Hello again Professor

@fredquantum. I believe that the knowledge of all these platforms and their different options gives us the freedom to make the most of our resources and our cryptos. Until now little did I know about these platforms that allow you to borrow money, and I am sure that options like these will make the Tron ecosystem grow even more.

Image edited by me in Powerpoint

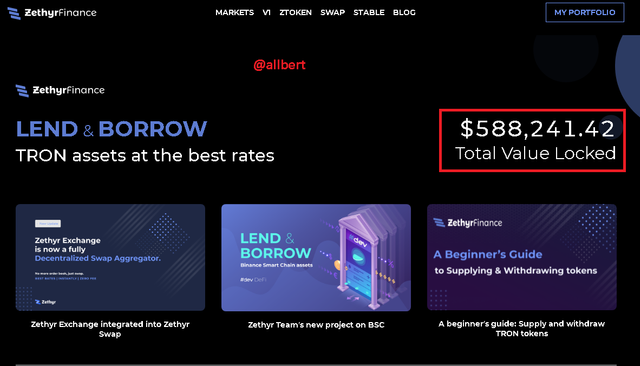

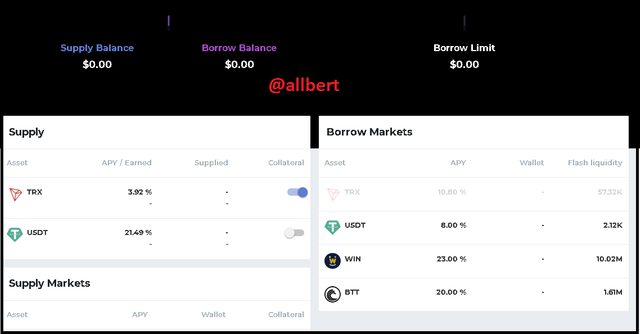

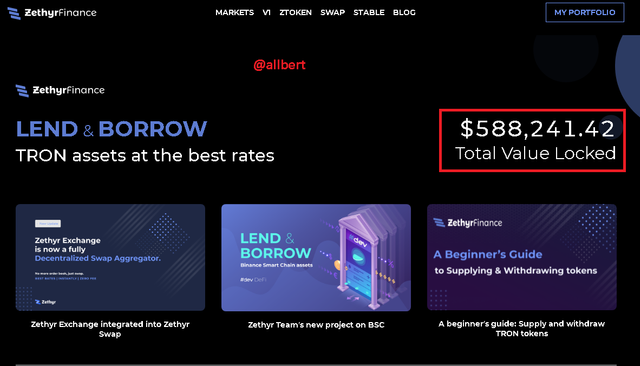

1. What is Zethyr Finance?.

It is a decentralized finance platform of the TRON ecosystem that enables various operations related to lending, exchange, and supply of cryptocurrencies in exchange for receiving an interest return.

An innovative aspect of this platform is that it allows borrowing through collateral formed by all the assets held or even lent in the platform.

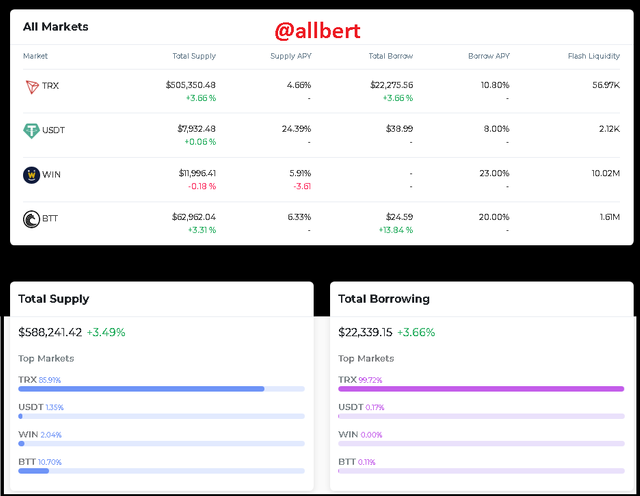

It is an emerging platform with relatively little time, therefore offers very good rates and so far manages a Total Value Locked of only $588,241.42.

Image taken from: Source

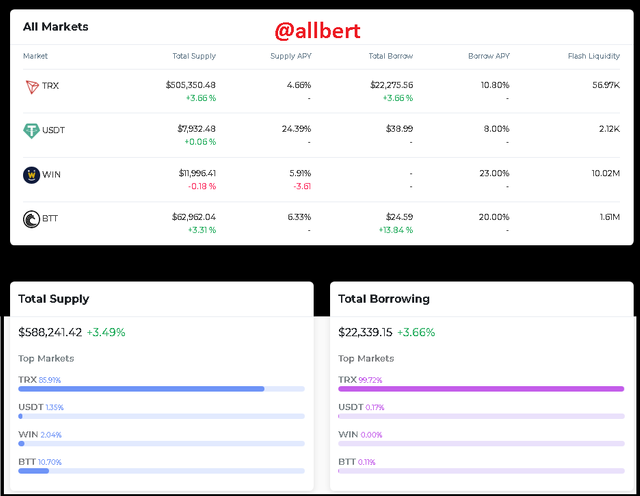

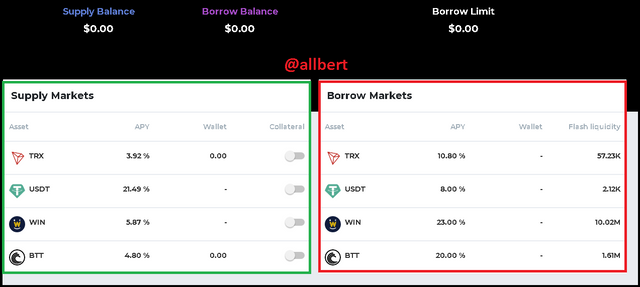

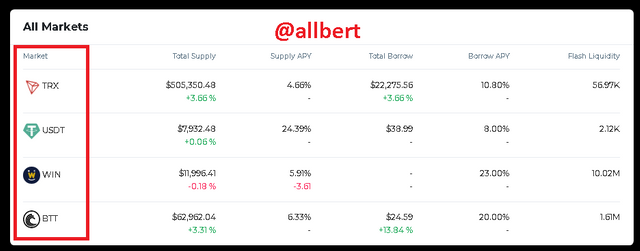

At the moment it only offers 4 cryptocurrency markets: TRX, USDT, WIN, and BTT (all belonging to the TRON ecosystem), with APYs ranging from 4 to 24%.

Image taken from: Source

They also have a borrowing supply of 22,339 USD.

2. What are the features of Zethyr Finance? Discuss them. What's your understanding about DEX Aggregator?

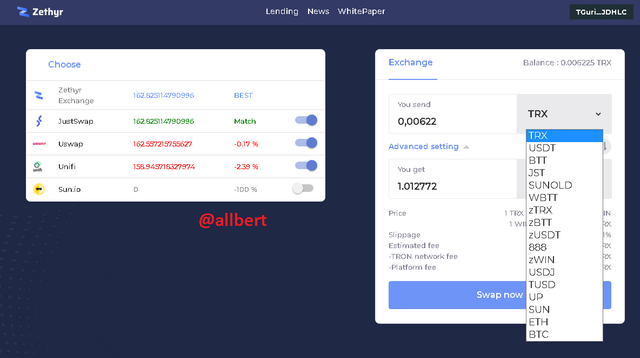

SWAP

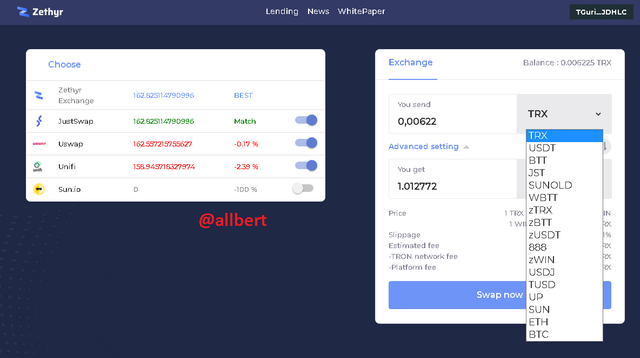

The first and most basic feature we will see is the SWAP, which like any other allows the exchange of different tokens: TRX, USDT, BTT, JSDT, SUNOLD, WBTT ZTRX, ZBTT ZUSDT, ZWIN, USDJ, TUSD, UP, SUN, ETH, and BTC.

Image taken from: Source

The major difference of this SWAP with respect to the rest is the Zethyr DEX Aggregator... but I will explain this later.

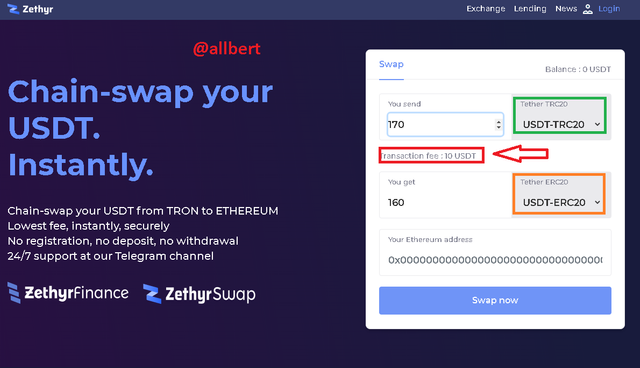

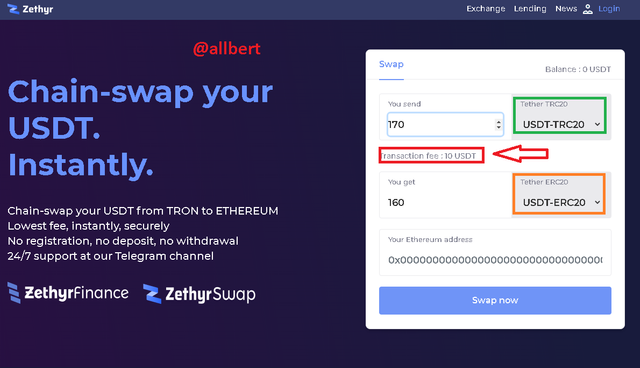

STABLE SWAP

It is a type of swap that allows the exchange only between the stable coins USDT of the TRON network (TRC20) with the USDT of the Ethereum network (ERC20). This application seems very simple but it is actually something fabulous as it allows us to exchange this type of token according to the need we have.

Image taken from: Source

Remember that commissions on the TRON network are much cheaper and operations much faster than on the Ethereum network.

Even so, we must be very attentive to the commission that the platform charges for this operation which is 10 USD which is not much if we are going to perform an operation of much capital, but that if it can be a lot when you do not have enough money... So we must be smart at the time of making it.

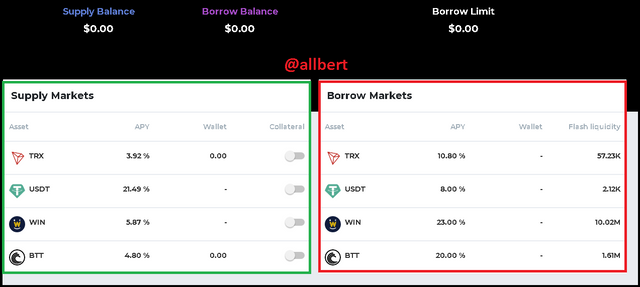

LEND AND BORROW

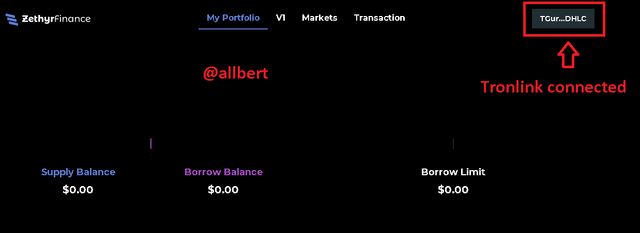

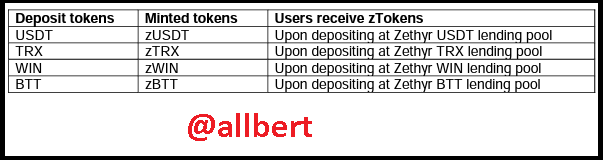

To access this feature we must do it through the "My Portfolio" option. As mentioned before, through this option we have the opportunity to offer liquidity to the platform by lending our coins in exchange for a return.

APYs range from 4% to 24%.

Image taken from: Source

We can also find the borrow option, with which, as its name says, we can borrow cryptocurrencies from the platform in exchange for the payment of interest. It is important for us to know that the debt limit is based on the amount of collateral we have invested within the platform.

Image taken from: Source

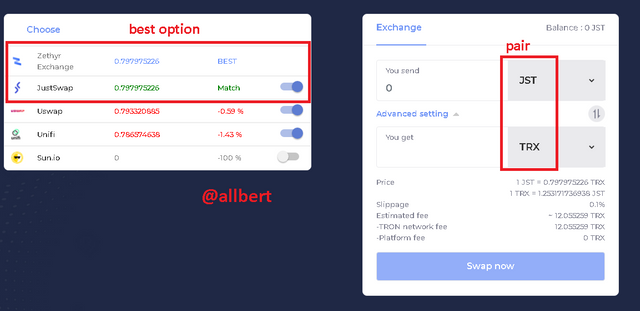

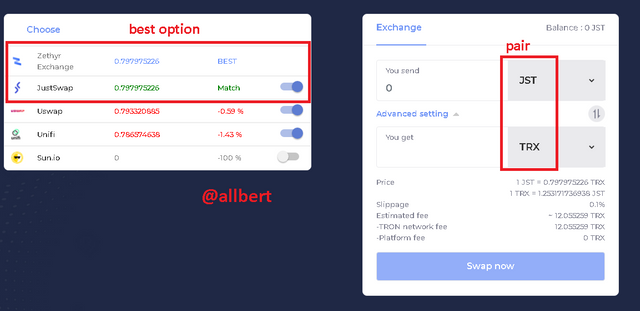

Zethyr DEX Aggregator

This is a novelty never seen before in the old models of exchanges and swaps, where the exchange rate was based on an Order Book. In the case of DEX Aggregator, they are joined in Zethyr Exchange with the Zethyr Swap protocol and its system allows the comparison between the exchange rates of several exchanges and several swaps.

This results in the Zethyr Finance system always providing us with the best exchange rates in the market, which vary not only depending not only on the type of Exchange but also on the time of day and traffic on certain networks.

Image taken from: Source

For example, in the image, we can see that for this moment, in the JST / TRX exchange the best exchange rate is provided by Justswap, ahead of Uswap, Unifi, and Sun.io.

This feature finally makes a swap service 100% decentralized, allowing the user to instantly choose more than one swap option and select the one that best suits themselves.

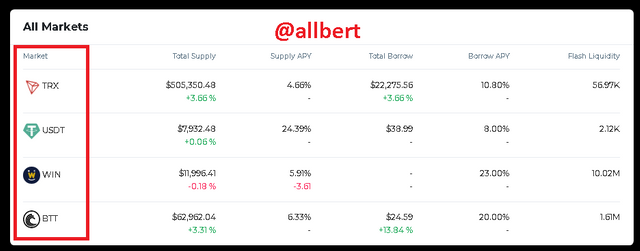

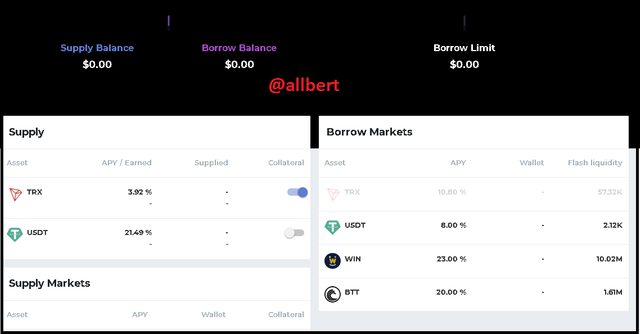

3. Explore the Zethyr Finance Markets and show your observations in terms of profitability of Supply and Borrow (Hint: Best Supply/Borrow APY). Screenshots required.

We know that being a recent project, this platform has little capital and little liquidity at the moment. In fact, its market is small and reaches only 4 cryptocurrencies belonging to the TRON ecosystem.

To access the Markets interface we must click on the top button "MARKETS".

Image taken from: Source

We will be sent to a section with the tables and market information of the platform, which at the time of this post are:

Image taken from: Source

As we can see the 4 Cryptocurrency markets are TRX, USDT, WIN and BTT.

1- TRX: Total supply of 505,350 USD ; supply APY of 4.66% ; total borrow 22,275 USD and Borrow APY 10.80%.

2- USDT: Total supply of 7,932 USD ; supply APY of 24.39% ; total borrow 38.99 USD and Borrow APY 8%.

3- WIN: Total supply of 11,996 USD ; supply APY of 5.91% ; total borrow 0 USD and Borrow APY 23%.

4- BTT: Total supply of 62,962 USD ; supply APY of 6.33% ; total borrow 24.59 USD and Borrow APY 20%.

As we can see from the data, TRX is the cryptocurrency with the highest adoption within the platform, then followed by BTT, WIN, and finally, USDT, which only has a supply of 7,932 USD.

For this reason, the market with Best Supply/Borrow APY is USDT, which has a supply APY of 24.39% for only a Borrow APY of 8%.

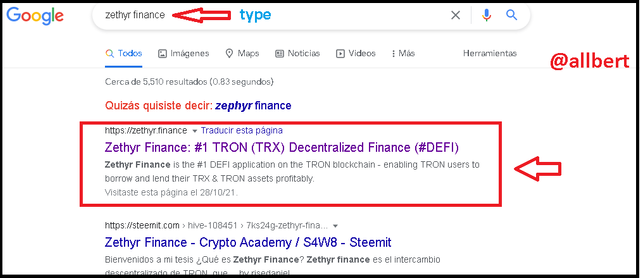

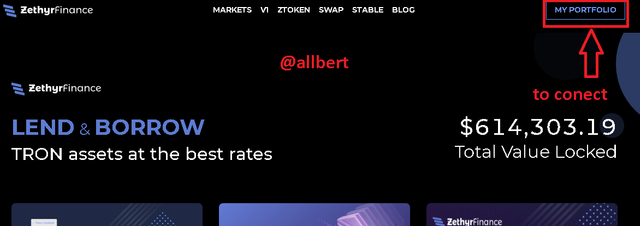

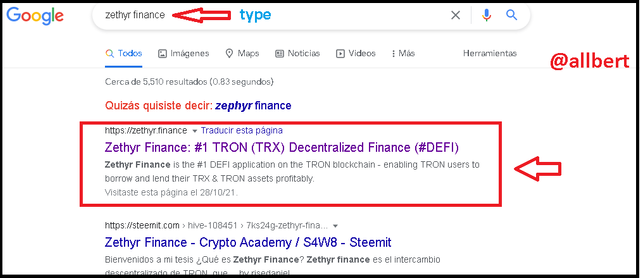

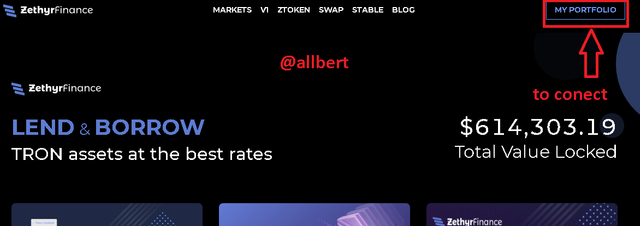

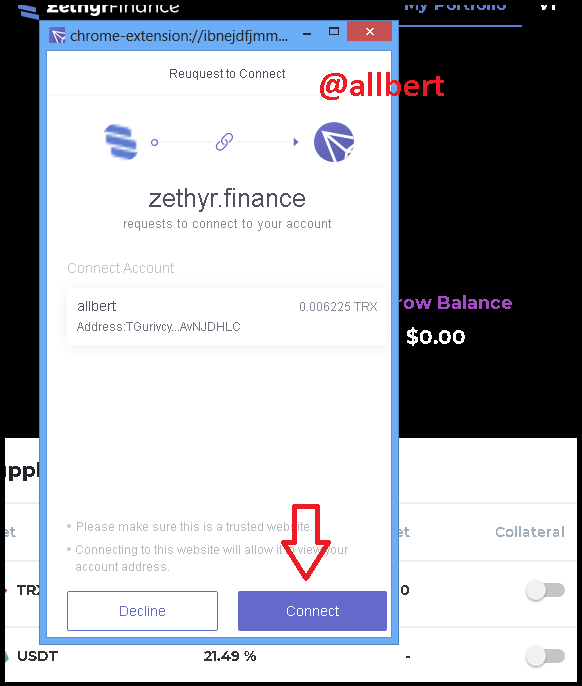

4. Show the steps involved in connecting the TronLink Wallet to Zethyr Finance. (Screenshots required).

This example will be done through the Zethyr Finance website (

https://zethyr.finance/#/) by connecting it to my Google chrome Tronlink extension.

1-In the google browser we type Zethyr Finance to access the site.

Image taken from: Source

2-Once in the Zethyr platform we click on the "My Portfolio" button.

Image taken from: Source

3-At this point, a Tronlink extension pop-up window will appear, asking for permission to connect to the Zethyr site. Click on "Connect".

Image taken from: Source

4-Finally we can see how the Tronlink wallet address will appear right where it used to say "My Portfolio" which tells us that the wallet is connected.

Image taken from: Source

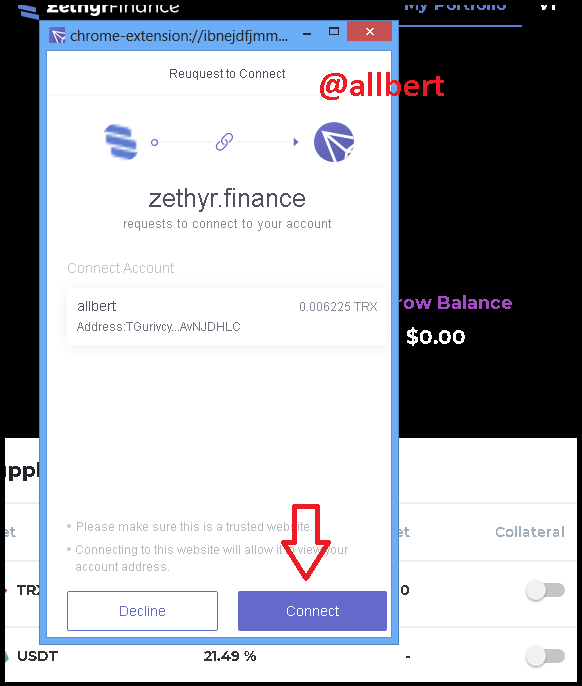

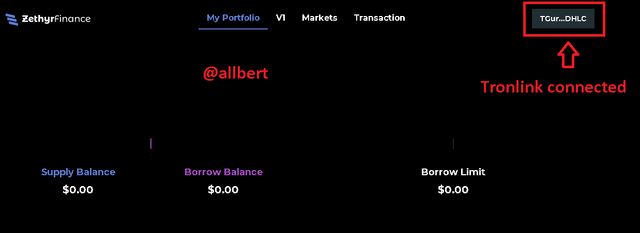

5. Give a detailed understanding of ztoken and research a token of another project that serves the same purpose as it.

Ztoken is a governance token of type TRC20 which allows its holders among other things to make decisions about the future of the platform while functioning as collateral for borrowing operations.

These tokens are obtained through lending operations or coin supply in which liquidity is given to the platform and in return, you receive a token with the same name as the borrowed token with the letter (Z) at the beginning, for example, ZTRX, ZBTT ZUSDT, ZWIN.

Image taken from Zethyr finance white paper: Source

These ztokens have a value on the external market and are equivalent to the same value of the underlying token from which they take their name. In fact when liquidity is supplied to the platform rewards are received in the form of these ztokens which can then be exchanged on the platform.

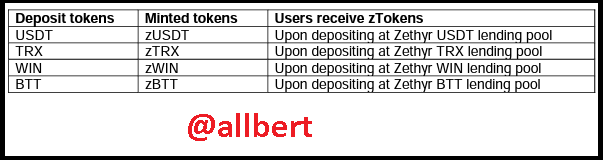

Another case

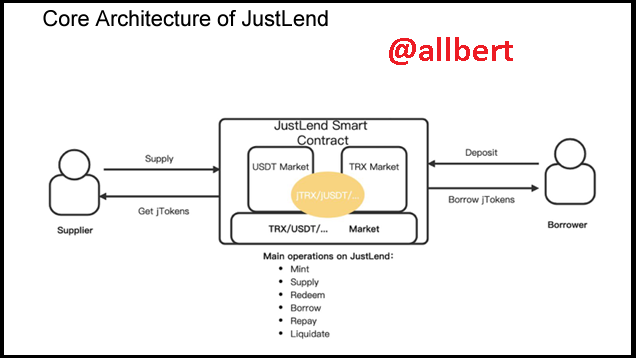

Within the TRON ecosystem, there is also the case of Justlend and its Jtokens, which is a token that you must first obtain as collateral to qualify for a loan.

Like Ztokens, the Jtoken is a TRC20 governance token that allows holders to vote on certain decisions regarding Justlend's platform.

Image taken from Justlend white paper: Source

The way to obtain Jtokens is through Lending operations, where the user will periodically receive Jtokens as interest payment for the tokens he has provided.

6. Perform a real Supply transaction on Zethyr Finance using a preferable market. Show it step by step (Screenshots required). Show the fees incurred.

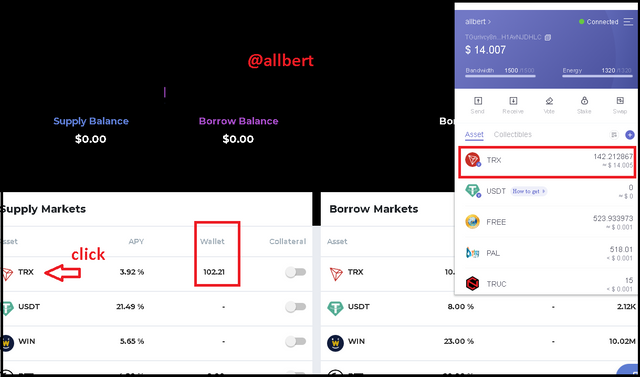

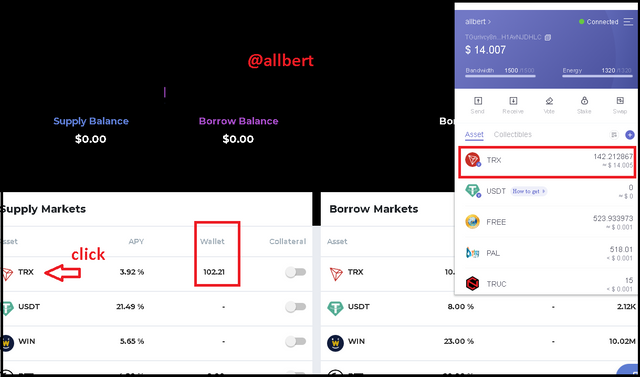

To start this activity I had to reload my Tronlink wallet with 102 TRX since all the operations will be done with this token. I also had to make sure I had enough Energia and bandwidth.

1-First we must press the "My Portfolio" button to connect the wallet. Once connected this window will appear where you can see the amount of TRX in my wallet. We click on the desired option (TRX in my case).

Image taken from: Source

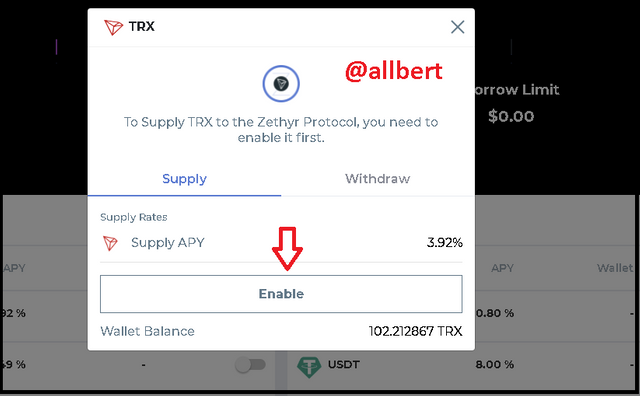

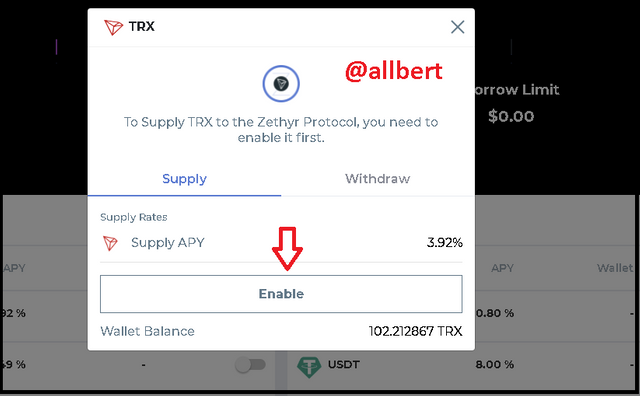

2- This procedure will serve to Enable the TRX supply, therefore when the popup window appears we click on "Enable".

Image taken from: Source

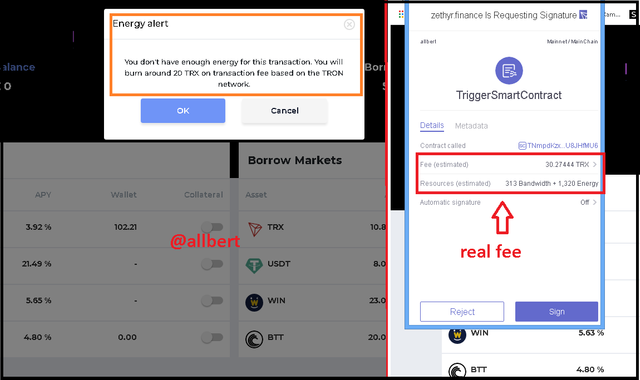

3- Then another popup window will appear warning us of the commission in which case it is 20 TRX. However, when we then sign the Tronlink authorization we realize that the real commission is much higher than we thought: 30.27 TRX or 3 USD, 313 Bandwidth, and 1320 Energy.

Image taken from: Source

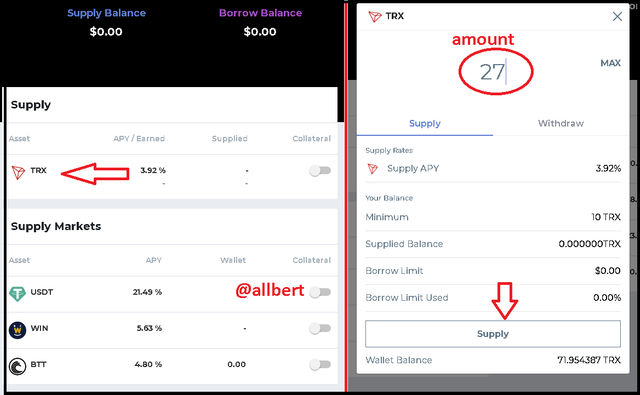

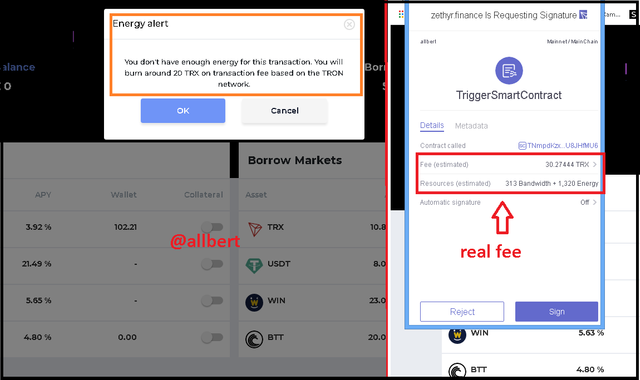

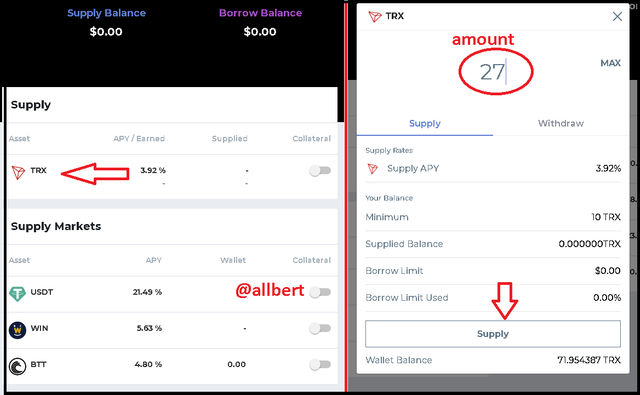

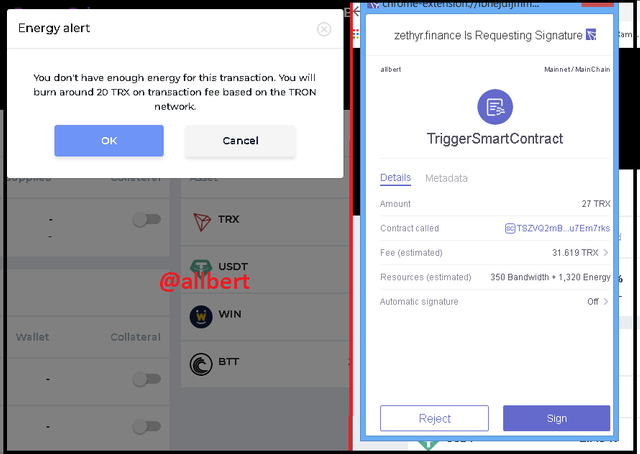

4-Then we go back to the provisioning interface, click on TRX. Next, the supply interface will appear, we select the amount (in my case 27 TRX) and then click supply.

Image taken from: Source

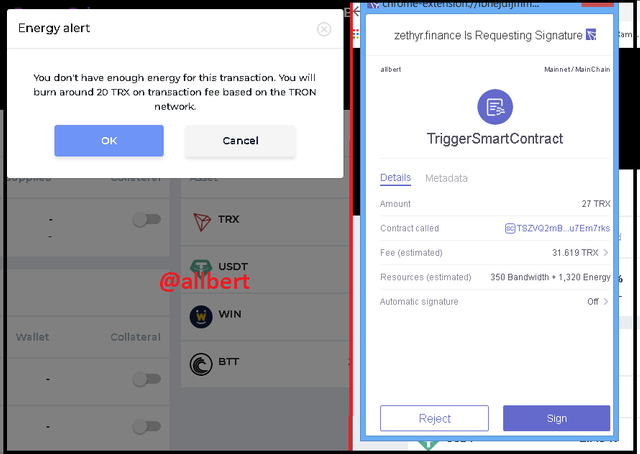

5-Again the commissions warning window appears and the Tronlink signature this time informing that the fee is 31.6 TRX, 350 Bandwith, and 1320 Energy.

Image taken from: Source

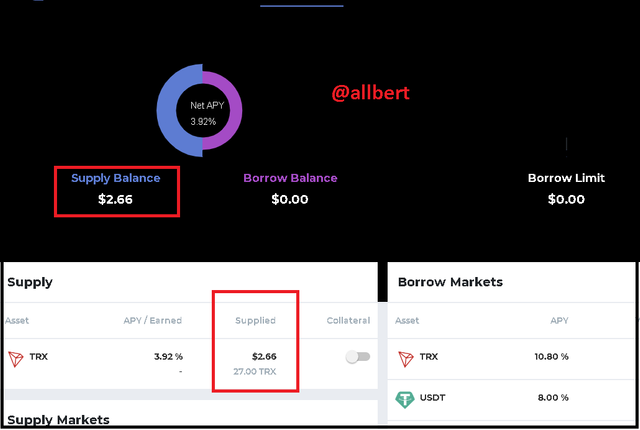

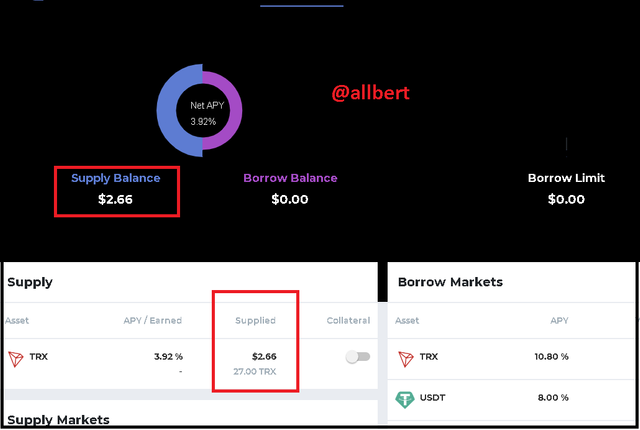

6- Finally the supply will appear on the page interface, a total of 2.66 USD with 3.92% APY.

Image taken from: Source

This is the link to the transaction: https://tronscan.io/#/transaction/2c082068066c60217b206060c9be5d5d23b8e4b8b7829255b1d09440a183eaca

7. Collateralize your asset to Borrow on Zethyr Finance, repay the borrowed asset and withdraw your supply. Show the steps involved and your observations (like the fees incurred). (Screenshots required).

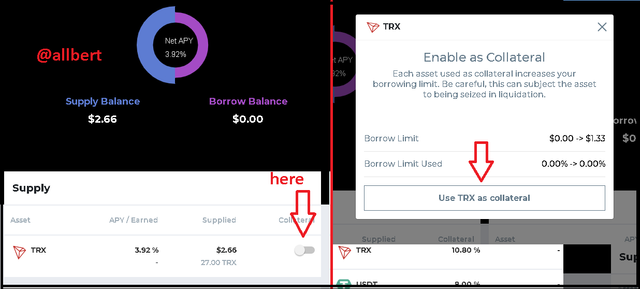

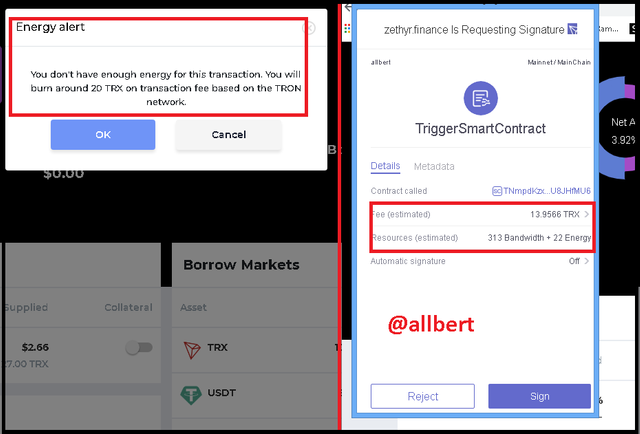

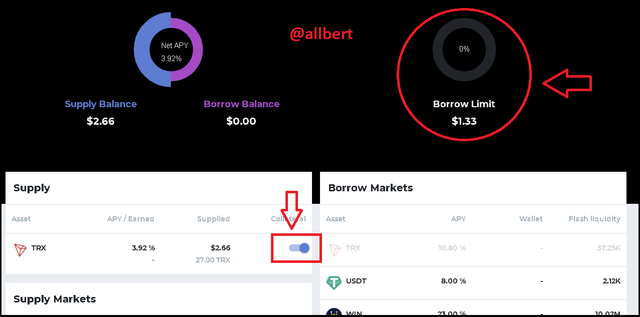

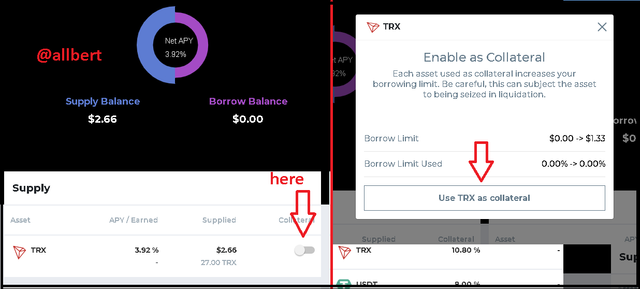

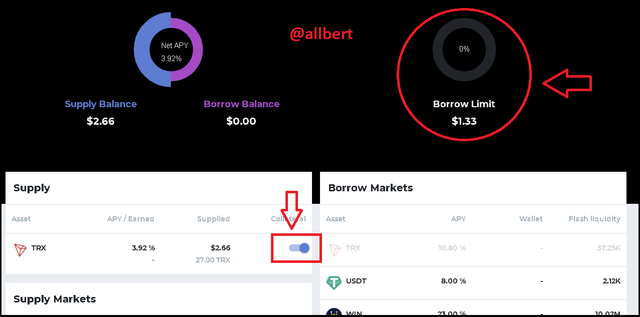

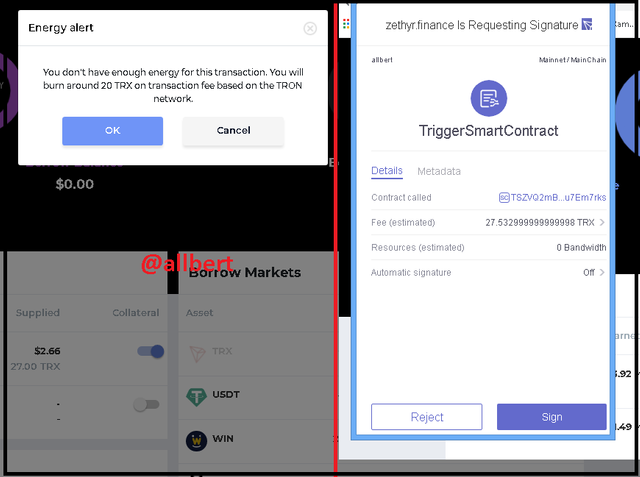

Collateralize

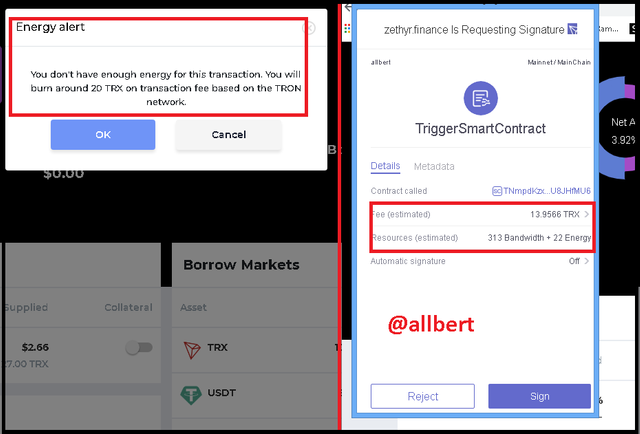

1-To collateralize we must click on the button under the "Collateral" option. A confirmation window will appear to use the TRX as collateral, click on it.

Image taken from: Source

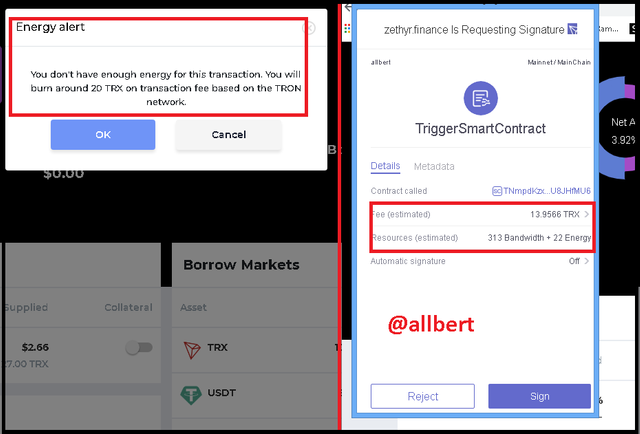

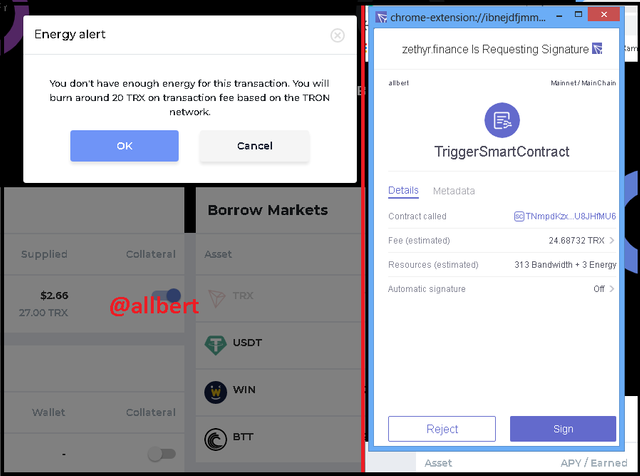

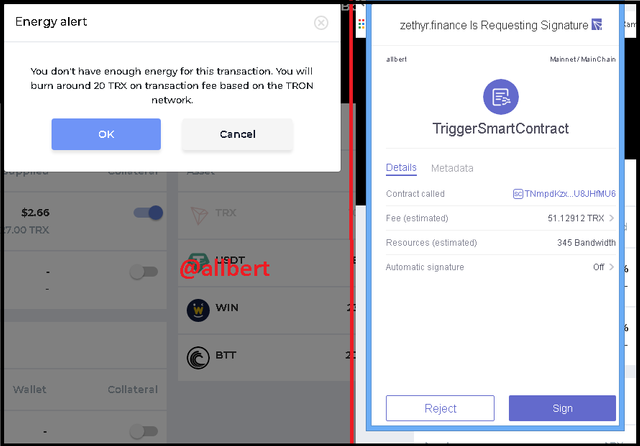

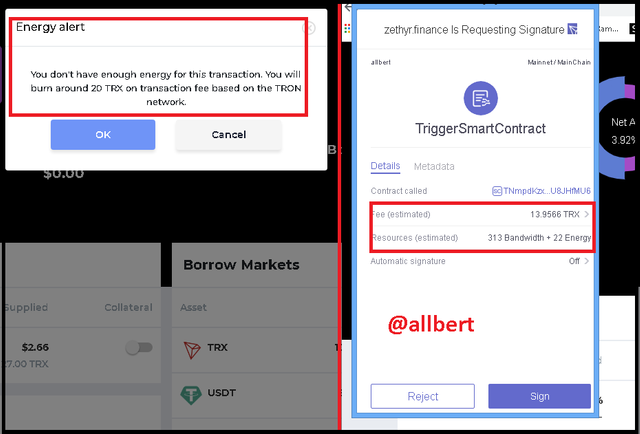

2-Again the Tronlink energy and signature alert windows will appear. In this case, we are informed that the fee is 13.95 TRX, 313 Bandwidth, and 22 Energy.

Image taken from: Source

3-Finally both the collateral button and the borrow limit will be updated.

Image taken from: Source

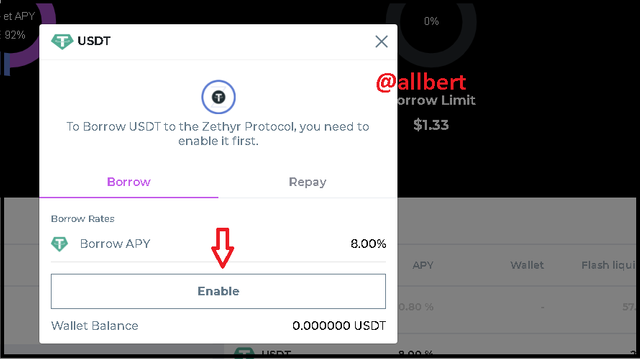

Borrow

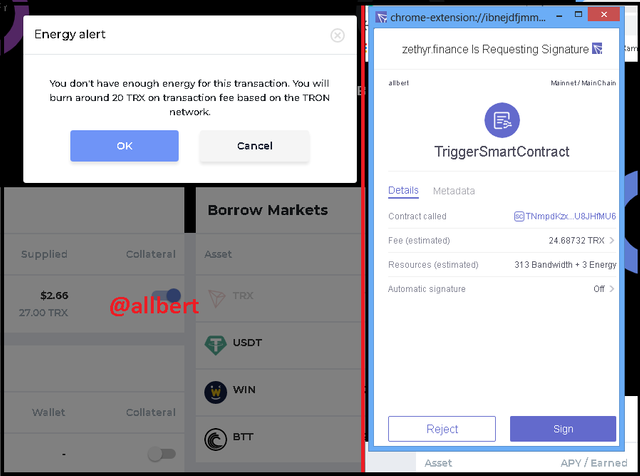

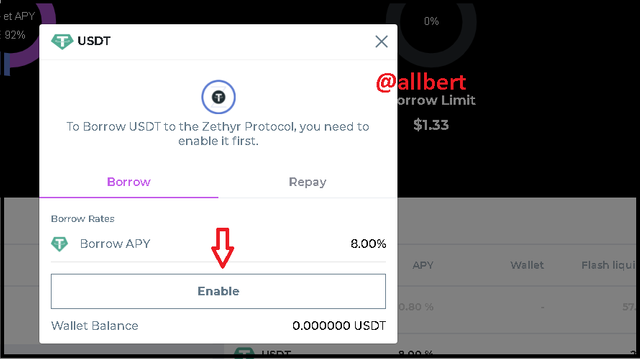

I will perform this part by applying for a USDT loan, so I have to perform the enable borrowing operation again.

1-After selecting USDT in the borrow markets interface a popup window will appear. We click on "Enable"

Image taken from: Source

2-Same as always Tronlink fee and signature alert windows will appear.

Image taken from: Source

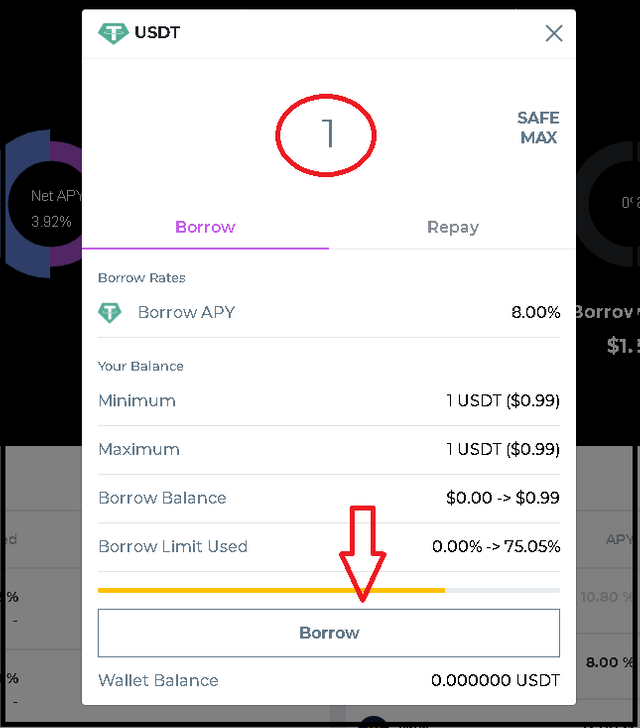

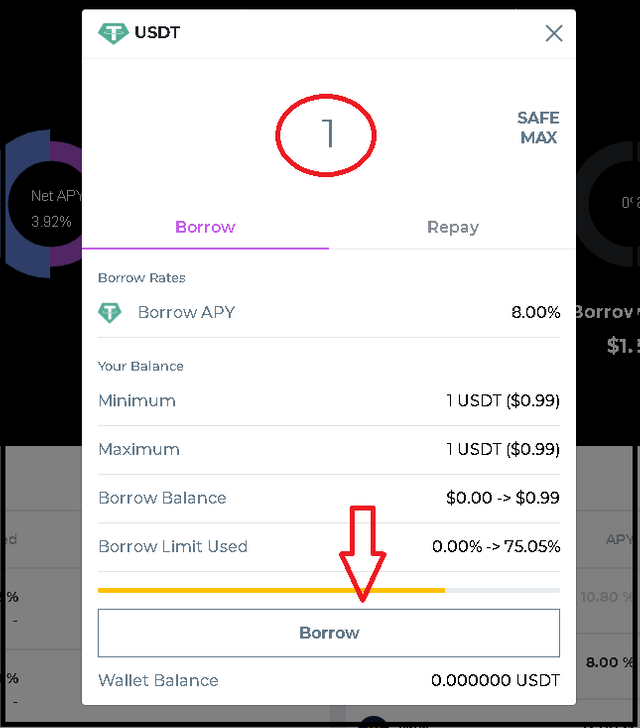

3-At this point the borrow USDT option will already be enabled, so we click again on the USDT option and this popup window will appear. Type the amount to borrow (in my case 1 USDT) and click on "Borrow".

Image taken from: Source

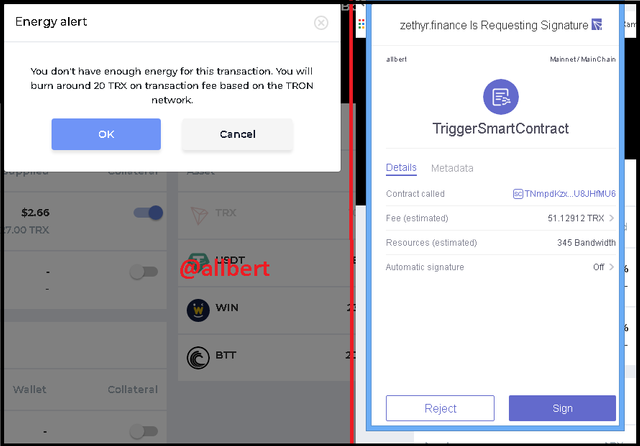

4-Same as always Tronlink fee and signature alert windows will appear. A total of 51.12 TRX eas deducted

Image taken from: Source

However due to unknown problems the loan did not run, in fact, I tried it twice and both times it failed, however, it still took a total of over 100 TRX in both tests. The two failed operations are these:

https://tronscan.io/#/transaction/434ad237e891c929f40296180912d1fc59c2d1875b36101f29e1a1ceccd6bd80

https://tronscan.io/#/transaction/50623ad3102e358439675a9368c73b55eb89af9ef928df9d285c36ead4966b40

According to both reports, the operation failed due to lack of ENERGY, the strange thing is that since the first operation I had already been without energy and the platform was responsible for burning TRX in compensation, however this time the platform burned a large amount of TRX without performing the operation.

In fact I had to reload my wallet again with 120 TRX more:

https://tronscan.io/#/transaction/1a483fdef68d054780db16d74afa6d6440b612d4955de37ca28d863bd677dcda

But even so, I could not continue with the Borrowing operation.

Repay

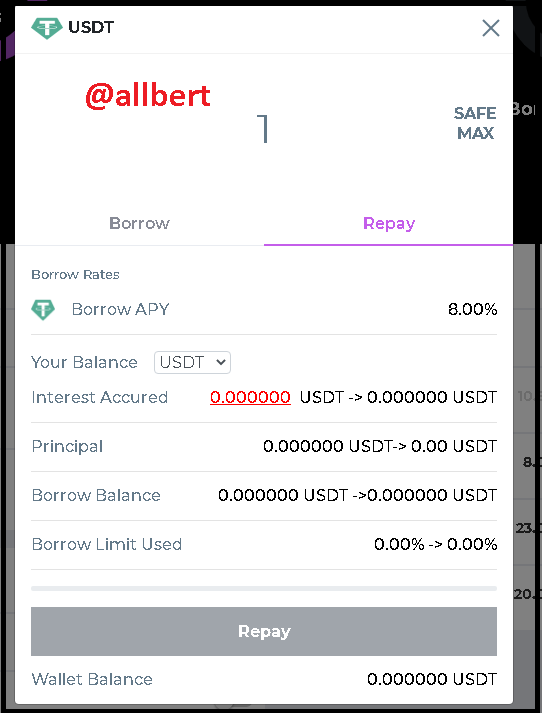

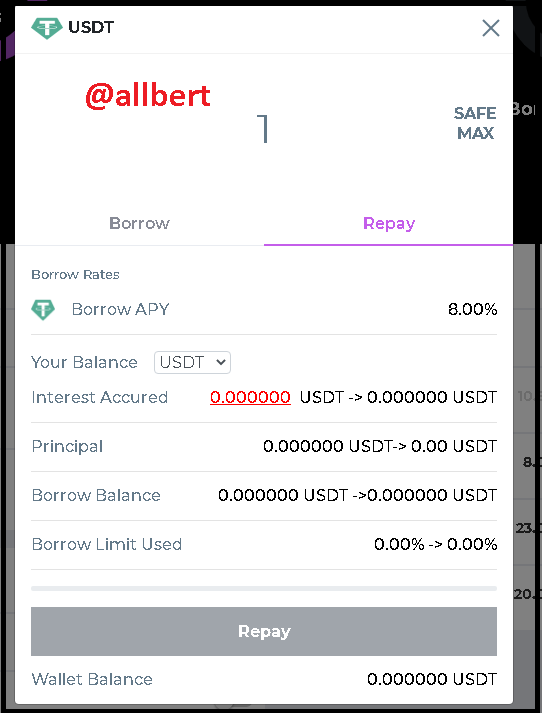

1-To execute this part again we go to the borrow market section and select the currency we want to pay. When the pop-up window appears, select the "Repay" option and enter the amount to be paid.

Image taken from: Source

2-After this part, as usual, the tronlink alert and signature windows will appear.

Image taken from: Source

Of course this part unfortunately I cannot execute it due to the problems presented in the platform in the last phase.

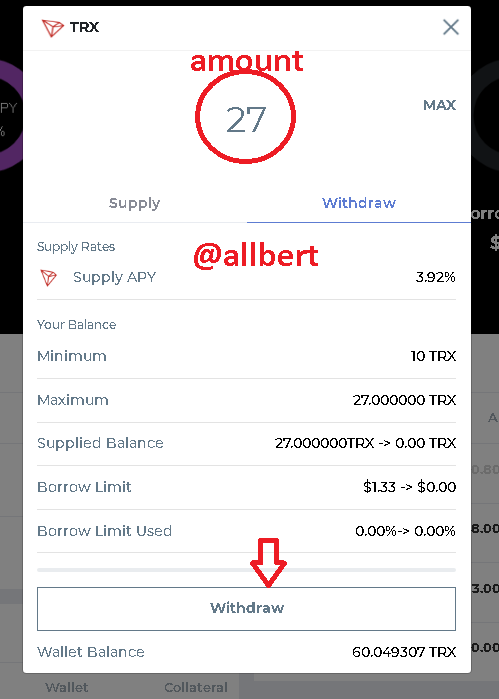

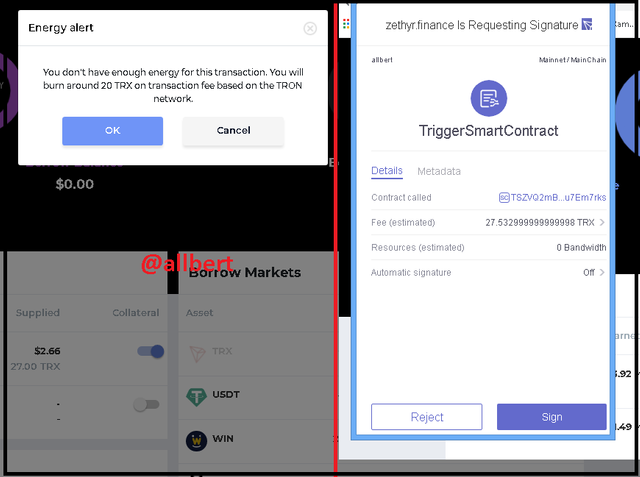

Withdraw

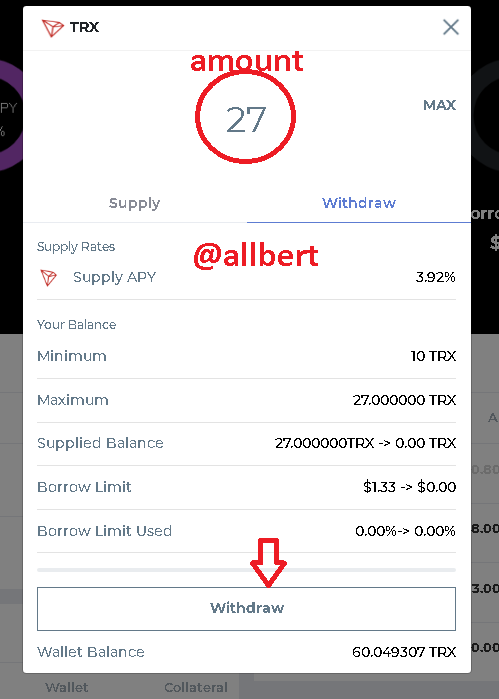

1-This time we must go to the supply section and select the token we supplied, in my case it was TRX. When we select it, a pop-up window will appear on which we must choose the withdraw option. We choose the amount of the withdrawal and click on Withdraw.

Image taken from: Source

2- As always the alerts and the Tronlink signature appear. This time it informs me that the fee is 27.53TRX , and 0 Bandwidth.

Image taken from: Source

3- Fortunately this time the operation went well. Here is the hash of the operation:

https://tronscan.io/#/transaction/b493950e51dcf6602ba8006220bc2022ad118677f9fc47de3bce9bb80556b9fc

Finally my balance is back to zero.

Image taken from: Source

8. What do you think of Zethyr Finance? Is it great or not? State your reasons.

To be frank I have mixed feelings about Zethry Finance. In fact, it's funny because during the three days of making this post I think I changed my mind about 4 or 5 times.

First of all, we must understand that this is an emerging platform, very new, which is starting to make its way into the TRON ecosystem. This often brings a lot of opportunities, because usually APY rates are high. However, honestly, I have seen higher APYs on Pancakeswap for example.

Also, we must weigh the risk of a new platform, which is that its functionalities are not 100% operational, in fact, there are many bugs before a platform has reached maturity.

Something I liked was the cross-chain Stable swap, I think it is very novel as well as the DEX Aggregator. In this sense, I think they have a promising future. The negative point in this aspect is the little liquidity they have and the few options of currencies... but it is logical that this is so in such a new platform.

Finally, there are the negative aspects, which for me are the ones that have more weight and which make this platform is not one of my favorites. For some reason, there is a problem in the borrowing operation, as it requires a high amount of energy. However, I believe like many other traders that the problem may be much deeper due to bugs in the codes.

Anyway, I consider it to be an unreliable platform in terms of borrowing service. Personally, I would supply cryptocurrencies, but I would not borrow.

I think this is a platform to be employed by people knowledgeable about the TORN ecosystem, I think it is not made for newbies, as many could lose a lot of money before I will understand what is going on wrong.

If I had to choose a lend and borrow platform I would definitely choose Justlend, due to the fact that they have higher liquidity, and that is always important as it gives us the guarantee of being able to withdraw our cryptos at any time.

I think we can't be hard on Zethyr Finance either, we will have to wait for the developers to give more momentum to the project and correct certain errors, but at the moment I would not recommend it.

#club5050 😀

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Brother, thank you for sharing and teaching us this new loan platform for all of us who are learning about cryptocurrencies, for me it was a great learning, best regards.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit