This is my post for Steemit Crypto Academy Trading Competition Season 6 Week 1. And I am joining the team TRADERS with Professor @kouba01 and Professor @fredquantum. This is my first trading article in the season 6 week 1 of Steemit Crypto Academy Trading Competition. And for this trade I chose the XRP, the native token of XRP Ledger.

Note : I performed this task on Windows 10 PC, Google Chrome.

1 – The Token: XRP (Ripple)

1.1. About XRP

1.1.1. A Brief Introduction of the Token

XRP is the the native token of XRP Ledger which has the ticker (symbol) also XRP. This token runs on RippleNet. RippleNet is a digital payment platform owned and run by a fintech company named Ripple. The digital payment platform RippleNet runs on top of distributed ledger which was named XRP Ledger.

At time of writing, according to coingecko.com, XRP was ranked on the 6th position based on the market capitalization, and was traded at USD0.789453 per token.

1.1.2. XRP Statistics

The table below shows the statistics of the XRP token as seen on coingecko.com on Februari 21 03:12 AM UTC.

| Aspect | Value |

|---|---|

| Token Name and Ticker | XRP (XRP) |

| Market Capitalization | USD38,217,578,960 |

| Market Cap Dominance | 2.05% |

| Circulating Supply | USD47,949,281,138 |

| Max Supply | 100,000,000,000 XRP |

| Total Supply | 100,000,000,000 XRP (100%) |

| All Time High | USD3.40 – January 7 2018 |

| All TimeLow | USD0.00268621 – May 22 2014 |

| Website | https://ripple.com/currency/ |

| Explorers | ripple; xrpscan; bithomp; oasis |

1.2. The Exchanges the Token Can Be Traded On

According to the XRP Exchange List uploaded by coingecko.com on this article, many exchanges is now supporting XRP trading, including major exchanges like Binance, Whitebit, FTX, TokoCrypto, Upbit, Crypto.com Exchange, Kraken, and many more.

The list also shows that XRP is traded with a variety of crypto pairs, including XRPBTC, XRPUSDT, XRPBUSD, and so on. XRP trading is also available on fiat pairs like XRPJPY, XRPUSD, XRPMXN, and so on. For local trader in Indonesia, UPbit exchange has listed the token on Indonesia fiat (IDR) market.

1.3. The Token Background

1.3.1. The Project

Ripple is a fintech company behind XRP. This company offers solution for global payment (and fund transfer / sending). Ripple is a private company and was founded in 2012 with the name OpenCoin. The Ripple Network (or famous by RippleNet) is its patented product on which the payment network runs. The development of Ripple’s consensus ledger which is known as XRP Ledger (XRPL for short) is funded by Ripple and is now available as open-source. The uniqueness is that XRP Ledger is not based on blockchain, but the distributed ledger database.

XRP is one of that “unique” token, which does not involve mining in its consensus reaching procedure. Instead of relying on Proof of Work like BTC does, XRP relies on its consensus algorithm which is named the Ripple Protocol Consensus Algorithm (RPCA) to achieve a consensus. A group of trusted nodes work to maintain the integrity of XRPL. This group of validators also work to process the XRP transaction. Before a transaction can be included in the XRPL, it needs to be agreed by a supermajority of trusted node, that’s how a consensus is achieved. What it means by “supermajority” is at least 80% of all the trusted nodes there is.

XRP, as mentioned above, does not involve mining. And Ripple has decided that XRP will only has a supply cap of 100 billion tokens. All 100 billion tokens have been pre-mined. That means the total supply has reached 100%.

1.3.2. The Brief History of XRP

- The history of XRP began in 2004, predating the history of Bitcoin. In 2004, a developer named Ryan Fuger created RipplePay which was the first version of Ripple.

- In 2012, the RipplePay project ownership handed over from Fuger to Chris Larsen and Jed McCaleb.

- In 2012, McCaleb and Larsen with Arthur Britto co-founded OpenCoin.

- In 2013, OpenCoin changed its name to Ripple Labs Incorporated.

- In 2016, Ripple Labs Incorporated changed its name again to Ripple.

2 – How I Feel About This Token

My opinions on this token is basically build by these facts:

- The market cap rank. As one of the tokens in the top 10 based on market capitalization, XRP has proven itself as a token to be reckoned with.

- In terms of production, XRP offers a global payment solution as well as fast and reliable and easy transfer of funds, I think this promises something for the future of this token.

- Implementation in various projects across the world. XRP has been involved in financial projects all over the world. That is, the idea has entered the level of practice and has been tested. Further development in the future could allow this token to continue to perform well. Some project implemented on XRP technology are:

- On August 11 last year, RippleNet added South Korean company Global Money Express (GME Remittance) to its list of money transfer companies and financial institution. This is the third partnership in South Korea following the previous two with CROSS ENF and Sentbe. The article can be read here.

- On October 14th 2020, pymnts.com reported on its article that Ripple has partnered with Cambridge Global Payments. The partnership was on cross-border payment.

- On March 2020, Ripple has partnered with a UAE bank, the National Bank of Fujairah PJSC (NBF). The partnership’s goal is to enable cross-border payments via the RippleNet platform. The article can be read here.

- Many more information about XRP partnership and practice implementation could be read here.

So based on those facts, I think XRP has a pretty solid foundation and it's safe to say that, if all goes well, this token has a great future.

3 – Token Analysis

Below is the screenshot of XRPBTC price chart on 30m timeframe. The screenshot was gained from UPbit Indonesia XRPBTC page. The screenshot was taken on Februari 20th 2022 05:01 PM UTC.

I used 2 technical analysis tools to examine the chart, namely Double EMA and William %R, with these settings:

- For Double EMA, I used 15 (blue line) and 50 (orange line) periods respectively as short and long-term EMA.

- For William %R, the lookback period I used was the default 14.

The above screenshot shows that on February 20th at 09:30 UTC, Golden Cross occurred on XRPBTC price chart. Golden Cross is when the short-term EMA crosses the long-term EMA from below. It is a sign of a bullish reversal. This is also supported by the indicator William %R (14) which shows a movement through the 20% line upwards. So, theoretically, it was a good time to enter the market soon after the February 20th 09:30 UTC.

4 – The Trade Plan

I entered this XRPBTC trade a bit late, 9 hours after the occurrence of the Golden Cross, precisely at 06:12 PM UTC that day, as the short-term EMA started to end its upside movement and headed in a gentler direction while the long-term EMA looks like it really wants to cut from below and offer Death Cross.

In such an uncertain market state that we are currently facing, I think I should enter the market with moderate vigilance. I can't expect too much. Circumstances can change drastically at any time. That is indeed the trend in the market, but under current conditions, things could be even worse.

So my plan was simple: I will enter the market and study the current trends, then will exit the market without expecting big profits or gains. It's good to be able to make a profit under these circumstances, but avoiding big losses is also an advantage. So, I will not use big money in this trade. It will just be a kind of "water testing". It was going to be an intraday trading.

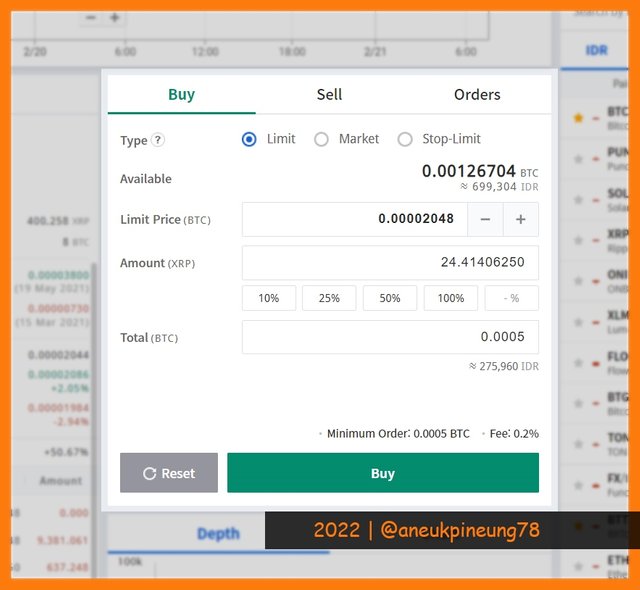

Below are screenshots of limit order creation on XRPBTC on UPbit exchange I made.

The above screenshot shows that I placed a limit order for as much as 0.0005 BTC (=IDR 275,960.00). And there was a 0.2% fee, so the total amount I spent was 0.000501 BTC or equal to about IDR 276,511.92.

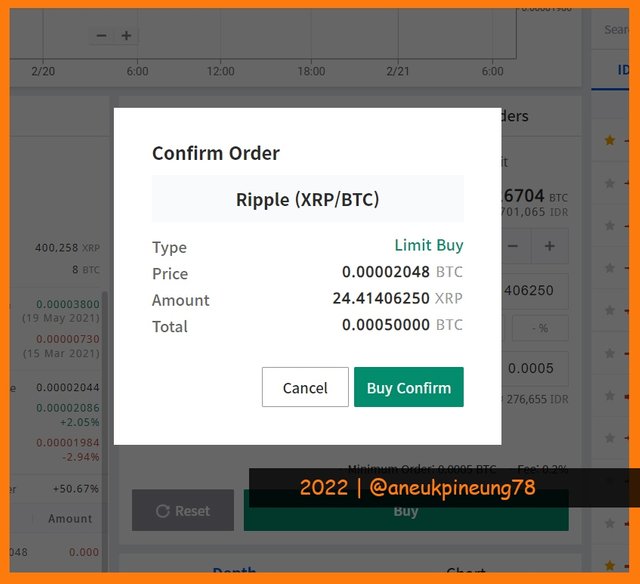

On a popped-up box, I confirm the order, as seen on the below screenshot.

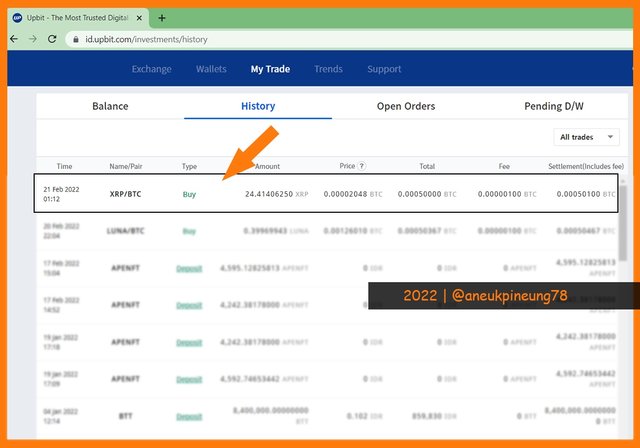

The screenshot below shows us that the order was successfully filled.

5 - Recommendation

To arrive at a recommendation, I want us to look at the current state of the XRP price chart. Now, when I am typing this, is February 21 12:49 PM UTC. About 18 hours has passed from the time I made the limit order. Here is the current price chart of XRPBTC as seen on https://id.upbit.com/exchange?code=CRIX.UPBIT.BTC-XRP.

The chart as seen on the screenshot above shows that Death Cross has formed on about 11 hours ago on the 21st at 01:30 UTC. So, to the best of my knowledge, under these circumstances I would not recommend anyone else to enter the market at this time. Waiting for a positive signal in my opinion makes more sense to do. The reason is that the Death Cross is known as the bearish signal.

Thanks

Thanks Professor @kouba01 and Professor @fredquantum.

Pictures Sourcing

- The editorial picture was created by me.

- Unless otherwise stated, all another pictures were screenshoots and were edited with Photoshop CS 3.

Sources and Reading Suggestion

- https://ripple.com/;

- https://ripple.com/xrp/;

- https://www.coindesk.com/price/xrp/;

- https://www.coingecko.com/en/coins/xrp;

- https://www.coindesk.com/company/ripple-labs/;

- https://coinmarketcap.com/currencies/xrp/;

- https://coinmarketcap.com/alexandria/article/xrp-a-history;

- https://www.pymnts.com/tag/ripplenet/;

- https://www.pymnts.com/blockchain/2018/ripple-kuwait-finance-house-cross-border-payments/;

- https://www.pymnts.com/blockchain/bitcoin/2018/bitcoin-daily-blockchain-startup-paypal-ripple-cryptocurrency/;

- https://www.coingecko.com/buzz/etoro-guide-to-xrp;

- https://www.coingecko.com/buzz/2021-yearly-cryptocurrency-report;

- https://www.coingecko.com/buzz/coingecko-consensus-algorithms-guide-part-1/;

- https://www.coingecko.com/buzz/coingecko-consensus-algorithms-guide-part-2;

Shared on Twitter : https://twitter.com/aneukpineung78a/status/1495760229757497344

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit