Image edited by me in Powerpoint

1. Explain the Williams %R indicator by introducing how it is calculated, how it works? And what is the best setting? With justification for your choice.

How it is calculated

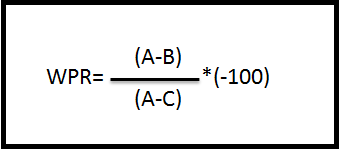

I will perform the explanation of the calculation by taking the data directly from a chart. To begin with, we will start from the formula of the indicator which is:

Image edited by me in Powerpoint

A: Highest price of the period.

B: Current price.

C: Lower quotation of the period.

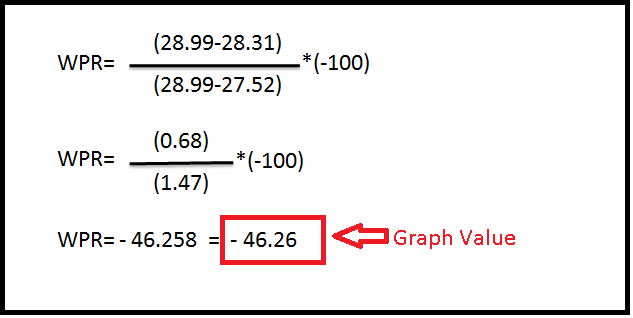

I will choose a period of 14 (completely inside the blue box) in the DOT/USDT pair to perform the example.

Image taken from: Source

Image edited by me in Powerpoint

What is the best setting?

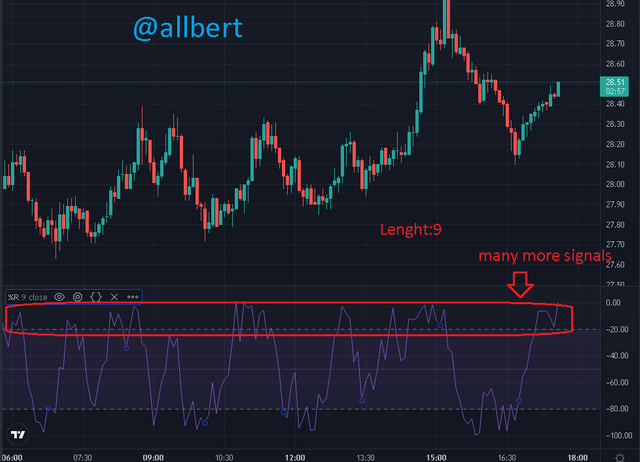

As we have seen with many other indicators, this answer really depends on the type of trading being done. Originally the indicator is programmed by default for 14 periods which is a standard length that allows it to be used for different uses in general. On the other hand, if you are looking for a more specialized use for example for a scalping or intraday operation I think it would be convenient to use a length of 21 periods with which the graph is smoothed and you are not at risk of receiving many false signals due to the sensitivity of the indicator. Look at what the WPR looks like with a very low set of 9 and a very high set of 50.

Image taken from: Source

Image taken from: Source

On the other hand, if you plan to perform long-term operations, it may be advisable to use low periods. However, this should be discovered with practice, since if you do not have enough experience with the indicator it is advisable to use 14 periods.

2. How do you interpret overbought and oversold signals with The Williams %R when trading cryptocurrencies? (screenshot required)

Image taken from: Source

Image taken from: Source

3. What are "failure swings" and how do you define it using The Williams %R? (screenshot required)

Image taken from: Source

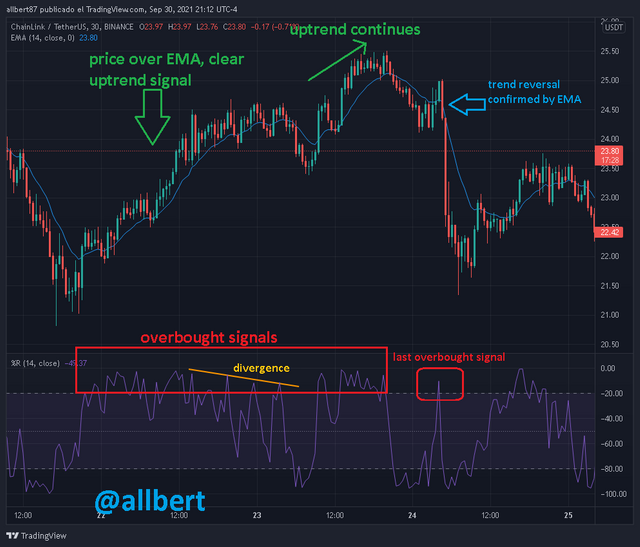

4. How to use bearish and bullish divergence with the Williams %R indicator? What are its main conclusions? (screenshot required)

Image taken from: Source

Conclusion:

In this case, we can see that although the price is in a marked uptrend, the WPR makes a divergence producing lower and lower overbuying peaks. This indicates buyer fatigue, therefore it is imminent that the price will start to fall.

It is therefore recommended to place a sell entry just at the moment where the price action indicates that the downtrend begins.

Image taken from: Source

Conclusion:

In this second case we can see that although the price is in a marked downtrend, the WPR makes a divergence producing higher and higher oversold peaks. This indicates a sellers' fatigue, therefore it is imminent that the price will start to rise.

Therefore it is recommended to place a buy entry just at the moment where the price action indicates that the uptrend begins. Note that in both cases we must wait for the price action to indicate a change in trend before placing the entry order. For both cases, I am using a stop loss below or above the low risk/reward trend. For the take profit, I follow a 1:1 or 1:2 risk/reward ratio.5. How do you spot a trend using Williams %R? How are false signals filtered? (screenshot required)

Image taken from: Source

6. Use the chart of any pair (eg STEEM/USDT) to present the various signals from the Williams %R indicator. (Screen capture required)

Image taken from: Source

1- We start with an oversold signal which syndicates a change in trend and the beginning of a bullish phase in the price.

2- During the beginning of the bullish phase the WPR generates several overbought signals, however, the trend is far from changing.

3-The overbought signals predict a small pullback in price. But after the pullback reaches the end a failure swing is generated indicating that the price resumes the main uptrend.

4 & 5-During the continuation of the uptrend two divergences are seen in the WPR which shows lower and lower overbought peaks. This indicates a loss in the momentum of the trend. A trend reversal is imminent.

6- A new failure swing confirms the definitive trend change. The downtrend begins.

7- When the new downtrend begins, several failure swings occur in the WPR. These failure swings predict the momentary trend change due to price retracement.

8-Finally the failure swings are confirmed by a copper sell signal that confirms the price retracement.

CONCLUSION

Through the measurement of the strength of the trend, we can predict a change of trend by detecting the loss of momentum of sellers or buyers.

On the other hand, we have observed that this indicator is a bit erratic since it shows too many signals and not all of them are reliable.

For this reason, it is advisable to use this indicator in conjunction with other indicators that can serve as confirmation. These other indicators will serve as a tool to filter out false signals.

Finally, it is important to note as always that we must accompany our trading operations with responsible risk management, and not download all the responsibility on an indicator.

Hello @allbert,

Thank you for participating in the 4th Week Crypto Course in its 4th season and for your efforts to complete the suggested tasks, you deserve a Total|8.5/10 rating, according to the following scale:

My review :

Good work in general in which the answers differed in their analysis and interpretation, and these are some notes.

Thanks again for your effort, and we look forward to reading your next work.

Sincerely,@kouba01

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit