Hello Crypto Academy Family,

In this content, I will be expatiating my understanding on the subject matter "Bid-Ask Spread". This course is a very interesting course as I learned alot from the said course.

But before I proceed with the assignment, I will like to list all questions of the assignments here, below is the questions to the assignment:

- Properly explain the Bid-Ask Spread.

- Why is the Bid-Ask Spread important in a market?

- If Crypto X has a bid price of $5 and an ask price of $5.20, a.) Calculate the Bid-Ask spread. b.) Calculate the Bid-Ask spread in percentage.

- If Crypto Y has a bid price of $8.40 and an ask price of $8.80, a.) Calculate the Bid-Ask spread. b.) Calculate the Bid-Ask spread in percentage.

- In one statement, which of the assets above has the higher liquidity and why?

- Explain Slippage.

- Explain Positive Slippage and Negative slippage with price illustrations for each.

In the market space, There's always a Bid price and an Ask price. The buyer and seller has to agree to a certain price they're ready to buy or sell their commodity at any given time. Without a buyer and a seller, a market cannot exist! These two entities are very important in a market.

What is a Bid price?

The Bid price of a commodity is the maximum amount of money a buyer is ready to purchase a certain commodity at a particular time.

What is Ask price?

The Ask price of a commodity is also the maximum amount of money a seller is ready to sell a commodity to a buyer at a particular given time.

When the Bid price and Ask price occurs in a market, the difference between the two prices is called Bid-Ask Spread

To define it clearly and make meaning out of it, the Bid-Ask Spread can be defined as the total difference between the Bidding price and the Asking price of a commodity in a market.

Mathematically,

Bid-Ask Spread = Ask price - Bid price

This Bid-Ask Spread is used to ascertain and figure out the Liquidity of a market and it is simply called Spread.

The Bid-Ask Spread is very important in a market because:

- It helps traders to mitigate some losses and thereby, make profit out of their assets.

- It is used to ascertain and figure out the Liquidity of a market when carefully analyzed.

What is Liquidity?

Two market forces determines Bid-Ask Spread in a market. These two market forces are: Demand and Supply. When a commodity is available in a market at a given time, it's termed Supply. When there's enough buyers readiness to purchase a commodity at a given time, it's termed Demand. When the Bidding price and the Asking price is high in a market, the market is said to be Liquid. Which means that trades will be carried out very fast!

When the Bid price is high and the Ask price is high, the Spread will be small and the Market will be Liquid. On the other hand, When the Bid price and the ask price is small, the Spread will be large and the market will be illiquid!

What is Limit orders?

The price that a buyer is ready to purchase a commodity at a given time. A buyer places an order on an existing commodity in a market, expecting to purchase the commodity when the Ask price matches the Limit order. The Limit order is also known as the Bidding price of a buyer!

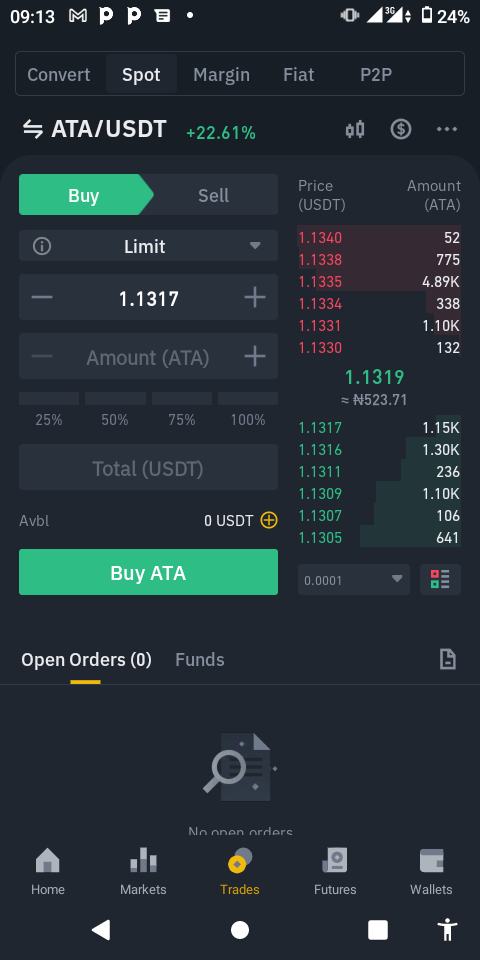

screenshot from Binance, ATA/USDT

From the image above,the Bidder has set the limit order to be 1.1317. The Bidder is willing to buy ATA when the Ask price matches the limit order. And trade will be carried out! The difference between these limit orders is called the Spread!

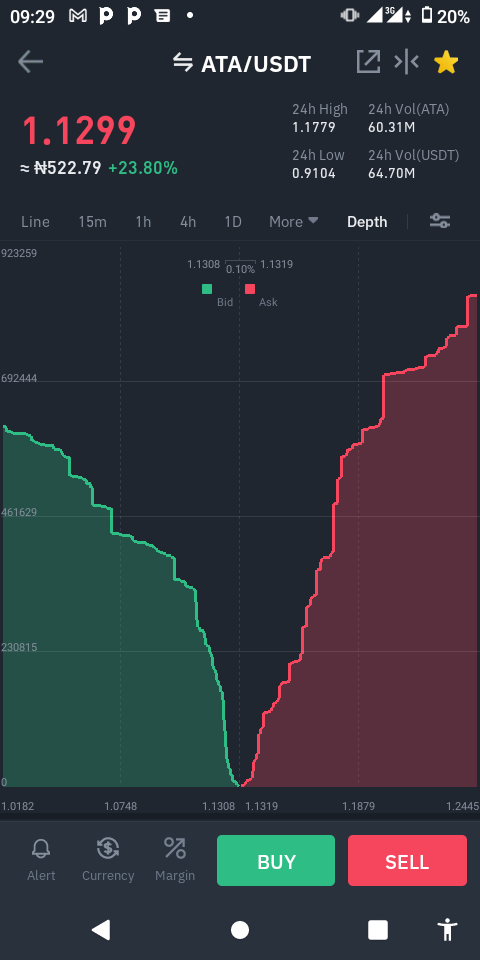

screenshot from Binance, ATA/USDT

In the image above, the green portion is Bid while the Red portion is Ask. The Bid and Ask price is high, therefore, leading to a small spread. This means that the market between ATA/USDT is liquid i.e there's high demand and supply of the coins, and the trading volume is high as well!

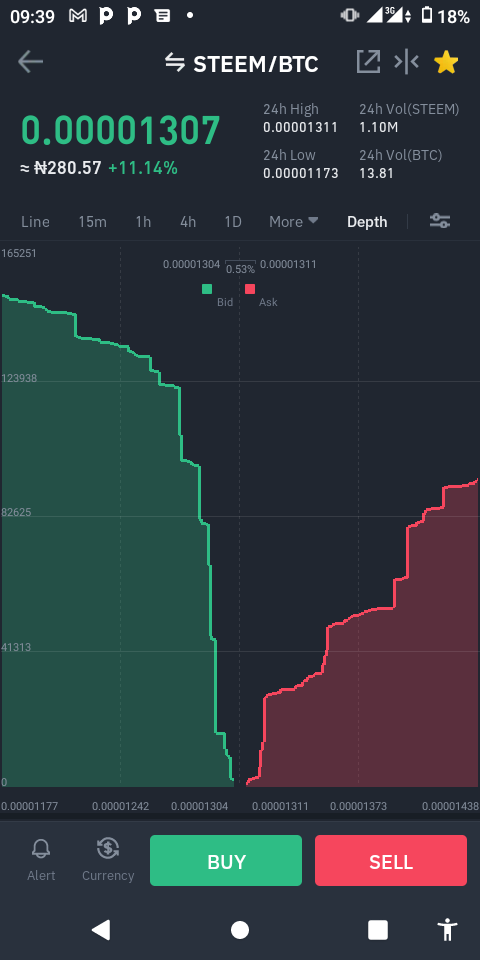

screenshot from Binance, STEEM/BTC

The image above shows that the Bid and ask price is low compared to that of ATA/USDT. However, the Spread is large, Hence, the market is illiquid!

Question 1: If Crypto X has a bid price of $5 and an ask price of $5.20,

a.) Calculate the Bid-Ask spread.

b.) Calculate the Bid-Ask spread in percentage.

Solution:

a) Formula for spread is given as;

Spread = Ask price - Bid price

So, if crypto X has a bid price of $5 and the Ask price of $5.20, the calculating the Spread of the market we have,

Spread = $5.20 - $5

= $0.20

b) formula for percentage Spread is given as;

%Spread = (Spread/Ask Price) x 100

Spread = $0.20

So,

%Spread = (0.20/5.20) x 100

= 0.038461538461 x 100

= 3.846153846153

Question 2: If Crypto Y has a bid price of $8.40 and an ask price of $8.80, a.) Calculate the Bid-Ask spread. b.) Calculate the Bid-Ask spread in percentage.

Solution,

a) Formula for spread is given as;

Spread = Ask price - Bid price

So, if crypto Y has a bid price of $8.40 and the Ask price of $8.80, the calculating the Spread of the market we have,

Spread = $8.80 - $8.40

= $0.40

b) formula for percentage Spread is given as;

%Spread = (Spread/Ask Price) x 100

Spread = $0.40

So,

%Spread = (0.40/8.80) x 100

= 0.045454545454 x 100

= 4.545454545454

From the assets above, Crypto X has the higher Liquidity because it has the smallest Spread.

Cryptocurrency is volatile i.e the price rises and falls in seconds. And because of it's volatility, it's a high risk to trade Cryptocurrency and also very profitable to trade Cryptocurrency, it happens vice versa. You can incur loss in cryptocurrency and you can also gain profit in cryptocurrency.

A buyer can place a market order on a coin, but due to it's volatility i.e the price changes in seconds, a slippage can occur between the time a market order is started and the the time it is carried out, and the buyer or the seller has to buy or sell at a price he does not intended.

Therefore, Slippage can be simply defined as the deviation from the price intended when a market order is begin.

Then, Slippage is given as the difference between the expected price of a trade and the price it is carried out.

1. Positive Slippage: Positive Slippage occurs when the price change favours the buyer or the seller when the order is executed. For an order issued by a buyer, a positive slippage occurs when an order is filled at a lower price than intended by the buyer. For an order issued by the seller, a positive slippage occurs when an order is filled at a higher price than intended by the seller.

For example, If a trade was place for crypto X to be bought at $250 and instead the trade was executed at $245,

the Positive slippage would be;

$250 - $245 = $5.

On the other hand, if a trade was placed for crypto X to be sold at $232 and instead the trade was carried out at $234, the Positive slippage would be;

$234 - $232 = $2.

2. Negative Slippage: Negative slippage occurs when the price change is no not favourable to neither the buyer nor the seller when the order is executed. For an order issued by a buyer, a negative slippage occurs when an order is filled at a higher price than intended by the buyer. For an order issued by the seller, a negative slippage occurs when an order is filled at a lower price than intended by the seller.

For example, if a trade was placed for crypto Y to be bought at $200 and instead the trade was executed at $200.60,

the negative slippage would be;

$200.60 - $200 = $0.60

Also, if a trade was placed for crypto Y to be sold at $100 and instead the trade was executed at $99.5, the negative slippage would be;

$100 - $99.5 = $0.5.

In Conclusion, the Concept of Bid-Ask Spread is very vital in todays crypto market so as to help traders make money out of their assets and at the same time mitigate loss! Traders should also endure when they encounter negative spillage when making an order in crypto markets!

Cc: @awesononso

Great job. I like the way you arranged your work.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks so much I appreciate

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit