Hello Professor

@kouba01. It is wonderful to be able to receive again a class about this Indicator which is an invaluable tool for all of us.

Let's get start it!

Image edited by me in Powerpoint

1. Show your understanding of the SuperTrend as a trading indicator and how it is calculated?

Supertrend is a trend following indicator that basically helps us to identify graphically and easily what is the main trend of an asset as well as to anticipate trend reversals.

For this, it is based on the price as well as the volatility of the asset expressed in the form of a multiplier factor and the ATR (Average True Range) of the average price determined over a certain period.

Graphically it is expressed as an oscillating band around the price, which turns green below the price (lowerband) in an uptrend and on the other hand turns red above (upperband) the price in a downtrend.

An interesting fact is that being an indicator built from the average price, the lines of the indicator represent dynamic support (in an uptrend) or resistance (in a downtrend). To this feature we must add that the indicator will never go in the opposite direction to the trend they denote, therefore, at the time of divergence (indicator in the opposite direction to the price) in reality the Supertrend will show a horizontal line as a result of taking the value of the previous period.

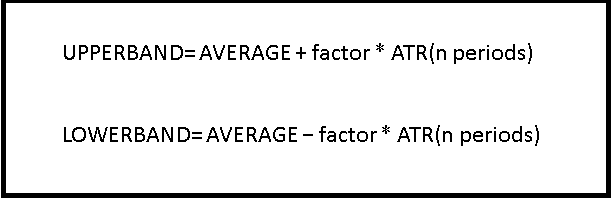

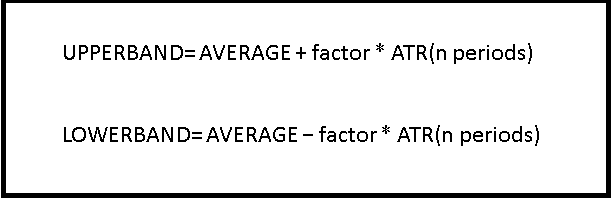

The above is explained with the formula for calculating both upperbands and lowerbands:

Image edited by me in Powerpoint

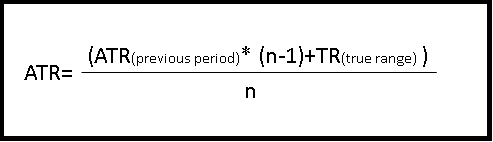

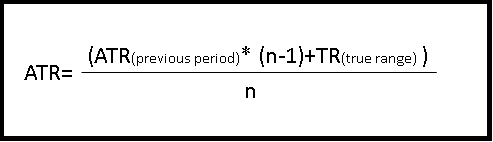

And the calculation of the ATR is through the formula:

Image edited by me in Powerpoint

Image edited by me in Powerpoint

Where n is the number of periods.

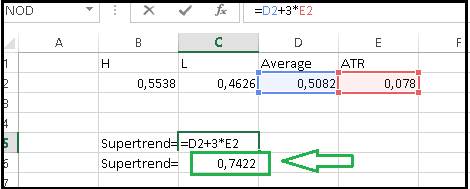

I will perform a real example taking data from the FET/USDT pair.

Image taken from: Source

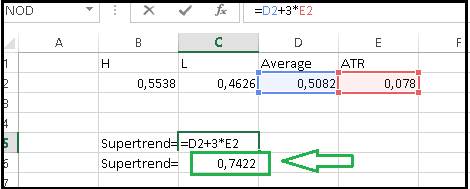

The first data will be taken from December 13th, where we can see that the highest value was 0.5538 and the lowest was 0.4626. Also, we can see the value of the supertrend indicator: 0.7422.

.

The calculation of the ATR can become a bit more complex, so I will take a shortcut by using the ATR indicator (n= 10 periods), placing it on the chart, and taking its value for that day which is: 0.078.

From all the data collected, I can build a formula in Excel, considering that clearly the price is in a downtrend and the upperband value will be used. I’ll use a multiplier factor = 3.

Edited by me in Excel

As can be seen, both results coincide. On the other hand, the value obtained is lower than that of the previous period, so the new value is placed on the graph. Now let's look at another example, the one for December 24.

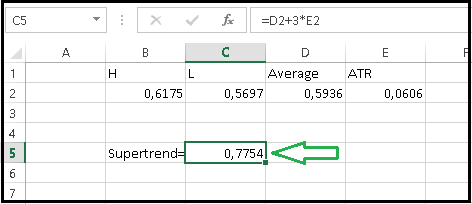

Image taken from: Source

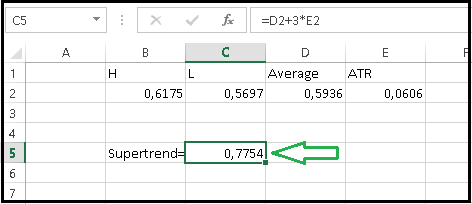

The data and calculation is as follows:

Edited by me in Excel

Again the formula is used to calculate the upperband, however, this time the value is higher than the previous period. For this reason, the new value is not drawn, but the value of the previous period is replaced, resulting in a horizontal line.

2. What are the main parameters of the Supertrend indicator and How to configure them and is it advisable to change its default settings? (Screenshot required)

The Supertrend indicator has 2 main parameters which are: Factor (multiplier) and ATR length (number of periods), as can be seen in the chart below.

Image taken from: Source

In tradingview, if we click on the "settings" button of the indicator, a pop-up window will appear with the options ATR length and Factor in the data entry menu. In both cases, you can change the amount by typing over the text field.

As already seen in the formula, this data represents the volatility level in the case of "Factor" and in the case of ATR length represents the number of periods taken into account to perform the ATR calculation.

In the case of Tradingview and other platforms, the default values are ATR length=10 and Factor=3, however, it is recommended to modify them according to the asset and timeframe to be traded.

For example, the Factor (multiplier) can be decreased to make it more sensitive to the variations of a less volatile asset such as stocks. In the example we see how by setting the factor= 1 the bands get much closer to the price and change color and direction more regularly, showing more buy and sell signals in a short period of time.

Image taken from: Source

The problem with this configuration is that because it is so sensitive it is susceptible to giving many false signals, therefore it is not recommended for use in very low seasonalities in highly volatile assets.

On the other hand, if you want to trade a volatile asset, such as cryptocurrencies, it is recommended to increase the factor to 4 or 5. This way the bands move away from the price and buy or sell signals will occur less frequently, thus filtering out the vast majority of false signals.

Image taken from: Source

As seen in the example, the number of trend changes is drastically reduced, with only long trends remaining.

However, it is advisable to backtest and adjust the indicator individually with each asset, thus defining which factor parameters and periods best fit the desired trade and timeframe.

3. Based on the use of the SuperTend indicator, how can one predict whether the trend will be bullish or bearish (screenshot required)

The term "predict" can be quite relative, as the supertrend indicator depends on the trader's settings of the main parameters. However, if done correctly, the Supertrend can accurately indicate the main trend of an asset.

If so it will be possible to observe how the supertrend indicator follows and confirms the direction of the main trend. Therefore when the indicator turns green and goes below the price we are in the presence of the main uptrend.

Image taken from: Source

If on the other hand the indicator is red and placed above the price, we are in a downtrend.

In addition to this, a simple way in which we can predict a trend change is by observing the direction of the indicator's bands. Normally the bands will move in the same direction as the main trend, however, when the price shows a pullback or reversal, the bands will start to be drawn as completely horizontal lines.

In this case, we should watch for the price to end up breaking these horizontal bands, as it may signify the early warning of a new trend to come.

Image taken from: Source

4. Explain how the Supertrend indicator is also used to understand sell / buy signals, by analyzing its different movements.(screenshot required)

The supertrend indicator can help to place buy or sell orders in a highly reliable position, as trend reversal signals (when properly configured) are only displayed when the reversal is confirmed.

For this case we should rely on the prediction strategy I explained in the last question.

So first of all we should look at the current trend of the supertrend and compare it with the price action. As long as the price is going in the same direction as the supertrend we don't do any trading.

As soon as the price starts to pull back we should be alert, but without making any entries yet. At this point, the supertrend will start to show longer and longer horizontal bands.

Finally, when the price breaks the current trend band and changes color we place our entry; For example:

Buy signals

In this case, we are first in a downtrend, however, the price shows clear evidence of reversal. Once the price breaks the upper band and the indicator changes color we place our entry for purchase.

Image taken from: Source

For the exit strategy, again wait for the supertrend indicator to change color (green to red), signifying a definite reversal of the main trend.

Even for the stop loss we can use the lowerband as a guide, and position it below the drawn curve as I indicate in the image.

Image taken from: Source

For this example, a 50% profit would have been obtained following this method.

Sell signals

For a sell entry, we would first be in an uptrend, however, the price must begin to show clear evidence of reversal. Once the price breaks the lower band and the indicator changes color we place our entry for sale.

Image taken from: Source

Again, for the exit strategy, you should wait for the supertrend indicator to change color (red to green), which means a definite reversal of the main trend.

5. How can we determine breakout points using Supertrend and Donchian Channel indicators? Explain this based on a clear examples. (Screenshot required)

The breakout strategy is based on the use of the Donchian Channel indicator (as the main indicator) in conjunction with the Supertrend indicator (as a filter).

In this strategy, we will look for breakout points through the Donchian Channel indicator, 2 consecutive breakout points to be more precise, and then compare them with the Supertrend signal. For example:

Buy signals

A buy position should be opened when two consecutive candlesticks break the upper limit of the Donchian Channel indicator. Additionally, the supertrend should indicate an uptrend to confirm that we are indeed in a bullish phase and the price will continue to rise.

Image taken from: Source

Sell signals

In the opposite case, a short position should be opened when two consecutive candlesticks break the lower limit of the Donchian Channel indicator. Additionally, the supertrend should indicate a downtrend to confirm that we are indeed in a bearish phase and the price will continue to decline.

Image taken from: Source

6. Do you see the effectiveness of combining two SuperTrend indicators (fast and slow) in crypto trading? Explain this based on a clear example. (Screenshot required))

This strategy has some similarities to the two EMA's strategies. Since you have two overlapping indicators with different values that interact with each other and with the price.

From this interaction, you can deduce several signals for buying and for selling, or simply as a confirmation of a trend. In this case, one looks for both supertrend indicators to be aligned in order to establish an entry order.

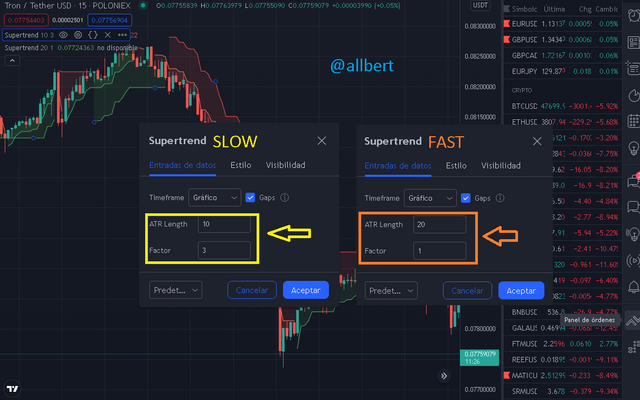

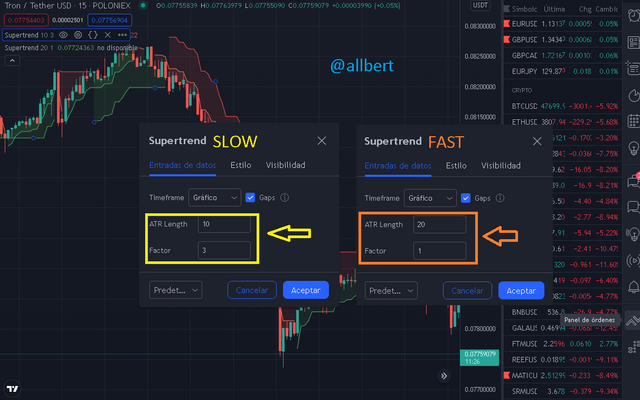

So we start with the setup, for which we must establish a slow and a fast indicator.

For the slow supertrend indicator we will take the default parameters ATR length=10 and Factor=3. On the other hand, for the fast supertrend indicator what we are looking for are parameters that make it more susceptible to changes, for that reason we will increase the parameters to a value that we consider appropriate. In my case, I set ATR length=20 and Factor=1. Remember that for the fast indicator we are looking for more sensitivity and that is achieved by increasing the volatility factor.

Image taken from: Source

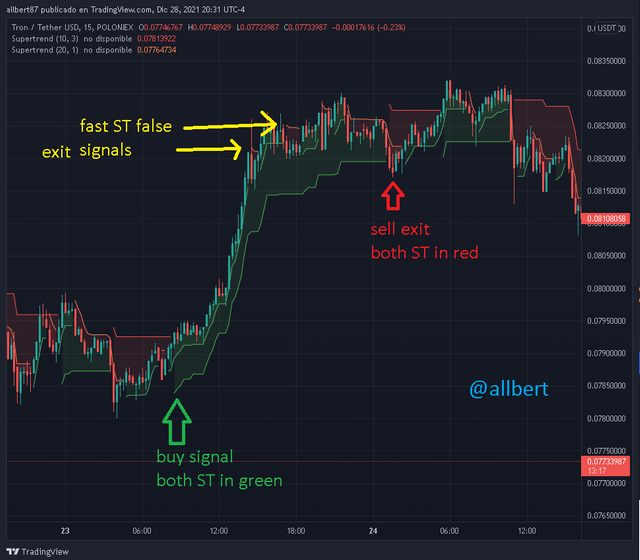

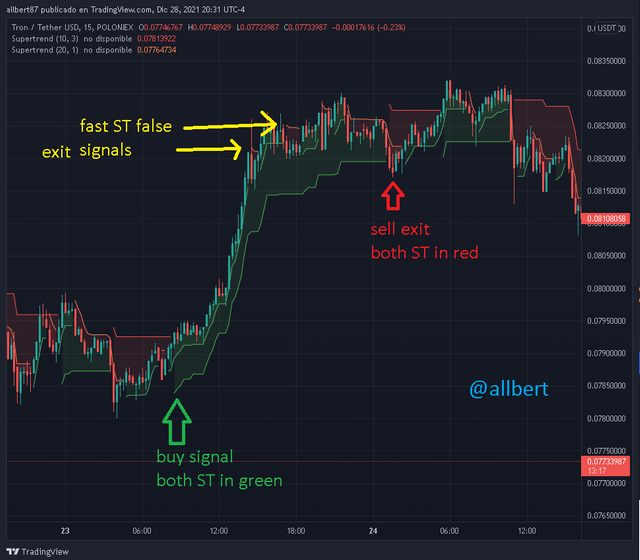

As already mentioned, basically the trigger for placing buy or sell orders will be when both indicators turn the same color.

Buy signals

In this case, the main trend must be bullish and this must be confirmed by the slow Supertrend. Then the entry to buy will be triggered at the moment when both indicators also change to green.

The exit will be when both indicators change to red, which will indicate a full trend reversal.

Image taken from: Source

Sell signals

In this case, the main trend must be bearish and this must be confirmed by the slow Supertrend. Then the entry to buy will be triggered at the moment when both indicators also change to red.

The exit will be when both indicators change to green, which will indicate a full trend reversal.

Image taken from: Source

Undoubtedly this, strategy has a certain degree of effectiveness, although personally I do not view it favorably due to some factors.

One positive aspect is that having a slow indicator probing the long-term trend behavior avoids exiting the trade early, as seen in the first example where several signals from the fast ST were filtered out by the slow ST.

On the other hand, although this strategy makes an entry at a good point, on exit valuable levels are lost because of the waiting time for both indicators to turn the same color, as I point out in the second example.

Personally, I find it more valuable and efficient to use the supertrend indicator with another indicator, rather than using two supertrends. Since we could use the supertrend as an additional confirmation against other elements of a different indicator, as in the case of the next question.

7. Is there a need to pair another indicator to make this indicator work better as a filter and help get rid of false signals? Use a graphic to support your answer. (screenshot required)

ABSOLUTELY. I totally agree in saying that the supertrend will always need other indicators to better filter its signals and ultimately give more accurate exit and entry points.

For my example, I will use a joint strategy of the supertrend with the parabolic SAR and the RSI, on the FTT/USDT pair at 1D timeframe. The parameters of the supertrend are 10:3 and the RSI at 14 periods.

In this case, I can use the parabolic SAR as the main indicator and the supertrend as a false signal filter. As we can see on the chart the SAR reacts first, positioning itself below the price, indicating a buy signal on July 24, however, we do not place our buy order until the end of July 28 when the supertrend changes to green indicating an uptrend.

Throughout the bull run, we observe that the SAR shows a sell signal in mid-August. However, that signal is not supported by the supertrend which is still in an uptrend. We, therefore, keep our long position open.

Image taken from: Source

Almost a month later we see that the price of the asset grew more than 59% since the SAR gave us a sell signal. In the first instance, the work of both indicators together allowed us to filter out a false trend reversal signal and made us gain almost 60% more than using only one indicator. But this is not over yet.

Image taken from: So,urce

For the exit strategy I will not only filter the signal with the SAR and supertrend but I will use the RSI divergence.

As you can see in the chart, between the two SAR exit points (peaks in the price) a bearish divergence in the RSI is formed, which tells us that the momentum of the uptrend is exhausted and at any moment a reversal will occur.

Image taken from: Source

If we were using only the SAR together with the supertrend we would have to exit just when the SAR and supertrend move above the price and signal sell. However, this does not occur until November 16. By the time this happens several price levels have been lost, dropping as much as 37%.

Image taken from: Source

Therefore, a strategy that I have learned throughout my research is that we can place our exit from the trade just when the RSI indicates divergence. This way we would be taking full advantage of the trend without losing levels due to the typical wait for the supertrend trend change confirmation.

8. List the advantages and disadvantages of the Supertrend indicator

| Advantages | Disadvantages |

|---|

| It offers clear and easy-to-understand signals. | Due to its simplicity, the Supertrend only relies on the study of two parameters that are not necessarily sufficient to offer a correct prediction of market movement. In fact, it may show false or delayed signals. |

| It offers an adjustable analysis by combining not only price action but also by taking into account a volatility factor that can be modified according to the asset being traded. | It is not a suitable indicator for novices, as it requires expert adjustment of the ATR and volatility factors as well as prior knowledge of the market. |

| It can function perfectly as a backup indicator for confirmation of the start of a new trend. | It only works when the market is in a marked trend. Not recommended for sideways moving markets. |

CONCLUSION

The supertrend indicator is a valuable tool for trend detection, confirmation, and monitoring.

Through it we have been able to realize that we can detect trend patterns in an easy, simple, and straightforward way, allowing us to make better entry decisions in our trading.

However, due to the inherent volatility factor in its formula, it can make it especially susceptible to give false signals that can make us make mistakes.

For this reason, it is recommended not to use this indicator alone, but to use it as confirmation support and filter of another more robust strategy or another main indicator.

It is also important to note that the main use of this indicator is in markets with a marked trend and that it is not recommended to operate in markets with lateral movements of distribution or accumulation.

Congratulations, your post has been upvoted by @scilwa, which is a curating account for @R2cornell's Discord Community. We can also be found on our hive community & peakd as well as on my Discord Server

Felicitaciones, su publication ha sido votado por @scilwa. También puedo ser encontrado en nuestra comunidad de colmena y Peakd así como en mi servidor de discordia

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit