Image Edited by me in Powerpoint

Image Edited by me in PowerpointIntroduction

For this class again I decided to have a purely practical approach. For me, it is more important that each student learn to read and interpret a graph, rather than memorize a concept. So the assignments for this week were based on this approach, and the assignments had to be completed in their entirety by the students in order to receive a grade. The assignments were:

The assignments were:1-Explain in your own words what FOMO is, wherein the cycle it occurs, and why. (crypto chart screenshot explanations needed).

2- Explain in your own words what FUD is, wherein the cycle it occurs, and why. (crypto chart screenshot explanations needed).

3- Choose two crypto-asset and through screenshots explain in which emotional phase of the cycle it is and why. Must be different phases.

4- Based on the analysis done in question 3, and the principles learned in class, make the purchase of 1 cryptocurrency in the correct market cycle. The minimum amount of 5USD (mandatory), add screenshots of the operation and the validated account.

Results

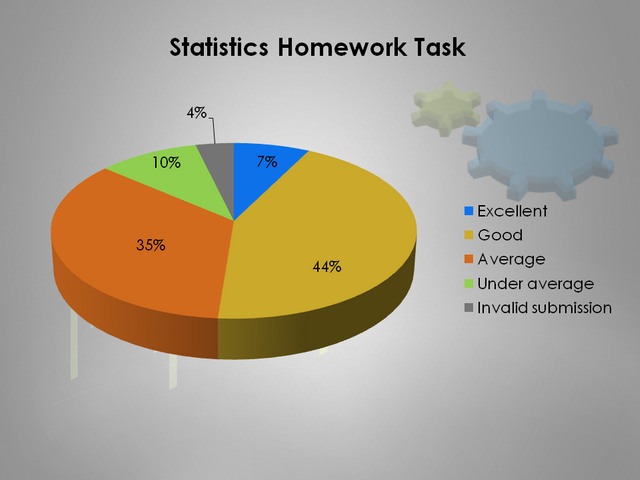

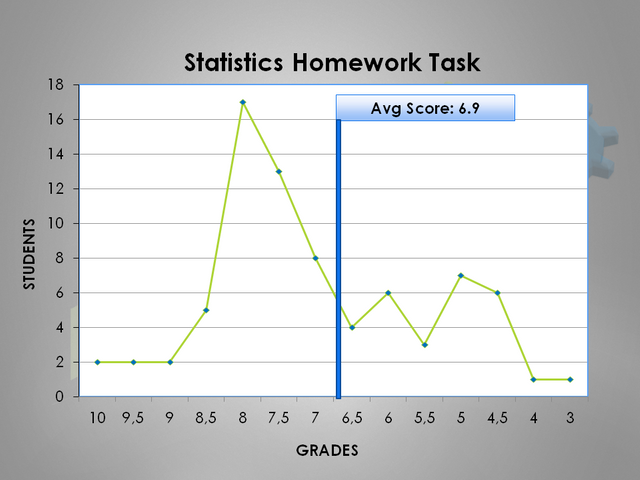

| Rating Content | Excellent | Good | Average | Under average | Invalid submission |

|---|---|---|---|---|---|

| Statistics | 6 | 35 | 28 | 8 | 3 |

Image Edited by me in Powerpoint

Image Edited by me in Powerpoint Image Edited by me in Powerpoint

Image Edited by me in Powerpoint

General observations:

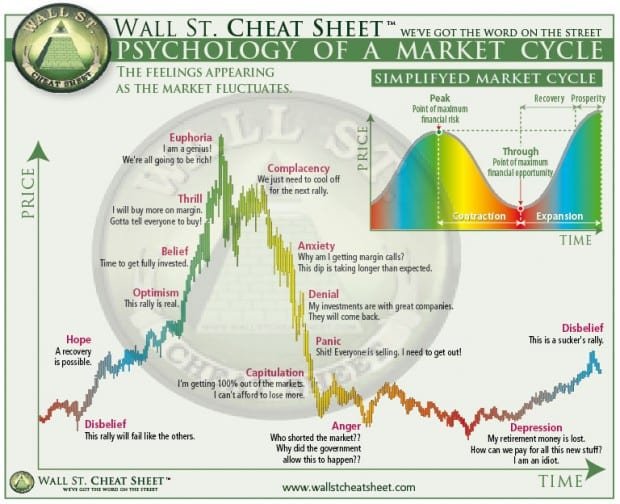

The first and second questions dealt with virtually the same thing. The result was mixed, on the one hand, everyone clearly understood the concepts of FOMO and FUD. On the other hand, some students failed to locate which emotional phase they are in.

In fact, many only limited themselves to answering that FOMO is in the bullish phase and FUD is in the bearish phase completely ignoring the 13 emotional phases.

In question 3, although most managed to understand the requirement, there were also wrong answers which again ignored the 13 phases. In fact, I wish to share the graph again with you.

Source

Another important factor in chart analysis is the use of the correct timeframe. To make a good analysis of the current market phase you should use a high timeframe, at least 1 hour or 1 day onwards so that you can visualize at least the last 3 or 4 months of the asset.

Otherwise, we will be fooling ourselves, as we will be seeing irrelevant up and down patterns that have nothing to do with the large-scale cycle.

Another question I got asked a lot was how to be sure that an asset was in one phase or the other. The answer is the breakout and confirmation of resistance and support.

For example, some people told me that BTC should be in a HOPE phase as it had reached as high as 42000 USDT. However, after breaking that support, the price was not able to retest and fell back below 40000. This is indicative that it has not yet changed phase and is in DISBELIEF.

Another detail, which although it may seem small is somewhat relevant to our platform. Many students share images from other platforms but are not posting the links and references of where they belong. Remember that not doing so can be taken as a type of plagiarism, since you are not giving credit to the person or platform that provides the resource.

Similarly, the overall presentation of the publication plays an important role. The use of subtitles, centered text, justified text, the use of separators, colored text are factors that will make your work stand out above that of others... on the other hand, the mishandling of them will detract from its value.

Suggestions

The clearest indication of this is that 99.9% knew how to define FOMO and FUD, which is the knowledge you may have acquired in other classes with other teachers. However many ignored the 13 emotional phases of the graph, which I also explained. They just glossed over them and continued to talk about the FOMO and FUD.

Others talked about topics that were beside the point. Don't get me wrong, I agree with using extra material, but only after you have covered the assignment question.As a friend rather than a teacher I recommend that you read the whole class well, then re-read. Then read the questions, then read them again when you are answering. Do not answer the first thing that comes to mind, as this is not the goal of the Academy.

The goal of the Academy is to acquire new knowledge week after week and to use that knowledge to change our lives. But first, we must open our minds and our eyes and not simply limit ourselves to what we already know or think we know.

TOP GEAR 3

The three most outstanding Gears of the week are:

- @beckie96830

https://steemit.com/hive-108451/@beckie96830/crypto-academy-season-3-week-5-homework-post-for-professor-allbert

- @ikhsanmanikam

https://steemit.com/hive-108451/@ikhsanmanikam/steemit-crypto-academy-season-3-week-5-or-homework-post-for-professor-allbert-psychology-and-market-cycle

- @msquaretk

https://steemit.com/hive-108451/@msquaretk/crypto-academy-season-3-week-5-or-homework-post-for-professor-allbert-or-psychology-and-market-cycle

To those selected, congratulations and keep up the good performance. To the rest of you, don't give up, study, improve and keep trying. Next week your name could be right here.

I see you next week my Friends. Your Crypto Professor @allbert.

Cc: @steemitblog @steemcurator01 @steemcurator02

Thank you Professor @allbert. I'm happy I attended your lecture and to be part of the top 3. Thanks.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you professor @allbert for this week’s lesson. Please can you help me with your text justification?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Of course mate!!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you professor @allbert the lesson was indeed an insightful one. I'm happy to have participated.

Thank you once again.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit