Hey, everyone I go through the lecture of professor @allbert about the topic psychology and market cycle . I understand the topic very well and enjoyed the lecture alot. Now am submitting my homework post.

Introduction

When it comes upon market trend and buying and selling in short investing your money in crypto or any market you have to be very much patient and understand the trend very carefully. But we always have lot of expression and emotions attached to our buying and selling. So. here we gonna discuss about expression. Mindset and expression are much important to trade.

Question: 1

Explain in your own words what FOMO is, wherein the cycle it occurs, and why. (crypto chart screenshot explanations needed)

FOMO

FOMO is an abbreviation of the word "fear of missing out." This is an emotional position for a trader to buy an asset because it is in an uptrend, and many people around the trader may be benefiting or have already benefited from it, so the trader joins the trend now instead of staying. Trophy. Therefore, in this position, we can clearly see that asset purchases are based on sentiment, sentiment and market noise, without any real technical analysis of market price movements.

These emotion-driven (FOMO) trading decisions are very common among newcomers to the cryptocurrency market, and most professional and experienced traders today are likely to become victims of the FOMO trend. This is because this is an emotional bias. Of course, people are easily controlled by their own emotions; in fact, a high degree of discipline and awareness is required when trading to control your emotional bias. So even now, we still have many traders who fall into this curse in every uptrend in the market.

Another interesting observation about FOMO is that it will cause traders to buy assets and succumb to resistance at the end of a bull market or when the uptrend is already weak, after which a downtrend may occur. When this happens, the value of the asset begins to fall, and traders begin to calculate their losses, and then other emotional biases such as fear and regret will follow.

In above chart I showed that how a person got panic and sentimental. When he/she get pressurized and confused of bullish trend and on peak of market purchased the asset and faces loss. This is FOMO.

Question: 2

Explain in your own words what FUD is, wherein the cycle it occurs, and why. (crypto chart screenshot explanations needed)

FUD

FUD is short for fear, uncertainty and doubt. These are also sentimental biases that affect traders' investment decisions during downtrends and highs and lows. In fact, traders who buy assets due to the FOMO mindset are more likely to experience FUD in a downtrend than traders who buy assets with the correct mindset.

FUD causes traders to start selling their positions when the price is at its lowest point, because they do not want to lose more than they think they have already lost, and by doing so they end up trading at very high losses. for profit, which also makes them dissatisfied with investing in assets again, even if there is another sign of an uptrend.

The FUD mentality is also common among newcomers to the cryptocurrency market. Many traders have been in this situation at one time. This may be due to a lack of understanding of how the market actually works, or because they still find it difficult. Analyze when making trading decisions instead of focusing on public sentiment and opinions in the market.

As, you see in above explanation person purchased a asset at some price and then price goes a bit up and after that showing bearish trend and fell down at thattime person purchased more asset and then market start showing bearish trend for long time person got Doubt and sell all the asset at loss. After that market got stable and person have anger in mind.

Questio: 3

Choose two crypto-asset and through screenshots explain in which emotional phase of the cycle it is and why. Must be different phases

A) POLS/USDT

I choose POLS/USDT as my first crypto for analyzing the expression of person in the market trend. There are many type of expression are there during the small span of time. Like panic, hope, anxiety, optimism , belief and thrill many more. Here in the graph above All the expression throughout the market is mentioned when person got belief , anxiety and more in 15 minutes market trend.

There are two main things in between this that is Euphoria & Complacency. Which means in short term trade where in the running market bullish one we can buy the asset and when having a profit in some time we can sell that asset. Many people recover there money through these trades large firms always do this whales trade. To earn huge profits.

In the graph above as we can see at the price of $0.970 we can purchase the asset and at the price of $1.030 sell the asset and earn profit in small span of time. The best time to buy and hold is 0.970 & sell and earn profit at 1.030. So, we can say that it is on "HOPE STAGE".

B) IOST/USDT

I choose IOST/USDT as my second crypto for analyzing the expression of person in the market trend. There are many type of expression this too like panic, hope, anxiety, optimism , belief and thrill many more in 15 minutes market trend.

In this crypto there are many variations in the trend but from very bearish point market is becoming bullish so this is the time of phrases like "Panic" but somehow there is "hope" phrase also. But for Euphoria & Complacency we can purchase for small time span and earn more and more profit as we can see in graph best point to buy & hold asset is $0.022 and to sell and earn profit is $0.025.

Question: 4

Based on the analysis done in question 3, and the principles learned in class, make the purchase of 1 cryptocurrency in the correct market cycle. The minimum amount of 5USD (mandatory), add screenshots of the operation and the validated account.

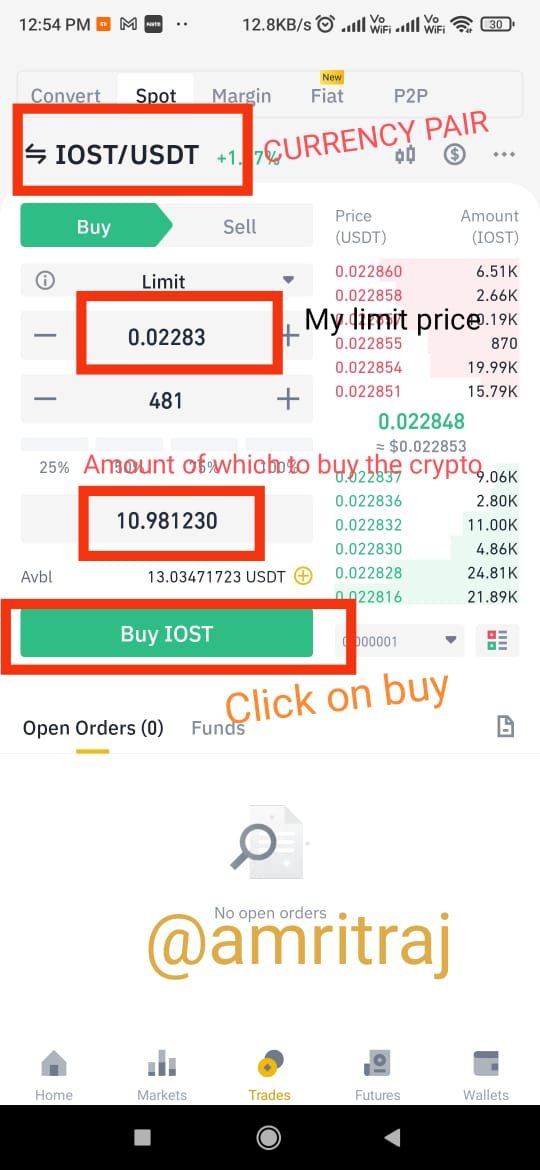

From Above Question three i have decided to purchase the IOST/USDT. I am selecting this currency because its showing 2.95% profit from last day. And according to my beileve it will provide me profit in future.

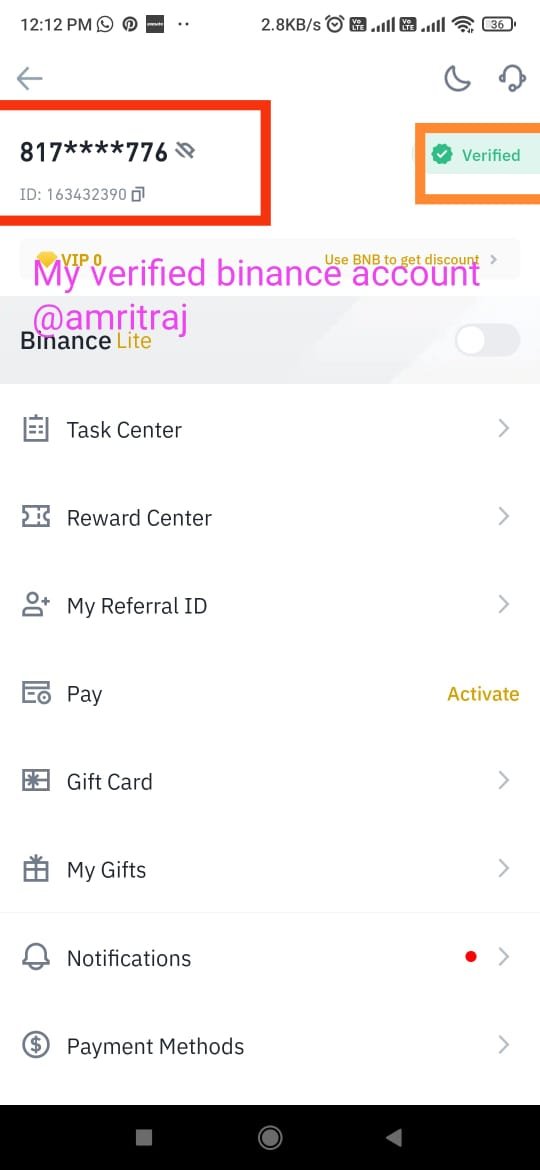

Here is my verified account on binance screenshot is attached below.

Step 1

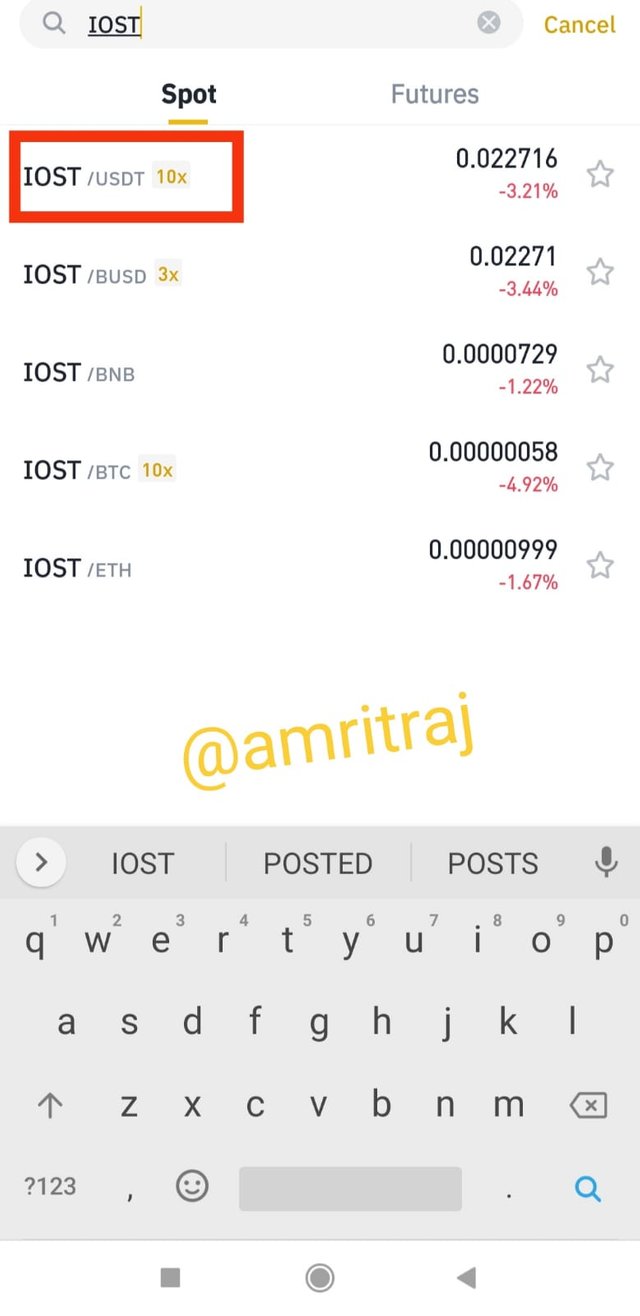

In search bar write iost/usdt & select the currency.

Step 2

Click on Buy and set your desired limit rate amount of usdt you want to exchange click on buy and wait till price matches your desired limit.

Step 3

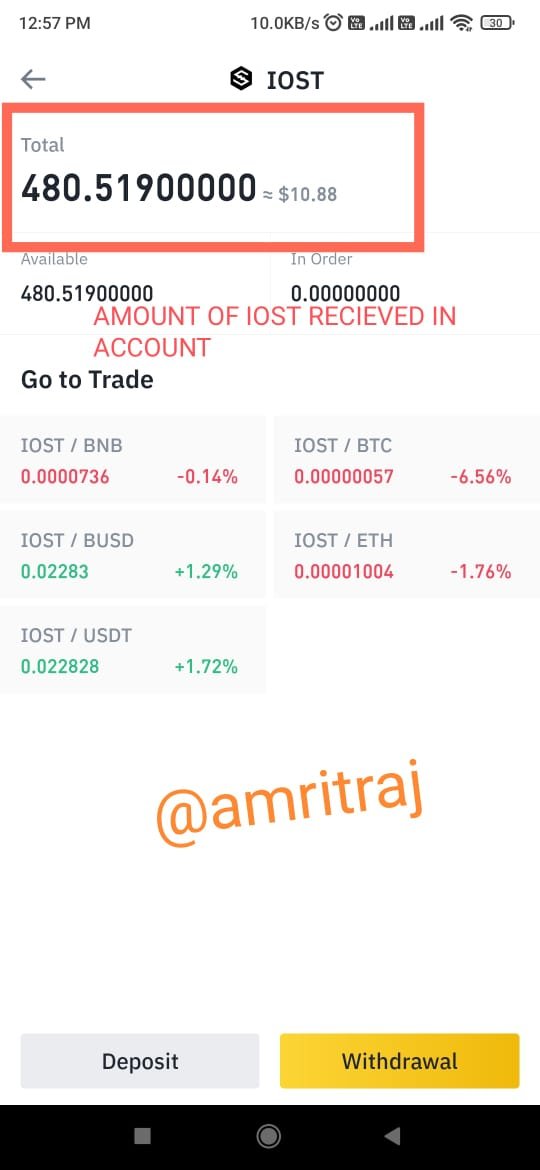

After price matches your desired rate check your wallet you will recieve IOST in wallet.

CONCLUSION

Understanding the market cycle and its psychology, especially the sentiment analysis part, can help traders make the right decisions when trading and cultivate a professionalism that is not controlled by emotions or the desire to make incredible profits. It can also be seen that FOMO and greed-driven traders are very prone to falling into FUD at the end of the day when they trade, because they are both emotionally biased and closely related. FOMO allows traders to buy positions at the wrong time when they really should sell, while FUD allows them to sell positions at the wrong time when they really should buy. So in the long run, these traders tend to relax on both ends.

Note :- All the screenshot are from my verified binance account on my mobile and pc.

Hello @amritraj Thank you for participating in Steemit Crypto Academy season 3 week 5.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you so much professor @allbert i will try to improve

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit