Good day Everyone,

Hope we are all fine? Happy weekend to y'all. It's my first time attending Prof. @stream4u class. But to be sincere, I must say i really enjoyed the class because it was simple and well explained. Am also happy to be one of the participant. Below is the homework given to me by Prof. @stream4u.

Before I start with this week assignment I would like to briefly pinpoint the meaning of "Trading". Trading is the act of buying and selling Cryptocurrency, raw materials, collectibles,etc. It is also the process of speculating on a particular market price like Cryptocurrency through a CFD trading account. Investors speculate the price of markets to buy a large amount of assets when price is down or reduce in price and sell when assets grow or rise to gain a massive profit.

source

sourceWe have different types of tradings style depending on the timeframe. Which are;

- Sclaping - Short Term trading

- Day Trading - Short Term trading

- Swing Trading - Short/ Medium Term Trading

- Position Trading - Long Term Trading

Sclaping

This is a very short trading style that last for seconds or minute. Traders only trade for a very short time.

Day Trading

Traders of this set is also called a short term trading because it last for seconds, minute, max 1 day. They Do not leave there capital for so long. They can now sell and trade with it again.

Swing Trading

This trading style is a short term trading but we can also call it medium term trading. It last for days while sometime weeks before the trader put the asset for sell. After selling, trader can put the same capital for trading.

Position Trading

This is a long term trading. It can be there for a very long time. Traders that do long term trade can leave there asset to grow for weeks, month, and even years.

As position trader does not bothered about monitoring of price fluctuation. Their trade does not need a constant monitoring as the other trader need to always check there own trade. Instead they can check it occasionally.

source

sourceCrypto margin Trading is the act of trading on an exchange that gives traders opportunity to borrow capital and to earn massively from it. The Exchange who act as the third party can borrow capital from other traders or the Exchange itself. crypto margin Trading is a trading platform that lend traders who doesn't have much capital money to trade and earn from it.

Margin trading is mostly refers to as laverage Trading. A laverage is the amount a trader use to multiply their position.

For example, A Trader that opens a 50X laverage. If the trader's profit is increasing the profit will be multifing by 50 while if the trader is loosing, the loss will be multiply by 50.

Do you think it is a good idea to do margin trading? It seems like a good way to boost your profit. But it is important for a trader to know what they are into.

Do not forget that trading is very risky. Do not use capital you can not afford to loose!

How To Plan For Trading In Crypto Margin Trading.

Before you start planning at all, make sure you have some assest in your wallet and make transactions I.e transfer asset to another account to show you are an active user. For example Binance can not borrow you capital if you do not have any assest.

After that, you can now borrow the funds from third party like a margin lender or a broker. Let me remind us, do not forget to invest intial deposit to open a position in crypto and you need to hold some in your wallet to keep your position.

Crypto Exchanges Name That Provide Margin Trading Service and What Margin They Provide?

* Binance

Binance is rated the world largest crypto trading platform. It allow traders to safe, trade, buy and sell Cryptocurrencies. It offer margin trading with a laverage of up to 125X.

* Huobi Global

This is one of the best trading platform also. It charge lower commission fee. Houbi Global offer margin trading with laverage of 3X.

* Bityard

It is a trading platform is also one of the best. Bityard has licenses of four different country and offers leverage up to 200X.

* Bybit

This is a crypto trading plaform for trader. It offer margin trading with laverage up to 100X.

* Deribit

It is also a crypto trading platform that offers margin trading up to 100X.

What Is Leveraged Tokens Trading?

source

sourceLeveraged token are the easiest way to do leverage trading. They are ERC20 token. It allow to gain exposure to leveraged trading position without maintaining any risk, management, magain, collateral and of course there is no risk of liquidation. Leverage token are not design to buy and hold but buy and sell quickly, do not hold.

Leverage token offer fixed and veriable leverages. However, different trading platform follow different techniques to rebalance there leverage token. Leverage token are not a long term investment.

How To Plan For Trading In Leveraged Tokens.

Trader that are planning to trade leverage tokens must know it is very important and pays for trader to make there own research in order to understand the underlying crypto asset that made up leverage token as they are planning to trade leverage tokens.

Leverage token are tokens that volatility factor can affect. So it will be a good thing to know how the history of each token perform. And ignoring this part of volatility can distroy your trade. Vitality is not curial in picking the right token for your strategy but critical factor that can help to mitigate risk.

It is important to know how to apply breakout strategy with leverage token.

Leverage token are ideal for traders who can make their research very well especially does that basically depend on technical trading strategy and trader's should not invest money they can not afford to loose.

Crypto Exchanges Name That Provide Leveraged Tokens Service and What Margin They Provide In Leveraged Tokens?

Binance

Binance offers Binance Leverage Tokens (BLVT) that up to 1.25X and 4X valuable leverage.FXT

FXT is the first exchange that introduce leverage tokens to trader (Bull and Bear Tokens) It provide leverage up to 3X.Huobi

It is an exchange that offers leverage up to 5X.

Price Forcast For Crypto Assets XXXXXX. (This is similar question from last course, take any Crypto Assets Chart graph, as per its current price and its market trend predict its future price for only next week, what will be its future price for next 1 week.You can predict for any direction up or down but explain it properly on what basis you have predicted the price. What will be the possible low level and high level fornext week.).

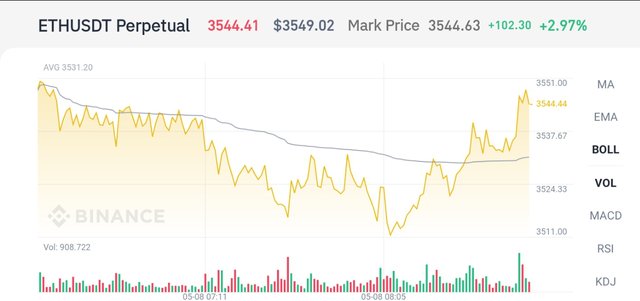

(Trading view of Eth/USDT)

I will be making forcast on the price of Ethereum using Binance. Ethereum price is currently $3544.41 as at when I screenshoted the image above. It's pretty a good price to purchase.

Ever since Bitcoin have been struggling to gain back it foot when it dropped last month (April 2021) there as been an agrresive gains for those that invested in Ethereum and the cause of that is that, there is an increase in demand of Ethereum by developer.

(Trading view of Eth/USDT)

The image above is screenshoted few minutes after the first chart image. Ethereum is now $3573 and it's still on increase. With the agrresive speed of how the Eth price is running up, I think Ethereum price will rise up to $4500 in a week. And we can only achieve this increase if Ethereum volume of demand keep increasing.

Conclusion

I have learned a lot from this class and would be happy to be a part of it in the future. Prof. thought us about margin trading and leverage token trading. He explain how risky it is to use the trading methods and showed us how to make plans. A very big thank you to Prof. @stream4u.

Hi @anyagladys

Thank you for joining The Steemit Crypto Academy Courses and participated in the Homework Task.

Your Homework Task verification has been done by @Stream4u, hope you have enjoyed and learned something new.

Thank You.

@stream4u

Crypto Professors : Steemit Crypto Academy

#affable

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Oh! Okay,

Thanks for reading through my post Professor @stream4u.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit