.png)

INTRODUCTION

Good day fellow steemians and everyone in cryptoacademy, it's an awesome week with yet another awesome lecture from Prof @awesononso. Today id like to answer the questions given from this lecture in the best way i know how, focused on the knowledge of what was given.

QUESTION NO 1

EXPLAIN WHY STABILITY IS IMPORTANT IN DIGITAL CURRENCIES.

The importance of stability in digital currency is definitely one that cannot be overlooked or overemphasized. But before i go into its importance i feel its best to first explain what stability in digital currency is

Stability in the sense of the word simply means that something is in a position of which it remains fixed on and therefore making it unable to be easily overturned, influenced, or changed.

Now what is currency?

Currency is simply money and it(money) is what we use for all our daily transactions. The hard currency of any country is controlled by a central body for instance in Nigeria it currency is controlled by the CBN(central bank of Nigeria) or rather by the government of that country but that is not the case as regards digital currency because it is literally what it is i.e money that is digital and therefore it belongs internet hence, nobody controls it.

Being digital currency its important to note that its very volatile i.e it can be lost or gained within the blink of an eye and this in turn makes it a very risky endeavor on its part and because of this individuals tend to look more at the risk of loosing money than the reward of gaining at least some people do.

Another thing to note is that the price of digital currency is directly affected in the market by the level of demand and supply i.e the more people ask for the digital currency the more would need to enter the market and the more people enter market the bigger it grows and the bigger it grows the more stable the market becomes.

The more stable the price of a digital currency in the market possesses the lower the probability of people loosing their money would be, and this in turn will encourage more individuals to start getting involved in trading which would in turn lead to further growth of the market.

Also, if the price of digital currency can be stable, its value tends to increase as more people beigin to trust in the currency since it has an equivalent value with the normal currency.

In the end, stability in digital currency is important majorly for the fact that it adds value and gains the trust of more individuals which would lead to more people wanting to partake, and who knows how long it'll be before more people come in and it becomes the finance of the future.

QUESTION NO 2

DO YOU THINK CBDCs WOULD BE GOOD IN THE FUTURE?? WEIGH THE PROS AND CONS IN YOUR OWN UNDERSTANDING.

CBDC'S is an abbreviation for Central Bank Digital Currency which is simply how a country is able to accurately represent their currency in a digital format.

The concept of CBDC'S is a very new one to me but in making my research in courtesy of this lectures I was able to better understand that it's basically the same thing as the regular currency of a country but just this is represented digitally. My country Nigeria uses a currency called Naira, now the central bank digital currency of my country is eNaira and this currency will be online although it still has the same value with the local currency.

PROS OF CBDCs

1)The CBDCs will ensure safety of lives because carrying physical cash can attract armed robbers but with this nobody will be carrying cash anymore and lives will be preserved.

2)It wont give room for third party interference of any form and in doing so will ensure privacy. There won't be any interference from the bankers who will be in charge of ones account, here it will just be you and the system.

3)lower cost of transaction seeing as it is a digital currency this will hence provide a lower bank charge than physical bank transactions

CONS OF SBDC'S

1)The tokens are still centralized and controlled. What This means is that poor management of the economy of the country would to a great extent affect the prices of the tokens. They would loose their value and because the government owns the platform, they (the government) can still gain control of individual wallets and ledgers.

2)Investors wealth and assets are largely placed at a higher risk seeing as how they are subject to hackers and server failures.

3)A great number of citizens of the country are ignorant as to the use of digital currency. this in turn would lead to a lower usage of this form of exchange (remember that lower users and usage of the tokens leads to less stability of that token).

4)The CBDCs would give rise to competition amongst the commercial banks and this will in turn lead to the loosing customers.

5 ) There would be a serious reduction in the level of privacy due to the fact the user account activities are being monitored by the central authority in charge

After much deliberations on how CBDCs would affect the future as a whole, my opinion stands as a No. This is mostly because (as you can see) my cons far out weigh than my pros. As the name implies, Central Bank Digital Currency, it is made by a central authority and this makes ownership of the token governed by the policies of that country, and in doing so, i believe, eliminates the purpose for which digital currencies were created which was to counter the restrictions that can be placed on a unit of exchange.

QUESTION NO 3

EXPLAIN IN YOUR OWN WORDS HOW REBASE TOKENS WORKS, GIVE ILLUSTRATION.

A REBASE token is a special kind of token that is able to achieve stability with the aid of a mechanism that is able to adjust its circulating supply when the price has been changed. This mechanism is known as a Rebase mechanism.

A Rebase token can also be referred to as an Elastic Supply Token and this is because its supply varies directly with its price

Now, when there is a fluctuation in the demand for the token the supply in circulation is correspondingly affected i.e for instance if the demand for the asset increases its supply will increase accordingly and if the demand should reduce its supply reduces.

Unlike other coins like BUSD for an instance, when there is a bullish market , there will be an positive effect on coins in your wallet, likewise in a bearish market, the price is affected negatively but in REBASE token, reverse is the case.

Rebase tokens are known to have a component, the Rebase Mechanism, which entails that the REBASE tokensmaintain price but iuncreae in amount found in a user's wallet when there is a price increase in the market

For example Ampleforth’s AMPL has a rebase routine which occurs every 24 hours, with a target price of $1. lets say this price increases past $1, the supply in circulation enlarges while the rebase is happening, which in turn reduces the value of each AMPL token. on the contrary, if the price of AMPL falls below $1, the current supply in circulation diminishes during the rebase, which in turn increases the value of each token.

What the user observes is that the number of tokens in each wallet will either grow or fall accordingly. but while this occurs the net value of each wallet remains the same, and this is because of the rebasing mechanism.

to further explain, lets say Ojo has 1 AMPL, that then doubles in value to become $2, its supply will then inflate during the period of rebase. what this means is that Ojo's 1 AMPL will fall to 0.5 AMPL, but the value will still be $1 since 1 AMPLE would now be worth $2

QUESTION NO 4

GO TO THE HTTPS://WWW.AMPLEFORTH.ORG/DASHBOARD/. CHECK THE NECESSARY PARAMETERS AND CALCULATE THE REBASE %. WHAT ELSE CAN YOU FIND ON THE PAGE?

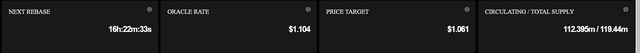

Using the data from the Ampleforth website, I got the following figures and will calculate the rebase using them:

Making use of existing parameters we have

The Oracle rate is 1.104

The price target is 1.061

To calculation the rebase %;

Rebase % = {[(Oracle Rate - Price Target) / Price Target] x 100} / 10

= {[( 1.104 - 1.061) / 1.061 ] ×100} / 10

={[(0.043) / 1.061 ] × 100} / 10

= {[(0.041)] × 100} /10

= (4.1) / 10

= -0.41

:. REBASE % = -0.41%

From the illustration given above the The total Supply in circulation in the screenshot of Prof. @awesononso lesson was 111.749m/118.75m, where as the one in mine was 112.395m/119.44mthis means the supply in circulation for the Ampleforth token at the moment increased and this was probably because of an increase in the demand.

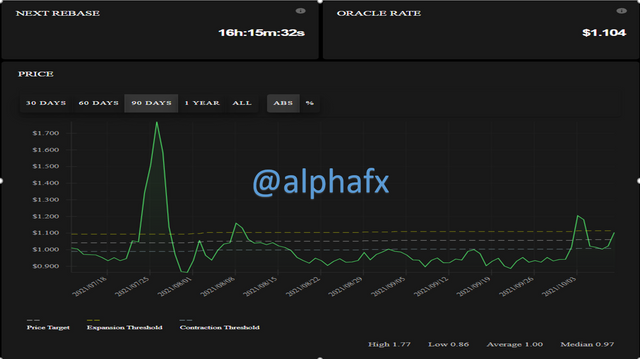

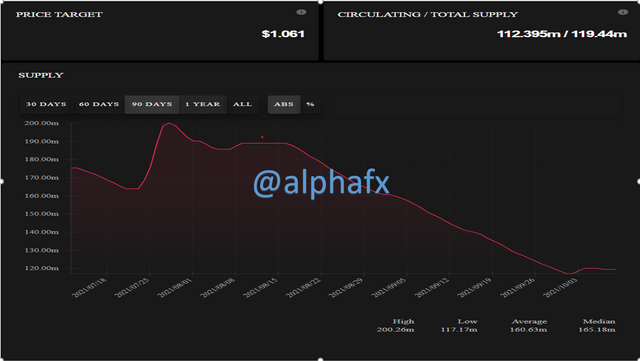

Furthermore, I was able to see few more things in the page that include the following:

THE PRICE CHART

THE SUPPLY IN CIRCULATION

THE MARKET CAP

QUESTION NO 5

TRADE SOME TOKENS FOR AT LEAST $15 WORTH OF USDT ON BINANCE AND EXPLAIN YOUR STEPS. (GIVE NECESSARY SCREENSHOTS OF THE TRANSACTION).

First I open my binance and I have 17 xrp there, then I click on the XRP/USDT pair

.jpeg)

My XRP balanceYou select market for trading options, input the amoutnof XRP, i sold 17 xrp for about 21usdt at 1.17 usdt per xrp

.jpeg)

Trading XRP for USDTThe USDT is deposited to my spot wallet

.jpeg)

USDT balance

QUESTION NO 6.

TRANSFER THE USDT TO ANOTHER WALLET WITH THE TRON NETWORK. FROM THE TRANSACTION, WHAT'S ARE THE PROS OF THE STABLE COIN OVER FIAT MONEY TRANSACTIONS? (GIVE SCREENSHOT OF THE TRANSACTION

For the sake of this homework, I will transfer the USDT using the (TRC20) which is the Tron network from my BINANCE wallet to my trust wallet.

First thing I did was to go to my trust wallet and copied my USDT address, then I went to my Binance and opened my spot wallet, clicked on USDT and when it opened I clicked on withdrawal. The slide that opened requires me filling out the form which include the address am transferring to and the quantity of USDT am transferring. After filling the details I clicked on confirm and to confirm the transaction a code has to be sent to both my phone number and my Gmail which I input before the transaction could be completed.

The screenshot below shows the process of the transaction;

.jpeg)

getting my USDT address from my tronlink

.jpeg)

Withdrawing from my binance

.jpeg)

Transaction successful

.jpeg)

Tronlink after the transaction

I observed certain pros that stable coins has over Fiat money.

That the stable coin transactions are way faster than in comparison to that of the fiat currency although sometimes it could be affected by poor network from the banks.

I also observed that the rate at which I got the USDT in my trust wallet happened just within one minute but when using fiat money network is always delaying usually taking several hours to days before a transaction can be confirmed by the recipient.

another thing i observed was that there was a high security level. Before completing the transaction, a confirmation code was sent to both my Gmail and my phone number that verified that I was actually the one carrying out the transaction, but in Fiat money transaction it's not always like this just a password or finger print is enough to carry out transaction.

CONCLUSION

Honestly one of the best topics I've had the privilege of learning in this season so far. it is a well known fact that cryptocurrencies easily fluctuates because of their volatile nature and this in turn prevent people from investing in and trading it but if it can attain a certain amount of stability I strongly believe that more people would want to get involved in it.

I learnt alot from this lesson especially about the REBASE token. This is my first time hearing about all its all because of the assignment. I was really able to study, research, discover and learn more about the REBASE token. Thank you so much Prof. @awesononso for an amazing lecture