Hi Professor

@reminiscence01, Here is the result of my third Trade of the Week.

Image edited by me in Powerpoint

1. The name and introduction of the project token, which exchanges it can be traded on, project / technical information of the coin/ team background, etc.

AVAX is the native token of the Avalanche Project which we could summarize as a competitor to Ethereum.

If we dig a little deeper we can say that Avalanche is a layer one blockchain that works as a platform for developing and editing decentralized Dapps applications and smart contracts.

We can see Avalanche as its own ecosystem not only for Dapps but also for DeFi platforms. In fact, Avalanche has bridges that allow it to have interoperability with Ethereum based platforms such as Sushiswap.

Their network consists in turn of 3 joint blockchains called: X-Chain, C-Chain, and P-Chain, which are used in parallel but with different purposes, which gives this project a high speed in the verification of transactions. They aim to reach more than 6500 transactions per minute.

AVAX is relatively new, its launch was in 2020 by its creators Emin Gün Sirer, Kevin Sekniqi, and Ted Yin who among other things are Professors of Computer Science at Cornell University. Emin Gün Sirer who is the pillar of this project has extensive experience in the world of cryptocurrencies, participating in Bitcoin technical papers, especially in the area of solving scaling problems.

He was also involved in research in 2016 before the first hack of the Ethereum network.

As a bonus fact, in its ICO Avalanche raised more than $42 million.

AVAX currently can be found in centralized exchanges such as Binance, OKX, Coinbase, Upbit, FTX, KuCoin, among others. Also in FTX, we can find the AVAX Perpetual Futures token, which we will use in this post.

2. Why you are optimistic about this token today, and how long do you u wish it can rise.

AVAX Currently has a Market value ranging around USD 100, with a market capitalization of USD 26.8 billion and a daily volume of approximately USD 2 Billion.

It ranks 10th in the Coinmarket cap cryptocurrency ranking (which is impressive for such a new project), and has a maximum supply of 395 million AVAX, of which only 268 million is in circulation.

First of all, I consider myself a fan of this token because it represents a solution to key problems in the world of cryptocurrencies, scalability, and speed. At the same time, it offers a whole interesting ecosystem for the development of all kinds of applications.

In addition, something interesting about this project is the way its architecture is composed, in the way of 3 large blockchains that run different functions and thus decongest the main network.

First, it has an exclusive chain for exchanges (X chain) of AVAX tokens with other tokens, then a contract chain (C chain) that hosts the smart contracts, and finally a platform chain (P chain) that coordinates the validators and the networks.

Another factor is that throughout these two years of life we have seen a great acceptance and adoption by the public and by institutions, which makes us confident that the value of the token will continue to escalate.

Regarding the price projection, it is not unreasonable to think that AVAX will manage to recover and return to its historical high of around 140 USD, not before stopping in the zone e 120 USD. This is a short-term projection.

In the long term, given the reception that the Project has had in recent years, it is likely that we will find AVAX above 200 USD, however, it is difficult to be completely sure.

3. Technical Analysis

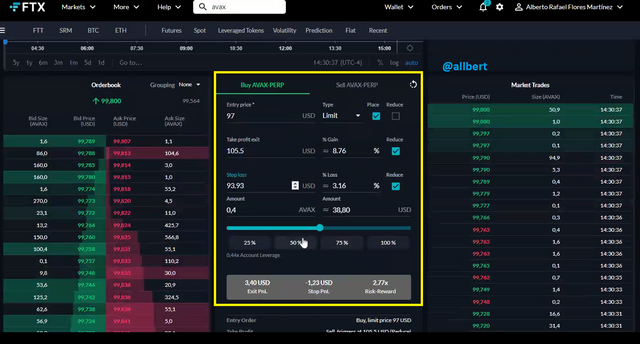

In this part I will perform the analysis of AVAX Perpetual Futures, making the trade in my FTX account. For this I will use my analysis using knowledge of Elliott waves, chartism, and Fibonacci tools. Beforehand I must say that it was a long analysis, with which I had a lot of patience.

First of all, I look at the development on a 5-minute chart of a large 5 wave bullish impulse, of which only 2 have developed and the third one is in process.

Image taken from: Source

If I switch to a 1-minute chart, I can see internally wave 3, which by fractality principle is composed of 5 smaller waves, of which 4 are fully developed and the 5th is developing. All this indicates to me that wave 3 of greater temporality is about to come to an end and that it will be immediately followed by corrective wave 4.

Image taken from: Source

Faced with this scenario I have multiple options, however, for experience (and taste) I will wait for the wave 4 pullback and then trade the momentum of the following wave 5. Therefore, I will look for a buy.

Image taken from: Source

As can be seen in the image above, wave 5 of the major wave 3 is a wedge, so I expect an imminent trend change (wave 4 development), therefore I use Fibonacci retracement on the entire major Wave 3 to determine a good entry point.

This entry point usually for me should be between 0.618, however as wave 2 was deep and already reached that level, by Elliott's law wave 4 should not be so deep (in theory) therefore I select my entry point at the 0.382 Fibonacci level or 97 USD.

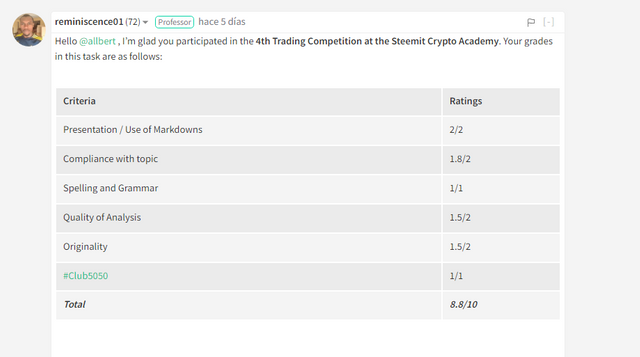

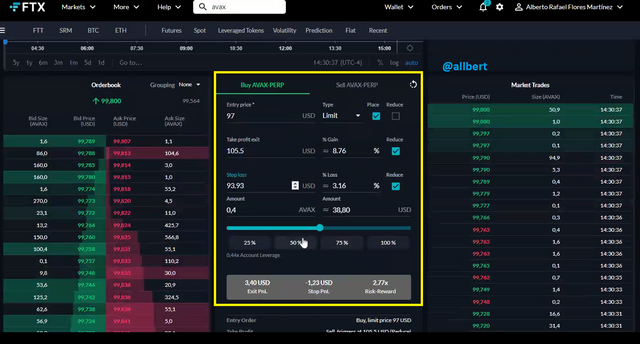

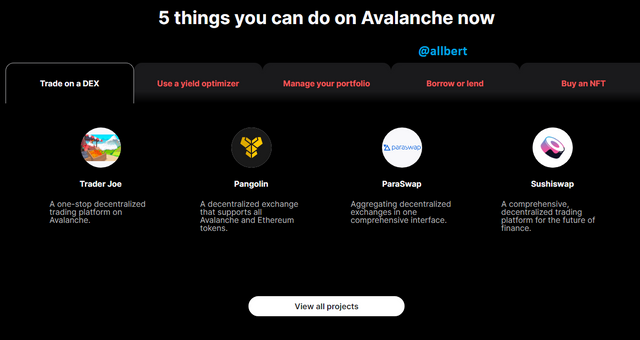

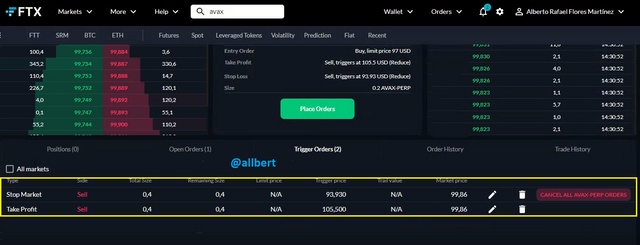

Before I continue I must say that I found a new feature in the FTX platform that allows me to place buy orders together and not separately as I usually did. So for this case in my FTX account, I place a Buy Limit order, at 97 USD with a Lottage of 0.4 AVAX.

I also set the exit parameters, which I will explain in the next section.

Image taken from: Source

4. Your plan to hold it for a long time or when to sell.

My plan for this token is to do an intraday trade, and not float it for more than a couple of days while in token reaches the expected price.

Regarding my exit parameters, the analysis is as follows:

The Stop Loss I will place it slightly below the endpoint of Wave 1, that is at the level of 93.93 USD since by Elliot Wave theory wave 4 should not exceed the end of wave 1, if this is not met the count is invalid and it would not be worth to continue trading.

Image taken from: Source

Regarding the take profit, I use the Fibonacci Extension tool, and as I usually do I choose the 100% level as the take profit level, or 105.5 USD. Here are the pending exit orders in my FTX account.

Image taken from: Source

Hours later we can see how the trade has developed, first opened the operation at the given point, and although later the price fell further, as you can see the level of wave 1 was respected as established by the Elliott Wave theory.

Image taken from: Source

In fact, we can see how Wave 4 was completed, and now Wave 5 is in development. As you can see, at this point I am already in Profit, in fact for that reason I allowed myself to raise the Stop Loss level, and as the price continues to climb I will continue to raise it to protect my profits in case of an unexpected drop in price.

5. Do you recommend everyone to buy this to,ken? Give reasons for your answer.

In this part I want to be as honest as possible. Regarding AVAX I have mixed feelings.

On the one hand, I consider the project to be good, solid, and promising, so in that case yes I would recommend it to everyone.

On the other hand, I consider that its best time to acquire it passed, and that we are now at a point where the price is high, so I would not recommend acquiring it at this time. Rather, I would recommend waiting for the price to pull back again to the 90 or 88 USD area, or even lower.

Being an expensive token, I also do not think it is for all the public, or rather, I do not think that fits everyone's budget, for such reason one of my recommendations is to buy the token gradually, making DCA as small amounts (around 10 or 20 USD) each time the price retreats, and make partial sales each time the price increases, to thus build a portfolio until owning a full token of AVAX.

After owning a full AVAX token, my recommendation is to float it up to at least 200 USD for as long as necessary, so I estimate this to be a long-term investment.

6. Any other thing you might want to share about this coin/token.

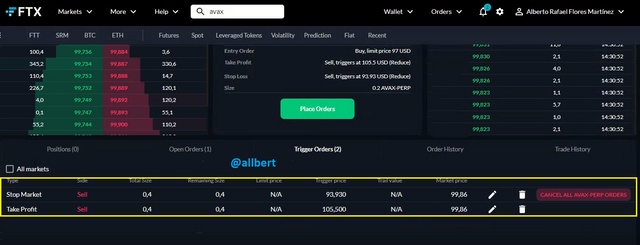

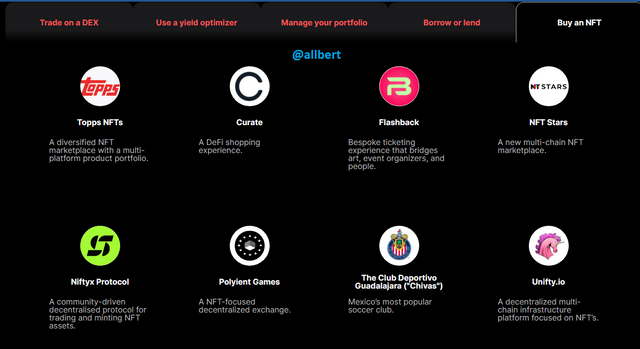

Personally, I think what strikes me most about Avalanche is the rapid growth they have had in such a short time. First of all they have managed to consolidate an ecosystem full of options within the crypto world.

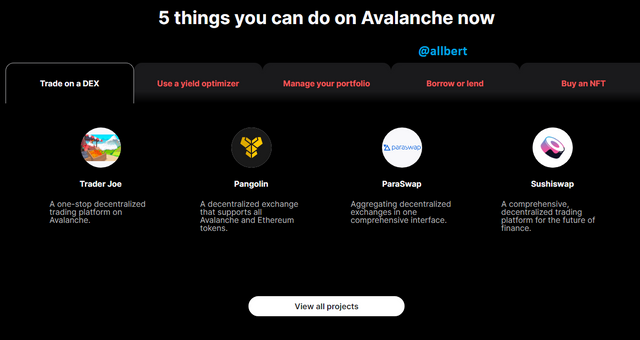

For example, within the Avalanche ecosystem, we can find projects and trading platforms such as Trader Joe, Pangolin, and Sushiswap.

Image taken from: Source

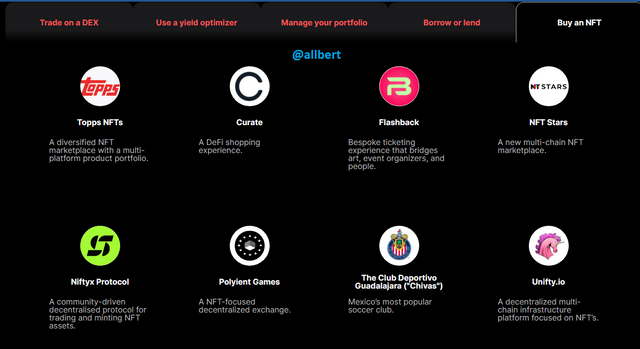

There are also associated yield farm platforms such as yieldyac and snowball, lending platforms such as AAVE, and even platforms for exchanging and buying NFTs.

Image taken from: Source

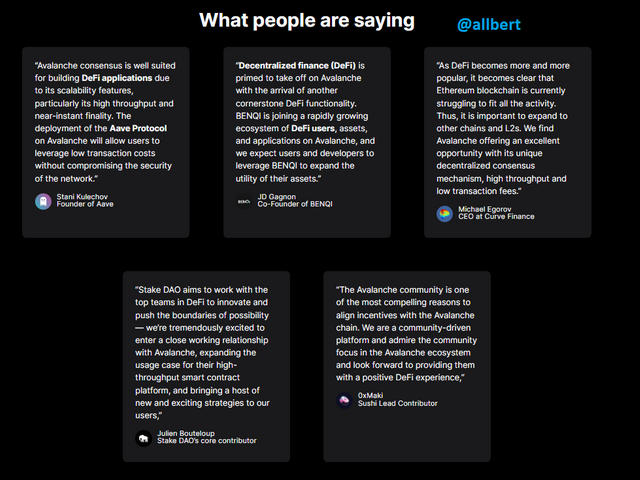

The number of projects associated with Avalanche and AVAX is a good indication of the solidity of this project and above all the image, they have in the crypto world. Remember that this is a medium where trust and image are everything.

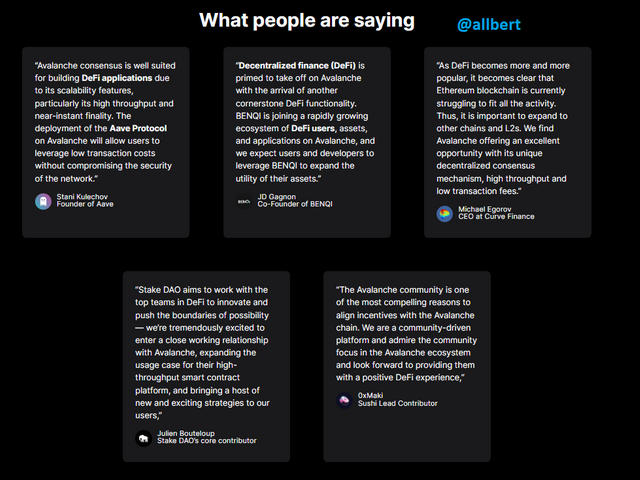

In fact, here we can see the comments of some representatives of the most relevant projects in the crypto world today.

Image taken from: Source