Define in your own words what Harmonic Trading is?

Harmonic Trading is the practice of "trading" stocks, futures contracts, indexes and other financial instruments by identifying their harmonic patterns.

Harmonic Trading gets its name from the natural law of fractals known as the Harmonic Law of Nature. Fractal patterns occur in all shapes and sizes, on any scale. Our eyes are designed to see them since they are recognized as significant features in our environment that require no conscious thought to detect, nor do they require any preconceived sorting or classification.

Fractal patterns form the basis of the universe, physical and metaphysical. Fractals occur naturally in nature on all scales. What is more, they appear in all facets of human life including science, art, architecture, economics, politics, culture and religion.

The Harmonic Law of Nature is a universal law that is also known as the Principle of Similarity or Principle of Affinity. It describes the apparent tendency for forms to resemble one another in shape over time based upon their underlying geometric structure or character . There is a natural tendency for nonlinear systems to self-organize into macroscopic patterns that are similar to the behavior observed at smaller scales.

So harmonic trading is based on finding those patterns that are also the key to the stock, gold, silver and commodity markets. Unlike simple technical analysis which follows a trend, Harmonic Trading is a decision making tool. It not only identifies trends but also gives you a prediction of what else may be on the way for those stocks. You might say Harmonic Trading combines Technical Analysis and Fundamental Analysis efforts into one. In more technical terms, it uses the laws of fractals to identify market trends and develop trading strategies for them based upon market timing of market moving events.

In essence, Harmonic Trading is pattern recognition coupled with pattern analysis.

Define and Explain what the pattern AB = CD is and how can we identify it?

The AB = CD pattern represents a situation where an asset is being pushed up or down in waves, which are themselves being pushed in the same direction. It is commonly seen when there are big buyers or sellers involved. The general rule with this pattern is to sell when it's fully formed and buy again when there's a confirmation after each wave down in price.

Example:

We have been following a coin from point A to B. When the price reaches a high at point C, we sell it and notice that it falls back down to where AB is shown on the graph. We buy it back in at point B, after this we wait for confirmation of a spike up again. This confirmation happens at point D and we sell out of the coin again.

As with all these patterns, a clear chart with a combination of candlesticks and lines would make identifying this pattern easier for you as a trader. A good example is the ETHUSD pair.

If you had the ability to identify patterns like these then your trading would be that much more effective as you would know when to sell and buy. This knowledge will allow you to make money, as you know when to take profits and cut losses on trades.

Clearly describe the entry and exit criteria for both buying and selling using the AB = CD pattern?

Entry and exit criteria for buying:

For placing buy, point C of AB-CD should be below point A and point D should be below point B and price should be falling. And as you can see in the below image point C should be between 0.618(61.8%) and 0.786(78.6%) of the fibonacci retracement. And point D should be between 1.272(127.2%) and1.618(161.8%) of the Fibonacci Retracement. Point C should be between A and B and point B should be between C and D.

Entry and exit criteria for selling:

For placing sell, point C of AB-CD should be above point A and point D should be above point B and price should be going up. See the below image point C should be between 0.618(61.8%) and 0.786(78.6%) of the fibonacci retracement. And point D should be between 1.272(127.2%) and1.618(161.8%) of the Fibonacci Retracement. Point C should be between A and B and point B should be between C and D. And C must be between B and D.

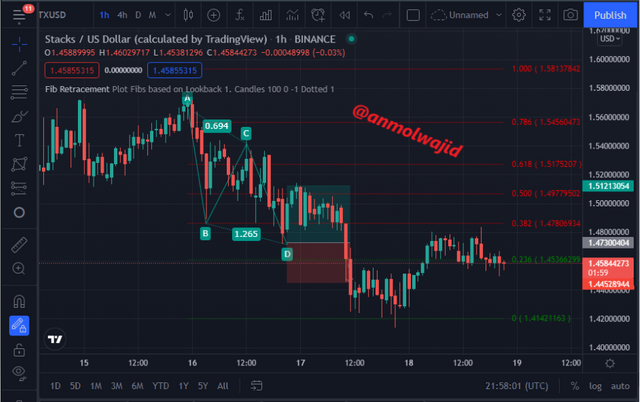

Make 2 entries (Up and Down) on any cryptocurrency pair using the AB = CD pattern confirming it with Fibonacci.

Buy/Long Entry:

Here we buying Stacks(STXUSD) at the price of $1.473, setting stop loss(SL) below lower low of ABCD which is $1.445 and setting take profit(TP) at $1.512 which is right between CD.

Sell/Short Entry: