INTRODUCTION.

Source

1 - A TRADING PLAN.

Planning is a very essential part of our daily life and it is now thing we cannot avoid if we want to succeed. More often than not, many people sit down and draft out what they want to do in the next days, weeks, months, or even years. This is also applicable in the cryptocurrency trading profession. As a matter of fact, it is the key to the success of a cryptocurrency trader.

A trading plan is a technical method for figuring out and trading securities which takes a lot of factors into consideration, these factors include; the time, risk involved and the objectives of the investor. A good trading plan must outline the way a trader will find and execute his or her trades. Including the conditions that he or she will buy and sell the securities, how large of a position they will take, how the trader will manage positions while in them, the securities that should be traded, and other rules for the conditions to trade and the conditions not to.

A Trading plans could be built using different ways. An Investor will always customize his or her own trading plan based on his/her personal aims and targets. Trading plans can be quite lengthy and indepth, especially for the active day traders like the day traders or the swing traders. Trading plans can also be very simple and straightforward, such as the one for an investor who just wants to enter an automatic investment every week into the same mutual funds or maybe the exchange traded funds (ETFs) until retirement.

2 - WHY IT IS ESSENTIAL TO HAVE A TRADING PLAN IN CRYPTOCURRENCY TRADING.

As a mentioned earlier, the key to the success of any trader is his plan, and the cryptocurrency trading world is not an exception. As a matter of fact, it seems more important to have a trading plan when doing crypto trading because cryptocurrencies and tokens are always very volatile and you can lose all your investments if you do not plan properly before entering a trade. Here are some essentials of trading plan in crypto trading;

• Minimizing losses: The aim of every crypto trader and even other traders is to make profits at the end of the session and not losses. But this cannot be achieved without a good trading plan because a trader is not expected to succeed when he or she is just trading randomly without a plan. A trading plan will help the trader to identify the those things that can bring losses. Then, the crypto trader will be able to adjust and avoid those losses.

• It serves as a roadmap for the trader: In most of the things we do in real life, we are given laid down roadmaps that will guide us. But when you want to trade crypto tokens, you are seemingly on your own. But you can give your self a good roadmap through a good trading plan. It will serve as a guide to you and it will even put your trading activities in check.

• It reduce risks: When you have a good trading plan, you will not be tempted to jeopardize all your capital in a single trade. For instance, a good trading plan will contain that you will trade bit by bit instead of using huge capital at an early stage.

• A trading plan can also help a trader to realize that the trade is not going as expected and this will make the trader to know that the session might not end up as expected. Hence, the trader can withdraw while he/she has not lost all the available capital.

3 - DEFINE AND EXPLAIN IN DETAILS EACH OF THE FUNDAMENTAL ELEMENTS OF A TRADING PLAN.

TIME MANAGEMENT: Time management is the proper utilization of time by the he trader, this includes the goal that the trader wants to achieve in a certain period of time, the time frame of a particular trading session, when to enter the trade and when to exit. A good trading plan must have a time scale for every single trading activity.

RISK MANAGEMENT: The cryptocurrency trading business is indeed a very risky one and the risk is so heavy due to the volatility. Risk management are those activities and strategies that the trader will use to reduce these risks while trading. I would like to aim at a less profit of $20 with less capital instead of aiming at $100 at once and then risk losing a heavier capital.

Again, For instance, I would like to always like to break my trading capital into minute qualities and maybe enter every trade with a minimum of $10 and I would like to keep my maximum at $20. This will help me to reduce the risk of losing maybe up to $100 at once.

CAPITAL MANAGEMENT: This has to do with the decisions we make in order to sustain our capital and make gains on it instead of losing. It has to do with the loss Percentage and the profit percentage. For instance, a trader should always specify the percentage of lost that will make the trader to withdraw from the trade in order to salvage the capital and the percentage gain that he or she is aiming at before the end of the session.

TRADING PSYCHOLOGY: This comes in when we are dealing with real money and we know that it will be disastrous if we lose it, this tension might lead us into activities that are even worst. So we need some psychological guides to manage the situation. This might include the trader listing out not to deviate from the plan, not being in a rush to trade, and so on.

PLANNING AND ACCOUNT CONTROL: This involve doing some calculations and coalitions to find out what profit has been made over a period of time, the losses that has been witnessed and many other things that has happened. This will help the trader to improve in his/her planning and it can help in making more profits.

4 - MY TRADING PLAN.

Photo Credit: MS power point.

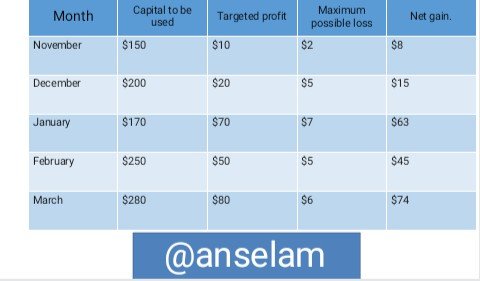

The first column of my trading plan shows the months that the trading plan is covering. As seen, the plan cuts across five months period; November to March. The second column is for the capital to be used. The opening capital is $150 and the capital for other months are increased as the trade yields profits. The third column is for the targeted profit which is estimated based on the capital to be used. The fourth Column is the maximum losses that can be allowed, else the trade will be withdrawn. This also is made to be less than 10% value of the expected profit. The final column is the net profit that is expected, excluding expenses of the trading.

CAPITAL MANAGEMENT: As seen in the table, my capital starts from a small amount of $150, but it has risen to $280 by the fifth month, this prevents me from losing my capital at an early stage. Another good capital management plan is to use the stop-loss so that I will not lose more than expected.

RISK MANAGEMENT: As seen in the table, I start the first month with a small amount and this reduces my risk of losing a high capital at an early stage. I take the trading bit by bit and I do not make too much increase the capital for the next month despite meeting the targeted profit of the previous month.

MY TRADING PSYCHOLOGY: Here, I understand that I could easily go outside my trading plan due to some circumstances or pressure. So I make some guidelines and rules that will help me stick to the plan.

♣ I make reference to the trading plan every time, this reminds me of what I am going to do next and I will also remember frequently the dangers of deviating from the plan.

♣ I avoid making amends to my trading plan just because of a recent experience. I do not make changes to the plan just because the last trade did not go well.

♣ Always reviewing how my trading has performed in a short period of time, this might help me to see that the plan will work out.

♣ Avoiding sentiments: I make all my trades based on analysis and not how I feel or think towards the securities that I trade.

CONCLUSION.

As I said earlier, planning is the key to success. Without planning, you are just following the wind around. This is the same for crypto trading. The nature of the crytpto market is not the kind f market that one can easily succeed without a plan. Thanks to professor @lenonmc21 for lecturing us on how to make a good trading plan, thanks for your time. Regards.