Hello Everyone, I am Inviting you all to Read My Crypto Homework. I am doing the Homework for Professor @kouba01. This Homework was Quite Interesting. Lets Start

made by canva: @amjadsharif

1 - Williams %R indicator by introducing how it is calculated, how it works? And what is the best setting? With justification for your choice.

The Williams Percent Range is often known as the Williams Percent R, we can determine the pace of the moving price in the market and predict forthcoming trend reversals. Its value ranges from 0 to -100. It is a sort of momentum indicator that monitors overbought and oversold conditions and travels between 0 and -100.

The Williams% R can be used to determine market entrance and exit points. The indicator is extremely similar to the Stochastic oscillator and functions similarly. Larry Williams made this oscillator.

The formula for calculating Williams percent R:

The most current closing price, and the highest high in the last 14 periods, and the lowest low in the last 14 periods are used in the Williams percent R calculation. The number of periods might be 14 seconds, minutes, hours, days, or months, with 14 being the most prevalent.

Williams %R = (PMax - PC) / (PMax - PMin) × -100

Where:

Pmax=Highest of 14 days

Pc=Closing of the observation day

Pmax=Highest of 14 days

Pmin=Lowest of 14 days

Now, for example, the supposed values of an asset for this criteria are:

where

Highest Value of last 14 Periods = 50

Lowest Value of last 14 periods = 38

Closing Price = 48

Williams %R = (PMax - PC) / (PMax - PMin) × -100

=((50 - 48)/(50 - 38))* -100

=-16.6 an overbought condition

How to work on Williams's %R Indicator?

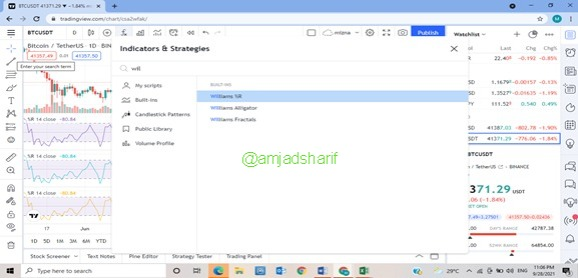

For this, I am visiting tradingview.com open the chart and then click on the Fx indicator option at the top of the chart. Search for William and then click on the William percent Indicator, as seen in the image below.

Best Setting:

For using this indicator, 14 is the best setting which is invented by William larry. I believe its created after doing so much research. It is a default setting. It is preferable to use 14 periods as a suitable option.

2 - How do you interpret overbought and oversold signals with The Williams %R when trading cryptocurrencies? (screenshot required).

The Williams percent R fluctuates between the extreme readings of zero and -100, It is an oscillator. Identifying overbought and oversold conditions while trading cryptocurrencies is critical. First, you must have a thorough understanding of what overbought and oversold means, as I m discussing it now.

Overbought signals, is if the William percent R Indicator is in the 0 to -20 range. We should wait for the cryptocurrency price to fluctuate for a while. That signal is favorable for selling assets because the price may fall due to the overbought position & the prices usually fall after being in the overbought conditions that are understood.

When compared to situations where we have -20 and 0, this one is considered as overbought. William's percent R percentage has a range of -80 and -100 correspondingly, which helps in recognizing a powerful ove\sold. After this condition, we should wait a while for the crypto price to move.

From my point of view, this Range is better to buy assets as from Oversold Condition, Price can take a /upward move too. Cryptocurrency prices vary, they go up and down. Place your trade when the price goes down, purchasing the market up to the resistance level when profit can be taken. You avoid buying at the resistance level to avoid practicing Overbought.

3 - What are "failure swings" and how do you define them using The Williams %R?

If the oscillator fails to climax above the reference line of -20 in the uptrend/bull phase or make a descent below -80 in the downtrend/bear phase, we consider it a failure swing. It is a reversal pattern used to make buy or sell entries, and it serves as a signal in an uptrend or downtrend. During failure swings, different highs are formed, higher highs, higher lows, and it will eventually get to a point where price will set, forming a lower low, from which you can enter the market and buy it up.

4 - How to use bearish and bullish divergence with the Williams %R indicator? What are its main conclusions? (screenshot required)

Before using bearish and bullish divergence we need to understand a little about what is a bearish and bullish divergence.

BEARISH DIVERGENCE:

If the price is making a higher high. But indicator is making a higher low in an uptrend. If the price is making a Higher low But the indicator is making a Higher High in an uptrend. It is a bearish divergence.

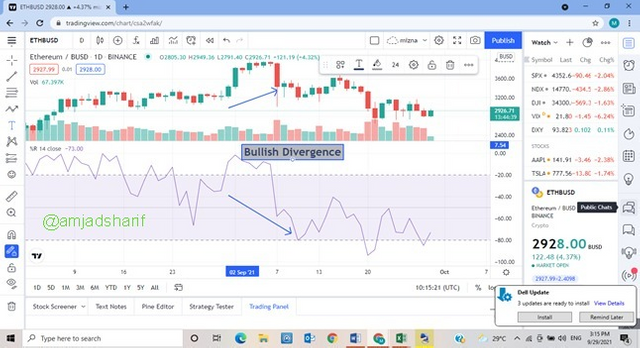

BULLISH DIVERGENCE:

If the price is making a lower low but the indicator is making a higher low. It is a bullish divergence.

When the price declines to form new lows, but the indicator fails to reach or indicate the new low, this is known as a bullish divergence. When this happens, it sends out a strong buy signal, and the bulls will be eager to take control of the market.

5 - How do you spot a trend using Williams %R? How are false signals filtered?

The Williams percent R indicator is a great way to spot bullish and bearish trends, as well as trend reversals. Trends are similar to buying or selling opportunities in the market; when the price changes, the trend lines show the price movement; if you can figure out market/price trends, you can easily determine when to purchase or sell.

You may recognize a trend and create a trend line to visually indicate support and resistance. You can choose a time range for your analysis, and as price moves, new trends emerge, allowing you to know when to enter and exit the market.

6 - How do you spot a trend using Williams %R? How are false signals filtered? (screenshot required)

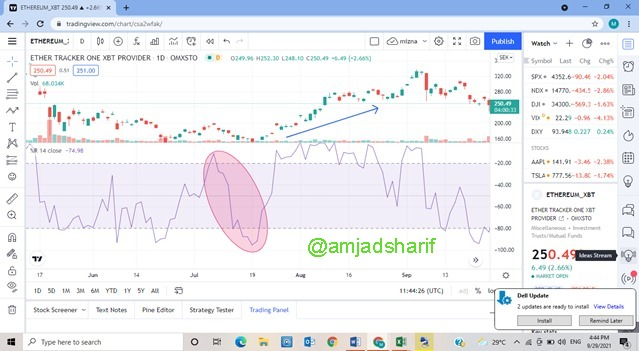

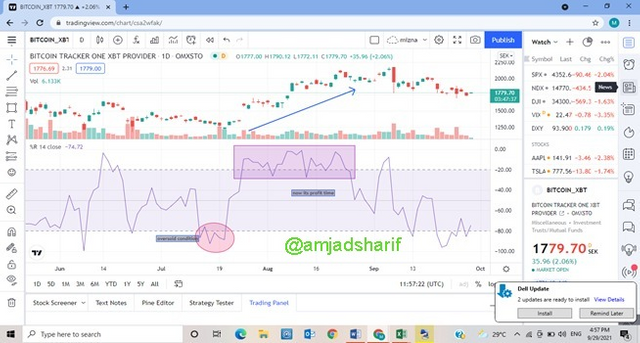

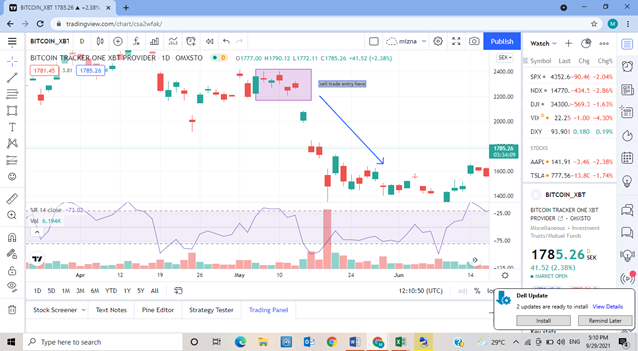

For this Question, I'd like to use the Bitcoin/XBT chart to generate Buy/Sell Signals using William percent

Bitcoin/XBT BUY TRADE SIGNAL:

When the Williams percent R indicator moves over the -80 line after being in oversold conditions, we can obtain a buy trade signal. Using the Williams percent R indicator. The Williams percent R indicator was in oversold conditions in this example, following which it broke the -80 line and proceeded upwards. We can see that the price level has also broken the EMA, so there's where I put my buy trade, with a stop loss below the latest low candle and a 1:2 take profit ratio (R: R)

Bitcoin/XBT SELL TRADE ENTRY:

The overbought circumstances of the market are indicated by the Williams percent R indicator in the example above. The indicator quickly fell below the -20 line, signaling a bearish indication. When the Williams percent R indicator drops below the -20 line after being in overbought conditions, we can get a sell trading signal. Using the Williams percent R indicator, I was able to get a nice sell trade entry.

CONCLUSION:

IIf we can combine this signal with other tools, it will be a really wise decision that will assist us in making better decisions. William percent R is an Oscillator that may be used by traders to determine the strength of a trend, reversal points, divergences, and the overbought/oversold zone. If we solely take the William percent R's Over Bought and Over Sold readings for entry signals without any other compelling reason/confirmation, we may have to go through a string of losing trades. The Williams percent R indicator is an excellent addition to my collections of technical indicators. The Williams percent R indicator provides market information by indicating overbought and oversold levels, It also allowsi+7u`` us to acquire good trend signals and possible trend reversals.

This was an interesting Lecture professor @kouba01

Regards,

please verify

https://steemit.com/hive-172186/@immy05/achievement-2-task-basic-security-on-steemit-by-immy05

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

https://steemit.com/hive-109286/@blessinglove/photo-event-with-editing please vote for me

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

please voted me on my post

https://steemit.com/hive-172186/@ahtashamch456/achievement-3-task-content-etiquette-by-ahtashamch456

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hi @amjadsharif

Thanks for participating in the Steemit Crypto Academy

Feedback

This is fairly done. Your article lacked an in-depth analysis of Trading using William's %R Otherwise thanks for the effort.

Total| 6/10

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you for your feedback.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Good work

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

https://steemit.com/hive-172186/@blessinglove/achievement-2-blessinglove-task-basic-security-on-steem

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit