Hello again Professor

@kouba01. I think your classes on indicators are great, I never get tired of them, each indicator is a wonderful tool with different characteristics that can help us to have a better performance in our operations.

Let's Get started!!!.

Image edited by me in Powerpoint

1. In your own words, give a simplified explanation of the CMF indicator with an example of how to calculate its value?

CMF is a volume indicator that basically uses the daily accumulation and distribution reading of an asset.

In other words, it is the degree of buying or selling pressure that can be determined by the closing location relative to the highest and lowest value for a given period.

Finally, the value that the indicator will give us is the volume of people who are buying the asset and the volume of how many are selling.

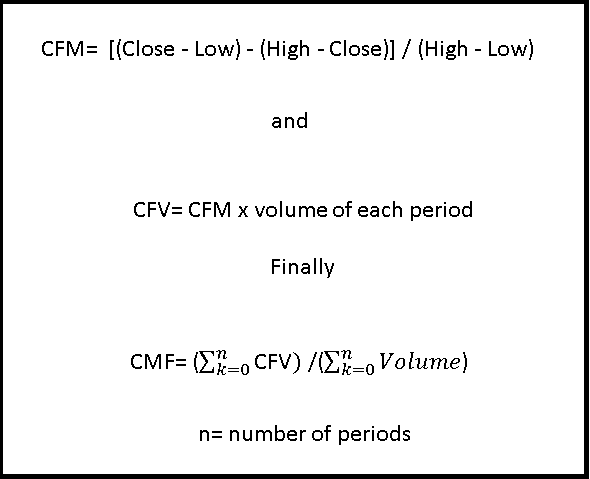

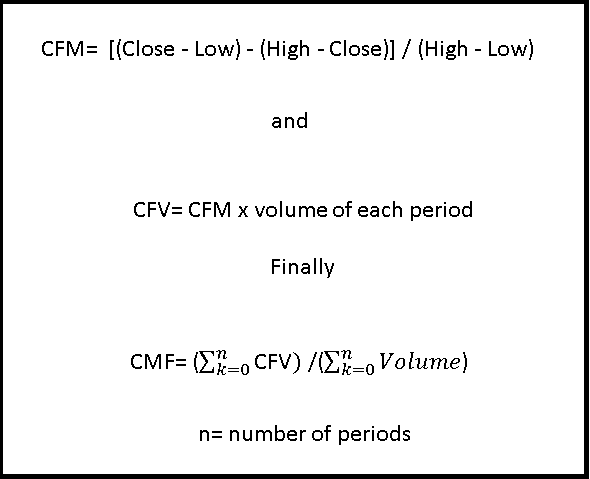

Although the formula looks long, it is actually very simple to explain with an example. The formula is as follows:

Image edited by me in Powerpoint

CFM is Cash Flow Multiplier and CFV is the Cash flow volume. On the other hand, n is the number of periods, which for our examples will be 20.

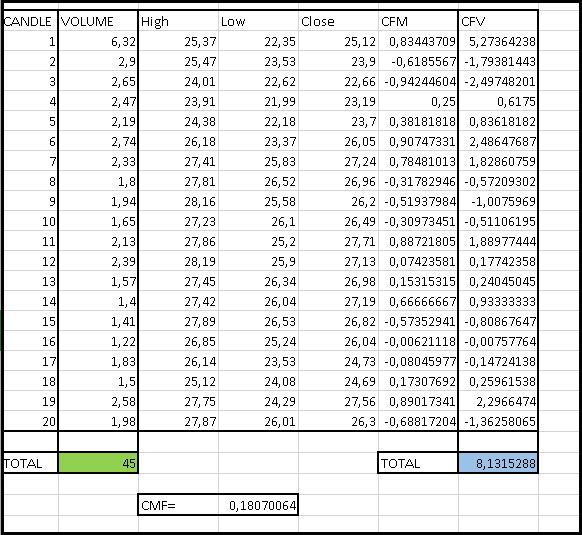

The calculation procedure is to take the high, low, and closing values of each candle during the selected 20 periods. At the same time, we must take the volume value corresponding to each period.

Image taken from: Source

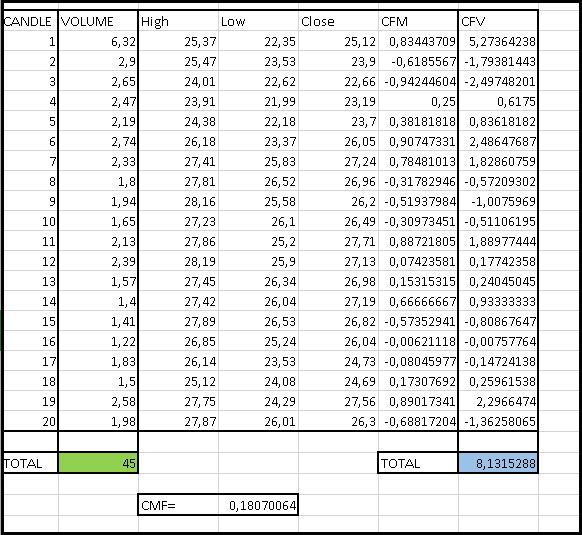

For example, if we take the candle value of period 1, the calculation would be as follows:

Close:25.12

High:25.37

Low:22.35

volume:6.32

CFM= [(25.12 – 22.35) - (25.37 – 25.12)] / (25.37 – 22.35)= 0.83

CFV= 0.83*6.32 = 5.27

This result is for the first candle. If we want the CMF value, we must calculate the CFV of each candle and add them together, and then divide it by the total volume of the whole period. For this, I made a table in Excel and this was the result:

Image edited by me in Excel

As you can see, the result of my calculation (CMF=0.18) agrees with the value of the CMF over period number 20 on the tradingview chart.

Image taken from: Source

2. Demonstrate how to add the indicator to the chart on a platform other than the tradingview, highlighting how to modify the settings of the period(best setting).(screenshot required)

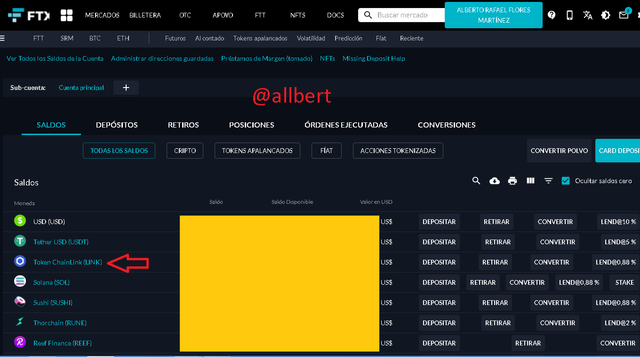

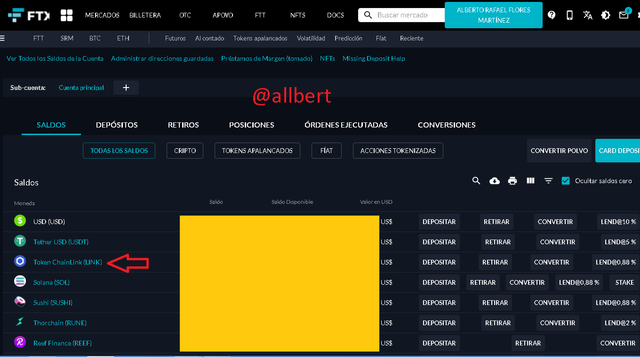

The demonstration will be done on the FTX centralized exchange platform. Naturally, the first step is to log in to the FTX website and then go to the Wallet section.

https://ftx.com/wallet

1-First we must select the token on which the operation is to be performed. In my case I selected chainlink.

Image taken from: Source

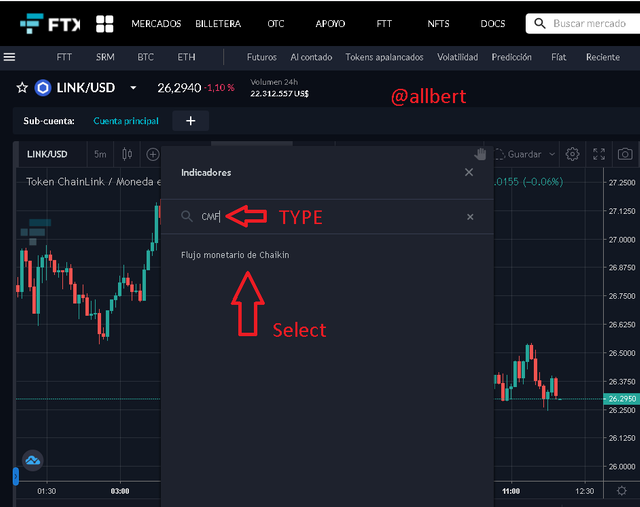

2-Then we click on the indicator button marked with the red arrow.

Image taken from: Source

Image taken from: Source

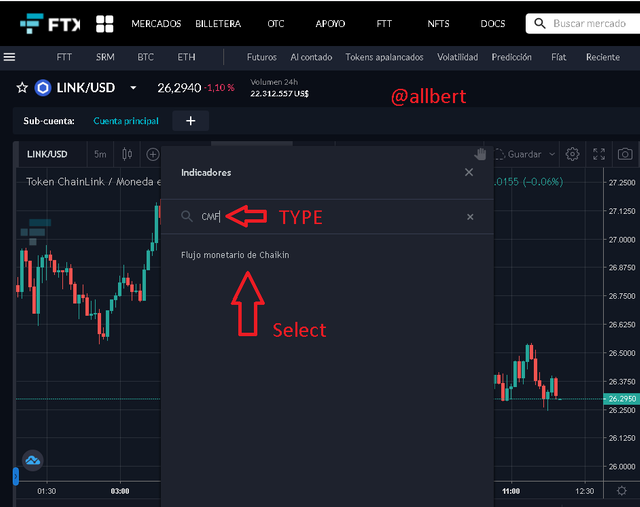

3-A pop-up window will appear, on which we must write "CMF" in an empty field. Then select the option shown.

Image taken from: Source

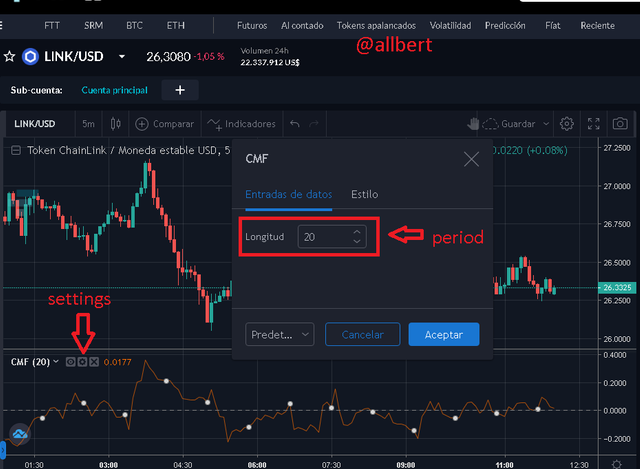

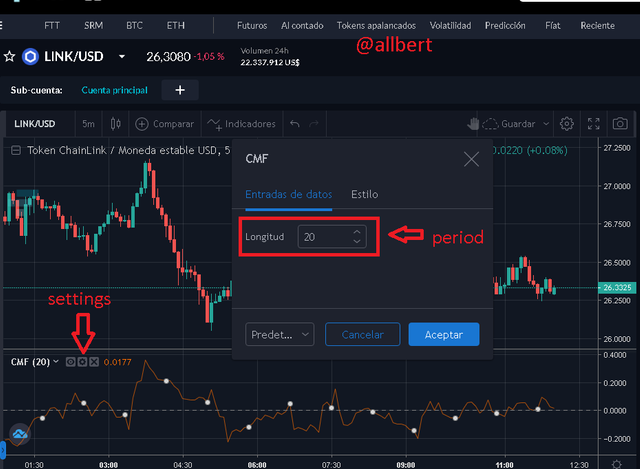

4-Once the indicator has appeared, click on the settings button. Another pop-up window will appear where we will configure the number of periods. By default, it will appear for 20 periods which is the most recommended for this indicator.

Image taken from: Source

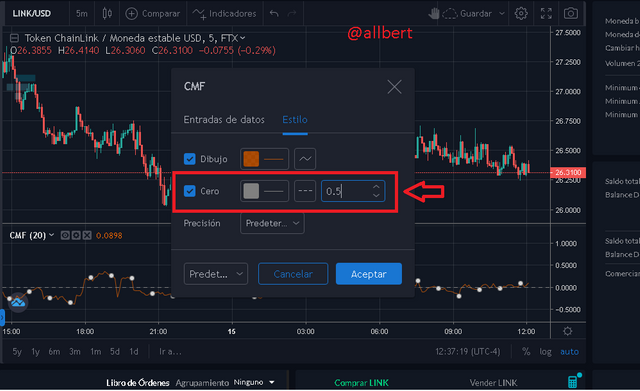

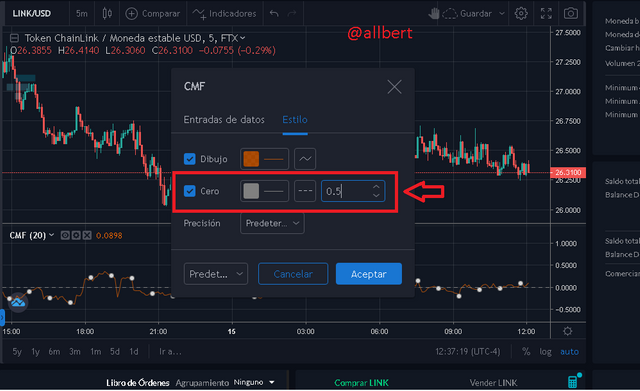

5- We also have another option if we select "STYLE". We will be able to set the appearance and the zero level of the indicator. By default, it is set to 0, but we can set it to 0.5, 1, 1.5, 2. With this, an auxiliary line will appear to mark some important level in our trading.

Image taken from: Source

6-Finally this is what the indicator looks like. Notice how the zero line is at the value of 0.5 as I configured it.

Image taken from: Source

3. What is the indicator’s role in confirming the direction of trend and determining entry and exit points (buy/sell)؟(screenshot required)

The CMF indicator indicates the buying and selling pressure on an asset, So if for example the price of an asset is in an uptrend and the CMF indicator is above the 0 level, then this is a confirmation that there is buying pressure and the uptrend is strong and will continue.

Image taken from: Source

If on the other hand the price of crypto is in a downtrend and the CMF indicator is below the 0 level, this is a confirmation that there is selling pressure and the downtrend is strong and will continue.

Regarding the entry and exit points (buy/sell), the signal will be given when the CMF Indicator line crosses the 0 line, depending also on where it crosses the line.

Sell Entry and exit

So if the indicator line breaks the 0 level from above, this is a sell entry confirmation. The exit will be when the indicator breaks the 0 line from below, which in theory would mark the beginning of the bullish pressure.

Image taken from: Source

Buy Entry and exit

If on the other hand, if the indicator breaks the 0 level from below, this is a buy confirmation. The exit will be when the indicator breaks the 0 line from above, which in theory would mark the beginning of the bearish pressure.

Image taken from: Source

4. Trade with a crossover signal between the CMF and wider lines such as +/- 0.1 or +/- 0.15 or it can also be +/- 0.2, identify the most important signals that can be extracted using several examples. (screenshot required)

For my example, I will perform a trade between the CMF indicator along the lines +/- 0.1, +/- 0.15 and +/- 0.2. What we expect is that the entry and exit signals will be provided by the interaction of the indicator with these levels.

In other words what we expect is for the indicator to break these lines. Depending on where the breakout occurs from we will determine whether we should make sell entries or buy entries.

Crossover signal between the CMF and +/- 0.1

Image taken from: Source

In this first case we can see that the buy signal occurs when the indicator crosses the +0.1 level from below, which is the confirmation of buying pressure and continuation of the uptrend. Later, the exit signal occurs when the indicator crosses the -0.1 level from above, so the trade is sold and closed, obtaining a 9% profit. The stop loss is placed below the nearest low peak.

Crossover signal between the CMF and +/- 0.15

Image taken from: Source

In this second case, the sell signal occurs when the indicator crosses the -0.15 level from above, which is the confirmation of selling pressure and continuation of the downtrend. Later, the exit signal occurs when the indicator crosses the level +0.15 from below, which is the confirmation of buying and closing the trade, earning 9.5% profit. The stop loss is placed above the nearest high peak.

Crossover signal between the CMF and +/- 0.2

Image taken from: Source

In the third case, we can see that the buy signal occurs when the indicator crosses the +0.2 level from below, which is the confirmation of buying pressure and continuation of the uptrend. Later, the exit signal occurs when the indicator crosses the -0.2 level from above, so the trade is sold and closed, obtaining a 34.7% profit. The stop loss is placed below the nearest low peak.

5. How to trade with divergence between the CMF and the price line? Does this trading strategy produce false signals?(screenshot required)

A divergence occurs when the CMF indicator is not in line with the direction of the asset price. In other words when we see that the price has a marked trend in one direction but the CMF indicator line goes in the opposite direction.

Typically this is a sign of exhaustion in buying or selling pressure depending on the current trend. So we can identify 2 types of divergences.

Bullish Divergence

Occurs when the price of the asset is in a marked downtrend forming lower low peaks lower, on the other hand, the CMF indicator forms higher high peaks higher. This divergence tells us that although the asset price is falling, at some nearby point it will change trend due to the exhaustion of the selling pressure signaled by the indicator.

Anticipating this trend change we can place a long entry (buy).

Image taken from: Source

The procedure I would use to trade this divergence would be to draw a trend line joining the high peaks of the price. Since there is a divergence I am sure that at some point the price will go back up, (the trend line will tell me this).

Then when the price breaks the trend line I make my buy entry. For the exit, I will consider a stop loss slightly below the recent low peak of the price, and for the take profit, I can consider a Risk/Reward ratio of 1:1 or 1:2 or 1:3.

Bearish Divergence

Occurs when the asset price is in a marked uptrend forming higher high peaks higher, on the other hand, the CMF indicator forms lower low peaks lower. This divergence tells us that although the asset price is rising, at some nearby point it will change trend due to the exhaustion of the buying pressure signaled by the indicator.

Anticipating this trend change we can place a short entry (sell).

Image taken from: Source

The procedure I would use to trade this divergence would be to draw a trend line joining all the low peaks of the price. Since there is a divergence I am sure that at some point the price will go back down, (the trend line will tell me this).

Then when the price breaks the trend line I make my sell entry. For the exit, I will consider a stop loss slightly above the recent low peak of the price, and for the take profit, I can consider a Risk/Reward ratio of 1:1 or 1:2 or 1:3.

False Signals

The CMF indicator is simple to calculate because it does not use many elements, but mainly volume and price action, which makes it susceptible to false signals during a divergence. That is why it is advisable not to use it alone.

For example, there may be a divergence that is indicating a bearish trend change, however, it happens that this may be a very early signal of a trend change that will not occur until much later.

Image taken from: Source

These early signals can cause us to get our trade wrong and place a sell (or buy) order too early, making us lose money.

Conclusion

After learning about the CMF indicator I understand why it is so well suited for novice traders. It is a simple to use, user-friendly indicator with easy to identify signals.

However, I don't consider it a good indicator to have as a primary indicator, because it is susceptible to false signals of buying pressure or selling pressure.

It is good to use the CMF indicator as a support indicator, or secondary indicator, which cannot help confirm signals from another indicator or confirm price trends. One of the negative aspects of the CMF is that it does not yield much information about support and resistance, so it is good to accompany trading with identifying liquidity levels for ourselves.

On the other hand, something I really like about this indicator is that it shows us in a very accurate way the buying and selling pressure of the market, with which we can clearly see the effect of this phenomenon on the price of the asset.

Image taken from: Source

Image taken from: Source

Hi @allbert

Thanks for participating in the Steemit Crypto Academy

Feedback

Total| 9.5/10

This is good content. Thanks for demonstrating your understanding of Trading using the Chaikin Money Flow Indicator.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

nice post, thanks for the information

very useful sir...

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

nice post, thanks for the information

very useful sir

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit