Am gladdened once again for yet another opportunity of this wonderful edition by the cryptoacademy. From the lecture offered by Professor @awesononso, reading through this lecture series have given me a better insight on the Bid-Ask Spread. To this, I will be writing based on the task given by the Professor.

Properly explain the Bid-Ask Spread

In a scenario where a seller has a commodity for example, a computer system, to sell at the rate of 500 steem and a buyer wants to buy the computer system at the rate of 400 steem. 500 steem that the seller wants to sell the computer system is what is known as the Ask price and 400 steem that the buyer is willing to buy the computer system is what is known as the Bid price.

Ask Price

Ask Price is the price that an asset or cryptocurrency holder is willing to sell his/her asset or cryptocurrency and as such cannot go beyond that benchmark.

Bid Price

Bid Price is the price in which a buyer is willing to buy a particular asset or cryptocurrency from a seller. This is the price benchmark of which he/she can go beyond thus the highest price he/she can go beyond.

Bid-Ask Spread

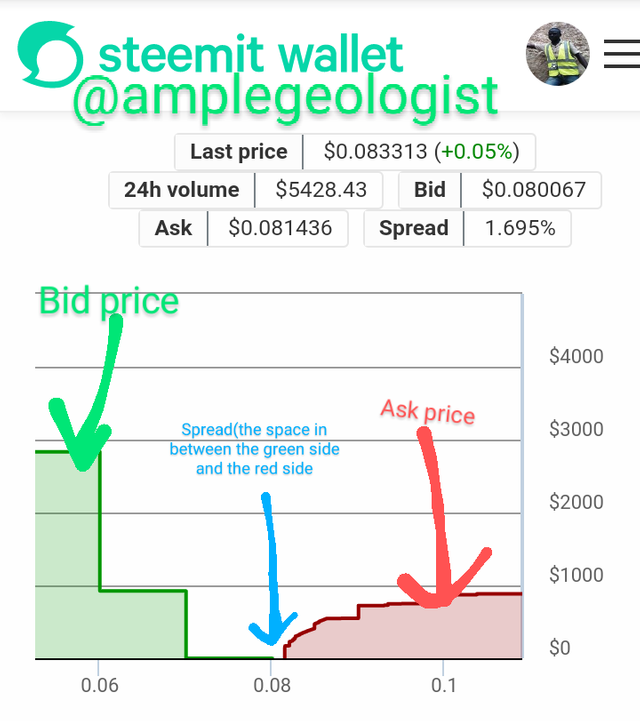

Looking at the screenshot above, the green side represents the bid price while the red side represents the ask price. In between the red side and the green side, you can see a gap, that gap is what is known as the spread.

Bid-Ask Spread is simply the difference shown between the price in which a buyer wants to buy an asset (Bid price) and the price in which an asset holder is willing to sell the asset (Ask price).

From the explanation I gave earlier, the asset holder is willing to sell his/her asset at the rate of 500 Steem but the buyer is willing to buy it at the rate of 400 Steem, thus the difference between the two parties (i.e the seller and the buyers price) is what is known as the Bid-Ask Spread, which in this case is going to be (500 – 400) Steem = 100 Steem (Bid- Ask Spread).

Why is the Bid-Ask Spread important in a market?

The Bid-Ask Spread which is the difference between the Ask Price and the Bid Price is important in a market because it helps investors in making proper decision on when to buy or sell a particular asset that is available. It shows the level at which an asset can be sold and also bought.

It also helps investors to be able to determine how high or low the liquidity of a particular asset is in the market, so as to know the right asset to invest on.

It also helps a trader to know the spread between the willing buyers and that of the willing seller’s price and the influx of buyers and sellers of a particular asset at a particular time period.

If Crypto X has a bid price of $5 and an ask price of $5.20,

a.) Calculate the Bid-Ask spread

Given, Bid price = $ 5

Ask price= $5.20

Ask price - Bid price = Bid-Ask spread

Inputting the values; $ (5.20 - 5.00) = $0.20

Therefore, the Bid-Ask spread = $0.20

b.) Calculate the Bid-Ask spread in percentage.

Given, Ask price = $5.20

Bid-Ask Spread = $0.20

(Bid-Ask Spread/Ask Price) x 100 = Bid-Ask Spread in percentage

Inputting the values; (0.20/5.20) x 100 = 3.84%

Therefore, Bid-Ask Spread in percentage = 3.84%

If Crypto Y has a bid price of $8.40 and an ask price of $8.80,

a.) Calculate the Bid-Ask spread

Given, Bid price = $ 8.40

Ask price= $8.80

Ask price - Bid price = Bid-Ask spread

Inputting the values; $ (8.80 – 8.40) = $0.40

Therefore, the Bid-Ask spread = $0.40

b.) Calculate the Bid-Ask spread in percentage

Given, Ask price = $8.80

Bid-Ask Spread = $0.40

(Bid-Ask Spread/Ask Price) x 100 = Bid-Ask Spread in percentage

Inputting the values; (0.40/8.80) x 100 = 4.545%

Therefore, Bid-Ask Spread in percentage = 4.545%

In one statement, which of the assets above has the higher liquidity and why?

According to the above, Crypto Y asset has a wider spread than that of Crypto X, thus Crypto X asset has a higher liquidity than Crypto Y asset.

Explain Slippage

Let’s look into a scenario where an investor wants to buy or places a buy or sell order on an asset that is worth 15 Steem, but eventually before the order placed is executed, there is a decrease or increase in the asset the investor placed an order on due to volatility of the crypto market assets. The decrease or increase experienced by the asset before the execution of that order is what is known as Slippage.

Slippage is a deviance in the price order of an asset from its original Ask price or Bid price and it often happens when there is a low liquidity an asset determined by the wide Bid-Ask spread in the asset.

Explain Positive Slippage and Negative slippage with price illustrations for each

Positive Slippage

Positive Slippage is a type of slippage with a positive outcome in the deviance of price of an asset from the original bid or Ask price.

In a scenario where I make a sell order on a particular asset worth 25 Steem, but before the sell order is executed, it happens that there is deviance in the price I placed a sell order on and thus was executed worth 30 Steem. This deviance in the price of the sell order is known as positive Slippage; thus as calculated;

30 Steem – 25 Steem = 5 Steem

Therefore, the positive slippage in the asset I placed a sell order is now 5 Steem.

Same method is applicable when making a buy order but in the reverse case.

Here, take for instance I place a buy order on an asset worth 25 Steem, but by the time my order is executed, the asset that was worth 25 Steem becomes 20 Steem. This single deviance in the price is known as a positive slippage; thus as calculated;

25 Steem – 20 Steem = 5 Steem.

From the above explanation, you can see that there is gain in the slippage or deviance in price of the asset at execution.

Negative Slippage

Negative Slippage is a type of slippage with a negative outcome in the deviance of price of an asset from the original bid or Ask price.

In a scenario where I place a buy order on a particular asset worth 25 Steem, but before the buy order is executed, it happens that there is a deviance in the price I placed the buy order on and thus was executed worth 27 Steem. This deviance in the price of the buy order is known as negative Slippage; thus as calculated;

27 Steem – 25 Steem = 2 Steem

Therefore, the negative slippage in the asset I placed a buy order is now 2 Steem.

Same method is applicable when making a sell order but in the reverse case.

Here, take for instance I place a sell order on an asset worth 25 Steem, but by the time my order is executed, the asset that was worth 25 Steem becomes 23 Steem. This single deviance in the price is known as a negative slippage; thus as calculated;

25 Steem – 23 Steem = 2 Steem.

From the above explanation, you can see that there is loss in the slippage or deviance in price of the asset at execution.

Conclusion

Just as the topic is, Bid-Ask Spread is a necessary tool which can be used by investors or traders to avert some possible loss as well as helping investors to make profit during the process of buying and selling their assets in the crypto market.

.png)

Hello @amplegeologist,

Thank you for taking interest in this class. Your grades are as follows:

Feedback and Suggestions

You should improve on your arrangement and markdown use. Also present your images better.

There are a couple of details missing in the presentation.

Thanks again as we anticipate your participation in the next class.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit