Hello again Professor

@cryptokraze. I find the whole study of these patterns and their behaviors wonderful, as they offer us real tools to get out there and make the market work for us. There is no better teaching than that which we can use in our real-life.

Let's start.

Image edited by me in Powerpoint

1. What is your understanding of Sharkfin Patterns. Give Examples (Clear Charts Needed)?

These are candlestick patterns that form when the price experiences a sudden and rapid impulse in one direction (up or down), but instead of continuing the trend, at a certain point, it experiences a reversal in the opposite direction, which is as rapid and accelerated as the first move. This whole pattern is the anticipation of a trend reversal.

We could mention that the first impulse is the product of the strong entry of some trader or group of traders into the market, and the second (reversal) is the result of the price finding a liquidity level and bouncing back. In the Sharkfin pattern, we can observe a typical behavior product of market volatility.

Due to the resulting shape of the candles, it receives its name, since its V-shape is reminiscent of a shark's fin.

In the first example, we can see a sharkfin of downtrend reversal.

SOL/USDT, 1h chart. Image edited by me and taken from Tradingview: Source

In the second example, we can see a sharkfin of uptrend reversal.

FTT/USDT, 1h chart. Image edited by me and taken from Tradingview: Source

2. Implement RSI indicator to spot sharkfin patterns. (Clear Charts Needed)

Before showing the examples, let's remember that the RSI is an oscillator type indicator that shows whether the asset is overbought or oversold. So the RSI will work in this case as a confirmation of the Sharkfin pattern.

In this sense, what we are looking for are Sharkfin patterns in the price accompanied by an overbought or oversold signal on the RSI, to validate a change in trend.

First case, sharkfin of downtrend reversal.

SOL/USDT, 1h chart. Image edited by me and taken from Tradingview: Source

The behavior sought is for the RSI to move below the 30 line (oversold) and then suddenly rise away from the 30 line and form a V.

Second case, sharkfin of uptrend reversal.

FTT/USDT, 1h chart. Image edited by me and taken from Tradingview: Source

The behavior sought is for the RSI to move above the 70 line (overbought) and then suddenly move down away from the 70 line and form an inverted V.

Although it may not seem like it, the RSI plays an important role, as peaks can constantly form that resemble Sharkfin patterns in the price but not be true trend changes.

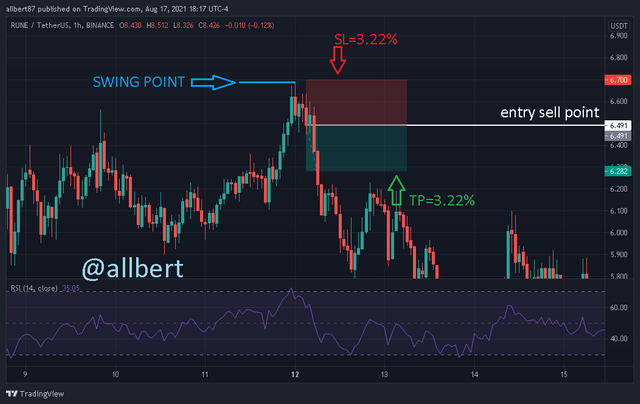

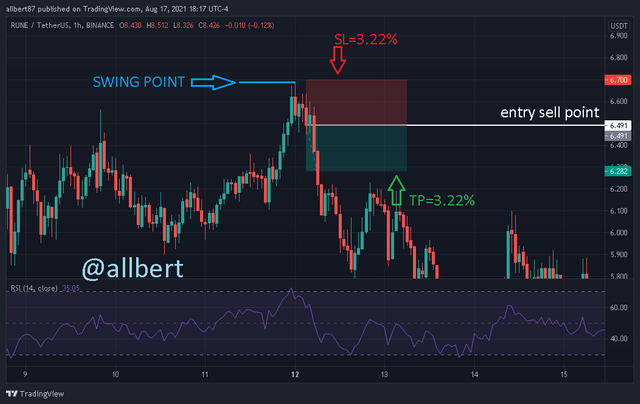

RUNE/USDT, 1h chart. Image edited by me and taken from Tradingview: Source

3. Write the trade entry and exit criteria to trade sharkfin pattern (Clear Charts Needed)

SELL POSITION

Entry Criteria

1- Wait for the price to form an inverted V-shaped sharkfin pattern.

2- Simultaneously, the RSI should move above the 70 line and then move down rapidly away from it.

3- At the instant when the RSI moves away from the 70 line we make our short entry (sell).

RUNE/USDT, 1h chart. Image edited by me and taken from Tradingview: Source

Exit Criteria

1- Our first exit will be the Stop Loss, which can be a little above the peak of the sharkfin pattern or the swing point.

2- Following a 1:1 risk/reward range, we take profit with the same margin as the stop loss in the same direction of the new downtrend.

RUNE/USDT, 1h chart. Image edited by me and taken from Tradingview: Source

BUY POSITION

Entry Criteria

1- Wait for the price to form a V-shape sharkfin pattern.

2- Simultaneously, the RSI should move below the 30 line and then rise rapidly away from it.

3- At the instant when the RSI moves away from the 30 line we make our long entry (buy).

RUNE/USDT, 1h chart. Image edited by me and taken from Tradingview: Source

Exit Criteria

1- Our first exit will be the stop loss, which can be a little below the peak of the sharkfin pattern or the swing point.

2- Following a 1:1 risk/reward range, we take a Take profit with equal margin as the stop loss in the same direction of the new uptrend.

RUNE/USDT, 1h chart. Image edited by me and taken from Tradingview: Source

4. Place at least 2 trades based on sharkfin pattern strategy (Need to actually place trades in demo account along with Clear Charts)

I will perform both trades on my Paper Trading DEMO account, which belongs to my Tradingview account.

First Demo

My first trade was made on the ETH/USDT pair. First I observe a sharkfin pattern that occurs after a downtrend. At the same time, the RSI indicator shows an oversold pattern going below the 30 line and then moving up and away quickly. Everything indicates a change in trend.

Before RSI moves further away, I place a Buy Stop order at 3054.95 USDT. From here I place my stop loss below swing point at 2946 USDT and take profit of 3162 USDT.

ETH/USDT, 45min chart. Image edited by me and taken from Tradingview: Source

As can be seen, the buy order was triggered at 3054.10 USDT. Shortly after that, the price suffered a pullback but didn't touch the stop loss. It finally resumed the uptrend and looks very good.

ETH/USDT, 45min chart. Image edited by me and taken from Tradingview: Source

Second Demo

My second trade was performed on the AXS/USDT pair. First I observe an inverted V sharkfin pattern, accompanied by an oversold RSI signal. The RSI rises above the 70 line and then quickly falls and pulls back. At this point, I place a Sell order at a market price of 69.72 USDT.

AXS/USDT, 2H chart. Image edited by me and taken from Tradingview: Source

From my entry point, I set a stop loss at 82.61 USDT above the sharkfin pattern's swing point and take profit at 55.88 USDT in the downtrend direction.

AXS/USDT, 2H chart. Image edited by me and taken from Tradingview: Source

In this case, the price also had a pullback and is currently in consolidation however I expect it to resume the downtrend and reach Profit.

Conclusion

It is wonderful to learn how you can get such good results so quickly through the observation of such simple patterns.

Compared to other types of patterns and technical analysis, the Sharkfin pattern is shown as one that is friendly and easy to use for novice traders. Its identification is quick and its confirmation is also simple, through one of the most user-friendly indicators, the RSI.

On the other hand, we must not forget, that although it seems simple, the market is still unpredictable, and this is just a tool that can fail, so it is always recommended to carry good risk management, as well as operate in a Demo account until it is mastered to perfection.

Respected professor plz chech post and give me marks..Thanks

https://steemit.com/hive-108451/@ansardillewali/steemit-crypto-academy-or-or-season-3-week-8-or-or-risk-management-in-trading

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit