LEADING AND LAGGING INDICATORS.

Source

WHAT IS A LEADING INDICATOR.

A leading indicator is an indicator which is aimed at providing information before another metric. There are indicators which points at where the price could move next. If the price of a cryptocurrency asset is going down and an indicator starts to rise before the price does, then such Indicator can be considered to be a leading indicator, because that indicator is forewarning of a rise in the price of the asset.

An example of a leading indicator is the Fibonacci retracements and extension tools. These Indicators are consideredas leading indicators because of the fact that they always attempt to forecast where the price may be heading next before it happens.

One fact is that leading indicators are not always correct all the times. sometimes the price might probably move in the direction that indicator indicated, but it might move in a direction opposite to the direction that was indicated. This is why it should be used as guidance for strategies of trading and the investor should not rely completely on it.

Examples;

• Relative Strength Index.

• Fibonacci retracements.

• Stochastic.

• Auto Fibonacci Extension.

• Auto Fibonacci Retracements.

• Awesome Oscillator.

WHAT IS A LAGGING INDICATOR.

A Technical indicator that is regarded as a lagging indicator is one which only look at the historical data of an asset and it is not suggesting which way the price will go in the future.

A lagging indicator is always moving behind the price and it provides a kind of delayed information or feedback to the trader.

An example of a lagging indicator is the moving average, If the price of an asset falls and then start to move upward again, the moving average will likely continue to go higher after the price does.

Lagging indicators are very useful to the investor because it always simplifies the price action and show the traders where the price has been. This will improve their sight on the price and will decide where the price may go next.

Examples;

• Exponential moving averages.

• MACD.

• Accumulation/ distribution Indicators.

• Advanced decline Ratio.

• Advanced decline bars.

• Average True range.

MARKET REACTION OF MACD INDICATOR.

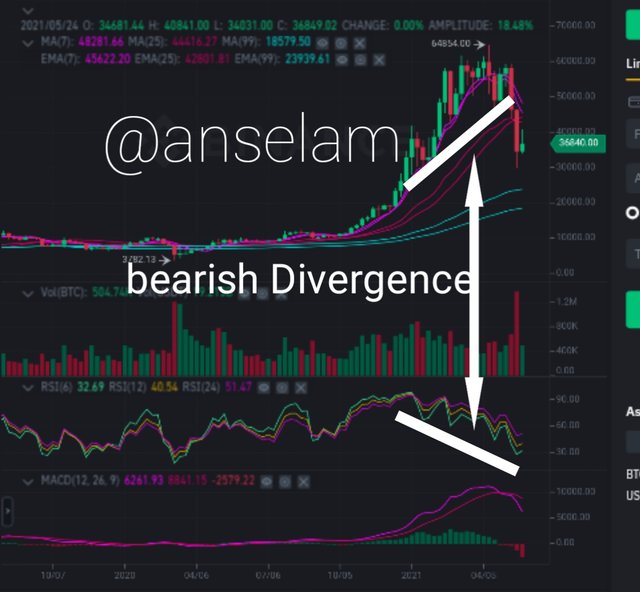

The MACD (Moving Average Convergence Divergence) is a lagging indicator and a momentum indicator which shows when a bearing or bullish is high and it helps in choosing the entry and exit point of a trade.

In the chart above, the bearish divergence was high before the date 06/01 and it has been indicated by the MACD indicator. After that, the price was bullish, but it can be seen through the MACD indicator that it was not so high. The price action also had bearish and bullish trends around 07/01 but they were very minimal as seen in the chart. But towards 08/01 they was a high bullish trend.

MARKET REACTION OF STOCHASTIC INDICATOR.

The stochastic indicator is an indicator which uses two lines and it can be applied in any kind of chart. It shows how the present price of an asset compares to the highest andnlowest price levels of the asset over a predetermined previous period. The past period always 14 individual periods.

In the chart above, the indicator attempts to predict the price reversal point. Just before August, the stochastic Indicator read above 80, this shows that the asset was trading near the top of Its high-low range, it also shows that it was overbought. But it went below 80 and at some point below 40 after September, showing that it traded near the bottom of its high-low range, and it was oversold.

FACTORS TO CONSIDER WHEN USING INDICATORS.

Your trading plan: One important factor that you must consider while using a Technical indicator is your trading plan, it should always be at the back of your mind. It is the factor that you will use in selecting the type of indicator that you will use. For instance, if your plan is to do swing trading or day trading, you will choose the basic moving average Indicators.

The category of the Indicator: It is very important for a trader to understand if the Indicator he or she is using is a lagging indicator or a leading Indicator. This will help the trader to know of the Indicator is just attempting to predict the future direction of the price action or it is giving the historical representation of the price action.

The success rate of the Indicator: Some leading Indicators are known to have a low success rate, this means that most of the actions that they predicted previously did not actually happen that way. So it is important for a trader to always find out if a particular leading Indicator has been very successful or very unsuccessful in its attempts.

CONFLUENCE IN CRYPTOCURRENCY TRADING.

In daily life, the word "confluence" is used in describing a point where two or more rivers meet together to form one body of water. But in cryptocurrency, it is used in the context of technical analysis to describe the situation where several technical analysis tools (usually Indicators, price action, chart patterns or even chart overlay tools) give the same trading signal.

Confluence in trading is also when a trader combines more than one technique of trading or technical analysis tool to increase his chances of succeeding with a trade. The cryptocurrency trader uses multiple trading indicators which gives him the same “signal”.

For example, if a trader uses one technical analysis tool which has an accuracy rate of 40% to predict the price movement of an asset, and then he uses a another on-correlated technical analysis tool to filter his decision more, then he increases his chances of getting it right.

ANALYSIS OF THE BTC/USDT PAIR CHART USING ITS CONFLUENCE.

The chart above is that of the BTC/USDT pair, a confluence can be seen in the chart as some technical indicators have met at the same point and they are giving the same signal.

**MA and EMA Indicators: These two Indicators are meeting at the same point, they are currently going down on the chart above and they show that the price has been moving down.

The MA Indicator is approximately at $42000 and the EMA is approximately also in that position, they are both signaling a high-probability buy zone. The price action is at $37000 and it might be near the support zone.

RSI and MACD: The RSI(6) is at 32.91 the RSI(12) is at 32.26 while the RSI(24) is at 30.32 They are all approximately below the 40.00 mark and they are currently on a downward trend. This confirms that it is a good entry point for a trader because it is still signaling a buy zone.

The MACD indicator seem to have gotten to a resistant point as it is now going down, only the MACD(6) is above the 0.00 mark, they rest are below it. But they are still very close to each other and they are still signaling that it is not a good time to sell or exit trade.

HOW TO FILTER FALSE SIGNALS.

False signals are always misleading the trader because the market might tend to move in one direction, but it is actually preparing to move in the the opposite direction. It is all because of volatility, which in this case, however, turns out to be false.

Eliminating false signals totally might look impossible, but it can be done using some techniques; some of them are;

• Using the RSI Indicator: For a trader to identify false signals, he or she can use the RSI Indicator. This indicator allows the trader to identify most of those areas that the market is exaggerating to one direction with the price level. If those levels that are imposed are violated by the RSI Indicator, then it might be a false signal.

• Using Stochastic Indicator: The stochastic Indicator is almost as effective as the RSI Indicator in filtering false signals, they can be used to determine the size of the position. For instance, if the size is contrasting to the signal gotten previously with the use of another Indicator, then it might be a false signal.

• Using confluence: This is another technique that can be used to filter a false signal. If the trader is depending on one Indicator for his strategy, then he might get to follow a false signal. But a combination of more than one indicators can help him confirm the genuine signal and also red flag the false signals.

DIVERGENCE.

Divergence is said to be a disagreement between an indicator and the price action of an asset, this is when the price action and the oscillators are following different paths which are contrasting and thereby generating two different and contrasting signals.

For instance, a crypto asset price creates a new low while the oscillator is not generating a new low, this is a clear case of Divergence. Some traders might not be quite aware of this scenarios, but it has been happening. This is made possible by the fact that most of these Indicators are probabilistic and independent. So they can move in any direction that they predict irrespective of where the price action is moving.

Divergence are helpful to traders because it prepares them for a new trend. An example is the bearish Divergence which can aid the trader in making a good entry for a short term trade, the bullish Divergence can also aid the traders in choosing a good entry point for a long term investment. It can also help them in filtering false signals.

BULLISH DIVERGENCE

A bullish divergence takes place when the price of the cryto falls to a new low while an oscillator fails to take a new low. This situation shows that the bears are losing power while the bulls are the ones who are on course to control the market at that period. More often than not, a bullish divergence is always marking the end of a downtrend.

An example is in the chart in the screenshot above, the price of the asset took a new low but the oscillator failed to do so.

BEARISH DIVERGENCE.

This is the opposite of the bullish Divergence, here the Price action makes a flat top or the higher high while the oscillator makes a higher low.

The chart above shows an example of a bearish Divergence where the price action is not falling to a new low, but the oscillator has done so.