Image edited by me in Powerpoint

1. Discuss Dark Pools in Cryptocurrency in your own words. How does dark pool works?

How does dark pool works?

The reason why an institution chooses a Dark Pool is that they can exchange large amounts of a crypto asset without it generating market sentiment which in turn affects the price as it does on a traditional public exchange... as in the case of Binance, FTX, OKEX, Bittrex, etc. This happens because the dark pool operates in isolation and hidden from the market of a cryptocurrency and it is the users themselves who set the buy and sell prices. When the prices of the orders of the counterpart users match, then the exchange is executed which is called "block trade" which represents high amounts of money. As the buy price matches the selling price the slippage is reduced. Before continuing I should clarify that within a Dark pool there is no order book visible to all, so there is no way to check the positions taken by the other members before they are filled. The reason it works this way is to avoid making the intentions of the users known and thus avoid the fear effect on the market that can ultimately affect the price of the asset. Therefore a fair and speculation-free price is achieved for all users. A final consideration with respect to the operation of Dark pools is that only trading with own funds is permitted; trading with collateral or trading on margin is not permitted.

2. Discuss any crypto exchange that offers a dark pool. How does its dark pool work?

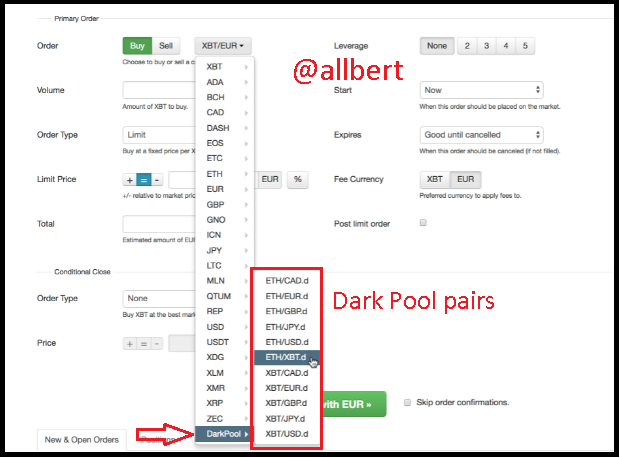

Kraken Dark Pool

Image taken from: Source

How does it works?

Within the Kraken dark pool, there are two important factors, the first: there is no order book and second: market price orders are not allowed, only limit orders. For this reason, no user can see the positions of other users and take advantage of them. Rather, buy-sell orders are placed anonymously and at some point must match to complete the block trade. The system is responsible for matching the orders. When the buy-sell prices match, the limit orders are executed and Crossed, so that the trades are not recorded in any order book. An important factor of Kraken's Dark pool is that it does not set different fees for market takers or market makers, (both have the same rates) so it is impossible to know which of the two groups you belong to. This adds even more privacy to the operation. However, even with all its apparent advantages, Kraken's Dark Pool still belongs to an Exchange with a centralized entity that controls all transactions and can manipulate the environment in a negative way. I will talk about this topic later.

3. What are the supported assets on the dark pool mentioned in (2) above? What are the requirements for getting involved in dark pool trading on the platform? Is there any fee attracted? Explain.

| ETH pairs | BTC pairs |

|---|---|

| ETH/BTC | BTC/ETH |

| ETH/CAD | BTC/CAD |

| ETH/EUR | BTC/EUR |

| ETH/GBP | BTC/GBP |

| ETH/JPY | BTC/JPY |

| ETH/USD | BTC/USD |

Requirements

All data shown is taken from the Kraken website (https://support.kraken.com/hc/es/articles/360001391906-Introduciendo-el-Dark-Pool-de-Kraken). However, all comments and analyses are my own.These requirements are targeted especially at the size of the user's Capital, so first of all, we have to:

There is also a special requirement, which has to do with the fact that Kraken has intended this service for a certain type of customers, therefore:1-The minimum order size for trade in currency pairs and BTC is approximately 100000 USD.

2-The minimum order size for trade with currency pairs and ETH is approximately 50000 USD.

3-You must have a verified account (individual or corporate) at the PRO level. This is the last level of verification after Basic, Express, and Intermediate. To obtain a verified PRO account the requirements are:

I don't know what you may think, but all of these requirements definitely take away the "PRIVATE" part of the Dark Pool.3.1-Proof of Residence Document, including Insurance statement, Tax document, Residence certificate, among others.

3.2-Valid government-issued ID documents such as passports or driver's licenses.

3.3- Face Photo if you live in the USA or South Africa.

3.4- Social Security Number or Individual Taxpayer Identification Number, only if you live in the United States.

4-Finally the last requirement is that you can only place limit orders.

Is there any fee attracted?

Actually YES... the idea behind Kraken's Black Pool is that the more people use the service the lower the commissions will be. Remember also that within the Black pool, the commissions for takers and makers will be equal, so there is no inequality of fees as there is with other services such as stable coins & FX pair, Margin, or Futures. In fact, the commission rate is around 0.20% to 0.36% applied for both, so anonymity is maintained.

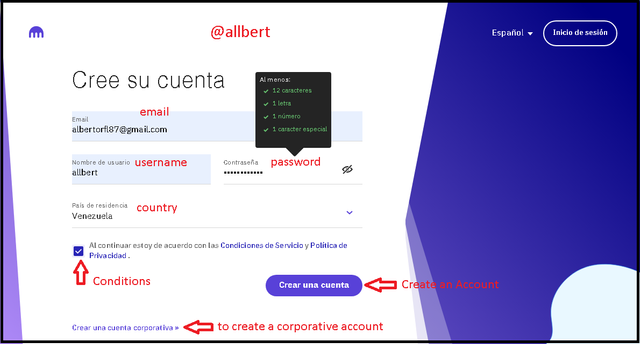

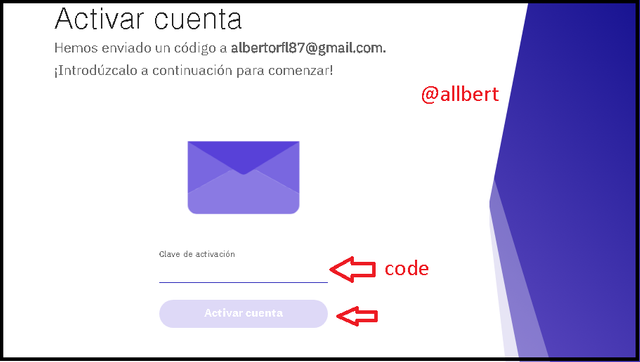

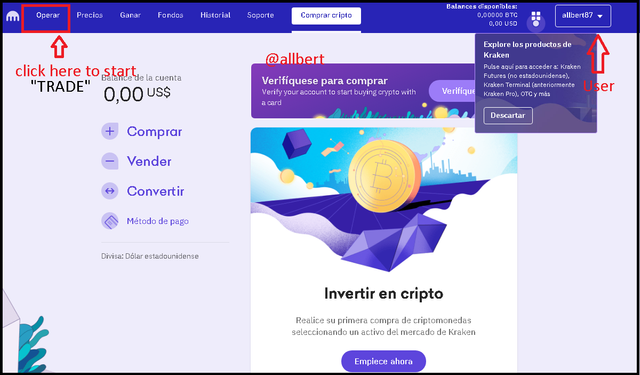

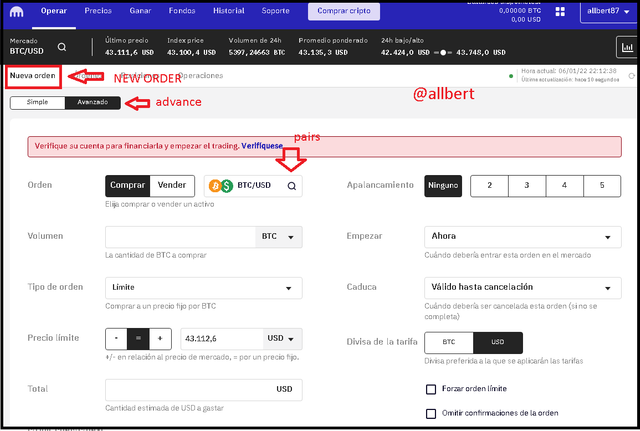

4. For the chosen dark pool, give a brief illustration of how to perform block trading on the platform. (Screenshots required).

Image taken from: Source

Image taken from: Source

Image taken from: Source

Image taken from: Source

Image taken from: Source

5. What's your understanding of the Decentralized dark pool? What do you understand by Zero-Knowledge Proofs?

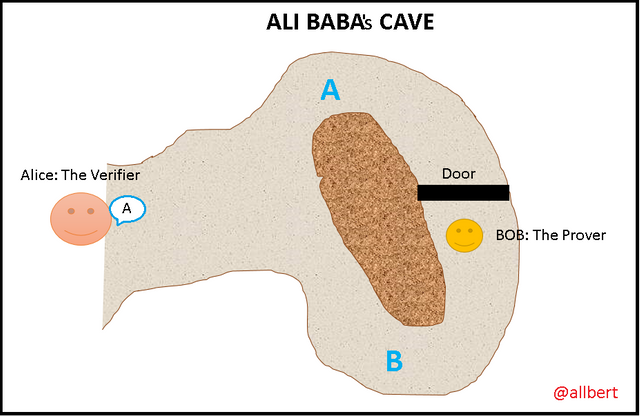

Zero-Knowledge Proofs

In short, it is a cryptographic protocol whose function is to verify or prove the veracity of a piece of information without having to reveal the data that proves it. In this protocol, there are two figures: a prover and a verifier. The function of the prover is to mathematically prove to the verifier that a statement is correct without revealing any additional data. It is possible to prove and verify information without revealing data to third parties, so it works perfectly as a security and privacy protocol. The best example I know to explain Zero-Knowledge Proofs is the example of Ali Baba's cave, Bob and Alice. Let's imagine that Ali Baba's cave has two paths (A/B), and both paths communicate through a door with a secret code; Bob (Prover) knows the code, and Alice (Verifier) wants to buy the code. How to check that Bob truly has the code without revealing it? Well, that's how Zero-Knowledge Proofs works: Bob would enter the cave by one of two paths, without Alice knowing. Then Alice would shout and request Bob to exit by one of the two random paths. If Bob really knows the code no matter which way Alice tells him to go he will be able to get out 100% of the time in the requested path. It is true that there is a 50% chance that Bob could fool Alice on one occasion, but that probability would be reduced to 0 if the same procedure is repeated several times.

Image edited by me in Powerpoint

It is for this reason that Zero-Knowledge Proofs is used in Decentralized dark pools, due to the ability to verify exchange operations in an environment where privacy and anonymity are key. This protocol provides an additional layer of security.

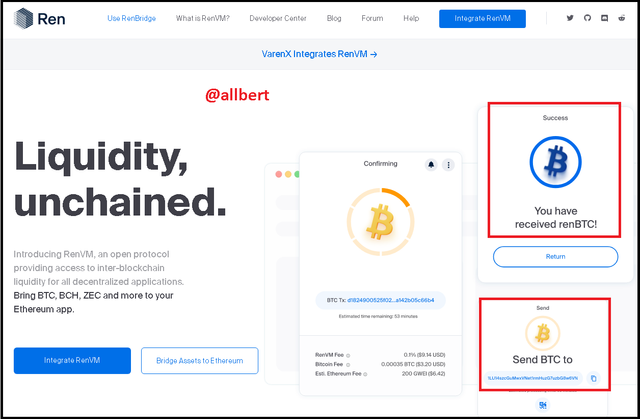

6. State one decentralized dark pool in cryptocurrency and discuss it. How does it work?

Image taken from: Source

The key point in REN Protocol is the "Ren Virtual Machine" (RENVM), which allows generating private transactions in parts (fragments). For this, it uses the ZK-Snarks which is a kind of zero-knowledge proof.

However this is not all, Ren Virtual Machine can be replicated in other Virtual Machines called Dark Nodes, which can be in the VPS of personal computers. Dark Nodes can communicate with each other and increase computational power and storage. In addition, a Dark Nodes host receives rewards from transaction fees.

Dark nodes play a crucial role because it is between them that the encryption process of the operations in the dark pools takes place. When an order is activated, the information is divided into several parts and distributed among the dark nodes; which then perform the necessary calculations to reorder them; then the verification occurs with the zero-knowledge proof, and finally, the exchange of the assets is approved. With this development, Ren not only solves the problem of liquidity in the market but also interoperability, keeping transaction data completely secret.

7. Compare a crypto centralized exchange dark pool with a decentralized dark pool. What are the distinctive differences?

| Centralized | Decentralized) |

|---|---|

| 1- Privacy is relative since the Exchange knows your personal data. | 1- No one knows your personal data or your identity. |

| 2- Although no user can see the orders, the central Exchange server which controls everything can see them and therefore filter the information. | 2- Absolutely no one could see the orders because the whole process works with Smart contracts. |

| 3- Less secure in terms of privacy. | 3- In terms of privacy, it is more secure. |

| 4- There are several minimum requirements for an exchange such as the minimum amount of funds and completion of a KYC form. | 4- The only requirement is to have a crypto wallet.. |

| 5- The entire process takes place within the Exchange platform which makes it susceptible to hacking. | 5- The process is divided into nodes for more security. To hack the process you would have to alter all the nodes. This is virtually impossible. |

| 6- It only allows the exchange of a few crypto-assets and fiat currencies. | 6- It allows the exchange of a wide variety of cryptocurrencies such as BTC, ETH, Bitcoin Cash, Zcash, and Doge, among others. It also allows the conversion of a currency from one network to another, such as renBTC. |

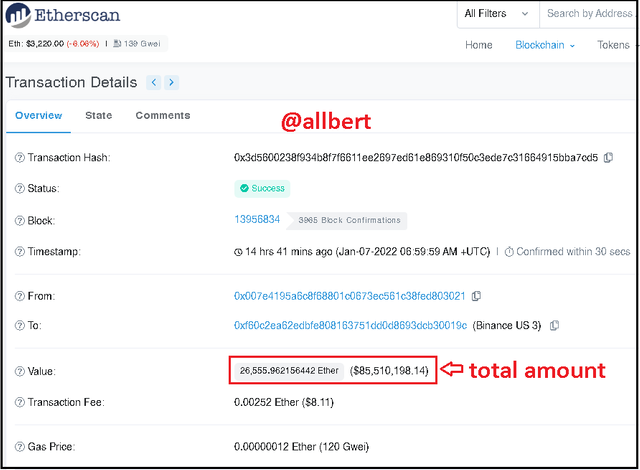

8. Research any recent huge sale in any market in the crypto ecosystem and how it has affected the market. What difference would it have made if the dark pool was utilized for such sales?

Image taken from: Source

Image taken from: Source

It is clear that we are in a bearish phase of the market, however that sale alone drove the price down, and I am sure that over the next few days it will drive the price down even further. The sale was made on the Binance Exchange.

What difference would it have made if the dark pool was utilized for such sale.

It is logical to realize that selling such an amount of ETH on a public exchange puts selling pressure on the asset price. This concluded in the price falling. It could not be otherwise, the operation is so public that it was even publicized on a news portal: > Read Article Additionally, it is logical to think that if he made the trade on Binance he had the opportunity to make a limit or market trade. I think it was market because if it had been reflected in the order book maybe the price would have dropped more. On the other hand, if this trade had been done in a Dark Pool, the price would not have fallen that way in the first place. As I said before it is true that we are in a bearish cycle, but for ETH to fall more than 4% it takes a large sum of money. Making the sale in a Dark pool makes the transaction data confidential, therefore it is not released to the general public and therefore does not generate market sentiment. On the other hand, for that specific user I think he did not sell at the price he wanted, he had to have suffered slippage to some extent. Had he made the sale in a Dark Pool he would have received a better price for his 26,555 ETH.

9. In your own opinion, qualitatively discuss the impacts of trades carried out in the dark pool on the market price of an asset. (At least 150 words).

Similarly, just the existence of a buy and sell order for a gigantic volume in the order book would generate sentiment in the general public... bullish or bearish sentiment depending on whether the orders are buy or sell.

However, this traditional Market principle does not apply to the Dark pool (or at least not directly). It is true that by operating in isolation and secret from the public, a Dark pool block trade does not affect the public exchange price instantly, since as no one knows of the existence of the limit orders or their volume, no expectation is generated.

However, although it may not seem like it, dark pools indirectly affect the traditional public market. The effect of dark pools is not immediate (during the execution of the block trade) but afterward when the exchanged funds return to the market.

It is usual that when an institution sells its assets it does so gradually, however, if a dark pool is made at a lower price and then injected into the market a difference is obtained, an imbalance.We are talking about a huge amount of assets suddenly appearing and bursting into the Market, changing the supply and demand balance. This can affect the price as wildly as a public sell-off would, since the movements do not occur organically.

The same effect can occur before the dark pool occurs, as the funds to add liquidity must come from somewhere. Most likely at least some of the liquidity will come from the public market which must be affected in some way by the withdrawal of capital or cryptos from circulation.

10. What are the advantages and disadvantages of Dark pool in Cryptocurrency?

Advantages

1-First of all, I think the biggest advantage is that Dark Pools allow the price of assets to remain more stable. If not for them the price would fluctuate more volatile to how it normally happens. 2-For those fortunate enough to participate in them, dark pools offer additional security of not revealing their identity or wealth publicly. Since some wealthy individuals may become targets and victims of organized crime. 3-Allows adding liquidity to the market and in the case of decentralized dark pools, rewards are offered to other people (nodes) from trading fees. 4-Better bid/ask prices can be obtained, more in line with the user and with relatively low slippage.Disadvantages

1-The first disadvantage I think of is the lack of transparency. Because they are highly exclusive and private operations, dark pools can function as places to cover up transactions related to drug trafficking, white slavery, human organs black market, terrorism, money laundering, organized crime, etc. 2- In the case of centralized dark pools, privileged information can be sold to third parties about buy or sell orders. Conflicts of interest can be generated. 3-Since there is no order book, there is no way these processes can be audited. 4-The impact on the market is not completely eliminated, as the liquidity provided in a dark pool must come from somewhere...usually the public sector, which can be affected when injecting funds into the dark pool. 5-Personally I feel it is a service created for whales, by whales to benefit whales... and therefore relegates retail traders.

CONCLUSION

I am sure that every day more and more exchanges and platforms will begin to offer the services of Dark Pools; since it is a constant of the market and human operations to move in the direction where the money is.

The dark pools offer crypto exchange services with large sums of money in a private and secure way. This is an attractive business for any exchange platform.

In a very personal opinion, maybe this can be bad for the rest of the traders since every day the exchanges will focus more on the needs of the few with a lot of money than the many with little money.