Hello again Professor

@sapwood. I am really surprised by the potential of these indicators, I had never known them before and I think they are wonderful because they help us to understand in more detail why the supports and resistances that we see in the charts occur, and why the prices of an asset behave as they do.

Let's go!

Image edited by me in Powerpoint

1. What do you mean by Global In/Out of the Money? How is a cluster formed? Explain ITM, ATM OTM, etc with examples?

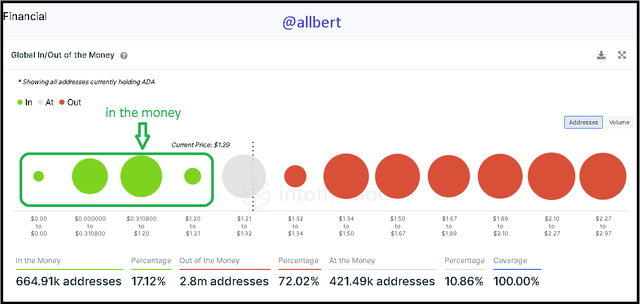

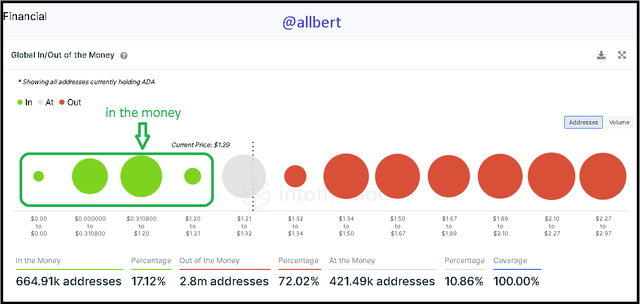

I wish to get straight to the point on this topic, as it is an extremely simple concept to understand. Global In/Out of the Money is an on-chain metric that shows how many addresses own a Crypto asset, in what proportion, and whether they currently have gains or losses relative to their purchase price and current price.

Although it is certainly a simple concept it is actually very useful and powerful, as in a very visible way it can reveal whether an asset is in bearish or bullish momentum showing us whether the majority of accounts are (in the money) or (out of the money).

How is a cluster formed?

The way this on-chain metric works is by grouping the addresses into "Clusters". This is done because it would be really impractical to show the thousands or millions of account addresses separately.

For this reason, the cluster grouping process starts by collecting the purchase price information for each account that holds the cryptocurrency separately and then associating them into groups with relatively close purchase prices. This is the reason why a cluster has not only the volume of the held asset but also a minimum and maximum price range which represents the whole range of addresses that bought the cryptocurrency between those prices.

It is this clustered structure that allows to easily compare then with the current price of the asset and to establish the following concepts:

ITM

Means "In the money" and refers to all those clusters whose maximum purchase price is below the current price of the asset, or in other words, when the current price of the asset is higher than the upper price range of the cluster. It is said that when a cluster is in the money, the totality of the addresses that conform to it is in profit because the current price is higher than their purchase prices.

As we can see in Cardano's GIOM, the green clusters (green circles) represent all the accounts that are in the money.

Image taken from: Source

At the moment there are 664.91k addresses in the money, which equates to 17.12% of the total number of accounts holding the ADA token.

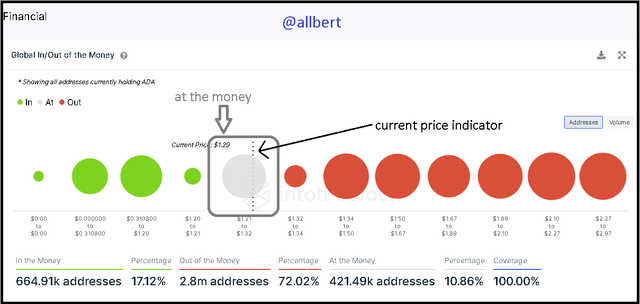

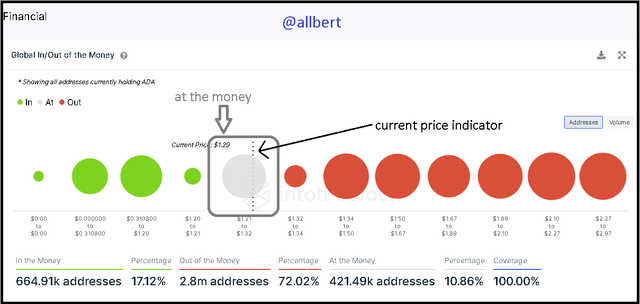

ATM

Stands for "At the money" and refers to the cluster in which the current price of the asset is just inside the high and low price range. It is said that when a cluster is at the money a portion of the addresses that make up the cluster are in profit and another portion is in the loss.

As we can see in Cardano's GIOM, the gray cluster (gray circle) represents all the accounts that are at the money.

Image taken from: Source

At the moment there are 421.49k addresses at the money, which equals 10.86% of the total number of accounts holding the ADA token.

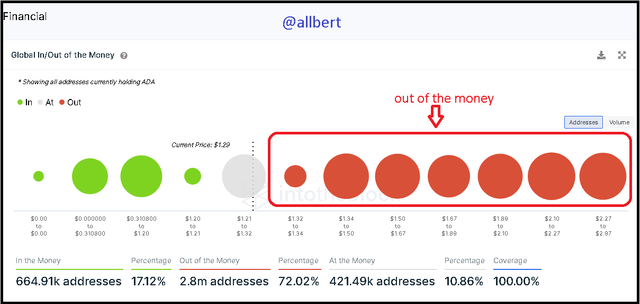

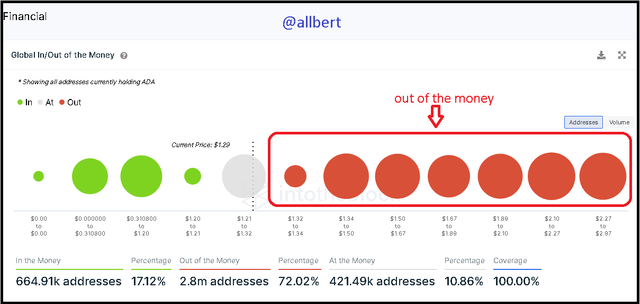

OTM

Stands for "Out of the money" and refers to all those clusters whose minimum purchase price is above the current price of the asset, or in other words when the current price of the asset is lower than the lower price range of the cluster. It is said that when a cluster is out of the money, the totality of the addresses that conform to it is in loss because the current price is lower than their purchase prices.

As we can see in Cardano's GIOM, the red clusters (red circles) represent all the accounts that are out of the money.

Image taken from: Source

At the moment there are 2.8 million out-of-the-money addresses, which equates to 72.02% of the total number of accounts holding the ADA token.

The ratio between green (in the money) and red (out of the money) clusters tells us whether there is buying or selling pressure. In this particular case (Cardano) there is currently selling pressure because there are more addresses belonging to out of the money clusters.

2. Explain about Large Transaction Volume indicator with examples? What is the difference between Total and Adjusted Large Transaction Volume?Examples?

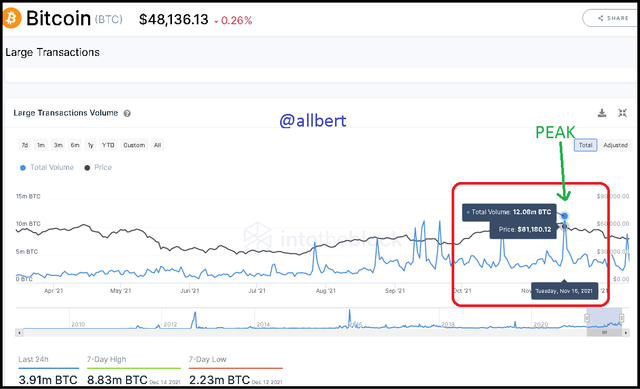

The Large Transaction Volume indicator simply records the volume of transactions made greater than 100,000 USD involving the crypto asset. Since 100000 USD is considered to be an amount of money that a retail trader does not handle, this indicator is considered to be a guide to identify the movement of whales and financial institutions in the market.

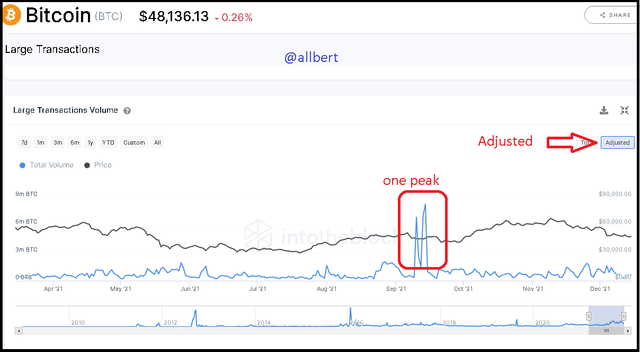

Graphically, this indicator behaves as a smooth curve representing the volume of the crypto asset. When a trade occurs above 100000USD the indicator registers it as a spike in the volume curve. These spikes represent the whales' interest in a certain asset.

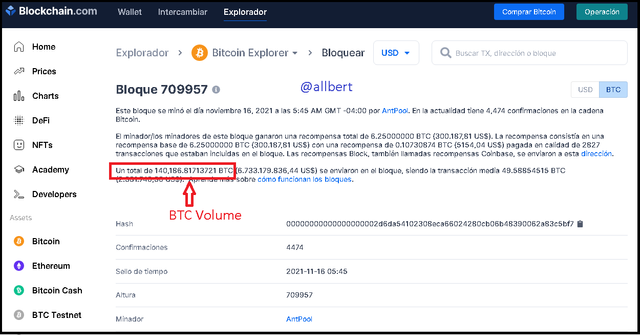

As an example of this case, I will take BTC because I intend to explore the blocks in the explorer

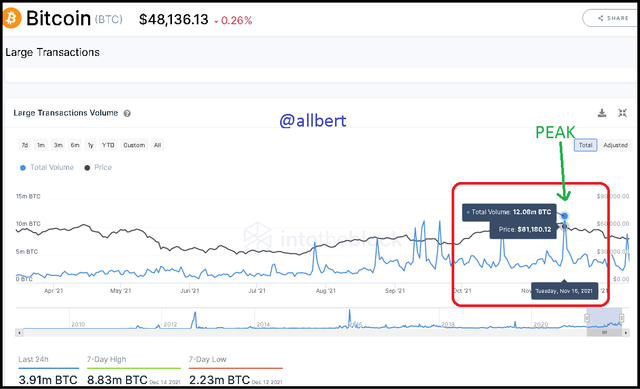

https://www.blockchain.com/ . First of all, we can see on the previous 6-month chart of the Large Transaction Volume indicator that on Tuesday, November 16 there was a 12m spike in BTC.

Image taken from: Source

That spike caught my attention because right after that occurs the decline in BTC prices after its ATH, which makes me suspect that maybe they were sell trades that occurred at the 61k USD level.

To be honest, I thought I would have a much harder time finding the blocks of those trades, but it turns out I have both the day and the price, so thanks to Tradingview I located that the price was in that range around 00.00hrs – 01.00hrs, 05.00 hrs, 10.00hrs, and 18.30hrs;

Image taken from: Source

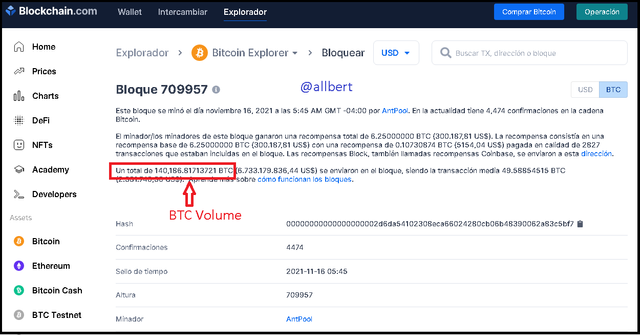

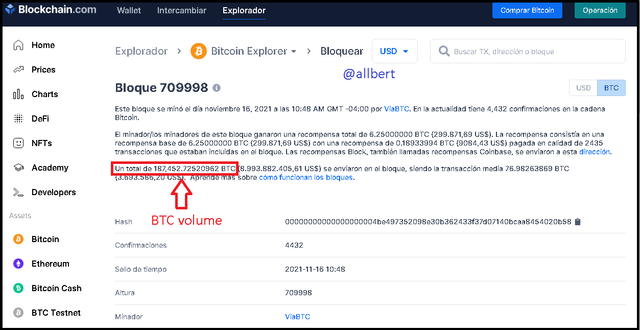

which allowed me to find this:

Image taken from: Source

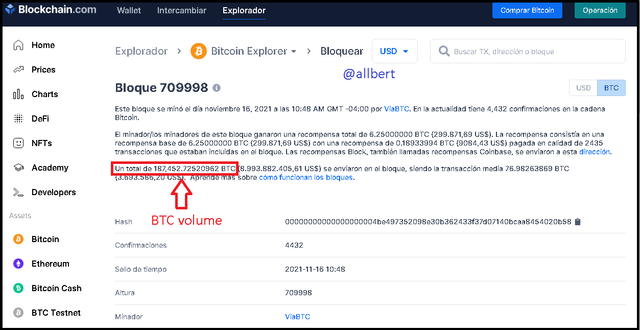

And this:

Image taken from: Source

Given the average number of trades made that day, those two blocks stand out above the rest due to their high volume (although I also found 3 more blocks that exceed 120000 BTC ).

This leads me to conclude that some of the trades that the Large Transaction Volume indicator highlighted on November 16 may be contained in those blocks.

Total and Adjusted Large Transaction Volume

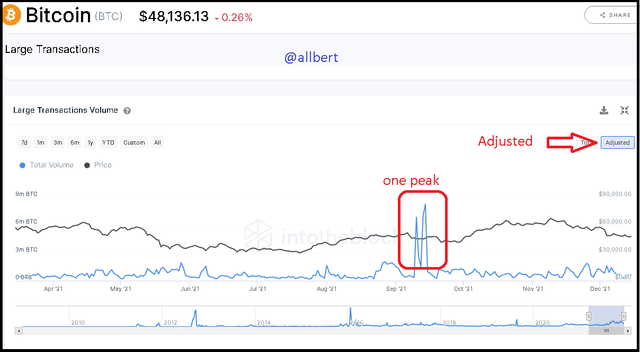

This indicator can be configured on two types of basis: Total and Adjusted, which are two different ways of viewing the information.

On the one hand, we have the Total base which shows in a crude way all the transactions made over 100000 USD without making any distinction as to the origin of the tokens (source account - destination account).

On the other hand, the Adjusted base generates a filter where the transactions that return to their origin address are automatically eliminated. Only the rest of the operations greater than 100,000 USD that do not return are reflected. For example:

Suppose that from my address I send to Sapwood 200000 USD, but then Sapwood returns them back to my address. First of all the view generated on the TOTAL basis will reflect 2 separate peaks, however, the view generated on the adjusted basis will not show any peaks at all, as shown in the graphs.

Image taken from: Source

Image taken from: Source

As we can see, the graph in TOTAL shows the "totality" of operations, however when switching to adjusted the number of peaks is drastically reduced to only one, which leads us to conclude that the rest of the operations registered by the indicator were transactions that returned to their address of origin.

3. Analyze a crypto asset(other than BTC) using on-chain metric: GIOM, and Adjusted Large Transaction Volume? Ascertain whether it supports a Bullish or Bearish bias or Neutral? How do you find the support and resistance using GIOM? How do you ascertain the upside/downside momentum using GIOM? Use InTotheBlock app or any suitable app? (Examples/Screenshots)?

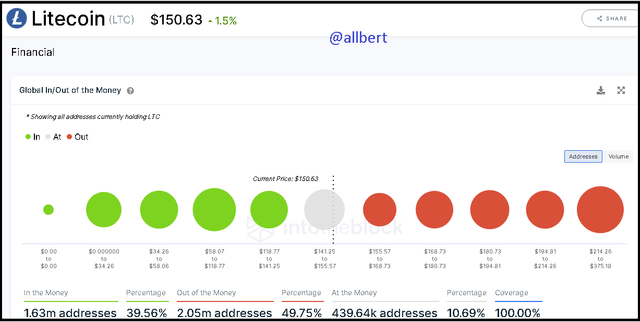

The crypto asset I will analyze will be Litecoin (LTC) and I will do so using the on-chain metrics provided by intotheblock the day December 16th, 2021.

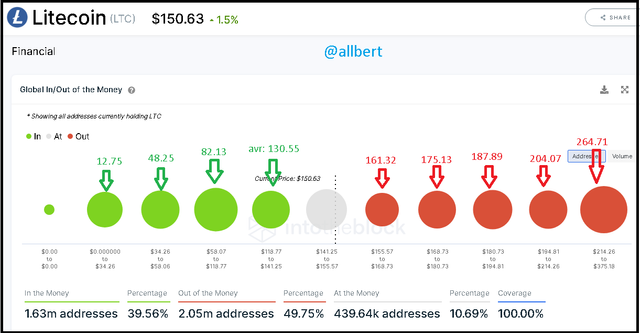

GIOM

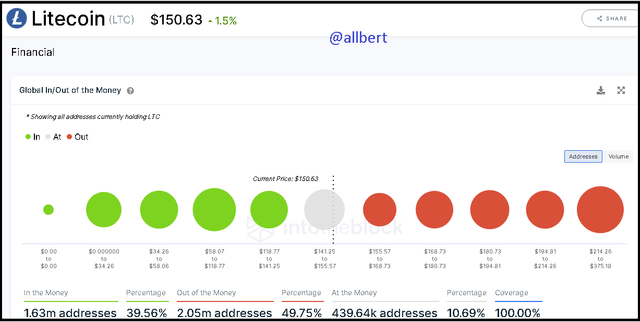

We start with the Global In/Out of the Money indicator, which shows a total of 1.63 million addresses in the money and 2.05 million addresses out of the money, therefore ITM is 39.56% and OTM is 49.75%, leaving ATM at only 10.69%.

Image taken from: Source

As you can see the buying and selling forces are relatively balanced, almost neutral, showing a slight inclination to a bearish bias.

Supports and Resistances

Short-term

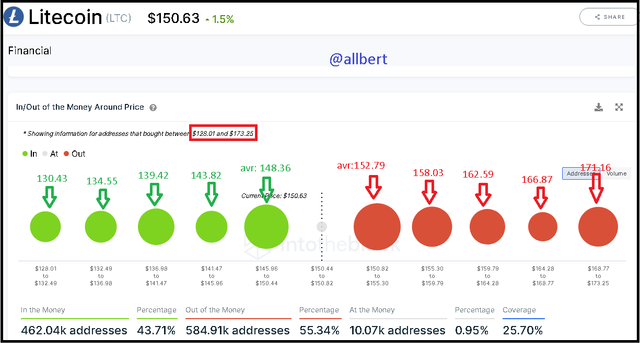

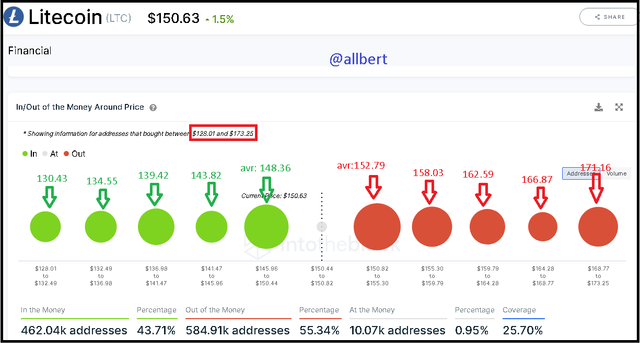

Regarding the definition of support and resistance, we will check the short-term data or information for addresses that bought between $128.01 and $173.25 through the In/Out of the Money Around Price indicator.

Image taken from: Source

In this case we observe an even more marked balance of forces, with ITM 43.71% and OTM 55.34%.

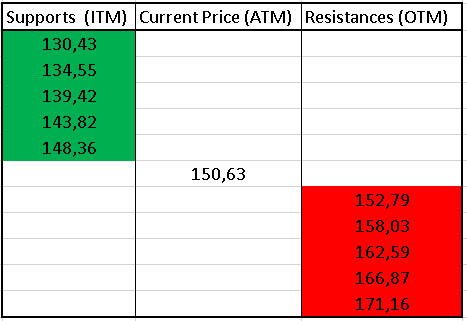

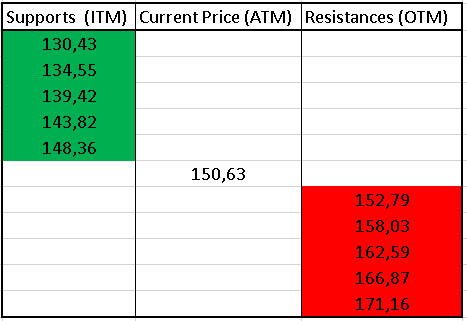

The resistances and supports are as follows:

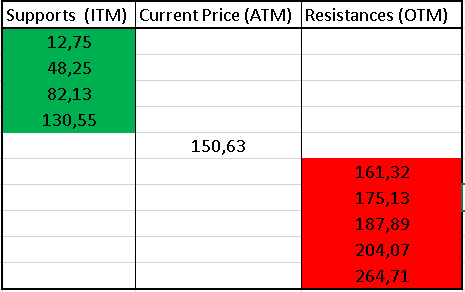

Image edited by me in EXCEL

As can be seen, the most immediate resistance is at the 152.79 level which is the nearest OTM cluster average price above the current price. On the other hand, the nearest support is at the 148.36 level which is considerably stronger than its resistance counterpart as it has a higher volume (5.21m LTC).

Long-term

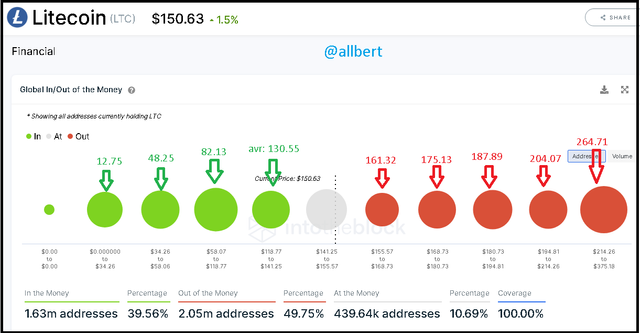

To identify long-term support and resistance we will again use the Global In/Out of the Money indicator to observe all addresses currently holding LTC.

Image taken from: Source

ITM is 39.56% and OTM is 49.75%, which shows a neutral bias with a slight inclination to turn bearish in the long run.

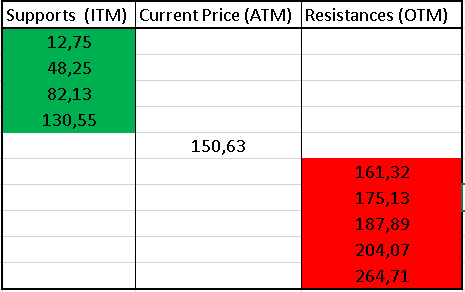

The resistances and supports are as follows:

Image edited by me in EXCEL

The most immediate resistance is 161.32 and the most immediate support is at the 130.55 level. In this case, it is the resistance that has the highest volume (4.22m LTC) so it further supports my conclusion of the bearish bias.

On the other hand, another interesting aspect of this chart is that it shows that the highest volume cluster is the one belonging to the last resistance (8.95m LTC) which warns us that the price must break through a major resistance (264 level) before it starts experiencing historical highs again.

Momentum based on GIOM

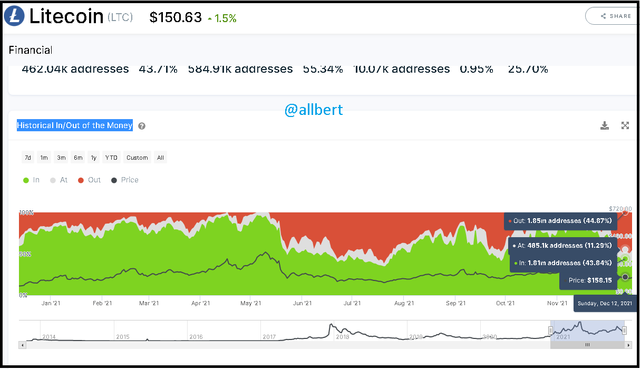

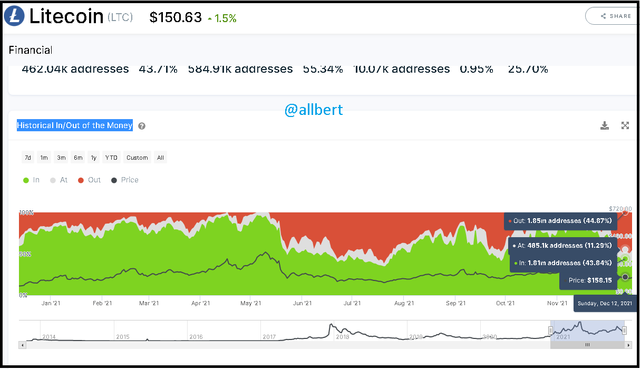

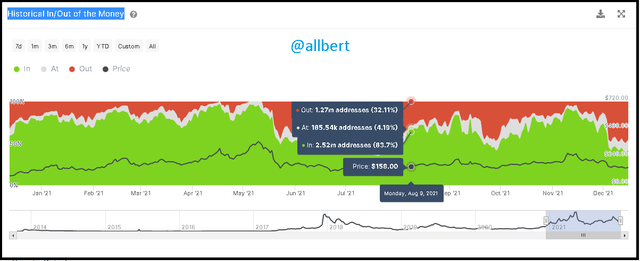

To determine the momentum we will use the Historical In/Out of the Money chart. For this case, I will study only for the year 2021.

First I select as a reference the 12th of December, in which the price of LTC was 158.15 USD; ITM 43.84%, and OTM 44.87%.

Image taken from: Source

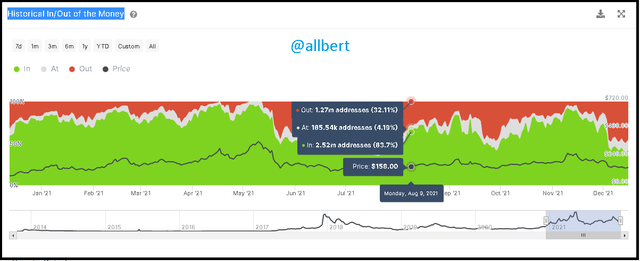

Secondly, we must compare it with a period that has a similar price range, in my case I choose Monday, August 9, 2021, in which the LTC price is 158 USD; ITM 63.7%, and OTM 32.11%.

Image taken from: Source

As can be seen in the graph, between both periods there is a decrease in the number of ITM addresses (63.7% to 43.84%) and an increase in OTM (32.11% to 44.87%), so we conclude that the momentum is accompanying the current downward movement of the cryptocurrency.

Adjusted Large Transaction Volume

By setting the "Adjusted" option we can see several large trades throughout the year but which have been decreasing in volume month after month. For example, the highest volume trade we can see was on May 13, 2021, in which the price was 312.52 USD and a volume of 86.5m LTC.

After that peak, we would see a rapid decline in the price of LTC, and during the months of May and June, another three trades between 40m and 30m LTC.

Image taken from: Source

After these months the whales lose some interest in the crypto asset until December 4 where a peak of over 32 million LTC is recorded, which is still low for mid-year volume.

Indisputably the indicator shows a gradual loss of interest of the whales towards this currency, which further reinforces the neutral period of the price, however, it is expected that in the long short-medium term the bearish bias will be accentuated.

CONCLUSION

These indicators studied in class really never cease to amaze me, because concentrating very basic information can become very complete and revealing about the state of a cryptocurrency.

Naturally, there is a necessary element that cannot be overlooked: the analyst's or trader's ability to interpret. It is important not only to read the signals of the indicators in the short term but to understand the context experienced by the asset in a given period.

In fact, it is the union of these indicators, GIOM, Large Transaction Volume that helps us to have a more expanded and holistic view of the crypto asset we are studying.