0Image edited by me in Powerpoint

Intro

The interest in trends is obvious, as it is like riding a wave and expecting it to take us to the promised land. But what is a trend...or how do we measure them...and more importantly, when do we know there is going to be one?

With this in mind, Welles Wilder tried to solve this problem by creating an indicator that would objectively tell us when there was or was not a trend. This is when the ADX indicator was born.

1. Discuss your understanding of the ADX indicator and how it is calculated? Give an example of a calculation. (Screenshot required)?

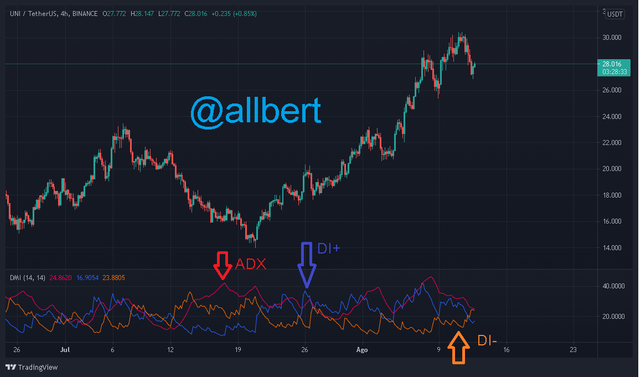

UNI/USDT, 4h chart. Image edited by me and taken from Tradingview: Source

-0 to 25: No trend.

-25 to 50: Existence of a trend.

-50 to 75: Very strong trend not very common over long periods of time.

-75 to 100: Extremely volatile trend. Very strange and very uncommon.

-If DI+ is above DI- the trend is Bullish.

-If DI- is above DI+ the trend is Bearish.

Calculation

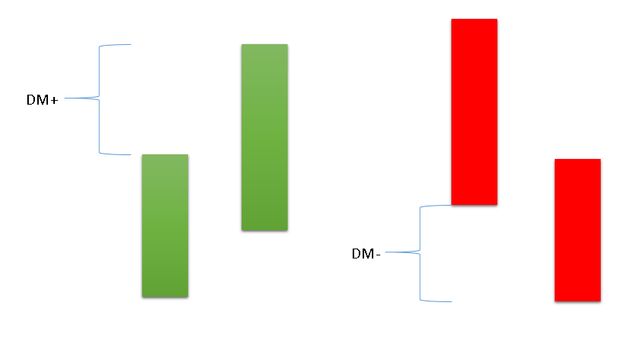

If on the other hand, we have a low below the previous low we consider that there is bearish directionality and the difference we call it DM-.

Their formulas are these:-DM+ = current high - previous high

-DM- = previous low – current low

Image edited by me in Powerpoint

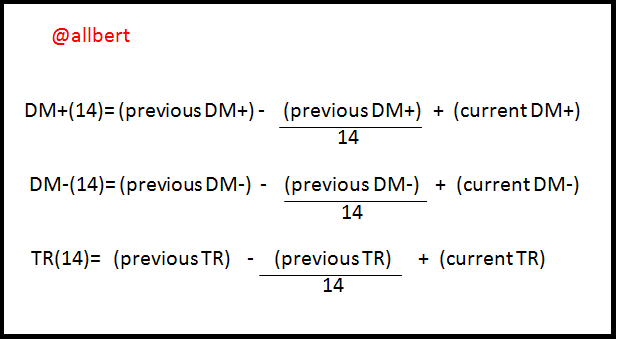

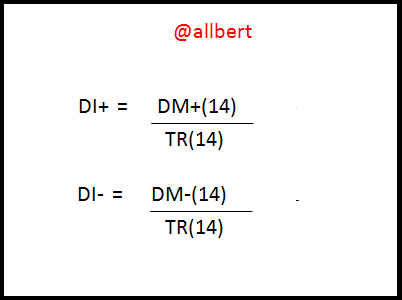

These lines are constructed by taking the DM+ and DM- of the last 14 periods (the original number of periods chosen by its creator) and dividing it by the TR (True Range) of the same period.

The TR formula is, The maximum value of:-Current high - current low

-Current high - previous close

-Current low - previous close

Image edited by me in Powerpoint

Then, the calculation of DI+ and DI- is through these formulas:

Image edited by me in Powerpoint

Finally:

DX= ABS[(DI+) – (DI-)] / [(DI+) + (DI-)]

And, then a 14 period smoothing is applied again on DX resulting in:

ADX= Sum of 14 [((DI +) - (DI-)) / ((DI +) + (DI-))] / 14

Example

| DATA | VALUE |

|---|---|

| current high | 0.6 |

| previous high | 0.48 |

| previous low | 0.40 |

| current low | 0.46 |

| previous close | 0.45 |

DM+ = 0.6 – 0.48 =0.12

DM- = 0.40 – 0.46=-0.06

0.6 – 0.46=0.14

0.6 – 0.45=0.15

0.46 – 0.45=0.01

DI+ = 0.12 / 0.15 =0.8

DI- = -0.06 / 0.15=-0.4

DX= ABS[(0.8) – (-0.4)] / [(0.8) + (-0.4)]

DX= ABS[1.2] / [0.4]

DX=3

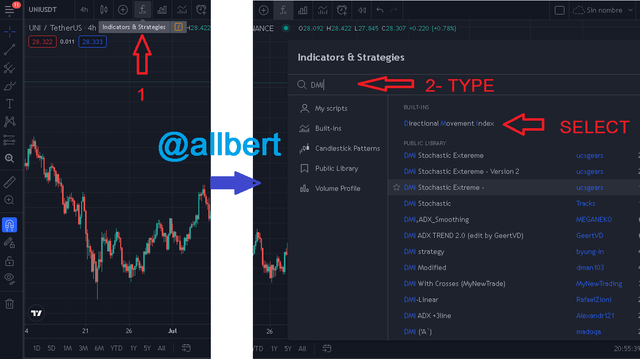

Naturally, this is only one value of several that must then be applied in the ADX Exponential Moving Average formula.2. How to add ADX, DI+ and DI- indicators to the chart, what are its best settings? And why? (Screenshot required) ?

Image edited by me and taken from Tradingview: Source

Image edited by me and taken from Tradingview: Source

Finally, the last question has a catch... since, in reality, the ADX is an indicator ADAPTABLE to any trading style, so there are not better settings than another.

Actually, the 14 period setting was chosen by its creator because it is a mid-range that he used in other of his indicators. But we could simply work with 7, 9, and 30 settings. We must be careful at what point we are going to use those values. For example, the 7 and 9 period setting is very sensitive and is perfect for use in some swing trading, however, if used in another type of trading such as scalping it can show many false signals. On the other hand, a 30 setting is perfect for scalping as it is less sensitive, smoothed, and will show more accurate not volatile values. However, if it is used for swing trading for example... we will find that the indicator will give very late signals.3. Do you need to add DI+ and DI- indicators to be able to trade with ADX? How can we take advantage of this indicator? (Screenshot required) ?

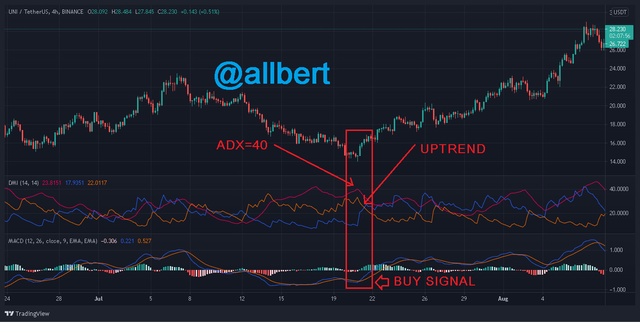

Image edited by me and taken from Tradingview: Source

Image edited by me and taken from Tradingview: Source

4. What are the different trends detected using the ADX? And how do you filter out the false signals? (Screenshot required) ?

1-Weak or non-existent trend.

In this trend, the ADX is in a range between 0 and 25. This occurs just at the moments where the price experiences sideways movement or consolidation. In other words, there is no marked downtrend or uptrend.

Image edited by me and taken from Tradingview: Source

2-Strong Trend

In this trend, the ADX is in a range between 25 and 50. At this point, the price begins to show a strong start of a trend.

Image edited by me and taken from Tradingview: Source

3-Very strong trend

This trend is very rare and occurs for short periods of time when the price undergoes very sharp and rapid upward or downward movements. The ADX is in a range between 50 and 75.

Image edited by me and taken from Tradingview: Source

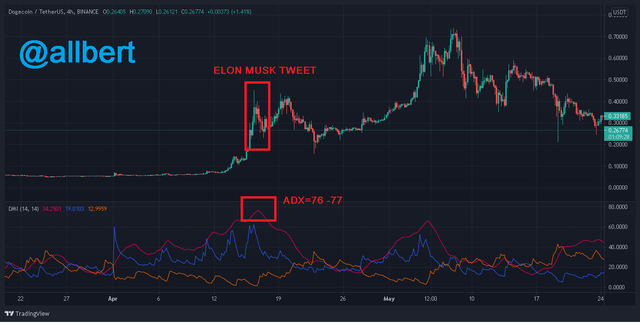

4-Extremely volatile trend

This case is even stranger, it occurs when the price experiences out-of-the-ordinary volatile behavior, which is almost always the result of external news that affects the market. In this case, the ADX is between 75 and 100.

Image edited by me and taken from Tradingview: Source

The only case I found was DOGE's sudden rise due to Elon Musk's tweets in April. The ADX was positioned for an instant at 76.

How do you filter out the false signals?

The way we can filter out false signals is through observation of the ADX line with respect to the price action. For example:

Image edited by me and taken from Tradingview: Source

Image edited by me and taken from Tradingview: Source

Image edited by me and taken from Tradingview: Source

5. Explain what a breakout is. And How do you use the ADX filter to determine a valid breakout? (Screenshot required) ?

Image edited by me and taken from Tradingview: Source

Image edited by me and taken from Tradingview: Source

6. What is the difference between using the ADX indicator for scalping and for swing trading? What do you prefer between them? And why? ?

For Scalping

As we know these trades are very short and look for quick profits in low time frames of 1 to 5 minutes. These time frames experience a lot of volatility, so it is recommended to set the ADX to 30 periods or more to counteract the volatility. p>

Image edited by me and taken from Tradingview: Source

For Swing trading

On the other hand, for Swing trading what we are looking for are long-term investments and operations, with high timeframes, preferably at 1D. For this reason, to maximize the possibility of entries you can set the ADX to 9 or 7, this way the indicator is more sensitive and can detect movements more quickly. Otherwise, some trend movements may be overlooked.

Image edited by me and taken from Tradingview: Source

What do I prefer?

I think at this point in my career I prefer Scalping using a 30 period ADX. The reason is simple, it goes hand in hand with my financial goals and is in line with my personality. I have nothing against swing trading, in fact, until a few months ago I preferred it, so what made me change my mind? Through scalping, I can set small short-term goals that motivate me every day to achieve them. I feel that even if the profits are few, I keep myself active and moving forward, consolidating my experience and my experiences. Every day I advance one step at a time. In other words, I see more action more often. Otherwise with swing trading I only see action or movement in very long or spaced periods of time.Conclusion

An important point to remember is that the indicator is only supporting but does not decide the context. First of all, we are the ones who should always define how to use the indicator so that we can set the timing and smoothing correctly.

Finally, a personal recommendation is that we should pay close attention to the highs of the ADX, in order to be sure of the reliability of the trend and also to try to anticipate consolidations, because when divergences occur we are indicating that the trend is losing strength and perhaps a period of sideways movement begins. If we think about it, this can help us to think about making an entry or an exit in our operation.

Hello @allbert,

Thank you for participating in the 7th Week Crypto Course in its third season and for your efforts to complete the suggested tasks, you deserve a 8/10 rating, according to the following scale:

My review :

An article with good content in which you answered all the questions effectively and with a clear methodology and certain points were taken.

Thanks again for your effort, and we look forward to reading your next work.

Sincerely,@kouba01

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks for the feedback mate!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit