Hello Steem CryptoAcademy,

1. Define the Order Book and explain its components with Screenshots from Binance.

2. Who are Market Makers and Market Takers?

3. What is a Market Order and a Limit order?

4. Explain how Market Makers and Market Takers relate with the two order types and liquidity in a market.

5. Place an order of at lease 1 SBD for Steem on the Steemit Market place by a) accepting the Lowest ask. Was it instant? Why? b) changing the lowest ask. Explain what happens. (Make sure you are logged in to your wallet).

6. Place a TRX/USDT Buy Limit order on the Binance exchange for at least $15. Explain your steps and explain the impact of your order in the market. (Give Screenshots).

7. Place a TRX/USDT Buy Market order on the Binance exchange for at least $15. Explain your steps and explain the impact of your order in the market. (Give Screenshots of the completed order).

8. Take a Screenshot of the order book of ADA/USDT pair from Binance on the day you are performing this task. Take note of the highest bid and Lowest ask prices: a) Calculate the Bid-Ask. b) Calculate the Mid-Market Price.

ORDER BOOK

An Order book is an electronic list of buy and sell orders of an asset pair which is arranged in a descending and ascending order by it's price level i.e. from the highest price to the lowest price for the Bid side and from the lowest price to the highest price for the ask side.

The Bid side is on the left coloured green while the Ask side is on the right coloured red. The price level of the order book fluctuates according to the highest/lowest price level at a very small time intervals (in seconds). The highest Bid price is always at the top and it fluctuates.

The Bid side has two sides too. The two sides on the Bid side signifies the amount buyers are bidding for (on the left) and the price they are bidding it (on the right). The Ask side has two sides too. The left side of the Ask side is the price sellers are willing to sell while right side is the amount they're asking for. The lowest Ask price is always at the top and it fluctuates too.

The order Book heighten the Transparency of cryptocurrency. It's a tool used to know the liquidity of an asset i.e. whether the asset has a high number of demand and supply. If it has, then the Bid-Ask Spread will be small indicating that the market of the asset is liquid.

MARKET MAKERS and MARKET TAKERS

A Market Maker is someone who places a limit order on an asset waiting for the order to be filled. While waiting for these orders to be filled, all the open Limit orders are arranged in an order book. As soon as you place a limit order on an asset and click buy, your order will immediately be recorded in the order book according to the price level. Until this order is filled it will remain in the order book.

Market Takers are the people that take an order at the current market price i.e. they filled the order opened by the Market Makers. They don't have time to place a Limit order on an asset and at the same waiting for the order to be filled but rather they buy at the Ask price and sell at the Bid price.

A market maker can also be called Liquidity provider. This people that places these Limit orders are the Bidders and Askers of an exchange. Market Makers helps limit price variation by setting their own price limit they're willing to buy or sell an asset. That's one of the function of Market Makers.

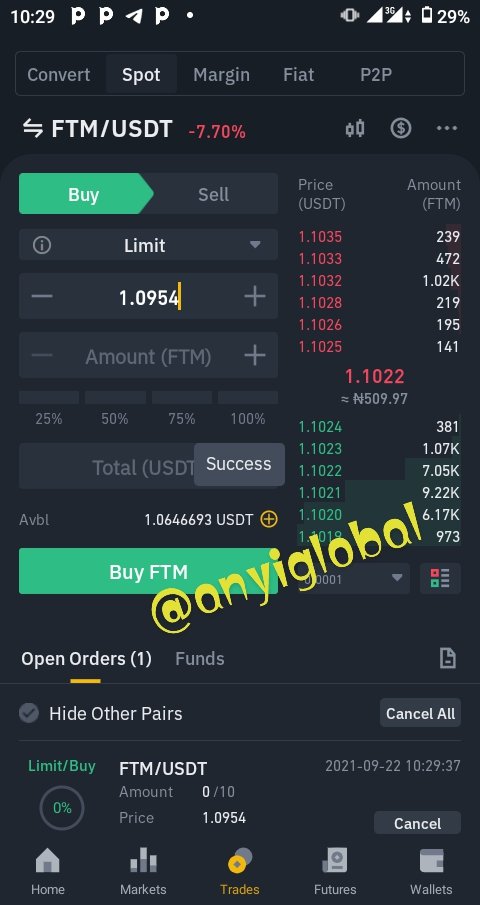

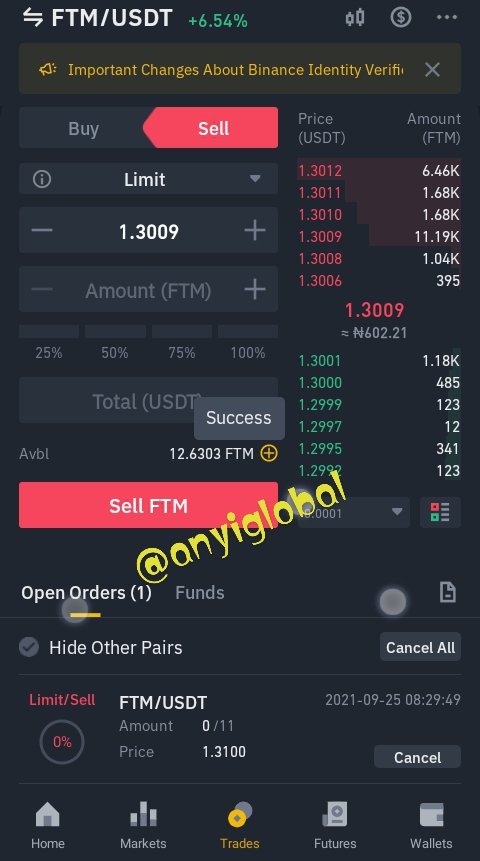

Below is the illustration where I placed Buy and Sell Limit orders on FTM/USDT pair;

MARKET ORDER and LIMIT ORDER

A Market Order is an order that is filled at the current market Price. A market order does not go to an order book because the order is filled instantly. And a Market Order is filled by Market Takers.

Limit order is an order which is set to a certain price level by bidders and Askers before it is filled. People who initiate Limit orders are willing to wait until the other is filled and they're called Market Makers. A limit order goes to the order book immediately it is initiated until it is filled!

RELATIONSHIP BETWEEN MARKET MAKERS AND MARKET TAKERS

Market Makers and Market Takers are related in the sense that, The Market Markers provides the limit order for an asset and Market Takers will come with the Market Order and take it. The order will be filled when the Market Order matches with a corresponding Limit order. In other words, we can say that the Market Makers provides the Liquidity while the Market Takers take the Liquidity. And the bid-ask spread will be small indicating a Liquid Market.

STEEMIT MARKET PLACE

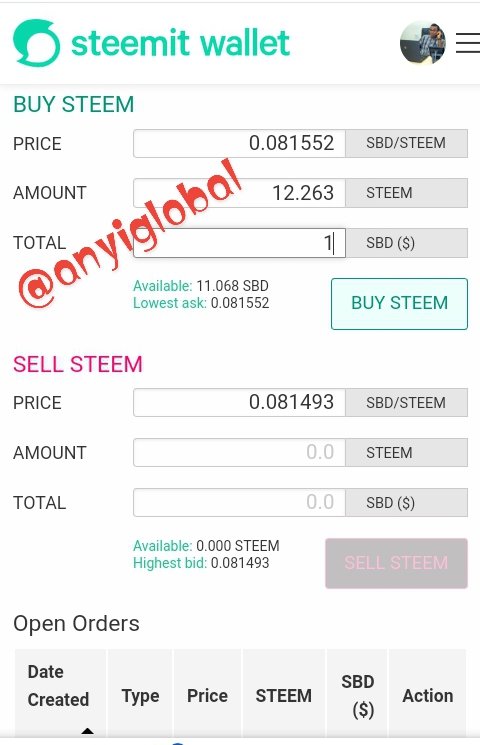

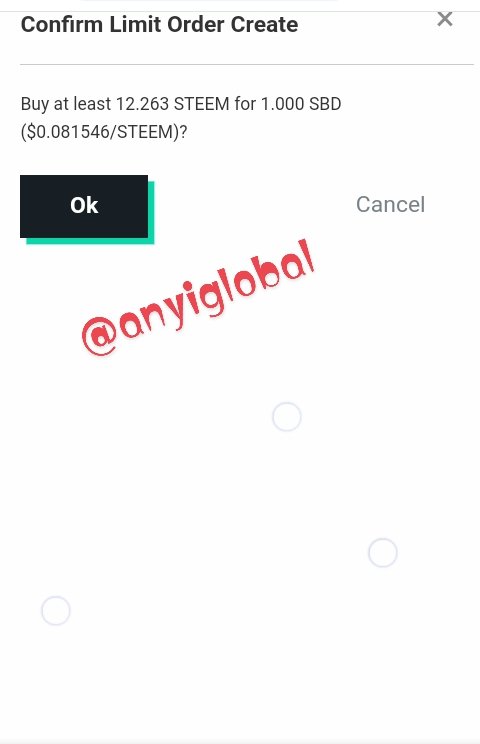

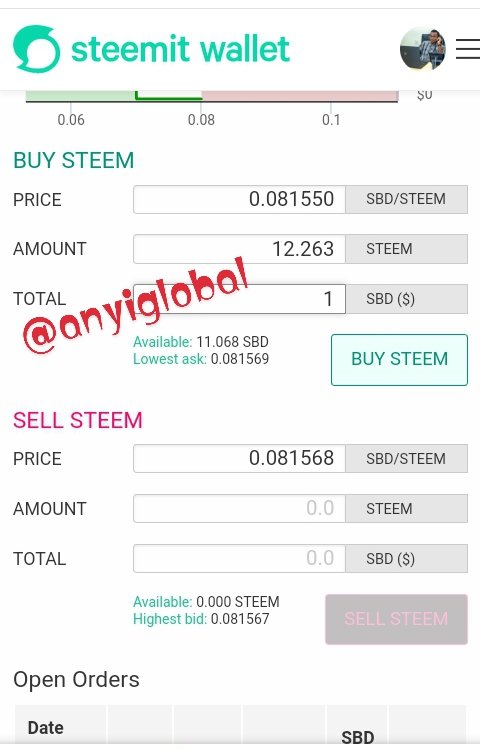

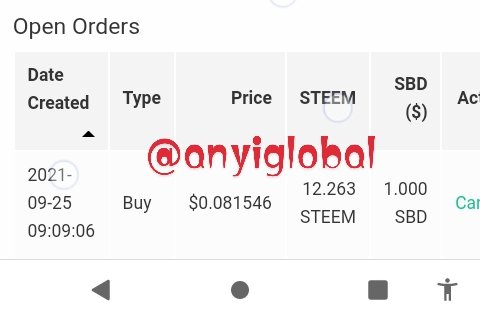

a) Accepting the Lowest Ask

I will illustrate below how to accept Lowest ask on steemit market and whether the order is filled instantly or not;

From the screenshot above, I placed an order of 1SBD for 12.263 Steem at the lowest ask price. When I click on "Buy Steem", I signed in with my Key. But at the Transaction period, the lowest Ask price changes from 0.081552 to 0.081546 and the order is not filled immediately. The transaction is recorded in the order book. Screenshots shown below;

b) Changing the Lowest Ask

I will illustrate What happened when I changed the lowest Ask price below;

From the screenshot above, I changed the lowest Ask price from 0.081569 to 0.081550. When I clicked on"Buy Steem", the system prompted me to enter my password which I did, then on clicking "ok", my order was recorded on the order book as shown below;

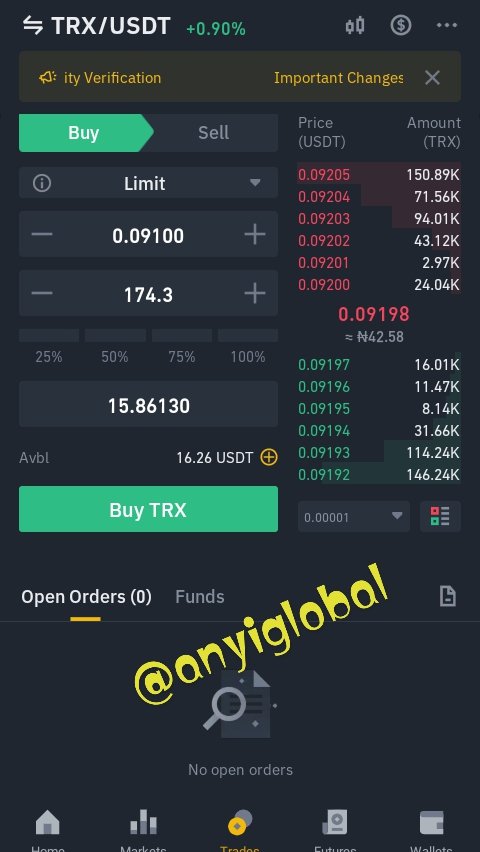

TRX/USDT Buy Limit Order on Binance

I placed a Buy Limit order of 0.09100 on Binance for at least $15 on TRX/USDT;

Then when I clicked on "Buy TRX", my order was recorded in the order book (open orders). This is because the Limit order has not matched with the corresponding Market order for the order to be filled and completed. In other words I acted as a Market Maker by placing an order at my own price Level (Limit order).

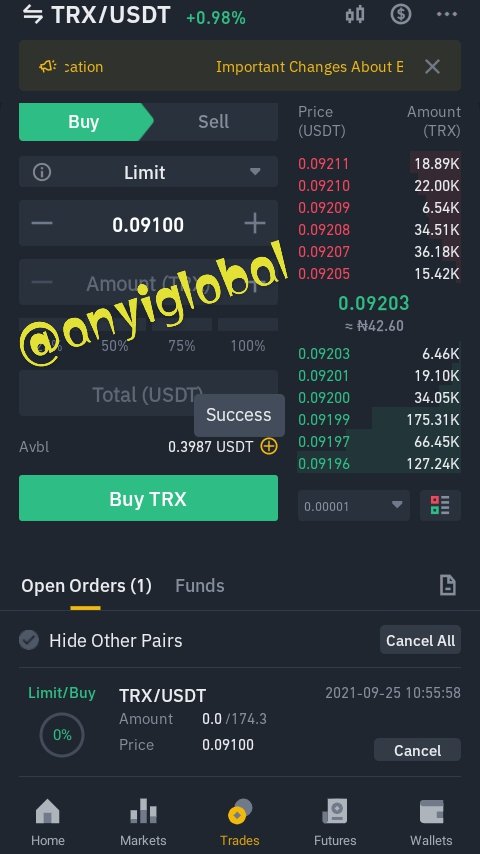

TRX/USDT Buy Market Order on Binance

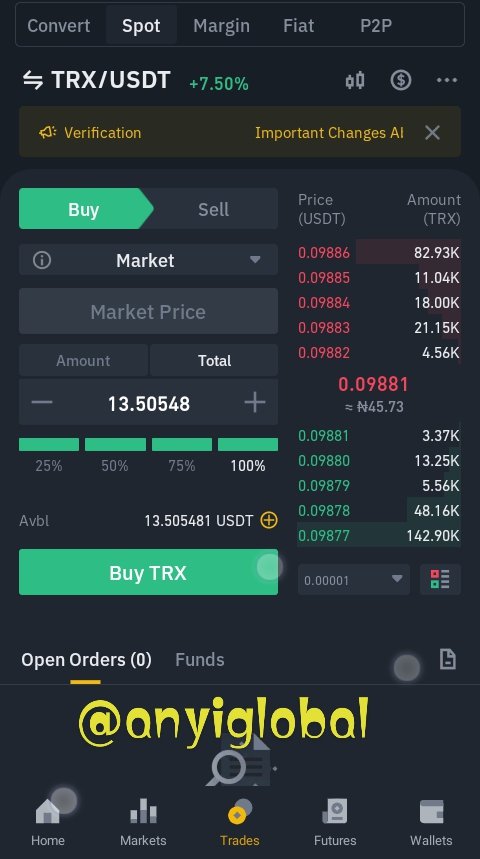

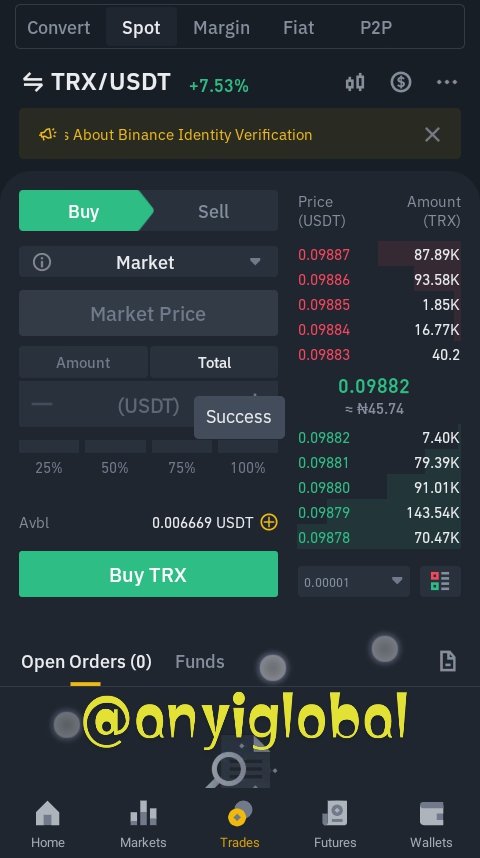

The screenshot below shows a Buy Market Order of at least $15 on TRX/USDT;

When I clicked on "Buy TRX", the transaction was a success as shown;

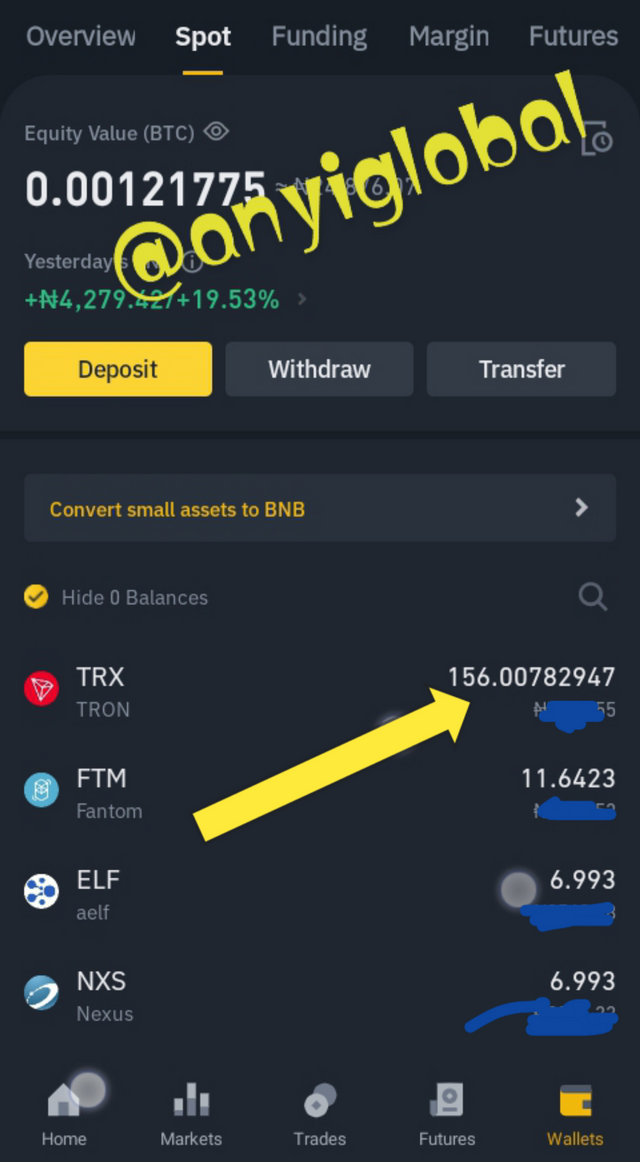

After the successful Transaction, I received the TRX asset on my "Spot wallet" as shown below;

In the above transaction I acted as a Market Taker by taking the Liquidity provided by a Market Maker

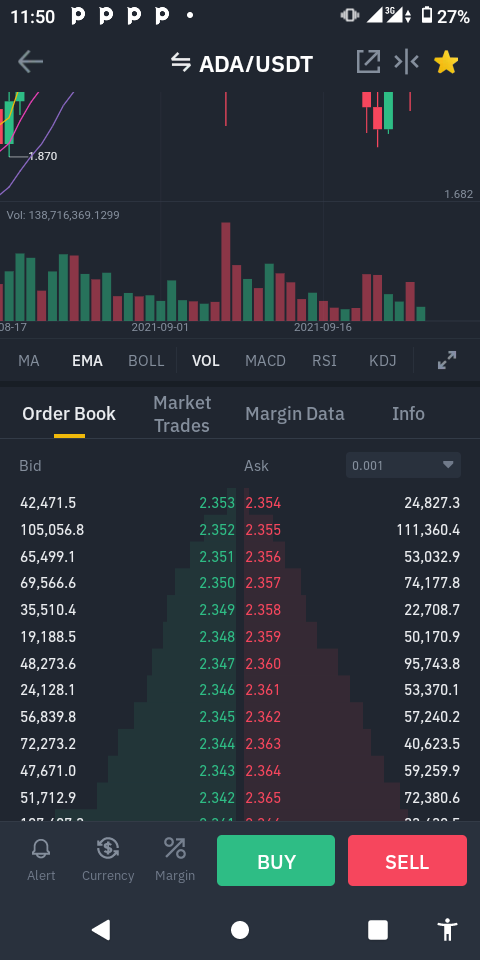

ORDER BOOK OF ADA/USDT

a) To calculate the Bid-Ask Spread we have;

Mathematically,

Bid-Ask Spread = Ask price - Bid price

From the order book of ADA/USDT above,

Bid price = 2.353

Ask price = 2.354

Therefore;

Spread = $2.354 - $2.353

= $0.001

b) To calculate the Mid-Market Price we have;

Mathematically,

Mid-Market Price = (Bid Price + Ask Price)/2

From the order book of ADA/USDT above,

Bid price = 2.353

Ask price = 2.354

Therefore,

Mid-Market Price = (2.353 + 2.354)/2

= 4.707/2

= 2.3535

Conclusion

The order book is very helpful in calculating the Bid-Ask Spread and the Mid-Market price of an asset! Thanks and God bless you!!!

Cc: @awesononso

Awesome and very educative post

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

It's my pleasure

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

@etainclub

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit