Hello Everyone I am Inviting you to read my homework of professor @reddileep.

MARKET MAKING:

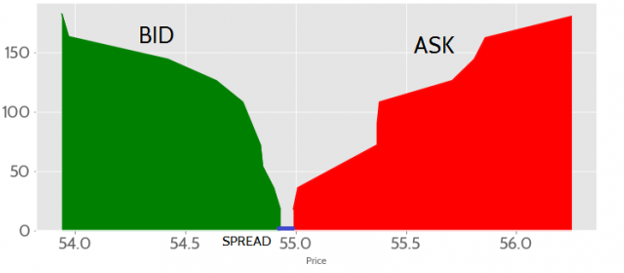

Market making is a circumstance in which an individual quotes two-sided markets in a specific item. This is accomplished by supplying the bid and ask prices, as well as the market size of each of them. Individuals or brokers who are able to provide liquidity in the crypto market by making quotations for buy and sell orders in the market are known as market makers. Once they receive an order, whether from the buy or sell side, the order is executed using their own inventory or cash earned from the market. The market-creating concept describes the process of generating liquidity for a buy and sell limit order.

Let me give you an example:

• Person 1 is a vendor who owns an iPod and wishes to sell it for cash.

• Person 2 is a cash-strapped buyer looking for an iPod.

• The market maker pays $199 for Person 1's iPod and then sells it to Person 2 for $201.

• The market maker can profit $2 on the bid-ask spread if the bid price is $199 $ the asking price is $200.

Explain the Psychology behind Market Maker?

Market makers are based on a lot of psychology. Market makers come up with a technique to profit by charging greater ask (selling) prices than bid prices (buying). The spread is the difference in price between two items.

Furthermore, the spread compensates market makers for the risk they take in placing such transactions, which may include price indicator movement that is adverse to their trading position. For example, a market maker might purchase 1000 APPLE shares for $100 each (the ask price) and then sell them to a buyer for $100.05. (the bid price).

Market makers influence the price movement of crypto assets by placing orders at predefined levels based on analysis and projections. Market makers place low-priced buy orders and high-priced sell orders. As a result, crypto assets may have market liquidity. Other traders profit from the current market condition by placing buy and sell orders at prices that are between the market maker's orders.

Explain the Benefits of Market Maker Concept?

• Market makers assist stock exchanges in increasing both the liquidity of stocks in the market and the volume of shares traded. In addition, stock exchanges have been able to reduce the time it takes to execute an order as well as the transaction costs associated with trading equities.

• The market maker concept can attract more traders to the market by increasing the value of the coins. Traders who aren't very experienced in trading hunt for any opportunity to profit.

• They also help us because their absence may cause investors to lose interest. Not being able to sell their asset since the market does not always have ready-made customers. This may make the seller to wait in order to peer with a buyer, which will take time.

• Market makers also help to keep the price of undervalued or overvalued assets in check. Because market makers may control the amount of assets in the market and, as a result, establish the price for each asset based on supply and demand, they can help expand the price of an undervalued asset by raising its price or lowering the price of an overvalued asset by lowering its price.

• Market makers help to keep the price of crypto assets in the market stable by setting bid and ask prices that differ for a predetermined amount of time. This is advantageous for traders because crypto assets are difficult to lose when they decline in value.

• When a market's volatility is strong, trades are sometimes executed at a price that differs from the one that was set, which increases market leakage. Market makers typically limit spills by lowering market volatility.

Explain the Disadvantages of Market Maker Concept?

• Market makers cannot guarantee that liquidity will be available in the market for an extended period of time. They are unregulated and manipulate the crypto asset market in a short period of time. As a result, the trader is at a disadvantage.

• There's also the issue of unjust profits to consider. With the unfair gains, we can see that market makers are infamous for keeping information hidden from the broader public, a practise known as insider trading.

• The same thing happens in the case of liquidity providers or market makers, just as it does with whales who enter the market, make a profit, and then remove their liquidity. They do not have a time frame for how long their liquidity will endure, and it is impossible to predict how long it will continue because it can be withdrawn at any time.

• Market makers may make blunders when manipulating the market by placing a high-priced sell order, causing other traders to react to the scenario. The price of the crypto asset will drop as a result of this.

• Customers can frequently be used by a market maker who is not properly regulated, such as in crypto markets.

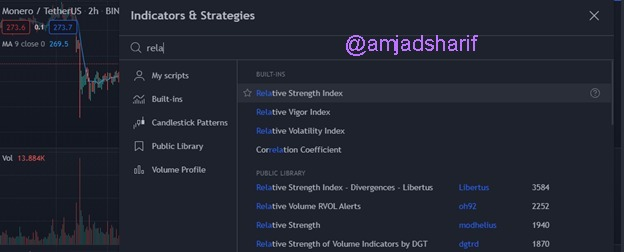

Explain any two indicators that are used in the Market Maker Concept and explore them through charts. (Screenshot Required)

Moving Average (MA):

Traders can use the Moving Average (MA) as an indicator or tool to undertake technical analysis on a crypto asset by putting it on the trading chart. Traders can use this indicator to spot market patterns because it displays the average price movement of crypto assets. To give accurate analytical findings, MA lines can be modified according to a trader's trading strategy. This indicator is used by the market maker to manipulate the market and generate false signals for traders in this situation.

The Moving Average (MA) is used by traders to predict when the market's crypto assets will reverse their direction. The MA lines frequently cross as a result of up and down price fluctuations, and this is a confirmation.

Screenshot from tradingview

The XMR/USDT trading chart depicts the uptrend and death trend established in the market over a period of time, as shown in the chart above. In this case, the market maker is in charge of driving the market and causing prices to rise and fall. They provide liquidity, allowing the market to experience price movements and trend reversals that the Moving Average (MA) indicator can detect. Traders can use this indicator for technical analysis and to enter and exit positions at the appropriate times in this situation. The Golden Cross, which indicates a buy signal, and the Death Cross, which indicates a sell signal for the XMR/USDT pair, demonstrate this.

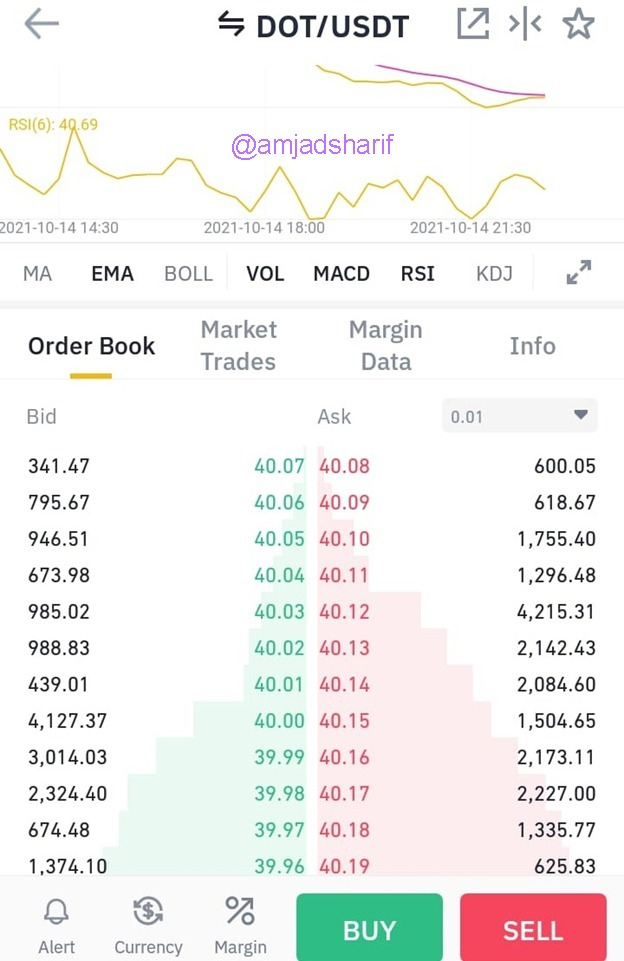

Relative strength Index:

The Relative Strength Index (RSI) is a technical analysis indicator or tool that traders can use to analyse crypto assets by adding them to trading charts. This indicator depicts the trend's relative strength in a bullish or bearish phase, and traders can use it to spot hints that the trend is coming to an end. To deliver accurate analytical findings, RSI lines can be modified according to a trader's trading strategy. Market makers are using this signal to manipulate the market and drive the price movement of crypto assets in this situation.

The Relative Strength Index (RSI) is used by traders to determine the current state and movement of crypto assets in the market. The RSI line reaches the peak level above 70 or the bottom level below 30, depending on whether the trend is up or down, and this is a sign that the trend is going to terminate. On the trading chart, traders can see if the market is overbought or oversold. Overbought is a signal that the trend is strong in the bullish phase, indicating that the price is rapidly rising, and traders can utilise it to place sell orders at this time.

Screenshot from Trading View

The XMR/USDT trading chart exhibits Overbought and Oversold conditions in both bullish and bearish phases, as shown in the chart above. In this case, the market maker is responsible for pushing the market and causing major price fluctuations. They supply liquidity such that the market experiences big price changes, and the Relative Strength Index (RSI) indicator can detect the end of the trend. In this instance, traders can utilise this indication for technical analysis and profit maximisation at this time. Overbought, which indicates a sell signal, and Oversold, which indicates a buy signal for XMR/USDT, demonstrate this.

CONCLUSION:

Market making is a concept that market makers demonstrate by simultaneously buying and selling a specific item, hence establishing a barrier for other investors and retail traders. Individual traders or companies with a high amount of investment are known as market makers, and they are in charge of determining price quotes, boosting liquidity, and assuring speedier and easier transactions within the trading ecosystem. A market maker's mindset is to profit from the spread. Although the spread looks to be little, when compounded by the volume of sales per day, it becomes a tempting profit. He also wants to acquire at a low price and sell at a high price. Following market makers as they move the market is known as the market maker idea. Using trend following indicators like as Bollinger bands, momentum indicators such as RSI, volume indicators, or a combination of two or more in a single chart.

CC:-

Thanks for Anticipation:

@amjadsharif.

Respected Sir, please verify my achievement 5 task 4

https://steemit.com/hive-172186/@zohaibb/achievement-5-task-4-by-zohaibb-review-steemdb-io

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit