AssalamuAlaikum & Greetings Everyone!

AssalamuAlaikum & Greetings Everyone!

It's me @amjadsharif

From #pakistan

From #pakistan

| Q.1 - Understanding Order Book in Steme/USDT Trading |

|---|

| What is the order book? |  |

|---|

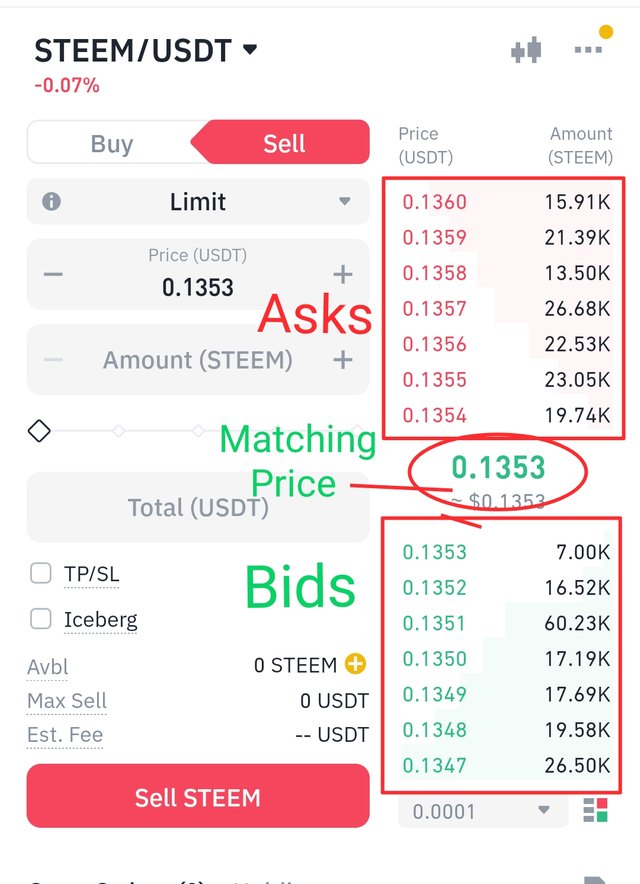

Order Book has a list of buying and selling orders between buyers and sellers in any financial market. This book shows prices, liquidity and supply and demand in the market. In steam/USDT trading, the order book is a place where buyers make their bid and sellers show their demand (ASK).

How Does Order Book Work?

Order book usually contains three basic parts:

Bids: These are the prices on which buyers are ready to buy stem. These are always less than the minimum price and less than the maximum price.

Asks: These are the prices on which sellers are ready to sell their steem. They are always higher than the maximum price and less than the minimum price.

Order Matching: When a buyer's bid matches a seller's demand, the order is completed and the trade exchange is recorded.

Elements of Order Book

Price Level: Each order is given at a certain price, called Price Level.

Volume: The quantity for sale at each price level is called volume.

Market Depth: This order shows the total number of buying and selling orders at various prices in the book. Being high market depth means that the market is high, that is, prices will be more stable.

Why is the Order Book Necessary?

The order book plays a key role in any trading market as it helps us understand the following things:

Market Lakedity: If there are high number of orders in the order book, it means that the market is high in the market, which makes it easier to buy and sell.

Supply and Demand: Order Book shows how many people are ready to buy or sell at a specific price. This gives traders what the market trend can go.

Price Forecasts: If there are large numbers of purchase orders at a certain level, it will act as a level support. Similarly, a large number of sales orders make a price resistance.

Better Trading Opportunities: By analyzing the order book, traders can trade in places where they can get excellent entry and exit points.

Order Book Trading vs. Traditional Technical Analysis

Traders usually use two types of analysis: order book trading and traditional technical analysis. It is important to understand the difference between the two methods.

| Aspect | Order Book Trading | Technical Analysis |

|---|---|---|

| Type of Data | Real-time buy and sell orders | Historical price patterns and charts |

| Main Focus | Market liquidity and supply/demand | Price patterns, moving averages, and indicators |

| Market Understanding | Helps in short-term price movement predictions | Useful for long-term trends and price forecasting |

| Trading Opportunities | Suitable for short-term trades, scalping, and intraday trading | Best for swing trading and long-term investments |

Trading methods from Order Book

If you want to use the order book effectively, consider the following points:

See the Market Depth: If there are more orders at any cost, it means that the market can get support or resistance.

Test Volume: If there are large orders to buy or sell suddenly at any cost, this may be a potential breakout or a revenue indication.

Understand Spofers: Sometimes large traders give artificial orders to create wrong signals in the market. It is important to recognize them.

Spread: The difference between bid and demand is high means that the market is less liquid, while there is less difference means trading will be easier.

Is the Use of the Order Book Enough?

The order book is a valuable device, but it should not be the only source of analysis. Many times big investors (whales) impose fake orders to deceive the market and later remove them. Therefore, it is important to use technical analysis and other methods with the order book.

Order Book is a powerful tool for any trader who in real time helps to understand market orders, liquidity, and price trends. Better entry and exit points can be obtained by effective use of order books in steam/USDT trading, but it should always be used in conjunction with technical analysis and other indicators.

| Q.2 - Market Depth Analysis and Order Flow |

|---|

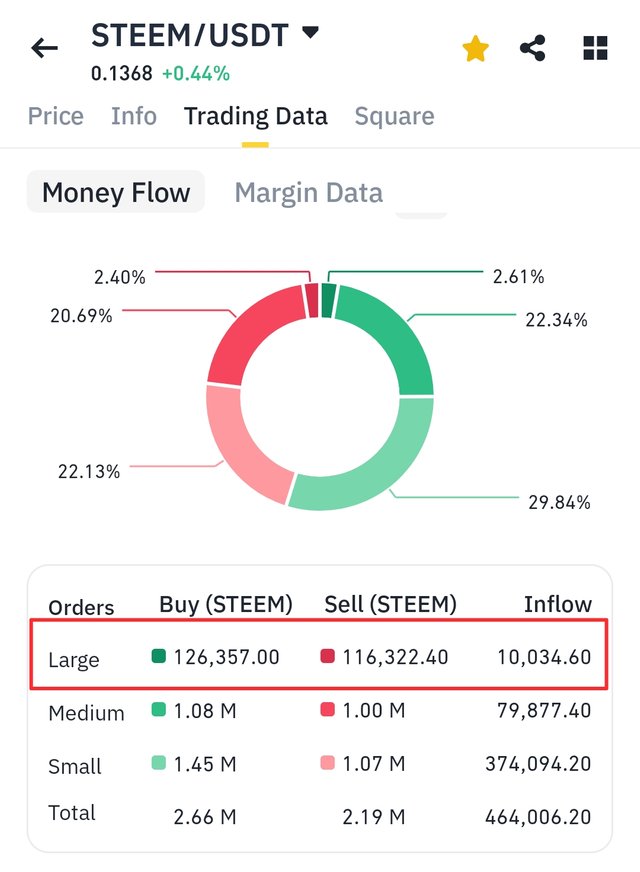

The market depth and order flow are two basic elements to understand the price movement in the market. Using them, traders can know where support and resistance levels are forming and how the market is working and selling.

What is the market depth?

The Market Depth, also known as Level 2 Data, shows the underlined orders for buying and selling for a particular financial asset. This includes Budd (purchase offers) and Ask (sales offer), which helps traders to understand how many buyers and sellers are present at a particular price.

The elements present in the market depth:

Bid Orders: Prices where buyers are ready to buy.

Ask Orders: Prices where sellers are ready to sell.

Quantity of Orders How many units are being purchased or sold at every cost.

Market depth shows where there is more liquidity and where large quantities of orders are placed.

Particularly of Support and Resistance Kevels

- Support Level

Support is the level where there are a lot of budget orders, which prevent the price from going down further. When the price reaches this level, buyers become more vibrant and the market starts to grow.

- Resistance Level

Resistance is the level where there are a lot of ascension orders, which prevent the price from rising. When the price reaches this level, the sellers become more vibrant and the sale pressure in the market begins to rise.

Detection of Support and Resistance Through Market Depth

If the biding orders are high at any cost, that price can be a potential support level.

If there are high orders at any cost, that price can be a potential resistance level.

If orders suddenly increase at some level in the market depth, a major trading activity may be expected at this level.

What is Order Flow Analysis?

Order Flow Analysis observes which orders are actually being completed in the market and in which direction there is more pressure. Through this, it can be understood whether buyers are more powerful or sellers dominate the market.

Main Aspect included in the Order Flow

Volume Test: How many units are being purchased and sold in the market.

Large Orders:

If a large quantity is being purchased or sold, it can be a strong signal.Aggressive Buying or Selling: If buyers are constantly giving market orders, it can take up the price. Similarly, if sellers are giving market orders, the price can go down.

Understanding Market Trends through Order Flow

| Green Left Buying Order and Red Right Selling Order |

|---|

- Identify the Pressure Bid Side

If most orders in the market are being completed on the Bid side, this means that buyers are strong.

If the purchase orders are increasing at a certain price, it can become a level support level.

- Identify the Pressure Ask Side

If most orders in the market are being completed on the Ask side, this means that the sellers are stronger.

If sales orders are increasing at a certain price, it can become a level resistance level.

- Fake Orders and Market Menoplation

Occasionally large traders try to mislead the market by placing artificial orders. They can give a false impression to the market by putting too much buds or ascending orders, but as soon as the price reaches this level, they remove their orders. Using Order Flow Analysis, it can be seen which orders are real and which are artificially placed.

| Q.3 - Identify and React to Large Orders |

|---|

Impact of Large Buying and Selling Orders on the Market and Strategies for Traders

Impact of Large Buying and Selling Orders on the Market and Strategies for Traders

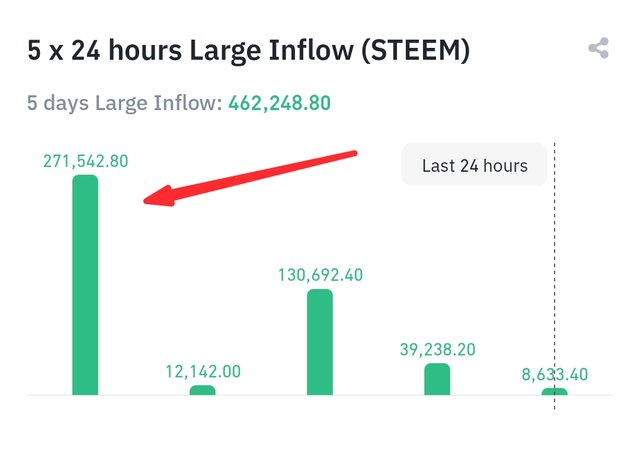

In financial markets, especially in crypto currency and stock market, large buying and selling orders have a profound impact. These major orders are often called "wheel orders" because they come from big investment companies or individual investors. Understanding and reacting to these orders can be a profitable strategy.

Effect of the Larger Orders on the Market

When a large buying order enters the market, it can create a strong support level and push the price upside down. On the other hand, a larger sales order can produce resistance and can cause price reduction.

This effect is more prominent in the weak markets in terms of liquidity, especially in terms of liquidity. If there are not much buyers and sellers in the market, a large order price can be taken up or down fast, called "slippage".

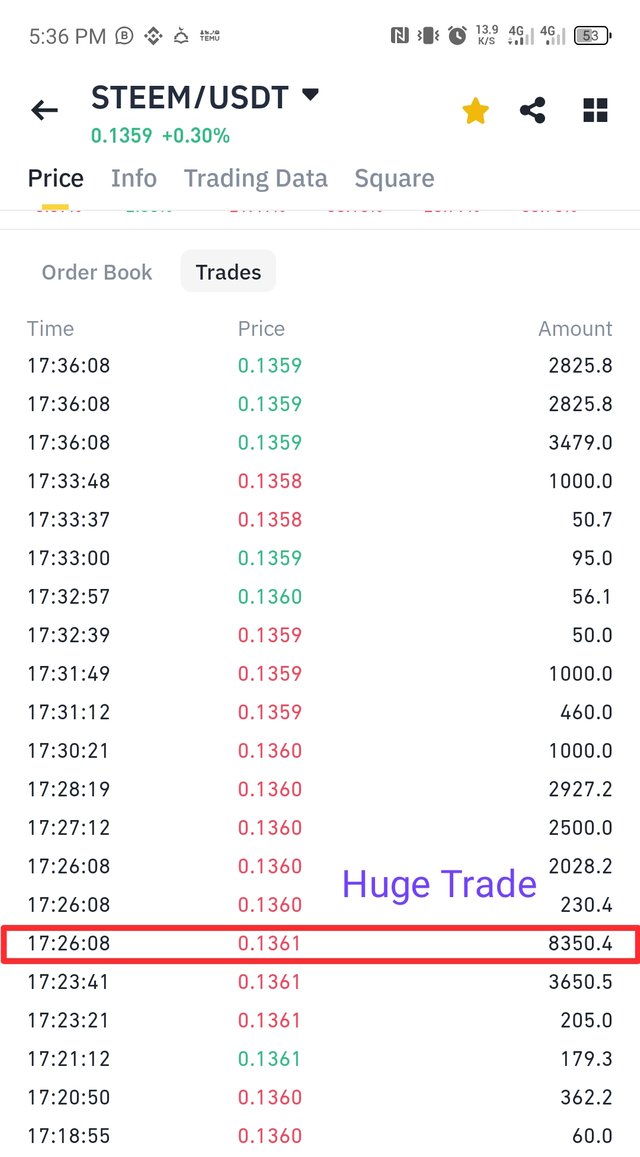

Identification of Large Orders

The following techniques can be used to identify large orders:

- Order Book (Order Book) Observed

If the market order appears extraordinarily large orders, it may mean buying or selling a large wheel. If there are too much purchase orders at a certain price, this means that the market has strong support, while more sales orders indicate resistance.

- Trade Volume Analysis

If the volume suddenly increases, especially at a time when the market is relatively quiet, it can identify a large buy or sell order.

- Spofing and Fishing Orders

Sometimes big investors apply fake big orders to deceive the market, called spoling. These orders are later removed so that the price can be taken in a certain direction.

Trading Strategy

Professional trading can be done by proper analysis of major orders.

- To Trade with the Wheel

If a large purchase order is identified, traders can also benefit by applying the order in the same direction. For example, if a whale plays a big buyer at $ 50,000, it is possible that the price will go up further, so becoming a buyer can be profitable.

- Large Sales

Large sales orders can take the price down, so if pressure is under pressure in the market, the damage can be avoided by applying proper stop loss.

- Keep an Eye on the Breakout (Breakout)

If a large wheel is buying at an important resistance level, it may mean that she is preparing for a breakout. In this case, traders can make a profit by buying with a breakout.

- Money Management and Emotional Control

Large wheel orders can sometimes produce fear (FUD) or greed in the market. A successful trader should make logical decisions while controlling his emotions.

Large buying and selling orders can cause short -term and long -term fluctuations in the market. Traders must closely review the order book and the trade volume and set their strategies by determining the direction of the market. If properly analyzed, wheel orders can be used in favor of their trading and make more profit.

| Q.4 - Order Book -Based Trading Strategy for Steem/USDT |

|---|

Order Book analysis is an effective method in the trading of Steem/USDT that can determine entry and exit points. Order books show buy and sell orders, which help identify support and resistance levels. In this strategy, we will understand how to make better decisions in the market using the order book.

Basic Understanding of the Order Book

Order Books have two main parts:

BIDS (Purchase Orders): Prices on which people are ready to buy STEEM.

Asks (Sale Orders): Prices on which people are ready to sell Steem.

| Important points |

|---|

If there are more buying orders at a specific price, it can become a support level.

If there are more sell orders at any cost, it can become a resistance level.

Spread, ie, reduce the difference in buying and selling price means more liquidity, and more differences mean less liquidity.

How to choose the Entry Point?

The best entry points can be found by analyzing the order book.

Way for Entry:

| Entry Point: Buying at Support Level after Breakout |  |

|---|

Purchase at Support Level: If the Order Book has more biding orders at a certain price, it can be a strong support level.

Entry in the Low - Spreads Market: Where there is less difference between biding and asking price, purchase can be beneficial.

Purchase on Breakout: If a price is repeatedly trying to break a resistance level, and more purchases appear in the order book, the breakout entry can be a good opportunity.

Choice of the Exit Point

|

|---|

| Entry Point 👇 Support Level | Target Point 👇 Resistance Level | Exit Point 👉 Below Support Level |

|---|

It is necessary to get out at the right time to take advantage of trading.

Strategy for Exit:

Sale at Resistance Level: If more cell orders in the Order Book are at a certain price, it may be your Exit Point.

Buy Wall Expires Sales: If a large quantity is being purchased at a support level, but suddenly these orders are over, the price can fall down, so it would be better to sell.

Fixed Tech Proof: Set a limit for profit and sell on time.

Importance of Liquidity

In case of more liquidity:

Orders are executed soon.

Price does not fluctuate.

Trading costs are low.

In lower liquidity:

The price can suddenly go up or down too much.

It may take time for an order to be exemplified.

Slippage may be high, that is, the order is not complete at the expected cost.

To check the leakage:

Find large quantity orders in the order book.

See 24 hours trading volume.

Check the spread, the less difference is a sign of more liquidity.

Risk Management

The loss in any trading strategy is necessary to restrict.

Rule of Risk Management:

Do not invest more than 2-3% of each trade.

Apply a stop loss to control the damage.

Monitor the market constantly and keep an eye on the changes in the order book.

| Q.5 - Real World Order Book Case Study: Steem/USDT Trading |

|---|

Analysis of order books in the crypto currency market is an important skill, which helps traders to assess the cost direction and make better decisions. In this case study, we will understand the movements of the order book on the Steem/USDT couple, see the experiences of a trader, and know how it changed its strategy.

Order Book Preliminary Observation

Trader considered the following points while studying Steem/USDT's order book:

Bid and Ask Spread: There was a clear difference between orders for purchase (Bid) and sales (Ask), which was indicating less liquidity in the market.

Large Order Position: There were large quantities of buying and selling orders at certain prices, showing potential support and resistance levels.

Spofing Signs: Some major orders were visible from time to time, but as the price approached, they disappeared, which was indicating a potential market manipulation.

Initial Strategy of the Trader

Trader adopted the following strategy based on these observations:

Purchase at Support Level: Where large quantities of purchase orders were visible, he set his entry points.

Limited Profit Strategy: Since there was more volatility in the market, it preferred short -term scalloping.

Be Careful about Large Sales Orders: Where there were large quantities of sales orders, he was cautious to take position so that the resistance brakes could be confirmed.

Sudden Change in the Market and Adjustment of Strategy

One day, Steem/USDT saw a sudden purchase with high volume, which pushed the market up.

Significant changes:

Low Bid Orders: Despite the price rising, there was no new demand, which was showing the possibility of PUMP & Dump.

Lack of Liquidity: As the price went up, large sales orders gradually disappeared, which was a sign of market volatility.

Defense Orders: A large purchase wall was built, but as soon as the price reached there, the orders were removed and the market fell down.

New Strategies and Learned Lessons

Trader made the following changes:

Pay Attention to Market Volume: Instead of order books, began to look at the real buy and sale volume to avoid artificial pump & dump.

Better use of Stop Loss: I learned that wall orders are not always real, so he started wearing a tough stop.

Avoid Trading in Low Liquidity: When orders are low in order books, price can be more fluctuated, so it starts to prioritize the high liquidity market.

Considering Open Interest and Total Volume: Instead of just relying on the order book, it also included the open interest and the overall volume in the analysis to make better decisions.

Results and the Main Lessons

This case taught the following important points to the study traders:

The Order Book does not always Reflect the Truth: some major orders are placed only to cheat in the market.

Do not just Rely on Order Book: trading must include volume, open interest, and other technical indicators.

Understand Spoons and fake Walls: large buying or sales walls are not always real, so they should approach them and take a cautious attitude.

Low Liquidity can be Dangerous: such market fluctuates are high, so the use of small stop las is essential.

This Order Book Case Study teaches us that the market must be clever, analyzing capacity and flexibility in strategies. Just looking at the order book can be dangerous, so a complete analysis with other market indicators is essential.

Wish best for all friends!

I invite @alfazmalek, @chant and @shabbir86,

Thank you

Wah bhai wah, man gaye

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit