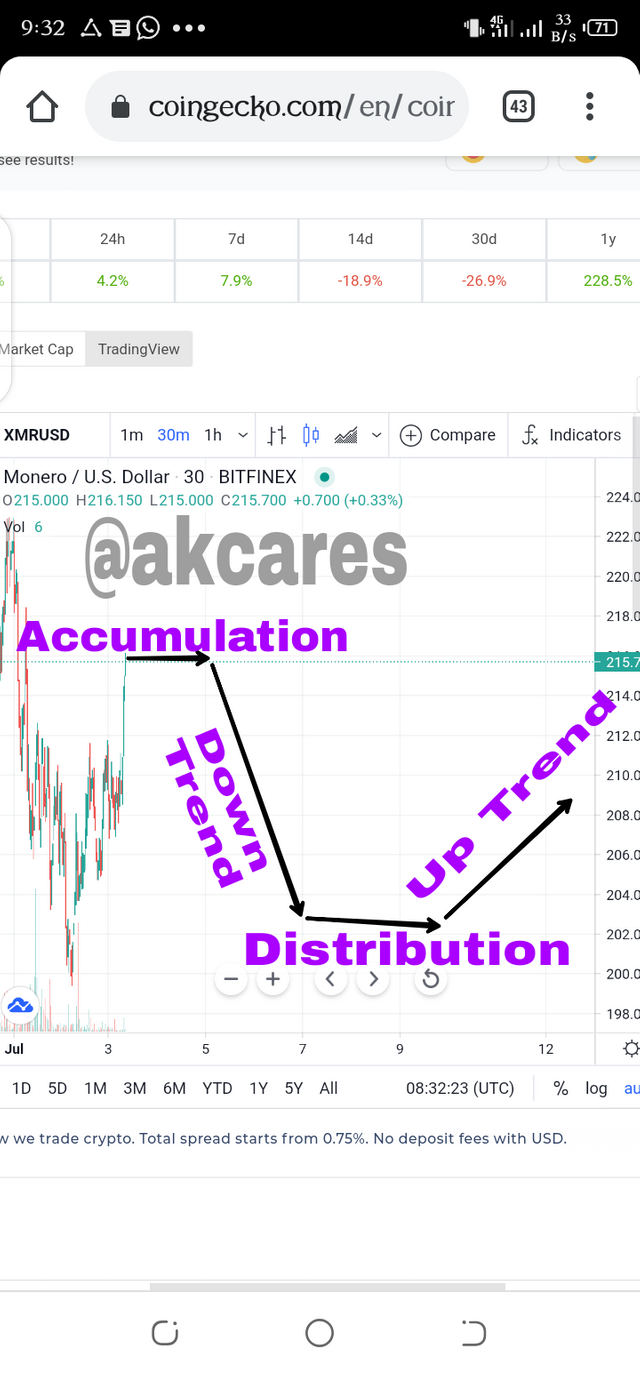

Looking at the chart of my chosen currency which is Monero at the moment, I may not be able to simulate a buy trade because the candles are already high up and as the law of trade states that the market will always readjust to balance up, this chart would rather favor a selling trade. Thus I will go short on this one. I am going to give a breakdown of how I will do this below using the different phases.

Accumulation Phase: Since my forecasted chart will span only a matter of days, and it is still the first week of the month of July. Noticing that the market is already in an uptrend so to manipulate it to favor me, I have to reverse the trend. Thus, I will start selling small units of my Monero coins gradually. I will be selling off my coins at high prices. This will continue for a day or two. You can see the schedule in the screen shot above. At the current price of monero being about $235.32. I am targeting getting it lower to about $130.25. That is, I will be looking at a percentage decrease of about 44% and below.

Down Trend PhaseAt about the 5th of July, I will begin selling out large chunks of my token. This will surely create a stir in the market as this will increase the supply of the coin. Eventually the value of the token will drop making people to sell out their tokens in line with the trend. This selling rush will continue till the 7th of July. The continuous drop in price will cause more small investors to keep selling their units and a feeling of distress will grow and they will all want to be safe. At this date, the price must have plummeted to about $123.23.

Distribution Knowing that I have reached my target price, I will slowly begin to buy Monero. As a whale, I have a direction I am heading to which will not be visible to the small investments as most of them will continue to be selling. This they will do at very low prices while I keep buying and making gain. As there is concurrent selling and buying, the direction of the chart is not very clear. Thus the chart is almost horizontal. This will take place between the 7th and the 9th of July.

Down Trend

With the change in the direction of my trade, very soon, many other investors will want to buy Monero token so they could hold them as potential equity when the price climbs. accordingly the chart will now begin an upward trend from about the 9th up into the middle of the month.

You can view a these phases in the screen shot above.

Conclusion

It has always been known that holding more capital in whatever form equals owning more power to control the dynamics of and economy.

In cryptocurrency economy, it is obvious and evident that it is the Whales that dictate which direction the market takes.

In reality without having high equity and holding large sums of a particular cryptocurrency unit, you will rarely be able to effect any change in what is happening in the market.

Thus, small investors are only left with the option of closely monitoring the whales and their moves because they call the shots.

Still, small investors should not expose themselves and be totally vulnerable to the schemes of the whales.

Thus, they should avoid falling victims of FOMO ( fear of missing out) or going all in after a shabby observance of the market or still, neglecting to calculate and evaluate their risk profile.

Preferably, small investors should take their time and conduct adequate and proper technical analysis of the trends before making a move.

Truly, this class has been a revelation and has been quite interesting. I pay my unreserved respect to Prof. @wahyunahrul for this educating class. Kudos! Sir.

Krsuccess

#cryptoacademy #wahyunahrul-s3week1 #whales #cryptocurrency #homework #nigeria

#Krsuccess