Am gladdened once again for yet another opportunity of this wonderful edition by the cryptoacademy. From the lecture offered by Professor @awesononso, reading through this lecture series have given me a better insight on stability in digital currencies. To this, I will be writing based on the task given by the Professor.

1. Explain why Stability is important in Digital currencies.

When talking about stability, we are dealing with how firm or steady a thing is. When we look at digital currencies, we see that there are lots of swing highs and lows caused by the users of different digital currencies. This fluctuations or volatility in prices of this currencies which are caused by demand and supply of the digital currencies tends to affect the stability of the currencies.

When there is much demand for a digital currency, we see that the price of that currency will rise, because it has a value that is why people demand for more of it, but when much of the digital currency is sold out, we see that the price of that currency will reduce and as such the value will reduce.

So, for a digital currency to have a value and be demanded by many, the value must be stable so as for people to have the yearning to invest more on it. When it is of value based on its stability, people will tend to use digital currency as a good medium of exchange thereby making the populace in the crypto world to increase as well as the growth of the cryptocurrency world.

Take for instance, if I make an investment on a particular asset, and at the end of that investment, I find out that I am running at loss, I will definitely not want to invest on it again because I am not gaining. But if I invest on a particular asset and at the end, I make an income or more than what I investment, I will want to invest more on it. This same is applicable in digital currency and its stability. If the price of a digital currency is not stable, people will not want to invest on it because it is now like a probability for them to either run at loss or gain. This is why stability is important in digital currencies, to make digital currencies have a proper store of value for more investment on it.

2. Do you think CBDCs would be good in the future?

CBDCs which is a digital currency owned by a particular country is a new development in the affairs of currency circulation and usage as to the new era of technology. To my own opinion on if it will be good in future, I would say yes because it will ease the delay and stress of having to belong to a particular bank before a transaction can be carried out but there is a clause when it comes to it being centralized, because there is no limit to privacy of people’s account, it is still controlled by the government.

In the other hand, I think it is a nice development to making digital currency to be stable, because if the CBDCs of a particular country is in consonant with the fiat currency value of that country, it will give the digital currency stability and as such will be greatly demanded for by people for investment because it is a legal and authorized medium of exchange and thus gives it a more security when it comes to certainty of transactions.

Weigh the pros and cons in your own understanding and state your position.

Pros of CBDCs

CBDCs allows for ease in accessing your wallet without having to pass or own an account in a particular bank.

CBDCs are currencies that have been clearly approved and authorized as a legal medium of exchange.

CBDCs allows for easy and faster transactions to be carried out without an intermediary as well no cost or transaction fees charged.

CBDCs allows citizens to grow and be up-to-date in the thriving advanced technology that emerges the world.

Cons of CBDCs

CBDCs which operates as a centralized system delimits users to their privacy since the central bank has full control and central authority over the account.

CBDCs will create a gap in the employment status of people who were working under the banking sector since transactions are carried out without intermediaries and as such will render those that were working under the banking sector jobless.

CBDCs will reduce the income that would have been generated by banks over transaction charges.

CBDCs will lead to a loop hole for those who are not convenient or exposed to the usage of internet or assessing of internet services since it is a currency that can only be accesses in a digital format via online.

3. Explain in your own words how Rebase Tokens work. Give an illustration.

Rebase token works just like the demand and supply principle. in demand and supply, the higher the demand, the higher the price but the higher the supoly, the lower the price and value. In rebase tokens, the more token demanded, the higher the price and if there is a drop in the demand of the token, the price will eventually suffer. Also, if there is a high demand of the token, the supply of the token will this reduce, causing a rise in the value of the token, but if the demand reduces and the supply increases, the token will be devalued. But in rebase token, as the supply reduces and the value tends to reduce, the rebase mechanism will help in circulating the token less so as for the value of the token not to drop as it should be.

Take for instance, a token is traded and accumulated based on more buyers, the price will increase thus an increase in the value, but by the time the holders of the token tends to sell off their tokens, for the price value not to fall, the rebase mechanism will help in making the circulation less so that the value will still be close to or up to to what it should be. This is how rebase token works.

4. Go to the https://www.ampleforth.org/dashboard/. Check the necessary parameters and calculate the rebase %. What else can you find on the page?

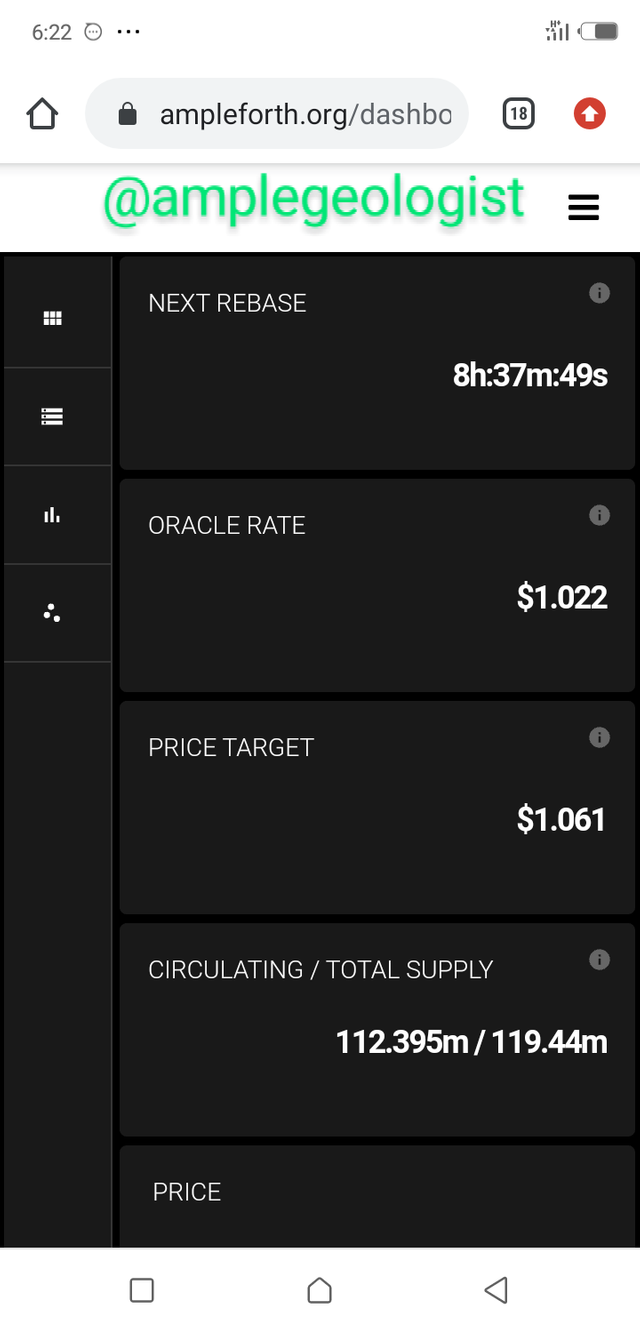

To calculate the Rebase%; from the screenshot above, the Oracle Rate = $1.022 and the Price Target = $1.061

Therefore the Rebase % = {[(Oracle Rate - Price Target) / Price Target] x 100} / 10

Substituting the values; ={[(1.022 - 1.061) / 1.061] x 100} / 10

= [(-0.039/1.061) x 100] / 10

= (-0.0367577757 x 100) / 10

= -3.6757775683 / 10

= -0.36757%

= -0.37%

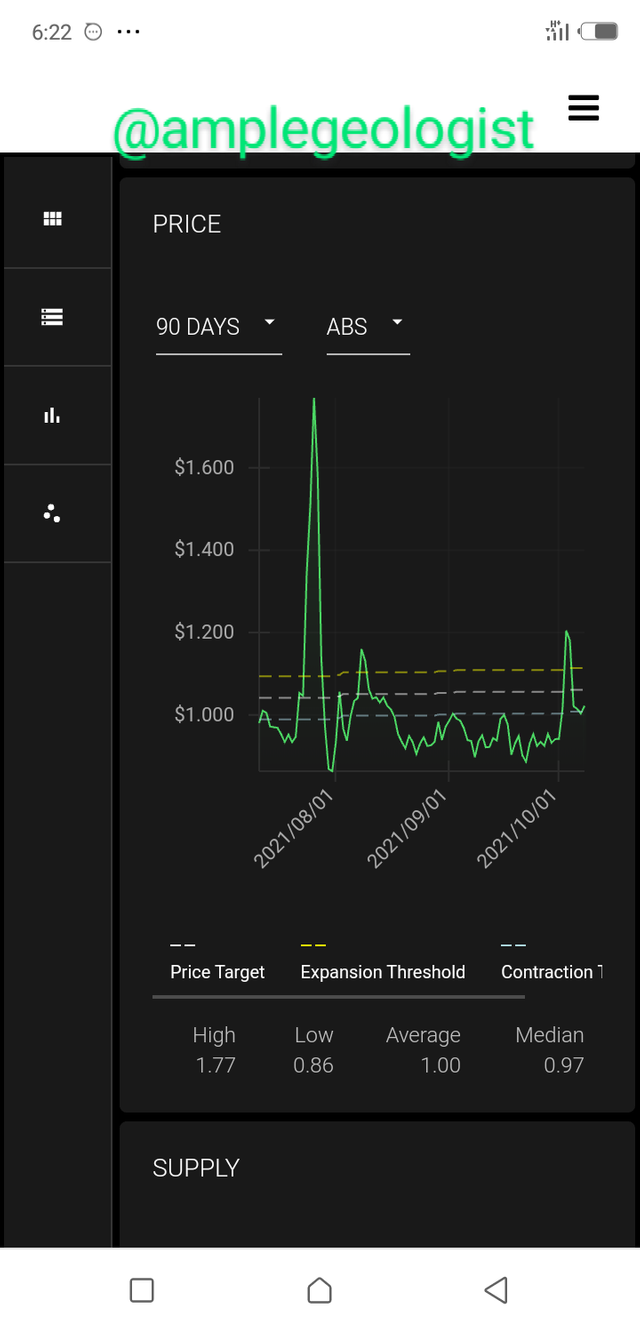

Other things that can be found on the page are:

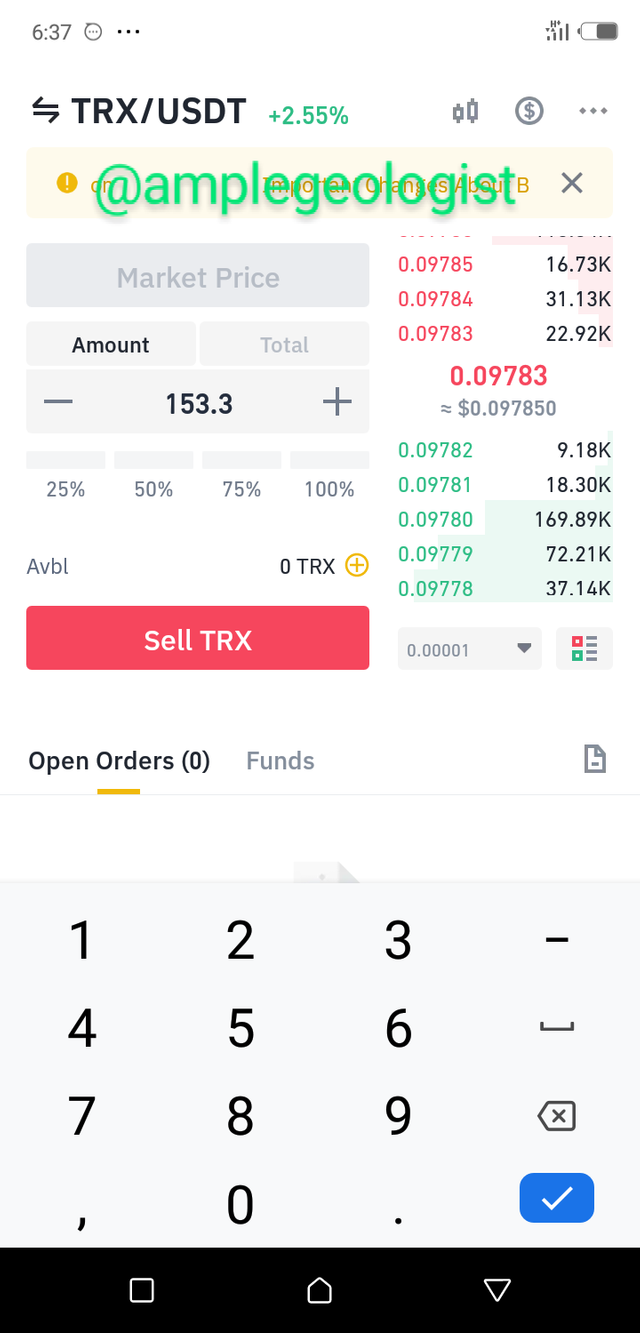

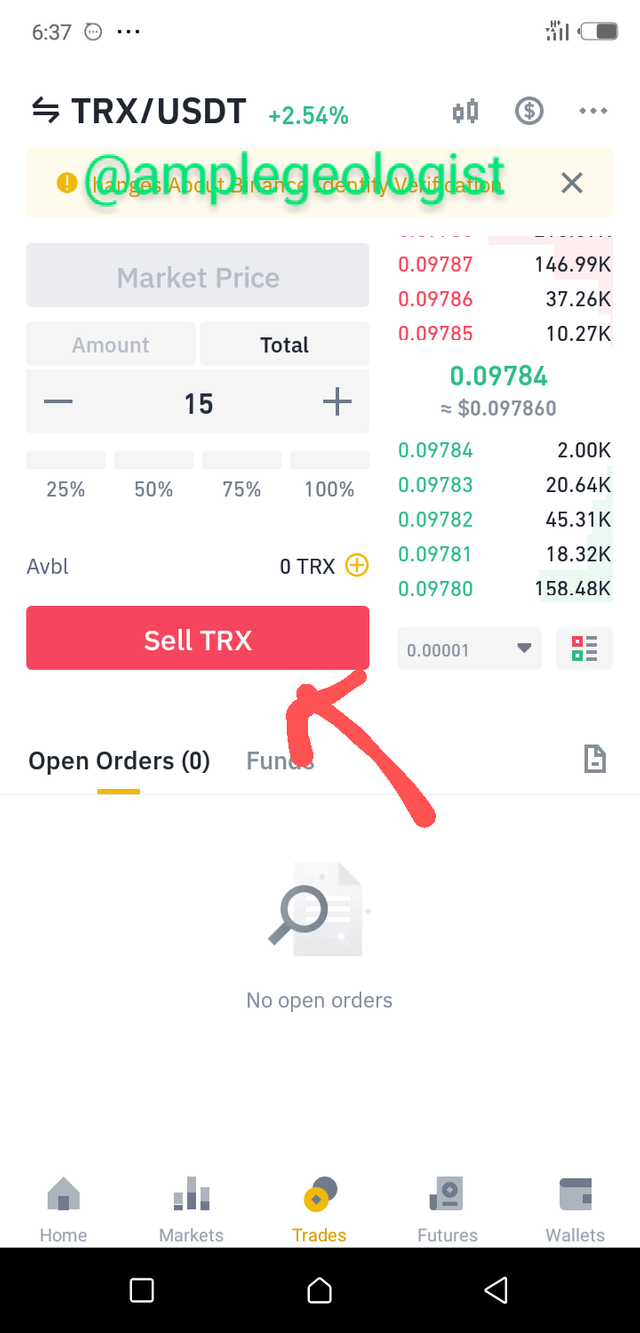

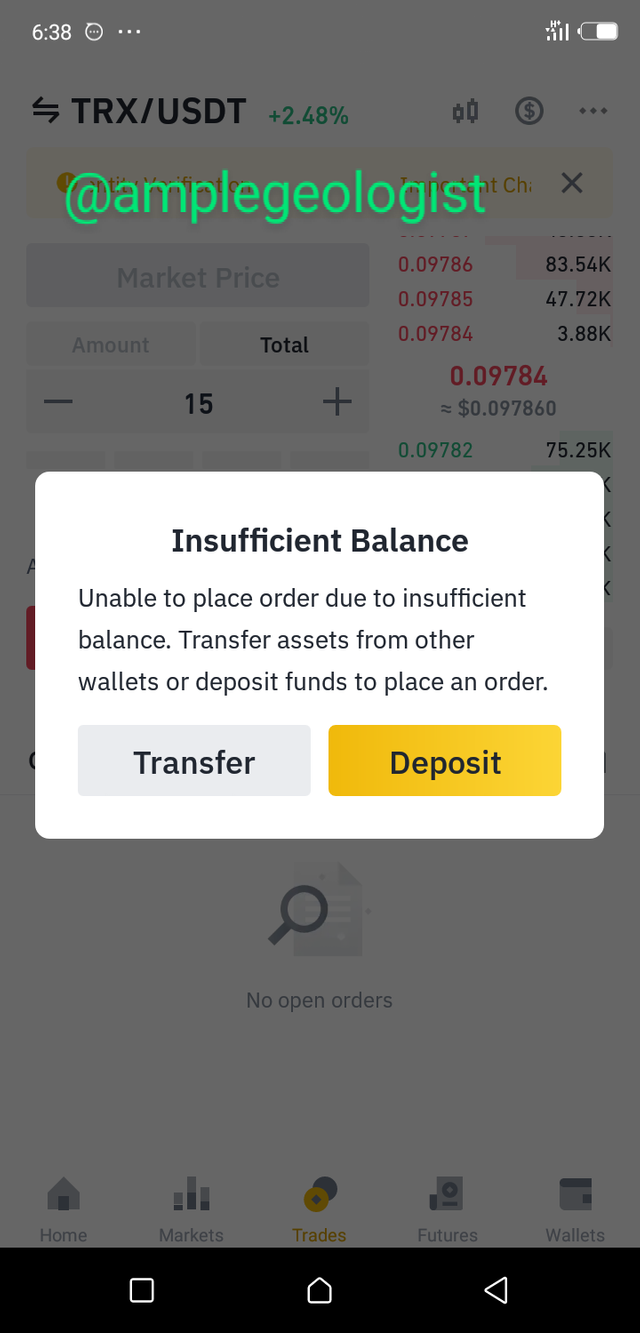

5. Trade some tokens for at least $15 worth of USDT on Binance and explain your steps. (Give necessary Screenshots of the transaction).