Progressing to direct topics that deals with trades is quite exciting for me as a student of this academy season. Reading through the lesson by Prof. @reminiscence, I can help but get attracted to exploring all the prospects that trading cryptocurrencies holds. I will now move to supplying answers to the assignment questions.

Number One: Explain the Following Stating its Advantages and Disadvantages:

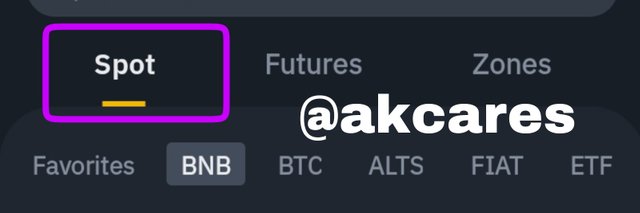

Spot Trading

This is a method of trading whereby a buyer or investors purchase units of a crytopcurrency asset in anticipation of an increase in the value of the asset so they can sell it off at a higher value and thus make profit. It entails acquiring real units of cryptocurrencies, keeping them for some time in wait for the price to rise significantly from the price at which the purchase was made and then when the price increase occurs, the trader then sell the units. In this trading, the activity that brings profit is basically the sell of the asset units once the price has increased.

ADVANTAGES

It is well fitted for beginners as much Technical analytic skills are not necessary.

It gives traders the opportunity to own actual units of the cryptocurrency asset.

Any amount of capital can be used to obtain assets and make gains. No minimum capital is stipulated.

A trader can enjoy all the benefits attached to the asset and can even have active participation in the activities of the blockchain by virtue of owning real units of the asset.

A trader is not in danger of having his capital liquidated no matter the outcome of the market as he has the leisure of keeping his units until a favourable market condition is available.

DISADVANTAGES

Profit potentials is low.

Is it not very sustainable as a trader has to wait for long periods to make gain and this is not even assured.

Traders can buy assets that are over priced and may not have real potentials an as such may be at risk of losing his investment.

Favourable trades can only be in one direction that is when the price is increasing. If a trader proceeds to sell during a downtrend, he may have to sell at a loss.

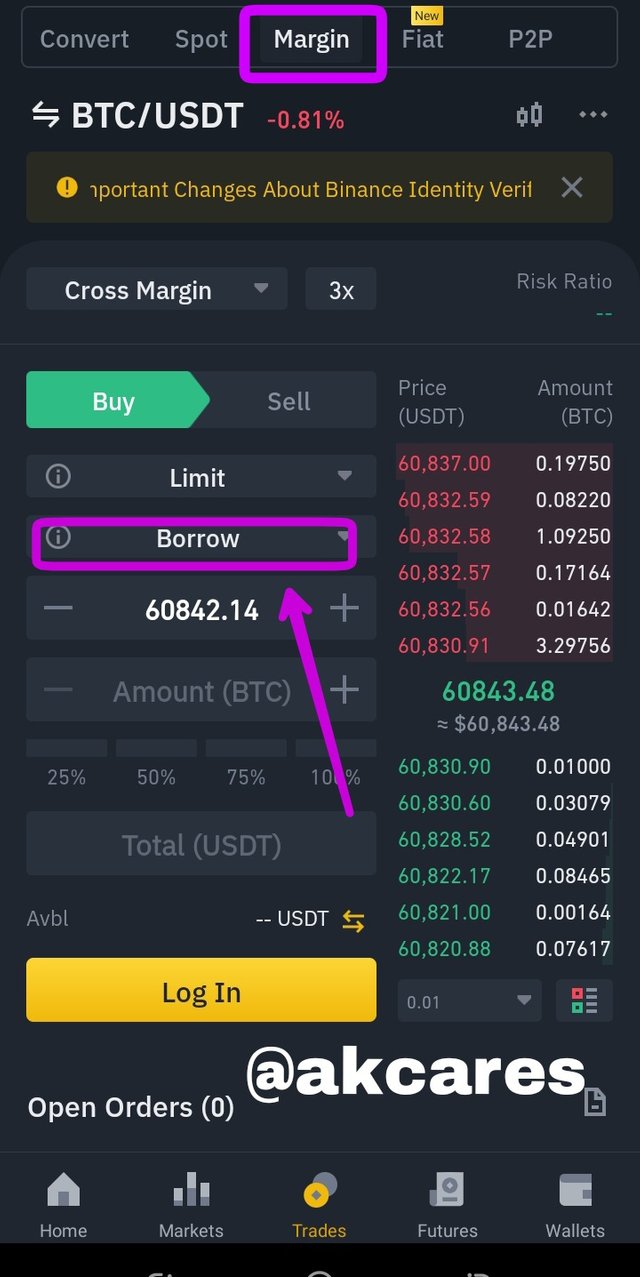

Margin Trading

Margin trading showing option to borrow.

Margin Trading describes a trading arrangement whereby a trader is able to acquire purchasing power that is higher than his or her trading capital through taking loans from a third party which can be fellow traders or from the trading platform or an exchange or a broker. It means using burrowed funds to increase purchasing power used in trading.

Here, trader or investor does not require to own actual units of the asset in order to trade, rather the contracts for the asset pairs which has attached prices is what is used for trading. The tendency for rapid change in prices of cryptocurrency assets makes this type of trading to be quite risky.

ADVANTAGES

A trader can afford to enter multiple positions in a particular trade as well as split his or her positions.

Possessing small trading capitals do not hinder the traders from gaining large projects.

Traders can enter trade positions that are way higher than using the levarage provided.

DISADVANTAGES

Traders do not have limited liability. They can have losses that are way above the value of their accounts.

The trading technique requires high levels of skills and technical abilities as such does not accommodate amateur traders.

In cases of erroneous predictions, the losses are always massive.

There are dangers of escalating issues when repaying loans and it might result to litigation.

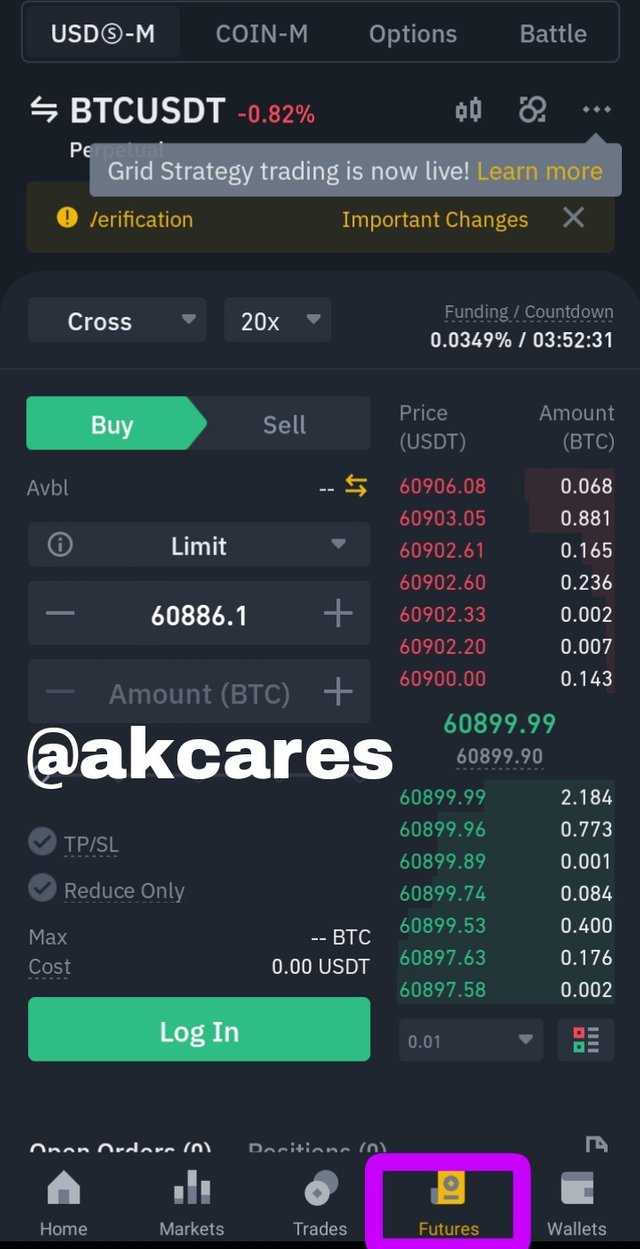

Futures Trading

This is another high risk trading system where a trader also uses uses futures contract which is an agreement to buy or sell an asset on a future date at an agreed-upon price, instead of the actual currency to enter positions in the market either going bullish of bearish.

Traders can decide to trade in exponential equivalents of their trading capital using a particular value of leverage.

Here, traders purchase stake and rights in form of currency pairs to bet or speculate the potential rise or fall in the price of an asset from which outcome they make their profit depending on the outcome.

ADVANTAGES

Profit can be made by the traders irrespective of whether the price of the asset is gaining in price or losing value.

Traders can afford to increase their profit margin by adopting larger levarage sizes.

The technique has very high profit potentials.

Traders can improve their investments using the process of hedging.

DISADVANTAGES

There is a very high risk of traders losing their trading capitals and getting their account liquidated once they make a wrong prediction.

There is no ownership of actual currency units thus, the trader cannot benefit from the privileges of the asset or its blockcain.

Number Two

Explain the Different Types of Orders in Trading

Orders in cryptocurrency trading simply means an act of specifically indicating intention to buy or sell a crytopcurrency with stated amount and price. There are different types of orders such as market, pending and exit orders. I am going to briefly consider them below with their specific subtypes.

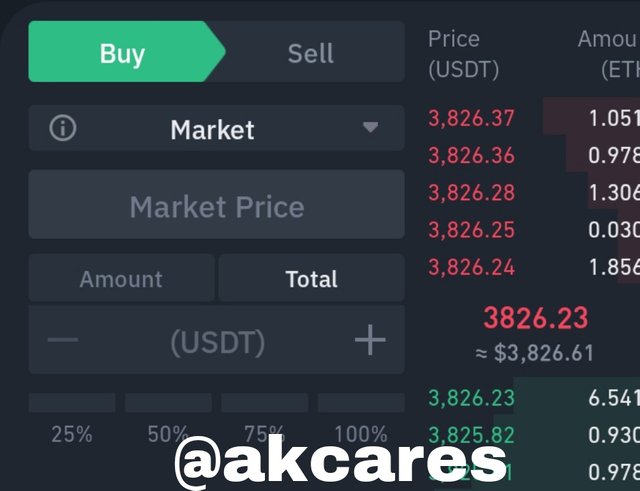

Market Order

Market orders refer to the expression of interest to buy or sell an asset in the market at the current market prices. It is a desire to exchange and asset at an already existing price level in the market. These are orders do not get indexed in the order book because they are executed immediately.

A market order is a reference to an instruction or command for asset to be bought or sold not at a pre-stated price, but at the available prevailing price in the market.

For example: In the pair of ADA/USDT, A trader studies the market and discovers a current increase in price of Cardano and he immediately places a buy order at that price and the order trade is completed instantly. This is a a market order as the trader did no provide any specific price at which the purchase should be carried out.

Pending Orders

Pending orders are those which require some time before they are being executed or filled. As the name implies, these orders do not get processed immediately rather, they are kept pending untill the condition stipulated in the order such as the price and the amount are being met by subsequent market orders.

With these orders, a trader can place a trade at speculated prices and once the market gets to that price that order is filled. The order to buy and sell is kept at a targeted price and it is only when this target price is attained that the order progresses.

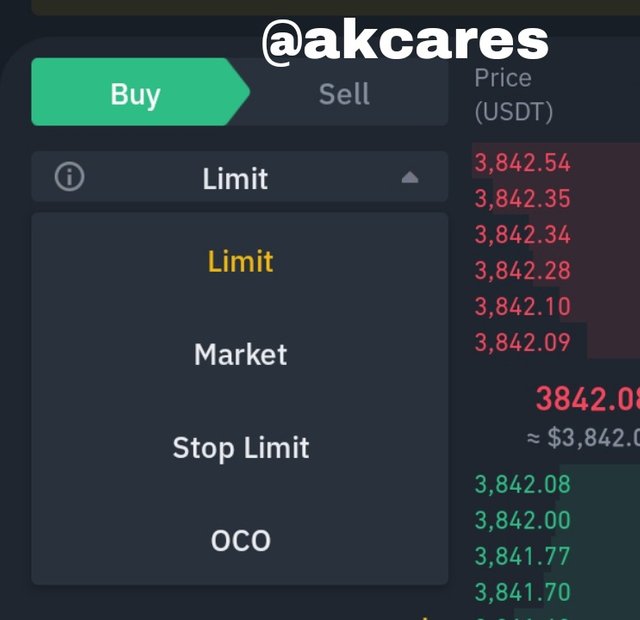

There are different types of pending orders. I will be discussing three of them which are: limit order, stop-limit order and OCO order.

- i. LIMIT ORDER

Limit orders refer to orders to buy or sell and asset at a particular price level which is usually stipulated ahead of time. A limit order is the type of order that is indexed in the order book to be executed at a later time when the quoted price is being matched by a market order.

For example: A trader after observing the chat of ADA/USDT, concludes from his analysis that the value of the asset is going to rise from the current price of $ 1.70 to $1.99 before beginning to drop. He then places sell order and specifies the sell order be filled at $1.99. That is, the order will have to wait for the price to rise to that value.

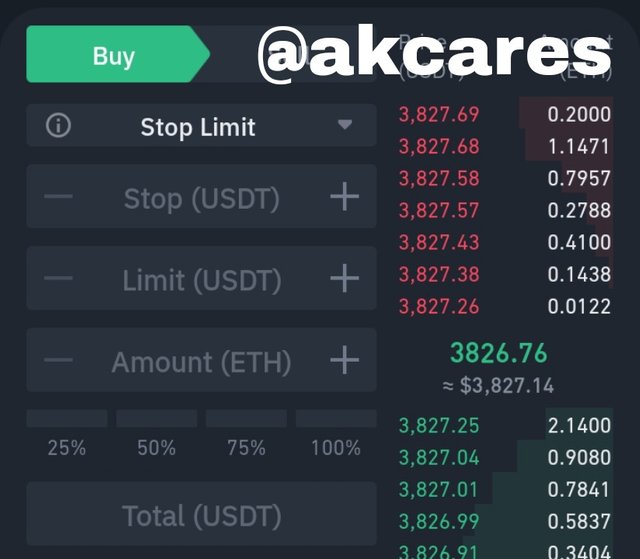

- ii. STOP-LIMIT ORDER

This type of pending order is one whereby the trader is able to set a limit order only once a certain price level called the stop price has been attained. It refers to fixing a limit order to be placed as the market reaches a certain price value.

For example: If Cardano which has a present price of $1.82 is in a bearish market. If a trader discovers that the bearish trend will continue for sometime before reversing, he can place a buy stop limit order at $1.55 which serves as the stop price to buy the pair of ADA/USDT at $1.40.

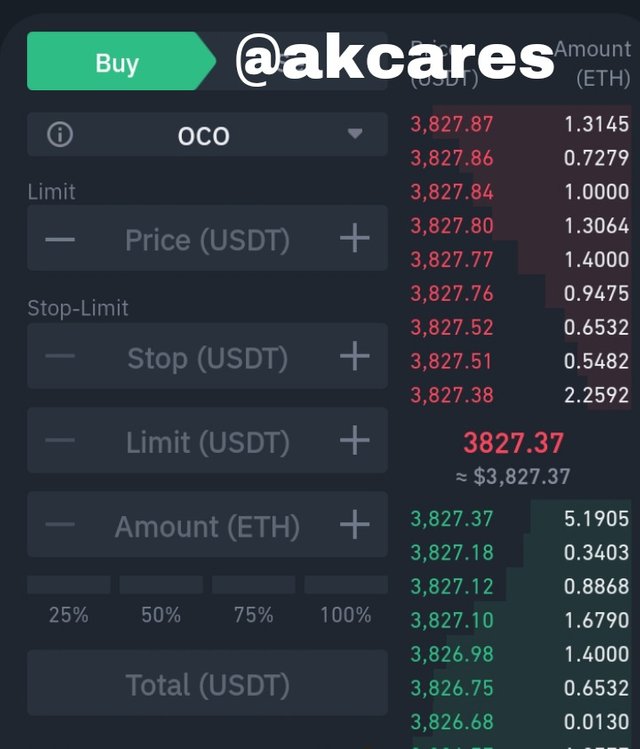

- iii. OCO (One Cancels the Other) ORDER

This is a special other which allows and trader to place two trading positions in one order such that once the condition of one of the positions is met, the other is instantly cancelled. This describes a pair of pending orders are placed at the same time whereby if one one them gets filled the other becomes invalid.

It is a pair of conditional orders that the execution of one terminates the other. Typically, this order has a limit order and a stop limit order in combination. Either of the two which meets the criteria for execution proceeds while the other is cancelled.

For example, if the price of cryptocurrency asset like Solana is currently $6,000, a trader or investor can place a high sell order at $8,000 and a stop-loss sell order at $5,000 paraventure the market moves in the opposite direction. In cases of a buying situation, this method can also be employed.

EXIT ORDERS

Setting stop loss and take profit on Meta Trader 4.

As the name suggests, these are orders placed at points or positions where a trader wishes to close his trades. They are order placed when a trader is leaving it exiting the market. Here, the trader no longer wishes to hold his position and so terminates his trades.

Exit orders also have subtypes which include: the stop loss order and the take profit order. Both of these orders can be combined with either market order or pending order.

- i. TAKE PROFIT ORDER

This refers to an order placed such that when the main order which can be a market order or a pending order gets executed favourably upto a certain level, the trade will terminate in profit.

It is used to secure a traders profits and guarantee that the trader wins trade rather than become greedy which may eventually result in loss supposing the market trend reverses. In a buy trade, the take profit order i placed much higher than the entry price and in a sell trade, the take profit is placed below the entry price as the price is expected to keep dropping.

- i. STOP LOSS ORDER

This order is one which shows courage to move on. Here, when price goes against a trader or his prediction turns out wrongly and the trade is in a loss, this order which is supposed to be set at the beginning of a trade is so specify at what level of losses the trader is willing to concede defeat and stop the trade.

This means, the is to end the trade at a point where the trader is no more willing to let the losses continue. It states the amount of losses that a trader is ready to bear. It is set in combination with other main order types.

How can a Trader manage risk using an OCO order? (technical example needed).

A trader can manage trading risks using OCO order because of the mechanism that order operates on. Here, the trader to able to open two opposing positions in a particular market where one is to enable him maximize profit and the order stop his losses. The market predominant trend can change drastically within few minutes.

Thus, a limit order is placed in the positive direction such that when price gets to that point, the order is filled and if paraventure the declines, the stop-limit order is triggered.

For example: If the price of Solana is currently $6,000, a trader can place a high sell order at $8,000 and a stop-loss sell order at $5,000 supposing the market moves in the opposite direction. This can also be applied can for buy orders too.

Number Three

a) Open a limit order on any crypto asset with a minimum of 5USDT and explain the steps followed. (Screenshots needed from any cryptocurrency exchange).

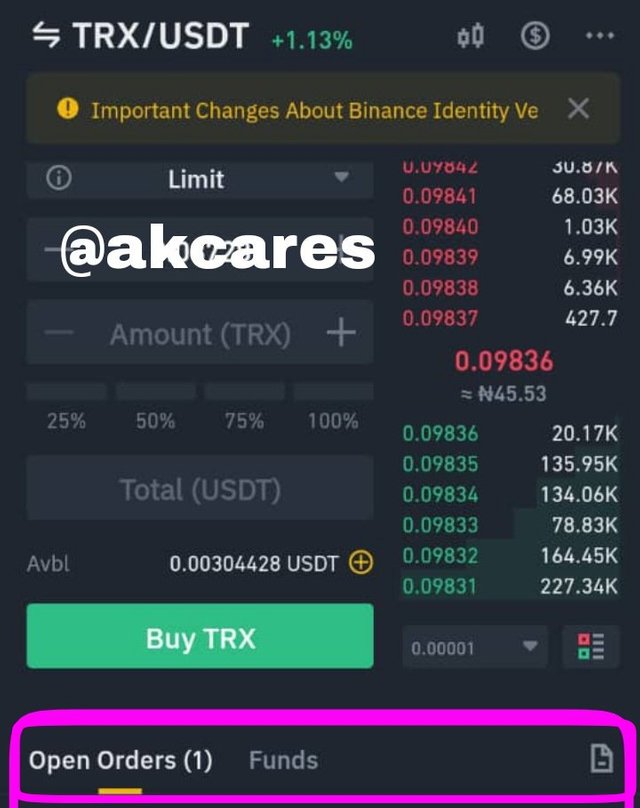

Here, I will be placing to purchase the pair TRX/USDT on Binance exchange app. I will be placing the trade for $15.

Step One

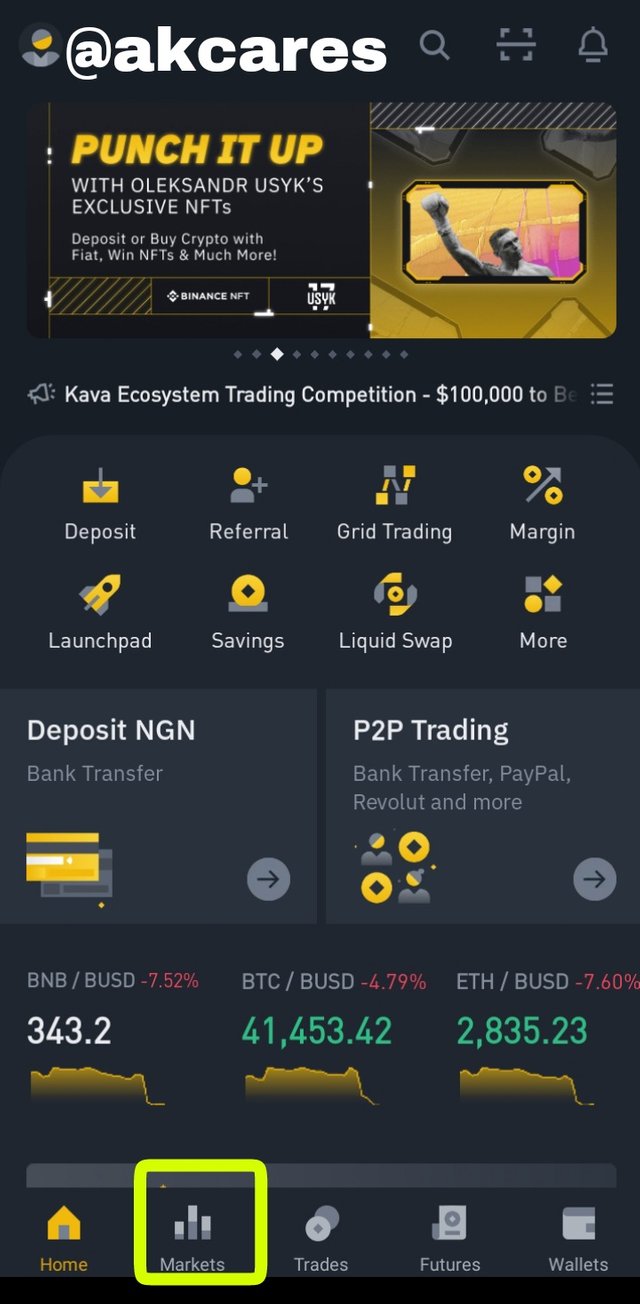

o place a TRX/USDT buy market order. Loaded my Binance app.

Step Two

After loading the app. I went through some processes to be able to take the trade.

I tapped on the *Market option and the next display came out, I located the search bar to find the pair I intended to trade on. Here, there is a list it various currency pairs. To hasten the process, it is wise to make use of the search interface.

Step Three

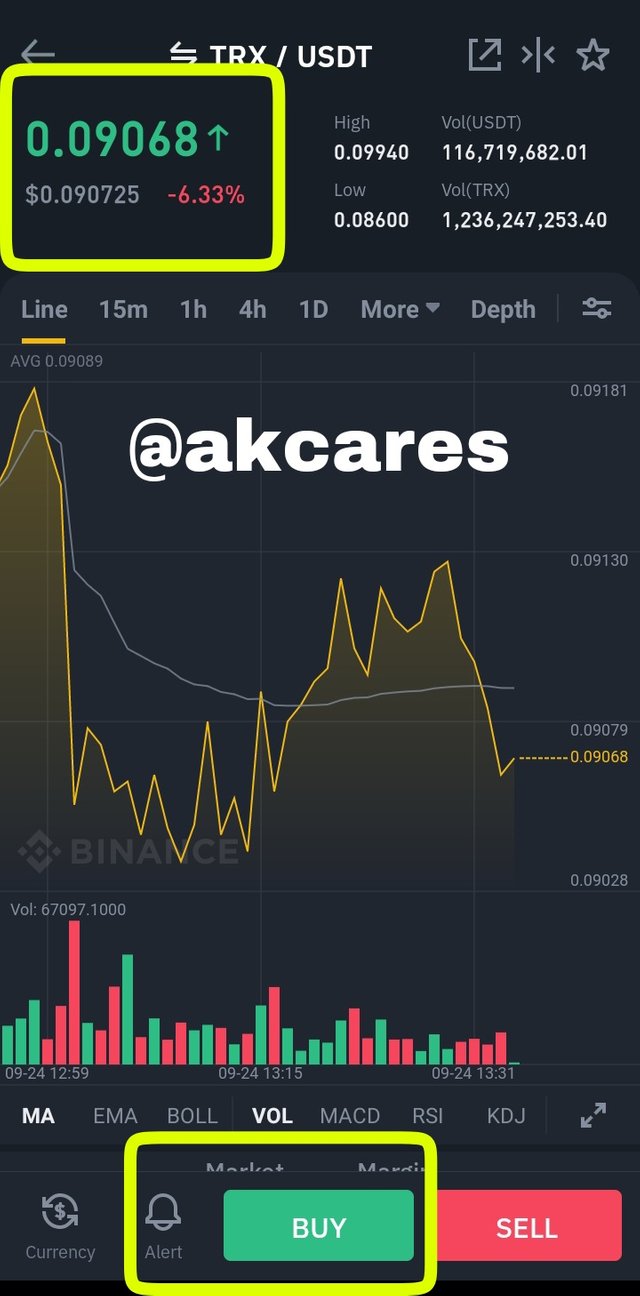

So, in the search bar and typed in my query, on this occasion, trx. I then selected the required pair which was was TRX/USDT and I clicked on it.

Step Four

The next interface that loaded showed the details of the currency pair. Here I could see the price was displayed (0.09068) and also the market chart. Under the chart I saw the buy and sell buttons and I tapped buy which was what I wanted to do.

Step Five

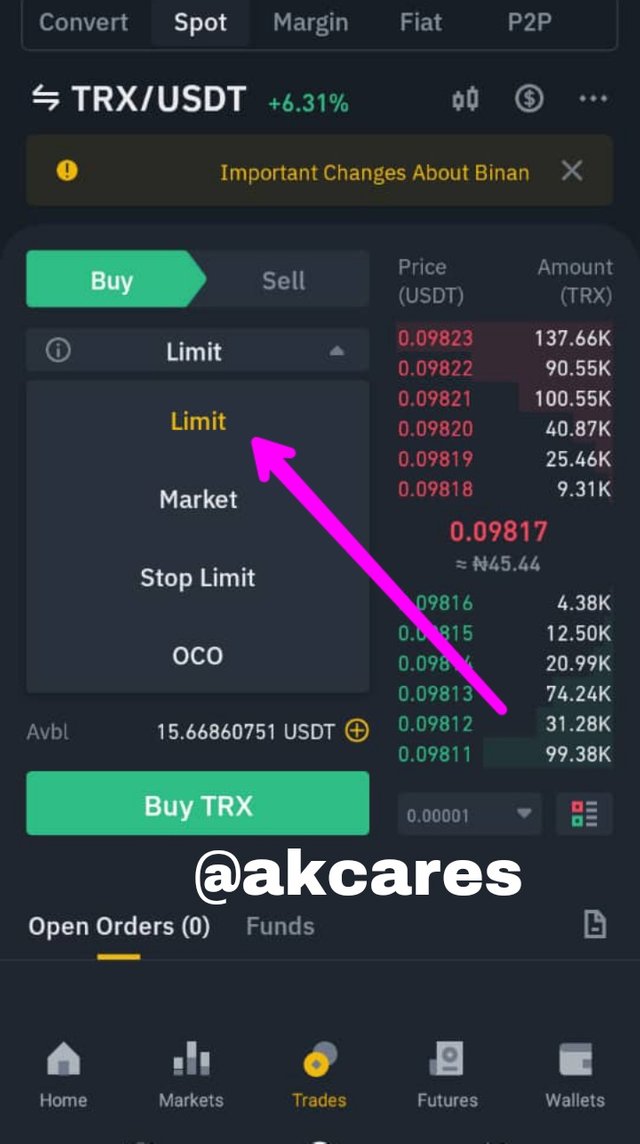

From picking the buy option, I proceeded to the next page which displayed different types of buying orders. Below is the button for selecting that type of buy order I wanted to make.

Step Six

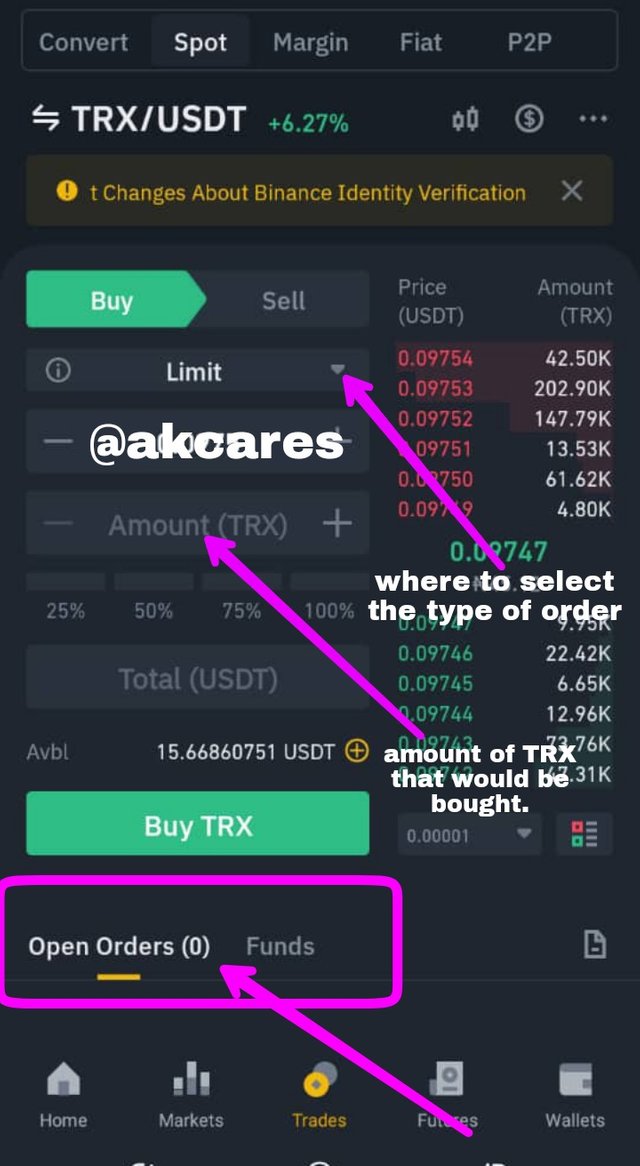

I then picked the buy limit order. Here, I saw the space displaying the quantity of Tron token that will exchanged witt the USDT amount I wanted to offer.

In the open order space, there are no records of any pending orders lt as I was yet to make an order.

Step Seven

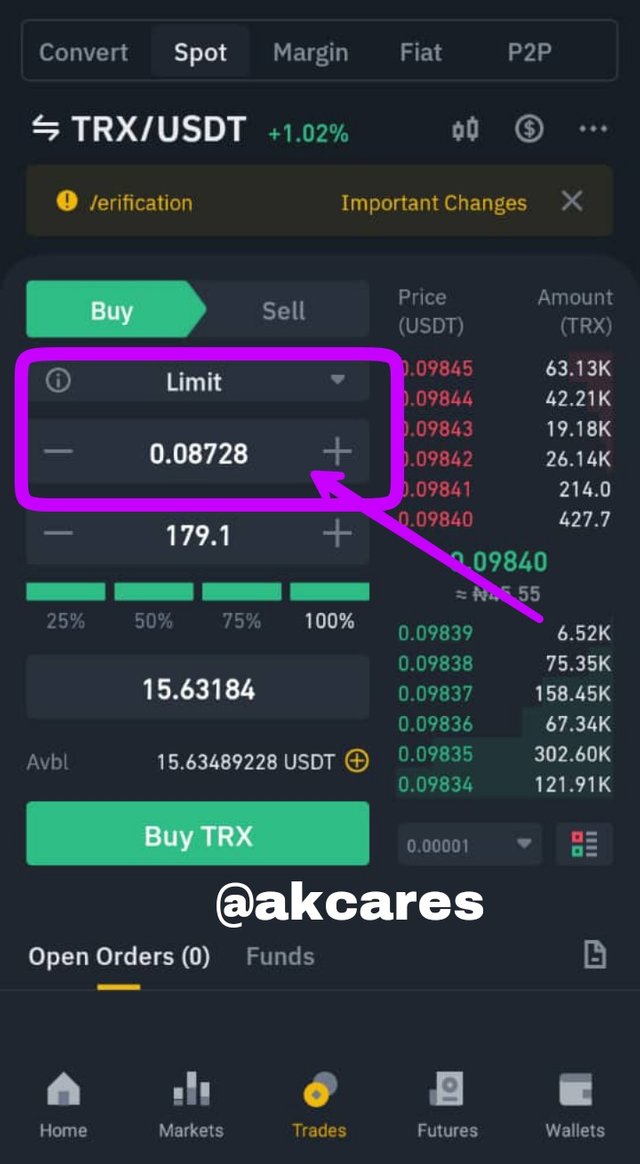

I then selected the desired type of order and also typed in the specific price at which I wanted to purchase the pair (0.08728).

My order could not be matched instantly as it was a limit order at a price different from the market price (09068), the order was left pending and was recorded in the order book as shown below.

These are the steps I took to place a limit order in the pair of TRXUSDT

Number Four

Using a demo account of any trading platform, carry out a technical analysis using any indicator and open a buy/sell position on any crypto asset. The following are expected.

i)Why you chose the crypto asset

ii)Why you chose the indicator and how it suits your trading style.

iii)Indicate the exit orders. (Screenshots required).

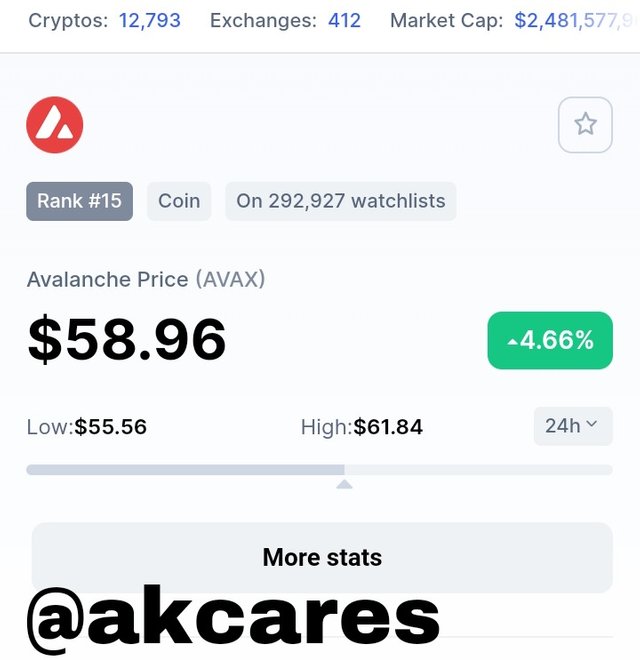

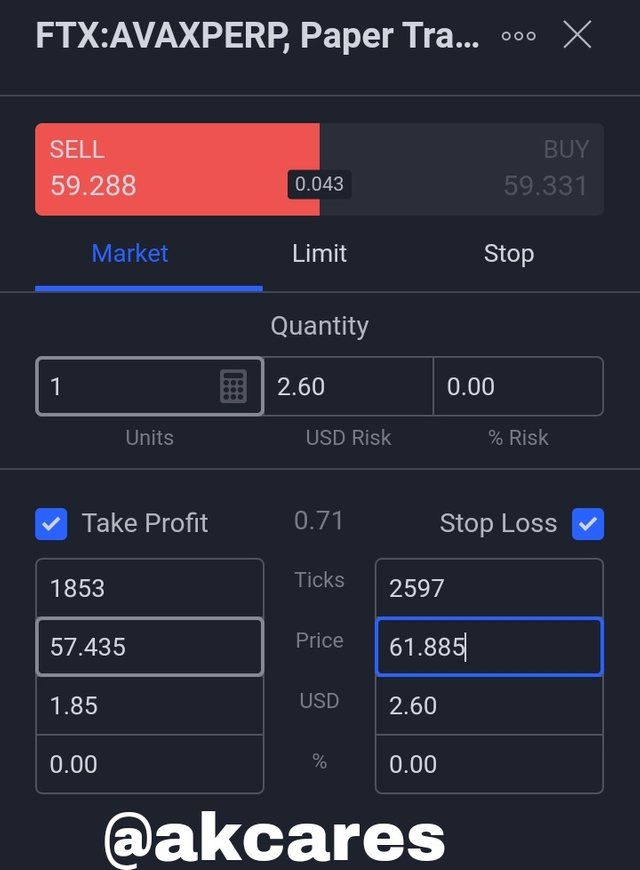

For this question, I picked the crytopcurrency pair of AVAXPER ( Avalanche and Perpetual Futures) using my paper trading account on my Tradingview app.

Why I Chose Avalanche

I decided to pick Avalanche because of a number of reasons. Some of these reasons include:

Avalanche has experienced tremendous growth in all aspects in just the very short time if its existence. Having been launched officially, back in 2020 it had increased massively in value even ahead of many other projects that has existed before it.

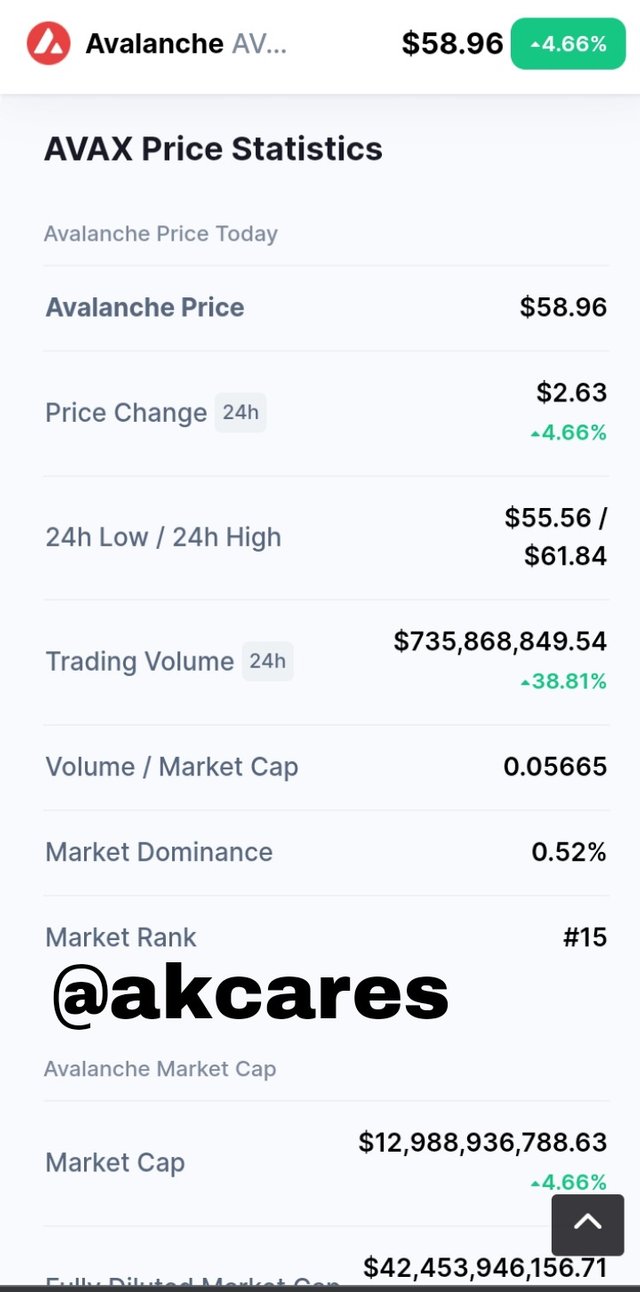

In terms of rank, Avalanche is ranked #15 on CoinMarketCap. This is a really high rank for project as young as this.

Avalanche currently has a price of $58.96, a market capitalization of almost $13 billion. The price is experiencing an increase of ivf 5% as well as the market capitalization.

Avalanche supports the development of smart contracts and thus rivals the likes of Ethereum. It even has some other advantages over Ethereum blockchain such as supporting higher volume of transactions.

Up to 6,500 transactions can be executed in a second on the avalanche blockcain. It boast of better scalability than most other blockchain projects.

Also, Avalanche support a great deal of interoperability and it has three individual blockchains in its network which are compatible with each other. The project is also aiming for greater compatibility with other blockchains and is constantly improving its network.

In terms of patronage, there are so many users of the network. A large number of DApps and DeFis have also been built on this network.

These are a few is the reasons why I picked the asset.

Reasons for the Choice of Indicator

I decided to make use of the Relative Strength Index (RSI) because it helps to show market swings and situations where an asset's price is in an overbought or oversold region.

With this it is easy for a trader to be able to enter a trade by waiting for the reversal of the trend to occur.

The RSI in graduated from 0 to 100. The areas between 0 and 30 is tagged that oversold region while the area between 70 to 100 is tagged the overbought region.

When price approaches overbought region, there is a strong tendency for it to reverse and this indicates selling opportunities to traders. On the other hand, when price enters the oversold region, there is high probability of reversing upward signalling a sell trade.

The indicator is quite straight forward and easy to understand. It is not as complex as some other indicators.

Rationale for buying the pair of AVAXPER

- The RSI indicator was just reversing from the overbought region and was going down.

*There were price rejections at the point of reversal of the recent uptrend.

- The trendline seem to be quite viable as it had been respected by the price a significant number of times and as such there was great possiblity that the reversing price will be heading to meet it.

The screenshots for the trade are given below along and exit orders are indicated as well.

Trading the cryptocurrency market involve different techniques and trading styles.

Depending on a traders level of knowledge and experience, he can decide to employ any one that best suits his trading needs. However, these different trading styles come with their pros and cons. As such, it is left for a trader to decide to practice spot, futures or margin trading, as he weighs his options properly.

Generally trading is executed using orders. Even in the mainstream market, a trader can only buy or sell a commodity by stating his position in regard to what price is going to be offered or demanded for the goods or services. One type of order or another need to be placed before a trade can made.

A deep understanding of the different trading regimes and methods and the different kinds of orders will be helpful to a trader in engaging in trades. As these different trading and order types have their pros and cons, a trader is both exposed to risks and gains depending on how he makes use of them.

Prof. @reminiscence01 has really taken time to expatiate the lesson and I have learnt a great deal from it. Nice work!

Hello @akcares, I’m glad you participated in the 6th week Season 4 of the Beginner’s class at the Steemit Crypto Academy. Your grades in this task are as follows:

Recommendation / Feedback:

Thank you for participating in this homework task.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit