In this week's class, professor

@yohan2on took us through how to trade in the market with a scalping trading strategy. We looked at the types of trading personalities in the market, ie. scalping, and swing trading personalities. But we delved much into the scalping, the types of scalping, the elements or requirements of scalping, the advantages and disadvantages of scalping, the differences between scalping trading and other trading styles, etc.

I personally enjoyed the class and learned a lot from my trading journey, I have completed my assignment and it is presented below.

Trading in the Forex market and Crypto market can be very risky at the same time very lucrative, this will only depend on the trading strategy style you employ and the level of discipline and experience you are at your game. There are many trading styles in the market one can try his hands on and of which include shorter and medium period and longer period trading styles, one can talk about swing trading to be a medium or longer period trading style and scalping to be shorter period trading style. In this homework, I will be focusing on the shorter period trading style and will be concentrating on scalping trading style and the types of scalping.

Scalping is a trading strategy where a trader wants to capitalise on the small movement of prices within a shorter period of time, the period of time considered in this type of trading style is at most one hour. It is very profitable when the price movement goes in your favor and it takes much time to make a substantial profit, though it is considered to be less risky because of the time frame used but can be very dangerous when you make consistent losses which can wipe the little profit you have made over time. Scalping needs a lot of attention and time depending on the time frame used.

Using the finger-trap Scalp trading strategy, practically demonstrate the scalp trading style on at least 2 crypto asset pairs such as BTCUSD, ETHUSD.

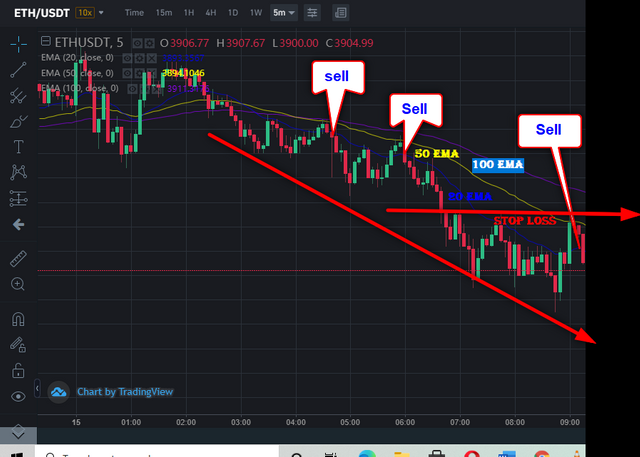

image source

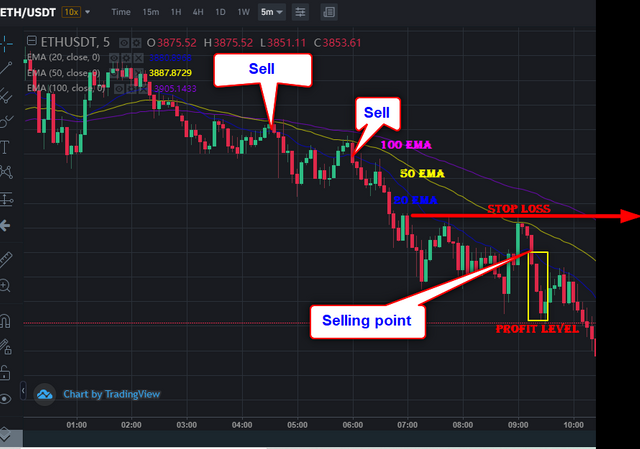

image source

When it comes to scalping trading strategy, there different examples one can give, of which we can talk about high win rate strategy, simple strategy, finger trap strategy, and many more. For the sake of this homework, I will be toughing on finger-trap Scalp trading strategy. As the name implies, a finger-trap is a small tube weaved using bamboo which traps your finger when inserted into it and tries pulling out, the technique here is to rather push your finger into it and with gentleness, you then remove your finger. This scalping trading strategy uses the same analogy hence its name, we use this strategy to try to find out the elements that cause or show a strong trend, and those elements are normally strong and found at one side of the price. The idea is to use these elements to push the trade to our favor just like the finger-trap analogy. This style is used for short period trading at most an hour.

Elements/Requirements for finger-trap Scalp trading strategy

The usage of Exponential Moving Averages (EMAs)

At least two EMAs are normally used in this type of trading, but depending on the trader's preference, one can use three EMAs. The period for the EMAs can be 10 EMA, 50 EMA, and 100 EMA, it solely depends on the trader's choice. The smaller EMA is much closer to the price movement and it represents the price movement on the shorter trend, following it the next smaller EMA which represents price in the medium term and the last EMA represent price on the longer term. All these are used to guide the trader with respect to price fluctuation and volatility.

Finding an existing trend

It is very important to identify the state of the market before opting for a finger-trap trading style, it's most advisable to finger-trap trade in a strong trending market, either uptrend and downtrend movement. We can identify market trends using the EMAs as an indicator if all the EMAs are moving in the same direction and are parallel to each other, also if the market price movement is above all EMAs we say the market is an uptrend. For the downtrend, if all the EMAs are below the market price movement and the EMAs move in the same direction and parallel to each other.

Setting up a tight Stop loss

Setting a point to exit the market automatically when you are making a loss is very important in scalping, Profit earn over time can be wiped out in seconds when scalping. There is little room to commit errors when it comes to scalping so it is very necessary to set a stop loss level to save you from loosing all your assets in a short time. The technique behind setting a stop loss is that you have to adjust the stop-loss orders, over time. This is done in the direction of the trend being traded. In an upward trend, move your stop loss up to below the low of the most recent pullback, but in a downtrend, move your stop loss down to above the high of the last peak.

Advantages of Finger-trap trading style

It is considered less risky because of the shorter time period used in trading, and one can automatically exit the market by setting a stop loss if prices are moving against you.

It is a less difficult trading style to use in the market and one does not need to be highly expertise to engage in this type of trading.

It uses a shorter time period which makes it easier to realize your trading outcome within a short period and more profit can be realized in a day which prices move in your favor.

Disadvantages of finger-trap trading style

It requires much attention and time because of the time frame that is use and the volatility of price which causes constant changes in prices.

Because of the amount of attention and time required, it sometimes makes it so tiring and exhaustive and cumbersome to practice.

Because of the several trades done each day, the cost of trading also increases and even can eat into your small profit you made over a long time leaving you with little profit.

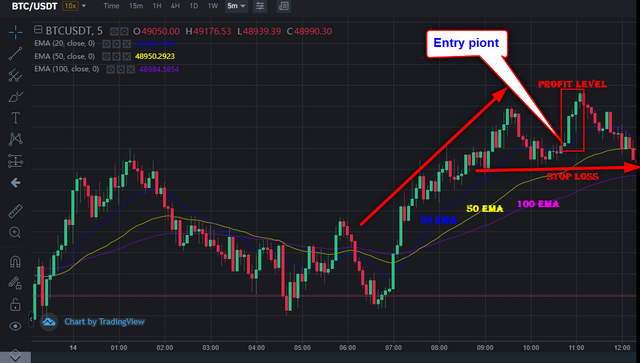

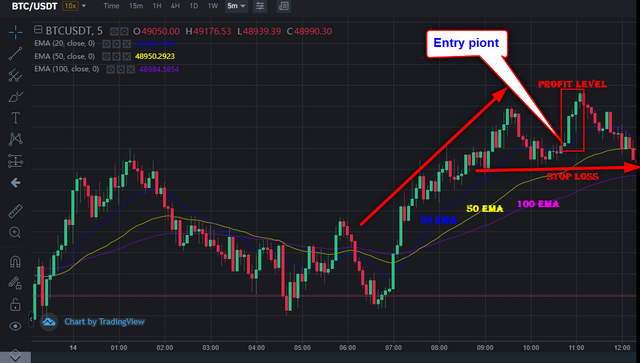

I will practicalize the theoretical exposition made above about the finger-trap trading style by using three EMAs which are 20 EMA, 50 EMA, and 100 EMA. I prefer to use a 5 minutes period chart with a pair BTC/USDT.

First of all, we have to identify an existing trend in the market, and from the example above, we have a strong uptrend price movement. As explained earlier of how to identify a strong trend when using the finger-trap trading style, all the EMAs are below the price and at one side.

Now, to enter the market, we have to patiently wait untill the price pull back across the 20 EMA or 50 EMA and reverse back to above the 20 EMA. This indicates an entry signal or buying. As shown above in the screenshot.

Stop loss as shown above is drawn just below the last pull back, when the price movement goes against you and get to the stop level, it will exit the market automatically to minimise your losses.

After identifying all these indicators, we then wait patiently to see if our prediction will be right.

From the from above chart after the stipulated period, we can see that the price movement upwards in my favour and the profit level shows the gain level. So after the time period, it exits the party.

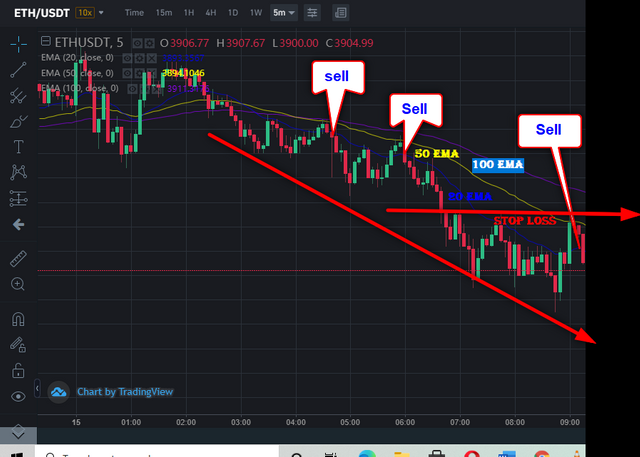

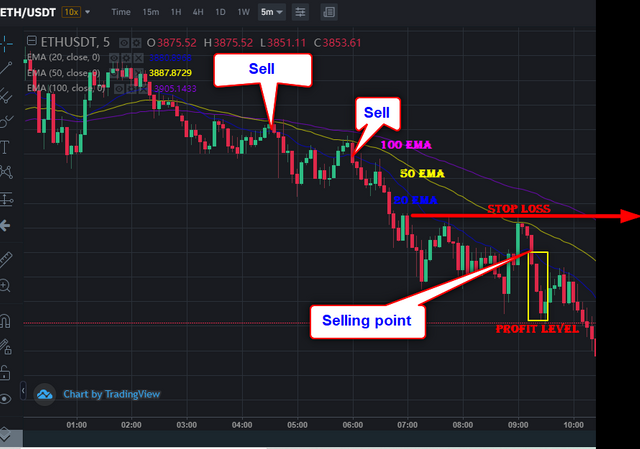

In my second demonstration, I will consider the pair ETH/USDT on the trading of my Binance account with the same EMAs used in the above illustration and the period is also 5minutes.

From the above screenshot, we can see that we have a down trend price movement, which is the opponent of our first example. The price is below all the EMAs, but we will wait to take a short position if the price move up across the 20 EMA or the 50 EMA and pull back to below the 20 EMA as shown in the diagram above.

We then set our stop loss above the high of the last peak as shown above , so when price move up to the stop price level, the you will exit the party automatically to avoid further losses.

We then wait for the stipulated period to elaspe for us the know the result of our trade.

From the above diagram, after the period has elasped, price continued to move downwards for the trading period, thereby creating a profit for the trade.

Conclusion

The finger-trap scalping style is mostly used in trading, but it is advisable to trade with the asset you are willing to loss, about only 0.5% of your total asset should be use for scalping to put you in the safer side.

Thank you very much professor @yohan2on for this wonderful class, looking forward to meet you in your next class.

Hello @albertodecrutor,

Thank you for participating in the 5th Week Crypto Course in its second season and for your efforts to complete the suggested tasks, you deserve a 4/10 rating, according to the following scale:

My review :

An article in which you failed to set the finger trap strategy correctly due to your reliance on three exponential moving averages and therefore the results you got were unrelated to it. You have mainly focused on the stop-loss order and that is only part of what is being asked for.

Thanks again for your effort, and we look forward to reading your next work.

Sincerely,@kouba01

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you so much professor, very glad I attempted the homework task, can not believe I was able to do something small. Am yet to actually start trading so I don't understand technical analysis when it comes to trading, I promise to go and study very hard and come back very strong. Thanks for all your corrections, enjoy your day professor, shalom.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit